Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 28 2024 - 8:15AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE

ACT OF 1934

For

the month of October, 2024

Commission

File Number: 001-41353

Genius

Group Limited

(Translation

of registrant’s name into English)

8

Amoy Street, #01-01

Singapore

049950

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

On

October 25, 2024, the Board of Directors of Genius Group Limited (the “Company”) passed two resolutions in response to the

CEO Letter to the Board, published in the Company’s 6-K on September 25, 2024. These resolutions are in light of the control risks

related to the FatBrain AI (“LZGI”) transaction with the Company, which resulted in the Company’s inability to pass

the necessary resolutions to remain compliant with its financing agreement with Ayrton Capital due to the breach of contract by LZGI

and its principals in failing to vote the 7.4 million shares of the Company under LZGI’s name. The Board believes these resolutions

prevent a similar event from reoccurring in the future.

Approval

of CEO’s application to acquire 5.5 million additional shares of Genius Group

On

September 25, 2024 Roger James Hamilton, the Company’s CEO, applied to the company to be issued and to receive 5.5 million additional

shares of Genius Group. These consisted of shares to be acquired as part of the CEO Share Purchase Plan approved by the Board on August

8, 2024 to purchase up to 10 million shares at 105% of the closing price on the prior trading day, and as part of the Change of Control

provisions of the CEO Compensation Plan approved by the Board on October 16, 2023. Of these shares, 500,000 have already been approved

and issued.

On

October 25, 2024, the Board approved the issuance of the remaining 5.0 million of these shares to Mr Hamilton, and have instructed the

company to make the SLAP application to NYSE for the approval of the issuance. Once these shares have been issued, Mr. Hamilton will

own 6.3 million shares of the Company, which will equate to 24.6% of the issued shares of the Company.

Approval

of Legal Action to protect shareholders interests related to the LZGI shares

On

October 25, 2024, the Board also approved Mark R. Basile, Esq. of the The Basile Law Firm P.C., who were engaged by the Company on October

2, 2024, to provide litigation services prosecuting or defending the company in action involving LZGI, to file an Application for Arbitration

under the rules of the International Court of Arbitration of the International Chamber of Commerce (“ICC”), in accordance

with the Expedited Procedure set out in Article 30 of the ICC Rules, to resolve the issues related to the LZGI transaction

Furthermore,

the Board approved the filing of a Petition for a Preliminary Injunction in Aid of Arbitration and a Temporary Restraining Order to enjoin

the Company’s transfer agent, VStock, from reissuing shares without restrictive legend or otherwise preventing VStock from issuing

any shares related to the transaction, specifically on the 7.4 million shares of the Company currently held by VStock in LZGI’s

name.

Furthermore,

the Board approved the filing of an application to place these 7.4 million shares under the stewardship of a Trustee in order for the

shares to be voted at the Company’s upcoming AGM in compliance with LZGI’s principal’s signed undertaking to vote in

accordance with the interests of the Company.

Whilst

it is too early for the Company to make any comment or speculation about the outcome of the arbitration, the Board’s intention

is that for the period during which the arbitration is ongoing, these 7.4 million shares, which account for 29% of the Company’s

issued capital following the issuances described above, will remain restricted. Only in the event the transaction issues are resolved

will the shares become tradeable, and in the event the transaction is rescinded the shares will be cancelled and the issued shares of

the Company will reduce by 29%.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GENIUS

GROUP LIMITED |

| |

|

|

| Date:

October 28, 2024 |

|

|

| |

By: |

/s/

Roger Hamilton |

| |

Name: |

Roger

Hamilton |

| |

Title: |

Chief

Executive Officer

(Principal

Executive Officer) |

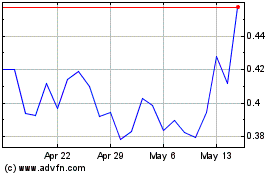

Genius (AMEX:GNS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Genius (AMEX:GNS)

Historical Stock Chart

From Dec 2023 to Dec 2024