Thanks to extremely warm and dry weather across much of the

Midwest, a number of agricultural products have appeared on

investors’ radars. This has especially been the case of corn so far

this summer as the crucial commodity has been surging higher in the

summer.

In fact, the main ETF tracking this commodity, the

Teucrium Corn ETF (CORN), has surged by 34% in the

past three months and 11.5% in the past one month period. This has

put the product at the top of many ETF performance lists for both

the time periods and it has also caused CORN to become a much more

popular and liquid fund as well (read Buy American with these Three

Commodity ETFs).

The product’s incredible performance has also rekindled investor

demand for commodity ETFs in general, although now investors seem

to be focused in on natural resources in the agricultural market as

opposed to the metal space.

This could be great news for new investors searching for new

ways to play the space as a number of products have been doing

quite well outside the gold and silver market, suggesting some

investors have done quite well by taking a look at often overlooked

commodities.

While corn was certainly one of these overlooked natural

resources, that is clearly no longer the case. The commodity now

attracts a great deal of media attention and is constantly in focus

at numerous weather reports or crop quality updates (also read

Teucrium Launches Basket Agriculture ETF).

This has made corn arguably a very crowded trade and it could

push investors to look beyond the product to other top commodity

ETFs in the marketplace. For these investors, we have highlighted

three other commodity ETFs, besides CORN, that have had a great

summer and could be worth looking at should the focus of commodity

investors remain on America’s staple crop:

Teucrium Wheat ETF (WEAT)

Much like corn, wheat has been heavily impacted by the weather.

Conditions for growing the staple have been terrible not only in

the U.S. but in some key grain growing regions in Europe as well.

Due to this, wheat prices have also been soaring, much like their

counterparts in the corn market.

Investors can easily play this trend via WEAT, another commodity

product from Teucrium. This fund invests in wheat futures that are

traded on the CBOT but does it in a way that looks to lower

contango issues and hopefully result in better overall—and more

true to the underlying commodity—returns (see more in the Zacks ETF

Center).

The fund has been on an absolute tear as of late but it hasn’t

exactly received the same level of hype or press that CORN has. The

ETF is now up roughly 6.3% in the past one month and close to 28.7%

in the trailing three month period, so not quite CORN’s gains, but

still quite impressiveness nonetheless.

iPath Dow Jones-UBS Sugar ETN (SGG)

Another agricultural commodity that has been a solid performer

is in the sugar market. The commodity has been holding up well

despite some weakness in other softs, making it a decent choice for

many investors.

Surprisingly, drought is also impacting this market although the

issue is coming from India as opposed to the American heartland. In

fact, close to 50% of India is facing a drought thanks to a weak

monsoon season, pushing fears over sugar prices to higher levels in

recent weeks.

Meanwhile, the situation isn’t that much better in Brazil as the

opposite situation—heavy rains-- have delayed production in the

country’s main growing region. This part of the country is now

looking to produce roughly 20% less this year as intense rains have

crushed long-term precipitation averages and rocked the country’s

sugar market.

This is especially important because India and Brazil are two of

the five biggest exporters of the product. Some analysts now expect

the global sugar surplus to decline by 27% in the 2012-2013 year,

suggesting higher prices could be at hand in this corner of the

market.

One of the more liquid ways to play this trend is via the iPath

Dow Jones UBS Sugar ETN (SGG). This ETN charges investors about 75

basis points a year in fees and does weak volume of about 19,000

shares a day.

However, the note has held up rather well in recent time periods

as SGG is flat in the past month and has gained about 9.3% in the

past three month period. While this is pretty much nothing compared

to CORN’s return in the time period, this is pretty impressive when

looking at SGG against the other products in the soft commodity

space (see Hard Times in Soft Commodity ETFs).

This is best demonstrated by comparing SGG to the iPath Dow

Jones-AIG Softs Total Return Sub-Index ETN (JJS) which is actually

in the red for the trailing three month period. Furthermore, given

the product’s impressive Zacks ETF rank of 1 or ‘Strong Buy’

further gains could certainly be had in this sweet commodity.

United States Natural Gas Fund (UNG)

Another incredible performer as of late has been in the world of

natural gas. The commodity had been severely beaten down to

multi-year lows thanks to fracking and low demand pushing the

product to unheard of levels.

However, investors have witnessed a pretty dramatic reversal in

this space during the summer months as prices and demand for

natural gas has soared. Luckily for investors who are looking for

exposure to this segment, there are a number of choices including

the ultra popular UNG (read Have the Natural Gas ETFs Finally

Bottomed Out?).

This fund provides exposure to natural gas futures that are

delivered to Henry Hub, Louisiana. The product does charge about 98

basis points a year in fees but sees incredible volume of over 10

million shares in a normal session.

The product has been on another solid performer in the summer

months, adding about 2% in the past month—after a steep drop at the

end of July-- and 18.1% in the past three month period. In fact,

before UNG’s big drop to close out July and start August, UNG was

performing on par with CORN, although longer term charts certainly

do favor the Teucrium product.

Want the latest recommendations from Zacks Investment

Research? Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

TEUCRM-CORN FD (CORN): ETF Research Reports

IPATH-DJ-A SUGR (SGG): ETF Research Reports

US-NATRL GAS FD (UNG): ETF Research Reports

TEUCRM-WHEAT FD (WEAT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

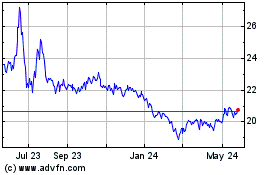

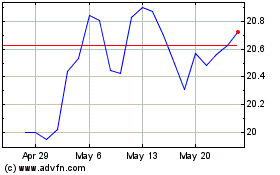

Teucrium Corn (AMEX:CORN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Teucrium Corn (AMEX:CORN)

Historical Stock Chart

From Jan 2024 to Jan 2025