UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION,

Washington, D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 4)*

| Check-Cap

LTD |

| (Name

of Issuer) |

| Ordinary

Shares, par value NIS 48.00 |

| (Title

of Class of Securities) |

| Barry

Shiff, 2828 Bathurst Street, Suite 400, Toronto, Canada M6B-3A7, 416-453-7832 |

| (Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| September

11, 2023 |

| (Date

of Event Which Requires Filing of This Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

| * |

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| CUSIP

M2361E179 |

| |

| (1) |

Names

of reporting persons: Symetryx Corporation |

| |

|

| |

|

| (2) |

Check

the appropriate box if a member of a group (see instructions) |

| |

(a)

☐ |

| |

(b)

☐ |

| |

|

| |

|

| (3) |

SEC

use only |

| |

|

| |

|

| (4) |

Source

of funds (see instructions) WC |

| |

|

| |

|

| (5) |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) |

| |

|

| |

|

| (6) |

Citizenship

or place of organization: Ontario, Canada |

| |

|

| |

|

| |

Number

of shares beneficially owned by each reporting person with: |

| |

|

|

| |

(7) |

Sole

voting power: 338,626 |

| |

|

|

| |

|

|

| |

(8) |

Shared

voting power: 338,626 |

| |

|

|

| |

|

|

| |

(9) |

Sole

dispositive power: 338,626 |

| |

|

|

| |

|

|

| |

(10) |

Shared

dispositive power: 338,626 |

| |

|

|

| |

|

| (11) |

Aggregate

amount beneficially owned by each reporting person 338,626 |

| |

|

| |

|

| (12)

|

Check

if the aggregate amount in Row (11) excludes certain shares (see instructions) |

| |

|

| |

|

| (13) |

Percent

of class represented by amount in Row (11) 5.8%* |

| |

|

| |

|

| (14) |

Type

of reporting person (see instructions): CO |

| |

|

| * |

Percent

of class is based on 5,849,216 shares of Common Stock issued and outstanding as at June 30, 2023, as reported by Check-Cap LTD on

its Form 6-K filed with the Securities and Exchange Commission. |

ITEM

1. SECURITY AND ISSUER.

This

Schedule 13D pertains to the common stock, par value NIS 2.40 (“Common Stock”), of Check-Cap LTD, an Israeli corporation

(“Issuer”). The Issuer’s principal executive office is located at Check-Cap Building 29 Abba Hushi Avenue, P.O. Box

1271, Isfiya, 30090, Mount Carmel, Israel.

ITEM

2. IDENTITY AND BACKGROUND.

(a)

This statement on Schedule 13D is filed by Symetryx Corporation (“Symetryx”).

(b)

The principal business and office address of Symetryx is:

2828

Bathurst Street Suite 400

Toronto,

Canada M6B3A7.

(c) Symetryx is a Family Office that invests its funds in business entities. The principal business address of Symetryx is as set forth in (b) above.

(d)

During the last five years, Symetryx has not been convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors).

(e)

During the last five years, Symetryx has not been a party to a civil proceeding of a judicial or administrative body of competent

jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to

such laws.

(f)

Symetryx is incorporated in Ontario, Canada.

ITEM

3. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION.

Symetryx

used USD$1,043,073 of working capital to purchase shares of the Common Stock of Issuer.

ITEM

4. PURPOSE OF TRANSACTION.

(a)

Symetryx does not intend to sell shares of Issuer Common Stock or purchase additional shares of Issuer Common Stock.

(b)

On July 18, 2023, Symetryx issued a press release stating, among other information, that Symetryx announced a non-binding proposal to

acquire shares of Issuer Common Stock from Issuer’s shareholders at a price of $4.35 per share in cash, contingent upon satisfying

specified conditions (“Non-binding Proposal”). These conditions included, among others, that the Issuer’s Board of

Directors immediately engage with Symetryx, and completion of a due diligence review of Issuer. Symetryx also urged that the Board of

Directors enter into a nondisclosure agreement with Symetryx.

On

July 25, 2023, Symetryx issued a press release stating, among other information, it increased the cash purchase price per share of Issuer

Common Stock from $4.35 per share to $4.60 per share in cash. Symetryx stated that Issuer’s Board of Directors had not yet responded

to Symetryx request to communicate with them and allow Symetryx to begin due diligence as outlined in Symetryx July 18, 2023, press release.

Symetryx also stated that, if Issuer’s Board of Directors does not engage in communications with Symetryx regarding its non-binding

proposal to acquire shares, Symetryx may consider making a tender offer directly to Issuer’s shareholders in accordance with U.S.

federal securities law and regulations.

On

August 10, 2023, the Chairman of Issuer’s Board of Directors sent an email to Symetryx proposing a conversation with him and another

member of the Board. Symetryx did not reply to that email.

As

of September 26, 2023, Symetryx withdraws and terminates its Non-binding Proposal.

Symetryx

is aware (based on the Form 6-K filed by Issuer with the SEC) that, on August 16, 2023, Issuer entered into a business combination agreement

(“BCA”) with Keystone Dental Holdings, Inc., a Delaware corporation, Capstone Dental PubCo, Inc., a Delaware corporation

and a direct, wholly-owned subsidiary of Keystone, Capstone Merger Sub Ltd., an Israeli company and a direct, wholly owned subsidiary

of PubCo, and Capstone Merger Sub Corp., a Delaware corporation and a direct, wholly owned subsidiary of PubCo (collectively “Capstone

Dental”). Closing of the transactions contemplated by the BCA requires, among other items, approval of Issuer’s shareholders

at a Special Meeting of Shareholders that Issuer has publicly reported it anticipates holding in the fourth quarter of 2023.

On

September 21, 2023, Symetryx issued a press release stating, among other information, that Symetryx will strongly oppose the transactions

contemplated by the BCA as it believes that the merger target does not represent the maximum value that shareholders could receive on

completion of a transaction

Symetryx

intends to vote its shares of Issuer Common Stock against the transactions contemplated by the BCA, and to encourage other holders of

Issuer Common Stock to vote their shares against these contemplated transactions.

Symetryx

intends to propose to Issuer a different merger candidate. As of the filing date of this Schedule 13D, Symetryx does not yet have a specific

merger candidate that it intends to propose to Issuer.

(c)

Not applicable.

(d)

Based solely upon the Form 20-F Issuer filed with the SEC on March 31, 2023, Symetryx believes that Issuer’s Board of Directors

is currently comprised of five members: Steven Hanley, Clara Ezed, Mary Jo Gorman, XiangQian (XQ) Lin, and Yuval Yanai (each a “Current

Director”). Under the Israeli Companies Law, a holder of not less than 5% of the shares of outstanding stock of an Israeli corporation

is entitled to demand that corporation’s board of directors call a special meeting of its shareholders. Symetryx sent Issuer’s

Board of Directors a letter, dated September 29, 2023 (“Demand Letter”), demanding that the Board calls a special meeting

of Issuer’s shareholders to consider and vote upon removal of each of the Current Directors as directors and electing/ appointing

the certain experienced and independent director nominees, namely Avital Shafran, Jordan Lipton, Idan Ben Shitrit, William Vozzolo and

Liliane Malczewsky in their places.

The

Demand Letter is filed with this Schedule 13D as Exhibit 99.3.

On

September 29, 2023, Symetryx requested the board of directors of Check-Cap Ltd. to call an extraordinary general meeting of its shareholders

no later than October 20, 2023. Since the Check-Cap declined our request to convene, and has not timely called nor convened the meeting

as required by applicable law, Symetryx has taken it upon itself to convene a shareholders meeting. The full notice of meeting and proxy

are attached as Exhibit 99.4.

On

November 12, 2023, Check-Cap and Symetryx reached terms of settlement under which Symetryx will cancel its special shareholders meeting

and Check-Cap has agreed that it will convert its special shareholder meeting to an annual general meeting of shareholders to be held

on December 18, 2023.

The

notice and proxy materials will be sent to shareholders of record by Check-Cap this week, which will include, the election of five directors

to the Check-Cap Board out of ten director nominees (five being proposed by Symetryx and five being proposed by Check-Cap) and other

proposals in connection with an annual shareholders meeting including the proposed Check-Cap- Keystone Transaction.

The

parties have agreed that once the Check-Cap annual shareholder meeting has been convened, the pending legal proceedings filed by Symetryx

will be withdrawn.

Symetryx

is pleased with this outcome as it will avoid unnecessary delays, further court proceedings and the preservation of funds (for the benefit

of the shareholders) that would otherwise have been spent by Check-Cap on legal and court fees.

Symetryx

intends to vote AGAINST the Keystone transaction (the “Transaction”) and vote FOR its five-nominees to the Check-Cap Board

of Directors which include: Idan Ben Shitrit, Avital Shafran, Jordan Lipton, William Vozzolo and Lilian Malczewski. Symetryx also urges

its fellow shareholders to likewise vote AGAINST the Transaction and to vote FOR all five of Symetryx’s highly qualified and independent

director nominees.

