HIGHLIGHTS

- 30.7% increase in revenue to €2,143 million (+28.6% at

constant exchange rates and scope1) compared with H1 2022

- Strong growth in adjusted EBITDA to €659 million in H1

2023, compared with €425 million in H1 2022 (+54.9%)

- Significant improvement in adjusted EBITDA margin to

30.8% in H1 2023 from 26.0% in H1 2022 (+480 bp vs H1

2022)

- Net income2 attributable to shareholders of €311

million, compared with €174 million in H1 2022 (+78.8% vs H1

2022), and earnings per share2 of €2.65

- The net debt ratio eased to 1.3x adjusted EBITDA for the

last 12 months, compared with 1.3x at the end of March 2023 and

1.5x at the end of June 2022

Regulatory News:

Verallia (Paris:VRLA):

“Our first-half results are excellent and demonstrate our

ability to continue to sustainably improve our profitability and

EBITDA, regardless of the economic environment. This remarkable

performance stems from the agility and entrepreneurial spirit of

our teams, our ability to generate a positive price-mix / cost

spread in any circumstances and our operational excellence

programme geared towards reducing expenses. These strengths are

part of the Group’s business model and will continue to spur the

regular improvement in Verallia’s results. On the strength of

another quarter of improvement, we are raising our adjusted EBITDA

guidance for 2023. We are also continuing to implement our

decarbonisation action plan through innovative and pioneering

projects such as the electric and hybrid furnaces currently under

construction.” said Patrice Lucas, CEO of Verallia.

REVENUE

Revenue breakdown by region

In € million

H1 2023

H1 2022

% Change

Of which organic

growth

Southern and Western

Europe

1,404.8

1,136.3

+23.6%

+24.5% 3

Northern and Eastern Europe

514.6

307.8

+67.2%

+34.4%

Latin America

223.3

194.8

+14.6%

+42.9% (+15.1% excl.

Argentina)

Group total

2,142.7

1,638.9

+30.7%

+28.6% (+25.7% excl.

Argentina)

Revenue for the first half of 2023 totalled €2,143

million, a significant increase of 30.7% on a reported basis

compared with the same period last year.

Exchange rates had a negative impact of 4.8% over the

half-year (-€79 million). This largely reflected the

depreciation of the Argentinian peso and, to a lesser extent, the

Ukrainian hryvnia.

Change in scope, linked to the acquisition of Allied

Glass in November 2022 (renamed Verallia UK in January 2023), had a

positive impact of €114 million (+7.0%). The spirits segment

grew strongly, driven by a good performance from Verallia UK.

At constant exchange rates and scope, revenue increased by

28.6% (+25.7% excluding Argentina).

Group sales volumes declined slightly in the first half, mainly

as a result of weak beer sales in Europe since the start of the

year, as well as a decrease in still wine sales. This trend may be

partly attributable to inventory destocking in the value chain.

Sales of sparkling wines and soft drinks are holding up well.

The production cost inflation was lower than initially expected

in the first half of 2023. As a result, Verallia was able to make

moderate and selective price reductions in Europe in the second

quarter, after having increased its selling prices at the beginning

of 2023. Lastly, the product mix was positive over the

half-year.

Revenue breakdown by region:

- Southern and Western Europe saw

revenue grow by 23.6% on a reported basis and by 24.5% at constant

exchange rates and scope. Volumes were down slightly over the

half-year, mainly in beer and still wine. It should be noted that

the decrease in volumes observed in the second quarter slowed down

compared to the first quarter.

- In Northern and Eastern Europe,

revenue grew by 67.2% on a reported basis and by 34.4% at constant

exchange rates and scope. Exchange rates had a negative impact of

4.3% due to the depreciation of the Ukrainian hryvnia. Change in

scope linked to the acquisition of the UK business in November 2022

increased revenue by 37.1% or €114 million. Sales volumes were down

over the half-year, affected by the weakness of the beer market in

Germany and, to a lesser extent, of still wine. As announced in

April, the remarkable commitment of the local teams has allowed the

second furnace at the Ukraine plant to be restarted.

