false

0000879585

0000879585

2023-12-14

2023-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 14, 2023

ATN INTERNATIONAL, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-12593 |

|

47-0728886 |

| (State or other |

|

(Commission File Number) |

|

(IRS Employer |

| jurisdiction of incorporation) |

|

|

|

Identification No.) |

500 Cummings Center

Beverly, MA 01915

(Address of principal executive offices

and zip code)

(978) 619-1300

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $.01 per share |

|

ATNI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

| Regulation FD Disclosure |

On December 14, 2023,

the Company issued a press release regarding its Share Repurchase Program and its quarterly cash dividend. A copy of the press release

is furnished herewith as Exhibit 99.1 and hereby incorporated by reference.

The information set forth

under this “Item 7.01 Regulation FD Disclosure,” including the exhibits attached hereto, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference

into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such

filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is

required to be disclosed solely by Regulation FD.

| Item 9.01 |

| Financial Statements and Exhibits. |

* * *

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ATN INTERNATIONAL, INC. |

| |

|

|

| |

By: |

/s/ Justin D. Benincasa |

| |

|

Justin D. Benincasa |

| |

|

Chief Financial Officer |

| |

|

|

| Dated: December 14, 2023 |

|

|

Exhibit 99.1

|

|

News

Release |

| |

Contact: |

ATN International, Inc. |

| December 14, 2023 |

|

Justin Benincasa |

| |

|

Chief Financial Officer |

| |

|

978-619-1300 |

| |

|

|

| |

|

Ian Rhoades |

| |

|

Investor Relations |

| |

|

ATNI@investorrelations.com |

ATN

International Board of Directors Expands Share Repurchase Program to $25 Million and Increases Dividend by 14%

BEVERLY,

MA, December 14, 2023 – ATN International, Inc. (“ATN” or the “Company”) (Nasdaq:

ATNI), today announced that the Company’s Board of Directors has authorized the expansion of the share repurchase program to $25

million of common stock and approved a quarterly dividend increase of 14% to $0.24 from $0.21 per share. The quarterly dividend will

be payable on January 5, 2024, on all common shares outstanding to stockholders of record as of December 31, 2023.

“As we approach 2024, we are moving into

the final and smallest phase of ATN’s three-year infrastructure expansion plan, positioning us to increase direct

capital returns to shareholders,” said Michael Prior, ATN’s Chairman and Chief Executive Officer. “The Board’s

decision to expand the share repurchase plan and increase our quarterly dividend reflects their continued confidence in our ability to

execute our strategic plan that has produced strong and reliable operating cash flows, sustainable growth across our markets, and a healthy

balance sheet. Going forward, we remain committed to a balanced capital allocation strategy. This includes seeking the highest total

return opportunities for shareholders across acquisitions, internal investments, share repurchases and dividends, while remaining prudent

in how we manage our net debt position.”

The refresh of the plan brings the aggregate

amount available for share repurchases to $25.0 million. The timing and amount of any repurchases of common stock will be determined

by ATN’s management based on its evaluation of market conditions and other factors, including price, regulatory requirements, capital

availability and other potential uses of the Company’s cash.

About ATN

ATN

International, Inc. (Nasdaq: ATNI), headquartered in Beverly, Massachusetts, is a provider of digital infrastructure and

communications services in the United States and internationally, including the Caribbean region, with a focus on

rural and remote markets with a growing demand for infrastructure investments. The Company’s operating subsidiaries today primarily

provide: (i) advanced wireless and wireline connectivity to residential, business and government customers, including a range of

high-speed Internet and data services, fixed and mobile wireless solutions, and video and voice services; and (ii) carrier and enterprise

communications services, such as terrestrial and submarine fiber optic transport, and communications tower facilities. For more information,

please visit www.atni.com.

Cautionary Language

Concerning Forward-Looking Statements

This press release contains forward-looking statements

relating to, among other matters, our plans with respect to our share repurchases and dividends and the possible benefits to our shareholders,

management’s plans and strategy, and future results of the Company. These forward-looking statements are based on estimates, projections,

beliefs and assumptions and are not guarantees of future events or results. Actual future events and results could differ materially

from the events and results indicated in these statements as a result of many factors, including, among others, the following: (1) the

general performance of the Company’s operations, including operating margins, revenues, capital expenditures, and the retention

of and future growth of the Company’s subscriber base and ARPU; (2) the Company’s reliance on a limited number of key

suppliers and vendors for timely supply of equipment and services relating to the Company’s network infrastructure; (3) the

Company’s ability to satisfy the needs and demands of the Company’s major carrier customers; (4) the Company’s

ability to realize expansion plans for its fiber markets; (5) the adequacy and expansion capabilities of the Company’s network

capacity and customer service system to support the Company’s customer growth; (6) the Company’s ability to efficiently

and cost-effectively upgrade the Company’s networks and information technology platforms to address rapid and significant

technological changes in the telecommunications industry; (7) the Company’s continued access to capital and credit markets

on terms it deems favorable; (8) government subsidy program availability and regulation of the Company’s businesses, which

may impact the Company’s telecommunications licenses, the Company’s revenue and the Company’s operating costs; (9) the

Company’s ability to successfully transition its US Telecom business away from wholesale mobility to other carrier

and consumer-based services; (10) ongoing risk of an economic downturn, political, geopolitical and other risks and opportunities

facing the Company’s operations, including those resulting from the continued inflation and other macroeconomic headwinds including

increased costs, increasing interest rates and supply chain disruptions; (11) the loss of, or an inability to recruit skilled personnel

in the Company’s various jurisdictions, including key members of management; (12) the Company’s ability to find investment

or acquisition or disposition opportunities that fit the strategic goals of the Company; (13) the occurrence of weather events and natural

catastrophes and the Company’s ability to secure the appropriate level of insurance coverage for these assets; and (14) increased

competition. These and other additional factors that may cause actual future events and results to differ materially from the events

and results indicated in the forward-looking statements above are set forth more fully under Item 1A “Risk Factors” of the

Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 15,

2023, and the other reports the Company files from time to time with the SEC. The Company undertakes no obligation and has no intention

to update these forward-looking statements to reflect actual results, changes in assumptions, or changes in other factors that may affect

such forward-looking statements, except as required by law.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

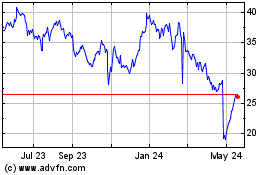

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Dec 2024 to Jan 2025

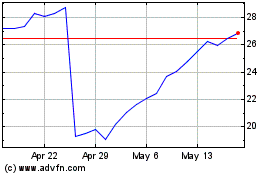

ATN (NASDAQ:ATNI)

Historical Stock Chart

From Jan 2024 to Jan 2025