Ethereum Faces ‘Sell-Off Risk’ If It Loses $2,300 Resistance – Analyst

October 11 2024 - 8:30AM

NEWSBTC

Ethereum is at a pivotal moment after failing to break above the

$2,500 mark on Monday. With the entire crypto market anticipating a

potential rally, Ethereum investors carefully watch for any signs

of strength within the network. However, growing concerns about a

possible deeper correction loom over the market. Related Reading:

Dogecoin Could Break Yearly Highs ‘Any Moment Now’ – Crypto Analyst

Key metrics from IntoTheBlock indicate that if Ethereum breaks

below the $2,300 level, a significant sell-off could follow,

increasing pressure on the price. This has created a tense

atmosphere among traders and investors as they wait for a clear

confirmation that Ethereum can hold strong above this critical

support level. As the broader market experiences uncertainty,

Ethereum’s performance in the coming days will likely determine its

trajectory. Investors are hoping for bullish momentum, but many

remain cautious, aware of the risks that a drop below $2,300 could

trigger. The next few days will be critical in shaping Ethereum’s

future price action. Ethereum Price Testing Crucial Demand Ethereum

is at a crucial turning point as its price remains indecisive,

hovering between two significant levels that could result in

substantial gains or losses once the trend becomes clear. Currently

trading in a tight range, ETH investors and analysts carefully

observe key support and resistance areas. Top analyst and investor

Ali recently shared important data from IntoTheBlock on X,

highlighting the critical nature of the $2,300 support level for

Ethereum. According to the report, around 2.4 million addresses

purchased approximately 52.6 million ETH around this level. This

makes $2,300 a significant demand zone that, if breached, could

trigger a wave of selling as investors look to protect their

portfolios and minimize losses. If Ethereum holds above this

critical support, the sentiment around ETH could shift toward a

more positive outlook. Traders and investors may gain confidence,

leading to a potential rally. Ali’s analysis underlines the

importance of the coming days in shaping Ethereum’s price action.

Related Reading: Dogecoin Targets $0.11 As Short-Term Traders Fuel

DOGE Price – Details Ethereum’s performance at the $2,300 level

will likely determine its short-term future, either as a foundation

for gains or a trigger for deeper corrections. ETH Technical

Analysis Ethereum (ETH) is trading at $2,420, following a 3%

rebound from the lower demand zone around $2,330. Despite the

recent recovery, the price remains under 2% away from the 4-hour

200 moving average (MA) at $2,467 and about 3% away from the 200

exponential moving average (EMA) at $2,495. These moving averages

are critical resistance levels for ETH in the short term. Ethereum

must break above the 200 MA and EMA and target resistance levels

above $2,500 to push the price higher. A clear breakout above could

open the door for further gains, with investors looking for signs

of sustained momentum. Related Reading: Solana Bullish Pattern

Signals Massive Gains Ahead – 2021 Rally Could Repeat However, if

Ethereum fails to reclaim both indicators in the coming sessions,

the risk of a deeper correction increases. In such a case, ETH

could retrace to lower demand zones, potentially dropping toward

$2,150. Traders and investors closely watch these levels as

Ethereum’s next move will likely determine the near-term trend.

Featured image from Dall-E, chart from TradingView

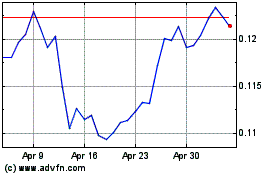

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024