On

November 24, 2023 Check-Cap filed its proxy materials on EDGAR along with the position statement of Symetryx with respect to its view

on how fellow shareholders should vote on the Keystone Transaction. Symetryx strongly opposes the Keystone Transaction for the reasons

disclosed in its position statement – a copy of which is included as Exhibit 99.5.

On December 13, 2023 Symetryx filed a news release

in respect to the testimony of certain directors during a recent court hearing regarding the upcoming meeting with respect to the Transaction.

On December 18, 2023, Symetryx disseminated a correction regarding a clerical error in that press release – a copy of which is included

as Exhibit 99.6

(e)

Not applicable.

(f)

Not applicable.

(g)

Not applicable.

(h)

Not applicable.

(i)

Not applicable.

(j)

Not applicable.

ITEM

5. INTEREST IN SECURITIES OF THE ISSUER.

(a) Symetryx is the beneficial owner of 338,626

shares of Common Stock of Issuer. To the best of Symetryx knowledge, based solely upon information in Issuer’s Form 6-K for the

quarter ended June 30, 2023, filed with the SEC, the number of shares of Issuer Common Stock issued and outstanding as at June 30, 2023,

the beneficial ownership of Symetryx shares of Issuer Common Stock represents 5.8% of the total number of 5,849,216 shares of Issuer Common

Stock outstanding at that date. Symetryx does not have a current right to acquire additional Issuer Common Stock.

(b) As at November 27, 2023, Symetryx has

sole power to vote or direct the vote and sole power to dispose or direct the disposition of 338,626 shares of Issuer Common Stock. None

of these shares is subject to joint power to vote or direct the vote or joint power to dispose or direct the disposition of these shares.

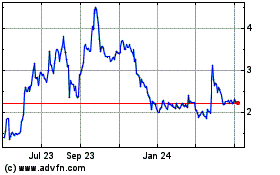

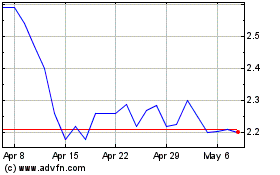

(c) During the last 60 days, Symetryx purchased

shares of Issuer Common Stock on the Nasdaq Stock Market on the dates and at the prices per share as specified in Exhibit 99.1 to

this Schedule 13D.

(d) No person other than Symetryx has the

right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of shares of Issuer Common Stock

beneficially owned by Symetryx.

(e)

Not applicable.

ITEM

6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

Neither

Symetryx nor, to its knowledge, any other person is a party to any contract, arrangement, understanding or relationship with respect

to any securities of Issuer, including the transfer or voting of any Issuer securities, finder’s fees, joint ventures, loan, or

option arrangements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies.

ITEM

7. MATERIAL TO BE FILED AS EXHIBITS.

| Exhibit No. |

| |

| 99.1 |

| Purchases by Symetryx Corporation of Shares of Issuer Common Stock During the Past 60 Days. |

| |

| |

| 99.2 |

| Power of Attorney of Symetryx and Barry Shiff Authorizing Legal Counsel to Cause this Schedule 13D to be filed with the Securities and Exchange Commission (“SEC”) is incorporated herein by reference to Exhibit 99.2 to the Schedule 13 dated August 24, 2023 filed with the SEC by Symetryx. |

| |

| |

| 99.3 |

| Letter from Symetryx to Issuer’s Board of Directors, dated September 29, 2023, demanding a Special Meeting of Shareholders to remove and replace Directors. |

| |

| |

| 99.4 |

| Notice of Extraordinary General Meeting of Shareholders from Symetryx, dated October 30, 2023, as a result of inaction from Issuer’s Board of Directors following the above Exhibit 99.3. |

| |

| |

| 99.5 |

| Position Statement of Symetryx regarding rejecting the Keystone Transaction at the December 18, 2023 shareholders meeting. |

| |

| |

| 99.6 |

| Press release of December 13, 2023 from Symetryx and a clerical correction dated December 18, 2023. |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief,

the undersigned certify that the information set forth in this statement is true, complete and correct as of December 18, 2023.

| |

By: |

/s/ Barry Shiff, President, Symetryx Corporation |

Exhibits

to this Schedule 13D:

| 99.1 |

| Purchases by Symetryx of Shares of Issuer Common Stock During the Past Sixty Days. |

| |

| |

| 99.2 |

| Power of Attorney of Symetryx and Barry Shiff Authorizing Legal Counsel to Cause this Schedule 13D to be filed with the Securities and Exchange Commission (“SEC”) is incorporated herein by reference to Exhibit 99.2 to the Schedule 13 dated August 30, 2023 filed with the SEC by Symetryx. |

| |

| |

| 99.3 |

| Letter from Symetryx to Issuer’s Board of Directors, dated September 29, 2023, demanding a Special Meeting of Shareholders to remove and replace Directors. |

| |

| |

| 99.4 |

| Notice of Extraordinary General Meeting of Shareholders from Symetryx, dated October 30, 2023, as a result of inaction from Issuer’s Board of Directors following the above Exhibit 99.3. |

| |

| |

| 99.5 |

| Position Statement of Symetryx regarding rejecting the Keystone Transaction at the December 18, 2023 shareholders meeting. |

| |

| |

| 99.6 |

| Press release of December 13, 2023 from Symetryx and a clerical correction dated December 18, 2023. |

Exhibit 99.1

Purchases by Symetryx of Issuer Common Stock

in the Past Sixty Days.

All of the purchases of Issuer Common Stock were made by Symetryx on

the Nasdaq Stock Market.

| Trade Date | |

Number of Shares | |

Trade Price | |

| June 16, 2023 | |

93 | |

$ | 2.470 | |

| June 16, 2023 | |

4807 | |

$ | 2.480 | |

| June 16, 2023 | |

100 | |

$ | 2.470 | |

| June 20, 2023 | |

1000 | |

$ | 2.700 | |

| June 20, 2023 | |

3077 | |

$ | 2.690 | |

| June 20, 2023 | |

100 | |

$ | 2.730 | |

| June 20, 2023 | |

823 | |

$ | 2.740 | |

| June 20, 2023 | |

9368 | |

$ | 2.740 | |

| June 20, 2023 | |

500 | |

$ | 2.740 | |

| June 20, 2023 | |

1000 | |

$ | 2.750 | |

| June 20, 2023 | |

200 | |

$ | 2.600 | |

| June 20, 2023 | |

200 | |

$ | 2.600 | |

| June 20, 2023 | |

200 | |

$ | 2.600 | |

| June 20, 2023 | |

100 | |

$ | 2.600 | |

| June 21, 2023 | |

100 | |

$ | 2.830 | |

| June 21, 2023 | |

200 | |

$ | 2.840 | |

| June 21, 2023 | |

300 | |

$ | 2.840 | |

| June 21, 2023 | |

100 | |

$ | 2.840 | |

| June 21, 2023 | |

100 | |

$ | 2.840 | |

| June 21, 2023 | |

557 | |

$ | 2.840 | |

| June 21, 2023 | |

3643 | |

$ | 2.840 | |

| June 21, 2023 | |

400 | |

$ | 2.800 | |

| June 21, 2023 | |

500 | |

$ | 2.800 | |

| June 21, 2023 | |

600 | |

$ | 2.800 | |

| June 21, 2023 | |

500 | |

$ | 2.800 | |

| June 21, 2023 | |

200 | |

$ | 2.750 | |

| June 21, 2023 | |

100 | |

$ | 2.750 | |

| June 21, 2023 | |

330 | |

$ | 2.750 | |

| June 21, 2023 | |

100 | |

$ | 2.760 | |

| June 21, 2023 | |

100 | |

$ | 2.760 | |

| June 21, 2023 | |

6 | |

$ | 2.760 | |

| June 21, 2023 | |

500 | |

$ | 2.780 | |

| June 21, 2023 | |

200 | |

$ | 2.780 | |

| June 21, 2023 | |

1 | |

$ | 2.800 | |

| June 21, 2023 | |

100 | |

$ | 2.800 | |

| June 21, 2023 | |

100 | |

$ | 2.800 | |

| June 21, 2023 | |

100 | |

$ | 2.800 | |

| June 21, 2023 | |

200 | |

$ | 2.800 | |

| June 21, 2023 | |

100 | |

$ | 2.820 | |

| June 21, 2023 | |

100 | |

$ | 2.830 | |

| June 21, 2023 | |

100 | |

$ | 2.830 | |

| June 21, 2023 | |

600 | |

$ | 2.850 | |

| June 21, 2023 | |

500 | |

$ | 2.850 | |

| June 21, 2023 | |

100 | |

$ | 2.840 | |

| June 21, 2023 | |

1 | |

$ | 2.840 | |

| June 21, 2023 | |

100 | |

$ | 2.850 | |

| June 21, 2023 | |

500 | |

$ | 2.850 | |

| June 21, 2023 | |

100 | |

$ | 2.840 | |

| June 21, 2023 | |

100 | |

$ | 2.840 | |

| June 21, 2023 | |

500 | |

$ | 2.850 | |

| June 21, 2023 | |

600 | |

$ | 2.850 | |

| June 21, 2023 | |

100 | |

$ | 2.850 | |

| June 21, 2023 | |

600 | |

$ | 2.850 | |

| June 21, 2023 | |

100 | |

$ | 2.840 | |

| June 21, 2023 | |

1300 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

3 | |

$ | 2.900 | |

| June 21, 2023 | |

150 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

30 | |

$ | 2.900 | |

| June 21, 2023 | |

200 | |

$ | 2.890 | |

| June 21, 2023 | |

900 | |

$ | 2.890 | |

| June 21, 2023 | |

7 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.880 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.880 | |

