TIDMMUL

RNS Number : 3310T

Mulberry Group PLC

24 November 2021

Mulberry Group plc

Results for the twenty-six weeks ended 25 September 2021

Further strategic progress amid strong consumer demand

Mulberry Group plc (the "Group" or "Mulberry"), the British

sustainable luxury brand, announces unaudited results for the

twenty-six weeks ended 25 September 2021 (the "period").

THIERRY ANDRETTA, CHIEF EXECUTIVE OFFICER, COMMENTED:

"I am proud of Mulberry's performance during the period. Our

long-term strategy, namely our innovative and sustainable products

made in our carbon neutral Somerset factories, our market-leading

omni-channel distribution model, and our expansion into Asia

Pacific, has delivered a strong financial performance.

"Product innovation and sustainability are central to our

strategy, demonstrated by the recent launch of our "The Lowest

Carbon collection", further supporting the commitments we made in

our Made to Last manifesto and our goal to reach zero carbon

emissions by 2035.

"The bold decisions we have taken with regards to focussing on

our UK production capabilities, means that we are well placed for

the festive trading period and beyond. Finally, I would like to

take this opportunity to thank my colleagues for their hard work,

commitment and achievement over the period."

Financial Highlights

-- Group revenue increased 34% to GBP65.7m (2020: GBP48.9m)

-- Profit before tax of GBP10.2m (2020: loss before tax GBP2.4m)

includes a one-off profit on disposal of Paris lease of GBP5.7m

-- Gross margin of 69% (2020: 59%) due to a strategic focus on

full-price sales and increased volume efficiencies

-- UK retail sales increased 36% to GBP38.0m (2020: GBP28.0m)

-- China retail sales increased 38%, which contributed to the

23% increase in Asia Pacific retail sales to GBP11.8m (2020:

GBP9.5m), reflecting ongoing investment in the region

-- US retail sales increased 57% to GBP3.3m (2020: GBP2.1m)

-- International retail sales represented 40% of Group revenue (2020: 41%)

-- Franchise and wholesale sales increased 67% to GBP10.1m (2020: GBP6.0m)

-- Strong period end net cash of GBP30.3m (2020: GBP8.6m) and

deferred liabilities of GBP5.0m (2020: GBP4.6m)

Operating Highlights

-- Business and infrastructure responded well to increased

demand following easing of COVID-19 restrictions

-- Digital sales 29% of Group revenue in the period, lower than

last year when stores were closed but up from 20% (H1 2019),

reflecting the ongoing strength of this channel

Sustainability Highlights

-- Launched on 22 November 2021, "The Lowest Carbon collection",

crafted from the world's lowest carbon leather and using a local

and transparent supply chain. This is Mulberry's first capsule

collection of regenerative "farm to finished product", further

supporting our Made to Last manifesto

-- Continue to focus on embedding sustainability and circularity

across the entire business, following the launch of the Made to

Last manifesto in April 2021

-- Successful launch of our resale programme "Preloved Bags", across all channels

-- Further investment in the Lifetime Service Centre at The

Rookery which is now restoring more than 10,000 bags a year

-- Committed to set Science Based Targets aligned with our 2035 Net Zero emissions target

-- 86% of the collection now uses leather and suede sourced from

environmentally accredited tanneries; on track to increase to 100%

by Autumn/Winter 2022. All other non-leather materials are fully

sustainable

-- Collaborations with contemporary British Designers

emphasising sustainable techniques and materials

Current Trading

-- Retail revenue in the 8 weeks to 20 November 2021 increased

35% compared to the same period last year

-- Gross margin in the second half is expected to be similar to,

or slightly higher than, the 67% achieved in the second half of

last year

-- The Group is expected to continue generating cash from

operations in the second half and, with its deferred liabilities

expected to unwind, the Group will maintain a strong cash position

at the year end

FOR FURTHER DETAILS PLEASE CONTACT:

Mulberry

Charles Anderson Tel: +44 (0) 20 7605 6793

Headland (Public Relations)

Lucy Legh / KIRSTY CARRUTHERS Tel: +44 (0) 20 3805 4822

mulberry@headlandconsultancy.com

GCA Altium Limited (FINANCIAL ADVISER AND NOMAD)

Tim Richardson Tel: +44 (0) 20 7484 4040

OVERVIEW

The Group has delivered a strong performance. Group revenue

increased by 34%, returning to pre-COVID-19 levels and profit

before tax was GBP10.2m (2020: loss of GBP2.4m), which included a

profit of GBP5.7m on the lease in Paris. The underlying profit

before tax of GBP4.5m (2020: loss before tax of GBP 1.9 m) and

financial strength of the Group reflects the benefits of the

actions we took during the pandemic and a strong consumer reaction

to the Group's product.

Sales in the UK recovered strongly once our stores re-opened.

The sales lost from the absence of tourists in the UK and the

rationalisation of stores in Europe were replaced by strong growth

in Asia.

Gross margin increased to 69% (2020: 59%) driven by a strategic

focus on full-price sales and increased volume efficiencies .

The combination of our UK factories, careful planning and agile

supply chains has enabled us to successfully navigate the

well-publicised difficulties in global logistics, with no impact on

fulfilment to our sales channels.

We ended the period with net cash of GBP30.3m (2020: GBP8.6m)

and deferred liabilities of GBP5.0m (2020: GBP 4.6 m).

