Charlotte Russe Holding, Inc. (Nasdaq: CHIC) today announced

financial results for the third quarter and nine months ended June

27, 2009.

Third quarter fiscal 2009 net sales increased 4.9% to $202.7

million, compared to $193.2 million in the third quarter of fiscal

2008. Comparable store sales for the period decreased 3.6%. Net

income for the 2009 third quarter was $6.3 million, or $0.29 per

diluted share compared to $6.6 million, or $0.31 per diluted share,

for the same period in 2008. In the third quarter of fiscal 2009,

the Company recorded cash charges of $1.3 million related to

expenses for proxy solicitation, management transition and

severance, as well as costs related to the review of strategic

alternatives and subsequent sale process. Third quarter 2009

diluted earnings per share, excluding the aforementioned expenses,

were $0.33. The Company opened seven new stores and closed two

locations during the period.

Net sales for the nine month period ended June 27, 2009

increased 2.9% to $634.6 million compared to $616.5 million in the

same period of fiscal 2008. Comparable store sales for the period

decreased 7.1%. Net income for the first nine months of fiscal 2009

was $2.5 million, or $0.12 per diluted share, compared to $24.8

million, or $1.04 per diluted share, for the same period in fiscal

2008. In the first nine months of fiscal 2009, the Company recorded

cash charges of $5.0 million related to expenses for proxy

solicitation, management transition and severance, as well as costs

associated with the review of strategic alternatives and subsequent

sale process. The Company also recorded a non-cash charge of $1.6

million for store impairment. Diluted earnings per share, excluding

the aforementioned expenses, were $0.29.

At June 27, 2009, the Company had $60.0 million in cash and no

long-term debt. Cash flow from operations in the first nine months

of fiscal 2009 totaled $31.6 million.

� � Third Quarter Ended Nine Months Ended June 27, � June 28, June

27, � June 28, (in thousands, except per share data) 2009 2008 2009

2008 � Net sales $ 202,711 $ 193,233 $ 634,617 $ 616,528 GAAP net

income $ 6,255 $ 6,577 $ 2,524 $ 24,811 GAAP net income per share:

Basic $ 0.30 $ 0.31 $ 0.12 $ 1.05 Diluted $ 0.29 $ 0.31 $ 0.12 $

1.04 � Non-GAAP net income (1) $ 6,974 $ 6,577 $ 6,098 $ 25,341

Non-GAAP net income per share: Basic $ 0.33 $ 0.31 $ 0.29 $ 1.07

Diluted $ 0.33 $ 0.31 $ 0.29 $ 1.07

�

(1) Please refer to the financial statements portion of this

press release for an explanation of the non-GAAP financial measures

contained in the table above and a reconciliation of such measures

to the comparable GAAP financial measures.

John D. Goodman, Chief Executive Officer, stated, �During the

third quarter, we continued to make progress with our strategic and

operational initiatives, which resulted in reduced markdown levels

and improved gross profits versus a year ago. The strength of gross

margin, combined with prudent cost controls, enabled us to deliver

higher than anticipated non-GAAP diluted earnings per share of

$0.33.

�Although the environment remains extremely challenging, we

believe there is a tremendous opportunity for Charlotte Russe to

improve its leadership position in the fast fashion category.

Importantly, we�re engaging the customer with trend right

merchandise and providing her with a compelling shopping

environment, both in-store and online. We�re excited about our

back-to-school product assortments, which began arriving in stores

earlier this month. The new collections communicate a distinct

Charlotte Russe point of view, which is supported by elevated

fashion imagery in stores and on our web site, as well as extensive

editorial coverage in leading fashion publications.�

Goodman concluded, �We�re continuing to manage the business

conservatively by controlling inventories, conserving costs and

prudently investing in the resources, talent and systems necessary

to help take the Charlotte Russe brand to the next level. At

quarter-end, the Company had $60 million in cash and no long-term

debt, affording us the financial flexibility to execute our growth

plans despite the ongoing challenges presented by the macro

environment.�

Outlook

For the fourth quarter of fiscal 2009, the Company expects

comparable store sales to be in the negative low- to mid-single

digits. Non-GAAP diluted earnings per share are expected to be in

the range of $0.18 to $0.26, exclusive of anticipated charges

related to management transition and severance, as well as the

review of strategic alternatives and subsequent sale process. This

compares to non-GAAP diluted earnings per share of $0.01 in the

prior year period.

Conference Call Information

A conference call to discuss 2009 third quarter results is

scheduled for today, Tuesday, July 21, 2009, at 1:30 p.m. Pacific

Time (4:30 Eastern Time). The call will be hosted by John D.

Goodman, Chief Executive Officer, Emilia Fabricant, President and

Chief Merchandising Officer, and Frederick G. Silny, Chief

Financial Officer. To access the call, please dial (888) 841-5034

approximately ten minutes prior to the start of the call. The

conference call will also be webcast live and archived at

www.charlotterusse.com. A telephone replay of this call will be

available until July 28, 2009, and can be accessed by dialing (800)

642-1687 and entering code 11671210.

