Blink Charging Co. (Nasdaq: BLNK) (“Blink” or the “Company”), a

leading manufacturer, owner, operator, and provider of electric

vehicle (EV) charging equipment and services, today announced

financial results for the third quarter and nine months ended

September 30, 2023.

The following top-line highlights are in

thousands of dollars and unaudited.

| |

Three Months Ended |

|

|

|

Nine Months Ended |

|

|

| |

September 30, |

|

|

|

September 30, |

|

|

| |

2023 |

|

2022 |

|

Increase |

|

2023 |

|

2022 |

|

Increase |

|

Product Sales |

$ |

35,059 |

|

|

$ |

13,358 |

|

|

162 |

% |

|

$ |

76,035 |

|

$ |

30,238 |

|

|

151 |

% |

|

Service Revenues (1) |

|

6,735 |

|

|

|

3,079 |

|

|

119 |

% |

|

|

18,491 |

|

|

6,831 |

|

|

171 |

% |

|

Other Revenues(2) |

|

1,583 |

|

|

|

810 |

|

|

95 |

% |

|

|

3,361 |

|

|

1,464 |

|

|

130 |

% |

|

Total Revenues |

$ |

43,377 |

|

|

$ |

17,247 |

|

|

152 |

% |

|

$ |

97,887 |

|

$ |

38,533 |

|

|

154 |

% |

(1) Service Revenues consist of charging service

revenues, network fees, and car-sharing service revenues.(2) Other

Revenues consist of other revenues, warranty fees, and grants and

rebates.

“We delivered our second consecutive quarter of

record-breaking performance with third quarter revenue of $43.4

million, demonstrating growth of more than 150% as compared to the

third quarter of 2022, and enhanced gross margin of 29.5%. Our

third quarter results reflect a continuation of the momentum and

growth that we’ve driven throughout this fiscal year, as we’ve seen

strong demand for both equipment and services, as well as increased

network fees. Notably, in the first nine months of 2023, Blink has

generated $98 million in revenue, putting the Company significantly

ahead of our full year 2022 revenue of $61.1 million, with another

quarter of 2023 revenue still to be recorded. We are driving

operational excellence across all aspects of our business. From the

design and manufacturing of our chargers, to our network services

and our innovative sales strategy, Blink is equipped to meet the

charging needs of virtually any customer. Our success is rooted in

our global team’s experience and capabilities who are intently

focused on capturing market share and growing our customer base.

Blink is the only U.S.-based vertically integrated EV charging

company – our capabilities, which include manufacturing and selling

our charging equipment while also owning and operating our own

chargers and network, are driving consistent and sustainable

growth,” commented Brendan Jones, President and Chief

Executive Officer.

“EV adoption continues to grow as Blink builds a

best-in-class charging infrastructure and provides equipment and

services to an underserved market. Blink chargers work with all

OEMs, and we incorporate both NACS and CCS into our full line of

charging products to further expand our charger compatibility. We

are essentially EV agnostic, with a portfolio of universally

accessible EV chargers to meet all charging needs. We remain

focused on capitalizing on the many opportunities we’re seeing in

the market as individual consumers and fleets transition to EV

alternatives, and federal, state, and local legislation continue to

incentivize transition to EVs. Moving forward, we believe we are

well positioned with our growing footprint, increased brand

recognition, innovative products, and advanced technology to

strengthen our leadership role in the rapidly expanding EV charging

marketplace.”

Revenue and Adjusted EBITDA

Targets

Given the strong momentum in the business, Blink

is increasing its 2023 revenue target to $128 - $133 million from

$110 - $120 million. Furthermore, the Company is targeting

achieving a positive Adjusted EBITDA run rate by December 2024.

The Company reiterates its previously stated

annual gross margin target of 30%+.

Third Quarter Financial

Results

RevenuesTotal Revenues

increased 152% to $43.4 million for the third quarter of 2023

compared to the third quarter of 2022, an increase of $26.1

million.