Looking ahead, our mission continues to be focused on becoming

the leading responsible British luxury brand and a pioneer in

sustainability. Through our Made to Last manifesto, launched in

April, we are committed to transform our business to be a

regenerative and circular model that will encompass the entire

supply chain, from field to wardrobe by 2030. We believe the

opportunity is substantial and we have taken a progressive

leadership position in this space, investing in products that are

made to last, and offering customers circular repair and buy back

options through the Mulberry Exchange.

Mulberry's results demonstrate the continued relevance and

popularity of the brand and show ongoing progress against both

financial and operational goals.

CURRENT TRADING AND OUTLOOK

The underlying sales trends experienced in the first half

continued into October and November with improving store sales, a

strong digital performance and continuing growth in Asia. The

comparative period in the prior year was affected by sporadic

closures and lockdowns which make direct comparisons difficult but,

subject to unforeseen events, sales are expected to continue to

grow in the second half. Retail revenue in the 8 weeks to 20

November increased 35% compared to the same period last year.

Gross margin in the second half is expected to be similar to, or

slightly higher than, the 67% achieved in the second half last

year.

The Lowest Carbon collection, crafted from the world's lowest

carbon leather and using a local and transparent supply chain,

launched on 22 November 2021. This is Mulberry's first capsule

collection of regenerative "farm to finished product", further

supporting our Made to Last manifesto. This collection represents

the future of the business as we continue to build a network of

regenerative and organic farms to supply the hides to create our

leather across the UK and Europe. The capsule was also featured at

the recent G20 Summit in Rome.

In view of the strong performance in the first half and the

Group's substantial cash reserves, a progressive increase in

marketing expenditure is planned in the second half to continue

building brand awareness worldwide.

Projects are in place to move the Group's legacy systems

forward, and to develop the next generation of digital and

omni-channel platforms. This is expected to lead to increased

capital expenditure next year and beyond.

The Group is expected to continue generating cash in the second

half and with the deferred liabilities expected to unwind, the

Group will maintain a strong cash position at the year end.

It should be noted that the outlook continues to be subject to a

degree of uncertainty as the important festive period commences.

The Group's performance would undoubtedly be negatively affected by

any further countrywide lockdowns or a further wave of

COVID-19.

FINANCIAL REVIEW

Group revenue and gross profit

By 12 April 2021, all our stores worldwide were reopened

following a second wave of global lockdowns due to COVID-19.

Sales analysis for the 26 weeks to 25 September 2021 compared to

the same period last year is as follows:

2021 2020

GBP'm GBP'm % Change

Digital 19.1 23.4 -19%

Stores 36.5 19.5 +87%

-------

Retail (omni-channel) 55.6 42.9 +30%

------- ------- -----------

Franchise and wholesale 10.1 6.0 +67%

------- ------- -----------

Group revenue 65.7 48.9 +34%

======= ======= ===========

Digital 14.2 18.0 -21%

Stores 23.8 10.0 +139%

----- ----- ------

Omni-channel - UK 38.0 28.0 +36%

----- ----- ------

Digital 2.2 1.7 +30%

Stores 9.6 7.9 +22%

----- ----- ------

Omni-channel - Asia Pacific 11.8 9.5 +23%

----- ----- ------

Digital 2.7 3.7 -28%

Stores 3.1 1.7 +82%

----- ----- ------

Omni-channel - Rest of world 5.8 5.4 +7%

----- ----- ------

Total Retail (omni-channel) 55.6 42.9 +30%

===== ===== ======

Q1 Q2 H1 2021

GBP'm % Change GBP'm % Change GBP'm % Change

Sales Sales Sales

Digital 9.3 -36% 9.8 +11% 19.1 -18%

Stores 16.6 +202% 19.9 +42% 36.5 +87%

------- --------- ------- --------- ------- ---------

Retail (omni-channel) 25.9 +29% 29.7 +30% 55.6 +30%

------- --------- ------- --------- ------- ---------

Franchise and wholesale 6.4 +276% 3.7 -14% 10.1 +68%

------- --------- ------- --------- ------- ---------

Group revenue 32.3 +48% 33.4 +23% 65.7 +34%

------- --------- ------- --------- ------- ---------

Group revenue increased by 34% and was 3 % above the same period

in 2019 (pre COVID-19) on a comparable basis (adjusting for store

openings and closures). In the UK, total retail sales recovered

strongly and were 7% above the same period in 2019 on a comparable

basis. UK digital sales declined by 21% as stores re-opened, but

represented 37% of UK retail sales, compared to 26% in 2019,

reflecting the accelerated shift to digital and omni-channel

shopping.

China sales increased 38%, which contributed to the 23% increase

in Asia Pacific, driven by ongoing investment in the region. China

digital sales represented 43% of China retail sales.

Franchise and wholesale sales increased by 67% as our Franchise

partners benefited from the post COVID-19 recovery and increased

demand following the easing of restrictions.

Gross margin increased to 69% (2020: 59%) driven by a strategic

focus on full-price sales and increased volume efficiencies .

Other operating expenses

Other operating expenses in the period increased by 11.7% to

GBP40.0m (2020: GBP35.8m) due to further marketing spend to support

international growth and additional revenue related costs. The

Group continued to benefit from the business rates relief, albeit

at a lower level than in the previous year.

Following the cost actions taken in response to COVID-19, the

Group is managing its cost base in line with anticipated trading

levels.

