UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

BioSig

Technologies, Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

|

No

fee required. |

| |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

| ☐ |

|

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

|

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

55

Greens Farms Road, 1st Floor

Westport,

Connecticut 06880

(203)

409-5444

,

2023

Dear

Stockholder:

You

are cordially invited to attend a special meeting of stockholders of BioSig Technologies, Inc. (the “Special Meeting”) to

be held at 10:00 a.m., Eastern Time, on December 27, 2023, at our headquarters located at 55 Greens Farms Road, 1st Floor, Westport,

Connecticut 06880.

To

facilitate an orderly meeting, we strongly encourage you to advise Lora Mikolaitis by email at info@biosigtech.com or phone at (203)

409-5444 ext. 117 if you plan to attend the meeting prior to 5:00 p.m., Eastern Time, on December 26, 2023, and to arrive at the meeting

no later than 9:30 a.m., Eastern Time.

We

are delivering to our stockholders a copy of the notice of Special Meeting of stockholders, the proxy statement, and the proxy card (collectively,

the “Proxy Materials”) beginning on or about , 2023.

Your

vote is very important, regardless of the number of shares of our voting securities that you own. Whether or not you expect to be present

at the Special Meeting, after receiving the Proxy Materials please vote as promptly as possible to ensure your representation and the

presence of a quorum at the Special Meeting. As an alternative to voting in person at the Special Meeting, you may vote via the Internet,

by telephone, or by signing, dating and returning the enclosed proxy card. If your shares are held in the name of a broker, trust, bank

or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the

materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in

order to obtain a proxy issued to you by your nominee holder to attend the meeting and vote in person. Failure to do so may result in

your shares not being eligible to be voted by proxy at the meeting.

On

behalf of the Board of Directors, I urge you to submit your vote as soon as possible, even if you currently plan to attend the meeting

in person.

Thank

you for your support of our company. I look forward to seeing you at the Special Meeting.

| Sincerely, |

|

| |

|

| |

|

| Kenneth L. Londoner |

|

| Chairman and Chief Executive Officer |

|

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE

STOCKHOLDER MEETING TO BE HELD ON DECEMBER 27, 2023:

Our

Official Notice of Special Meeting of Stockholders, Proxy Statement and Form of Proxy Card

are

available at:

www.proxyvote.com

BIOSIG

TECHNOLOGIES, INC.

55

Greens Farms Road, 1st Floor

Westport,

Connecticut 06880

(203)

409-5444

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

Be Held December 27, 2023

A

special meeting of stockholders (the “Special Meeting”) of BioSig Technologies, Inc., a Delaware corporation (the “Company”),

will be held on December 27, 2023, at 10:00 a.m. Eastern Time, at our headquarters at 55 Greens Farms Road, 1st Floor, Westport, Connecticut.

We will consider and act on the following items of business at the Special Meeting:

| |

(1) |

A

proposal to authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock, par

value $0.001 per share (the “Common Stock”) underlying certain warrants issued by us pursuant to the terms of (i) that

certain Securities Purchase Agreement, dated November 8, 2023, by and between the Company and an institutional investor and (ii)

that certain Engagement Agreement, dated October 31, 2023, by and between the Company and H.C. Wainwright & Co., LLC, in an amount

equal to or in excess of 20% of our Common Stock outstanding immediately prior to the issuance of such warrants (the “Issuance

Proposal”); and |

| |

(2) |

Such

other business as may arise and that may properly be conducted at the Special Meeting or any adjournment or postponement thereof. |

Stockholders

are referred to the proxy statement accompanying this notice (the “Proxy Statement”) for more detailed information with respect

to the matters to be considered at the Special Meeting. After careful consideration, the Board of Directors (the “Board”)

recommends a vote “FOR” the Issuance Proposal.

The

Board has fixed the close of business on November 3, 2023, as the record date (the “Record Date”) for the Special Meeting.

Only holders of record of shares of our Common Stock and Series C Preferred Stock on the Record Date are entitled to receive notice of

the Special Meeting and to vote at the Special Meeting or at any postponement(s) or adjournment(s) of the Special Meeting. A complete

list of registered stockholders entitled to vote at the Special Meeting will be available for inspection at the office of the Company

during regular business hours for the ten (10) calendar days prior to the Special Meeting.

To

facilitate an orderly meeting, we strongly encourage you to advise Lora Mikolaitis by email at info@biosigtech.com or phone at (203)

409-5444 ext. 117 if you plan to attend the meeting prior to 5:00 p.m., Eastern Time, on December 26, 2023, and to arrive at the meeting

no later than 9:30 a.m., Eastern Time.

YOUR

VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

If

your shares are registered in your name, even if you plan to attend the Special Meeting or any postponement or adjournment of the

Special Meeting in person, we request that you vote by telephone, over the Internet, or complete, date, sign and mail the enclosed proxy

card in accordance with the instructions set out in the proxy card and in the Proxy Statement to ensure that your shares will be represented

at the Special Meeting.

If

your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or

through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker

or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the Special

Meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the Special Meeting.

| By Order of the Board, |

|

| |

|

| |

|

| Kenneth L. Londoner |

|

| Chairman and Chief Executive Officer |

|

| |

|

| ,

2023 |

|

TABLE

OF CONTENTS

BIOSIG

TECHNOLOGIES, INC.