Product Sales increased 162% to $35.1 million in

the third quarter of 2023, an increase of $21.7 million from the

same period in 2022 primarily driven by increased sales of

commercial L2 and DCFC chargers.

Service Revenues, which consist of charging

service revenues, network fees, and car-sharing service revenues,

increased 119% to $6.7 million in the third quarter of 2023, up

$3.7 million from the third quarter of 2022, primarily driven by

greater utilization of chargers in the U.S. and internationally, an

increased number of chargers on the Blink networks, and revenues

associated with the Blink Mobility car-sharing service program.

Other Revenues, which are comprised of warranty

fees, grants and rebates, and other revenues, increased 95% to $1.6

million in the third quarter of 2023, an increase of $773,000.

Gross Profit Gross Profit

increased 167% to $12.8 million, or 29.5% of revenue, in the third

quarter of 2023, compared to gross profit of $4.8 million, or 27.7%

of revenue, in the third quarter of 2022. Gross margin increased in

the third quarter of 2023, when compared to third quarter of 2022,

due primarily to increased sales of chargers manufactured in-house,

which provide a higher margin than contract manufactured chargers,

as well as growth in service revenue such as charging revenues and

network fees.

Operating Expenses

Operating expense in the third quarter of 2023

was $123.5 million compared to $29.3 million in the third quarter

of 2022. Operating expense in the quarter includes a non-cash

goodwill and intangible assets impairment charge of $94.2 million

related to a quantitative impairment analysis which determined that

the fair value of all reporting units of the Company were less than

the carrying amount. Excluding the non-cash impairment charge,

operating expenses were $29.3 million.

Net Loss and Loss Per ShareNet

Loss for the third quarter of 2023 was $112.7 million, or $(1.74)

per share, compared to a Net Loss of $25.6 million, or $(0.51) per

share in the third quarter of 2022. The increase in the loss per

share was primarily attributable to the non-cash goodwill and

intangible assets impairment charge of $1.54 per share in the

quarter.

Adjusted EBITDA and

Adjusted EPSAdjusted EBITDA for the third quarter

of 2023 was a loss of $11.7 million compared to an Adjusted EBITDA

loss of $17.6 million in the prior year period.

Adjusted EBITDA (defined as earnings/loss before

interest income/expense, provision for income taxes, depreciation

and amortization, stock-based compensation, acquisition related

costs, one-time non-recurring expense, non-cash impairment charges,

and non-cash loss on extinguishment of notes payable) is a non-GAAP

financial measure management uses as a proxy for net income/loss.

See “Non-GAAP Financial Measures” for a reconciliation of GAAP to

Non-GAAP financial measures included at the end of this

release.

Adjusted EPS for the third quarter of 2023 was a

loss of $(0.16) compared to an adjusted EPS loss of $(0.47) in the

third quarter of 2022.

Adjusted EPS (defined as earnings/loss per

diluted share) is a non-GAAP financial measure management uses to

assess earnings per diluted share excluding non-recurring items

such as acquisition-related costs, amortization expense of

intangible assets, additional stock-based compensation expense,

one-time non-recurring expense, non-cash impairment charges, and

non-cash loss on extinguishment of notes payable. See “Non-GAAP

Financial Measures” for a reconciliation of GAAP to Non-GAAP

financial measures included at the end of this release.

Cash and cash equivalentsAs of

September 30, 2023, Cash and Cash Equivalents totaled $66.7

million. Third quarter of 2023 cash burn meaningfully improved to

$17 million.

Recent Highlights:

- Wholly-owned

Belgium-based subsidiary, Blue Corner, is now operating as Blink

Charging, positioning the Company for further expansion in

Europe.

- Signed a 7-year

agreement to become the official EV charging provider for the city

of Miami Beach, Florida. The agreement sets the stage for Blink and

the City to electrify city fleets and provide charging solutions

for employees, residents and visitors.

- Blink is

partnering with Parkopedia, a leading global connected car and

parking service provider, to integrate more than 4,000 Blink EV

charging locations onto the Parkopedia platform in North America.

This strategic integration will grant the platform access to nearly

12,000 Blink public EV chargers, which includes 129 DC Fast

Chargers.