Other operating income

Included within other operating income in the period is GBPnil

(26 weeks ended 26 September 2020: GBP4.1m and 52 weeks ended 27

March 2021 GBP4.9m) of grants receivable under the Coronavirus Job

Retention Scheme (CJRS). The Group decided not to utilise the CJRS

in the period due to the strong trading performance.

Profit before tax

The Group's reported profit before tax for the period was

GBP10.2m (2020: loss before tax of GBP2.3m), which included a

one-off profit of GBP5.7m on the early termination and the exit of

a lease in Paris. The Group's underlying profit before tax was

GBP4.5m (2020: loss before tax of GBP 1.9 m) .

See note 2 for further details of Alternative Performance

Measures.

Taxation

The Group reported a tax charge for the period of GBP2.9m (2020:

GBP0.3m) which includes a GBP2.4m charge on the profit on the

disposal of an intangible lease asset, in respect of the early

termination of the Paris lease. The effective tax rate is 14 %

(2020: 14%) on underlying profit and is lower than the UK tax rate

for the period of 19% primarily due to the use of brought forward

tax losses and not recognising deferred tax assets on the Group's

accumulated tax losses.

Balance Sheet

Intangible assets decreased by GBP8.6m to GBP6.4m (2020:

GBP15.0m) predominantly due to the early termination of the Paris

lease. Right-of-use assets decreased by GBP8.3m to GBP34.6m (2020:

GBP42.9m) due to an impairment charge against right-of-use assets

recorded in the 26 weeks to 27 March 2021.

Net working capital, which comprises inventories, trade and

other receivables and trade and other payables decreased by GBP2.0m

to GBP19.4m (2020: GBP21.4m). This was mainly due to the decrease

in inventories, as we continue to manage our inventory position,

and the increase in debtors and creditors due to increased volume.

There has been a slight increase in inventories since 27 March 2021

with increased inventories of raw materials to protect the Group

from supply chain delays, balanced by reduced finished goods as the

agile supply chain systems continue to deliver results.

The reduction in lease liabilities (current and non-current) by

GBP17.3m to GBP70.9m (2020: GBP88.2m) is primarily due to the

renegotiation and termination of certain leases.

Cash flow

The net increase in cash and cash equivalents per the cash flow

statement of GBP18.5m (2020: GBP0.6m) mainly reflected the strong

financial performance in the period and the net proceeds from the

early termination of the Paris lease , slightly offset by higher

capital expenditure in Asia Pacific.

The profit and proceeds from the disposal of intangibles of

GBP5.4m and GBP13.3m respectively relate to the early termination

of the Paris lease.

Borrowing facilities

The Group had no bank borrowings at 25 September 2021. The

borrowings shown in the balance sheet are loans from minority

shareholders in the Chinese and Japanese subsidiaries.

The Group's net cash balance (cash and cash equivalents less

overdrafts) at 25 September 2021 was GBP30.3m (2020: GBP8.6m). Net

cash comprises cash balances of GBP30.3m (2020: GBP8.6m).

During the period the Group extended its secured revolving

credit facility (RCF) with HSBC until March 2023, and renegotiated

covenants to reflect the ongoing COVID-19 environment. The RCF

covenants are tested quarterly on a "frozen GAAP" basis (excluding

the impact of IFRS 16) and contain a net debt to EBITDA ratio, and

a fixed charge cover ratio. The RCF was undrawn during the period,

and we do not anticipate drawing on the facility in the second

half.

In addition, the Group has a GBP4.0m overdraft facility which is

renewed annually.

Going concern

The Group has continued to trade significantly ahead of the

Directors' original base case forecasts with a cash position

materially ahead of assumptions, enhanced by the net proceeds from

the early termination of a lease in Paris, announced on 6 July

2021. As a result, the Directors remain confident that despite the

current uncertainties, the Group has the financial resources to

enable it to continue to operate as a going concern for the

foreseeable future.

PROGRESS AGAINST OUR STRATEGY

With our rich heritage in leather craftmanship and reputation

for innovation, we strive to grow the Group through our four

strategic pillars which focus on omni-channel distribution,

international development, constant innovation, and a sustainable

lifecycle.

Strategic pillar 1 - Omni-channel distribution

Our omni-channel distribution model is designed to allow

customers to research, buy and return product anywhere across our

stores and digital platforms.

We aim to enhance our customers' experience and drive

engagement, and this includes developing our store network through

selective store openings and closures, the continued roll-out of

the new Mulberry store concept and further enhancements to our

digital network.

Most of our retail stores were open by 12 April 2021 and except

for some localised restrictions, trade was uninterrupted in the

first half of the year. UK retail sales also benefited from the

development of our omni-channel distribution, providing the

customer with a single view of inventory, which helped to drive a

stronger full price sales mix.

Virtual and in-store appointments continue to play an important

part in the customer journey, even after the stores reopened,

representing 8% of all UK store sales and resulting in an increased

average transaction value (compared to store walk-ins).

Digital sales represented 29% of Group revenue, which

demonstrates the accelerated shift to digital and omni-channel

shopping across all regions. In Asia Pacific, digital sales grew to

19% of the region's sales, supported by local fulfilment in Japan

and the development of strategic partnerships, including T-Mall in

China. China digital sales grew 22% and represented 43% of total

China sales. On 15 July 2021 we also launched a We Chat programme

in China, which coincided with the Alexa x Alexa launch. This is a

long-term programme with the aim of building brand awareness in the

region, with content regularly updated and tailored to relevant

campaigns, products, and customers.