55

Greens Farms Road, 1st Floor

Westport,

Connecticut 06880

(203)

409-5444

PROXY

STATEMENT

FOR

SPECIAL

MEETING OF STOCKHOLDERS

To

Be Held December 27, 2023

Unless

the context otherwise requires, references in this proxy statement (the “Proxy Statement”) to “we,” “us,”

“our,” “the Company,” or “BioSig” refer to BioSig Technologies, Inc., a Delaware corporation, and

its consolidated subsidiaries as a whole. In addition, unless the context otherwise requires, references to “stockholders”

are to the holders of our voting securities, which consist of our common stock, par value $0.001 per share (the “Common Stock”),

and our Series C Convertible Preferred Stock (the “Series C Preferred Stock”) entitled to vote at the special meeting of

stockholders of the Company (the “Special Meeting”).

The

accompanying proxy is solicited by the Board of Directors (the “Board”) on behalf of BioSig to be voted at the Special Meeting

to be held on December 27, 2023, at the time and place and for the purposes set forth in the accompanying Notice of Special Meeting of

Stockholders (the “Notice”) and at any adjournment(s) or postponement(s) of the Special Meeting. This Proxy Statement and

accompanying proxy card are dated , 2023 and are expected to be first sent or given to stockholders on or about , 2023.

The

executive offices of the Company are located at, and the mailing address of the Company is 55 Greens Farms Road, 1st Floor, Westport,

Connecticut 06880.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR

THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 27, 2023:

Our

Official Notice of Special Meeting of Stockholders, Proxy Statement and Form of Proxy Card

are

available at:

www.proxyvote.com

ABOUT

THE SPECIAL MEETING

What

is a proxy?

A

proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document,

that document is also called a “proxy” or a “proxy card.” If you are a “street name” holder, you

must obtain a proxy from your broker or nominee in order to vote your shares in person at the Special Meeting.

What

is a proxy statement?

A

proxy statement is a document that regulations of the U.S. Securities and Exchange Commission (the “SEC”) require that we

give to you when we ask you to sign a proxy card to vote your stock at the Special Meeting.

What

is the purpose of the Special Meeting?

At

our Special Meeting, stockholders will act upon the matters outlined in the Notice, which include the following:

| |

(1) |

A

proposal to authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our Common Stock underlying

certain warrants issued by us pursuant to the terms of (i) that certain Securities Purchase Agreement, dated November 8, 2023 (the

“Securities Purchase Agreement), by and between the Company and an institutional investor (the “Investor”) and

(ii) that certain Engagement Agreement, dated October 31, 2023 (the “Engagement Agreement”), by and between the Company

and H.C. Wainwright & Co., LLC (the “Placement Agent”), in an amount equal to or in excess of 20% of our Common Stock

outstanding immediately prior to the issuance of such warrants (the “Issuance Proposal”); and |

| |

|

|

| |

(2) |

Such

other business as may arise and that may properly be conducted at the Special Meeting or any adjournment or postponement thereof. |

What

is “householding” and how does it affect me?

With

respect to eligible stockholders who share a single address, we may send only one set of proxy materials to that address unless we receive

instructions to the contrary from any stockholder at that address. This practice, known as “householding,” is designed to

reduce our printing and postage costs. However, if a stockholder of record residing at such address wishes to receive a separate set

of proxy materials in the future, he or she may contact BioSig Technologies, Inc. at 55 Greens Farms Road, 1st Floor, Westport, Connecticut

06880, Attn: Lora Mikolaitis or call (203) 409-5444 ext. 117. Eligible stockholders of record receiving multiple copies of our Proxy

Statement can request householding by contacting us in the same manner. Stockholders who own shares through a bank, broker or other nominee

can request householding by contacting the nominee.

We

hereby undertake to deliver promptly, upon written or oral request, a copy of the proxy materials to a stockholder at a shared address

to which a single copy of the document was delivered. Requests should be directed to Lora Mikolaitis at the address or phone number set

forth above.

SEC

rules permit companies to send you a notice that proxy information is available on the Internet, instead of mailing you a complete set

of materials. In the future, the Company may choose to distribute proxy information in this manner.

What

should I do if I receive more than one set of voting materials?

You

may receive more than one set of voting materials, including multiple copies of this Proxy Statement and multiple proxy cards or voting

instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction

card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage

account, you will receive a set of proxy materials for shares held in your name and a voting instruction card for shares held in “street

name.” Please follow the separate voting instructions that you received for your shares of Common Stock held in each of your different

accounts to ensure that all of your shares are voted.

What

is the record date and what does it mean?

The

record date to determine the stockholders entitled to notice of and to vote at the Special Meeting is the close of business on November

3, 2023 (the “Record Date”). The Record Date is established by the Board as required by Delaware law. On the Record Date,

81,110,643 shares of Common Stock were issued and outstanding. On the Record Date, 105 shares of Series C Preferred Stock were issued

and outstanding, and after application of the beneficial ownership limitation pursuant to the terms of the Series C Preferred Stock as

set forth in the certificate of designation for the Series C Preferred Stock, certain holders of Series C Preferred Stock are entitled

to an aggregate of 653,778 votes on the proposals described in this Proxy Statement. See “What are the voting rights of the stockholders?”

below.

Who

is entitled to vote at the Special Meeting?

Holders

of Common Stock and the Series C Preferred Stock at the close of business on the Record Date may vote at the Special Meeting.

What

are the voting rights of the stockholders?

