The European economy has finally turned around with reduced debt

concerns, considerable growth in some key nations like the U.K.,

Germany and France, a stronger currency and respectable economic

data at regular intervals.

All major nations in the Eurozone – France, Germany, the

Netherlands, Italy and Denmark-- emerged out of recession last

year. Markit’s Flash Eurozone Composite Purchasing Managers Index

(PMI), which measures overall business activity, grew to 53.2

in January, the fastest clip in two and a half years, suggesting

that the region is well on track to recovery.

Strength in the manufacturing sector exhibited the fastest

expansion since May 2011. The German PMI is hovering at a 32-month

high level while reduction in French PMI moderated. Struggling

regions like Greece and Spain are also recording steady growth in

manufacturing activity.

Investors should, however, note that recovery is still in its

nascent stage and things are not yet out of the woods as

deflationary risks loom large with credit growth data for December

recording a month-on-month shrinkage. The present inflation

level at 0.7% (at the end of January 2014) remains well behind the

ECB target of 2.0%.

However, as per ECB, the retrenchment in December credit growth

might be a seasonal phenomenon as banks intended to clean their

balance sheets prior to an ECB review and stress tests for 2013.

The ECB also anticipates a rise in demand across all loan

categories for the first quarter of 2014.

Thus, though the region is still to attain sustainable growth, just

the end of a long-run recession is in itself great news. Investors

are also turning more positive on the continent.

Thus, given the region’s slow-but-assuring fundamentals, a look at

the top ranked ETF in Europe, or even just some countries in the

Eurozone could be a good idea, especially based on our Zacks ETF

Ranking system (read: Play a Resurgent Europe with These ETFs).

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook for the underlying industry, sector, style

box or asset class (Read: Zacks ETF Rank Guide). Our proprietary

methodology also takes into account the risk preferences of

investors. ETFs are ranked on a scale of 1 (Strong Buy) to 5

(Strong Sell) while they also receive one of three risk ratings,

namely Low, Medium or High.

The aim of our models is to select the best ETFs within each risk

category. We assign each ETF one of the five ranks within each risk

bucket. Thus, the Zacks ETF Rank reflects the expected return of an

ETF relative to other products with a similar level of risk.

For investors seeking to apply this methodology to their portfolio

in the European equities space, we have taken a closer look at the

top ranked FEP. This ETF has a Zacks ETF Rank of 1 or ‘Strong Buy’

(see the full list of top ranked ETFs) and is detailed below:

FEP in Focus

Launched in April 2011,

First Trust Europe

AlphaDEX Fund ETF (

FEP) looks to offer

enhanced exposure to the Defined Europe Index before fees and

expenses which is a modified equal-dollar weighted index (read: Top

Ranked Europe ETF in Focus: EZU).

The benchmark is designed by the S&P to objectively

identify and select stocks from the S&P Europe BMI Index that

may generate positive alpha relative to traditional passive-style

indices through the use of the AlphaDEX selection methodology.

All the component stocks in a benchmark are ranked separately on

both growth factors like price appreciation, sales to price and

one-year sales growth as well as value factors including book value

to price, cash flow to price and return on assets.

The top 200 ranked stocks in the benchmark are then divided into

quintiles and each stock is weighted and ranked equally within each

quintile with top rated stocks getting more assets.

The fund, though not among the most popular ones in the Europe

equities space, has decent assets of about $504.8 million. Its

trading volume of around 170,600 shares a day also suggests modest

liquidity.

The choice is a bit costly with 57 basis points in fees a year

which is slightly higher than the average expense ratio in the

Europe equities space. Its enhanced approach has helped to increase

the price, though it could be worth it for some investors.

FEP Portfolio

With 199 stocks in its basket, this fund from First Trust puts only

8.93% of its total assets in the top 10 holdings with no company

accounting for more than 1.04% of the total, suggesting very low

concentration risk. Top companies include Faurecia, Piraeus Bank

S.A. and Valeo S.A., three of which account for around 3.07% of the

assets.

In terms of sector exposure, the top allocation, financials,

comprise a little greater than one-fifth of the total assets

followed by consumer discretionary companies making up around

17.78%. Beyond this, industrials (17.54%) and utilities (10.8%)

round out the top four, while Healthcare (1.34%) gets the least

weight.

As far as country allocations go, France takes up the top spot with

18.65% of the total closely followed by the U.K. at 17.55%. Germany

with about 11.28% of the assets fills up the third place.

Style-wise, the fund has a nice mix of value and growth stocks. The

fund is well-diversified capitalization wise as well, with mid caps

grabbing 45% share of assets followed by large caps (39%). FEP is

also a good tool for international diversification as it has a low

correlation with the S&P 500 Index as indicated by an R-squared

of 25.1% against the S&P 500.

The fund has returned around 22.54% over the last one year (as of

January 30) surpassing the biggest European fund by assets

Vanguard FTSE Europe ETF’s (

VGK)

14.5% return. The fund is currently hovering a little lower than

the 52-week high. FEP pays out a yield of 1.56% per annum.

Bottom Line

This ETF is appropriate for investors looking for a targeted bet on

European stocks but with a cautious stance. Given the AlphaDEX

methodology, equal-weighted approach, tilt toward stronger nation –

all indicate that FEP has a relatively low risk outlook. Notably

the U.K. economy – FEP’s second largest allocation – is now

expanding at the fastest pace since 2007.

Just one word of caution, the fund is unhedged, making it

vulnerable to any weakness in the Euro which has more than 60%

exposure, though recent trends suggest that this doesn’t look to be

too much of an issue in 2014 (read: Forget Europe's Currency Risks

with These Hedged ETFs).

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

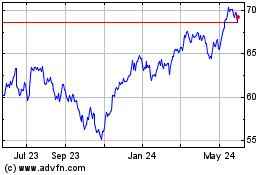

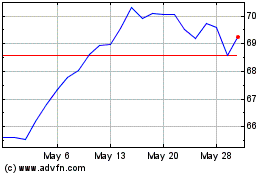

Vanguard FTSE Europe (AMEX:VGK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vanguard FTSE Europe (AMEX:VGK)

Historical Stock Chart

From Feb 2024 to Feb 2025