About Charlotte Russe

Charlotte Russe Holding, Inc. is a mall-based specialty retailer

of fashionable, value-priced apparel and accessories targeting

young women in their teens and twenties. As of June 27, 2009, the

Company operated 501 stores in 45 states and Puerto Rico. For more

information about the Company, please visit

http://www.charlotterusse.com.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995: Except for the historical information contained

herein, this press release contains forward-looking statements.

Such statements include, but are not limited to, projections of the

Company�s fourth quarter financial results, as well as the impact

of the Company�s business strategies, including future growth,

inventory and cost control, customer penetration and value

creation. Such forward-looking statements are subject to certain

risks and uncertainties that could cause actual results to differ

materially from historical results or from any results expressed or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to, the risks that the

Company will not achieve anticipated financial results or

comparable store sales increases, the Company will not be able to

execute its new strategic plan as intended, the Company will not

open new Charlotte Russe stores or remodel existing stores in the

numbers or on the schedule anticipated, general and regional

economic conditions, industry trends, consumer demands and

preferences, competition from other retailers and uncertainties

generally associated with women's apparel and accessory retailing.

A complete description of these factors, as well as others that

could affect the Company's business, is set forth in the Company's

annual report on Form 10-K and quarterly reports on Form 10-Q,

filed with the Securities and Exchange Commission.

� CHARLOTTE RUSSE HOLDING, INC. CONSOLIDATED STATEMENTS OF INCOME

(amounts in 000's, except per share data) (unaudited) � � � � �

Third Quarter Ended Nine Months Ended June 27, June 28, June 27,

June 28, 2009 2008 2009 2008 � Net Sales $ 202,711 $ 193,233 $

634,617 $ 616,528 Cost of goods sold � 146,755 � 141,599 � 483,285

� 451,310 Gross profit 55,956 51,634 151,332 165,218 � Selling,

general & administrative expenses � 45,080 � 41,273 � 146,960 �

128,253 Operating income 10,876 10,361 4,372 36,965 � Interest

income, net � 22 � 298 � 261 � 2,311 � Income before income taxes

10,898 10,659 4,633 39,276 � Income tax expense � 4,643 � 4,082 �

2,109 � 14,465 � Net income $ 6,255 $ 6,577 $ 2,524 $ 24,811 �

Income per share - basic: Income per basic share $ 0.30 $ 0.31 $

0.12 $ 1.05 � Income per share - diluted: Income per diluted share

$ 0.29 $ 0.31 $ 0.12 $ 1.04 � Basic weighted average shares

outstanding � 20,936 � 20,990 � 20,917 � 23,610 Diluted weighted

average shares outstanding � 21,296 � 21,168 � 21,136 � 23,772 �

CHARLOTTE RUSSE HOLDING, INC. RECONCILIATION OF GAAP TO NON-GAAP

CONSOLIDATED STATEMENTS OF INCOME (amounts in 000's, except per

share data) (unaudited) � � � � � Third Quarter Ended June 27, 2009

June 28, 2008 Adjusted As Reported Adjustments (non-GAAP) As

Reported (GAAP)

(1)(2)

(1)(2)

(GAAP) � Net Sales $ 202,711 $ - $ 202,711 $ 193,233 Cost of goods

sold � 146,755 � 74 � � 146,829 � � 141,599 Gross profit 55,956 (74

) 55,882 51,634 � Selling, general & administrative expenses �

45,080 � (1,326 ) � 43,754 � � 41,273 Operating income 10,876 1,252

12,128 10,361 � Interest income, net � 22 � - � � 22 � � 298 �

Income before income taxes 10,898 1,252 12,150 10,659 � Income tax

expense � 4,643 � 533 � � 5,176 � � 4,082 � Net income $ 6,255 $

719 � $ 6,974 � $ 6,577 � Income per share - basic: Income per

basic share $ 0.30 $ 0.33 � $ 0.31 � Income per share - diluted:

Income per diluted share $ 0.29 $ 0.33 � $ 0.31 � Basic weighted

average shares outstanding � 20,936 � 20,936 � � 20,990 Diluted

weighted average shares outstanding � 21,296 � 21,296 � � 21,168

�

�

(1) In the third quarter of fiscal 2009, the Company recorded

cash charges of $1.3 million related to expenses for proxy

solicitation, management transition and severance, as well as costs

associated with the review of strategic alternatives and subsequent

sale process. An adjustment has also been reflected for the related

tax impact.

(2) This earnings release contains non-GAAP financial measures.

Pursuant to the requirements of Regulation G, the Company has

provided reconciliations of the non-GAAP financial measures to the

most directly comparable GAAP financial measures. The Company

believes presenting its 2009 results excluding expenses for proxy

solicitation, management transition and severance, as well as costs

associated with the review of strategic alternatives and subsequent

sale process, and a non-cash charge for store impairment, which is

on a non-GAAP basis, provides useful additional information to

investors. The Company believes that the exclusion of such amounts

facilitates the comparability of the Company's results from period

to period and provides a basis for comparing current results

against future results by eliminating amounts that it believes are

not comparable between periods. The Company will use its results

excluding these amounts to evaluate its operating performance and

to discuss its business with investment institutions, the Company's

Board of Directors and others. These non-GAAP measures should be

considered in addition to, not as a substitute for, measures of

financial performance prepared in accordance with GAAP.