The

Company has two outstanding classes of voting stock entitled to vote at the Special Meeting, Common Stock and Series C Preferred Stock.

Each holder of Common Stock is entitled to one vote per share of Common Stock on all matters to be acted upon at the Special Meeting.

Each holder of Series C Preferred Stock is entitled to the number of votes equal to the number of whole shares of Common Stock into which

the shares of Series C Preferred Stock held by such holder are then convertible (subject to the 4.99% beneficial ownership limitations)

with respect to any and all matters presented to the stockholders for their action or consideration. Holders of the Series C Preferred

Stock vote together with the holders of Common Stock as a single class, except as provided by law and except as set forth in the respective

certificates of designation for the Series C Preferred Stock. Holders of our Common Stock and Series C Preferred Stock will vote together

as a single class on all matters described in this Proxy Statement.

The

holders of one-third of the voting power of the stock issued, outstanding and entitled to vote, present in person or represented by proxy,

constitutes a quorum for the transaction of business at the Special Meeting. If a quorum is not present or represented at the Special

Meeting, then either (i) the chairperson of the meeting or (ii) the stockholders entitled to vote at the Special Meeting, present in

person or represented by proxy, may adjourn the meeting from time to time, without notice other than announcement at the Special Meeting,

until a quorum is present or represented.

What

is the difference between a stockholder of record and a “street name” holder?

If

your shares are registered directly in your name with Securities Transfer Corporation, the Company’s stock transfer agent, you

are considered the stockholder of record with respect to those shares. The Proxy Materials have been sent directly to you by the Company.

If

your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those

shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” A notice or Proxy

Statement and voting instruction card have been forwarded to you by your nominee. As the beneficial owner, you have the right to direct

your nominee concerning how to vote your shares by using the voting instructions the nominee included in the mailing or by following

such nominee’s instructions for voting.

What

is a broker non-vote?

Broker

non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred

to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received

voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the

broker chooses not to vote on a matter for which it has discretionary voting authority. Under the rules of the New York Stock Exchange

(the “NYSE”) that govern how brokers may vote shares for which they have not received voting instructions from the beneficial

owner, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions

have not been timely received from a beneficial owner. The Issuance Proposal is not considered a “routine matter.” In the

absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to the

Issuance Proposal.

How

do I vote my shares?

If

you are a record holder, you may vote your shares at the Special Meeting in person or by proxy. To vote in person, you must attend the

Special Meeting and obtain and submit a ballot. The ballot will be provided at the Special Meeting. To vote by proxy, you may choose

one of the following methods to vote your shares:

| |

● |

Via

Internet: as prompted by the menu found at www.proxyvote.com, follow the instructions to obtain your records and submit an electronic

ballot. Please have your Stockholder Control Number, which can be found on your proxy card, when you access this voting site. You

may vote via the Internet until 11:59 p.m., Eastern Time, on December 26, 2023. |

| |

|

|

| |

● |

Via

telephone: call 1-800-690-6903 and then follow the voice instructions. Please have your Stockholder Control Number, which can

be found on your proxy card, when you call. You may vote by telephone until 11:59 p.m., Eastern Time, on December 26, 2023. |

| |

|

|

| |

● |

Via

mail: if you would like to vote by mail, complete and sign the accompanying proxy card and return it in the postage-paid envelope

provided. If you submit a signed proxy without indicating your vote, the person voting the proxy will vote your shares according

to the Board’s recommendation. |

The

proxy is fairly simple to complete, with specific instructions on the electronic ballot, telephone or card. By completing and submitting

it, you will direct the designated persons (known as “proxies”) to vote your stock at the Special Meeting in accordance with

your instructions. The Board has appointed Kenneth L. Londoner and Steve Chaussy to serve as the proxies for the Special Meeting.

Your

proxy will be valid only if you complete and return it before the Special Meeting. If you properly complete and transmit your proxy but

do not provide voting instructions with respect to a proposal, then the designated proxies will vote your shares “FOR”

each proposal as to which you provide no voting instructions in accordance with the Board’s recommendation in the manner described

under “What if I do not specify how I want my shares voted?” below. We do not anticipate that any other matters will come

before the Special Meeting, but if any other matters properly come before the meeting, then the designated proxies will vote your shares

in accordance with applicable law and their judgment.

If

you hold your shares in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions

along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how

to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then

your nominee may be unable to vote your shares with respect to the proposal as to which you provided no voting instructions. See “What

is a broker non-vote?” Alternatively, if you want to vote your shares in person at the Special Meeting, you must contact your nominee

directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a stockholder

is not the same as a nominee-issued proxy. If you fail to bring a nominee-issued proxy to the Special Meeting, you will not be able

to vote your nominee-held shares in person at the Special Meeting.

Who

counts the votes?

All

votes will be tabulated by Lora Mikolaitis, the inspector of election appointed for the Special Meeting. Each proposal will be tabulated

separately.

Can

I vote my shares in person at the Special Meeting?

Yes.

If you are a stockholder of record, you may vote your shares at the meeting by completing a ballot at the Special Meeting.

If

you hold your shares in “street name,” you may vote your shares in person only if you obtain a proxy issued by your bank,

broker or other nominee giving you the right to vote the shares.

Even

if you currently plan to attend the Special Meeting, we recommend that you also return your proxy or voting instructions as described

above so that your votes will be counted if you later decide not to attend the Special Meeting or are unable to attend.

What

are my choices when voting?

