Brightcove Stockholders to Receive $4.45 Per

Share in Cash

Bending Spoons enters the enterprise SaaS

market and will draw on its technology expertise to further

strengthen Brightcove and bring its cutting-edge platform to new

heights

Brightcove Inc. (NASDAQ: BCOV), the world’s most trusted

streaming technology company, today announced that it has entered

into a definitive agreement to be acquired by Bending Spoons, in an

all-cash transaction valued at approximately $233 million. Under

the terms of the agreement, Brightcove shareholders will receive

$4.45 per share in cash for each share of Brightcove common stock

that they own. The per share purchase price represents a 90%

premium over Brightcove’s 60-day volume weighted average share

price as of the close on November 22, 2024.

“We are pleased to have entered into this definitive agreement

with Bending Spoons, which represents the culmination of a

comprehensive strategic review process led by our Board of

Directors and with the support of our management team and

advisors,” said Diane Hessan, Chairman of Brightcove’s Board of

Directors. “As the Board considered the long-term path for

Brightcove, we unanimously determined that this transaction

represents the best opportunity to maximize the value of the

business and deliver compelling, certain, and immediate cash value

to our stockholders.”

Marc DeBevoise, Brightcove’s Chief Executive Officer and Board

Director, said, “Brightcove is a storied and successful enterprise

SaaS leader with 20 years of history, 12 of them as a public

company. We have been a pioneer and innovator in the streaming

market, from the early days of video player technologies to the

leading video-powered engagement platform we are today. Today’s

announcement will enable Brightcove to leverage the technology and

market expertise of Bending Spoons and best position Brightcove to

continue to thrive in the streaming and engagement technology

market.”

Luca Ferrari, Bending Spoons CEO and co-founder, said, “We’re

delighted to welcome Brightcove into the Bending Spoons portfolio.

Brightcove is a trusted and respected name in the streaming

technology space, and we look forward to serving its large global

customer base. When Bending Spoons acquires a business, we do so

with the intention of owning and operating it indefinitely. With

this in mind, we’re excited about building on the strong work of

the current team, and ensuring Brightcove thrives for many years to

come.”

Transaction Details

The transaction, which was unanimously approved by Brightcove’s

Board of Directors, is expected to close in the first half of 2025,

subject to customary closing conditions and approvals, including

approval by Brightcove’s stockholders, and the receipt of required

regulatory approvals.

Upon the completion of the transaction, Brightcove will become a

privately held company and its common stock will no longer be

listed on any public stock exchange.

Advisors

Lazard is serving as exclusive financial advisor to Brightcove,

and Goodwin Procter LLP is serving as Brightcove’s legal

advisor.

Latham & Watkins LLP is serving as legal advisor to Bending

Spoons, and EY Advisory SpA provided financial and tax due

diligence services. JP Morgan and Wells Fargo served as the M&A

advisors to Bending Spoons.

About Brightcove

Brightcove creates the world’s most reliable, scalable, and

secure streaming technology solutions to build a greater connection

between companies and their audiences, no matter where they are or

on which devices they consume content. In more than 60 countries,

Brightcove’s intelligent video platform enables businesses to sell

to customers more effectively, media leaders to stream and monetize

content more reliably, and every organization to communicate with

team members more powerfully. With two Technology and Engineering

Emmy® Awards for innovation, uptime that consistently leads the

industry, and unmatched scalability, we continuously push the

boundaries of what video can do. Follow Brightcove on LinkedIn, X,

Facebook, Instagram, Threads, and YouTube. Visit

Brightcove.com.

About Bending Spoons

Bending Spoons has served a billion people across the globe

through its suite of digital technology products; including

Evernote, Issuu, Meetup, Remini, StreamYard, Splice, and

WeTransfer. Its products are currently used by more than 200

million people each month.

