Amundi acquires aixigo to accelerate the deployment of

technological solutions to distributors of savings products

Amundi acquires aixigo to accelerate the

deployment of technological solutions to distributors of savings

products

Amundi announces the acquisition of aixigo, a

technology company that has developed a high value-added

modular service offering for distributors of savings

solutions. Its platform, which is entirely based

on API1,

enables new services to be deployed quickly and easily into

existing IT infrastructures of banks and financial

intermediaries.

Whilst digital technology has become a key lever

to managing customer relations for wealth managers, the latter are

also seeking to leverage technologies to enable their staff to

advise, distribute and manage investment solutions more

effectively. As a result, the market for technological

services for wealth management players as well as private and

retail banks, is growing significantly.

Amundi, which is already active in this buoyant

market through its Amundi Technology business line and its solution

Alto, will accelerate its development with the acquisition

of aixigo, and thus reinforces its positioning as

a leading provider of technology and services. The

client and geographical coverage of Amundi in this

market will be further enhanced by aixigo’s client

base in Germany, Switzerland and the UK.

A combination of two complementary

platforms

Founded in Germany 25 years ago by a group of

academics, aixigo has expanded rapidly in recent years, with

significant growth in revenues. aixigo and its 150 staff, currently

serve over 20 clients, including leading international financial

institutions representing over €1 trillion in assets under

management. Some 60,000 advisors already use aixigo's services

daily to onboard clients, build and manage allocations, place

orders and generate reports.

Amundi Technology has also significantly

enhanced its offering, providing the investment and savings

industry with technological solutions for portfolio management,

employee savings & retirement, wealth management and asset

servicing. Its highly diversified client base comprises over 60

clients, including banks, private banks, pension funds, insurers,

fund custodians and asset managers in Europe and Asia.

From this point on, aixigo’s tools will be part of the solutions

Amundi Technology provides to its clients across the entire savings

value chain.

A transaction creating substantial

value

This transaction, which is in line with Amundi's

strategic plan and financial discipline, will create significant

value thanks to the business growth potential, as well as the

revenue and cost synergies. The amount of the transaction is 149

million euros2. The return on investment will be nearly

10% after 3 years, and above 12% after 4 years.

Valérie Baudson, Chief Executive Officer

of Amundi, commented: “Institutions that are distributing

saving products are increasingly looking for solutions and external

partners that enable them to improve their operational efficiency,

and enhance the quality, the speed and the personalization of the

advice, services and products they offer.

To address these needs, Amundi has built a range of services and a

technological platform that will be further strengthened with

aixigo. With the addition of new expertise, which have already been

adopted and recognized by leading financial firms, we will continue

to roll out new innovative services, and play an active part in the

developments of the financial advisory and wealth management

sector. This transaction will create significant value for our

clients, partners and shareholders.”

Guillaume Lesage, Chief Operating

Officer at Amundi, added: “We are delighted to

welcome aixigo's experienced teams, who will bring their

entrepreneurial spirit, their cutting-edge technological skills, as

well as their in-depth knowledge of the customer needs. Thanks to

this new development, we will accelerate the deployment of Amundi

Technology's services to private banks and wealth managers, with a

broader, more flexible, more scalable offering that will enable us

to respond to an even wider range of business cases.”

Benjamin Lucas, Chief Executive Officer

of Amundi Technology, said: “Amundi Technology is fully

committed to delivering pioneering technology solutions and

exceptional service to our clients globally. By bringing together

the leading capabilities and solutions from Amundi Technology and

aixigo, we will create a transformative offering for the wealth

management and banking industry. We share a vision and ethos of

delivering excellence and growth for all of our stakeholders, and

we are extremely excited to welcome the aixigo teams as we continue

along this journey together.”

Arnaud Picut, Chief Executive Officer of

aixigo, declared: “Joining Amundi Technology presents

aixigo with a unique opportunity to expand our service offerings

and leverage Amundi's expertise, allowing us to become the

undisputed European leader before gradually extending our reach

into Asia, a vision that perfectly aligns with our values and

ambitions. It is also an opportunity to thank Urs Ehrismann,

Founder of fronttrail Equity Partners that has accompanied aixigo

as an equity investor over the past six years, enabling to build a

successful European wealthtech platform provider. “

Christian Friedrich, Executive Board

Member and co-founder of aixigo said: “A real wealthtech

powerhouse will emerge from aixigo and Amundi Technology. I am very

excited about the opportunities and possibilities this will create

for the aixigo team. Our long-standing customers will benefit from

the bundling of our joint skills and strengths and will be

able to drive new services in the wealth management market. I am

already looking forward to the innovations that this partnership

will bring.”

Press Contacts:

Corentin

Henry

Tel: +33 1 76 32 26

96

corentin.henry@amundi.com

Daniele Bagli

Tel : +33 1 76 32 75 16

daniele.bagli@amundi.com

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players3, offers its 100

million clients - retail, institutional and corporate - a complete

range of savings and investment solutions in active and passive

management, in traditional or real assets. This offering is

enhanced with IT tools and services to cover the entire savings

value chain. A subsidiary of the Crédit Agricole group and listed

on the stock exchange, Amundi currently manages close to €2.2

trillion of assets4.

With its six international investment

hubs5, financial and extra-financial research

capabilities and long-standing commitment to responsible

investment, Amundi is a key player in the asset management

landscape.

Amundi clients benefit from the expertise and

advice of 5,500 employees in 35 countries.

Amundi, a trusted partner, working every day in the

interest of its clients and society

www.amundi.com

1 APIs (application programming

interfaces) enable a quick integration of new features into

existing software. These interfaces act as gateways,

connecting one software to another so that they can exchange data

or functionality.

2 Net of cash available in aixigo’s balance

sheet.

3 Source: IPE “Top 500 Asset Managers”

published in June 2024, based on assets under

management as at 31/12/2023

4 Amundi data as at

30/09/2024

5 Boston, Dublin, London, Milan, Paris and

Tokyo

- PR - Amundi acquires aixigo to accelerate the deployment of

technological solutions to distributors of savings products

vFINAL

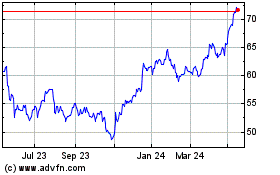

Amundi (EU:AMUN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Amundi (EU:AMUN)

Historical Stock Chart

From Feb 2024 to Feb 2025