With

respect to the Issuance Proposal, stockholders may vote for the proposal, vote against the proposal, or abstain from voting on the proposal.

What

are the Board’s recommendations on how I should vote my shares?

The

Board recommends that you vote FOR the Issuance Proposal.

What

if I do not specify how I want my shares voted?

If

you are a record holder who returns a completed proxy that does not specify how you want to vote your shares on one or more proposals,

the proxies will vote your shares for each proposal as to which you provide no voting instructions, and such shares will be voted FOR

the Issuance Proposal.

If

you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker or other

nominee may be unable to vote those shares. See “What is a broker non-vote?” above.

Can

I change my vote?

Yes.

If you are a record holder, you may revoke your proxy at any time by any of the following means:

| |

● |

Attending

the Special Meeting and voting in person. Your attendance at the Special Meeting will not by itself revoke a proxy. You must vote

your shares by ballot at the Special Meeting to revoke your proxy. |

| |

|

|

| |

● |

Completing

and submitting a new valid proxy bearing a later date. |

| |

|

|

| |

● |

Giving

written notice of revocation to the Company addressed to Lora Mikolaitis, VP, Administration, at the Company’s address above,

which notice must be received before 5:00 p.m., Eastern Time, on December 25, 2023. |

If

you are a “street name” holder, your bank, broker or other nominee should provide instructions explaining how you may change

or revoke your voting instructions.

What

votes are required to approve each proposal?

Assuming

the presence of a quorum, the approval of the Issuance Proposal will require a majority of the total votes cast on such proposal at the

Special Meeting.

How

are abstentions and broker non-votes treated?

Any

stockholder who is present at the Special Meeting, either in person or by proxy, who abstains from voting on the Issuance Proposal will

still be counted for purposes of determining whether a quorum exists for the Special Meeting. Abstentions will have no effect on the

outcome of the vote with respect to the Issuance Proposal.

Because

the Issuance Proposal is not considered a routine matter, if you hold your shares in “street name” and you do not instruct

your bank, broker or other nominee how to vote, your broker will be unable to vote your shares on the Issuance Proposal, and your shares

will not be included in the determination of the number of shares present at the Special Meeting for determining a quorum and will have

no effect on the outcome of the vote with respect to the Issuance Proposal.

Do

I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Special Meeting?

No.

None of our stockholders has any dissenters’ or appraisal rights with respect to the matters to be voted on at the Special Meeting.

What

are the solicitation expenses and who pays the cost of this proxy solicitation?

Our

Board is asking for your proxy and we will pay all of the costs of asking for stockholder proxies. We will reimburse brokerage houses

and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the

beneficial owners of Common Stock and collecting voting instructions. We may use officers and employees of the Company to ask for proxies,

as described below.

Is

this Proxy Statement the only way that proxies are being solicited?

No.

In addition to the solicitation of proxies by use of the mail, officers and employees of the Company may solicit the return of proxies,

either by mail, telephone, telecopy, e-mail or through personal contact. These officers and employees will not receive additional compensation

for their efforts but will be reimbursed for out-of-pocket expenses. Brokerage houses and other custodians, nominees and fiduciaries,

in connection with shares of the Common Stock registered in their names, will be requested to forward solicitation material to the beneficial

owners of shares of Common Stock.

Are

there any other matters to be acted upon at the Special Meeting?

Management

does not intend to present any business at the Special Meeting for a vote other than the matters set forth in the Proxy Materials and

has no information that others will do so. If other matters requiring a vote of the stockholders properly come before the Special Meeting,

it is the intention of the persons named in the form of proxy to vote the shares represented by the proxies held by them in accordance

with applicable law and their judgment on such matters.

Where

can I find voting results?

We

expect to publish the voting results in a current report on Form 8-K, which we expect to file with the SEC within four business days

after the Special Meeting.

Who

can help answer my questions?

The

information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the

information contained in this Proxy Statement. We urge you to carefully read this entire Proxy Statement, including the documents we

refer to in this Proxy Statement. If you have any questions, or need additional materials, please feel free to contact Lora Mikolaitis,

our VP, Administration, at (203) 409-5444 ext. 117.

PROPOSAL

1: THE ISSUANCE PROPOSAL

Background

and Description of the Issuance Proposal

The

Registered Direct Offering

On

November 8, 2023, we entered into the Securities Purchase Agreement with the Investor”), pursuant to which we agreed to sell and

issue, in a registered direct offering (the “Offering”), (i) 6,996,922 shares (the “Shares”) of Common Stock,

(ii) Series A warrants (the “Series A Warrants”) to purchase up to 6,996,922 shares of Common Stock (the “Series A

Warrant Shares”), and (iii) Series B warrants (the “Series B Warrants”, and together with the Series A Warrants, the

“Series Warrants”) to purchase up to 6,996,922 shares of Common Stock (the “Series B Warrant Shares”, and together

with the Series A Warrant Shares, the “Series Warrant Shares”), at a purchase price of $0.3573 per Share and associated Series

Warrants. The Shares and the Series Warrants (and shares issuable upon exercise of the Series Warrants) were offered and sold pursuant

to a shelf registration statement on Form S-3 (File No. 333-251859), previously filed with the SEC on December 31, 2020, and declared

effective by the SEC on January 12, 2021, and the base prospectus included therein, and a final prospectus supplement relating to the

Offering, dated November 8, 2023, and the accompanying prospectus, has been filed with the SEC. The Offering closed on November 13, 2023,

and we received total gross proceeds of approximately $2.5 million from the Offering. In connection with the Offering, we entered into

the Engagement Agreement with the Placement Agent to act as the exclusive placement agent for the Offering. Pursuant to the Engagement

Agreement, we agreed to issue the Placement Agent or its designees, warrants (the “Placement Agent Warrants”, and together

with Series Warrants, the “Warrants”) to purchase up to 489,785 shares of Common Stock (the “Placement Agent Warrant

Shares”, and together with the Series Warrant Shares, the “Warrant Shares”).