- In Latin America, revenue showed a

strong reported increase of 14.6% and remarkable organic growth of

+42.9%. Sales volumes rose slightly over the half-year. Argentina

continues to be affected by political uncertainty and economic

instability. Volumes were down sharply in Chile, a market still

penalised by high inventories held by distributors and customers,

and a fall in the exports of local customers. Brazil continues to

perform well. The plan to build a new furnace at Campo Bom in

Southern Brazil is proceeding to plan, with commissioning scheduled

for the first half of 2024.

ADJUSTED EBITDA

Breakdown of adjusted EBITDA by region

In € million

H1 2023

H1 2022

Southern and Western Europe

Adjusted EBITDA

436.5

286.1

Adjusted EBITDA margin

31.1%

25.2%

Northern and Eastern Europe

Adjusted EBITDA

141.5

59.9

Adjusted EBITDA margin

27.5%

19.5%

Latin America

Adjusted EBITDA

81.0

79.4

Adjusted EBITDA margin

36.3%

40.8%

Group total

Adjusted EBITDA4

659.0

425.4

Adjusted EBITDA margin

30.8%

26.0%

Adjusted EBITDA increased strongly by 54.9% in H1 2023 (and

by 57.2% at constant exchange rates and scope) to €659 million.

Exchange rates had an adverse impact of €32 million over the

half-year, mainly attributable to the depreciation of the

Argentinian peso and Ukrainian hryvnia.

In addition, inventory rebuild over the half-year positively

contributed to the Activity pillar.

This performance was made possible by a net reduction of €27

million in cash production costs (Performance Action Plan) over the

half-year (i.e. 2.0% of cash production costs). The success of this

approach is once again making a major contribution to improving the

Group’s profitability.

In addition, the price-mix / cost spread5 remained positive

across the Group, amounting to €231 million over the half-year.

The Group also managed to significantly improve its adjusted

EBITDA margin, which rose to 30.8% from 26.0% in H1 2022.

Adjusted EBITDA breakdown by region:

- Southern and Western Europe posted

adjusted EBITDA of €437 million (vs €286 million in H1 2022) and a

margin of 31.1% (vs 25.2%). A particularly well oriented product

mix in Italy and a positive inflation spread contributed to the

increase in adjusted EBITDA. The Performance Action Plan (PAP) also

generated cost savings in line with targets.

- In Northern and Eastern Europe,

adjusted EBITDA came to €142 million (vs €60 million in H1 2022),

lifting the margin to 27.5% from 19.5%. The increase in EBITDA was

attributable to the generation of a positive inflation spread and

an industrial performance more than in line with the cost reduction

objective.

- In Latin America, adjusted EBITDA

grew only slightly to €81 million (vs €79 million in H1 2022) due

to negative exchange rate impacts. The margin was 36.3%, compared

with 40.8%. Lower volumes in Chile weighed on fixed cost absorption

and industrial performance.

The increase in net income attributable to shareholders to

€311 million (€2.65 per share) was mainly attributable to the

improvement in adjusted EBITDA, which more than offset the increase

in financial expense and income tax. First-half net income

includes, as it does every year until 2027, an amortisation expense

for customer relationships, recognised upon the acquisition of

Saint-Gobain’s packaging business in 2015, in the amounts of €22

million and €0.19 per share (net of taxes). This expense will

remain in place until 2027. If it had not been taken into

account, net income attributable to shareholders would have been

€333 million and €2.84 per share. It was €23 million and €0.20 per

share in H1 2022.

Capital expenditure amounted to €150 million (i.e. 7.0%

of total revenue), compared with €96 million in H1 2022. This

increase reflects the planned rollout of the Group’s investment

plan, with more balanced timing this year than last. These

investments comprise €93 million in recurring investments (compared

with €69 million in H1 2022) and €57 million in strategic

investments (vs €27 million in H1 2022).

Cash flow from operations6 rose to €316 million in

line with the H1 2022 figure of €314 million as the increase in

adjusted EBITDA was offset by higher capital expenditure and an

increase in inventory levels.

Free cash-flow7 totalled €248 million, up from €226

million in H1 2022.

SOUND FINANCIAL POSITION LEADING TO AN INVESTMENT GRADE

RATING FROM THE TWO RATING AGENCIES

At the end of June 2023, Verallia’s net debt stood at €1,401

million, bringing its debt ratio to 1.3x adjusted EBITDA for the

last 12 months, compared with 1.3x at the end of March 2023 and

1.5x at the end of June 2022.

