Is Ethereum Undervalued? Investors Hold Firm While Price Targets Rise

November 20 2024 - 3:00AM

NEWSBTC

Ethereum has experienced a noticeable surge in its price recently,

trading above the psychological $3,000 price mark, which has

reignited interest in the crypto market. According to on-chain

analysis, retail investors appear to be adopting a “hold” strategy,

resisting the urge to sell despite the increase in ETH’s value.

Market analysts view This holding behavior as significant,

especially considering the broader market sentiment influenced by

the so-called “Trump Trade,” which has contributed to easing risks

and enhancing market conditions. Related Reading: Ethereum Price

Readies for a Fresh Climb: Will Momentum Build? Limited Ethereum

Deposits To Exchanges According to the onatt, the CryptoQuant

analyst behind the analysis, this trend of holding ETH without

significant profit-taking suggests that many investors still

perceive the cryptocurrency as “undervalued,” even at its elevated

levels. Another factor onatt mentioned supporting this observation

is the limited inflow of ETH to major exchange deposit addresses

such as Binance and OKX, indicating that traders are not moving

their assets to sell. Generally, large volumes of ETH flow into

exchanges typically signal impending selling pressure. However,

this has not been the case, reflecting a cautious but optimistic

outlook among retail market participants. Key Metric Highlighting

Investor Sentiment Another major metric the CryptoQuant analyst

highlighted reinforcing this “hold” sentiment is the Spent Output

Profit Ratio (SOPR), which tracks the profitability of spent coins.

onatt reveals that this metric remains close to 1, indicating that

most Ethereum transactions are happening near breakeven levels.

This data indicates a lack of significant profit realization among

ETH holders, highlighting a strong “buy and hold” sentiment.

According to the analyst, when paired with low exchange inflows,

this metric also suggests that investors are maintaining confidence

in Ethereum’s long-term growth potential. Furthermore, onatt’s

analysis suggests that as long as ETH maintains levels above

$2,800, it could pave the way for a swift move toward the $4,000

range. So far, Ethereum is currently still trading above just above

$3,000. While the asset’s price increase is nowhere near that of

BTC, it has managed to maintain stability above the crucial

psychological price level. Related Reading: Ethereum Price

Confronts Barriers to a New Surge—Can Bulls Prevail? At the time of

writing, ETH has surged by 0.2% in the past day with a current

trading price of $3,100—a price mark that brings Ethereum a 36.4%

decrease away from its all-time high (ATH) of $4,878 registered in

2021. Analysts have suggested that the current market price of ETH

is a notable buying opportunity for the asset. A crypto enthusiast

known as venturefounder has particualry predicted a “conservative”

$10k-$13k price target for ETH. $ETH: road to $13k This could be a

transformative cycle for #Ethereum. $10k-$13k is conservative.

pic.twitter.com/q3Er9EG9gS — venturefounder (@venturefounder)

November 19, 2024 Featured image created with DALL-E, Chart from

TradingView

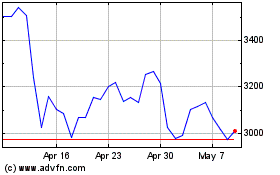

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024