U.S. Dollar Lower Against Euro, Pound

February 11 2025 - 6:52AM

RTTF2

The U.S. dollar dropped against the euro and the pound in the

New York session on Tuesday, as investors assessed the potential

impact of new tariffs imposed by the Trump administration on steel

and aluminum imports.

President Donald Trump imposed a 25 percent tariff on steel and

aluminium imports, which will take effect on March 12.

Investors fear that the new tariffs might lead to higher

inflation and slower economic growth.

Fed officials need not rush to adjust the policy stance, Chair

Jerome Powell told lawmakers in the Senate Banking Committee.

Powell noted interest rates have been lowered by a full

percentage point since last September, describing the Fed's current

policy stance as "significantly less restrictive than it had

been."

"We know that reducing policy restraint too fast or too much

could hinder progress on inflation," Powell said. "At the same

time, reducing policy restraint too slowly or too little could

unduly weaken economic activity and employment."

The greenback fell to 4-day lows of 1.0350 against the euro,

0.6296 against the aussie and 1.4302 against the loonie, off its

early highs of 1.0291, 0.6260 and 1.4345, respectively. The

greenback may face support around 1.05 against the euro, 0.65

against the aussie and 1.38 against the loonie.

The greenback declined to 0.5659 against the kiwi, from an early

1-week high of 0.5629. The greenback is poised to challenge support

around the 0.59 level.

The greenback weakened to 1.2421 against the pound, from an

early 8-day high of 1.2332. The greenback is likely to face support

around the 1.26 level.

In contrast, the greenback climbed to an 8-day high of 0.9140

against the franc and a 5-day high of 152.59 against the yen, off

its early lows of 0.9106 and 151.64, respectively. The currency is

seen finding resistance around 0.93 against the franc and 158.00

against the yen.

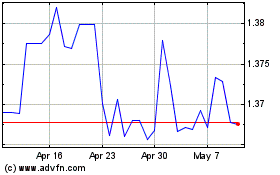

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Jan 2025 to Feb 2025

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Feb 2024 to Feb 2025