The Group had liquidity8 of €837 million at 30 June

2023.

On 5 May 2023, Verallia announced that Standard & Poor’s had

upgraded the Group’s long-term credit rating to BBB- with a

positive outlook. The credit ratings of the two Sustainability

Linked bonds of €500 million each, issued in May and November 2021

respectively, were also upgraded from BB+ to BBB-.

The previous month, Moody’s had also upgraded the Group’s

long-term credit rating to Baa3 with a stable outlook.

These upgrades reflect full recognition of the Group’s financial

strength and the robustness of its profitable growth model.

Verallia is now rated Baa3 by Moody’s with a stable outlook and

BBB- by Standard & Poor’s with a positive outlook.

RESULTS OF VOTES AT THE 25 APRIL 2023 GENERAL MEETING

With holders of 84.29% of Verallia’s share capital present or

represented, the Annual General Meeting of 25 April 2023 approved

all resolutions put to the vote.

Shareholders approved the parent company and consolidated

financial statements for the year ended 31 December 2022, as well

as the payment of a cash dividend of €1.40 per share, paid in full

on Wednesday 10 May 2023.

The General Meeting also approved the renewal of the terms of

office of Brasil Warrant Administração De Bens e Empresas S.A

(BWSA), BW Gestão de Investimentos Ltda (BWGI) and Bpifrance

Investissement, and Marie-José Donsion, Michel Giannuzzi, Virginie

Hélias, Cécile Tandeau de Marsac and Pierre Vareille as

directors.

Following the renewal of his term of office, Michel Giannuzzi

remains Chairman of the Board of Directors for a term equivalent to

that of his directorship, i.e. for a period of four years expiring

at the close of the Annual General Meeting called to approve the

financial statements for the year ending 31 December 2026, to be

held in 2027.

FURTHER SUCCESS FOR THE EIGHTH EMPLOYEE SHAREHOLDING OFFER IN

2023 Proof of the success of its strategy and its resolute CSR

ambitions, Verallia has completed an outstanding eighth edition of

its employee shareholding offer. At the close of trading on 22 June

2023, more than 3,600 employees (i.e. 41% of eligible employees

across 9 countries) had invested in the Group, benefiting from an

attractive unit subscription price of €30.45.9 The total amount

invested by the Group’s employees (including the company’s matching

contribution) accordingly amounts to more than €18.6 million.

At closing, 611,445 new ordinary shares, representing 0.5% of

the share capital and voting rights, were issued by the Company. As

in previous years, in order to offset the dilutive effect of this

transaction, Verallia at the same time completed a capital

reduction via the cancellation of 611,445 treasury shares acquired

under the share buyback programme.10

In just eight years, these transactions have already enabled

more than 48% of Group employees to become Verallia shareholders,

as well as 88% of French employees, directly and through the

Verallia FCPE (employee investment fund). Employees now hold 4.2%11

of Verallia’s capital.

2023 OUTLOOK

We remain confident in our various markets, which benefit from

solid fundamentals for the coming semesters and over the long

term.

The very good results for the first half of 2023 illustrate more

than ever the strength and validity of Verallia’s profitable growth

model, based on regular organic growth, a positive inflation spread

and a 2% annual reduction in cash production costs (PAP).

In line with its excellent first-half performance, the Group

accordingly expects to achieve an adjusted EBITDA of between €1.100

billion and €1.250 billion over the full year.

Verallia also confirms its revenue growth target of more than

20% in 2023.

Lastly, the Group is continuing to deploy its decarbonisation

technologies, in particular with the construction of electric and

hybrid furnaces, which are essential in the implementation of its

CSR roadmap.

The Verallia Group’s consolidated financial statements for the

six months to 30 June 2023 were approved by the Board of Directors

on 25 July 2023 and will be available on www.verallia.com.

An analysts’ conference call will be held on Wednesday, 26 July

2023 at 9.00 am (CET) via an audio webcast service (live and

replay) and the results presentation will be available on

www.verallia.com.

FINANCIAL CALENDAR

- 28 September 2023: start of the quiet period.

