TIDMSREI

RNS Number : 0223C

Schroder Real Estate Inv Trst Ld

08 June 2023

For release 8 June 2023

Schroder Real Estate Investment Trust Limited

('SREIT' / the 'Company' / 'Group')

RESULTS FOR THE YEARED 31 MARCH 2023

LOW COST, LONG TERM DEBT PROFILE AND INCOME-LED OUTPERFORMANCE

DELIVERS FURTHER INCREASE IN FULLY COVERED DIVID

Schroder Real Estate Investment Trust Limited, the actively

managed UK focused REIT, today announces its final results for the

year ended 31 March 2023. These are also available on the Company's

website, https://www.srei.co.uk .

High income return and a sector leading debt profile

underpinning earnings and a further dividend increase

-- Net asset value ('NAV') decreased to GBP300.7 million or 61.5

pps (31 March 2022: GBP372.2 million, or 75.8 pps), with equivalent

yield expansion of 152 bps to 7.8% (MSCI Benchmark: 123 bps to

6.2%) as a result of the higher interest rate environment,

partially offset by ERV growth of 9.2% (MSCI Benchmark: 3.4%)

-- 14% increase in dividends paid during the financial year to

GBP15.8 million, or 3.22 pps (31 March 2022: GBP13.9 million, or

2.83 pps) , fully covered by EPRA earnings

-- NAV total return -15.1% (31 March 2022: 30.9%)

-- Long debt maturity profile of 10.6 years and a low average

interest cost of 2.9%, with 90% either fixed or hedged against

movements in interest rates

-- Loan to value, net of all cash, of 36.0% (31 March 2022: 28.6%)

-- Change of independent valuer at the financial year end

-- 12 month total return from the underlying portfolio of -7.9%

compared with the MSCI Benchmark at -13.5%

-- Further 2% increase in the quarterly dividend to 0.836 pps

for the quarter ended 31 March 2023, to be paid in June

Asset management and transactional activity leading to long term

outperformance against the MSCI Benchmark, strong rental value

growth and an improvement in defensive qualities

-- Sustained, long term outperformance of the underlying

portfolio with a total return of 6.0% per annum on a rolling three

year basis (MSCI Benchmark Index: 1.9% per annum)

-- 65 new lettings, rent reviews and renewals across 973,000 sq

ft completed since the start of the financial year, totalling

GBP6.7 million in annualised rental income and generating GBP2.3

million per annum of additional rent, including:

-- Rent reviews and lease renewals at Langley Park Industrial

Estate in Chippenham with Siemens Mobility and IXYS which increased

the headline annual rent by GBP0.4 million or 21%

-- 40,000 sq ft lease regear completed with Buckinghamshire New

University in Uxbridge, extending the lease contract by five years

at 13% higher rent

-- Post year end completion of Stanley Green Trading Estate

80,000 sq ft operational net zero development in Manchester, with

approximately 40% of the GBP1.3 million ERV let or in legals

-- Acquisition of St. Ann's House, a mixed-use office and retail

asset in Manchester City Centre, for GBP14.7 million, reflecting a

net initial yield of 7.8%, a reversionary yield of 9.1% and a low

average capital value of GBP283 per sq ft, and, post year end, a

small adjoining ownership in Chelmsford, for GBP800,000, reflecting

a net initial yield of 11.1%

-- Three disposals totalling GBP12.6 million at a 13% average

premium to the valuation at the start of the financial year

Strong progress improving sustainability performance as future

strategy evolves

-- Further improvement in the Company's Global Real Estate

Sustainability Benchmark ('GRESB') score, placing first amongst a

group comprising seven diversified REITs

-- 58% of the portfolio A-C rated (31 March 2022: 41%), the

Company's first 'A+' ratings were achieved at the new development

at Stanley Green Trading Estate post year end

-- Announced 'Pathway to Net Zero Carbon', includes operational

whole buildings emissions to be aligned to a 1.5degC pathway by

2030

Alastair Hughes, Chair of the Board, commented:

" There are signs that real estate values are stabilising, and

approaching fair value. The attractive portfolio income and

pipeline of asset management activity should contribute to

continued earnings and dividend growth, further improve the

defensive qualities of the portfolio, and enhance returns as the

market recovers.

"Whilst a relaxation in monetary policy is expected in 2024,

interest rates will remain elevated compared with the recent past.

The prudent balance sheet management implemented by the Company,

resulting in the lowest cost, longest duration debt in the peer

group, largely removes this risk to earnings, and provides a solid

foundation to deliver future dividend growth."

Nick Montgomery, Fund Manager, added:

"Whilst the Company's asset values were impacted by

macro-economic headwinds, our diversified portfolio delivered a

further increase in the fully covered dividend level, driven by

asset management-led rental growth. Importantly, the strength of

our balance sheet, underpinned by low cost, long-term, fixed rate

debt, is a key competitive advantage and provides significant

protection from the impact of higher interest rates. These factors,

combined with an increasing emphasis on sustainability-led

initiatives, will further and more clearly differentiate the

Company's strategy, helping to drive more sustainable, long-term

returns for shareholders."

A webcast presentation for analysts and investors will be hosted

today at 10.00am. In order to register, please visit:

https://registration.duuzra.com/form/feedback/SREIAnnualResultsJun23

For further information:

Schroder Real Estate Investment Management

Limited

Nick Montgomery / Bradley Biggins 020 7658 6000

Schroder Investment Management Limited

(Company Secretary)

Matthew Riley 020 7658 6000

--------------

FTI Consulting

Dido Laurimore / Richard Gotla / Oliver

Parsons 020 3727 1000

--------------

Contents

Overview 1

Performance Summary 4

Strategic Report 6

Chair's Statement 6

Investment Manager's Report 11

Sustainability Report 26

Business Model 33

Our stakeholders 36

Risk and Uncertainties 38

Governance Report 43

Board of Directors 43

Report of the Directors 45

Corporate Governance 48

Audit Committee Report 53

Management Engagement Committee Report 56

Nomination Committee Report 57

Directors' Remuneration Report 59

Statement of Directors' Responsibilities 61

Independent Auditor's Report to the members of Schroder Real

Estate Investment Trust Limited 63

Financial Statements 74

Consolidated Statement of Comprehensive Income 74

Consolidated Statement of Financial Position 75

Consolidated Statement of Changes in Equity 76

Consolidated Statement of Cash Flows 77

Notes to the Financial Statements 78

Other information (unaudited) 98

EPRA Performance Measures (unaudited) 98

Alternative Performance Measures (unaudited) 104

AIFMD Disclosures (unaudited) 105

Task Force on Climate-related Financial Disclosures ('TCFD') 107

Sustainability Performance Measures (Environmental) (unaudited) 112

Streamlined Energy and Carbon Reporting 128

Asset list 132

Report of the Depositary to the Shareholders 133

Glossary 134

Notice of Annual General Meeting 138

Corporate Information 141

Performance Summary

Property performance

31 March 2023

------------------------------------------------------- -------------- ----------

Value of Property Assets and Joint Venture Assets [1] GBP470.4m GBP523.5m

------------------------------------------------------- -------------- ----------

Annualised rental income [2] GBP29.3m GBP30.1m

------------------------------------------------------- -------------- ----------

Estimated open market rental value [3] GBP37.8m GBP33.8m

------------------------------------------------------- -------------- ----------

Underlying portfolio total return (7.9%) 23.5%

------------------------------------------------------- -------------- ----------

MSCI Benchmark total return [4] (13.5%) 19.9%

------------------------------------------------------- -------------- ----------

Underlying portfolio income return 6.0% 6.3%

------------------------------------------------------- -------------- ----------

MSCI Benchmark income return 4.1% 3.9%

------------------------------------------------------- -------------- ----------