| June 21, 2023 | |

100 | |

$ | 2.880 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

150 | |

$ | 2.900 | |

| June 21, 2023 | |

500 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.860 | |

| June 21, 2023 | |

500 | |

$ | 2.870 | |

| June 21, 2023 | |

100 | |

$ | 2.870 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

6 | |

$ | 2.890 | |

| June 21, 2023 | |

300 | |

$ | 2.887 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

757 | |

$ | 2.890 | |

| June 21, 2023 | |

388 | |

$ | 2.890 | |

| June 21, 2023 | |

12 | |

$ | 2.880 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

200 | |

$ | 2.888 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.880 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

1 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

400 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

107 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

1000 | |

$ | 2.900 | |

| June 21, 2023 | |

87 | |

$ | 2.890 | |

| June 21, 2023 | |

200 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.880 | |

| June 21, 2023 | |

14 | |

$ | 2.890 | |

| June 21, 2023 | |

200 | |

$ | 2.900 | |

| June 21, 2023 | |

300 | |

$ | 2.900 | |

| June 21, 2023 | |

10 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.850 | |

| June 21, 2023 | |

100 | |

$ | 2.850 | |

| June 21, 2023 | |

250 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

300 | |

$ | 2.900 | |

| June 21, 2023 | |

900 | |

$ | 2.900 | |

| June 21, 2023 | |

200 | |

$ | 2.900 | |

| June 21, 2023 | |

1500 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

5 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

200 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

82 | |

$ | 2.880 | |

| June 21, 2023 | |

100 | |

$ | 2.865 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

1 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

700 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.880 | |

| June 21, 2023 | |

400 | |

$ | 2.890 | |

| June 21, 2023 | |

489 | |

$ | 2.900 | |

| June 21, 2023 | |

10 | |

$ | 2.900 | |

| June 21, 2023 | |

1 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

69 | |

$ | 2.890 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.890 | |

| June 21, 2023 | |

82 | |

$ | 2.900 | |

| June 21, 2023 | |

400 | |

$ | 2.900 | |

| June 21, 2023 | |

100 | |

$ | 2.900 | |

| June 22, 2023 | |

199 | |

$ | 2.820 | |

| June 22, 2023 | |

300 | |

$ | 2.830 | |

| June 22, 2023 | |

300 | |

$ | 2.830 | |

| June 22, 2023 | |

443 | |

$ | 2.830 | |

| June 22, 2023 | |

300 | |

$ | 2.830 | |

| June 22, 2023 | |

150 | |

$ | 2.830 | |

| June 22, 2023 | |

400 | |

$ | 2.830 | |

| June 22, 2023 | |

100 | |

$ | 2.830 | |

| June 22, 2023 | |

20 | |

$ | 2.830 | |

| June 22, 2023 | |

2681 | |

$ | 2.870 | |

| June 22, 2023 | |

1300 | |

$ | 2.860 | |

| June 22, 2023 | |

100 | |

$ | 2.870 | |

| June 22, 2023 | |

12 | |

$ | 2.870 | |

| June 22, 2023 | |

100 | |

$ | 2.870 | |

| June 22, 2023 | |

200 | |

$ | 2.860 | |

| June 22, 2023 | |

100 | |

$ | 2.920 | |

| June 22, 2023 | |

50 | |

$ | 2.920 | |

| June 22, 2023 | |

400 | |

$ | 2.950 | |

| June 22, 2023 | |

10 | |

$ | 2.950 | |

| June 22, 2023 | |

300 | |

$ | 2.950 | |

| June 22, 2023 | |

131 | |

$ | 2.950 | |

| June 22, 2023 | |

300 | |

$ | 2.950 | |

| June 22, 2023 | |

1100 | |

$ | 2.947 | |

| June 22, 2023 | |

10 | |

$ | 2.950 | |

| June 22, 2023 | |

5 | |

$ | 2.940 | |

| June 22, 2023 | |

100 | |

$ | 2.900 | |

| June 22, 2023 | |

700 | |

$ | 2.900 | |

| June 22, 2023 | |

100 | |

$ | 2.900 | |

| June 22, 2023 | |

100 | |

$ | 2.900 | |

| June 22, 2023 | |

100 | |

$ | 2.900 | |

| June 22, 2023 | |

250 | |

$ | 2.910 | |

| June 22, 2023 | |

100 | |

$ | 2.900 | |

| June 22, 2023 | |

28 | |

$ | 2.910 | |

| June 22, 2023 | |

100 | |

$ | 2.910 | |

| June 22, 2023 | |

10 | |

$ | 2.910 | |

| June 22, 2023 | |

100 | |

$ | 2.910 | |

| June 22, 2023 | |

100 | |

$ | 2.920 | |

| June 22, 2023 | |

100 | |

$ | 2.920 | |

| June 22, 2023 | |

36 | |

$ | 2.910 | |

| June 22, 2023 | |

100 | |

$ | 2.910 | |

| June 22, 2023 | |

100 | |

$ | 2.910 | |

| June 22, 2023 | |

300 | |

$ | 2.920 | |

| June 22, 2023 | |

100 | |

$ | 2.930 | |

| June 22, 2023 | |

100 | |

$ | 2.920 | |

| June 22, 2023 | |

1500 | |

$ | 2.930 | |

| June 22, 2023 | |

31 | |

$ | 2.930 | |

| June 22, 2023 | |

100 | |

$ | 2.920 | |

| June 22, 2023 | |

100 | |

$ | 2.930 | |

| June 22, 2023 | |

836 | |

$ | 2.930 | |

| June 22, 2023 | |

300 | |

$ | 2.930 | |

| June 22, 2023 | |

354 | |

$ | 3.030 | |

| June 22, 2023 | |

4942 | |

$ | 3.040 | |

| June 22, 2023 | |

58 | |

$ | 3.040 | |

| June 22, 2023 | |

1000 | |

$ | 3.000 | |

| June 22, 2023 | |

500 | |

$ | 3.000 | |

| June 22, 2023 | |

500 | |

$ | 3.000 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

200 | |

$ | 3.010 | |

| June 22, 2023 | |

700 | |

$ | 3.010 | |

| June 22, 2023 | |

1 | |

$ | 3.010 | |

| June 22, 2023 | |

1 | |

$ | 3.010 | |

| June 22, 2023 | |

1 | |

$ | 3.010 | |

| June 22, 2023 | |

200 | |

$ | 3.010 | |

| June 22, 2023 | |

1750 | |

$ | 3.010 | |

| June 22, 2023 | |

5 | |

$ | 3.010 | |

| June 22, 2023 | |

145 | |

$ | 3.000 | |

| June 22, 2023 | |

680 | |

$ | 3.000 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

35 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

1 | |

$ | 3.010 | |

| June 22, 2023 | |

300 | |

$ | 3.000 | |

| June 22, 2023 | |

63 | |

$ | 2.990 | |

| June 22, 2023 | |

1 | |

$ | 3.000 | |

| June 22, 2023 | |

100 | |

$ | 3.000 | |

| June 22, 2023 | |

100 | |

$ | 3.000 | |

| June 22, 2023 | |

100 | |

$ | 3.000 | |

| June 22, 2023 | |

3 | |

$ | 3.000 | |

| June 22, 2023 | |

2 | |

$ | 3.000 | |

| June 22, 2023 | |

100 | |

$ | 3.000 | |

| June 22, 2023 | |

100 | |

$ | 3.000 | |

| June 22, 2023 | |

39 | |

$ | 3.000 | |

| June 22, 2023 | |

61 | |

$ | 3.000 | |