- Became a

provider of EV charging solutions for Royal Farms, a

Baltimore-based convenience store chain with locations throughout

Maryland and Delaware. Royal Farms will install a total of 30 Blink

state-of-the-art DC Fast Chargers (DCFC), providing 60 charging

ports and bringing more accessible EV charging to a critical region

of the Mid-Atlantic.

- Awarded contract

from the State of Utah prioritizing Blink products and services for

government, non-profit, K-12, and higher education agencies in

Utah, preparing their properties and facilities for the growing

demand for EV charging nationwide. As a direct result of the

contract, Blink was selected by the Salt Lake City International

Airport for its EV charging needs.

- Selected as EV

charging supplier for Tennessee Valley Authority, the nation’s

biggest government-owned electric utility, to provide a range of

charging solutions including L2 and DCFC charging solutions for

both public and commercial fleet applications.

- The Company is

actively expanding EV charging infrastructure across Latin America

with region-specific products as the region experiences continued

steady growth of EV sales. Since 2002, Blink has sold or deployed

more than 2,100 EV chargers across eight countries, including its

IQ 200 charger, the residential HQ 200 charger compatible with type

1 J1772 (American) plug and the EQ 200 charger for the type 2

(European) connector.

Earnings Conference Call

Blink Charging will host a conference call and

webcast to discuss third quarter 2023 results today, November 9,

2023 at 4:30 PM, Eastern Time. To access the live webcast, log onto

the Blink Charging website at www.blinkcharging.com, and click on

the News/Events section of the Investor Relations page. Investors

may also access the webcast via the following

link:https://www.webcaster4.com/Webcast/Page/2468/49331

To participate in the call by phone, dial (877)

545-0320 approximately five minutes prior to the scheduled start

time. International callers please dial (973) 528-0002. Callers

should use access code: 526841.A replay of the teleconference will

be available until December 9, 2023, and may be accessed by dialing

(877) 481-4010. International callers may dial (919) 882-2331.

Callers should use conference ID: 49331.

###

About Blink Charging

Blink Charging Co. (Nasdaq: BLNK), a global

leader in electric vehicle (EV) charging equipment, has contracted,

sold, or deployed nearly 85,000 charging ports worldwide, many of

which are networked EV charging stations, enabling EV drivers to

easily charge at any of Blink’s charging locations. Blink’s

principal line of products and services includes the Blink EV

charging network (“Blink Network”), EV charging equipment, EV

charging services, and the products and services of recent

acquisitions, including SemaConnect, Blue Corner, BlueLA and Envoy.

The Blink Network uses proprietary, cloud-based software that

operates, maintains, and tracks the EV charging stations connected

to the network and the associated charging data. With global EV

purchases forecasted to half of passenger cars sold in the US by

2030, Blink has established key strategic partnerships for rolling

out adoption across numerous location types, including parking

facilities, multifamily residences and condos, workplace locations,

health care/medical facilities, schools and universities, airports,

auto dealers, hotels, mixed-use municipal locations, parks and

recreation areas, religious institutions, restaurants, retailers,

stadiums, supermarkets, and transportation hubs.

For more information, please visit

https://blinkcharging.com/.

Forward-Looking Statements

This press release contains forward-looking

statements as defined within Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. These forward-looking statements, and terms such

as “anticipate,” “expect,” “intend,” “may,” “will,” “should” or

other comparable terms, involve risks and uncertainties because

they relate to events and depend on circumstances that will occur

in the future. Those statements include statements regarding the

intent, belief or current expectations of Blink Charging and

members of its management, as well as the assumptions on which such

statements are based. Prospective investors are cautioned that any

such forward-looking statements are not guarantees of future

performance and involve risks and uncertainties, including those

described in Blink Charging’s periodic reports filed with the SEC,

and that actual results may differ materially from those

contemplated by such forward-looking statements. Except as required

by federal securities law, Blink Charging undertakes no obligation

to update or revise forward-looking statements to reflect changed

conditions.