Financial summary

31 March 2023

---------------------------------- -------------- ----------

Net Asset Value ('NAV') GBP300.7m GBP372.2m

---------------------------------- -------------- ----------

NAV per Ordinary Share 61.5p 75.8 p

---------------------------------- -------------- ----------

EPRA Net Tangible Assets [5] GBP300.7m GBP372.2m

---------------------------------- -------------- ----------

EPRA Net Reinstatement Value (5) GBP332.2m GBP407.3m

---------------------------------- -------------- ----------

EPRA Net Disposal Value (5) GBP317.4m GBP375.9m

---------------------------------- -------------- ----------

IFRS (loss)/profit for the year (GBP54.7m) GBP89.4m

---------------------------------- -------------- ----------

EPRA earnings (5) GBP16.0m GBP15.7m

---------------------------------- -------------- ----------

Dividend cover [6] 101% 113%

---------------------------------- -------------- ----------

Capital values

31 March 2023 31 March 2022

----------------------------- -------------- --------------

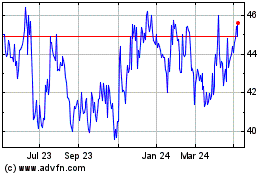

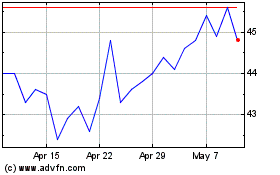

Share price 43.6p 57.8 p

----------------------------- -------------- --------------

Share price discount to NAV (29.1%) (23.7 %)

----------------------------- -------------- --------------

NAV total return [7] (15.1%) 30.9%

----------------------------- -------------- --------------

Earnings and dividends

31 March 2023 31 March 2022

------------------------------------------------------- -------------- --------------

EPRA earnings (5) (pps) 3.3 3.2

------------------------------------------------------- -------------- --------------

Dividends paid (pps) 3 .22 2.83

------------------------------------------------------- -------------- --------------

Annualised dividend yield on the 31 March share price 7.4% 4.9%

------------------------------------------------------- -------------- --------------

Bank borrowings

31 March 2023 31 March 2022

------------------------------------------------------ -------------- --------------

On-balance sheet borrowings [8] GBP177.90m GBP162.25m

------------------------------------------------------ -------------- --------------

Loan to Value ratio ( ' LTV ' ), net of all cash [9] 36.0% 28.6%

------------------------------------------------------ -------------- --------------

Ongoing charges

31 March 2023 31 March 2022

------------------------------------------------------------- -------------- --------------

Ongoing charges (including fund and property expenses) [10] 2.28% 2.21%

------------------------------------------------------------- -------------- --------------

Ongoing charges (including fund only expenses) [11] 1.32% 1.26%

------------------------------------------------------------- -------------- --------------

Strategic Report

Chair's Statement

Overview

Schroder Real Estate Investment Trust Limited (the 'Company')

today announces its audited results for the financial year to 31

March 2023, a challenging period that has seen financial market

volatility, and a significant correction in UK real estate values.

As expected, the rising interest rate environment has led to a

re-rating in real estate yields, contributing to a -13.1% valuation

decline in our underlying portfolio over the year. Whilst this

compared favourably with the MSCI peer group Benchmark (the

'Benchmark') at -16.9% over the same period, the valuation movement

resulted in a net asset value ('NAV') as at 31 March 2023 of

GBP300.7 million, or 61.5 pence per share ('pps'), a decline of

-18.9%.

More positively, a high level of portfolio activity contributed

to an above average income return of 6.0% over the year, comparing

favourably with the Benchmark at 4.1%. Earnings growth, underpinned

by low cost, long-term, fixed rate debt, boosted the dividend to

GBP15.8 million, a 14% increase compared with the prior financial

year, and we are the only member of our peer group where the

dividend is above the pre-pandemic level. Importantly, the dividend

was fully covered by recurring earnings and, combined with the

movement in the NAV, resulted in a NAV total return for the

financial year of -15.1%.

As a result of income focused asset management activity, the

Company has today separately announced a further 2% increase in its

quarterly dividend to 0.836 pps, to be paid in June 2023. This

reflects an attractive yield of 7.5% based on the share price of

44.35 pps as at close on 6 June 2023.

Whilst the decline in NAV over the financial year is, of course,

unwelcome, it is encouraging that the underlying portfolio

continues to deliver long term relative outperformance compared

with the Benchmark, with an annualised total return of 6.0% per

annum over the past three years, compared with the Benchmark at

1.9% per annum, placing the portfolio on the fifth percentile of

its peer group.

Market context

My statement in the interim report highlighted the risk of

average UK commercial real estate values falling 15% to 20% from

the half year point, resulting in an overall decline from mid 2022

of approximately 20% to 25%. Average values have now fallen -17.7%

between 1 July 2022 and 31 March 2023, with the Company's portfolio

value falling by -14.1% over the same period.

The principal cause of this correction is more persistent core

inflation, driven by high energy and food prices, leading to

increasing interest rates, with the Bank of England base rate

currently 4.5%, the highest level since October 2008. Tighter

fiscal and monetary conditions, combined with a withdrawal of

pandemic related business support programmes, have led to a rise in

business insolvencies and a slowdown in consumer spending. In real

estate markets, higher interest rates have impeded debt-backed

buyers and increased refinance risk for many borrowers, with a

related fall in equity and bond prices leaving some institutions

over-allocated to real estate. This environment has led to weaker

sentiment and a sharp fall in transaction volumes.

The resultant decline in values has increased average real

estate net initial yields from 3.8% in June 2022 to 4.7% today, the

highest level since June 2020, with our portfolio now yielding

5.8%. As expected, lower yielding, higher growth real estate

sectors such as South East and London industrial have been most

adversely impacted by this rerating, resulting in a reversal in the

unprecedented polarisation of returns over recent years. Higher

yielding sectors - such as retail warehousing, and offices in

stronger regional centres - have been less adversely impacted,

leading to a convergence in returns across the main sectors.

Against this backdrop, our well diversified portfolio has

outperformed the Benchmark due to the active management of the

higher yielding, regional industrial estates, as well as

higher-yielding retail warehousing and offices in stronger regional

centres.

Occupational markets have, so far, remained more resilient, with

average nominal rental value growth for UK real estate of 2.5% per

annum since June 2022. Although below current inflation levels,

there remains a strong positive long-term correlation between

rental growth rates and inflation, with sectors benefiting from

structural demand drivers and lower vacancy rates delivering rental

growth well above the long-term average of approximately 0.9%. For

example, in contrast with the sharp decline in capital values,

average industrial rental values have increased by 5.9% since June

2022.

There are initial signs that the investment market is now

stabilising, with a capital value decline from our underlying

portfolio of -0.5% over the quarter to March 2023 (Benchmark:

-1.3%), contrasting with -11.9% over the quarter to December

(Benchmark: -13.2%). The extent of any subsequent recovery will

depend on falling inflation, with the Bank of England currently

forecasting a return to its target rate in 2024. In this seemingly

benign scenario, interest rates should fall, but probably to a

higher equilibrium rate of around 3%, above the ultra-low levels of

the recent past. A gap of approximately 2% between property yields

and 10 year gilts is approaching the long term average for fair

value, which, combined with a more a stable political backdrop and

currency, should attract domestic and international capital flows

back to the sector.

Looking forward, long term structural trends such as

urbanisation, technological change, demographics and sustainability

should continue to drive returns, with multi-let industrial

estates, retail warehousing, certain London office sub-markets and

some alternative sectors expected to outperform. These sectors

should also benefit from limited new development. This contrasts

with secondary office and weaker retail assets, where obsolescence,

higher vacancy and lower levels of occupational demand will

negatively impact returns.