| June 22, 2023 | |

10 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

900 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

2 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.010 | |

| June 22, 2023 | |

1 | |

$ | 3.010 | |

| June 22, 2023 | |

100 | |

$ | 3.060 | |

| June 23, 2023 | |

147 | |

$ | 3.050 | |

| June 23, 2023 | |

191 | |

$ | 3.070 | |

| June 23, 2023 | |

341 | |

$ | 3.070 | |

| June 23, 2023 | |

100 | |

$ | 3.090 | |

| June 23, 2023 | |

100 | |

$ | 3.084 | |

| June 23, 2023 | |

104 | |

$ | 3.050 | |

| June 23, 2023 | |

100 | |

$ | 3.050 | |

| June 23, 2023 | |

593 | |

$ | 3.050 | |

| June 23, 2023 | |

145 | |

$ | 3.090 | |

| June 23, 2023 | |

200 | |

$ | 3.090 | |

| June 23, 2023 | |

3 | |

$ | 3.087 | |

| June 23, 2023 | |

142 | |

$ | 3.090 | |

| June 23, 2023 | |

1200 | |

$ | 3.090 | |

| June 23, 2023 | |

5 | |

$ | 3.090 | |

| June 23, 2023 | |

400 | |

$ | 3.090 | |

| June 23, 2023 | |

400 | |

$ | 3.090 | |

| June 23, 2023 | |

900 | |

$ | 3.090 | |

| June 23, 2023 | |

300 | |

$ | 3.090 | |

| June 23, 2023 | |

1000 | |

$ | 3.180 | |

| June 26, 2023 | |

2 | |

$ | 2.830 | |

| June 26, 2023 | |

30 | |

$ | 2.850 | |

| June 26, 2023 | |

32 | |

$ | 2.850 | |

| June 26, 2023 | |

1 | |

$ | 2.830 | |

| June 26, 2023 | |

1 | |

$ | 2.830 | |

| June 26, 2023 | |

200 | |

$ | 2.830 | |

| June 26, 2023 | |

1 | |

$ | 2.830 | |

| June 26, 2023 | |

100 | |

$ | 2.830 | |

| June 26, 2023 | |

1 | |

$ | 2.830 | |

| June 26, 2023 | |

1 | |

$ | 2.830 | |

| June 26, 2023 | |

9 | |

$ | 3.040 | |

| June 26, 2023 | |

1 | |

$ | 2.950 | |

| June 26, 2023 | |

90 | |

$ | 2.950 | |

| June 26, 2023 | |

1000 | |

$ | 2.948 | |

| June 26, 2023 | |

8 | |

$ | 2.940 | |

| June 26, 2023 | |

99 | |

$ | 2.860 | |

| June 26, 2023 | |

100 | |

$ | 2.940 | |

| June 26, 2023 | |

92 | |

$ | 2.950 | |

| June 26, 2023 | |

1400 | |

$ | 2.948 | |

| June 26, 2023 | |

99 | |

$ | 2.940 | |

| June 26, 2023 | |

100 | |

$ | 2.930 | |

| June 26, 2023 | |

7 | |

$ | 2.910 | |

| June 26, 2023 | |

300 | |

$ | 2.950 | |

| June 26, 2023 | |

82 | |

$ | 2.950 | |

| June 26, 2023 | |

100 | |

$ | 2.940 | |

| June 26, 2023 | |

1000 | |

$ | 2.950 | |

| June 26, 2023 | |

18 | |

$ | 2.950 | |

| June 26, 2023 | |

800 | |

$ | 2.947 | |

| June 26, 2023 | |

100 | |

$ | 2.950 | |

| June 26, 2023 | |

1 | |

$ | 2.940 | |

| June 26, 2023 | |

1 | |

$ | 2.860 | |

| June 27, 2023 | |

22 | |

$ | 2.650 | |

| June 27, 2023 | |

100 | |

$ | 2.670 | |

| June 27, 2023 | |

100 | |

$ | 2.660 | |

| June 27, 2023 | |

19 | |

$ | 2.650 | |

| June 27, 2023 | |

18 | |

$ | 2.650 | |

| June 27, 2023 | |

100 | |

$ | 2.670 | |

| June 27, 2023 | |

200 | |

$ | 2.660 | |

| June 27, 2023 | |

100 | |

$ | 2.670 | |

| June 27, 2023 | |

50 | |

$ | 2.670 | |

| June 27, 2023 | |

1 | |

$ | 2.670 | |

| June 27, 2023 | |

50 | |

$ | 2.670 | |

| June 27, 2023 | |

50 | |

$ | 2.670 | |

| June 27, 2023 | |

43 | |

$ | 2.670 | |

| June 27, 2023 | |

50 | |

$ | 2.670 | |

| June 27, 2023 | |

50 | |

$ | 2.670 | |

| June 27, 2023 | |

50 | |

$ | 2.670 | |

| June 27, 2023 | |

50 | |

$ | 2.670 | |

| June 27, 2023 | |

100 | |

$ | 2.850 | |

| June 27, 2023 | |

100 | |

$ | 2.850 | |

| June 27, 2023 | |

1 | |

$ | 2.860 | |

| June 27, 2023 | |

100 | |

$ | 2.850 | |

| June 27, 2023 | |

100 | |

$ | 2.860 | |

| June 27, 2023 | |

400 | |

$ | 2.858 | |

| June 27, 2023 | |

100 | |

$ | 2.860 | |

| June 27, 2023 | |

100 | |

$ | 2.860 | |

| June 27, 2023 | |

600 | |

$ | 2.860 | |

| June 27, 2023 | |

55 | |

$ | 2.840 | |

| June 27, 2023 | |

147 | |

$ | 2.860 | |

| June 27, 2023 | |

45 | |

$ | 2.860 | |

| June 27, 2023 | |

100 | |

$ | 2.860 | |

| June 27, 2023 | |

100 | |

$ | 2.850 | |

| June 27, 2023 | |

166 | |

$ | 2.860 | |

| June 27, 2023 | |

100 | |

$ | 2.850 | |

| June 27, 2023 | |

100 | |

$ | 2.860 | |

| June 30, 2023 | |

5 | |

$ | 2.900 | |

| June 30, 2023 | |

710 | |

$ | 2.900 | |

| June 30, 2023 | |

90 | |

$ | 2.900 | |

| June 30, 2023 | |

200 | |

$ | 2.890 | |

| June 30, 2023 | |

50 | |

$ | 2.900 | |

| June 30, 2023 | |

945 | |

$ | 2.900 | |

| June 30, 2023 | |

50 | |

$ | 2.900 | |

| June 30, 2023 | |

113 | |

$ | 2.920 | |

| June 30, 2023 | |

87 | |

$ | 2.920 | |

| June 30, 2023 | |

100 | |

$ | 2.890 | |

| June 30, 2023 | |

400 | |

$ | 2.749 | |

| June 30, 2023 | |

1200 | |

$ | 2.760 | |

| June 30, 2023 | |

5 | |

$ | 2.768 | |

| June 30, 2023 | |

100 | |

$ | 2.760 | |

| June 30, 2023 | |

195 | |

$ | 2.760 | |

| June 30, 2023 | |

100 | |

$ | 2.760 | |

| June 30, 2023 | |

185 | |

$ | 2.760 | |

| June 30, 2023 | |

100 | |

$ | 2.760 | |

| June 30, 2023 | |

10 | |

$ | 2.760 | |

| June 30, 2023 | |

195 | |

$ | 2.760 | |

| June 30, 2023 | |

100 | |

$ | 2.770 | |

| June 30, 2023 | |

1110 | |

$ | 2.768 | |

| June 30, 2023 | |

300 | |

$ | 2.768 | |

| June 30, 2023 | |

-15 | |

$ | 2.710 | |

| June 30, 2023 | |

-485 | |

$ | 2.710 | |

| July 7, 2023 | |

33 | |

$ | 2.850 | |

| July 7, 2023 | |

200 | |

$ | 2.860 | |

| July 7, 2023 | |

67 | |

$ | 2.850 | |

| July 7, 2023 | |

100 | |

$ | 2.850 | |

| July 7, 2023 | |

100 | |

$ | 2.850 | |

| July 7, 2023 | |

100 | |

$ | 2.860 | |

| July 7, 2023 | |

125 | |

$ | 2.860 | |

| July 7, 2023 | |

100 | |

$ | 2.860 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

400 | |

$ | 2.870 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

50 | |

$ | 2.900 | |

| July 7, 2023 | |

300 | |

$ | 2.910 | |

| July 7, 2023 | |

200 | |

$ | 2.920 | |

| July 7, 2023 | |

100 | |

$ | 2.920 | |

| July 7, 2023 | |

345 | |

$ | 2.910 | |

| July 7, 2023 | |

200 | |

$ | 2.920 | |

| July 7, 2023 | |

200 | |

$ | 2.920 | |

| July 7, 2023 | |

75 | |

$ | 2.920 | |

| July 7, 2023 | |

100 | |

$ | 2.920 | |

| July 7, 2023 | |

200 | |

$ | 2.920 | |

| July 7, 2023 | |

267 | |

