Uniswap Processes Over $2 Trillion On Ethereum: UNI Bull Run Inevitable?

October 22 2024 - 11:30PM

NEWSBTC

Uniswap, the leading decentralized exchange (DEX) on Ethereum, is

building and growing, looking at the number of processed volumes

over the years. Uniswap Processes Over $2 Trillion On Ethereum

Since launching in late 2018, on-chain data shows that the DEX has

processed over $2 trillion in cumulative volume on the Ethereum

mainnet. Related Reading: Top Crypto Analyst Unveils Strategy To

‘Make Millions’ By March 2025 The steady climb in cumulative volume

points to Uniswap’s growth over the years and the team’s dedication

to ensuring that the platform functions as originally designed.

Unlike centralized exchanges like Binance or Coinbase, Uniswap

relies on smart contracts for swapping. All transactions are

initiated from a non-custodial wallet such as MetaMask, ensuring

the holder retains control of all assets. No transaction is

approved unless the wallet owner authorizes it. For the unique

value proposition Uniswap presents, the platform continues to grow

by leaps and bounds. The latest data from DeFiLlama reveals that

the DEX manages over $4.9 billion worth of assets. At this level,

Uniswap is the sixth largest DeFi protocol, cementing the dominance

of Ethereum-based dapps. While users can choose from three protocol

versions, the latest iteration, v3, is the largest, managing over

$3 billion. Uniswap v3 was the first DEX to introduce concentrated

liquidity to improve capital efficiency. Besides v3, users can swap

on Uniswap across multiple chains, including the BNB Chain and

Avalanche. However, DEX trading via Uniswap is popular on Ethereum,

where the exchange manages over $3.9 billion. DeFi Dominance, UNI

To $12? As DeFi gains traction and more traders opt to swap

trustlessly, Uniswap will likely process even more transactions.

Most importantly, the DEX may dominate DEX trading on Ethereum

layer-2s, looking at trends. DeFiLlama data reveals that the dapp

has a total value locked (TVL) of over $277 million. Related

Reading: Bitcoin Signal That Led To At Least 70% Surge Has Formed

Again Considering the role of the DEX on Ethereum and the fact that

it is among the biggest contributors of gas fees, UNI could benefit

in the coming sessions. From the daily chart, UNI is posting

impressive higher highs and approaching a key resistance level.

After dumping to $4.7 in early August, the token has almost doubled

in valuation and is on the cusp of printing fresh Q4 2024 highs. A

break above $8.5 could trigger a wave of demand that may see UNI

float to $12. Feature image from Adobe Stock, chart from

TradingView

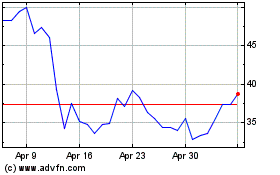

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024