Strategy

Our strategy is focused on delivering sustainable dividend

growth and improving the quality of the underlying portfolio

through a disciplined, research-led approach to transactions,

capital investment and active management. This activity will be

complemented by maintaining a robust balance sheet and continuing

to manage costs efficiently. Furthermore, with a growing consensus

that there is a meaningful rental premium for buildings with a

green certification, which we are seeing across our own portfolio,

we believe there is an opportunity to differentiate our strategy by

placing even greater emphasis on how sustainability-led asset

improvements will deliver enhanced returns for shareholders. This

reflects our strong conviction that only by transforming less

sustainable buildings into modern, fit for purpose assets, will we

deliver these enhanced returns and the wider real estate industry

reach its net zero carbon targets.

The relative outperformance of the underlying portfolio during

the market correction has demonstrated the benefits of owning a

diversified portfolio, with expertise to invest across all sectors.

The portfolio remains diversified, but with a higher weighting to

sectors and assets expected to deliver higher total returns and

income growth. Approximately half the portfolio by value comprises

multi-let industrial estates, and exposure to retail warehousing

increased slightly to 11.6% during the year. The exposure to

offices was unchanged at 27.5% and, although the occupational

market remains more challenging, progress has been made reducing

risk through lease extensions to retain existing tenants, targeted

refurbishment programmes to improve letting prospects, including by

improving environmental and social credentials, and to support

potential disposals.

During the year, we acquired a higher yielding mixed-use office

and retail building in Manchester and, post year end, a small

adjoining ownership in Chelmsford. Three disposals completed or

contracted totalling GBP12.6 million at a 13% average premium to

the valuation at the start of the financial year, with one office

asset having exchanged contracts at the year end, due to complete

in June. The primary focus has been on optimising earnings across

the existing portfolio through an extensive asset management and

targeted capital expenditure programme, targeting growth areas and

sustainability improvements. The ongoing development at Stanley

Green Trading Estate in Manchester, the first operational net zero

scheme in the North West, completed post year end, has contributed

strongly to performance with approximately 40% already let or in

legals. Other examples include pre-lettings to Starbucks for

'drive-thru's' at two retail warehouse assets which are currently

under construction.

Successful implementation of the strategy means we are well

positioned in terms of income characteristics. As noted in the

overview, the portfolio generates a materially higher income return

compared with the Benchmark, with the high reversionary yield of

8.0% also comparing favourably with the Benchmark at 5.7%.

Furthermore, the portfolio is highly diversified, with 312 tenants

across 41 assets.

The Manager's active approach, leveraging the wider Schroders

Capital Real Estate platform of 42 sector and regional specialists,

resulted in 65 lettings exchanging or completing since the start of

the financial year, totalling GBP6.7 million of annualised rental

income. Improving the portfolio's defensive qualities has been a

key focus, with major lease agreements completed during the year

with large corporate occupiers and educational providers such as

Siemens, IXYS Westcode, and Buckinghamshire New University. This

active approach has supported high rental collection rates, with

99% collected over the financial year and a reduction in the

portfolio void rate on a like-for-like basis.

The market correction and weak investor sentiment means

virtually all listed real estate owners are now trading at material

discounts to asset value. Although our share price rating improved

over the year, driven by a high, fully covered dividend, and a

sector leading debt profile, the Board and Manager are highly

focused on delivering a further improvement by clearly articulating

the opportunities within the portfolio and attracting a more

diverse shareholder base.

Sustainability

Our strategic focus on improving sustainability performance,

where the Manager has a strong track record, has delivered positive

results at both an asset and portfolio level. The Company achieved

a further improvement in its Global Real Estate Sustainability

Benchmark ('GRESB') score, placing it first amongst a group

comprising seven diversified REITs. The EPC profile of the

portfolio has improved markedly and the Company's first 'A+'

ratings were achieved at the development at Stanley Green Trading

Estate.

We are also making progress with our pathway to net zero

commitments, with a 10% and 19% reduction in the Company's energy

intensity and greenhouse gas intensity targets over the most recent

reporting period. The Company also retained its Gold level

compliance with the EPRA Sustainability Best Practice

Recommendations for the fifth successive year.

Balance sheet

The average interest rate for total debt drawn at the year end

was 2.9%, with an average maturity of 10.6 years, and 90% either

fixed or hedged against movements in interest rates.

The debt refinancing with Canada Life in 2019 is now providing a

significant benefit in a higher interest rate environment. This

long term loan, that represented GBP129.6 million of the GBP177.9

million total borrowings at the year end, has an average loan

maturity of 13.1 years, with a fixed average interest rate of 2.5%.

At the year end, incremental positive fair value benefit of this

fixed rate loan was GBP16.8 million, which is not reflected in the

Company's NAV.

The balance of borrowings at the year end totalling GBP48.3

million comprised a revolving credit facility ('RCF') from RBSI.

This is used as a tactical facility that can be drawn and repaid at

any time. To provide additional capacity to invest into the

portfolio and pursue market opportunities, during the year the

total amount that can be drawn was increased to GBP75.0 million,

with the loan maturity extended by 4.2 years to June 2027. GBP30.5

million of the RCF benefitted from an interest rate cap at 1.5%,

which was due to expire in July 2023 and, together with the RCF

margin of 1.65%, resulted in an average interest rate on the drawn

RCF of 4.1% at the year end.

Since the year end, this cap has been replaced with a hedging

instrument termed an interest rate 'collar' which applies to

GBP30.5 million of the GBP48.3 million now drawn. The collar, which

runs to the end of the RCF term in June 2027, allows the Company to

benefit from future falls in interest rates down to a 3.25% floor,

whilst at the same time protecting the Company from rate increases

above 4.25%. After netting off the value of the interest rate cap,

the net cost of the collar was GBP567,000.

Since the year end, the RCF has also been converted into a

'Sustainability Linked Loan', with criteria linked to reduced

energy consumption, future improvements in the GRESB rating and

building certification linked to building improvements.

At the year end, the Company had a net loan to value ('LTV')

ratio of 36.0%, which is slightly above the long-term strategic

target range of 25% to 35%. The Company has significant headroom

against all loan covenants, but steps are being taken to bring the

net LTV back in line with the target range, including contracted

and further planned disposals, which are set out in the Manager's

Report.

Board succession

Since Lorraine Baldry's retirement as Chair in July 2022, I have

continued our comprehensive succession planning process. Following

Graham Basham's subsequent retirement in November 2022, the Company

appointed Alexandra Innes as an Independent Non-Executive Director.

Alexandra has a strong track record across investment banking and

investment management, with relevant non-executive roles at the

Bank of England, Securities Trust of Scotland PLC and Knight Frank

LLP. As part of the succession process, the Board asked the

appointed specialist search firm to review Board remuneration

levels, which were last reviewed and increased in 2015. This

resulted in an aggregate increase of GBP20,000, or 13%. On behalf

of my fellow directors and the Manager, we would like to thank

Lorraine and Graham again for their service to the Company.

Independent valuers

It is expected that the Standards and Regulation Board of the

Royal Institution of Chartered Surveyors (the 'RICS') will adopt

the recommendations relating to governance and valuer rotation

outlined in the independent review of January 2022, although final

details are still to be confirmed by the RICS.

In preparation for these changes, and following a comprehensive

tender process, CBRE Limited ('CBRE') have replaced Knight Frank

LLP, the Company's principal independent valuer since 2004. CBRE

prepared the valuation used within these accounts and have entered

into a three year contract at a material fee saving. CBRE will also

replace BNP Paribas as valuer of the Company's two joint venture

investments with effect from 30 June 2023. On behalf of my fellow

directors and the Manager, I would like to thank Knight Frank for

their service to the Company.

Outlook

The UK economy continues to face headwinds this year as higher

inflation and interest rates cause consumers to retrench, reducing

disposable incomes and hitting household demand for goods and

services. Although inflation pressures are expected to ease, and

recent surveys indicate improved business confidence, an imbalanced

UK labour market means wage growth remains a significant

burden.

On a more positive note, there are signs that real estate values

are stabilising, and approaching long term fair value. The

attractive portfolio yield profile and pipeline of asset management

activity should contribute to continued earnings and dividend

growth, further improve the defensive qualities of the portfolio,

and enhance returns as the market recovers.