For more information, visit bendingspoons.com

Bending Spoons logos: https://we.tl/t-VJTJEkg41a

Additional Information and Where to Find It

In connection with the proposed transaction by and among

Brightcove Inc., a Delaware Corporation (the “Company”), Bending

Spoons US Inc., a Delaware Corporation (“Parent”), and Bending

Spoons S.p.A, an Italian società per azioni (“Guarantor”), and

Blossom Merger Sub Inc., a Delaware corporation and wholly-owned

subsidiary of Parent (“Merger Sub”), the Company intends to file

with the Securities and Exchange Commission (“SEC”) a proxy

statement on Schedule 14A (the “Proxy Statement”), the definitive

version of which will be sent or provided to Company stockholders,

in connection with a special meeting of the Company’s stockholders

for purposes of obtaining, stockholder approval of the proposed

transaction. The Company may also file other documents with the SEC

regarding the proposed transaction. This document is not a

substitute for the Proxy Statement or any other document which the

Company may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE

URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS

THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS AND DOCUMENTS

INCORPORATED BY REFERENCE THEREIN, CAREFULLY AND IN THEIR ENTIRETY

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and

security holders may obtain free copies of the Proxy Statement

(when it is available) and other documents that are filed or will

be filed with the SEC by the Company through the website maintained

by the SEC at www.sec.gov, the Company’s investor relations website

at investor.brightcove.com or by contacting the Company’s investor

relations department at the following:

InvestorRelations@brightcove.com.

Participants in the Solicitation

The Company and certain of its directors, executive officers and

other members of management and employees may be deemed to be

participants in the solicitation of proxies from the Company’s

stockholders in respect of the proposed transaction and any other

matters to be voted on at the special meeting. Information

regarding the Company’s directors and executive officers, including

a description of their direct interests, by security holdings or

otherwise, is contained in the Company’s proxy statement for its

2024 annual meeting of stockholders, which was filed with the SEC

on March 29, 2024, the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, which was filed with the SEC

on February 22, 2024, and in subsequently filed Current Reports on

Form 8-K and Quarterly Reports on Form 10-Q, and will be included

in the Proxy Statement (when available). Company stockholders may

obtain additional information regarding the direct and indirect

interests of the participants in the solicitation of proxies in

connection with the proposed transaction, including the interests

of Company directors and executive officers in the proposed

transaction, which may be different than those of Company

stockholders generally, by reading the Proxy Statement and any

other relevant documents that are filed or will be filed with the

SEC relating to the proposed transaction. You may obtain free

copies of these documents using the sources indicated above.

Cautionary Statement Regarding Forward Looking

Statements

This communication contains “forward-looking statements” within

the meaning of the federal securities laws, including Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Exchange Act. These forward-looking statements are based on the

Company’s current expectations, estimates and projections about the

expected date of closing of the proposed transaction and the

potential benefits thereof, its business and industry, management’s

beliefs and certain assumptions made by the Company, Parent, Merger

Sub, and Guarantor all of which are subject to change. In this

context, forward-looking statements often address expected future

business and financial performance and financial condition, and

often contain words such as “expect,” “anticipate,” “intend,”

“plan,” “believe,” “could,” “seek,” “see,” “will,” “may,” “would,”

“might,” “potentially,” “estimate,” “continue,” similar expressions

or the negatives of these words or other comparable terminology

that convey uncertainty of future events or outcomes. All

forward-looking statements by their nature address matters that

involve risks and uncertainties, many of which are beyond our

control, and are not guarantees of future results, such as

statements about the consummation of the proposed transaction and

the anticipated benefits thereof. These and other forward-looking

statements, including the failure to consummate the proposed

transaction or to make or take any filing or other action required

to consummate the proposed transaction on a timely matter or at

all, are not guarantees of future results and are subject to risks,

uncertainties and assumptions that could cause actual results to

differ materially from those expressed in any forward-looking

statements. Accordingly, there are or will be important factors

that could cause actual results to differ materially from those

indicated in such statements and, therefore, you should not place

undue reliance on any such statements and caution must be exercised

in relying on forward-looking statements. Important risk factors

that may cause such a difference include, but are not limited to:

(i) the ability of the parties to consummate the proposed

transaction in the anticipated time period or at all; (ii) the

satisfaction (or waiver) of closing conditions to the consummation

of the proposed transaction, including the receipt of required

regulatory approvals and the requisite approval of the Company’s

stockholders; (iii) potential delays in consummation of the

proposed transaction; (iv) risks associated with the disruption of

management’s attention from ongoing business operations due to the

pendency and announcement of the proposed transaction; (v) the

occurrence of any event, change or other circumstance or condition

that could give rise to the termination of the merger agreement;

(vi) the Company’s ability to implement its business strategy;

(vii) significant transaction costs associated with the proposed

transaction; (viii) the risk that Company’s stock price may decline

significantly if the proposed transaction is not consummated; (ix)

the nature, cost and outcome of any potential litigation relating

to the proposed transaction; (x) the risk that disruptions from the

proposed transaction will harm the Company’s business, including

current plans and operations; (xi) the effects of the proposed

transaction on relationships with employees, other business

partners or governmental entities; (xii) potential adverse

reactions or changes to business relationships resulting from the

announcement or completion of the proposed transaction; (xiii)

legislative, regulatory and economic developments affecting the

Company’s business; (xiv) general economic and market developments

and conditions; (xv) the evolving legal, regulatory and tax regimes

under which the Company operates; (xvi) potential business

uncertainty, including changes to existing business relationships,

during the pendency of the merger that could affect the Company’s

financial performance; (xvii) restrictions during the pendency of

the proposed transaction that may impact the Company’s ability to

pursue certain business opportunities or strategic transactions;

and (xviii) unpredictability and severity of catastrophic events,

including, but not limited to, acts of terrorism or outbreak of war

or hostilities, as well as the Company’s response to any of the

aforementioned factors. These risks, as well as other risks

associated with the proposed transaction, will be more fully

discussed in the Proxy Statement to be filed with the SEC in

connection with the proposed transaction. Additional risks and

uncertainties that could cause actual outcomes and results to

differ materially from those contemplated by the forward-looking

statements are included under the caption “Risk Factors” in the

Company’s most recent annual and quarterly reports filed with the

SEC and any subsequent reports on Form 10-K, Form 10-Q or Form 8-K

filed from time to time and available at www.sec.gov. While the list of factors presented

here is, and the list of factors presented in the Proxy Statement

will be, considered representative, no such list should be

considered to be a complete statement of all potential risks and

uncertainties. Unlisted factors may present significant additional

obstacles to the realization of forward-looking statements.

Consequences of material differences in results as compared with

those anticipated in the forward-looking statements could include,

among other things, business disruption, operational problems,

financial loss, legal liability and similar risks, any of which

could have a material adverse effect on the Company’s financial

condition, results of operations, or liquidity. The forward-looking

statements included herein are made only as of the date hereof. The

Company does not assume any obligation to publicly provide

revisions or updates to any forward-looking statements, whether as

a result of new information, future developments or otherwise,

should circumstances change, except as otherwise required by

securities and other applicable laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241124779994/en/

Brightcove Investor: ICR for Brightcove Brian Denyeau,

646-277-1251 brian.denyeau@icrinc.com

Brightcove Media: Brightcove Sara Griggs, 929-888-4866

sgriggs@brightcove.com

Bending Spoons Media: Bending Spoons Christy Keenan

ck@bendingspoons.com

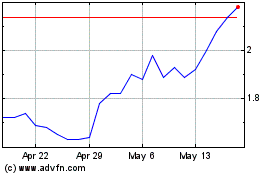

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Oct 2024 to Nov 2024

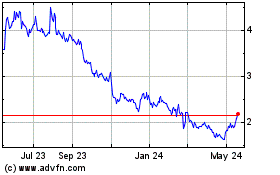

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Nov 2023 to Nov 2024