$ | 2.920 | |

| July 7, 2023 | |

100 | |

$ | 2.910 | |

| July 7, 2023 | |

88 | |

$ | 2.920 | |

| July 7, 2023 | |

100 | |

$ | 2.920 | |

| July 7, 2023 | |

200 | |

$ | 2.920 | |

| July 7, 2023 | |

100 | |

$ | 2.910 | |

| July 7, 2023 | |

100 | |

$ | 2.920 | |

| July 7, 2023 | |

200 | |

$ | 2.920 | |

| July 7, 2023 | |

200 | |

$ | 2.910 | |

| July 7, 2023 | |

200 | |

$ | 2.920 | |

| July 13, 2023 | |

20 | |

$ | 2.690 | |

| July 13, 2023 | |

100 | |

$ | 2.690 | |

| July 13, 2023 | |

20 | |

$ | 2.690 | |

| July 13, 2023 | |

127 | |

$ | 2.690 | |

| July 13, 2023 | |

20 | |

$ | 2.690 | |

| July 19, 2023 | |

-400 | |

$ | 3.370 | |

| July 19, 2023 | |

-100 | |

$ | 3.360 | |

| July 19, 2023 | |

-100 | |

$ | 3.370 | |

| July 19, 2023 | |

-250 | |

$ | 3.350 | |

| July 19, 2023 | |

-100 | |

$ | 3.360 | |

| July 19, 2023 | |

-60 | |

$ | 3.360 | |

| July 19, 2023 | |

-200 | |

$ | 3.300 | |

| July 19, 2023 | |

-100 | |

$ | 3.300 | |

| July 19, 2023 | |

-100 | |

$ | 3.300 | |

| July 19, 2023 | |

-25 | |

$ | 3.310 | |

| July 19, 2023 | |

259 | |

$ | 3.300 | |

| July 19, 2023 | |

231 | |

$ | 3.300 | |

| July 19, 2023 | |

10 | |

$ | 3.300 | |

| July 19, 2023 | |

500 | |

$ | 3.300 | |

| July 19, 2023 | |

-1900 | |

$ | 3.280 | |

| July 19, 2023 | |

-200 | |

$ | 3.270 | |

| July 19, 2023 | |

-100 | |

$ | 3.270 | |

| July 19, 2023 | |

-518 | |

$ | 3.220 | |

| July 19, 2023 | |

-100 | |

$ | 3.220 | |

| July 19, 2023 | |

-3 | |

$ | 3.110 | |

| July 19, 2023 | |

-142 | |

$ | 3.110 | |

| July 19, 2023 | |

-363 | |

$ | 3.110 | |

| July 19, 2023 | |

-24 | |

$ | 3.115 | |

| July 19, 2023 | |

-100 | |

$ | 3.110 | |

| July 19, 2023 | |

-703 | |

$ | 3.110 | |

| July 19, 2023 | |

-300 | |

$ | 3.100 | |

| July 19, 2023 | |

-137 | |

$ | 3.200 | |

| July 19, 2023 | |

-300 | |

$ | 3.190 | |

| July 19, 2023 | |

-100 | |

$ | 3.180 | |

| July 19, 2023 | |

-100 | |

$ | 3.180 | |

| July 19, 2023 | |

-14 | |

$ | 3.180 | |

| July 19, 2023 | |

-480 | |

$ | 3.160 | |

| July 19, 2023 | |

-10 | |

$ | 3.190 | |

| July 19, 2023 | |

-1000 | |

$ | 3.160 | |

| July 19, 2023 | |

-41 | |

$ | 3.100 | |

| July 19, 2023 | |

-200 | |

$ | 3.100 | |

| July 19, 2023 | |

-8 | |

$ | 3.100 | |

| July 19, 2023 | |

-100 | |

$ | 3.100 | |

| July 19, 2023 | |

-100 | |

$ | 3.100 | |

| July 19, 2023 | |

-100 | |

$ | 3.080 | |

| July 19, 2023 | |

-100 | |

$ | 3.080 | |

| July 19, 2023 | |

-773 | |

$ | 3.080 | |

| July 19, 2023 | |

-25 | |

$ | 3.080 | |

| July 19, 2023 | |

-100 | |

$ | 3.080 | |

| July 19, 2023 | |

-100 | |

$ | 3.090 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-50 | |

$ | 3.140 | |

| July 19, 2023 | |

-200 | |

$ | 3.150 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-50 | |

$ | 3.140 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-50 | |

$ | 3.140 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-50 | |

$ | 3.140 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-300 | |

$ | 3.140 | |

| July 19, 2023 | |

-50 | |

$ | 3.140 | |

| July 19, 2023 | |

-51 | |

$ | 3.140 | |

| July 19, 2023 | |

-400 | |

$ | 3.150 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-50 | |

$ | 3.140 | |

| July 19, 2023 | |

-400 | |

$ | 3.140 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-100 | |

$ | 3.150 | |

| July 19, 2023 | |

-50 | |

$ | 3.140 | |

| July 19, 2023 | |

-200 | |

$ | 3.140 | |

| July 19, 2023 | |

-200 | |

$ | 3.140 | |

| July 19, 2023 | |

-40 | |

$ | 3.140 | |

| July 19, 2023 | |

-100 | |

$ | 3.150 | |

| July 19, 2023 | |

-1 | |

$ | 3.140 | |

| July 19, 2023 | |

-50 | |

$ | 3.140 | |

| July 19, 2023 | |

-15 | |

$ | 3.140 | |

| July 19, 2023 | |

-1000 | |

$ | 3.150 | |

| July 19, 2023 | |

-5 | |

$ | 3.185 | |

| July 19, 2023 | |

-7 | |

$ | 3.150 | |

| July 19, 2023 | |

-14 | |

$ | 3.185 | |

| July 19, 2023 | |

-200 | |

$ | 3.138 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-93 | |

$ | 3.150 | |

| July 19, 2023 | |

-74 | |

$ | 3.150 | |

| July 19, 2023 | |

-100 | |

$ | 3.130 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-75 | |

$ | 3.130 | |

| July 19, 2023 | |

-25 | |

$ | 3.130 | |

| July 19, 2023 | |

-25 | |

$ | 3.130 | |

| July 19, 2023 | |

-100 | |

$ | 3.140 | |

| July 19, 2023 | |

-100 | |

$ | 3.130 | |

| July 19, 2023 | |

-100 | |

$ | 3.130 | |

| July 19, 2023 | |

100 | |

$ | 3.210 | |

| July 19, 2023 | |

100 | |

$ | 3.200 | |

| July 19, 2023 | |

100 | |

$ | 3.200 | |

| July 19, 2023 | |

300 | |

$ | 3.210 | |

| July 19, 2023 | |

28 | |

$ | 3.200 | |

| July 19, 2023 | |

100 | |

$ | 3.200 | |

| July 19, 2023 | |

20 | |

$ | 3.190 | |

| July 19, 2023 | |

52 | |

$ | 3.200 | |

| July 19, 2023 | |

300 | |

$ | 3.200 | |

| July 19, 2023 | |

200 | |

$ | 3.210 | |

| July 19, 2023 | |

400 | |

$ | 3.210 | |

| July 19, 2023 | |

100 | |

$ | 3.210 | |

| July 20, 2023 | |

100 | |

$ | 3.210 | |

| July 21, 2023 | |

100 | |

$ | 3.060 | |

| July 21, 2023 | |

100 | |

$ | 3.060 | |

| July 21, 2023 | |

400 | |

$ | 3.060 | |

| July 21, 2023 | |

100 | |

$ | 3.060 | |

| July 21, 2023 | |

27 | |

$ | 3.060 | |

| July 21, 2023 | |

100 | |

$ | 3.060 | |

| July 21, 2023 | |

300 | |

$ | 3.070 | |

| July 21, 2023 | |

100 | |

$ | 3.110 | |

| July 21, 2023 | |

100 | |

$ | 3.100 | |

| July 21, 2023 | |

100 | |

$ | 3.110 | |

| July 21, 2023 | |

40 | |

$ | 3.110 | |

| July 21, 2023 | |

200 | |

$ | 3.230 | |

| July 21, 2023 | |

100 | |

$ | 3.140 | |

| July 21, 2023 | |

955 | |

$ | 3.230 | |

| July 21, 2023 | |

1090 | |

$ | 3.230 | |

| July 21, 2023 | |

100 | |

$ | 3.130 | |

| July 21, 2023 | |

69 | |

$ | 3.230 | |

| July 21, 2023 | |

149 | |

$ | 3.230 | |

| July 21, 2023 | |

800 | |

$ | 3.140 | |

| July 21, 2023 | |

100 | |

$ | 3.230 | |

| July 21, 2023 | |

400 | |

$ | 3.138 | |

| July 21, 2023 | |

50 | |

$ | 3.230 | |

| July 21, 2023 | |

200 | |