Whilst a relaxation in monetary policy is expected in 2024,

interest rates will remain elevated compared with recent past. The

prudent balance sheet management implemented by the Company,

resulting in the lowest cost, longest duration debt in the peer

group, largely removes this risk to earnings, and provides a solid

foundation to deliver future dividend growth.

Finally, as sustainability considerations become even more

important for investors and occupiers, we are making good progress

evolving our strategy, which we believe should clearly

differentiate the Company and help to drive more sustainable,

long-term returns. We anticipate providing further details on this

later in the year.

Alastair Hughes

Chair

Schroder Real Estate Investment Trust Limited

7 June 2023

Investment Manager's Report

Financial results

Schroder Real Estate Investment Trust Limited's ('SREIT', or

'the Company') net asset value ('NAV') as at 31 March 2023 was

GBP300.7 million or 61.5 pence per share ('pps'), compared with

GBP372.2 million, or 75.8 pps, as at 31 March 2022. This reflected

a decrease over the financial year of -14.3 pps or -18.9%. During

the period, dividends totalling GBP15.8 million were paid, which

resulted in a NAV total return of -15.1%. A detailed analysis of

the NAV movement is set out in the table below:

GBPm PPS

------------------------------------------------------- ------- -------

NAV as at 31 March 2022(1) 372.2 75.8

------------------------------------------------------- ------- -------

Unrealised change in the valuations of the direct

real estate portfolio and joint ventures(2) (61.1) (12.4)

------------------------------------------------------- ------- -------

Capital expenditure(3) (10.2) (2.1)

------------------------------------------------------- ------- -------

Acquisition costs (1.0) (0.2)

------------------------------------------------------- ------- -------

Realised gain on disposals, net of disposal costs 1.2 0.2

------------------------------------------------------- ------- -------

EPRA earnings(4) 16.0 3.3

------------------------------------------------------- ------- -------

Dividends paid (15.8) (3.2)

------------------------------------------------------- ------- -------

Others 0.4 0.0

------------------------------------------------------- ------- -------

NAV as at 31 March 2023 (excluding the share buyback) 301.7 61.4

------------------------------------------------------- ------- -------

Share buyback (1.0) 0.1

------------------------------------------------------- ------- -------

NAV as at 31 March 2023(5) 300.7 61.5

------------------------------------------------------- ------- -------

1. The calculation of pence per share is based on shares in

issue as at 31 March 2022 of 491,080,301.

2. Prior to all capital expenditure, acquisition costs and

movement in IFRS 16 lease incentives.

3. Comprises capital expenditure of GBP10.1 million on the

directly held portfolio and GBP0.1 million invested for the joint

ventures.

4. EPRA earnings as per the reconciliation on page 98.

5. The calculation of pence per share is based on shares in

issue as at 31 March 2023 of 489,110,576.

The underlying portfolio, including joint ventures and net of

capital expenditure, decreased in value by -13.1% on a

like-for-like basis over the financial year to 31 March 2023.

GBP 10.2 million of capital expenditure was invested in asset

management and redevelopment projects, including joint ventures,

that should drive capital growth and future rental increases over

the medium to longer term. GBP7.5 million of this related to the

operational net zero warehouse development at Stanley Green Trading

Estate in Cheadle, Greater Manchester.

Acquisition costs totalling GBP900,000 were incurred relating to

the acquisition of St. Ann's House, a mixed-use office and retail

asset in Manchester for GBP14.7 million in May 2022. Acquisition

costs totalling GBP58,792 were incurred relating to the acquisition

of 68 High Street, Chelmsford, for GBP800,000, which adjoins an

existing asset, where the rationale is to create a more liquid

investment.

During the financial year two sales were completed for a

combined price of GBP8.6 million, which was a 28.4% increase on the

31 March 2022 combined independent valuation of GBP6.7 million.

After transaction costs of GBP200,000, the aggregate realised gain

on disposal was GBP1.7 million. During the year unconditional

contracts were exchanged to sell an office for GBP4.0 million which

compared with a valuation at the start of the financial year of

GBP4.5 million and GBP4.0 million at the year end.

EPRA earnings for the period totalled GBP16.0 million, or 3.3

pps, an increase of GBP300,000 or 1.9%, on the prior financial year

of GBP15.7 million. This increase was driven by asset

management-led rental value growth, a positive contribution from

the off-market, higher yielding industrial portfolio acquired in

December 2021, and the St. Ann's House acquisition.

Between 28 July 2022 and 15 September 2022 the Company acquired

1,969,725 shares under its share buyback programme for GBP1.0

million, which reflected an average cost of 50.6 pps and a discount

to the 31 March 2022 NAV of 33%.

Our strategy

Investment objective

The Company aims to provide shareholders with an attractive

level of income with the potential for long term, sustainable

income and capital growth.

Investment strategy

The strategy to deliver this, and progress made during the year

and since year end, is set out below:

- Apply a research-led approach to determine attractive sectors

and locations in which to invest in commercial real estate

o Increased allocation to higher growth sectors, with

industrial, predominately multi-let estates, and retail warehousing

now comprising 58.6% by value

- Increase exposure to larger assets with strong fundamentals

and inherent opportunities for active management and

development

o Acquired St. Ann's House in Manchester, made significant

investment into Stanley Green Trading Estate also in Manchester.

Our top 15 assets now represent 78.5% of value.

- Sell smaller, secondary assets with higher sustainability performance risk

o Sold three small assets (two completed, one unconditionally

exchanged) at a 12.5% premium to the value at the start of the

year, with further small disposals expected

- Drive income and value growth through a hospitality approach

in tenant management (optimising tenant services and lease terms)

and operational excellence in all sectors (optimising operations in

the assets, minimising use of scarce resources and waste)

o Operationally net zero carbon developments at two industrial

estates, collaborating with Starbucks to develop 'drive-thru'

restaurants at two retail parks, negotiating regears with major

tenants Buckinghamshire New University and University of Law in

return for sustainability related asset improvements

- Apply our integrated sustainability and ESG approach at all

stages of the investment process and asset life cycle, targeting

improvement in the sustainability performance of assets to

manufacture the green premium for shareholders

o Further improvement in the Global Real Estate Sustainability

Benchmark ('GRESB') score to 77 out of 100 in 2022 (2021: 75),

achieving the maximum possible result for the management aspects of

the assessment and placing SREIT first amongst a group comprising

seven diversified REITs (2021: second of eight)

- Control costs

o Ongoing charges (including fund and property expenses) of

2.28% broadly in line with 2.21% for the prior financial year and

below the five year average of 2.30%

- Maintain a strong balance sheet with a long-term strategic

target loan to value, net of cash, within the range of 25% to

35%

o The Company has a peer group leading debt profile, with a

clear strategy to reduce the net LTV back to within the strategic

range from 36.0% at the year end.

Portfolio performance

The underlying portfolio continues to deliver strong relative

outperformance, with a total return for the financial year of -7.9%

compared to -13.5% for the MSCI Benchmark (the 'Benchmark'). This

relative outperformance was partly due to a stronger income return

from the portfolio at 6.0% compared to 4.1% for the Benchmark.

Targeted capital expenditure in larger assets to improve

sustainability performance and benefit from structural trends led

to significantly stronger rental value growth for the portfolio at

9.2% compared to 3.4% for the Benchmark. A key example of this

strategy is the operationally net zero carbon development at

Stanley Green Trading Estate in Cheadle, Greater Manchester, which

completed this May. A smaller proportionate increase in yields

resulted in a lower fall in capital values of -13.1% for the

portfolio compared to -16.9% for the Benchmark, which was mainly

driven by the higher yielding regional industrial portfolio.

The table below shows performance to 31 March 2023.

