CRV Price Recovers From 6-Month Lows, What’s Driving The Price?

August 03 2023 - 4:00PM

NEWSBTC

Curve Finance’s native token CRV has recovered from a 6-month low,

and many believe that the news of Huobi co-founder Jun Du buying

CRV tokens has contributed to it. Jun Du bought 10 million

tokens valued at $4 million from Micheal Egorov, founder of Curve.

Egorov had offered his tokens for sale to bolster his at-risk loan

positions, primarily for borrowing stablecoins using CRV tokens as

collateral. Some Positives For Curve Finance Despite Hack

Curve Finance, one of the biggest DeFi protocols on the Ethereum

blockchain, recently saw its in-house CRV price recover about 25%

at the start of the month. It had previously dropped by 35% between

July 30-31 following the panic selloff spearheaded by Curve

Finance’s $47 million exploit. Related Reading: Buying

Pressure Incoming? MicroStrategy Files Notice With SEC To Sell $750

Million In Stocks The July reentrancy attack was not the only

exploit recorded on Curve Finance as the DeFi protocol had

previously lost over $570,000 in August 2022 after hackers

compromised the front end of its liquidity pool. However, the

recent acquisition of 10 million tokens by Jun Du projects a

positive outlook for CRV tokens, especially the recent attack on

its ecosystem. Confirming the transaction, Du noted that he has

locked up his investment for a period of one year as veCRV.

Apart from Du, the Aave Chan Initiative, a delegate platform from

Aave’s governance forum, recently put forward a proposal for the

purchase of about $2 million worth of CRV. After the planned

purchase, which is to be made by the Aave Treasury, the CRV tokens

would also be locked up as veCRV for about four years. Token

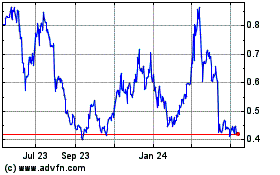

price recovers from weekly lows | Source: CRVUSD on Tradingview.com

CRV Remains Popular Among Investors Egorov has so far sold 72

million CRV tokens to various investors and the continued purchase

and acceptance of the CRV token demonstrates its popularity and

utility. One such investor who remains bullish on CRV is

Justin Sun, founder of the Tron network. He recently acquired 5

million CRV from Egorov by paying using Tether’s USDT in a direct

Over-the-counter (OTC) trade. Justin confirmed the purchase in a

tweet noting that both platforms “As steadfast partners” will keep

being “…committed to providing support whenever needed.” According

to a Twitter post by Sandra from Nansen, other popular purchasers

of Curve tokens include Cream Finance, Machi Big Brother, DWF Labs,

DCFGod, and Andrew Kang, co-founder of Mechanism Capital.

Related Reading: Ethereum ETFs Heat Up As Filings With SEC Climbs

To Six A vast majority of these transactions were conducted through

OTC, with Egorov realizing over $20 million, which he applied to

balancing his borrowings and removing himself from liquidation.

Egorov also sent another huge supply of CRV (17.5 million) to an

address starting with 0xf51. Once the largest DeFi protocol

on the Ethereum blockchain, the vast majority of Curve trading

volumes still come from Ethereum. Featured image from iStock,

chart from Tradingview.com

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

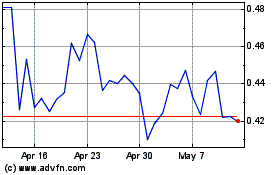

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024