Time To Buy The Rare Earth Metals ETF (REMX)? - Commodity ETFs

December 29 2011 - 5:01AM

Zacks

Although 2011 has been pretty rough for commodities across the

board, some sectors have managed to surge higher on the year. One

of the biggest gainers in the early part of the year was

undoubtedly rare earth metals as investors scooped up the miners of

these important products which are found in everything from cell

phones to guided weapons. Nevertheless, thanks to recent concerns

over Chinese demand and the European economy, prices for these

crucial elements are down significantly from the peak, casting a

shadow over the industry heading into 2012.

In light of this recent weakness for many rare earth metals,

China has decided to more or less keep the rare-earth export quota

constant for the new year, hoping that flat supply will boost

prices once again for the sector. This could especially be true

given that China currently dominates the market, making up nearly

90% of the total global supply. Yet, unfortunately for the sector,

the weakness in the economy is really beginning to hurt end users

of the metals, pushing them to really cut down on the use of these

ultra high cost products. “The quota has become pointless if export

demand falls short of the limits,” said Wei Chishan, a

Shanghai-based analyst at SMM Information & Technology Co., a

data provider. “Rare-earth users are under great pressure to pass

on surging costs, while the global slowdown has slashed demand.”

(read Is USCI The Best Commodity ETF?)

With these pressures and the general push away from

commodity-focused investments in the last few months, investors in

the main ETF tracking the sector, the Market Vectors Rare

Earth/Strategic Metals ETF (REMX) have seen huge losses. The

product is trending towards a 52 week low and has fallen by 36%

over the course of 2011, including a nearly 41% loss in the past

six months alone. Yet, while 2011 has been disastrous for REMX,

there is still some hope that 2012 will produce far better returns

for those invested in the sector (also read Can You Fight Inflation

With This Real Return ETF?).

That is because while demand is slack right now, the incredible

importance of the materials in this space and their wide range of

applications ensures that they will always see a decent level of

buying. Rare earths are used in everything from jet engines, hybrid

technologies, flat screen TVs, and a host of other applications

meaning that weakness in any one sector is unlikely to scar the

industry too badly. Furthermore, as Japan continues to rebound, its

use of rare earths—especially if it tilts towards clean

energy—could surge, putting upward pressure on prices going forward

(see Three Best Gold ETFs).

Add in the fact that China thoroughly dominates the supply of

these crucial products and that no further meaningful supplies can

come online quickly, and one can easily argue that the slump in

rare earths is more about confidence than fundamentals. For

investors seeking to make a play on this beaten down sector in

hopes that 2012 will be far better for the industry, a closer look

at the Market Vectors Rare Earth Strategic Metal ETF (REMX) is

needed:

Rare Earth Metal ETF In Focus

For investors seeking to make a play on the sector, REMX is

truly one of the only choices available in the space. The fund

tracks Market Vectors Rare Earth/Strategic Metals Index, which is a

rules based, modified capitalization weighted, float adjusted

benchmark intended to give investors a means of tracking the

overall performance of publicly traded companies primarily engaged

in a variety of activities that are related to the mining, refining

and manufacturing of rare earth/strategic metals. Currently, the

product charges investors 0.57% a year in fees and has close to

$210 million in AUM, suggesting that the product is in line with

others in the category for expenses and that the fund has attracted

a decent amount of interest from investors (read Time To Consider

The Silver Miners ETF).

In total, REMX holds 27 securities, putting just about 60% of

assets into the top ten holdings with high weightings going towards

Iluka Resources, Lynas Corp, and Titanium Metals (TIE). The fund

has a definite tilt towards small and mid cap securities as just

7.7% of assets go towards equities that have a market cap above $5

billion. The Van Eck fund also has heavy exposure to international

and especially developing markets, suggesting that it is already

prone to heavy bouts of volatility in short time frames.

Undoubtedly, REMX can experience another huge slump in 2012,

especially if the economy remains weak and investors continue to

shun commodity-focused assets. Yet, given the strong underlying

fundamentals of the industry, and the importance of rare earths to

virtually every sector of the high tech economy, there is a pretty

strong chance that this rare earth metal ETF could see a solid

period of trading going forward. As a result, a small allocation to

the space could be warranted by investors who have a high risk

tolerance and believe in the strength of these products over the

long term despite short term pressures.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

TITANIUM METALS (TIE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

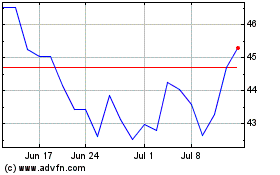

VanEck Rare Earth and St... (AMEX:REMX)

Historical Stock Chart

From Oct 2024 to Nov 2024

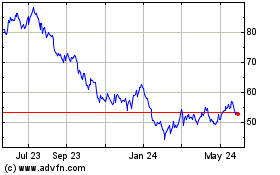

VanEck Rare Earth and St... (AMEX:REMX)

Historical Stock Chart

From Nov 2023 to Nov 2024