SREIT Total Return MSCI Benchmark* Relative

Total Return

Period One Three Since One Three Since One Three Since

to 31 March year years IPO** year years IPO** year years IPO**

2023 (%) (% p.a.) (% p.a.) (%) (% p.a.) (% p.a.) (%) (% p.a.) (% p.a.)

------ ---------- ---------- ------ ---------- ---------- ------ ---------- ----------

Retail -6.9 1.4 3.9 -8.1 -0.1 3.1 1.4 1.5 0.7

------ ---------- ---------- ------ ---------- ---------- ------ ---------- ----------

Office -8.9 1.4 7.0 -12.7 -2.5 5.9 4.4 4.0 1.0

------ ---------- ---------- ------ ---------- ---------- ------ ---------- ----------

Industrial -8.0 13.4 10.1 -21.0 8.3 8.6 16.4 4.7 1.4

------ ---------- ---------- ------ ---------- ---------- ------ ---------- ----------

Other 0.3 6.0 3.4 -6.4 1.0 6.5 7.2 4.9 -2.9

------ ---------- ---------- ------ ---------- ---------- ------ ---------- ----------

All sectors -7.9 6.0 7.1 -13.5 1.9 5.6 6.4 4.0 1.5

------ ---------- ---------- ------ ---------- ---------- ------ ---------- ----------

*MSCI Benchmark is formally 'MSCI UK Balanced Portfolios

Quarterly Property Index (unfrozen);

**IPO in July 2004

Real estate portfolio

As at 31 March 2023, the portfolio comprised 41 properties

valued at GBP470.4 million. This includes the share of joint

venture properties at City Tower in Manchester and the University

of Law in Bloomsbury, London. The portfolio generated rental income

of GBP29.3 [12] million per annum, reflecting a net initial yield

of 5.8%, which compared with the Benchmark 4.8%. The portfolio also

benefits from fixed contractual annualised rental income uplifts of

GBP2.0 million per annum over the next 24 months. The independent

valuers' estimated rental value ('ERV') of the portfolio is GBP37.8

million per annum, reflecting a reversionary income yield of 8.0%,

which compares favourably with the Benchmark at 5.7%.

The portfolio is diverse and granular should support more

resilient portfolio income in a weaker economic environment and a

more challenging period for consumers and businesses. The portfolio

is also both higher yielding with potential for more rental growth

relative to the Benchmark which positions it well for a higher

interest rate environment and where capital growth is muted in the

short term.

The portfolio is overweight multi let industrial estates where

we consider supply and demand dynamics to be favourable given there

has been relatively limited development. This is evidenced by the

rent reviews and lease renewals that we have completed since the

beginning of the financial year, where rents were agreed 24% higher

than the previous level. In addition, there is an overweight

position in retail warehouses, where we have sustainable levels of

rent and limited exposure to fashion. This is the only part of the

market which has seen a meaningful fall in vacancy since the

pandemic and we expect continued rental growth.

At the period end the portfolio void rate was 11.1%, calculated

as a percentage of estimated rental value. Excluding the recently

completed Stanley Green Trading Estate developed units, the

portfolio void rate reduced on a like for like basis from 8.6% to

7.9%, in the middle of the ten year range of 5-13% and compares

with the Benchmark void rate of 8.0%. The portfolio weighted

average lease length, calculated to the earlier of lease expiry or

break, is 5.0 years.

Approximately 11% of the portfolio by contracted rent is

inflation linked, typically structured as five yearly reviews to

either the Retail Price Index ('RPI') or the Consumer Price Index

('CPI'). In some cases these inflation-linked leases can also be

reviewed to open market value, if higher, or include fixed

guaranteed increases. A further 12% of rent benefits from fixed

uplifts without an inflation link. The proportion of the portfolio

with inflation-linked leases should increase with ongoing asset

management activity.

The tables below summarise the portfolio information as at 31

March 2023. The property values and weightings represent the year

end valuations as determined by the independent valuers as at 31

March 2023:

Portfolio metric SREIT 31 March 2023 SREIT 31 March 2022

(MSCI 31 March 2023) (MSCI 31 March 2022)

Portfolio value (GBPm) 470.4 523.5

----------------------------------------------- ----------------------- -----------------------

Number of properties 41 42

----------------------------------------------- ----------------------- -----------------------

Number of tenants 312 315

----------------------------------------------- ----------------------- -----------------------

Average lot size (GBPm) 11.5 12.5

----------------------------------------------- ----------------------- -----------------------

Net initial yield (%) 5.8 (4.8) 5.4 (3.9)

----------------------------------------------- ----------------------- -----------------------

Reversionary yield (%) 8.0 (5.7) 6.4 (4.6)

----------------------------------------------- ----------------------- -----------------------

Annual rent (GBPm) 29.3 30.1

----------------------------------------------- ----------------------- -----------------------

Estimated rental value (GBPm) 37.8 33.8

----------------------------------------------- ----------------------- -----------------------

Annual rent with inflation linked uplifts (%) 11 15

----------------------------------------------- ----------------------- -----------------------

Annual rent with fixed uplifts (%) 12 5

----------------------------------------------- ----------------------- -----------------------

WAULT (years to earliest of break or expiry) 5.0 (11.2) 5.4 (11.4)

----------------------------------------------- ----------------------- -----------------------

Void rate (%) 11.1 (8.0) 7.0 (7.8)

----------------------------------------------- ----------------------- -----------------------

Top 15 properties by value Sector Value (GBPm) % of portfolio

[13] value [14]

------------------------------------ --------------------- ------------- ---------------

Milton Keynes, Stacey

1 Bushes Industrial Estate Industrial 50.5 10.7

--- ------------------------------- --------------------- ------------- ---------------

Leeds, Millshaw Park

2 Industrial Estate Industrial 45.5 9.7

--- ------------------------------- --------------------- ------------- ---------------

London, Store Street,

The University of Law

3 Campus (50% share) Office/university 37.8 8.0

--- ------------------------------- --------------------- ------------- ---------------

Cheadle, Stanley Green

4 Trading Estate Industrial 35.5 7.5

--- ------------------------------- --------------------- ------------- ---------------

Manchester, City Tower Office/hotel/retail/

5 (25% share) leisure/car park 34.0 7.2

--- ------------------------------- --------------------- ------------- ---------------

Bedford, St. John's Retail

6 Park Retail warehouse 31.0 6.6

--- ------------------------------- --------------------- ------------- ---------------

Chippenham, Langley Park

7 Industrial Estate Industrial 24.7 5.3

--- ------------------------------- --------------------- ------------- ---------------

Norwich, Union Park Industrial

8 Estate Industrial 21.6 4.6

--- ------------------------------- --------------------- ------------- ---------------

9 Leeds, Headingley Central Retail/hotel/leisure 20.8 4.4

--- ------------------------------- --------------------- ------------- ---------------

Manchester, St. Ann's

10 House Office/retail 12.6 2.7

--- ------------------------------- --------------------- ------------- ---------------

Uxbridge, 106 Oxford

11 Road Office/university 12.5 2.7

--- ------------------------------- --------------------- ------------- ---------------

Telford, Horton Park

12 Industrial Park Industrial 12.1 2.6

--- ------------------------------- --------------------- ------------- ---------------

Birkenhead, Valley Park

13 Industrial Estate Industrial 12.0 2.6

--- ------------------------------- --------------------- ------------- ---------------

14 Edinburgh, The Tun Office 9.4 2.0

--- ------------------------------- --------------------- ------------- ---------------

15 Milton Keynes, Matalan Retail warehouse 9.4 2.0

--- ------------------------------- --------------------- ------------- ---------------

Total as at 31 March

2023 369.4 78.5

--- ------------------------------- --------------------- ------------- ---------------

Sector weighting by Like-for-like net of

value as at 31 March capex capital growth

2023 for the 12 month period

ended 31 March 2023

SREIT(1) Benchmark(1) SREIT Benchmark

========================================= ========= ============= =========== ==============