We have continued to refine the retail network. Our store

network closed the period with 113 points of sale inclusive of

retail and franchise. This included the opening of 7 doors

internationally 6 in our new store concept. There were 7 closures

in the same period, including the early exit of our Paris store. In

the UK we operated 45 retail stores([1]) at the period end (2020:

45 ), which included 12 John Lewis and 7 House of Fraser

concessions. We will continue to manage the business proactively

and focus on optimising the store network.

[1] Store numbers include own stores and concessions operated by

Mulberry employees

Strategic pillar 2 - International development

We are optimising our digital channels and global store network,

with a particular focus on Asia Pacific, which continues to offer

significant growth opportunities.

Asia Pacific retail sales increased by 23%, driven by ongoing

investment in the region, with China retail sales up 38%, South

Korea retail sales up 7% and Japan retail sales up 54%. Retail

sales in South Korea and Japan were disrupted to some extent by

regional and local lockdowns in the period. In Asia Pacific we

operated 38 retail stores at the period end (2020: 34 ). During the

period we opened 4 retail stores in China in Beijing (2), Chengdu

and Wuhan and 2 retail stores in South Korea, which included our

new store concept. This features design elements that represent our

distinctive British heritage and enables us to better display and

promote our collections. The concept includes innovative

customer-facing technology, creates more space and supports our

omni-channel proposition. It has helped to elevate our brand

position with the new concept stores outperforming more traditional

outlets.

As stated above, the 4 stores opened in China were Beijing World

Financial Centre, Beijing Shin Kong Place and Wuhan Heartland 66,

along with a pop-up in Chengdu International Finance Square. A

further opening in Shanghai International Finance Centre is due to

open in November 2021.

The investment in the Group's subsidiaries supported the overall

growth, with China and South Korea making further progress in the

period. Higher sell throughs and reduced mark down periods also

contributed to this success as well as better positioning for the

brand.

Our global pricing strategy, which sets retail prices in all

markets and currencies at the same level, is a competitive

difference giving our customers the confidence to shop the brand in

their home markets.

During the period it was agreed to terminate the lease of our

Paris store which closed on 24 July 2021. We plan to open a new

store in Paris once international tourism returns in a location

which supports the Company's omni-channel approach and optimises

its customer centric retail experience.

Strategic pillar 3 - Constant innovation

We continue to innovate with new services, new materials and

methods of creation and production to adapt to changing customer

tastes and meet demand. At the same time, we are transforming our

agile supply chain, enhancing market reactivity, and reducing lead

time, to match the increase in digital demand.

In September, we launched the Sadie family, a timeless satchel

with the new Typography lock, and the Billie family, a youthful

crossbody slouchy silhouette. Both families are crafted from

leather sourced from our partner tanneries with positive

environmental credentials and Leather Working Group ratings.

We have continued our 50th anniversary celebrations through a

series of joyful collaborations with three of the most visionary

designers of their generation - Priya Ahluwalia, Richard Malone and

Nicholas Daley. Each designer has created a capsule collection as

part of Mulberry Editions, a new offering of limited-edition

accessories that have been delivered throughout 2021. Crafted

entirely from surplus fabrics and leather, the Mulberry x Ahluwalia

collection heroes the Portobello Tote silhouette, which was our

first 100% sustainable leather bag, launched in 2019. The Richard

Malone capsule sees the Irish designer reinvent the iconic

Bayswater with his signature authenticity, resourcefulness,

sustainability, and experimentation. This Bayswater updates the

silhouette's timeless detailing and is crafted with our sustainable

Eco-Scotchgrain, made from recombined bio-plastic materials, and

embossed with a distinctive pebble grain finish. The Nicholas Daley

capsule will launch in January 2022.

Strategic pillar 4 - Sustainable lifecycle

Mulberry products have been Made to Last from the outset and we

are committed to lifetime service for a Mulberry item. In April

2021 we launched our Made to Last manifesto, which sets us apart

from our competition. We are committed to transform our business to

be a regenerative and circular model that will encompass the entire

supply chain, from field to wardrobe by 2030.

We launched Mulberry Exchange in February 2020, our circular

buy-back and re-sale programme. This was further extended in April

2021 through the digital launch of the Mulberry Exchange programme

on Mulberry.com. Through the Mulberry Exchange programme, we buy

back bags from customers who are ready for a change, repair and

restore them in our Lifetime Service Centre at The Rookery, and

list them through one of our resale channels. Any bags which are

not fit for repair are sent for energy reclamation at our strategic

partner, Scottish Leather Group, powering the production of new

leather to make the next Mulberry bags.

In July, Mulberry committed to setting Science Based Targets,

and joined a group of over 650 global businesses working to hold

temperature rise to 1.5degC above pre-industrial levels. Mulberry's

listing as "committed" is just the first step on our journey

towards our aim of achieving Net Zero emissions by 2035.

86 % of the collection now uses leather and suede sourced from

environmentally accredited tanneries; expected to increase to 100%

by Autumn/Winter 2022. All other non-leather materials are fully

sustainable.

Marketing and brand

To mark our 50th anniversary year, Mulberry announced the launch

of the Made to Last manifesto, laying out an ambitious commitment

to transform the business to a regenerative and circular model,

encompassing the entire supply chain, from field to wardrobe by

2030. The 360-campaign kicked off with a livestreamed launch event

(due to Covid restrictions), featured a series of global brand

advocates in the sustainability sphere and was supported by a

global media plan featuring the manifesto. May 2021 saw the launch

of The Mulberry Exchange on Mulberry.com; to support this we

partnered with Dazed on a Tik Tok focussed activation,

commissioning a series of up-and-coming Tik Tok stars to style a

selection of our pre-loved bags.