Blink Investor Relations

Contact Vitalie

Stelea IR@BlinkCharging.com (480)

805.8594

Blink Media Contact Jon

Myers PR@BlinkCharging.com (786) 706-6709

BLINK CHARGING CO.

Condensed Consolidated Statements of

Operations(in thousands, except for share and per

share amounts)(unaudited)

|

|

|

For The Three Months Ended |

|

|

For The Nine Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales |

|

$ |

35,059 |

|

|

$ |

13,358 |

|

|

$ |

76,035 |

|

|

$ |

30,238 |

|

|

Charging service revenue - company-owned charging stations |

|

|

3,859 |

|

|

|

1,256 |

|

|

|

11,111 |

|

|

|

3,857 |

|

|

Network fees |

|

|

1,973 |

|

|

|

1,456 |

|

|

|

5,268 |

|

|

|

2,089 |

|

|

Warranty |

|

|

849 |

|

|

|

309 |

|

|

|

2,163 |

|

|

|

475 |

|

|

Grant and rebate |

|

|

47 |

|

|

|

83 |

|

|

|

284 |

|

|

|

283 |

|

|

Car-sharing services |

|

|

903 |

|

|

|

367 |

|

|

|

2,112 |

|

|

|

885 |

|

|

Other |

|

|

687 |

|

|

|

418 |

|

|

|

914 |

|

|

|

706 |

|

|

Total Revenues |

|

|

43,377 |

|

|

|

17,247 |

|

|

|

97,887 |

|

|

|

38,533 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

|

24,619 |

|

|

|

8,663 |

|

|

|

49,509 |

|

|

|

21,134 |

|

|

Cost of charging services - company-owned charging stations |

|

|

566 |

|

|

|

235 |

|

|

|

2,196 |

|

|

|

769 |

|

|

Host provider fees |

|

|

2,399 |

|

|

|

973 |

|

|

|

6,285 |

|

|

|

2,345 |

|

|

Network costs |

|

|

407 |

|

|

|

508 |

|

|

|

1,339 |

|

|

|

924 |

|

|

Warranty and repairs and maintenance |

|

|

561 |

|

|

|

803 |

|

|

|

2,924 |

|

|

|

1,437 |

|

|

Car-sharing services |

|

|

931 |

|

|

|

470 |

|

|

|

3,162 |

|

|

|

1,555 |

|

|

Depreciation and amortization |

|

|

1,109 |

|

|

|

814 |

|

|

|

2,853 |

|

|

|

2,045 |

|

|

Total Cost of Revenues |

|

|

30,592 |

|

|

|

12,466 |

|

|

|

68,268 |

|

|

|

30,209 |

|

|

Gross Profit |

|

|

12,785 |

|

|

|

4,781 |

|

|

|

29,619 |

|

|

|

8,324 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation |

|

|

15,268 |

|

|

|

17,605 |

|

|

|

75,967 |

|

|

|

37,643 |

|

|

General and administrative expenses |

|

|

8,539 |

|

|

|

6,594 |

|

|

|

26,466 |

|

|

|

20,023 |

|

|

Other operating expenses |

|

|

5,444 |

|

|

|

5,079 |

|

|

|

14,555 |

|

|

|

12,159 |

|

|

Impairment of intangible assets |

|

|

5,143 |

|

|

|

- |

|

|

|

5,143 |

|

|

|

- |

|

|

Impairment of goodwill |

|

|

89,087 |

|

|

|

- |

|

|

|

89,087 |

|

|

|

- |

|

|

Total Operating Expenses |

|

|

123,481 |

|

|

|

29,278 |

|

|

|

211,218 |

|

|

|

69,825 |

|

|

Loss From Operations |

|

|

(110,696 |

) |

|

|

(24,497 |

) |

|

|

(181,599 |

) |

|

|

(61,501 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income

(Expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(970 |

) |

|

|

(917 |

) |

|

|

(2,373 |

) |

|

|

(1,056 |

) |

|

Gain (loss) on foreign exchange |

|

|

144 |

|

|

|

(595 |

) |

|

|

925 |

|

|

|

(836 |

) |

|

Loss on extinguishment of notes payable |

|

|

(1,000 |

) |

|

|

- |

|

|

|

(1,000 |

) |

|

|

- |

|

|