The

issuance of the Shares, the Series Warrant Shares and the Placement Agent Warrant Shares would constitute greater than 20% of the shares

of Common Stock outstanding immediately prior to the execution of the Securities Purchase Agreement. Nasdaq Listing Rule 5635 of the

Rules of the Nasdaq Stock Market (“Nasdaq”) requires that a listed company seek stockholder approval in certain circumstances,

including prior to the issuance, in a transaction other than a public offering under the Nasdaq rules, of 20% or more of the company’s

outstanding Common Stock or voting power outstanding before the issuance at a price that is less than the lower of (i) the Nasdaq Official

Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the binding agreement in connection with such transaction,

or (ii) the average Nasdaq Official Closing Price of the Common Stock (as reflected on Nasdaq.com) for the five trading days immediately

preceding the signing of such binding agreement (the “Minimum Price”).

The

Offering in a transaction other than a public offering under the Nasdaq rules and was priced at-the-market under Nasdaq rules, with the

Warrants only becoming exercisable upon obtaining stockholder approval as may be required by the applicable rules and regulations of

Nasdaq with respect to issuance of all of the Series Warrants and the Series Warrant Shares upon the exercise thereof. Pursuant to the

Securities Purchase Agreement, we agreed to seek approval from our stockholders for the issuance of the Series Warrants and the Series

Warrant Shares. See “– The Securities Purchase Agreement” below.

Reasons

for the Offering

As

of September 30, 2023, our cash on hand totaled approximately $0.4 million. In October 2023, our Board determined that it was necessary

to raise additional funds for working capital and general corporate purposes. We believe that the Offering, which yielded gross proceeds

of approximately $2.5 million, was necessary in light of our cash and funding requirements. In addition, at the time of the Offering,

our Board considered numerous alternatives to the transaction, none of which proved to be feasible or, in the opinion of our Board, would

have resulted in aggregate terms equivalent to, or more favorable than, the terms obtained in the Offering.

The

Securities Purchase Agreement

On

November 8, 2023, we entered into the Securities Purchase Agreement with the Investor, pursuant to which we agreed to sell and issue

(i) 6,996,922 Shares, (ii) Series A Warrants to purchase up to 6,996,922 Series A Warrant Shares, and (iii) Series B Warrants to purchase

up to 6,996,922 Series B Warrant Shares, at a purchase price of $0.3573 per Share and associated Series Warrants.

The

Securities Purchase Agreement contains representations and warranties of us and the Investor, which are typical for transactions of this

type. In addition, the Securities Purchase Agreement contains customary covenants on our part that are typical for transactions of this

type, as well as the following additional covenants: (i) we agreed not to enter into any variable rate transactions for a period of six

(6) months following the closing date of the Offering, subject to certain exceptions, (ii) we agreed not to issue any shares of Common

Stock or Common Stock equivalents or to file any registration statements with the SEC (in each case, subject to certain exceptions) until

forty-five (45) days following the closing date of the Offering, and (iii) we agreed to hold a meeting of our stockholders no later than

ninety (90) days following the closing date of the Offering to solicit our stockholders’ affirmative vote for approval of the issuance

of the Series Warrants and the Series Warrant Shares in accordance with the applicable law and rules and regulations of Nasdaq, and to

call a meeting every 90 days thereafter if stockholder approval is not obtained at the initial meeting, to seek such stockholder approval

until the earlier of the date on which stockholder approval is obtained or the Series Warrants are no longer outstanding. This Issuance

Proposal is intended to fulfill this final covenant.

The

Securities Purchase Agreement also contains a covenant that we shall set the record date for the stockholder approval of the Issuance

Proposal prior to the closing date of the Offering. Accordingly, the Record Date has been set prior to the closing date of the Offering.

The

Series Warrants

The

Series Warrants have an exercise price of $0.3573 per share and will become exercisable on the effective date of stockholder approval

for the issuance of the Series Warrants and the Series Warrant Shares (or, if permitted by the applicable rules and regulations of the

Nasdaq Stock Market, upon payment by the holder of $0.125 per share in addition to the applicable exercise price). The Series A Warrants

will expire five years from the date of issuance, and the Series B Warrants will expire eighteen months from the date of issuance. The

exercise price and the number of Series Warrant Shares issuable upon exercise of the Series Warrants are subject to customary adjustments

for stock dividends, stock splits, reclassifications and the like. Upon any such price-based adjustment to the exercise price, the number

of Series Warrant Shares issuable upon exercise of the Series Warrants will be increased proportionately. The Series Warrants may be

exercised for cash, provided that, if there is no effective registration statement available registering the issuance of the Warrant

Shares, the Warrants may be exercised on a cashless basis.