As mentioned above, to support our collaborations with designers

Priya Ahluwalia, Richard Malone and Alexa Chung, we held a series

of events to promote these visionary designers and their

collections globally. A highlight of these was an event at the

V&A in September's London fashion week to showcase Malone's

eco-friendly version of our timeless Bayswater bag using

Eco-Scotchgrain and leather from gold standard, environmentally

accredited tanneries.

We continued our focus on building relationships in the digital

marketing space, with new and existing digital media partners and

third-party affiliates to reach younger audiences and drive new

customer growth on our digital platforms. Our designer

collaborations across the year were aligned to reach these younger,

fashion forward audiences, with Alexa x Alexa being the peak of

this in July. The success of Alexa x Alexa also ran into August

with additional spend and placements booked to continue the strong

performance seen here.

CONSOLIDATED INCOME STATEMENT

26 WEEKSED 25 september 2021

Note

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended 27 March

25 September 2021 26 September 2020 2021

GBP'000 GBP'000 GBP'000

Revenue 65,719 48,919 114,951

Cost of sales (20,326) (20,019) (41,879)

Gross profit 45,393 28,900 73,072

Impairment charge related

to property, plant and

equipment - - (590)

Impairment charge related

to right-of-use assets - - (5,725)

Store closure credit (1) 5,700 1,992 3,702

Lease modification - 3,951

Other operating expenses (39,960) (35,785) (71,638)

Other operating income (2) 779 4,691 6,006

Operating profit/(loss) 11,912 (202) 8,778

Share of results of

associates 61 (32) (60)

Finance income 8 3 12

Finance expense (1,769) (2,121) (4,176)

Profit/(loss) before tax 10,212 (2,352) 4,554

Tax (charge)/credit 4 (2,929) 330 43

Profit/(loss) for the

period 7,283 (2,022) 4,597

Attributable to:

Equity holders of the

parent 7,568 (1,713) 4,773

Non-controlling interests (285) (309) (176)

Profit/(loss) for the

period 7,283 (2,022) 4,597

Basic profit/(loss) per

share 5 12.2p (3.4p) 7.7p

Diluted profit/(loss) per

share 5 12.2p (3.4p) 7.7p

All activities arise from continuing operations.

( 1) For the 26 weeks ended 26 September 2020 the store closure

credit of GBP1,992,000 was included within Other operating

expenses

(2) Included within Other operating income is GBPnil (26 weeks

ended 26 September 2020: GBP4,089,000; 52 weeks ended 28 March

2021: GBP4,868,000) of grants receivable under HM Revenue &

Customs Coronavirus Job Retention Scheme and GBP435,000 (26 weeks

ended 26 September 2020: GBP448,000; 52 weeks ended 28 March 2021:

GBP471,000) from similar overseas schemes.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

26 WEEKSED 25 SEPTEMBER 2021

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended 27 March

25 September 2021 GBP'000 26 September 2020 GBP'000 2021

GBP'000

Profit/(loss) for the

period 7,283 (2,022) 4,597

Items that may be

reclassified subsequently

to profit or loss;

Exchange differences on

translation of foreign

operations (295) 412 (49)

Total comprehensive

income/(expense) for the

period 6,988 (1,610) 4,548

Attributable to:

Equity holders of the

parent 7,287 (1,506) 4,294

Non-controlling interests (299) (104) 254

Total comprehensive

income/(expense) for the

period 6,988 (1,610) 4,548

CONSOLIDATED BALANCE SHEET

AT 25 SEptember 2021

Unaudited Unaudited Audited

25 September 2021 GBP'000 26 September 2020 GBP'000 27 March 2021

GBP'000

Non-current assets

Intangible assets 6,412 15,032 14,965

Property, plant and equipment 13,521 15,436 13,608

Right of use assets 34,592 42,936 33,511

Interests in associates 253 128 134

Deferred tax asset 635 1,487 1,234

55,413 75,019 63,452

Current assets

Inventories 32,041 33,580 31,476

Trade and other receivables 13,204 11,453 12,609

Current tax asset - 432 525

Cash and cash equivalents 30,328 8,595 11,820

75,573 54,060 56,430

Total assets 130,986 129,079 119,882

Current liabilities

Trade and other payables (25,845) (23,739) (22,629)

Current tax liabilities (1,912) - -

Lease liabilities (15,356) (17,849) (14,820)

Borrowings (1,321) (3,431) -

(44,434) (45,019) (37,449)

Net current assets 31,139 9,041 18,981

Non-current liabilities

Lease liabilities (57,342) (70,400) (59,054)

Borrowings (3,504) (1,491) (4,673)

(60,846) (71,891) (63,727)

Total liabilities (105,280) (116,910) (101,176)

Net assets 25,706 12,169 18,706

Equity

Share capital 3,004 3,004 3,004

Share premium account 12,160 12,160 12,160

Own share reserve (1,272) (906) (1,277)

Capital redemption reserve 154 154 154

Foreign exchange reserve 979 1,735 1,274

Retained earnings 14,546 (54) 6,957

Equity attributable to holders of the

parent 29,571 16,093 22,272

Non-controlling interests (3,865) (3,924) (3,566)