Change in fair value of derivative and other accrued

liabilities |

|

|

- |

|

|

|

108 |

|

|

|

10 |

|

|

|

35 |

|

|

Other income (expense), net |

|

|

608 |

|

|

|

254 |

|

|

|

1,258 |

|

|

|

(53 |

) |

|

Total Other Expense |

|

|

(1,218 |

) |

|

|

(1,150 |

) |

|

|

(1,180 |

) |

|

|

(1,910 |

) |

|

Loss Before Income Taxes |

|

$ |

(111,914 |

) |

|

$ |

(25,647 |

) |

|

$ |

(182,779 |

) |

|

$ |

(63,411 |

) |

|

Provision for income taxes |

|

|

(807 |

) |

|

|

- |

|

|

|

(1,225 |

) |

|

|

- |

|

|

Net Loss |

|

$ |

(112,721 |

) |

|

$ |

(25,647 |

) |

|

$ |

(184,004 |

) |

|

$ |

(63,411 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.74 |

) |

|

$ |

(0.51 |

) |

|

$ |

(3.02 |

) |

|

$ |

(1.39 |

) |

|

Diluted |

|

$ |

(1.74 |

) |

|

$ |

(0.51 |

) |

|

$ |

(3.02 |

) |

|

$ |

(1.39 |

) |

|

Weighted Average Number of Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

64,626,681 |

|

|

|

50,627,173 |

|

|

|

61,006,242 |

|

|

|

45,543,518 |

|

|

Diluted |

|

|

64,626,681 |

|

|

|

50,627,173 |

|

|

|

61,006,242 |

|

|

|

45,543,518 |

|

BLINK CHARGING CO.

Condensed Consolidated Balance

Sheets(in thousands, except for share

amounts)

|

|

|

September 30, |

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

66,678 |

|

|

$ |

36,562 |

|

|

Accounts receivable, net |

|

|

41,718 |

|

|

|

23,581 |

|

|

Inventory, net |

|

|

47,386 |

|

|

|

34,740 |

|

|

Prepaid expenses and other current assets |

|

|

5,059 |

|

|

|

4,399 |

|

|

Total Current Assets |

|

|

160,841 |

|

|

|

99,282 |

|

| Restricted cash |

|

|

74 |

|

|

|

71 |

|

| Property and equipment,

net |

|

|

34,002 |

|

|

|

25,862 |

|

| Operating lease right-of-use

asset |

|

|

7,867 |

|

|

|

4,174 |

|

| Intangible assets, net |

|

|

17,277 |

|

|

|

26,582 |

|

| Goodwill |

|

|

144,881 |

|

|

|

203,710 |

|

| Other assets |

|

|

654 |

|

|

|

2,861 |

|

|

Total Assets |

|

$ |

365,596 |

|

|

$ |

362,542 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

30,118 |

|

|

$ |

24,585 |

|

|

Accrued expenses and other current liabilities |

|

|

15,450 |

|

|

|

13,109 |

|

|

Notes payable |

|

|

4,795 |

|

|

|

10 |

|

|

Current portion of operating lease liabilities |

|

|

2,555 |

|

|

|

1,738 |

|

|

Current portion of financing lease liabilities |

|

|

1,235 |

|

|

|

306 |

|

|

Current portion of deferred revenue |

|

|

12,233 |

|

|

|

10,572 |

|

|

Total Current Liabilities |

|

|

66,386 |

|

|

|

50,320 |

|

| Contingent consideration |

|

|

1,345 |

|

|

|

1,316 |

|

| Consideration payable |

|

|

60,762 |

|

|

|

40,608 |

|

| Operating lease liabilities,

non-current portion |

|

|

6,277 |

|

|

|

3,030 |

|

| Financing lease liabilities,

non-current portion |

|

|

1,109 |

|

|

|

408 |

|

| Deferred revenue, non-current

portion |

|

|

9,702 |

|

|

|

5,258 |

|

| Other liabilities |

|

|

350 |

|

|

|

645 |

|

|

Total Liabilities |

|

|

145,931 |

|

|

|

101,585 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and contingencies

(Note 9) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 500,000,000 shares authorized,