South East 10.7% 19.6%

========================================= ============= =========== ==============

Rest of UK 36.1% 11.7%

========================================= ========= ============= =========== ==============

Industrial 46.8% 31.2% -12.6% -23.8%

========================================= ============= =========== ==============

City 0.0% 3.6%

========================================= ========= ============= =========== ==============

Mid-town and West End 8.0% 6.9%

========================================= ============= =========== ==============

Rest of South East 4.5% 7.3%

========================================= ========= ============= =========== ==============

Rest of UK 15.0% 7.3%

========================================= ============= =========== ==============

Offices 27.5% 25.2% -14.7% -15.8%

========================================= ========= ============= =========== ==============

Retail warehouse 11.8% 9.8% -9.1% -12.0%

========================================= ============= =========== ==============

South East 0.9% 6.7%

========================================= ========= ============= =========== ==============

Rest of UK 6.7% 3.0%

========================================= ============= =========== ==============

Standard retail 7.7% 9.7% -17.7% -14.1%

========================================= ========= ============= =========== ==============

Standard retail by ancillary/single use

========================================= ============= =========== ==============

- Retail ancillary to main use 4.9% -

========================================= ========= ============= =========== ==============

- Retail single use 2.8% -

========================================= ============= =========== ==============

Other 6.2% 18.1% -9.5% -10.3%

========================================= ========= ============= =========== ==============

Shopping centres - 2.1%

========================================= ============= =========== ==============

Unattributed indirects - 3.8%

========================================= ========= ============= =========== ==============

(1) Note: columns do not sum due to rounding.

Regional weighting by value as at 31 March

2023

SREIT Benchmark

============================== ================= ==========================

Central London 8.0% 17.1%

============================== ==========================

South East excluding Central

London 18.2% 34.5%

============================== ================= ==========================

Rest of South 10.5% 16.2%

============================== ==========================

Midlands and Wales 21.0% 13.2%

============================== ================= ==========================

North 40.3% 14.4%

============================== ==========================

Scotland 2.0% 4.4%

============================== ================= ==========================

Northern Ireland 0.0% 0.2%

============================== ==========================

Rental income is diverse and as at 31 March 2023 comprised 312

tenants, including the tenants of properties held by joint

ventures. The largest and top 15 tenants represent 7.06% and 33.04%

of the portfolio respectively, calculated as a percentage of annual

rent, and there are only two tenants that represent more than 3% of

annual rent.

Top 15 tenants by annual rent Annual rent (GBP % of total

million) annual rent

University of Law Limited 2.07 7.06%

===================================== ================= =============

Siemens Mobility Limited 1.22 4.16%

===================================== =============

Express Bi Folding Doors Limited 0.65 2.22%

===================================== ================= =============

The Secretary of State 0.59 2.01%

===================================== =============

Buckinghamshire New University 0.58 1.98%

===================================== ================= =============

Matalan Retail Limited 0.57 1.95%

===================================== =============

Cineworld Cinema Properties Limited 0.52 1.77%

===================================== ================= =============

TJX UK t/a HomeSense 0.51 1.74%

===================================== =============

IXYS UK Westcode Limited 0.47 1.60%

===================================== ================= =============

Jupiter Hotels Limited 0.46 1.57%

===================================== =============

Premier Inn Hotels Limited 0.42 1.43%

===================================== ================= =============

Lidl Great Britain Limited 0.42 1.43%

===================================== =============

Ingeus (UK) Limited 0.41 1.40%

===================================== ================= =============

Wickes Building Supplies Limited 0.40 1.37%

===================================== =============

Balfour Beatty Group Limited 0.39 1.33%

===================================== ================= =============

Total as at 31 March 2023 9.68 33.04%

===================================== =============

(1) Note: column does not sum due to rounding.

Rent collection

The diversification and granularity of the underlying rental

income, and a high level of occupier engagement, has supported

improving rent collection rates with 99% of the contracted rents

collected for the quarter to 31 March 2023. The breakdown between

sectors is 100% of office rent collected, 100% of industrial rent

collected and 97% of retail, leisure and other rent collected.

The Company has made good progress collecting historical arrears

during the year which totalled GBP3.3 million, net of VAT, at the

year end, of which GBP360,000 is provided against as a bad debt.

This compares to GBP3.8 million and GBP900,000 respectively as at

31 March 2022.

Transactions

Manchester, St. Ann's House (Mixed-use office and retail)

St. Ann's House in Manchester was acquired on 27 May 2022 for a

gross headline price of GBP14.7 million, reflecting a net initial

yield of 7.8%, a reversionary yield of 9.1% and a low average

capital value of GBP283 per sq ft. The mixed-use office and retail

asset generates GBP1.22 million per annum of headline rent compared

with an ERV of GBP1.33 million.

The freehold, 51,754 sq ft building, is 97% occupied by ERV and

comprises 40,277 sq ft of office space over five upper floors with

five retail units at the ground floor level and ancillary basement

space. It is prominently located on St. Ann's Square, near to the

prime retail core. St. Ann's Square features a listed church, the

Royal Exchange theatre, a mix of office occupiers and high-quality

luxury retail as well as leisure operators. The building benefits

from its close proximity to two tram stations.

The office space is fully let to four office tenants at an

average rent of GBP18.48 per sq ft, with the potential to increase

rental levels through refurbishment and improving sustainability

performance. There is also the opportunity to enhance income by

offering fitted out office space.

The appeal of St. Ann's Square to high quality luxury retailers

is reflected in the current tenant mix with complementary retailers

located in close proximity. During the pandemic rents were rebased

by the previous landlord and there are currently no arrears. At

acquisition, the tenants were Watches of Switzerland, Russell &

Bromley and Space NK. Since acquisition, we have let a unit to

David M Robinson Limited, a north-west based retailer of luxury

watches and jewellery, for GBP70,000 per annum, or GBP76.75 per sq

ft.

The weighted average unexpired lease term is 2.2 years to

earliest termination and 4.8 years to lease expiries. 58% of the

property by floor area currently has an EPC rating of 'B' with the

remainder rated 'C'.

The strategy is to undertake a rebranding of the building,

introduce additional amenities for the offices such as bike and

shower facilities and refurbish the property as floors become

available with a focus on improving sustainability performance.

This will increase the rental tone of the offices. We will aim to

leverage the close proximity of luxury jewellers and watch

retailers to attract similar occupiers to the subject asset at

higher rents.

Chelmsford, 68 High Street (Retail)

In March 2023, 68 High Street in Chelmsford was acquired for

GBP800,000, reflecting a net initial yield of 11.1%. This is an

adjoining ownership to 67 High Street, with both units let to

Esquire Retail on a lease expiring in September 2023.

Simultaneously, an agreement for lease was reached with

Co-operative Bank plc for them to take a new 10 year lease without

breaks with effect from September at a new rent of GBP175,000.

There will be 12 months rent free and we will make a capital

contribution of GBP110,000. The acquisition and letting are

expected to facilitate a profitable disposal of the combined

units.

Portsmouth, Southlink (Industrial)

In June 2022 Southlink, a 26,975 sq ft single let industrial

asset in Portsmouth, was sold for GBP6.5 million. The price

compares with the 31 March 2022 independent valuation of GBP4.9

million and reflects a net initial yield of 3.2%.

Situated within the Walton Road Industrial area, Southlink was

acquired in July 2004. The asset produced a net rent of GBP225,000

per annum with a lease term of 2.4 years. Based on the disposal

price, the asset has generated an ungeared total return of 13.2%

per annum since acquisition, compared with the All Property MSCI

Benchmark for the same period of 6.8% per annum, and MSCI All

Industrial for the same period of 10.6% per annum.

Rugby, Morgan Sindall House (Office)

In March 2023, contracts were exchanged to sell Morgan Sindall

House, a 34,334 sq ft single let office asset in Rugby for GBP4.0

million. The price is in line with the year end independent

valuation.

