Plan to report Phase 2 topline results in

August 2024 from ongoing Phase 2/3 trial (EBO-301) in

treatment-refractory Mycobacterium avium Complex (TR-MAC)

Phase 3 continues for 97 patients enrolled

before the voluntary enrollment pause; lifting of the Phase 3

enrollment pause to be determined after review of unblinded Phase 2

data and discussions with the FDA

Cash, cash equivalents, and investments of

$118.1 million at March 31, 2024

AN2 Therapeutics, Inc. (Nasdaq: ANTX), a clinical-stage

biopharmaceutical company focused on developing treatments for

rare, chronic, and serious infectious diseases with high unmet

needs, today reported financial results for the quarter ended March

31, 2024.

“The Phase 2 topline data, expected to be available in August,

will include the first clinical efficacy data for epetraborole in

patients with treatment-refractory MAC. The patients enrolled in

EBO-301 are highly refractory with limited to no treatment options;

and background regimens available provide little if any benefit,”

said Eric Easom, Co-Founder, President and Chief Executive Officer.

“We hope to see data demonstrating that epetraborole on top of

background therapy will show benefit in these toughest to treat

patients. The Phase 2 data package will be critical to informing

the path forward for epetraborole in patients with treatment

refractory MAC.”

First Quarter & Recent Business Updates:

Epetraborole Pivotal Phase 2/3 Clinical Study in TR-MAC Lung

Disease

This double-blind, placebo-controlled trial is comparing

epetraborole plus a background regimen versus placebo plus

background regimen in patients with TR-MAC lung disease. In

February 2024, the Company announced that it had voluntarily paused

Phase 3 enrollment in the seamless Phase 2/3 clinical trial,

pending further data review. While the Phase 3 part of the trial is

paused for new enrollment, the Company is continuing to dose

currently enrolled patients (n=97) under the existing protocol. The

voluntary pause was instituted following an analysis of blinded

aggregate data from the ongoing Phase 2 study, which showed

potentially lower than expected efficacy. A blinded review of the

aggregate baseline patient demographics points to a highly

refractory patient population with high incidence of resistance to

background regimens, prolonged nontuberculous mycobacteria (NTM)

lung disease and high levels of cavitary disease; the study

population also includes patients who are refractory to Arikayce,

the only FDA-approved drug for refractory NTM caused by MAC. The

decision to pause Phase 3 enrollment was not due to safety

concerns.

The Company expects to announce topline data from the Phase 2

part of the trial in August 2024. Continuation of enrollment in the

Phase 3 part of the study will be determined after reviewing the

unblinded Phase 2 data and following discussions with FDA.

Selected First Quarter Financial Results

- Research and Development (R&D) Expenses: R&D

expenses for the first quarter of 2024 were $14.7 million compared

to $12.0 million for the same period during 2023 due to increased

clinical trial expenses, personnel-related expenses, consulting and

outside services, and other expenses, partially offset by lower

chemistry manufacturing and controls expenses and lower costs

associated with research studies.

- General and Administrative (G&A) Expenses: G&A

expenses for the first quarter of 2024 were $3.6 million, compared

to $4.1 million for the same period during 2023 due to a decrease

in professional and outside services related to IPO expenses in

2023 and a decrease in insurance expenses, partially offset by an

increase in personnel-related expenses.

- Other Income, Net: Other income, net for the first

quarter of 2024 was $1.7 million, compared to $0.7 million for the

same period during 2023 due to increased interest and investment

income based on higher interest rates and higher cash, cash

equivalents, and investment balances.

- Net loss: Net loss for the first quarter of 2024 was

$16.6 million, compared to $15.3 million for the same period during

2023.

- Cash Position: The Company had cash, cash equivalents,

and investments of $118.1 million at March 31, 2024.

About AN2 Therapeutics, Inc.

AN2 Therapeutics, Inc. is a clinical-stage biopharmaceutical

company developing treatments for rare, chronic, and serious

infectious diseases with high unmet needs. Our initial candidate is

epetraborole, which we are studying as a once-daily, oral treatment

with a novel mechanism of action for patients with nontuberculous

mycobacteria (NTM) lung disease, a rare, chronic, and progressive

infectious disease caused by bacteria known as mycobacteria, that

leads to irreversible lung damage and can be fatal. For more

information, please visit our website at

www.an2therapeutics.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements expressed or implied in this press

release include, but are not limited to, statements regarding:

reporting topline data from Phase 2 of the EBO-301 trial; continued

analysis and expectations regarding incoming data; continuation of

the enrollment pause in Phase 3 of the EBO-301 trial; the

occurrence and outcome of FDA discussions; potential of

epetraborole; and other statements that are not historical fact.