67,077,698 and 51,476,445 shares issued and outstanding as of

September 30, 2023 and December 31, 2022, respectively |

|

|

67 |

|

|

|

51 |

|

|

Additional paid-in capital |

|

|

742,061 |

|

|

|

597,982 |

|

|

Accumulated other comprehensive loss |

|

|

(4,429 |

) |

|

|

(3,046 |

) |

|

Accumulated deficit |

|

|

(518,034 |

) |

|

|

(334,030 |

) |

|

Total Stockholders’ Equity |

|

|

219,665 |

|

|

|

260,957 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

365,596 |

|

|

$ |

362,542 |

|

BLINK CHARGING CO. AND

SUBSIDIARIES

Consolidated Statements of Cash

Flows(In

thousands)(unaudited)

|

|

|

For The Nine Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

| Cash Flows From

Operating Activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(184,004 |

) |

|

$ |

(63,411 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

9,694 |

|

|

|

5,175 |

|

|

Non-cash lease expense |

|

|

1,695 |

|

|

|

596 |

|

|

Change in fair value of contingent consideration |

|

|

28 |

|

|

|

- |

|

|

Gain on disposal of fixed assets |

|

|

(99 |

) |

|

|

- |

|

|

Change in fair value of derivative and other accrued

liabilities |

|

|

10 |

|

|

|

1,128 |

|

|

Provision for bad debt |

|

|

1,776 |

|

|

|

1,024 |

|

|

Provision for slow moving and obsolete inventory |

|

|

376 |

|

|

|

(14 |

) |

|

Loss on extinguishment of notes payable |

|

|

1,000 |

|

|

|

- |

|

|

Impairment of goodwill |

|

|

89,087 |

|

|

|

- |

|

|

Impairment of intangible assets |

|

|

5,143 |

|

|

|

- |

|

|

Stock-based compensation: |

|

|

|

|

|

|

|

|

|

Common stock |

|

|

11,486 |

|

|

|

4,986 |

|

|

Options |

|

|

3,975 |

|

|

|

2,835 |

|

|

Warrants |

|

|

5,082 |

|

|

|

- |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable and other receivables |

|

|

(19,655 |

) |

|

|

(7,289 |

) |

|

Inventory |

|

|

(14,844 |

) |

|

|

(15,790 |

) |

|

Prepaid expenses and other current assets |

|

|

(631 |

) |

|

|

3,372 |

|

|

Other assets |

|

|

947 |

|

|

|

(391 |

) |

|

Accounts payable and accrued expenses |

|

|

9,101 |

|

|

|

6,811 |

|

|

Other liabilities |

|

|

(295 |

) |

|

|

54 |

|

|

Lease liabilities |

|

|

(3,014 |

) |

|

|

(412 |

) |

|

Deferred revenue |

|

|

5,980 |

|

|

|

3,550 |

|

| |

|

|

|

|

|

|

|

|

|

Total Adjustments |

|

|

106,842 |

|

|

|

5,635 |

|

| |

|

|

|

|

|

|

|

|

|

Net Cash Used In Operating Activities |

|

|

(77,162 |

) |

|

|

(57,776 |

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows From

Investing Activities: |

|

|

|

|

|

|

|

|

|

Purchase consideration of Envoy, net of cash acquired |

|

|

(4,660 |

) |

|

|

- |

|

|

Purchase consideration of SemaConnect, net of cash acquired |

|

|

- |

|

|

|

(38,338 |

) |

|

Purchase consideration of Electric Blue, net of cash acquired |

|

|

- |

|

|

|

(11,360 |

) |

|

Note receivable |

|

|

- |

|

|

|

(1,500 |

) |

|

Capitalization of engineering costs |

|

|

(526 |

) |

|

|

(797 |

) |

|

Purchases of property and equipment |

|

|

(7,265 |

) |

|

|

(2,230 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Cash Used In Investing Activities |