$ | 3.230 | |

| July 21, 2023 | |

100 | |

$ | 3.230 | |

| July 21, 2023 | |

1220 | |

$ | 3.230 | |

| July 21, 2023 | |

100 | |

$ | 3.270 | |

| July 21, 2023 | |

100 | |

$ | 3.260 | |

| July 21, 2023 | |

100 | |

$ | 3.240 | |

| July 21, 2023 | |

200 | |

$ | 3.260 | |

| July 21, 2023 | |

100 | |

$ | 3.260 | |

| July 21, 2023 | |

100 | |

$ | 3.260 | |

| July 21, 2023 | |

1000 | |

$ | 3.268 | |

| July 21, 2023 | |

2400 | |

$ | 3.232 | |

| July 21, 2023 | |

400 | |

$ | 3.267 | |

| July 21, 2023 | |

100 | |

$ | 3.260 | |

| July 21, 2023 | |

100 | |

$ | 3.270 | |

| July 21, 2023 | |

100 | |

$ | 2.950 | |

| July 21, 2023 | |

93 | |

$ | 2.950 | |

| July 21, 2023 | |

200 | |

$ | 2.950 | |

| July 21, 2023 | |

100 | |

$ | 2.950 | |

| July 21, 2023 | |

100 | |

$ | 2.940 | |

| July 21, 2023 | |

400 | |

$ | 2.950 | |

| July 21, 2023 | |

100 | |

$ | 2.950 | |

| July 21, 2023 | |

1 | |

$ | 2.960 | |

| July 21, 2023 | |

100 | |

$ | 2.980 | |

| July 21, 2023 | |

59 | |

$ | 2.980 | |

| July 21, 2023 | |

50 | |

$ | 2.980 | |

| July 21, 2023 | |

701 | |

$ | 2.990 | |

| July 21, 2023 | |

100 | |

$ | 2.990 | |

| July 21, 2023 | |

311 | |

$ | 3.000 | |

| July 21, 2023 | |

200 | |

$ | 3.000 | |

| July 21, 2023 | |

100 | |

$ | 3.000 | |

| July 21, 2023 | |

100 | |

$ | 3.000 | |

| July 21, 2023 | |

400 | |

$ | 3.000 | |

| July 21, 2023 | |

550 | |

$ | 3.000 | |

| July 21, 2023 | |

500 | |

$ | 3.030 | |

| July 21, 2023 | |

221 | |

$ | 3.030 | |

| July 21, 2023 | |

503 | |

$ | 3.030 | |

| July 24, 2023 | |

-800 | |

$ | 2.950 | |

| July 24, 2023 | |

100 | |

$ | 3.000 | |

| July 24, 2023 | |

100 | |

$ | 3.000 | |

| July 24, 2023 | |

200 | |

$ | 2.997 | |

| July 24, 2023 | |

100 | |

$ | 3.000 | |

| July 24, 2023 | |

100 | |

$ | 3.000 | |

| July 24, 2023 | |

100 | |

$ | 3.000 | |

| July 24, 2023 | |

300 | |

$ | 2.997 | |

| July 24, 2023 | |

100 | |

$ | 3.000 | |

| July 25, 2023 | |

-100 | |

$ | 3.350 | |

| July 25, 2023 | |

-100 | |

$ | 3.320 | |

| July 25, 2023 | |

-1 | |

$ | 3.320 | |

| July 25, 2023 | |

-1000 | |

$ | 3.320 | |

| July 25, 2023 | |

-200 | |

$ | 3.320 | |

| July 25, 2023 | |

-300 | |

$ | 3.330 | |

| July 25, 2023 | |

-100 | |

$ | 3.320 | |

| July 25, 2023 | |

-312 | |

$ | 3.350 | |

| July 25, 2023 | |

-265 | |

$ | 3.380 | |

| July 25, 2023 | |

-1 | |

$ | 3.360 | |

| July 25, 2023 | |

-400 | |

$ | 3.350 | |

| July 25, 2023 | |

-300 | |

$ | 3.370 | |

| July 25, 2023 | |

-1 | |

$ | 3.350 | |

| July 25, 2023 | |

-100 | |

$ | 3.390 | |

| July 25, 2023 | |

-100 | |

$ | 3.390 | |

| July 25, 2023 | |

-220 | |

$ | 3.350 | |

| July 25, 2023 | |

-50 | |

$ | 3.350 | |

| July 25, 2023 | |

-1 | |

$ | 3.350 | |

| July 25, 2023 | |

-200 | |

$ | 3.350 | |

| July 25, 2023 | |

-2 | |

$ | 3.310 | |

| July 25, 2023 | |

-1100 | |

$ | 3.300 | |

| July 25, 2023 | |

-100 | |

$ | 3.310 | |

| July 25, 2023 | |

-2 | |

$ | 3.310 | |

| July 25, 2023 | |

-100 | |

$ | 3.300 | |

| July 25, 2023 | |

-28 | |

$ | 3.300 | |

| July 25, 2023 | |

-30 | |

$ | 3.320 | |

| July 25, 2023 | |

-50 | |

$ | 3.310 | |

| July 25, 2023 | |

-700 | |

$ | 3.300 | |

| July 25, 2023 | |

-50 | |

$ | 3.310 | |

| July 25, 2023 | |

-100 | |

$ | 3.300 | |

| July 25, 2023 | |

-100 | |

$ | 3.310 | |

| July 25, 2023 | |

-51 | |

$ | 3.310 | |

| July 25, 2023 | |

-100 | |

$ | 3.300 | |

| July 25, 2023 | |

-100 | |

$ | 3.270 | |

| July 25, 2023 | |

-100 | |

$ | 3.230 | |

| July 25, 2023 | |

-100 | |

$ | 3.220 | |

| July 25, 2023 | |

-150 | |

$ | 3.220 | |

| July 25, 2023 | |

-1 | |

$ | 3.220 | |

| July 25, 2023 | |

-100 | |

$ | 3.230 | |

| July 25, 2023 | |

-100 | |

$ | 3.220 | |

| July 25, 2023 | |

-200 | |

$ | 3.222 | |

| July 25, 2023 | |

-100 | |

$ | 3.223 | |

| July 25, 2023 | |

-800 | |

$ | 3.220 | |

| July 25, 2023 | |

-100 | |

$ | 3.210 | |

| July 25, 2023 | |

-100 | |

$ | 3.210 | |

| July 25, 2023 | |

-61 | |

$ | 3.210 | |

| July 25, 2023 | |

-100 | |

$ | 3.210 | |

| July 25, 2023 | |

-100 | |

$ | 3.210 | |

| July 25, 2023 | |

-2 | |

$ | 3.200 | |

| July 25, 2023 | |

-20 | |

$ | 3.200 | |

| July 25, 2023 | |

-100 | |

$ | 3.200 | |

| July 25, 2023 | |

-400 | |

$ | 3.200 | |

| July 25, 2023 | |

-71 | |

$ | 3.200 | |

| July 25, 2023 | |

-198 | |

$ | 3.200 | |

| July 25, 2023 | |

-1 | |

$ | 3.200 | |

| July 25, 2023 | |

-140 | |

$ | 3.200 | |

| July 25, 2023 | |

-50 | |

$ | 3.220 | |

| July 25, 2023 | |

-50 | |

$ | 3.220 | |

| July 25, 2023 | |

-50 | |

$ | 3.220 | |

| July 25, 2023 | |

-50 | |

$ | 3.220 | |

| July 25, 2023 | |

-50 | |

$ | 3.220 | |

| July 25, 2023 | |

-50 | |

$ | 3.220 | |

| July 25, 2023 | |

-50 | |

$ | 3.220 | |

| July 25, 2023 | |

-50 | |

$ | 3.220 | |

| July 25, 2023 | |

-50 | |

$ | 3.220 | |

| July 25, 2023 | |

-100 | |

$ | 3.200 | |

| July 25, 2023 | |

-100 | |

$ | 3.200 | |

| July 25, 2023 | |

-100 | |

$ | 3.200 | |

| July 25, 2023 | |

-100 | |

$ | 3.200 | |

| July 25, 2023 | |

-1000 | |

$ | 3.200 | |

| July 25, 2023 | |

-2000 | |

$ | 3.180 | |

| July 25, 2023 | |

-200 | |

$ | 3.182 | |

| July 25, 2023 | |

-100 | |

$ | 3.190 | |

| July 25, 2023 | |

-100 | |

$ | 3.180 | |

| July 25, 2023 | |

-45 | |

$ | 3.150 | |

| July 25, 2023 | |

-55 | |

$ | 3.150 | |

| July 25, 2023 | |

-100 | |

$ | 3.155 | |

| July 25, 2023 | |

-100 | |

$ | 3.150 | |

| July 25, 2023 | |

-4700 | |

$ | 3.150 | |

| July 28, 2023 | |

11719 | |

$ | 3.390 | |

| August 17, 2023 | |

-100 | |

$ | 2.550 | |

| August 17, 2023 | |

100 | |

$ | 2.320 | |

| August 17, 2023 | |

24 | |

$ | 2.320 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

64 | |

$ | 2.320 | |

| August 17, 2023 | |

19 | |

$ | 2.320 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

95 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.320 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

