Van Lanschot Kempen and Mercier Vanderlinden to take next step in collaboration by accelerating acquisition of remaining stake

December 22 2022 - 12:30AM

Van Lanschot Kempen and Mercier Vanderlinden to take next step in

collaboration by accelerating acquisition of remaining stake

Van Lanschot Kempen and

Mercier Vanderlinden to

take next step in

collaboration by accelerating acquisition of remaining

stakeVan Lanschot

Belgium and Mercier

Vanderlinden to continue

as Mercier Van Lanschot

Amsterdam/’s-Hertogenbosch in the Netherlands/Antwerp in

Belgium, 22 December 2022

- Van Lanschot Kempen to acquire remaining 30% stake in Mercier

Vanderlinden

- Transaction will be in cash (53%) and shares (47% through a

share issue)

- Mercier Vanderlinden partners to obtain a stake of more than 3%

in Van Lanschot Kempen, with a lock-up period to 2030

- Positive impact on capital ratio expected to amount to 80 basis

points

- Impact on 2022 results of around €18 million negative, due to

technical accounting treatment of the transaction; impact on

results turning positive going forward

- Combined company to continue under the name of Mercier Van

Lanschot in the course of 2023

Van Lanschot Kempen and Mercier Vanderlinden’s shareholders have

agreed to accelerate the takeover of their remaining 30% stake in

Mercier Vanderlinden by Van Lanschot Kempen. The acquisition will

be paid in part in Van Lanschot Kempen shares, giving Mercier

Vanderlinden’s managing partners a holding of over 3% in Van

Lanschot Kempen, with a lock-up period up to 2030. The partners

will also continue to serve in a management capacity.

In July 2021, Van Lanschot Kempen took a 70% stake in Mercier

Vanderlinden and agreed to extend this to 100% by the end of 2025

in two stages. Mercier Vanderlinden and Van Lanschot Belgium have

been working together ever more closely since then, including on

granting Lombard loans and using Van Lanschot Belgium custodian

banking services. The collaboration’s proven success has prompted

this decision to take the next step and enhance Van Lanschot

Belgium’s service offering to clients.

Maarten Edixhoven, Chair of

the Van Lanschot Kempen

Management Board, said: “Both Van Lanschot Belgium

and Mercier Vanderlinden are growing rapidly, demonstrating their

relevance to clients. The two parties are an excellent fit in terms

of client portfolio and network, product offering and expertise.

This feels like a logical time to speed up the process and embed

ourselves more deeply in Belgium with a distinctive and personal

proposition for our clients, headed up by a single management team

and working to a single, robust organisation under the name of

Mercier Van Lanschot. Let me add how delighted I am with the

Mercier Vanderlinden partners’ commitment towards the future.”

Thomas Vanderlinden,

Managing

Partner with

Mercier Vanderlinden, added:

“With this even stronger commitment we are emphasizing our belief

in our joint future. We will now start shaping this together, with

the conviction under a single brand and with a single team we’ll be

able to create greater clarity and enhance our product offering for

clients. Given our commitment to this combination, it goes without

saying that we’ll continue to keep our family wealth invested in

our MercLin investment funds, as we do today.”

Details about the

combined companyJoint assets

under management (AuM) for Mercier Vanderlinden and Van Lanschot

Belgium amounted to €9.6 billion by the end of November. The

combination have been growing sharply and up to and including

November of this year, joint net AuM inflows were €0.8 billion

(€0.4 billion Mercier Vanderlinden and €0.4 billion Van Lanschot

Belgium).

In the course of 2023, Van Lanschot Belgium and Mercier

Vanderlinden will start using a new name: Mercier Van Lanschot. The

plan is to further expand the collaboration under this name, led by

a joint management team consisting of Thomas Vanderlinden and Erwin

Schoeters as co-CEOs, alongside Frédéric Van Doosselaere and Paul

Timmermans. Stéphane Mercier will continue to manage the MercLin

funds. The team will flesh out their plans in the weeks and months

ahead.