|

|

(12,451 |

) |

|

|

(54,225 |

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows From

Financing Activities: |

|

|

|

|

|

|

|

|

|

Proceeds from sale of common stock in public offering, net [1] |

|

|

122,379 |

|

|

|

- |

|

|

Proceeds from exercise of options and warrants |

|

|

835 |

|

|

|

201 |

|

|

Repayment of notes payable |

|

|

- |

|

|

|

(588 |

) |

|

Repayment of financing liability in connection with finance

lease |

|

|

(2,103 |

) |

|

|

(144 |

) |

|

Repayment of financing liability in connection with internal use

software |

|

|

(220 |

) |

|

|

(235 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Cash Provided By (Used In) Financing

Activities |

|

|

120,891 |

|

|

|

(766 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of Exchange Rate Changes on Cash and Cash

Equivalents |

|

|

(1,159 |

) |

|

|

(5,193 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Increase (Decrease) In Cash and Cash Equivalents and

Restricted Cash |

|

|

30,119 |

|

|

|

(117,960 |

) |

| |

|

|

|

|

|

|

|

|

| Cash and Cash

Equivalents and Restricted Cash - Beginning of Period |

|

|

36,633 |

|

|

|

175,049 |

|

| |

|

|

|

|

|

|

|

|

| Cash and Cash

Equivalents and Restricted Cash - End of Period |

|

$ |

66,752 |

|

|

$ |

57,089 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash equivalents and

restricted cash consisted of the following: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

66,678 |

|

|

$ |

57,019 |

|

|

Restricted cash |

|

|

74 |

|

|

|

70 |

|

|

|

|

$ |

66,752 |

|

|

$ |

57,089 |

|

|

[1] |

|

Includes gross proceeds of $128,260, less issuance costs of

$5,881. |

Non-GAAP Financial Measures

The following table reconciles Net Loss attributable to Blink

Charging Co. to EBITDA and Adjusted EBITDA for the periods

shown:

| |

|

|

|

|

For The Three Months Ended |

|

For The Nine Months Ended |

|

|

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

|

|

$ |

(112,721 |

) |

|

$ |

(25,647 |

) |

|

$ |

(184,004 |

) |

|

$ |

(63,411 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

| |

Interest

Expense |

|

|

970 |

|

|

|

917 |

|

|

|

2,373 |

|

|

|

1,056 |

|

| |

Provision for

Income Taxes |

|

807 |

|

|

|

- |

|

|

|

1,225 |

|

|

|

- |

|

| |

Depreciation and

amortization |

|

2,869 |

|

|

|

1,782 |

|

|

|

9,694 |

|

|

|

5,175 |

|

|

EBITDA |

|

|

|

|

(108,075 |

) |

|

|

(22,948 |

) |

|

|

(170,712 |

) |

|

|

(57,180 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

| |

Stock-based

compensation |

|

1,105 |

|

|

|

4,832 |

|

|

|

20,543 |

|

|

|

7,821 |

|

| |

Acquisition-related costs |

|

50 |

|

|

|

509 |

|

|

|

333 |

|

|

|

3,783 |

|

| |

Impairment of

goodwill and intangible assets |

|

94,230 |

|

|

|

- |

|

|

|

94,230 |

|

|

|

- |

|

| |

Loss on

extinguishment of notes payable |

|

1,000 |

|

|

|

- |

|

|

|

1,000 |

|

|

|

- |

|

| |

One-time

non-recurring expense |

|

- |

|

|

|

- |

|

|

|

11,632 |

|

|

|

- |

|

| Adjusted

EBITDA |

|

|

$ |

(11,690 |

) |

|

$ |

(17,607 |

) |

|

$ |

(42,974 |

) |

|

$ |

(45,576 |

) |

The following table reconciles EPS attributable to Blink

Charging Co. to Adjusted EPS for the periods shown:

