Why Ethereum Could Present Unique Opportunity For Investors If It Drops Below $1,600

February 09 2023 - 12:00PM

NEWSBTC

Ethereum has been retracing on its previous weeks’ profits and

seems ready to re-test support levels below its current price. The

crypto market has seen significant gains as the macroeconomic

landscape shows signs of improvement, but the crypto winter is not

in the review mirror yet. Related Reading: Trust Wallet Comes Clean

On Rumors Regarding $4 Million ‘Hack’ As of this writing, Ethereum

(ETH) trades at $1,630 with a 1% loss in the last 24 hours. Over

the previous week, the cryptocurrency recorded sideways price

action outperforming other assets in the top 10, such as Bitcoin

(BTC) and XRP, which recorded a 5% and 3% loss, respectively. One

Macro Event, Two Opportunities For Ethereum Per a report from

investment firm Blofin, the two largest cryptos by market

capitalization, Bitcoin and Ethereum, have seen relatively slow

price action over the past 24 hours. However, this status quo could

change in the coming days. At least in the crypto options sector,

there has been a decline in Implied Volatility (IV), which measures

expectations of future price movement. This metric is approaching

its January 2023 level, suggesting the IV is bottoming and could

spike again. As seen in the chart below, IV declined after a

significant increase in early January. At that time, the price of

Ethereum and other cryptocurrencies appreciated and trended to the

upside. In the current context, Blofin notes less interest from

Market Makers to defend ETH’s current levels. These investors might

hedge against the spike in IV and potential downside price action

from macroeconomic events. The firm noted: Ether’s situation is not

very optimistic. (…) MMs will not tend to buy in spots hedging

against the gamma exposure once the price collapses before the

weekend. In other words, large investors could be waiting for a

clearer view of the macroeconomic landscape. Next week, the U.S.

will publish its Consumer Price Index (CPI), a proxy to gauge

inflation in the dollar. If the metric beats expectations, with

recent data pointing towards a strong U.S. labor market, the

Federal Reserve (Fed) could exercise more pressure on global

markets, including digital assets. These measures could lead

Ethereum to re-test its yearly lows. In a separate report from the

on-chain firm Jarvis Labs, an analyst points towards the clues

hinting at a change in the market regime. Supported by a decline in

the U.S. dollar and a historical bullish signal, Bitcoin’s (BTC)

golden cross of its 50-day moving average above the 200-day moving

average. Related Reading: Ethereum Staking Provider Lido Finance

(LDO) Climbs 10%, Is It Too Late To Get In? Whenever these moving

averages intertwine, the crypto market enters a new bull run amid a

spike in volatility and some price declines in the short term.

Thus, if ETH crashes below $1,600, long-term holders could take

advantage of a potential opportunity.

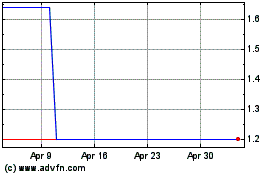

Trust Wallet (COIN:TWTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

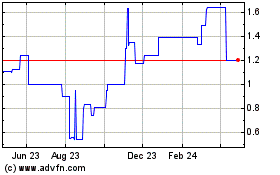

Trust Wallet (COIN:TWTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024