TIDMLMS

RNS Number : 8626P

LMS Capital PLC

22 October 2021

22 October 2021

LMS CAPITAL PLC

Third Quarter 2021 Update

LMS Capital plc (the "Company") the listed Investment Company

provides the following update covering the period from 30 June 2021

to date.

Financial Highlights

-- Unaudited Net Asset Value ("NAV") at 30 September 2021 was

GBP46.9 million (58.0p per share). This compares to GBP47.6 million

(59.0p per share) at 30 June 2021;

-- Interim dividend of GBP0.2 million paid in September; and

-- Cash at 31 September 2021 was GBP20.5 million compared to GBP21.4 million at 30 June 2021

Unaudited Net Asset Value at 30 September 2021

The GBP0.7 million decrease in the NAV during the third quarter

reflects payment of the interim dividend of GBP0.2 million and

GBP0.5 million of other movements. The other movements comprise the

following:

-- Unrealised losses of GBP0.7 million on the investment portfolio;

-- GBP0.4 million of portfolio and GBP0.3 million of

non-portfolio foreign exchange gains from the strengthening of the

U.S. Dollar against sterling; and

-- GBP0.4 million of running costs and GBP0.1 million of investment related costs.

The 30 September 2021 NAV is summarised below:

Unaudited Unaudited

30 September 30 June 2021

2021

GBP 000s

------------------------------

Quoted Investments 244 285

-------------- --------------

Unquoted Investments 8,067 7,568

-------------- --------------

Funds 13,216 13,562

-------------- --------------

Subtotal Investment portfolio 21,527 21,415

-------------- --------------

Cash 20,474 21,372

-------------- --------------

Dacian Investment - Funds

Deposited 6,730 6,557

-------------- --------------

Other Net Assets/Liabilities (1,873) (1,752)

-------------- --------------

Net Asset Value 46,858 47,592

-------------- --------------

The NAV at the end of September is based on the valuation of the

Company's investments as at 30 June 2021, adjusted for transactions

in the three months ended 30 September 2021, price movements on

quoted securities, movements in foreign currency exchange rates,

cash calls and distributions from funds, and the latest information

available from third party fund managers.

Portfolio Unrealised Net Gains

The portfolio net unrealised losses of GBP0.7 million, excluding

foreign exchange movements, are summarised below:

Quoted Investments

The Company's quoted investment valuations decreased by a net

GBP0.1 million during the third quarter of 2021, reflecting

underlying market price decreases.

Unquoted Investments

The Company's unquoted investments include assets managed by San

Francisco Equity Partners (ICU Eyewear and YesTo), our direct

holdings in Medhost and Elateral and a convertible debt instrument

with IDE Group Holdings.

Total unquoted investment unrealised losses were GBP0.1 million.

This primarily relates to YesTo where the remaining value of the

investment was written off.

Elateral - The Company has increased its investment by GBP0.4

million as part of an agreement to buyout the former 50%

co-investor and provide additional working capital. LMS' ownership

has increased from approximately 50% to 62.5% of the economic

interest in the company, the balance being held largely by our new

operating partner and the Elateral Chairman both of whom have

invested alongside LMS. Elateral operates in the digital marketing

sector and has a cloud-based software platform which facilitates

the creation and customisation of digital and print marketing

materials.

Funds

The Company's fund investments include its holding in Brockton

Capital Fund I, Opus Capital Partners, Weber Capital Partners

("Weber") and five other smaller fund interests.

Fund unrealised net losses were GBP0.5 million. The principal

movements were:

-- YesTo - Unrealised loss of GBP0.7 million. This investment,

held through and managed by San Francisco Equity Partners, has been

written down to zero pending the outcome of a review of the

financing requirements of the business;

-- Brockton Fund 1 - Unrealised gain GBP0.4 million, reflecting

the third quarter movement in the discounted cash flow valuation;

and

-- Weber - unrealised loss of GBP0.2 million due to the

performance in the U.S. microcap equities held in the fund. Year to

date the fund has increased by 17.2%

The carrying value of the funds is based on the latest available

information from the respective fund managers, generally the 30

June 2021 fund valuation reports except for Weber, which is based

on 30 September 2021 valuations.

Portfolio Realisations

There were no portfolio realisations or fund distributions

during the third quarter.

Liquidity and Outlook

The Company continues to maintain significant cash balances,

GBP20.5 million at 30 September, and remains highly cautious about

the way its liquid resources are deployed. The Company continues to

review opportunities with its real estate teams and has a pipeline

of opportunities for other investments.

Dacian

Dacian, the Romanian oil and gas production company in which

LMS, together with other investors, has committed to invest, has

not yet received the necessary approvals in Romania for its first

acquisition of a business comprising 40 onshore oil and gas

fields.

LMS' and other investors' commitments are conditional on the

necessary approvals being obtained. LMS has committed $9.1 million,

which comprises $9.1 million of senior loans bearing interest at

14% per annum and a 32% equity ownership in the company.

Notwithstanding some delay due to the impact of Covid-19 and

government reorganisations in Romania, the process is taking

substantially longer than envisaged at the time the commitment was

made.

The Dacian management team believes, based on the evidence

available to it, that the approval process is moving towards

successful conclusion, although the timing of such conclusion is

difficult to predict.

The Board maintains close contact with the Dacian team and

continues to monitor the situation closely. If circumstances change

the Board will reconsider its position, however at present it

remains of the view that the merits of the transaction outweigh the

delays, and therefore should await the conclusion of the approval

process.

The information contained in this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014. Upon publication of this

announcement, this inside information is now considered to be in

the public domain.

22 October 2021

For further information please contact:

LMS Capital PLC

Nick Friedlos, Managing Director

0207 935 3555

Shore Capital

Robert Finlay

0207 408 4050

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDMBBITMTITBTB

(END) Dow Jones Newswires

October 22, 2021 02:00 ET (06:00 GMT)

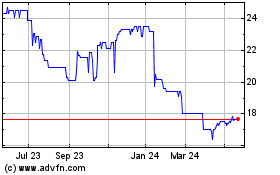

LMS Capital (AQSE:LMS.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

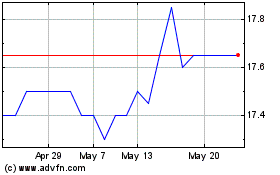

LMS Capital (AQSE:LMS.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025