- 19 October 2023: financial results for Q3 2023 – Press release

after market close and conference call/presentation the next day at

9.00 am CET.

About Verallia

At Verallia, our purpose is to re-imagine glass for a

sustainable future. We want to redefine how glass is produced,

reused and recycled, to make it the world’s most sustainable

packaging material. We are joining forces with our customers,

suppliers and other partners across the value chain to develop

beneficial and sustainable new solutions for all.

With more than 10,000 employees and 34 glass production

facilities in 12 countries, we are the European leader and the

world's third-largest producer of glass packaging for beverages and

food products. We offer innovative, customised and environmentally

friendly solutions to over 10,000 businesses worldwide.

In 2022, Verallia produced close to 17 billion glass bottles and

jars and posted revenue of €3.4 billion. Verallia is listed on

compartment A of the regulated market of Euronext Paris (Ticker:

VRLA – ISIN: FR0013447729) and is included in the following

indices: CAC SBT 1.5°, STOXX600, SBF 120, CAC Mid 60, CAC Mid &

Small and CAC All-Tradable.

After more than four years in the Financial Communication and

Investor Relations Department, Alexandra is leaving the Verallia

Group at the end of this month. She will be replaced by David

Placet (david.placet@verallia.com), who has been in charge of

development and strategy since the end of 2018.

Disclaimer

Certain information included in this press release are not

historical facts but are forward-looking statements. These

forward-looking statements are based on current beliefs,

expectations and assumptions, including, without limitation,

assumptions regarding Verallia’s present and future business

strategies and the economic environment in which Verallia operates.

They involve known and unknown risks, uncertainties and other

factors, which may cause actual performance and results to be

materially different from those expressed or implied by these

forward-looking statements. These risks and uncertainties include

those discussed and identified in Chapter 4 “Risk Factors” in the

Universal Registration Document approved by the AMF and available

on the Company’s website (www.verallia.com and the AMF’s website

(www.amf-france.org . These forward-looking information and

statements are no guarantee of future performance.

This press release includes only summary information and does

not purport to be comprehensive.

Personal data protection

You can unsubscribe from our press release distribution list at

any time by sending your request to the following email address:

investors@verallia.com. Press releases will still be available to

access via the website https://www.verallia.com/investisseurs.

Verallia SA, as data controller, processes personal data for the

purpose of implementing and managing its internal and external

communication. This processing is based on legitimate interests.

The data collected (last name, first name, professional contact

details, profiles, relationship history) is essential for this

processing and is used by the relevant departments of the Verallia

Group and, where applicable, its subcontractors. Verallia SA

transfers personal data to its service providers located outside

the European Union, who are responsible for providing and managing

technical solutions related to the aforementioned processing.

Verallia SA ensures that the appropriate guarantees are obtained in

order to supervise these data transfers outside of the European

Union. Under the conditions defined by the applicable regulations

for the protection of personal data, you may access and obtain a

copy of the data concerning you, object to the processing of this

data and request for it to be rectified or erased. You also have a

right to restrict the processing of your data. To exercise one of

these rights, please contact the Group Financial Communication

Department at investors@verallia.com. If, after having contacted

us, you believe that your rights have not been respected or that

the processing does not comply with data protection regulations,

you may submit a complaint to CNIL (Commission nationale de

l'informatique et des libertés — French regulatory body).

APPENDICES – Key figures

In € million

H1 2023

H1 2022

Revenue

2,142.7

1,638.9

Reported growth

+30.7%

+23.4%

Organic growth

+28.6%

+22.8%

of which Southern and Western

Europe

1,404.8

1,136.3

of which Northern and Eastern

Europe

514.6

307.8

of which Latin America

223.3

194.8

Cost of sales

(1,499.7)

(1,235.0)

Commercial, general and

administrative expenses

(118.9)

(97.5)

Acquisition-related items

(34.5)

(31.9)

Other operating income and

expenses

0.7

2.9

Operating income

490.3

277.4

Financial income and

expense

(55.7)

(30.2)

Profit (loss) before

tax

434.6

247.2

Income tax

(118.0)

(68.9)

