Australia Stocks End up Slightly as Key Inflation Data Looms

July 26 2016 - 2:14AM

Dow Jones News

By Rebecca Thurlow

SYDNEY--Australia's share market ended a fraction higher Tuesday

as investors awaited key inflation data that could determine

whether the Reserve Bank of Australia cuts official interest rates

further.

The S&P/ASX 200 closed up just 3.9 points, or 0.1%, at

5537.5, after spending most of the day in negative territory.

Taking its lead from weaker U.S. stock indices, the local bourse

started lower before edging up through much of the session.

Financial stocks and property trusts rose as attention turned to

inflation numbers due Wednesday. The data is expected to confirm

that a return to the Reserve Bank's desired inflation target band

of 2%-3% is still years away, giving the central bank a compelling

case to cut rates in August.

The four major banks all gained ground, led by ANZ, up 0.9%, and

National Australia Bank, up 0.7%.

Energy stocks fell as concerns about oversupply and weak demand

weighed on the oil price. Santos ended 2.4% lower, Oil Search 1.1%

and Woodside 0.8%.

Health-care companies also dragged on the index, giving up much

of Monday's gains. CSL fell 1.2% and ResMed 1.9%.

Woolworths, also retreated from highs set Monday. The retailer

rose Monday after announcing a restructure plan to help it battle

increased competition but analysts warned Tuesday it would take a

long time for management to turn the company around. The stock

ended down 3.3%.

Write to Rebecca Thurlow at rebecca.thurlow@wsj.com

(END) Dow Jones Newswires

July 26, 2016 02:59 ET (06:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

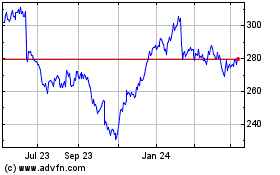

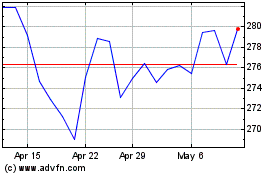

CSL (ASX:CSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

CSL (ASX:CSL)

Historical Stock Chart

From Dec 2023 to Dec 2024