Amended Statement of Beneficial Ownership (sc 13d/a)

April 01 2022 - 3:16PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No. 3)*

Indonesia

Energy Corporation Limited

(Name

of Issuer)

Common

Stock, $0.00267 par value

(Title

of Class of Securities)

G4760X

102

(CUSIP

Number)

C/O

Wirawan Jusuf

GIESMART

PLAZA 7th Floor

Jl.

Raya Pasar Minggu No. 17A

Pancoran – Jakarta 12780 Indonesia

(Name,

Address and Telephone Number of Person Authorized to

Receive

Notices and Communications)

March

30, 2022

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See section

240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or other subject to the liabilities of that section of Act but shall be subject

to all other provisions of the Act (however, see the Notes).

CUSIP

No. G4760X 102

| 1 |

Names

of Reporting Person.

HFO

Investment Group Limited |

| 2 |

Check

the Appropriate Box if a Member of a Group

(a) ☐

(b)

☐

|

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

WC |

| 5 |

Check

if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ☐

|

| 6 |

Citizenship

or Place of Organization

British

Virgin Islands |

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7 |

Sole

Voting Power

337,778 |

| 8 |

Shared

Voting Power (see Item 5 below)

0 |

| 9 |

Sole

Dispositive Power

337,778

(1) |

| 10 |

Shared

Dispositive Power (see Item 5 below)

0 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

337,778 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

4.42%

(2) |

| 14 |

Type

of Reporting Person

OO |

CUSIP

No. G4760X 102

| 1 |

Names

of Reporting Person.

Wan-Yu

Huang |

| 2 |

Check

the Appropriate Box if a Member of a Group

(a)

☐

(b) ☐

|

| 3 |

SEC

Use Only

|

| 4 |

Source

of Funds (See Instructions)

PF |

| 5 |

Check

if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) [ ]

|

| 6 |

Citizenship

or Place of Organization

Taiwan |

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7 |

Sole

Voting Power

337,778

(1) |

| 8 |

Shared

Voting Power (see Item 5 below)

0 |

| 9 |

Sole

Dispositive Power

337,778 (1) |

| 10 |

Shared

Dispositive Power (see Item 5 below)

0 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person

337,778 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11)

4.42% (2) |

| 14 |

Type

of Reporting Person

IN |

| |

(1) |

Represents

337,778 shares held by HFO Investment Group Limited (“HFO”). Wan-Yu Huang, has voting and dispositive control

over the shares held by HFO. Ms. Huang is the adult sister of James J. Huang, the Chief Investment Officer and a director of the

Issuer. Mr. Huang has no voting or dispositive control over the shares held by HFO. |

| |

|

|

| |

(2) |

Based

on a total of 7,647,214 Ordinary Shares issued and outstanding as of March 9, 2022 as reported by the Issuer in its Registration

Statement on Form F-1, filed by the Issuer with the SEC on March 9, 2022. |

Explanatory

Note

This Amendment No. 3 (“Amendment

No. 3”) amends and supplements the statement on Schedule 13D originally filed by the Reporting Persons on December 31, 2019

(as amended from time to time, the “Schedule 13D”). Except as specifically provided herein, this Amendment No. 3 does

not modify any of the information previously reported on the Schedule 13D. Unless otherwise indicated, each capitalized term used but

not defined in this Amendment No. 3 shall have the meaning assigned to such term in the Schedule 13D. The number of shares in

this Amendment No. 3 reflects a sale of shares by the Reporting Persons on March 30-31, 2022.

This Amendment No. 3 is the

Reporting Persons’ final amendment to the Schedule 13D and constitutes an exit filing as the Reporting Persons have ceased to be

the beneficial owners of more than five percent of the ordinary shares, $0.00267 par value (“Ordinary Shares”), of the Issuer.

| Item

1. |

Security

and Issuer |

This

statement on Schedule 13D (the “Schedule 13D”) relates to the Ordinary Shares of the Issuer.

| Issuer: |

Indonesia

Energy Corporation Limited (“Issuer”) |

| |

c/o

Wirawan Jusuf |

| |

GIESMART

PLAZA 7th Floor |

| |

Jl.

Raya Pasar Minggu No. 17A |

| |

Pancoran

– Jakarta 12780, Indonesia |

| Item

2. |

Identity

and Background |

Item

2 of the Schedule 13D is hereby amended and supplemented as follows:

HFO

Investment Group Limited, a British Virgin Islands company (“HFO”), which is the holder of record of approximately 4.42%

of the issued and outstanding Ordinary Shares as of March 31, 2022, derived from the number of Ordinary Shares outstanding

reported by the issuer in its Registration Statement on Form F-1 filed by the Issuer with the Securities and Exchange Commission (the

“Commission”) on March 9, 2022. Wan Yu-Huang is the director of HFO and has voting and dispositive control over the shares

held by HFO.

| Item

3. |

Source

and Amount of Funds or Other Consideration. |

Item

3 of the Schedule 13D is hereby amended and supplemented as follows:

On March 30, 2022, HFO

sold 60,000 Ordinary Shares in a market transactions for an aggregate price of $1,550,400, or $25.84 per Ordinary

Share, in reliance upon the exemption from the registration under the Securities Act of 1933, as amended, contained in Rule 144 promulgated

by the Securities and Exchange Commission under the Securities Act.