300 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.320 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

100 | |

$ | 2.320 | |

| August 17, 2023 | |

100 | |

$ | 2.320 | |

| August 17, 2023 | |

15 | |

$ | 2.320 | |

| August 17, 2023 | |

5 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.320 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

500 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.320 | |

| August 17, 2023 | |

1 | |

$ | 2.320 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

5 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.305 | |

| August 17, 2023 | |

25 | |

$ | 2.320 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

1 | |

$ | 2.320 | |

| August 17, 2023 | |

70 | |

$ | 2.320 | |

| August 17, 2023 | |

100 | |

$ | 2.340 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

300 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

300 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

400 | |

$ | 2.350 | |

| August 17, 2023 | |

300 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.350 | |

| August 17, 2023 | |

300 | |

$ | 2.350 | |

| August 17, 2023 | |

400 | |

$ | 2.350 | |

| August 17, 2023 | |

400 | |

$ | 2.350 | |

| August 17, 2023 | |

100 | |

$ | 2.360 | |

| August 17, 2023 | |

200 | |

$ | 2.360 | |

| August 17, 2023 | |

100 | |

$ | 2.360 | |

| August 17, 2023 | |

500 | |

$ | 2.360 | |

| August 17, 2023 | |

300 | |

$ | 2.360 | |

| August 17, 2023 | |

400 | |

$ | 2.360 | |

| August 17, 2023 | |

300 | |

$ | 2.360 | |

| August 17, 2023 | |

500 | |

$ | 2.360 | |

| August 17, 2023 | |

227 | |

$ | 2.360 | |

| August 17, 2023 | |

100 | |

$ | 2.380 | |

| August 17, 2023 | |

100 | |

$ | 2.380 | |

| August 17, 2023 | |

100 | |

$ | 2.370 | |

| August 17, 2023 | |

100 | |

$ | 2.380 | |

| August 17, 2023 | |

100 | |

$ | 2.380 | |

| August 17, 2023 | |

100 | |

$ | 2.380 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.400 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.390 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.400 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.400 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

200 | |

$ | 2.400 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.400 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