Share of net profit (loss) of

associates

0.6

0.5

Net income attributable to the

shareholders of the company12

310.8

173.8

Earnings per share

€2.65

€1.49

Adjusted EBITDA13

659.0

425.4

Group margin

30.8%

26.0%

of which Southern and Western

Europe

436.5

286.1

Southern and Western Europe

margin

31.1%

25.2%

of which Northern and Eastern

Europe

141.5

59.9

Northern and Eastern Europe

margin

27.5%

19.5%

of which Latin America

81.0

79.4

Latin America margin

36.3%

40.8%

Net debt at end of

period

1,401.4

1,146.6

Last 12 months adjusted

EBITDA

1,099.1

758.8

Net debt/last 12 months adjusted

EBITDA

1.3x

1.5x

Total Capex14

150.1

96.3

Cash conversion15

77.2%

77.4%

Change in operating working

capital

(192.6)

(15.4)

Operating cash flow16

316.3

313.7

Free cash flow17

247.8

226.4

Strategic

investments18

56.7

27.3

Recurring

investments19

93.4

69.0

Change in revenue by type in € million during H1 2023

In € million

H1 2022 revenue

1,638.9

Volumes

(76.2)

Price/Mix

+544.3

Exchange rates

(78.6)

Scope

+114.3

H1 2023 revenue

2,142.7

Change in adjusted EBITDA by type in € million during H1

2023

In € million

H1 2022 adjusted EBITDA20

425.4

Activity contribution

(13.9)

Price-mix/Cost spread

+231.1

Net productivity

+26.7

Exchange rates

(31.7)

Other

+21.4

H1 2023 adjusted EBITDA

659.0

Key figures by quarter

In € million

Q1 2023

Q1 2022

Revenue

1,051.6

749.9

Reported growth

+40.2%

Organic growth

+34.7%

Adjusted EBITDA21

307.4

182.7

Group margin

29.2%

24.4%

In € million

Q2 2023

Q2 2022

Revenue

1,091.1

889.0

Reported growth

+22.7%

Organic growth

+23.4%

Adjusted EBITDA

351.6

242.7

Group margin

32.2%

27.3%

Reconciliation of operating profit (loss) to adjusted EBITDA

In € million

H1 2023

H1 2022

Operating income

490.3

277.4

Depreciation and

amortisation22

162.9

142.3

Restructuring costs

2.0

0.5

IAS 29, Hyperinflation

(Argentina)23

(1.0)

(0.3)

Management share ownership plan

and associated costs

4.6

4.5

Company acquisition costs and

earn-outs

0.2

0.0

Other

-

1.0

Adjusted EBITDA

659.0

425.4

Adjusted EBITDA and cash conversion are alternative performance

measures according to AMF Position n°2015-12.

Adjusted EBITDA and cash conversion are not standardised

accounting measures meeting a single definition generally accepted

by IFRS. They must not be considered as a substitute for operating

income and cash flows from operating activities, which are measures

defined by IFRS, or as a measure of liquidity. Other issuers may

calculate adjusted EBITDA and cash conversion differently from the

definitions used by the Group.

IAS 29: Hyperinflation (Argentina)

Since 2018, the Group has applied IAS 29 in Argentina. The

adoption of this standard requires the restatement of non-monetary

assets and liabilities and of the statement of income to reflect

changes in purchasing power in the local currency. These

restatements may lead to a gain or loss on the net monetary

position included in the financial income and expense.

Financial items for the Argentinian subsidiary are converted

into euro using the closing exchange rate for the relevant

period.

In H1 2023, the net impact on revenue was (€1.8) million.

The hyperinflation impact has been excluded from consolidated

adjusted EBITDA as shown in the table “Reconciliation of operating

profit (loss) to adjusted EBITDA”.

