Time to Worry about the Chile ETF? - ETF News And Commentary

June 04 2013 - 11:30AM

Zacks

The Chilean economy has always been export-centric due to its

strong commodity focus. In particular, copper plays a huge role in

the economy, as the country produces nearly one-third of the

world’s total output. The country’s government also owns and

operates Codelco, the largest copper producing company in the

world.

As a result, the recent decline in copper prices has gone a long

way to hurt the Chilean economy. Also, the constant decrease in

industrial production in China – the world’s second largest economy

and one of Chile’s largest trading partners –remains a cause of

concern.

China Connection

China is a major user of copper and is in fact the world’s

biggest importer of that metal. Nearly one-fourth of all Chilean

exports are shipped to China, which makes Chile’s economy

vulnerable to changes in Chinese trading patterns (read: If China

Slumps, Avoid These Three Country ETFs).

With China’s import of copper falling to the lowest level (down

21.2% y/y and 7.4% q/q in Apr 2013) in almost two years owing to

the waning domestic demand for metals, Chilean strength seems to be

decreasing too. After all, copper comprises more than half of

Chile’s exports, an 8.2% drop in its prices this year through May

17, could hurt the country’s economy.

Also, adding to its woes are a higher peso and the country’s

general slowdown. The peso traded between CL$521.25 and CL$465.75

last year and is presently hovering around CL$492.5, up about 5.7%

from the 52-week low (as of May 29, 2013). The strong currency has

spoiled the country’s export efficiency to some extent.

Further, Chile’s economic expansion was lower-than-expected in

the first quarter due to a slowdown in investments. Gross

domestic product (GDP) grew 4.1%, which was 40 bps short of

analysts’ expectation, although GDP increased 0.5% sequentially.

The growth rate also marked the lowest since late 2011. Investment

grew 9.6% y/y, which was halved from growth of 18.1% experienced in

the previous three months.

iShares MSCI Chile Capped ETF

(ECH) in Focus

Given this trend, investors should definitely pay close

attention to ECH, the fund following the MSCI Chile Investable

Market Index. This product holds 44 securities in total and charges

investors 59 basis points a year in fees (see more in the

Zacks ETF Center).

The ETF has amassed $515 million in its asset base since its

introduction in November 2007. From a sector perspective, utilities

(24.8%) and financials (17.1%) account for nearly 42% of the total,

with consumer staples (13.6%) and materials (12.5%) making up

double-digit allocations as well. With almost 60% allocation

towards its top 10 holdings, the fund is exposed to higher

concentration risk.

The ETF has slumped quite a bit from its lofty levels of early

2011 as it bore the direct impact of the global economic slowdown

thanks to its extreme commodity focus. ECH got off to a decent

start in 2013, returning around 1.3% in the quarter ending March

2013.

But most of its gains were lost in the beginning of the second

quarter; as a result of which it lost around 10.4% year-to-date and

0.88% for the one-year period as of May 30, 2013. Some more

short-term losses might stem after the lower-than-expected GDP

data. The fund pays a decent yield of 1.47%.

Bottom Line

Despite all the downsides, we believe the longer-term outlook is

relatively bright for this ETF. There are certain positives in this

nation such as still-contained inflation, still-decent GDP rate on

a nominal basis and buoyant retail sales, suggesting unwavering

consumer confidence (read Andean ETFs: A Better Way to Play

Emerging Markets?).

So for investors who believe that the Chilean economy is strong

enough to battle the aforementioned issues, you can consider ECH an

interesting pick. The country could rebound if China finds a

bottom, and may pick up steam if the broader South American region

returns to prominence later this year.

For these reasons, we currently have a Zacks ETF Rank of 2 or

‘Buy’ on ECH, so we are definitely looking for brighter days ahead

for this fund as well.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-MSCI CHL (ECH): ETF Research Reports

IPATH-DJ-A COPR (JJC): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

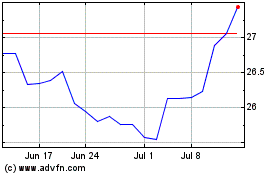

iShares MSCI Chile ETF (AMEX:ECH)

Historical Stock Chart

From May 2024 to Jun 2024

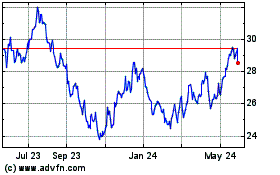

iShares MSCI Chile ETF (AMEX:ECH)

Historical Stock Chart

From Jun 2023 to Jun 2024