On March 31, 2022, HFO

sold 50,000 Ordinary Shares in a market transactions for an aggregate price of $1,159,000, or $23.18 per

Ordinary Share, in reliance upon the exemption from the registration under the Securities Act of 1933, as amended, contained in Rule

144 promulgated by the Securities and Exchange Commission under the Securities Act.

As

a result of the consummation of the transactions described above, HFO sold approximately 1.43% of the outstanding Ordinary Shares,

which decreased the percentage of HFO’s holding of the outstanding Ordinary Shares from 5.85% to 4.42%.

| Item

4. |

Purpose

of the Transaction |

Item

4 of the Schedule 13D is hereby amended and supplemented as follows:

The

transaction described in Item 3 of this Schedule 13D/A were undertaken by HFO for investment purposes only.

The

Reporting Persons currently have no plans or proposals that relate to or would result in: (a) the acquisition by any person of additional

securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction, such as a merger,

reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a material amount of assets

of the Issuer or any of its subsidiaries; (d) any change in the present Board of Directors or management of the Issuer, including any

plans or proposals to change the number or term of directors or to fill any existing vacancies on the Board except as may be required

for the Issuer to comply with exchange listing requirements with respect to the number of independent directors; (e) any material change

in the present capitalization or dividend policy of the Issuer; (f) any other material change in the Issuer’s business or corporate

structure; (g) any changes in the Issuer’s charter or by-laws or other actions which may impede the acquisition or control of the

Issuer by any person; (h) causing a class of securities of the Issuer to be delisted from a national securities exchange or cease to

be authorized to be quoted in an interdealer quotation system of a registered national securities association; (i) causing a class of

equity securities of the Issuer to become eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange

Act of 1934, as amended; or (j) any action similar to those enumerated above.

| Item

5. |

Interest

in Securities of the Issuer |

Item

5 of the Schedule 13D is hereby amended and restated in its entirety to read as follows:

(a)-(b)

The aggregate number and percentage of Ordinary Shares beneficially owned by the Reporting Persons (on the basis of a total of 7,647,214

Ordinary Shares issued and outstanding as of March 9, 2022) are as follows:

| Wan

Yu-Huang |

| a) |

|

Amount

beneficially owned: 337,778 |

|

Percentage:

4.42% |

| b) |

|

Number

of shares to which the Reporting Person has: |

|

|

| |

i. |

Sole

power to vote or to direct the vote: |

|

337,778 |

| |

ii. |

Shared

power to vote or to direct the vote: |

|

0 |

| |

iii. |

Sole

power to dispose or to direct the disposition of: |

|

337,778 |

| |

iv. |

Shared

power to dispose or to direct the disposition of: |

|

0 |

HFO

Investment Group Limited |

| a) |

|

Amount

beneficially owned: 337,778 |

|

Percentage:

4.42% |

| b) |

|

Number

of shares to which the Reporting Person has: |

|

|

| |

i. |

Sole

power to vote or to direct the vote: |

|

337,778 |

| |

ii. |

Shared

power to vote or to direct the vote: |

|

0 |

| |

iii. |

Sole

power to dispose or to direct the disposition of: |

|

337,778 |

| |

iv. |

Shared

power to dispose or to direct the disposition of: |

|

0 |

Wan

Yu-Huang is the Director of HFO.

(c)

As reported in Amendment No. 2 to the Reporting Persons’ Schedule 13D filed on March 25, 2022, the Reporting Persons sold

an aggregate of 200,000 Ordinary Shares in market transactions during the period of March 21, 2022 through March 25, 2022, which is within

60 days of this Amendment No. 3. The information regarding such sales in incorporated herein by reference to Amendment No. 2 to the Schedule

13D.

(d)

Not applicable.

(e) After giving effect to the sales described

in Item 3, as of March 31, 2022, the Reporting Persons ceased to be the beneficial owner of five percent or more of the Ordinary Shares.

| Item

6. |

Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Item

6 of the Schedule 13D is hereby amended and supplemented as follows:

The

Reporting Persons’ response to Item 4 is incorporated by reference into this Item 6.

| Item

7. |

Material

to be Filed as Exhibits |

None.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Date:

April 1, 2022 |

HFO

Investment Group Limited |

| |

|

|

| |

By: |

/s/

Wan Yu-Huang |

| |

Name: |

Wan

Yu-Huang |

| |

Title: |

Director |

| |

|

|

| Date:

April 1, 2022 |

|

/s/

Wan Yu-Huang |

| |

|

Wan

Yu-Huang |

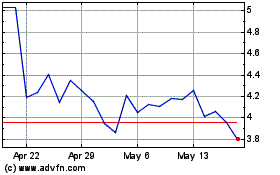

Indonesia Energy (AMEX:INDO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Indonesia Energy (AMEX:INDO)

Historical Stock Chart

From Dec 2023 to Dec 2024