The asset produces a net rent of GBP375,378 per annum with a

lease term of 5.9 years. Based on the disposal price, the asset has

generated an ungeared total return of 7.2% per annum since

acquisition, compared with the All Property MSCI Benchmark for the

same period of 6.2% per annum, and MSCI All Office for the same

period of 5.7% per annum.

Beech House, Fleet (Office)

Beech House, a 13,174 sq ft office asset in Fleet, was sold on

24 November 2022 for GBP2.1 million, 17% ahead of the 30 September

2022 independent valuation of GBP1.8 million and reflecting a net

initial yield of 7.8%. The asset was acquired in 2004 as part of a

bigger interest that has been broken up, and hence there is no

asset level performance data.

Further disposals of lower value, non-core properties are under

consideration and being progressed.

Active asset management

In aggregate, 65 new lettings, rent reviews and renewals

completed since the start of the period totalling GBP6.7 million in

annualised rental income and generating GBP2.3 million per annum of

additional rent above the previous level.

Set out below are examples of ongoing active asset management

initiatives that should support continued outperformance of the

underlying portfolio from both a financial and sustainability

perspective.

Manchester, Cheadle, Stanley Green Trading Estate

(Industrial)

Asset overview and performance

Stanley Green Trading Estate in Cheadle, Manchester was acquired

in December 2020 for GBP17.3 million. Following completion of a new

warehouse development this May, the asset comprises 233,730 sq ft

of trade counter, self-storage and warehouse accommodation across

25 units on a nine acre site.

As at 31 March 2023 the valuation was GBP35.5 million,

reflecting a net initial yield of 2.6% and a reversionary yield of

6.9%. Over the financial year the asset delivered a total return of

14.1% which compared with MSCI All Industrial over the same period

of -21.0%.

Asset strategy

The strategy over the financial year was to crystallise higher

rents, develop the 80,000 sq ft, operational net zero carbon

('NZC') scheme on the 3.4 acre site and begin marketing to pre-let

the new accommodation.

Key activity

- The speculative development of 11 warehouse and trade units

has completed with GBP8.1 million of capital expenditure incurred

on the project from inception to the year end. The target rental

income is GBP1.3 million per annum, or GBP16.41 per sq ft.

- The new units have achieved an 'A+' EPC rating and we are

targeting a BREEAM Excellent accreditation.

- Approximately 40% of the new estate is already let or in

legals. The objective is for the entire scheme to be let this

calendar year.

- Negotiations are progressing with a number of occupiers to

re-gear their leases across the original trading estate which

should support continued income growth.

Chippenham, Langley Park Industrial Estate (Industrial)

Asset overview and performance

Langley Park Trading Estate in Chippenham was acquired in

December 2020 for GBP19.3 million and comprises a multi-let

industrial estate comprising 400,000 sq ft of warehouse and

ancillary office accommodation on a large site of 28 acres located

close to Chippenham town centre. As at 31 March 2023, the valuation

of GBP24.7 million reflected a net initial yield of 6.5% and a

reversionary yield of 8.4%. Over the financial year the asset

delivered a total return of -3.4%, which compared with the MSCI All

Industrial Benchmark over the same period of -21.0%.

Asset strategy

The strategy over the period was to drive net income growth, the

average unexpired lease term, and quality of accommodation across

the estate.

Key activity

- Siemens Mobility Limited ('Siemens') rent review completed in

June 2022 at GBP1.2 million per annum or GBP4.64 per sq ft,

reflecting a 26% increase in contracted rental income. Following

completion of the rent review, which was backdated to June 2021,

Siemens became the Company's second largest tenant.

- A new ten year lease renewal without breaks completed in May

2022 with IXYS UK Westcode Limited ('IXYS'), the UK subsidiary of

Littelfuse, a global manufacturer which has provided a parent

company guarantee. The rent is GBP465,000 per annum, or GBP5.50 per

sq ft, reflecting a 31% increase over the previous contracted rent

of GBP355,000 per annum. IXYS receive 12 months' rent free which

ends in December 2023, and will receive a contribution to repair

works up to the value of GBP250,000 if undertaken within two years

of lease completion. The lease includes a rent review at year five

to the higher of open market value or RPI, with a collar of 1% per

annum and a cap of 5% per annum.

- The next phase of the business plan at Langley Park is to

consider longer term development plans which could involve the

creation of new space for existing tenants. Any development of new

warehouse units would be to an operational net zero carbon ("NZC")

standard and a pre-planning application to develop 130,000 sq ft of

space has been submitted to Wiltshire County Council.

Bedford, St. John's Retail Park (Retail warehouse)

Asset overview and performance

St. John's Retail Park comprises a 120,000 sq ft retail

warehouse scheme underpinned by income from tenants including Lidl,

Home Bargains, Bensons for Beds, TK Maxx and Costa, with an average

lease term, to the earlier of lease expiry of break, of 6.5 years.

The asset benefits from an affluent catchment and has good parking.

As at 31 March 2023, the asset was valued at GBP31.0 million

reflecting a net initial income yield of 6.2% and a reversionary

yield of 6.1%. Over the financial year the asset delivered a total

return of -1.4% which compared with the MSCI All Retail Warehousing

over the same period of -7.0%.

Asset strategy

The strategy over the year was to let vacant units, improve

retailer mix and retain tenants by negotiating new longer term

leases.

Key activity

- Resolution to grant planning consent has been received from

Bedford Borough Council for a new 'drive thru' at St. John's Retail

Park. As previously reported, a 15-year pre-let has completed with

Starbucks Coffee Company UK Limited ('Starbucks') who are now

constructing a new unit on the site and will receive a contribution

towards construction costs capped at GBP850,000. The rent is

GBP145,000 per annum, increasing by 10% of any construction cost in

excess of GBP750,000, capped at an additional GBP10,000 of rent per

annum. The yield on cost assuming the maximum construction cost,

including the current site value of GBP1.3 million, is therefore

7.2%.

- Starbucks are required to deliver the restaurant to a minimum

BREEAM rating of 'Very Good' and install electric vehicle charging

points for customer usage.

Balance sheet

At the year end, the average interest rate for drawn debt was

2.9%, with an average loan term of 10.6 years, and 90% of total

drawn debt was either fixed or hedged against movements in interest

rates.

The debt refinancing with Canada Life in 2019 is now providing a

significant benefit in a higher interest rate environment. This

long term loan, that represented GBP129.6 million of the GBP177.9

million total borrowings at the year end, has an average loan

maturity of 13.1 years, with a fixed average interest rate of 2.5%.

At the year end, the incremental positive fair value benefit of

this fixed rate loan was GBP16.8 million, which is not reflected in

the Company's NAV.

The balance of drawn debt at the year end totalling GBP48.3

million comprised a revolving credit facility ('RCF') from Royal

Bank of Scotland International ('RBSI').

At the year end, the Company had a net loan to value ('LTV')

ratio of 36.0%, which is slightly above the long-term strategic

target range of 25% to 35%. The Company has significant headroom

against all loan covenants, but steps are being taken to bring the

net LTV back in line with the target range, including contracted

and further planned disposals.

Details of the loans are set out below, together with cover

against covenants.