The

Engagement Agreement and the Placement Agent Warrants

The

Placement Agent Warrants were issued on the date of the closing of the Offering pursuant to the terms of the Engagement Agreement. The

Engagement Agreement provided for the issuance of the Placement Agent Warrants to the Placement Agent or its designees as partial compensation

for the Placement Agent’s services in connection with the Offering.

The

Placement Agent Warrants are substantially similar to the Series A Warrants, except that they will have an exercise price of $0.4466

per share and will expire five years from the commencement of sales in the Offering.

Effect

of the Issuance of the Warrant Shares

The

potential issuance of the Warrant Shares would result in an increase in the number of shares of Common Stock outstanding, and our stockholders

would incur dilution of their percentage ownership to the extent that the holders thereof exercise their Warrants.

Reasons

for Nasdaq Stockholder Approval

Nasdaq

Listing Rule 5635(d) requires us to obtain stockholder approval prior to the issuance of securities in connection with a transaction

other than a public offering under the Nasdaq rules involving the sale, issuance or potential issuance by us of our Common Stock (or

securities convertible into or exercisable for our Common Stock) at a price less than the Minimum Price. In the case of the Offering,

the 20% threshold is determined based on the shares of our Common Stock outstanding immediately preceding the signing of the Securities

Purchase Agreement, which we signed on November 8, 2023.

Immediately

prior to the execution of the Securities Purchase Agreement, we had 81,110,643 shares of Common Stock issued and outstanding. Therefore,

the potential issuance of 14,483,629 shares of our Common Stock (consisting of 13,993,844 Series Warrant Shares and 489,785 Placement

Agent Warrant Shares) in addition to the issuance of the Shares would have constituted greater than 20% of the shares of Common Stock

outstanding immediately prior to the execution of the Securities Purchase Agreement. We are seeking stockholder approval under Nasdaq

Listing Rule 5635(d) for the sale, issuance or potential issuance by us of our Common Stock (or securities exercisable for our Common

Stock) in excess of 16,222,128 shares, which is 20% of the shares of Common Stock outstanding immediately prior to the execution of the

Securities Purchase Agreement.

We

cannot predict whether the Warrant holders exercise their Warrants. For these reasons, we are unable to accurately forecast or predict

with any certainty the total amount of Warrant Shares that may ultimately be issued. Under certain circumstances, however, it is possible,

that we will issue more than 20% of our outstanding shares of Common Stock to the Warrant holders, when aggregated with the issuance

of the Shares. Therefore, we are seeking stockholder approval under this proposal to issue more than 20% of our outstanding shares of

Common Stock, if necessary, to the Warrant holders.

Approval

by our stockholders of this Issuance Proposal is also one of the conditions for us to receive up to an additional gross exercise price

of approximately $5.2 million upon the exercise of the Warrants, if exercised for cash. Loss of these potential funds could jeopardize

our ability to execute our business plan.

Any

transaction requiring approval by our stockholders under Nasdaq Listing Rule 5635(d) would likely result in a significant increase in

the number of shares of our Common Stock outstanding, and, as a result, our current stockholders will own a smaller percentage of our

outstanding shares of Common Stock.

Under

the Nasdaq Listing Rules, we are not permitted (without risk of delisting) to undertake a transaction that could result in a change in

control of us without seeking and obtaining separate stockholder approval. We are not required to obtain stockholder approval for the

Offering under Nasdaq Listing Rule 5635(b) because the terms of the Warrants include beneficial ownership limitations that prohibit the

exercise of the Warrants to the extent that such exercise would result in the holder and its affiliates, collectively, beneficially owning

or controlling more than 4.99% (which percentage can be increased to 9.99%) of the total outstanding shares of our Common Stock.

Consequences

of Not Approving the Issuance Proposal

After

extensive efforts to raise capital on more favorable terms, we believed that the Offering was the only viable financing alternative available

to us at the time. In addition, unless we obtain stockholder approval for the Issuance Proposal at the initial meeting, we will be required

to incur additional costs in order to hold additional stockholder meetings every 90 days following the initial meeting to seek such approval,

pursuant to the Securities Purchase Agreement. Further, until such time as we receive stockholder approval, we will not be able to issue

20% or more of our outstanding shares of Common Stock to the Warrant holders in connection with the Offering.

Further

Information

The

terms of the Securities Purchase Agreement and the Warrants are only briefly summarized above. For further information, please refer

to the forms of the Securities Purchase Agreement, the Series A Warrants, the Series B Warrants, and the Placement Agent Warrants, which

were filed with the SEC as exhibits to our Current Report on Form 8-K filed on November 13, 2023 and are incorporated herein by reference.

The discussion herein is qualified in its entirety by reference to the filed documents.

Required

Vote and Board Recommendation

Assuming

the presence of a quorum, the approval of the Issuance Proposal will require a majority of the total votes cast on such proposal at the

Special Meeting. Any stockholder who is present at the Special Meeting, either in person or by proxy, who abstains from voting on the

Issuance Proposal will still be counted for purposes of determining whether a quorum exists for the Special Meeting. Abstentions will

have no effect on the outcome of the vote with respect to the Issuance Proposal. Because the Issuance Proposal is not considered a routine

matter, if you hold your shares in “street name” and you do not instruct your bank, broker or other nominee how to vote,

your broker will be unable to vote your shares on the Issuance Proposal, and your shares will not be included in the determination of

the number of shares present at the Special Meeting for determining a quorum and will have no effect on the outcome of the vote with

respect to the Issuance Proposal.

