U.S. Dollar Rebounds After Jobs Report

September 06 2024 - 7:44AM

RTTF2

The U.S. dollar recovered against its major counterparts in the

New York session on Friday, as recession fears eased after jobs

data and traders pondered the size of rate cut expected later this

month.

Data from the Labor Department showed that employment in the

U.S. rose less than expected in the month of August.

Non-farm payroll employment climbed by 142,000 jobs in August

compared to economist estimates for an increase of 160,000

jobs.

The unemployment rate edged down to 4.2 percent in August from

4.3 percent in July.

While the data is seen as increasing the chances of a 50 basis

point interest rate cut by the Federal Reserve later this month,

traders seem worried the central bank may have waited too long to

prevent the economy from slipping into a recession.

According to CME Group's FedWatch Tool, there is a 45 percent

chance of a half point rate cut and a 55 percent chance of a

quarter point rate cut.

The greenback recovered to 1.3148 against the pound, 0.8475

against the franc and 143.89 against the yen, from an early 9-day

low of 1.3239, more than 7-month low of 0.8374 and more than a

4-week low of 141.97, respectively. The currency is seen finding

resistance around 1.27 against the pound, 0.92 against the franc

and 147.00 against the yen.

The greenback climbed to 2-day highs of 1.1065 against the euro,

1.3546 against the loonie and 0.6689 against the aussie, reversing

from an early 9-day low of 1.1155, 1-week low of 1.3466 and a 3-day

low of 0.6767, respectively. The currency is likely to locate

resistance around 1.06 against the euro, 1.38 against the loonie

and 0.63 against the aussie.

The greenback rose to 0.6184 against the kiwi, off an early

1-week low of 0.6254. It is poised to challenge resistance around

the 0.60 level.

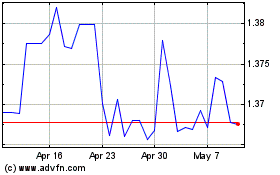

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Oct 2024 to Nov 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Nov 2023 to Nov 2024