Total equity 25,706 12,169 18,706

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

26 WEEKSED 25 SEPTEMBER 2021

Share Share Own Capital Foreign Retained Non-controlling Total

capital premium share re-demption exchange earnings Total interest equity

GBP'000 account reserve reserve reserve GBP'000 GBP'000 GBP'000 GBP'000

GBP'000 GBP'000 GBP'000 GBP'000

As at 28 March 2020 3,004 12,160 (1,061) 154 1,323 1,761 17,341 (3,820) 13,521

Loss for the period - - - - - (1,713) (1,713) (309) (2,022)

Other comprehensive

income/(expense) for

the period - - - - 207 - 207 205 412

Total comprehensive

income/(expense) for

the period - - - - 207 (1,713) (1,506) (104) (1,610)

Charge for employee

share-based payments - - - - - 53 53 - 53

Impairment of shares

in trust - - 155 - - (155) - - -

Non-controlling

interest foreign

exchange - - - - 205 - 205 - 205

As at 26 September

2020 3,004 12,160 (906) 154 1,735 (54) 16,093 (3,924) 12,169

Profit for the period - - - - - 6,486 6,486 133 6,619

Other comprehensive

(expense)/income for

the period - - - - (686) - (686) 225 (461)

Total comprehensive

(expense)/income for

the period - - - - (686) 6,486 5,800 358 6,158

Charge for employee

share-based payments - - - - - 52 52 - 52

Own shares - - 101 - - 5 106 - 106

Exercise of share

options - - - - - (4) (4) - (4)

Release of impairment

of shares in trust - - (472) - - 472 - - -

Non-controlling

interest foreign

exchange - - - - 225 - 225 - 225

As at 27 March 2021 3,004 12,160 (1,277) 154 1,274 6,957 22,272 (3,566) 18,706

Profit/(loss) for the

period - - - - - 7,568 7,568 (285) 7,283

Other comprehensive

expense for the

period - - - - (281) - (281) (14) (295)

Total comprehensive

(expense)/income for

the period - - - - (281) 7,568 7,287 (299) 6,988

Charge for employee

share-based payments - - - - - 24 24 - 24

Own shares - - 5 - - - 5 - 5

Exercise of share

options - - - - - (3) (3) - (3)

Non-controlling

interest foreign

exchange - - - - (14) - (14) - (14)

As at 25 September

2021 3,004 12,160 (1,272) 154 979 14,546 29,571 (3,865) 25,706

CONSOLIDATED CASH FLOW STATEMENT

26 WEEKSED 25 september 2021

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended 28 March 2020

25 September 2021 GBP'000 26 September 2020 GBP'000

GBP'000

Operating profit/(loss) for the

period 11,912 (202) 8,778

Adjustments for:

Depreciation and impairment of

property, plant and equipment 1,850 2,311 4,777

Depreciation and impairment of

right-of-use assets 3,257 3,654 13,245

Amortisation of intangible

assets 914 542 1,476

Gain on lease modifications and

disposals (548) (2,215) (10,314)

(Profit)/loss on sale of

property, plant and equipment (8) - 188

Profit on sale of intangible (5,343) - -

assets

Own shares transferred from

trust 5 - 106

Share-based payments charge 24 53 105

Operating cash flows before

movements in working capital 12,063 4,143 18,361

(Increase)/decrease in

inventories (604) 1,335 3,420

Increase in receivables (595) (378) (1,534)

Increase in payables 2,966 1,532 75

Cash generated by operations 13,830 6,632 20,322

Income taxes received 101 332 201

Interest paid (1,772) (943) (3,960)

Net cash inflow from operating

activities 12,159 6,021 16,563

Investing activities:

Interest received 8 3 12

Purchases of property, plant and

equipment (1,260) (657) (1,895)

Proceeds from disposal of

property, plant and equipment 8 - 26

Acquisition of intangible fixed

assets (868) (633) (2,233)

Proceeds from disposal of 13,316 - -

intangible assets

Net cash generated/(used) in

investing activities 11,204 (1,287) (4,090)

Financing activities:

Increase in loans from

non-controlling interests 165 - 167

Repayment of borrowings - (750) (750)

Principle elements of lease

payments (4,989) (3,343) (7,735)

Settlement of share awards - - (4)

Net cash used in financing

activities (4,824) (4,093) (8,322)

Net increase in cash and cash

equivalents 18,539 641 4,151

Cash and cash equivalents at

beginning of period 11,820 7,998 7,998

Effect of foreign exchange rate

changes (31) (44) (329)

Cash and cash equivalents at end

of period 30,328 8,595 11,820

Notes to the condensed financiAL statements

26 WEEKSED 25 SEPTEMBER 2021

1. GENERAL INFORMATION

Mulberry Group plc is a company incorporated in the United

Kingdom under the Companies Act 2006. The half year results and

condensed consolidated financial statements for the 26 weeks ended

25 September 2021 (the interim financial statements) comprise the

results for the Company and its subsidiaries (together referred to

as the Group) and the Group's interest in associates. The interim

financial statements for the 26 weeks ended 25 September 2021 have

not been reviewed or audited.

The information for the 52 weeks ended 27 March 2021 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. The statutory accounts for that period were

approved by the Board of Directors on 20 July 2021 and have been

filed with the Registrar of Companies. The auditor's report on

those statutory accounts was not qualified, did not include a

reference to any matters to which the Auditor drew attention by way

of emphasis without qualifying the report and did not contain

statements under section 498(2) (3) of the Companies Act 2006.