� CHARLOTTE RUSSE HOLDING, INC. RECONCILIATION OF GAAP TO NON-GAAP

CONSOLIDATED STATEMENTS OF INCOME (amounts in 000's, except per

share data) (unaudited) � � � � � � � Nine Months Ended June 27,

2009 June 28, 2008 Adjusted Adjusted As Reported Adjustments

(non-GAAP)

As Reported

Adjustments (non-GAAP) (GAAP)

(1)(2)

(1)(2)

(GAAP)

(1)(2)

(1)(2)

� Net Sales $ 634,617 $ - $ 634,617 $ 616,528 $ - $ 616,528 Cost of

goods sold � 483,285 � 22 � � 483,307 � � 451,310 � - � � 451,310 �

Gross profit 151,332 (22 ) 151,310 165,218 - 165,218 � Selling,

general & administrative expenses � 146,960 � (6,631 ) �

140,329 � � 128,253 � (840 ) � 127,413 � Operating income 4,372

6,609 10,981 36,965 840 37,805 � Interest income, net � 261 � - � �

261 � � 2,311 � - � � 2,311 � � Income before income taxes 4,633

6,609 11,242 39,276 840 40,116 � Income tax expense � 2,109 � 3,035

� � 5,144 � � 14,465 � 310 � � 14,775 � � Net income $ 2,524 $

3,574 � $ 6,098 � $ 24,811 $ 530 � $ 25,341 � � Income per share -

basic: Income per basic share $ 0.12 $ 0.29 � $ 1.05 $ 1.07 � �

Income per share - diluted: Income per diluted share $ 0.12 $ 0.29

� $ 1.04 $ 1.07 � � Basic weighted average shares outstanding �

20,917 � 20,917 � � 23,610 � 23,610 � Diluted weighted average

shares outstanding � 21,136 � 21,136 � � 23,772 � 23,772 �

�

�

(1) In the first three quarters of fiscal 2009, the Company

recorded cash charges of $5.0 million related to expenses for proxy

solicitation, management transition and severance, as well as costs

associated with the review of strategic alternatives and subsequent

sale process, and a non-cash charge of $1.6 million for store

impairment. In the first three quarters of fiscal 2008, the Company

recorded a non-cash charge for store impairment. An adjustment has

also been reflected for the related tax impact.

(2) This earnings release contains non-GAAP financial measures.

Pursuant to the requirements of Regulation G, the Company has

provided reconciliations of the non-GAAP financial measures to the

most directly comparable GAAP financial measures. The Company

believes presenting its 2009 results excluding expenses for proxy

solicitation, management transition and severance, as well as costs

associated with the review of strategic alternatives and subsequent

sale process, and a non-cash charge for store impairment, which is

on a non-GAAP basis, provides useful additional information to

investors. The Company believes that the exclusion of such amounts

facilitates the comparability of the Company's results from period

to period and provides a basis for comparing current results

against future results by eliminating amounts that it believes are

not comparable between periods. The Company will use its results

excluding these amounts to evaluate its operating performance and

to discuss its business with investment institutions, the Company's

Board of Directors and others. These non-GAAP measures should be

considered in addition to, not as a substitute for, measures of

financial performance prepared in accordance with GAAP.

� CHARLOTTE RUSSE HOLDING, INC. CONSOLIDATED CONDENSED BALANCE

SHEETS (amounts in 000's) (unaudited) � � � June 27, June 28, 2009

2008

ASSETS

Cash and cash equivalents $ 59,992 $ 45,902 Inventories 53,486

49,798 Landlord allowances receivable 441 9,770 Other current

assets 10,581 7,168 Deferred tax assets � 7,479 � 6,161 Total

current assets 131,979 118,799 � Fixed assets, net 205,879 222,291

Goodwill 28,790 28,790 Other assets 887 1,085 Deferred taxes �

3,190 � 970 Total assets $ 370,725 $ 371,935 � �

LIABILITIES AND STOCKHOLDERS' EQUITY

Accounts payable, trade $ 35,908 $ 30,929 Accounts payable, other

6,109 7,979 Accrued payroll and related expense 4,663 5,466 Income

and sales taxes payable 2,559 2,378 Other current liabilities �

9,875 � 9,541 Total current liabilities 59,114 56,293 � Deferred

rent 113,295 115,261 Other liabilities � 1,400 � 1,028 Total

liabilities 173,809 172,582 � � Total stockholders' equity �

196,916 � 199,353 � Total liabilities and stockholders' equity $

370,725 $ 371,935

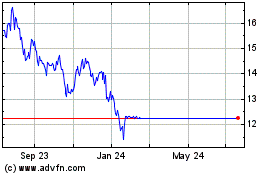

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Mar 2024 to Mar 2025