The

Board recommends that you vote “FOR” the Issuance Proposal.

|

STOCK

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth information regarding the beneficial ownership of our voting securities as of the Record Date by (i) each

person known to us to beneficially own five percent (5%) or more of any class of our voting securities; (ii) each of our named executive

officers and directors; and (iii) all of our directors and executive officers as a group. The percentages of voting securities beneficially

owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under the

rules of the SEC, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes

the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the

disposition of the security. Except as indicated in the footnotes to this table, to our knowledge and subject to community property laws

where applicable, each beneficial owner named in the table below has sole voting and sole investment power with respect to all shares

beneficially owned and each person’s address is c/o BioSig Technologies, Inc, 55 Greens Farms Road, 1st Floor, Westport, Connecticut

06880. For the purpose of calculating the number of shares beneficially owned by a stockholder and the percentage ownership of that stockholder,

shares of Common Stock subject to options or warrants that are currently exercisable or exercisable within sixty (60) days of the Record

Date by that stockholder are deemed outstanding.

| Name | |

Number of Shares of Common Stock Beneficially Owned (1) |

| |

Percentage Class (1) (2) | | |

Number of Shares of Series C Preferred Stock Beneficially Owned | | |

Percentage Class (2) | | |

|

Total Voting Power |

|

| Directors and Named Executive Officers | |

| |

| |

| | | |

| | | |

| | |

|

|

|

|

| Kenneth L. Londoner | |

| 3,863,344 |

(3) | |

| 4.75 | % | |

| — | | |

| — | | |

|

4.75 |

% |

| Patrick J. Gallagher | |

| 356,582 |

(4) | |

| | * | |

| — | | |

| — | | |

|

|

* |

| Steve Chaussy | |

| 1,220,864 |

(5) | |

| 1.51 | % | |

| — | | |

| — | | |

|

1.51 |

% |

| David Weild IV | |

| 510,371 |

(6) | |

| | * | |

| — | | |

| — | | |

|

|

* |

| Donald E. Foley | |

| 495,999 |

(7) | |

| | * | |

| — | | |

| — | | |

|

|

* |

| James J. Barry, PhD | |

| 171,249 |

(8) | |

| | * | |

| — | | |

| — | | |

|

|

* |

| Frederick D. Hrkac | |

| 144,999 |

(9) | |

| | * | |

| — | | |

| — | | |

|

|

* |

| James L. Klein | |

| 349,249 |

(10) | |

| | * | |

| — | | |

| — | | |

|

|

* |

| John Sieckhaus | |

| 569,784 |

(11) | |

| | * | |

| — | | |

| — | | |

|

|

* |

| | |

| |

| |

| | | |

| | | |

| | |

|

|

|

|

| All directors and executive officers as a group of ten persons | |

| 7,682,441 |

| |

| 9.30 | % | |

| — | | |

| — | | |

|

9.30 |

% |

| | |

| |

| |

| | | |

| | | |

| | |

|

|

|

|

| 5% Holders | |

| |

| |

| | | |

| | | |

| | |

|

|

|

|

| Donald E. Garlikov | |

| 11,536,634 |

(12) | |

| 13.80 | % | |

| — | | |

| — | | |

|

13.80 |

% |

| Ray Weber | |

| 288,551 |

(13) | |

| | * | |

| 45 | | |

| 42.86 | % | |

|

|

* |

| StoneX Group Inc C/F Raymond E Weber IRA | |

| 225,088 |

(14) | |

| | * | |

| 35 | | |

| 33.33 | % | |

|

|

* |

| Martin F. Sauer | |

| 160,777 |

(15) | |

| | * | |

| 25 | | |

| 23.81 | % | |

|

|

* |

| (1) |

Shares

of Common Stock beneficially owned and the respective percentages of beneficial ownership of Common Stock assume the exercise of

all options and other securities convertible into Common Stock beneficially owned by such person or entity currently exercisable

or exercisable within 60 days of the Record Date, except as otherwise noted. Shares issuable pursuant to the exercise of stock options

and other securities convertible into Common Stock exercisable within 60 days are deemed outstanding and held by the holder of such

options or other securities for computing the percentage of outstanding Common Stock beneficially owned by such person, but are not

deemed outstanding for computing the percentage of outstanding Common Stock beneficially owned by any other person. |

| (2) |

These

percentages have been calculated based on 81,110,643 shares of Common Stock and 105 shares of Series C Preferred Stock outstanding

as of the Record Date. |

| (3) |

Comprised

of (i) 2,507,020 shares of Common Stock directly held by Mr. Londoner, (ii) 1,181,324 shares of Common Stock held by Endicott Management

Partners, LLC, an entity for which Mr. Londoner is deemed the beneficial owner, and (iii) 175,000 options to purchase shares of Common

Stock that are currently exercisable or exercisable within 60 days of the Record Date. Mr. Londoner has sole voting and dispositive

power over the securities held for the account of Endicott Management Partners, LLC. |

| (4) |

Comprised

of (i) 133,743 shares of Common Stock directly held by Mr. Gallagher, (ii) 2,400 shares of Common Stock held by Amy E Gallagher Educational

Trust for which Mr. Gallagher is deemed the beneficial owner with sole voting and dispositive power over the securities held by the

trust, (iii) 2,400 shares of Common Stock held by Hans Gallagher Educational Trust for which Mr. Gallagher is deemed the beneficial

owner with sole voting and dispositive power over the securities held by the trust, and (iv) 218,039 options to purchase shares of