1 | |

$ | 2.400 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.400 | |

| August 17, 2023 | |

38 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.400 | |

| August 17, 2023 | |

200 | |

$ | 2.400 | |

| August 17, 2023 | |

200 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.400 | |

| August 17, 2023 | |

31 | |

$ | 2.400 | |

| August 17, 2023 | |

800 | |

$ | 2.400 | |

| August 17, 2023 | |

200 | |

$ | 2.400 | |

| August 17, 2023 | |

100 | |

$ | 2.450 | |

| August 17, 2023 | |

100 | |

$ | 2.440 | |

| August 17, 2023 | |

1 | |

$ | 2.450 | |

| August 17, 2023 | |

200 | |

$ | 2.450 | |

| August 17, 2023 | |

99 | |

$ | 2.450 | |

| August 17, 2023 | |

100 | |

$ | 2.440 | |

| August 17, 2023 | |

200 | |

$ | 2.450 | |

| August 17, 2023 | |

99 | |

$ | 2.450 | |

| August 17, 2023 | |

100 | |

$ | 2.450 | |

| August 17, 2023 | |

1 | |

$ | 2.450 | |

| August 17, 2023 | |

100 | |

$ | 2.450 | |

| August 21, 2023 | |

141 | |

$ | 2.770 | |

| August 21, 2023 | |

756 | |

$ | 2.770 | |

| August 21, 2023 | |

100 | |

$ | 2.770 | |

| August 21, 2023 | |

13 | |

$ | 2.770 | |

| August 21, 2023 | |

907 | |

$ | 2.770 | |

| August 21, 2023 | |

134 | |

$ | 2.770 | |

| August 21, 2023 | |

316 | |

$ | 2.770 | |

| August 21, 2023 | |

100 | |

$ | 2.770 | |

| September 1, 2023 | |

25 | |

$ | 3.000 | |

| September 1, 2023 | |

9 | |

$ | 3.000 | |

| September 1, 2023 | |

16 | |

$ | 3.000 | |

| September 1, 2023 | |

5 | |

$ | 3.000 | |

| September 1, 2023 | |

100 | |

$ | 2.990 | |

| September 1, 2023 | |

25 | |

$ | 3.000 | |

| September 1, 2023 | |

200 | |

$ | 2.990 | |

| September 1, 2023 | |

100 | |

$ | 2.990 | |

| September 1, 2023 | |

10 | |

$ | 3.000 | |

| September 1, 2023 | |

500 | |

$ | 2.990 | |

| September 1, 2023 | |

100 | |

$ | 3.000 | |

| September 1, 2023 | |

10 | |

$ | 3.000 | |

| September 1, 2023 | |

6 | |

$ | 3.000 | |

| September 1, 2023 | |

100 | |

$ | 3.000 | |

| September 1, 2023 | |

25 | |

$ | 3.000 | |

| September 1, 2023 | |

10 | |

$ | 3.000 | |

| September 1, 2023 | |

10 | |

$ | 3.000 | |

| September 1, 2023 | |

10 | |

$ | 3.000 | |

| September 1, 2023 | |

100 | |

$ | 2.990 | |

| September 1, 2023 | |

38 | |

$ | 2.990 | |

| September 1, 2023 | |

10 | |

$ | 3.000 | |

| September 1, 2023 | |

100 | |

$ | 3.000 | |

| September 1, 2023 | |

25 | |

$ | 3.000 | |

| September 1, 2023 | |

25 | |

$ | 3.000 | |

| September 1, 2023 | |

15 | |

$ | 3.000 | |

| September 1, 2023 | |

18 | |

$ | 3.000 | |

| September 1, 2023 | |

31 | |

$ | 3.000 | |

| September 1, 2023 | |

10 | |

$ | 3.000 | |

| September 1, 2023 | |

3 | |

$ | 3.000 | |

| September 1, 2023 | |

100 | |

$ | 2.990 | |

| September 1, 2023 | |

35 | |

$ | 3.000 | |

| September 1, 2023 | |

30 | |

$ | 3.000 | |

| September 1, 2023 | |

100 | |

$ | 3.000 | |

| September 1, 2023 | |

100 | |

$ | 3.010 | |

| September 1, 2023 | |

100 | |

$ | 3.050 | |

| September 1, 2023 | |

100 | |

$ | 3.030 | |

| September 1, 2023 | |

100 | |

$ | 3.030 | |

| September 1, 2023 | |

100 | |

$ | 3.050 | |

| September 1, 2023 | |

100 | |

$ | 3.050 | |

| September 1, 2023 | |

100 | |

$ | 3.010 | |

| September 1, 2023 | |

19 | |

$ | 3.050 | |

| September 1, 2023 | |

4500 | |

$ | 3.050 | |

| September 1, 2023 | |

9292 | |

$ | 3.050 | |

| September 1, 2023 | |

100 | |

$ | 3.050 | |

| September 1, 2023 | |

8 | |

$ | 3.050 | |

| September 8, 2023 | |

100 | |

$ | 3.040 | |

| September 8, 2023 | |

69 | |

$ | 3.040 | |

| September 8, 2023 | |

200 | |

$ | 3.040 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

200 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

100 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

150 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

25 | |

$ | 3.080 | |

| September 8, 2023 | |

100 | |

$ | 3.080 | |

| September 8, 2023 | |

100 | |

$ | 3.078 | |

| September 8, 2023 | |

300 | |

$ | 3.078 | |

| September 8, 2023 | |

1600 | |

$ | 3.080 | |

| September 8, 2023 | |

200 | |

$ | 3.080 | |

| September 8, 2023 | |

100 | |

$ | 3.070 | |

| September 8, 2023 | |

200 | |

$ | 3.070 | |

| September 8, 2023 | |

90 | |

$ | 3.090 | |

| September 8, 2023 | |

93 | |

$ | 3.090 | |

| September 8, 2023 | |

307 | |

$ | 3.100 | |

| September 8, 2023 | |

10 | |

$ | 3.100 | |

| September 8, 2023 | |

300 | |

$ | 3.140 | |

| September 8, 2023 | |

6 | |

$ | 3.100 | |

| September 8, 2023 | |

194 | |

$ | 3.137 | |

| September 8, 2023 | |

100 | |

$ | 3.130 | |

| September 8, 2023 | |

1 | |

$ | 3.140 | |

| September 8, 2023 | |

1 | |

$ | 3.140 | |

| September 8, 2023 | |

24 | |

$ | 3.140 | |

| September 8, 2023 | |

374 | |

$ | 3.140 | |

| September 8, 2023 | |

10 | |

$ | 3.160 | |

| September 8, 2023 | |

600 | |

$ | 3.160 | |

| September 8, 2023 | |

200 | |

$ | 3.157 | |

| September 11, 2023 | |

951 | |

$ | 3.190 | |

| September 11, 2023 | |

100 | |

$ | 3.180 | |

| September 11, 2023 | |

25 | |

$ | 3.190 | |

| September 11, 2023 | |

100 | |

$ | 3.190 | |

| September 11, 2023 | |

100 | |

$ | 3.180 | |

| September 11, 2023 | |

28 | |

$ | 3.190 | |

| September 11, 2023 | |

1 | |

$ | 3.190 | |

| September 11, 2023 | |

270 | |

$ | 3.190 | |

| September 11, 2023 | |

100 | |

$ | 3.190 | |

| September 11, 2023 | |

420 | |

$ | 3.190 | |

| September 11, 2023 | |

44 | |

$ | 3.180 | |

| September 11, 2023 | |

100 | |

$ | 3.160 | |

| September 11, 2023 | |

50 | |

$ | 3.180 | |

| September 11, 2023 | |

135 | |

$ | 3.180 | |

| September 11, 2023 | |

25 | |

$ | 3.180 | |

| September 11, 2023 | |

100 | |

$ | 3.240 | |

| September 11, 2023 | |

600 | |

$ | 3.260 | |

| September 11, 2023 | |

100 | |

$ | 3.250 | |

| September 11, 2023 | |

200 | |

$ | 3.260 | |

| September 11, 2023 | |

400 | |

$ | 3.250 | |

| September 11, 2023 | |

600 | |

$ | 3.249 | |

| September 11, 2023 | |

100 | |

$ | 3.250 | |

| September 11, 2023 | |

700 | |

$ | 3.257 | |

| September 11, 2023 | |

72 | |

$ | 3.277 | |

| September 11, 2023 | |

390 | |

$ | 3.280 | |

| September 11, 2023 | |

100 | |

$ | 3.267 | |

| September 11, 2023 | |

100 | |

$ | 3.280 | |

| September 20, 2023 | |

74,409 | |

$ | 3.7575 | |

| September 21, 2023 | |

75,591 | |

$ | 4.2083 | |

| November 10, 2023 | |

8 | |

| 3.51 | |

| November 10, 2023 | |

100 | |

| 3.5774 | |

| November 10, 2023 | |

400 | |

| 3.49 | |

| November 10, 2023 | |

3 | |

| 3.58 | |

| November 10, 2023 | |

1 | |

| 3.51 | |

| November 10, 2023 | |

100 | |

| 3.57 | |

| November 10, 2023 | |

100 | |

| 3.58 | |

| November 10, 2023 | |

200 | |

| 3.5648 | |

| November 10, 2023 | |

2 | |

| 3.5 | |

| November 10, 2023 | |

97 | |

| 3.58 | |

| November 10, 2023 | |

3 | |

| 3.59 | |

| November 10, 2023 | |

200 | |

| 3.5648 | |

| November 10, 2023 | |

400 | |

| 3.58 | |

| November 10, 2023 | |

100 | |

| 3.58 | |

| November 10, 2023 | |

3 | |

| 3.56 | |

| November 10, 2023 | |

500 | |

| 3.5838 | |

| November 10, 2023 | |

297 | |

| 3.59 | |

| November 10, 2023 | |

100 | |

| 3.5937 | |

| November 10, 2023 | |

99 | |

| 3.58 | |

| November 10, 2023 | |

100 | |

| 3.59 | |

| November 10, 2023 | |

5 | |

| 3.59 | |

| November 10, 2023 | |

500 | |

| 3.5776 | |

| November 10, 2023 | |

1 | |

| 3.58 | |

| November 10, 2023 | |

100 | |

| 3.59 | |

| November 10, 2023 | |

95 | |

| 3.58 | |

| November 10, 2023 | |

100 | |

| 3.59 | |

| November 10, 2023 | |

21 | |

| 3.39 | |

| November 10, 2023 | |

100 | |

| 3.4 | |

| November 10, 2023 | |

200 | |

| 3.41 | |

| November 10, 2023 | |

40 | |

| 3.4 | |

| November 10, 2023 | |

139 | |

| 3.498 | |

| November 10, 2023 | |

100 | |

| 3.5 | |

| November 10, 2023 | |

100 | |

| 3.49 | |

| November 10, 2023 | |

100 | |

| 3.5 | |

| November 10, 2023 | |

500 | |

| 3.5 | |

| November 10, 2023 | |

500 | |

| 3.5 | |

| November 10, 2023 | |

100 | |

| 3.5 | |

| November 10, 2023 | |

100 | |

| 3.5 | |

| November 10, 2023 | |

100 | |

| 3.48 | |

| November 10, 2023 | |

400 | |

| 3.49 | |

| November 10, 2023 | |

100 | |

| 3.5 | |

| November 10, 2023 | |

100 | |

| 3.5 | |

| November 10, 2023 | |

1800 | |

| 3.455 | |

| November 10, 2023 | |

100 | |

| 3.58 | |

| November 10, 2023 | |

400 | |

| 3.54 | |

| November 10, 2023 | |

100 | |

| 3.55 | |

| November 10, 2023 | |

20 | |

| 3.5 | |

| November 10, 2023 | |

300 | |

| 3.55 | |

| November 10, 2023 | |

500 | |

| 3.55 | |

| November 10, 2023 | |

300 | |

| 3.55 | |

| November 10, 2023 | |

200 | |

| 3.55 | |

| November 10, 2023 | |

100 | |

| 3.54 | |

| November 10, 2023 | |

100 | |

| 3.55 | |

| November 10, 2023 | |

1100 | |

| 3.55 | |

| November 10, 2023 | |

100 | |

| 3.53 | |

| November 10, 2023 | |

9 | |

| 3.58 | |

| November 10, 2023 | |

100 | |

| 3.58 | |

| November 10, 2023 | |

1071 | |

| 3.58 | |

| November 10, 2023 | |

6 | |

| 3.5 | |

| November 10, 2023 | |

1259 | |

| 3.5 | |

| November 10, 2023 | |

5 | |

| 3.5 | |

| November 10, 2023 | |

3 | |

| 3.5 | |

| November 10, 2023 | |

176 | |

| 3.5 | |

| November 13, 2023 | |

100 | |

| 3.5 | |

| November 13, 2023 | |

100 | |

| 3.58 | |

| November 13, 2023 | |

112 | |

| 3.57 | |

| November 13, 2023 | |

106 | |

| 3.57 | |

| November 13, 2023 | |

182 | |

| 3.57 | |

| November 13, 2023 | |

100 | |

| 3.57 | |

| November 13, 2023 | |

100 | |

| 3.58 | |

| November 13, 2023 | |

378 | |

| 3.58 | |

| November 13, 2023 | |

100 | |

| 3.57 | |

| November 13, 2023 | |

136 | |

| 3.58 | |

| November 13, 2023 | |

100 | |

| 3.58 | |

| November 13, 2023 | |

101 | |

| 3.58 | |

| November 13, 2023 | |

85 | |

| 3.58 | |

| November 13, 2023 | |

100 | |

| 3.57 | |

| November 13, 2023 | |

351 | |

| 3.58 | |

| November 13, 2023 | |

100 | |

| 3.58 | |

| November 13, 2023 | |

100 | |

| 3.58 | |

| November 13, 2023 | |

49 | |

| 3.58 | |

| November 13, 2023 | |

100 | |

| 3.58 | |

| November 13, 2023 | |

100 | |

| 3.58 | |

| November 13, 2023 | |

39 | |

| 3.58 | |

| November 13, 2023 | |

100 | |

| 3.59 | |

| November 13, 2023 | |

100 | |

| 3.59 | |

| November 13, 2023 | |

100 | |

| 3.59 | |

| November 13, 2023 | |

10 | |

| 3.59 | |

| November 13, 2023 | |

100 | |

| 3.59 | |

| November 13, 2023 | |

100 | |

| 3.56 | |

| November 13, 2023 | |

300 | |

| 3.59 | |

| November 13, 2023 | |

100 | |

| 3.59 | |

| November 13, 2023 | |

100 | |

| 3.588 | |

| November 13, 2023 | |

517 | |

| 3.59 | |

| November 13, 2023 | |

200 | |

| 3.59 | |

| November 13, 2023 | |

30 | |

| 3.59 | |

| November 13, 2023 | |

400 | |

| 3.6 | |

| November 13, 2023 | |

600 | |

| 3.6 | |

| November 13, 2023 | |

100 | |

| 3.6 | |

| November 13, 2023 | |

1 | |

| 3.6 | |

22

Exhibit

99.2

Power of Attorney of Symetryx Authorizing Legal Counsel to Cause this Schedule 13D

to be filed with the Securities and Exchange

Commission

LIMITED

POWER OF ATTORNEY FOR FILINGS UNDER

THE

SECURITIES ACT OF 1933, AS AMENDED AND

THE

SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

Know

all by these presents, that the undersigned hereby constitutes and appoints Cynthia Libby, Michael Bluestein, Melanie Sokalsky, Joyce