These statements are based on AN2’s current estimates,

expectations, plans, objectives, and intentions, are not guarantees

of future performance and inherently involve significant risks and

uncertainties. Actual results and the timing of events could differ

materially from those anticipated in such forward-looking

statements as a result of these risks and uncertainties, which

include, but are not limited to, risks and uncertainties related

to: the number of patients who remain enrolled in the Phase 2/3

trial; the ability of AN2 to resume enrollment in the Phase 2/3

trial, in the event the determination to resume enrollment is made;

discussions with FDA; the ability of AN2 to effectively and timely

make amendments to the Phase 2/3 pivotal trial design based on its

analysis of the Phase 2 portion of the study and/or pursuant to

additional FDA feedback; possible changes to AN2’s plans or

priorities as it assesses study data; potential for protocol

modifications, redesign, or study termination; timely enrollment of

patients in AN2’s existing and future clinical trials; AN2’s

ability to procure sufficient supply of its product candidate for

its existing and future clinical trials; the potential for results

from clinical trials to differ from preclinical, early clinical,

preliminary, or expected results; significant adverse events,

toxicities, or other undesirable side effects associated with AN2’s

product candidate; the significant uncertainty associated with

AN2’s product candidate ever receiving any regulatory approvals;

AN2’s ability to obtain, maintain, or protect intellectual property

rights related to its current and future product candidates;

implementation of AN2’s strategic plans for its business and

current and future product candidates; the sufficiency of AN2’s

capital resources and need for additional capital to achieve its

goals; global macroeconomic conditions and global conflicts; and

other risks, including those described under the heading “Risk

Factors” in AN2’s Annual Reports on Form 10-K and Quarterly Reports

on Form 10-Q, and AN2’s other reports filed with the U.S.

Securities and Exchange Commission (SEC). These filings, when made,

are available on the investor relations section of AN2’s website at

www.an2therapeutics.com and on the SEC’s website at www.sec.gov.

Forward-looking statements contained in this press release are made

as of this date, and AN2 undertakes no duty to update such

information except as required under applicable law.

AN2 THERAPEUTICS, INC.

CONDENSED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended

March 31,

2024

2023

Operating expenses:

Research and development

$

14,655

$

11,985

General and administrative

3,641

4,054

Total operating expenses

18,296

16,039

Loss from operations

(18,296

)

(16,039

)

Other income, net

1,679

716

Net loss attributable to common

stockholders

$

(16,617

)

$

(15,323

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.56

)

$

(0.79

)

Weighted-average number of shares used in

computing net loss per share, basic and diluted

29,763,278

19,385,646

Other comprehensive loss:

Unrealized (loss) gain on investments

(222

)

199

Comprehensive loss

$

(16,839

)

$

(15,124

)

AN2 THERAPEUTICS, INC.

CONDENSED BALANCE

SHEETS

(in thousands)

March 31, 2024

(unaudited)

December 31, 2023

Assets

Cash and cash equivalents

$

24,693

$

15,647

Short-term investments

89,517

91,648

Prepaid expenses and other current

assets

2,103

3,212

Long-term investments

3,904

27,194

Other assets, long-term

1,043

1,043

Total assets

$

121,260

$

138,744

Liabilities and stockholders’

equity

Accounts payable

$

2,433

$

2,676

Other current liabilities

8,230

11,367

Total liabilities

10,663

14,043

Stockholders’ equity

110,597

124,701

Total liabilities and stockholders’

equity

$

121,260

$

138,744

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514775764/en/

Lucy O. Day Chief Financial Officer

l.day@an2therapeutics.com

Anne Bowdidge Investor Relations

abowdidge@an2therapeutics.com

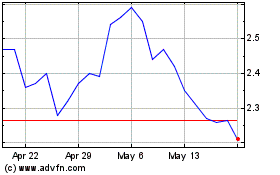

AN2 Therapeutics (NASDAQ:ANTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

AN2 Therapeutics (NASDAQ:ANTX)

Historical Stock Chart

From Nov 2023 to Nov 2024