The transactionVan Lanschot Kempen will be

paying 53% in cash for the remaining 30% stake, with 47% in shares

under a lock-up provision until 2030. To this end, it will issue

more than 1.5 million in new shares. The positive impact on the

capital ratio related to this issue is expected to amount to around

80 basis points. The impact on results is expected to be around €18

million negative in 2022, turning positive in subsequent years.

The transaction and appointments are subject to regulatory

approval. The transaction is expected to be completed in the first

quarter of 2023.

Media Relations: +31 20 354 45 85;

mediarelations@vanlanschotkempen.comInvestor

Relations: +31 20 354 45 90;

investorrelations@vanlanschotkempen.com

About Mercier VanderlindenMercier Vanderlinden,

an independent wealth management firm founded in 2000 by Stéphane

Mercier and Thomas Vanderlinden, has €4.3 billion in client assets

and runs three investment funds. Mercier Vanderlinden offers a

highly personal approach to wealth management by investing with its

clients. It employs some 50 and covers all of Belgium from its

offices in Antwerp, Brussels, Waregem and Luik.

For more information, visit merciervanderlinden.comAbout

Van Lanschot KempenVan Lanschot Kempen is a wealth manager

active in Private Banking, Professional Solutions, Investment

Management and Investment Banking, with the aim of preserving and

creating wealth, in a sustainable way, for both its clients and the

society of which it is part. In Belgium, we have been active as Van

Lanschot Belgium since 1991. As a sustainable wealth manager with a

long-term focus, Van Lanschot Kempen proactively seeks to prevent

negative impact for all stakeholders and to create positive

long-term financial and non-financial value. Listed at Euronext

Amsterdam, Van Lanschot Kempen is the Netherlands’ oldest

independent financial services company, with a history dating back

to 1737. To fully leverage the potential of the Van Lanschot Kempen

organisation for its clients, it provides solutions that build on

the knowledge and expertise across its entire group and on its open

architecture platform. Van Lanschot Kempen is convinced that it is

able to meet the needs of its clients by offering them access to

the full range of its products and services across all its

businesses.

For more information, please visit vanlanschotkempen.com

Important legal information and cautionary note on

forward-looking statements This press release may contain

forward-looking statements and targets on future events and

developments. These forward-looking statements and targets are

based on the current insights, information and assumptions of Van

Lanschot Kempen’s management about known and unknown risks,

developments and uncertainties. Forward-looking statements and

targets do not relate strictly to historical or current facts and

are subject to such risks, developments and uncertainties which by

their very nature fall outside the control of Van Lanschot Kempen

and its management. Actual results, performances and circumstances

may differ considerably from these forward-looking statements and

targets.

Van Lanschot Kempen cautions that forward-looking statements and

targets in this press release are only valid on the specific dates

on which they are expressed, and accepts no responsibility or

obligation to revise or update any information, whether as a result

of new information or for any other reason. The figures in this

press release have not been audited

This press release does not constitute an offer or solicitation

for the sale, purchase or acquisition in any other way or

subscription to any financial instrument and is not a

recommendation to perform or refrain from performing any

action.

Elements of this press release contain information about Van

Lanschot Kempen NV within the meaning of Article 7(1) to (4) of EU

Regulation No. 596/2014.

This press release is a translation of the Dutch language

original and is provided as a courtesy only. In the event of any

disparities, the Dutch language version will prevail. No rights can

be derived from any translation thereof.

- Van Lanschot Kempen press release

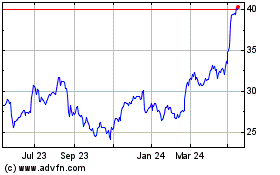

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Oct 2024 to Nov 2024

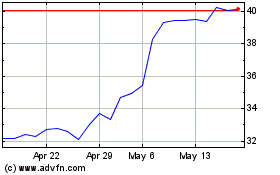

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Nov 2023 to Nov 2024