2. ACCOUNTING POLICIES AND BASIS OF PREPARATION

The accounting policies and methods of computation followed in

the interim financial statements are consistent with those as

published in the Group's Annual Report and Financial Statements for

the 52 weeks ended 27 March 2021.

These condensed consolidated interim financial statements for

the 26 weeks ended 25 September 2021 have been prepared in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union. This report should be read in conjunction with

the Group's financial statements for the 52 weeks ended 27 March

2021, which have been prepared in accordance with International

Financial Reporting Standards (IFRSs) as adopted by the European

Union.

The Annual Report and Financial Statements are available from

the Group's website (www.mulberry.com) or from the Company

Secretary at the Company's registered office, The Rookery,

Chilcompton, Bath, England, BA3 4EH.

CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION

UNCERTAINTY

Preparation of the condensed consolidated interim financial

statements requires the Directors to make certain estimates and

judgements that affect the measurement of reported revenues,

expenses, assets and liabilities.

The significant accounting judgements and key sources of

estimation uncertainty applied in the preparation of the condensed

consolidated interim financial statements are consistent with those

described on pages 74-76 of the Group's Annual Report and Financial

Statements for the 52 weeks ended 27 March 2021.

PRINCIPAL RISKS AND UNCERTAINTIES

The management of the business and the execution of the Group's

growth strategies are subject to a number of risks and

uncertainties that could adversely affect the Group's future

development. The principal risks and uncertainties for the Group,

and the key mitigating actions used to address them are consistent

with those outlined on pages 21-27 of the Group's Annual Report and

Financial Statements for the 52 weeks ended 27 March 2021.

ALTERNATIVE PERFORMANCE MEASURES

In reporting financial information, the Group presents

Alternative Performance Measure ("APMs"), which are not defined or

specified under the requirements of IFRS. The APM used by the Group

is adjusted profit/(loss) before tax.

The Group makes certain adjustments to the statutory profit or

loss measures in order to derive APMs. Adjusting items are those

items which, in the opinion of the Directors, should be excluded in

order to provide a consistent and comparable view of the

performance of the Group's ongoing business. Generally, this will

include those items that are largely one-off and material in nature

as well as income or expenses relating to acquisitions or disposals

of businesses or other transactions of a similar nature. Treatment

as an adjusting item provides stakeholders with additional useful

information to assess the year-on-year trading performance of the

Group.

A reconciliation of reported profit/(loss) before tax to

adjusted profit/(loss) before tax is set out below.

Audited

Unaudited Unaudited 52 weeks ended 27 March

26 weeks ended 25 26 weeks ended 26 2021

September 2021 GBP'000 September 2020 GBP'000 GBP'000

Reconciliation to adjusted

profit/(loss) before tax

Profit/(loss) before tax 10,212 (2,352) 4,554

Restructuring costs - 2,151 2,370

Store closure credit (5,700) (1,992) (3,702)

Impairment charge related

to property, plant and

equipment - - 590

Impairment charge related

to right-of-use assets - - 5,725

Lease modification - - (3,951)

Licence agreement exit

costs - 300 300

Adjusted profit/(loss)

before tax - non-GAAP

measure 4,512 (1,893) 5,886

Adjusted basic

profit/(loss) per share

(note 5) 6.8p (3.4p) 10.5p

Adjusted diluted

profit/(loss) per share

(note 5) 6.8p (3.4P) 10.5p

Restructuring costs

During the period, one-off charges of GBPnil (2020: GBP2,151,000) were incurred relating to

people restructuring costs.

Store closure credit

During the period, 1 international store (2020: 2 international stores) was closed. The credit/profit

on disposal is net of any closure and redundancy costs.

Licence agreement exit costs

During the period the Group incurred charges of GBPnil (2020: GBP300,000) from the write-off

of its ready-to-wear and footwear licence relating to final samples and materials on non-renewal

of the licence and distribution agreement for these lifestyle products.

3. GOING CONCERN

In determining whether the Group's accounts can be prepared on a

going concern basis, the Directors considered the Group's business

activities and cash requirements together with factors likely to

affect its performance and financial position.

The Group had net cash of GBP30.3 million (2020: GBP8.6 million)

and deferred liabilities of GBP5.0m (2020: GBP4.6m) at 25 September

2021 and had not drawn down on its revolving credit facility. The

Directors have also reviewed the 12-month forecasts including their

resilience in the face of possible downside scenarios.

Based on the assessment outlined above, the Directors have a

reasonable expectation that the Group has access to adequate

resources to enable it to continue to operate as a going concern

for the foreseeable future. For these reasons, the Directors

consider it appropriate for the Group to continue to adopt the

going concern basis of accounting in preparing the Interim Report

and financial statements.

4. TAXATION

The tax charge/(credit) is calculated by applying the forecast

full year effective tax rate to the interim profit(/loss) and

calculating the deferred tax balance for the period. The charge for

the 26 weeks ended 25 September 2021 also includes a charge of

GBP2.4m (2020: GBPnil) for the tax on the gain on disposal of an

intangible lease asset.

