Fbs joins the Banca IFIS Group

January 07 2019 - 5:44AM

Fbs joins the Banca IFIS Group

PRESS RELEASEFBS joins the Banca IFIS

Group

The acquisition of 90% of FBS has been finalized

today: introducing the first integrated player for Italian NPLs

with an overall portfolio of € 23.5 billion

Milan, January 7th, 2019 – Today Banca IFIS

Group has finalized the acquisition of FBS S.p.A, the fourth

national player focused on secured and corporate NPLs. The deal,

announced on May 15th, 2018 and entirely financed through Banca

IFIS's liquidity, pertains to 90% of FBS shareholders equity for a

cash consideration of € 58.5 million. Paolo Strocchi, majority

shareholder of FBS since its founding, will continue to act as

Chief Executive Officer and will remain shareholder together with

FBS top management, retaining a total stake equal to 10% of FBS’

shareholders capital. Put and call options established,

reciprocally, by top management and Banca IFIS that can be

exercised in the next 2-4 years in defined timeframes at a value

depending on FBS S.p.A’s performance.

The acquisition is in line with the Group's

growth strategy and involves the following:

- Attaining incremental value from

IFIS NPL’s banking and real estate portfolio through the FBS

servicing platform; IFIS NPL is a wholly owned subsidiary of Banca

IFIS;

- expanding the range of services,

streamlining processes, and cutting asset conversion times;

- maximising organisational and

process integration; leveraging FBS’s proprietary technological

platform;

- retaining FBS staff: approximately 131 employees across 3

offices (Milan, Ravenna, Bari);

- Banca IFIS’ technological investments to promote the digital

transformation of processes and servicing of the NPL business.

«Today two great sets of skills, professionalism

and experiences merge, strengthening and mutually complementing

themselves - explains Giovanni Bossi, Banca IFIS CEO -. Today we

have created the first integrated investment and asset management

platform on the Italian NPL market, with a portfolio of ca. € 23.5

billion, of which ca. € 16.7bn own assets and €6.8bn third party

assets under servicing. This is a system transaction for even

greater development in the non-performing loan market, thus

benefiting of all its players. We are a joint platform composed of

ca. 1,500 persons, 460 employees, involving over a thousand law

firms and loan professionals: the most important in Italy, capable

of providing a comprehensive service for all non-performing loan

categories, from small ticket unsecured consumer portfolios to

corporate and real estate ones».

Banca IFIS is a player active

in specialty finance with about 1.700 employees. The main business

activities regard: services and credit solutions for corporate,

acquisition and management of non-performing loans. Its own NPL

portfolio amounts to € 15.7 billion (nominal value) for over 1.6

million positions.

FBS S.p.A. operates in the NPL

market as a servicing specialist (including both master and special

servicer), manager of secured and unsecured NPL portfolios, due

diligence advisor, and investor authorized to conduct NPL

securitization transactions. It manages € 6.8 billion of

non-performing loans plus ca. € 1 billion own portfolio.

|

Banca IFIS S.p.A.Press Relation

OfficerEleonora VallinCell: +39 342

8554140eleonora.vallin@bancaifis.itwww.bancaifis.it |

IR and Corporate Development

OfficerMartino Da RioTel: +39 02

24129953martino.dario@bancaifis.itwww.bancaifis.it

|

- 20190107_FBS joins the Banca IFIS Group_ENG

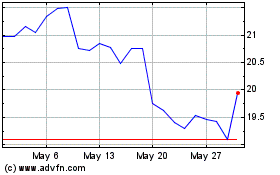

Banca IFIS (BIT:IF)

Historical Stock Chart

From Oct 2024 to Nov 2024

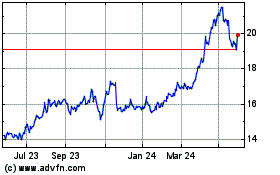

Banca IFIS (BIT:IF)

Historical Stock Chart

From Nov 2023 to Nov 2024