Capital Southwest Receives Investment Grade Rating from Moody’s Investors Service

April 03 2023 - 8:00AM

Capital Southwest Corporation (“Capital Southwest” or the

“Company”) (Nasdaq: CSWC), an internally managed business

development company focused on providing flexible financing

solutions to support the acquisition and growth of middle market

businesses, today announced that Moody’s Investors Service, Inc.

(“Moody’s”) has assigned Capital Southwest an investment grade

long-term issuer rating of Baa3 with a stable outlook.

Factors cited by Moody’s in support of its

rating include Capital Southwest’s strong capitalization and

funding profile, first-lien oriented investment portfolio, strong

recurring earnings generation, and internally managed structure.

Moody’s stated that its stable outlook for its rating reflects its

expectation that Capital Southwest’s core profitability will

continue to benefit from elevated reference rates, that the Company

will maintain adequate liquidity to meet potential liquidity needs,

and that regulatory leverage will be maintained within or below the

Company’s target range of 0.90x – 1.10x.

“We are extremely pleased that Moody’s has

initiated coverage of Capital Southwest with a Baa3 investment

grade rating,” stated Bowen Diehl, President and Chief Executive

Officer of Capital Southwest. “This rating is a further validation

of our first lien focused investment strategy, our strong credit

underwriting track record and our prudent balance sheet management

through a variety of capital markets environments. We are very

proud of what our team has accomplished since the launch of our

middle market credit strategy and we look forward to continuing to

be good stewards of our stakeholders capital for many years to

come.”

About Capital Southwest

Capital Southwest Corporation (Nasdaq: CSWC) is

a Dallas, Texas-based, internally managed business development

company with approximately $1.2 billion in investments at fair

value as of December 31, 2022. Capital Southwest is a middle market

lending firm focused on supporting the acquisition and growth of

middle market businesses with $5 million to $35 million investments

across the capital structure, including first lien, second lien and

non-control equity co-investments. As a public company with a

permanent capital base, Capital Southwest has the flexibility to be

creative in its financing solutions and to invest to support the

growth of its portfolio companies over long periods of time.

Forward-Looking Statements

This press release contains historical

information and forward-looking statements with respect to the

business and investments of Capital Southwest, including, but not

limited to, statements about Capital Southwest's future performance

and financial condition. Forward-looking statements are statements

that are not historical statements and can often be identified by

words such as "will," "believe," "expect" and similar expressions

and variations or negatives of these words. These statements are

based on management's current expectations, assumptions and

beliefs. They are not guarantees of future results and are subject

to numerous risks, uncertainties and assumptions that could cause

actual results to differ materially from those expressed in any

forward-looking statement. These risks include risks related to:

changes in the markets in which Capital Southwest invests; changes

in the financial, capital, and lending markets; the impact of the

rising interest rate environment on Capital Southwest's business

and its portfolio companies; the impact of supply chain constraints

and labor difficulties on Capital Southwest's portfolio companies;

elevated levels of inflation and its impact on Capital Southwest's

portfolio companies and the industries in which it invests;

regulatory changes; tax treatment and general economic and business

conditions; our ability to operate our wholly owned subsidiary,

SBIC I, as an SBIC; and uncertainties associated with the impact

from the COVID-19 pandemic, including its impact on the global and

U.S. capital markets and the global and U.S. economy, the length

and duration of the COVID-19 outbreak in the United States as well

as worldwide and the magnitude of the economic impact of that

outbreak; and the effect of the COVID-19 pandemic on our business

prospects and the operational and financial performance of our

portfolio companies, including our ability and their ability to

achieve their respective objectives.

Readers should not place undue reliance on any

forward-looking statements and are encouraged to review Capital

Southwest's Annual Report on Form 10-K for the year ended March 31,

2022 and subsequent filings, including the "Risk Factors" sections

therein, with the Securities and Exchange Commission for a more

complete discussion of the risks and other factors that could

affect any forward-looking statements. Except as required by the

federal securities laws, Capital Southwest does not undertake any

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

changing circumstances or any other reason after the date of this

press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial Officer214-884-3829

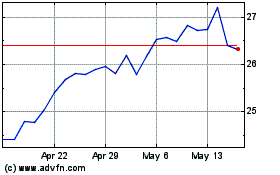

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Nov 2024 to Dec 2024

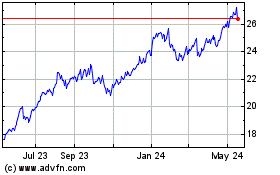

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Dec 2023 to Dec 2024