Common Stock that are currently exercisable or exercisable within 60 days of the Record Date. |

| (5) |

Comprised

of shares of Common Stock. |

| (6) |

Comprised

of (i) 114,999 shares of Common Stock and (ii) 395,372 options to purchase shares of Common Stock that are currently exercisable

or exercisable within 60 days of the Record Date. |

| (7) |

Comprised

of (i) 221,999 shares of Common Stock, (ii) 274,000 options to purchase shares of Common Stock that are currently exercisable or

exercisable within 60 days of the Record Date. |

| (8) |

Comprised

of (i) 71,249 shares of Common Stock and (ii) 100,000 options to purchase shares of Common Stock that are currently exercisable or

exercisable within 60 days of the Record Date. |

| (9) |

Comprised

of (i) 94,999 shares of Common Stock and (ii) 50,000 options to purchase shares of Common Stock that are currently exercisable or

exercisable within 60 days of the Record Date. |

| (10) |

Comprised

of (i) 299,249 shares of Common Stock and (ii) 50,000 options to purchase shares of Common Stock that are currently exercisable or

exercisable within 60 days of the Record Date. |

| (11) |

Comprised

of (i) 365,620 shares of Common Stock and (ii) 204,164 options to purchase shares of Common Stock that are currently exercisable

or exercisable within 60 days of the Record Date. |

| (12) |

Comprised

of (i) 9,070,475 shares of Common Stock and (ii) 2,466,159 warrants to purchase shares of Common Stock that are currently exercisable

or exercisable within 60 days of the Record Date. |

| (13) |

Comprised

of shares of Common Stock issuable upon the conversion of shares of our Series C Preferred Stock, including dividends accrued thereon

as of the Record Date. This stockholder’s address is 27 Zabriskie St., Jersey City, NJ 07307. |

| (14) |

Comprised

of shares of Common Stock issuable upon the conversion of shares of our Series C Preferred Stock, including dividends accrued thereon

as of the Record Date. Ray Weber may also be deemed beneficial owner of shares held by INTL FCStone Financial Inc C/F Raymond E Weber

IRA. Mr. Weber’s address is 27 Zabriskie St., Jersey City, NJ 07307. |

| (15) |

Comprised

of shares of Common Stock issuable upon the conversion of shares of our Series C Preferred Stock, including dividends accrued thereon

as of the Record Date. This stockholder’s address is 1028 Steeplechase Dr., Lancaster, PA 17601. |

OTHER

BUSINESS

The

Board knows of no other business to be brought before the Special Meeting. If, however, any other business should properly come before

the Special Meeting, the persons named in the accompanying proxy will vote the proxy in accordance with applicable law and as they may

deem appropriate in their discretion, unless directed by the proxy to do otherwise.

SUBMISSION

OF FUTURE STOCKHOLDER PROPOSALS

Pursuant

to Rule 14a-8 under the Exchange Act (“Rule 14a-8”), a stockholder who intends to present a proposal at our next annual meeting

of stockholders and who wishes the proposal to be included in the proxy statement and form of proxy for that meeting must submit the

proposal in writing no later than July 6, 2024, after which date such stockholder proposal will be considered untimely. Such proposal

must be submitted on or before the close of business to our corporate offices at 55 Greens Farms Road, 1st Floor, Westport, Connecticut

06880, Attn: Secretary.

Stockholders

wishing to nominate a director or submit proposals to be presented directly at the next annual meeting of stockholders instead of by

inclusion in next year’s proxy statement must follow the submission criteria and deadlines set forth in our Amended and Restated

Bylaws, as amended (the “Bylaws”), concerning stockholder nominations and proposals. Stockholder nominations for director

and other proposals that are not to be included in such materials must be received by our Secretary in writing at our corporate offices

at 55 Greens Farms Road, 1st Floor, Westport, Connecticut 06880 no earlier than August 20, 2024 and no later than the close of business

on September 19, 2024. Any such stockholder proposals or nominations for director must also satisfy the requirements set forth in our

Bylaws. To be eligible for inclusion in our proxy materials, stockholder proposals must also comply with the requirements of Rule 14a-8.

Stockholders are also advised to review our Bylaws, which contain additional advance notice requirements, including requirements with

respect to advance notice of stockholder proposals and director nominations. A proxy granted by a stockholder will give discretionary

authority to the proxies to vote on any matters introduced pursuant to the above advance notice provisions in the Bylaws, subject to

applicable rules of the SEC.

In

addition to satisfying the requirements under our By-laws, to comply with the universal proxy rules, stockholders who intend to solicit

proxies in support of director nominees other than Company nominees must provide notice that sets forth the information required by Rule

14a-19 under the Exchange Act no later than October 19, 2024 (i.e., the date that is 60 days prior to the anniversary date of 2023 annual

meeting of stockholders).

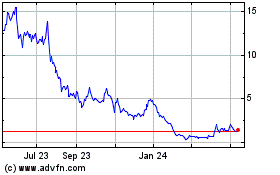

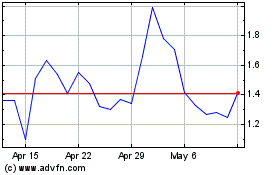

BioSig Technologies (NASDAQ:BSGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

BioSig Technologies (NASDAQ:BSGM)

Historical Stock Chart

From Apr 2023 to Apr 2024