5. EARNINGS PER SHARE ('EPS')

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended 27 March 2021

25 September 2021 26 September 2020

Basic profit/(loss) per share 12.2p (3.4p) 7.7p

Diluted profit/(loss) per share 12.2p (3.4p) 7.7p

Adjusted basic profit/(loss) per share 6.8p (3.4p) 10.5p

Adjusted diluted profit/(loss) per share 6.8p (3.4p) 10.5p

Earnings per share is calculated based on the following

data:

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

25 September 2021 GBP'000 26 September 2020 GBP'000 27 March 2021

GBP'000

Profit/(loss) for the period for basic

and diluted earnings per share 7,283 (2,022) 4,597

Adjustments to exclude exceptional

items:

Restructuring costs* - 1,757 1,931

Store closure credit* (3,242) (1,992) (3,611)

Impairment relating to retail assets - - 590

Impairment relating to right-of-use

assets - - 5,725

Lease modification* - (3,200)

Licence agreement exit costs* - 243 243

Adjusted profit/(loss) for the period

for basic and diluted earnings per

share 4,041 (2,014) 6,275

*These items are included net of tax

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended 27 March 2021

25 September 2021 Million 26 September 2020 Million Million

Weighted average number of

ordinary shares for the

purpose of basic EPS 59.5 59.5 59.5

Effect of dilutive potential - - -

ordinary shares: share

options

Weighted average number of

ordinary shares for the

purpose of diluted EPS 59.5 59.5 59.5

The weighted average number of ordinary shares in issue during

the period excludes those held by the Employee Share Trust.

6. BUSINESS AND GEOGRAPHICAL SEGMENTS

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reviewed by the Chief Operating Decision Maker ("CODM"),

defined as the Board of Directors, to allocate resources to the

segments and to assess their performance. Inter-segment pricing is

determined on an arm's length basis. The Group also presents

analysis by geographical destination and product categories.

(a) Business segment

The Group has identified one reportable segment.

The principal activities are as follows:

The accounting policies of the reportable segment are the same

as described in the Group's financial statements. Information

regarding the results of the reportable segment is included below.

The distribution of product globally is monitored and optimised at

a Group level and effected via the Group's distribution centres in

the UK, Europe, North America and Asia. Performance for the segment

is assessed based on operating profit/(loss).

The Group designs, manufactures and manages the Mulberry brand

for the segment and therefore the finance income and expense are

attributable to this segment.

GROUP INCOME STATEMENT

26 WEEKS ENDED 25 september 2021

Note

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended 27 March

25 September 2021 26 September 2020 2021

GBP'000 GBP'000 GBP'000

Retail 36,585 19,539 43,586

Digital 19,066 23,364 56,365

Wholesale 10,068 6,016 15,000

Total revenue 65,719 48,919 114,951

Cost of sales (20,326) (20,019) (41,879)

Gross profit 45,393 28,900 73,072

Impairment charge related

to property, plant and

equipment - - (590)

Impairment charge related

to right-of-use assets - - (5,725)

Store closure credit 5,700 1,992 3,702

Lease modification - - 3,951

Other operating expenses (39,960) (35,785) (71,638)

Other operating income 779 4,691 6,006

Operating profit/(loss) 11,912 (202) 8,778

Share of results of

associates 61 (32) (60)

Finance income 8 3 12

Finance expense (1,769) (2,121) (4,176)

Profit/(loss) before tax 10,212 (2,352) 4,554

Tax (charge)/credit 4 (2,929) 330 43

Profit/(loss) for the

period 7,283 (2,022) 4,597

Segment capital

expenditure 2,170 1,592 3,996

Segment depreciation and

amortisation 6,021 6,507 19,498

Segment assets 130,351 127,592 118,648

Segment liabilities 105,280 116,910 101,176

For the purposes of monitoring segment performance and

allocating resources between segments, the Chief Operating Decision

Maker, which is deemed to be the Board of Directors monitors the

tangible intangible and financial assets attributable to each

segment. All assets are allocated to the reportable segment.

(b) Geographical markets

Sales revenue by Non-current assets by

geographical market geographical market

(1)

Unaudited

26 weeks Unaudited Audited Unaudited Unaudited Audited

ended 26 weeks 52 weeks 26 weeks 26 weeks 52 weeks

25 September ended ended ended ended ended

2021 26 September 27 March 25 September 26 September 27 March

GBP'000 2020 2021 2021 2020 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

UK 40,002 29,038 68,573 45,829 61,037 50,792

Rest of Europe 8,651 7,132 15,014 1,483 9,564 8,487

Asia 13,313 10,199 24,636 4,160 3,274 3,362

North America 3,562 2,368 6,261 3,941 1,144 811

Rest of world 191 182 467 - - -

Total revenue 65,719 48,919 114,951 55,413 75,019 63,452

(1) Revenue by geographical market includes wholesale sales

based on the location of the customer.

(c) Product categories

Leather accessories account for over 90% of the Group's

revenues, of which bags represent over 70% of revenues. Other

important product categories include small leather goods, shoes,

soft accessories and women's ready-to-wear. Net asset information

is not allocated by product category.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDLILVFIL

(END) Dow Jones Newswires

November 24, 2021 01:59 ET (06:59 GMT)

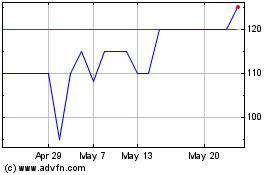

Mulberry (AQSE:MUL.GB)

Historical Stock Chart

From May 2024 to Jun 2024

Mulberry (AQSE:MUL.GB)

Historical Stock Chart

From Jun 2023 to Jun 2024