Financial structure

In € million

Nominal amount or max. amount

drawable

Nominal rate

Final maturity

30 June 2023

Sustainability-linked

bonds

May 202124

500

1.625%

May 2028

498.8

Sustainability-linked bond

November 202124

500

1.875%

Nov. 2031

498.8

Term loan – TL24

550

Euribor +1.50%

Apr. 2027 + 1-year extension

549.0

Revolving credit facility RCF1

550

Euribor +1.00%

Apr. 2028 +1-year + 1-year

extension

-

Negotiable commercial paper (Neu CP)24

400

175.3

Other liabilities25

142.8

Total borrowings

1,864.8

Cash and cash equivalents

463.4

Net debt

1,401.4

Consolidated statement of income

In € million

H1 2023

H1 2022

Revenue

2,142.7

1,638.9

Cost of sales

(1,499.7)

(1,235.0)

Commercial, general and

administrative expenses

(118.9)

(97.5)

Acquisition-related items

(34.5)

(31.9)

Other operating income and

expenses

0.7

2.9

Operating income

490.3

277.4

Financial income and

expense

(55.7)

(30.2)

Profit (loss) before

tax

434.6

247.2

Income tax

(118.0)

(68.9)

Share of net profit (loss) of

associates

0.6

0.5

Net income

317.3

178.8

Attributable to shareholders of

the Company 26

310.8

173.8

Attributable to non-controlling

interests

6.5

5.0

Basic earnings per share (in

€)

2.65

1.49

Diluted earnings per share (in

€)

2.65

1.49

Consolidated balance sheet

In € million

30 June 2023

31 Dec. 202227

ASSETS

Goodwill

672.1

664.6

Other intangible assets

453.4

482.4

Property, plant and equipment

1,667.0

1,609.0

Investments in associates

6.7

5.9

Deferred tax

22.0

27.5

Other non-current

assets

65.9

186.3

Non-current assets

2,887.1

2,975.7

Current portion of non-current

and financial assets

1.4

1.3

Inventories

647.4

536.8

Trade receivables

279.2

250.4

Current tax receivables

3.4

5.4

Other current assets

184.5

392.3

Cash and cash equivalents

463.4

330.8

Current assets

1,579.3

1,517.0

Total assets

4,466.4

4,492.7

LIABILITIES

Share capital

413.3

413.3

Consolidated reserves

475.5

590.1

Equity attributable to

shareholders

888.8

1,003.4

Non-controlling interests

68.4

64.0

Equity

957.2

1,067.4

Non-current financial liabilities

and derivatives

1,617.9

1,562.2

Provisions for pensions and other

employee benefits

86.2

87.4

Deferred tax

174.2

276.8

Provisions and other non-current

financial liabilities

48.2

23.2

Non-current

liabilities

1,926.5

1,949.6

Current financial liabilities and

derivatives

272.1

200.9

Current portion of provisions and

other non-current financial liabilities

58.7

54.3

Trade payables

674.2

740.6

Current tax liabilities

86.3

44.3

Other current liabilities

491.4

435.6

Current liabilities

1,582.7

1,475.7

Total Equity and

Liabilities

4,466.4

4,492.7

Consolidated cash flow statement

In € million

H1 2023

H1 2022

Net income

317.3

178.8

Depreciation, amortisation and

impairment of assets

162.9

142.3

Interest expense on financial

liabilities

23.8

14.3

Change in inventories

(117.7)

(17.0)

Change in trade receivables,

trade payables & other receivables & payables

4.1

24.0

Current tax expense

125.6

64.1

Taxes paid

(57.5)

(44.8)

Changes in deferred taxes and

provisions

15.3

(1.0)

Other

28.1

12.7

Net cash flows from operating

activities

501.9

373.4

Acquisition of property, plant

and equipment and intangible assets

(150.1)

(96.3)

Increase (decrease) in debt on

fixed assets

(77.6)

(29.8)

Acquisitions of subsidiaries,

takeovers, net of cash acquired

(8.0)

(2.0)

Other

3.1

0.7

Net cash flows from (used in)

investing activities

(232.6)

(127.4)

Capital increase (reduction)

18.6

13.0

Dividends paid

(163.8)

(122.7)

Increase (reduction) of own

shares

(38.1)

(0.5)

Transactions with shareholders

of the parent company

(183.3)

(110.2)

Transactions with

non-controlling interests

(3.1)

(0.6)

Increase (decrease) in bank

overdrafts and other short-term borrowings

69.1

50.1

Increase in long-term debt

561.7

4.0

Reduction in long-term debt

(536.5)

(20.4)

Financial interest paid

(22.1)

(14.0)

Change in gross debt

72.2

19.7

Net cash flows from (used in)

financing activities

(114.2)

(91.1)

Increase (reduction) in cash

and cash equivalents

155.2

154.9

Impact of changes in foreign

exchange rates on cash and cash equivalents

(22.4)

2.8

Opening cash and cash

equivalents

330.8

494.6

Closing cash and cash

equivalents

463.4

652.3

GLOSSARY

Activity: corresponds to the sum of the change in volumes

plus or minus the net change in inventories.

