Stacks (STX) Drops 15% Despite Continuous On-Chain Developments – Details

September 03 2024 - 11:30AM

NEWSBTC

Stacks struggles to stand on level ground as it continues to fall

despite the market’s attempt to rebound in the short term.

According to CoinGecko, STX bled 15% since last week with the token

attempting to reverse the downward momentum with a nearly 4% uptick

in the past 24 hours. Related Reading: SUI Crashes 23% As September

Unleashes Market Panic—Is A Comeback Possible? Stacks has been

teasing the community, creating hype for the upcoming Nakamoto

Upgrade with their ‘21 Days of Nakamoto’ event. The event, which

commenced back on the 28th of August, started September with a

whole suite of surprises for investors and community members. NFTs

And Financial Grants Back On The Menu For Stacks On a recent X

post, Megapont was revealed to be Stacks’s September 3 surprise for

the celebration of the upcoming mainnet release of the Nakamoto

upgrade. Megapont is an NFT project, launched and operates

primarily on the Stacks blockchain. Let’s celebrate a mega upgrade

for Stacks! 🧡 And who better to celebrate with than something truly

mega… Welcome back, @MegapontNFT! Orange List:

https://t.co/fOeckrNRVH pic.twitter.com/Z46xH5g1QL — stacks.btc

(@Stacks) September 2, 2024 The project released Nakapack, a

5,000-strong NFT collection to be given out to the Stacks

community. Users on the platform can mint the NFTs without a fee,

but they need to be whitelisted for this to happen. Despite 95% of

circulated NFTs now being deemed worthless by a recent report,

Megapont’s dedication to its community might spark interest in NFTs

within the Bitcoin L2 ecosystem. STXCUSD trading at $1.51 on the

24-hour chart: TradingView.com Another development that will

support Stacks in the long term is the second cohort of grants for

community-voted programs on-chain. On the thread, seven programs

were featured each granted $50,000 to aid their development

process. In total, over 31 programs have been given financial

assistance. $1.3-$1.6 Chokes STX’s Upside Potential As of writing,

STX is held tightly by the $1.3-$1.6 trading range, hampering the

token’s upside potential shortly. This leaves the bulls in an

interesting position which has the opportunity to break through the

$1.7 price ceiling. STX’s relative strength index (RSI) suggests

that the token will attempt to stabilize in its current trading

range which gives the bulls a much-needed platform to jump out

from. However, its relatively stable level reveals that the bears

still have some strength, enough to cancel the bullish momentum

that’s currently forming. Related Reading: Ripple Unleashes 1

Billion XRP: Could This Trigger A Price Tsunami? In the short term,

the bears will have the upper hand unless the market makes another

leap forward, creating enough momentum for STX to have a

breakthrough. However, the meager gains the broader market

experienced have little to no effect on STX’s future performance.

Fear, uncertainty, and doubt still plagues market sentiment for the

token. For now, investors and traders should exercise caution while

monitoring the broader market’s movement before making a decision.

STX’s significant correlation with BTC is both a boon and a curse

for investors as any swing made by the latter will have a strong

influence on the performance of the former. Featured image from

Host Merchant Services, chart from TradingView

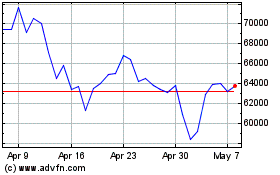

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024