GBP129.6 million term loan with Canada Life

Lender Loan Maturity Total Asset Cash LTV LTV ICR ICR Projected Projected

(GBPm) interest value (GBPm) ratio ratio (%)(7) covenant ICR ICR

rate (GBPm) (%)(6) covenant (%)(7) (%)(4) covenant

(%) (%)(6) (%)(4)

Facility

A 64.8 15/10/2032 2.4 271.8 2.0 46.9 65 480 185 449 185

------- ----------- --------- ------- ------- ------- --------- ------- --------- ---------- ----------

Facility

B 64.8 15/10/2039 2.6

------- ----------- --------- ------- ------- ------- --------- ------- --------- ---------- ----------

Canada

Life

Term

Loan 129.6 2.5(5)

------- ----------- --------- ------- ------- ------- --------- ------- --------- ---------- ----------

- Net LTV on the secured assets against this loan is 46.9%. On

this basis the properties charged to Canada Life could fall in

value by 28% prior to the 65% LTV covenant being breached;

- The interest cover ratio is 480% based on actual net rents for

the quarter to 31 March 2023. A 61% fall in net income could be

sustained prior to the loan covenant of 185% being breached;

- The projected interest cover ratio is 449% based on projected

net rents for the year to 31 March 2023. A 59% fall in net income

could be sustained prior to the loan covenant of 185% being

breached; and

- After utilising available cash and uncharged properties, the

valuation and actual net rents could fall by 40% and 66%

respectively prior to either the LTV or interest cover ratio

covenants being breached.

GBP75.0 million revolving credit facility ('RCF') with RBSI

The Company has headroom with both LTV and ICR covenants as

summarised below:

Lender Loan/ Maturity Total Asset LTV LTV Projected Projected

amount interest value ratio ratio ICR (%)(8) ICR covenant

drawn (GBPm) rate (GBPm) (%)(6) covenant (%)(8)

(%) (%)(6)

RBSI

RCF 75.0/ 48.3(9) 06/06/2027 5.8(10) 160.8 30.0 60(11) 351 250

-------- --------------- ------------ ---------- -------- -------- ---------- ------------ --------------

- Net LTV on the secured assets against this loan is 30.0%. On

this basis the properties charged to RBSI could fall in value by

54% prior to the 65% LTV covenant being breached;

- The projected interest cover ratio is 351% based on actual net

rents for the quarter to 31 March 2023. A 39% fall in net income

could be sustained prior to the loan covenant of 250% being

breached;

- After utilising available cash and uncharged properties, the

valuation and actual net rents could fall by 69% and 51%

respectively prior to either the LTV or projected interest cover

ratio covenants being breached;

- At the year end, GBP30.5 million of the RCF benefited from an

interest rate cap with a strike rate of 1.5%, which was due to

expire on 3 July 2023 and, together with the RCF margin of 1.65%,

resulted in an interest rate of 3.15% on the capped element of the

RCF;

- At the year end, the uncapped element of the RCF was subject

to the SONIA rate of 4.18% which, together with the RCF margin of

1.65%, resulted in an interest rate of 5.83% on the uncapped

element of the RCF; and

- This resulted in an average interest rate on the drawn RCF of 4.1%.

Since the year end, the cap, which was due to expire on 3 July

2023, has been replaced with a hedging instrument termed an

interest rate 'collar' which applies to GBP30.5 million of the

GBP48.3 million now drawn. The collar, which runs to the end of the

RCF term in June 2027, allows the Company to benefit from future

falls in interest rates down to a 3.25% floor, whilst at the same

time protecting the Company from rate increases above 4.25%. After

netting off the value of the interest rate cap, the net cost of the

collar was GBP567,000.

Since the year end, the RCF has also been converted into a

'Sustainability Linked Loan', with performance measured against

KPIs, with each KPI having the potential to either reduce the

margin by 1.65 basis points, increase it by 1.65 basis points or

have no impact;

- Change in landlord energy consumption (year on year)

o A reduction by 5% or more: reduce the margin

o No change or a reduction below 5%: no change

o An increase: increase the margin

- GRESB rating

o 4 stars or above: reduce the margin

o 3 stars: no change

o 2 stars or below: increase the margin

- Development or refurbishment projects that improve EPC or

BREEAM rating to a minimum of EPC B or BREEAM Very Good

o If all new developments or major renovations of the properties

meet the requirement: reduce the margin

o If no property has been refurbished or developed: no

change

o If one or more new developments or major renovations of the

properties carried out during the term of the facility does not

meet the requirement: increase the margin

1. Cash held at the balance sheet date includes GBP300,000 of

cash that is held within the joint ventures.

2. Loan balance divided by the property values as at 31 March 2023.

3. For the quarter preceding the Interest Payment Date ( ' IPD '

), (rental income received - void rates, void service charge and

void insurance)/interest paid.

4. The projected ICR covenant for the contracted four quarters

following the IPD deducting assumed non-recoverable costs (void

rates, void service charge and void insurance)/interest paid, based

on the average of the past four quarters.

5. Fixed total interest rate for the loan term.

6. Loan balance divided by the property values as at 31 March 2023.

7. For the quarter preceding the IPD, (rental income received -

void rates, void service charge and void insurance)/interest

paid.

8. The projected ICR covenant of the contracted four quarters

following the IPD deducting assumed non-recoverable costs (void

rates, void service charge and void insurance)/interest paid) based

on the average of the past four quarters.

9. Facility drawn as at 31 March 2023 from a total available facility of GBP48.3 million.

10. Total interest rate as at 31 March 2023 comprising the SONIA

rate of 4.18% and the margin of 1.65% at a LTV below 60%. Should

the LTV be above 60%, the margin increases to 1.95%.

11. LTV ratio covenant of 65% for years one to three, then 60% for years four and five.

Outlook

The financial year was characterised by persistent inflation,

rising interest rates, market volatility and lower levels of

economic growth. This led to the sharpest correction in real estate

values since the global financial crisis. Whilst our asset values

were impacted, a diversified portfolio combined with good progress

over the period delivering on the strategy resulted in sustained

relative outperformance of the underlying portfolio and a further

increase in the fully covered dividend level.

The strength of the balance sheet, with long term, mainly fixed

rate, debt is a key competitive advantage and there will be limited

impact on the Company from higher interest rates.

Looking forward, our programme of sustainability-led value add

investments into the existing portfolio, and an active approach to

asset management is leading to further income growth, with a

pipeline of new opportunities under active consideration. We have a

robust and diverse tenant base that we expect to be resilient in a

weaker economic environment.

Against this backdrop, our combination of a clear strategy with

increased emphasis on sustainability, a diversified portfolio and a

strong balance sheet should enable us to maintain relative

outperformance compared with our peers and continue delivering

attractive income and total returns for shareholders.

Nick Montgomery

Fund Manager

7 June 2023

Sustainability Report

Key achievements

Progress towards net zero carbon by -19% reduction in whole building

2040 operational GHG intensity (between

2019/20 and 2021/22)

Improved GRESB score 3-star rating; 77 score (up from

75 in 2021); First in peer group

--------------------------------------

EPRA sBPR Awards for Sustainability Gold Award for fifth year running

Reporting

--------------------------------------

No. specialist sustainability audits 10

--------------------------------------

Increasing number of sustainability +3 BREEAM In-Use and +2 WiredScore

certifications completed in reporting (Nine assets total)

year

(Total no. assets with sustainability

certifications)

--------------------------------------

Increasing no. assets with on-site Two assets with solar PV*

renewables *Additional solar PV installed

as part of Stanley Green development

due to PC May 2023.

--------------------------------------

Improved EPC performance

* 100% MEES compliance

* EPC coverage = 97%

* EPCs above C rating = 58%

--------------------------------------

Sustainability Linked Loan tied to RCF agreed with RBSI

Our approach to sustainability

The Board and Manager believe that focusing on sustainability,

and Environmental, Social and Governance ('ESG') considerations

more generally, throughout the real estate life cycle, will deliver

enhanced long-term returns for shareholders as well as have a

positive impact on the environment and the communities where the

Company is investing. A key part of our sustainability strategy is

delivering operational excellence for occupiers as well as

demonstrating continued improvements in sustainability

performance.

The Manager's real estate investment strategy, which aims to

proactively take action to improve social and environment outcomes,

focuses on the pillars of 'People, Planet and Place' which are

referenced to three core UN Sustainable Development Goals ('SDGs'):

(8) Decent Work and Economic Growth; (13) Climate Action and (11)