Organic growth: corresponds to revenue growth at constant

exchange rates and scope. Revenue growth at constant exchange rates

is calculated by applying the average exchange rates of the

comparative period to revenue for the current period of each Group

entity, expressed in its reporting currency.

Adjusted EBITDA: This is a non-IFRS financial measure. It

is an indicator for monitoring the underlying performance of

businesses adjusted for certain expenses and/or income which are

non-recurring or liable to distort the Company’s performance.

Adjusted EBITDA is calculated based on operating profit adjusted

for depreciation, amortisation and impairment, restructuring costs,

acquisition and M&A costs, hyperinflationary effects,

management share ownership plans, subsidiary disposal-related

effects and contingencies, plant closure costs and other items.

Capex: short for “capital expenditure”, this represents

purchases of property, plant and equipment and intangible assets

necessary to maintain the value of an asset and/or adapt to market

demand or to environmental and health and safety constraints, or to

increase the Group’s capacity. It excludes the purchase of

securities.

Recurring investments: Recurring Capex represents

purchases of property, plant and equipment and intangible assets

necessary to maintain the value of an asset and/or adapt to market

demand and environmental, health and safety constraints. It mainly

includes furnace renovation and maintenance of IS machines.

Strategic investments: Strategic investments represent

the acquisitions of strategic assets that significantly enhance the

Group’s capacity or its scope (for example, the acquisition of

plants or similar facilities, greenfield or brownfield

investments), including the building of additional new furnaces.

Since 2021 have also included investments related to the

implementation of the plan to reduce CO2 emissions.

Cash conversion: refers to the ratio between cash flow

and adjusted EBITDA. Cash flow refers to adjusted EBITDA less

Capex.

Free Cash Flow: Defined as the Operating cash flow –

Other operating impact – Interest paid & other financing costs

– Cash Tax.

The Southern and Western Europe segments comprises

production sites located in France, Spain, Portugal and Italy. It

is also designated by its acronym “SWE”.

The Northern and Eastern Europe segment comprises

production plants located in Germany, UK, Russia, Ukraine and

Poland. It is also designated by its acronym “NEE”.

The Latin America segment comprises production sites

located in Brazil, Argentina and Chile.

Liquidity: calculated as the Cash +Undrawn Revolving

Credit Facilities–Outstanding Neu Commercial Paper.

Amortisation of intangible assets acquired through business

combinations: corresponds to the amortisation of

customer relations recognis

1 Excluding Argentina, revenue growth at constant exchange rates

and scope was 25.7% in H1 2023 compared with H1 2022.

2 Net income for H1 2023 includes an amortisation expense for

customer relationships, recognised upon the acquisition of

Saint-Gobain’s packaging business in 2015, in the amounts of €22

million and €0.19 per share (net of taxes). This expense will

remain in place until 2027. If it had not been taken into account,

net income attributable to shareholders would have been €333

million and €2.84 per share. It was €23 million and €0.20 per share

in H1 2022.

3 Perimeter effect linked to the internal reorganisation of a

commercial activity.

4 Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and contingencies, plant

closure costs and other items.

5 Spread corresponds to the difference between (i) the increase

in selling prices and the mix applied by the Group after passing

any increase in production costs onto these selling prices and (ii)

the increase in production costs. The spread is positive when the

increase in sales prices applied by the Group is greater than the

increase in its production costs. The increase in production costs

is recorded by the Group at constant production volumes, before

production gap and taking into consideration the impact of the

Performance Action Plan (PAP).

6 Operating cash flow represents adjusted EBITDA less capex,

plus changes in operating working capital requirements including

changes in payables to fixed asset suppliers.

7 Defined as the Operating cash flow – Other operating impact –

Interest paid & other financing costs – Taxes paid.

8 Calculated as the Cash + Undrawn Revolving Credit Facilities –

Outstanding Commercial Paper.