| |

|

|

|

|

For The Three Months Ended |

|

For The Nine Months Ended |

|

|

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income - per

diluted share |

$ |

(1.74 |

) |

|

$ |

(0.51 |

) |

|

$ |

(3.02 |

) |

|

$ |

(1.39 |

) |

| Per diluted share

adjustments: |

|

|

|

|

|

|

|

| Add: |

Amortization

expense of intangible assets |

|

0.02 |

|

|

|

0.03 |

|

|

$ |

0.10 |

|

|

|

0.08 |

|

| |

Acquisition-related costs |

|

0.00 |

|

|

|

0.01 |

|

|

$ |

0.01 |

|

|

|

0.08 |

|

| |

Impairment of

goodwill and intangible assets |

|

1.54 |

|

|

|

- |

|

|

$ |

1.54 |

|

|

|

- |

|

| |

Loss on

extinguishment of notes payable |

|

0.02 |

|

|

|

- |

|

|

$ |

0.02 |

|

|

|

- |

|

| |

One-time

non-recurring expense |

|

0.00 |

|

|

|

- |

|

|

$ |

0.20 |

|

|

|

- |

|

| Adjusted EPS |

|

|

$ |

(0.16 |

) |

|

$ |

(0.47 |

) |

|

$ |

(1.15 |

) |

|

$ |

(1.23 |

) |

Blink Charging Co. publicly reports its

financial information in accordance with accounting principles

generally accepted in the United States of America (“US GAAP”). To

facilitate external analysis of the Company’s operating

performance, Blink Charging also presents financial information

that is considered “non-GAAP financial measures” under Regulation G

and related reporting requirements promulgated by the U.S.

Securities and Exchange Commission. Non-GAAP measures should be

considered in addition to, and not as a substitute for, or superior

to, Net Income (Loss) or other measures of financial performance

prepared in accordance with GAAP and may be different than those

presented by other companies, including Blink Charging’s

competitors. EBITDA and Adjusted EBITDA are not performance

measures calculated in accordance with GAAP and are therefore

considered non-GAAP measures. Reconciliation tables are presented

above.

EBITDA is defined as earnings (loss)

attributable to Blink Charging Co. before interest income

(expense), provision for income taxes, depreciation and

amortization. Blink Charging believes EBITDA is useful to its

management, securities analysts, and investors in evaluating

operating performance because it is one of the primary measures

used to evaluate the economic productivity of the Company’s

operations, including its ability to obtain and maintain its

customers, its ability to operate its business effectively, the

efficiency of its employees and the profitability associated with

their performance. It also helps Blink Charging’s management,

securities analysts, and investors to meaningfully evaluate and

compare the results of the Company’s operations from period to

period on a consistent basis by removing the impact of its merger

and acquisition expenses, financing transactions, and the

depreciation and amortization impact of capital investments from

its operating results.

The Company also believes that Adjusted EBITDA,

defined as EBITDA adjusted for stock-based compensation expense,

acquisition related costs, and one-time non-recurring expenses,

non-cash impairment charges, and non-cash loss on extinguishment of

notes payable is useful to securities analysts and investors to

evaluate the Company’s core operating results and financial

performance because it excludes items that are significant non-cash

or non-recurring expenses reflected in the Condensed Consolidated

Statements of Operations.

Our definition of Adjusted EBITDA and Adjusted

EPS may differ from other companies reporting similarly named

measures. These measures should be considered in addition to, and

not as a substitute for, or superior to, other measures of

financial performance prepared in accordance with GAAP, such as Net

Loss, and Diluted Earnings per Share.

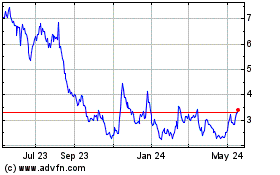

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Dec 2024 to Jan 2025

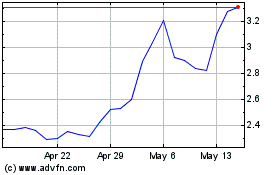

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Jan 2024 to Jan 2025