9 This represents a discount of 20% compared to the average

Verallia share price on the regulated market of Euronext Paris over

the 20 trading days preceding 29 April 2023.

10 A capital increase in a nominal value of €2,066,684.10, with

an issue premium of €16,551,816.15. The 611,445 new ordinary shares

immediately qualify for dividends, have the same rights and

obligations as shares outstanding, and have equal rights to any

dividends distributed, with no restrictions or conditions. Capital

reduction via the cancellation of 611,445 treasury shares acquired

under the share buyback programme of 6 December 2022. The Company’s

share capital remains unchanged, with the number of shares issued

corresponding to the number of shares cancelled. It amounts to

€413,337,438.54 and is composed of 122,289,183 ordinary shares with

a nominal value of €3.38 each.

11 After the 2023 employee share offering and the capital

increase and reduction.

12 Net income for H1 2023 includes an amortisation expense for

customer relationships, recognised upon the acquisition of

Saint-Gobain’s packaging business in 2015, in the amounts of €22

million and €0.19 per share (net of taxes). This expense will

remain in place until 2027. If it had not been taken into account,

net income attributable to shareholders would have been €333

million and €2.84 per share. It was €23 million and €0.20 per share

in H1 2022.

13 Adusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and contingencies, plant

closure costs and other items.

14 Capex (capital expenditure) represents purchases of property,

plant and equipment and intangible assets necessary to maintain the

value of an asset and/or adapt to market demand or to environmental

and health and safety constraints, or to increase the Group’s

capacity. It excludes the purchase of securities.

15 Cash conversion is defined as adjusted EBITDA less capex,

divided by adjusted EBITDA.

16 Operating cash flow represents adjusted EBITDA less capex,

plus changes in operating working capital requirements including

changes in payables to fixed asset suppliers.

17 Defined as the Operating cash flow – Other operating impact –

Interest paid & other financing costs – Taxes paid.

18 Strategic investments represent the acquisitions of strategic

assets that significantly enhance the Group’s capacity or its scope

(for example, the acquisition of plants or similar facilities,

greenfield or brownfield investments), including the building of

additional new furnaces. Since 2021, they have also included

investments related to the implementation of the plan to reduce CO2

emissions.

19 Recurring investments represent acquisitions of property,

plant and equipment and intangible assets necessary to maintain the

value of an asset and/or adapt to market demands and to

environmental, health and safety requirements. It mainly includes

furnace renovation and maintenance of IS machines.

20 Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and contingencies, plant

closure costs and other items.

21 Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and contingencies, plant

closure costs and other items.

22 Includes depreciation and amortisation of intangible assets

and property, plant and equipment, amortisation of intangible

assets acquired through business combinations, and impairment of

property, plant and equipment.

23 The Group has applied IAS 29 (Hyperinflation) since 2018.

24 Including accrued interest.

25 Including IFRS 16 lease liabilities (€59.5 million), local

debts (€15.5 million), Engie collateral (€41.5 million).

26 Net income for H1 2023 includes an amortisation expense for

customer relationships, recognised upon the acquisition of

Saint-Gobain’s packaging business in 2015, in the amounts of €22

million and €0.19 per share (net of taxes). This expense will

remain in place until 2027. If it had not been taken into account,

net income attributable to shareholders would have been €333

million and €2.84 per share. It was €23 million and €0.20 per share

in H1 2022.

27 In accordance with IFRS 3R, the balance sheet published as of

December 31, 2022 has been restated for the value adjustments of

the assets acquired and liabilities assumed from the Allied group

acquired in 2022 that occurred during the acquisition price

allocation period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230725741239/en/

Verallia press Annabel Fuder & Stéphanie Piere

verallia@wellcom.fr | +33 (0)1 46 34 60 60

Verallia investor relations contact Alexandra Baubigeat

Boucheron | alexandra.baubigeat-boucheron@verallia.com

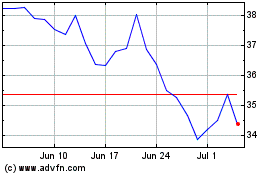

VERALLIA (EU:VRLA)

Historical Stock Chart

From Apr 2024 to May 2024

VERALLIA (EU:VRLA)

Historical Stock Chart

From May 2023 to May 2024