Dada Nexus Limited (NASDAQ: DADA, “Dada”, the “Company”, or “we”),

China’s leading local on-demand retail and delivery platform, today

announced its unaudited financial results for the first quarter

ended March 31, 2024.

“We are pleased to announce that our on-demand

retail service has been upgraded to JD NOW, aiming to bring quality

goods to consumers at top-notch speeds. With the introduction of

the new brand, we have entered a new chapter with a focus on

building a sustainable ecosystem,” said Mr. Bing Fu, Interim

President of Dada, “For JD NOW, we are determined to fully embrace

the JD.com ecosystem in a customer-centric approach and are making

dedicated investments to improve customer experience, including

rolling out delivery fee waiver program and further lowering the

free delivery threshold to RMB29. This strategic focus has

catalyzed a significant boost in our core operating metrics from

January through April this year. Notably, the number of monthly

transacting users1 and orders through the JD App increased by over

70% in the first quarter of 2024 and by over 100% in April year

over year. For Dada Now, we continue to strengthen partnerships

with chain restaurant and beverage customers while consolidating

our leading position among supermarket chains, with year-over-year

revenue growth in the first quarter reaching the highest of the

past eight quarters.”

“We remain highly optimistic about the potential

of the on-demand retail and delivery industries. Looking ahead, for

JD NOW, we remain committed to making the shopping journey smoother

and continuously improving selection, speed, quality, and value, to

enhance user experience and drive greater penetration among JD.com

users. For Dada Now, we will strengthen our rider ecosystem and

enhance fulfillment capabilities to continue expanding our market

share in the third-party on-demand delivery industry,” added Mr.

Fu.

“Starting in 2024, we undertook a comprehensive

business review and decided to further strengthen our commitment to

customer experience and focus on high-quality development, which we

believe will pave the way for our long-term sustainable growth,”

said Mr. Henry Mao, Chief Financial Officer of Dada. “While the

voluntary business adjustment and investment in user experience may

bring pressure to JD NOW’s overall revenue growth in the near

future, we are encouraged to see that our core metrics including

user growth have resumed strong growth momentum, which strengthens

our confidence on the path towards market leadership. Dada Now

continued to deliver robust revenue growth that significantly

outpaced the on-demand delivery industry. Despite the investments

in core business to uplift customer experience, in the quarter, our

non-GAAP net loss margin remained largely stable year over

year.”

First Quarter 2024 Financial

Results

Total net revenues were

RMB2,451.8 million, compared with RMB2,535.4 million in the same

period of 2023.

|

|

|

For the three months ended March 31, |

|

YoY%change |

|

|

|

2023 |

|

2024 |

|

|

|

|

(RMB in thousands) |

|

|

|

Net revenues |

|

|

|

|

|

|

|

JD NOW2 |

|

|

|

|

|

|

|

Services note (1) |

|

1,786,564 |

|

1,278,538 |

|

(28.4 |

)% |

|

Subtotal |

|

1,786,564 |

|

1,278,538 |

|

(28.4 |

)% |

|

Dada Now |

|

|

|

|

|

|

|

Services |

|

733,775 |

|

1,160,010 |

|

58.1 |

% |

|

Sales of goods |

|

15,070 |

|

13,207 |

|

(12.4 |

)% |

|

Subtotal |

|

748,845 |

|

1,173,217 |

|

56.7 |

% |

|

Total |

|

2,535,409 |

|

2,451,755 |

|

(3.3 |

)% |

|

|

|

|

|

|

|

|

|

Note:(1) Includes net revenues from (i)

commission fee, and online advertising and marketing services of

RMB1,099,175 and RMB786,589 for the three months ended March 31,

2023 and 2024, respectively; and (ii) fulfillment services and

others of RMB687,389 and RMB491,949 for the three months ended

March 31, 2023 and 2024, respectively.

- Net

revenues generated from JD NOW was RMB1,278.5 million in

the first quarter of 2024, compared with RMB1,786.6 million in the

first quarter of 2023, mainly due to a decrease in online

advertising and marketing services revenues, and a decrease in

fulfillment service revenues as a result of the full rollout of

delivery fee waiver program for orders exceeding RMB59, which order

threshold was further lowered to RMB29 starting in February

2024.

- Net

revenues generated from Dada Now increased by 56.7% from

RMB748.8 million in the first quarter of 2023 to RMB1,173.2 million

in the first quarter of 2024, mainly driven by an increase in order

volume of intra-city delivery services provided to various chain

merchants.

Total costs and expenses were

RMB2,817.5 million, compared with RMB2,934.1 million in the same

quarter of 2023.

-

Operations and support costs were RMB1,840.0

million, compared with RMB1,397.1 million in the same quarter of

2023. The increase was primarily due to an increase in rider cost

as a result of the increasing order volume of intra-city delivery

services provided to various chain merchants.

- Selling

and marketing expenses were RMB818.3 million, compared

with RMB1,316.6 million in the same quarter of 2023. The decrease

was primarily due to a decrease in promotion activities conducted

on the JD NOW platform.

- General

and administrative expenses were RMB50.6 million, compared

with RMB78.6 million in the same quarter of 2023. The decrease was

primarily due to a decrease in amortization of intangible assets

arising from the acquisition of JD NOW2 in 2016.

-

Research and development expenses were RMB94.1

million, compared with RMB128.8 million in the same quarter of

2023. The decrease was mainly attributable to a decrease in

research and development personnel costs.

Loss from operations was

RMB364.8 million, compared with RMB386.4 million in the same

quarter of 2023.

Non-GAAP loss from

operations3 was RMB229.7 million,

compared with RMB216.6 million in the same quarter of 2023.

Net loss was RMB328.0 million,

compared with RMB350.4 million in the same period of 2023.

Non-GAAP net

loss4 was RMB194.8 million, compared with

RMB182.0 million in the same period of 2023.

Basic and diluted net loss per ordinary

share was RMB0.31, compared with RMB0.34 for the first

quarter of 2023.

Non-GAAP basic and diluted net loss per

ordinary share5 was RMB0.18 for the first

quarters of 2024 and 2023, respectively.

As of March 31, 2024, the Company had RMB3,813.2

million in cash, cash equivalents, restricted cash and

short-term investments, compared with RMB3,970.6 million

as of December 31, 2023.

Pursuant to our US$40 million share

repurchase program announced in March 2024, as of April

30, 2024, we had repurchased approximately US$8.4 million of

American Depositary Shares (ADSs) under this repurchase

program.

Environment, Social Responsibility and

Governance (ESG)

- Recognition by

the government:

- In February

2024, Dada was awarded the "2023 Yangpu District Innovative

Enterprise Award" by the Shanghai Yangpu District Government.

- Care for

riders:

- At the end of

January 2024, partnering with Haleon, a world-leading consumer

health company, Dada provided thousands of riders in Beijing and

Shanghai with Chinese New Year gifts such as Centrum multivitamins

and Calcrate calcium supplements to help them improve health.

- In March 2024,

Dada secured accommodation for a group of riders in the Yangpu

Riverside Home for City Builders and Managers in the New Era, a

government-subsidized rental housing project, improving the quality

of life and reducing the cost of living for our riders.

Conference Call

The Company will host a conference call to

discuss the earnings at 9:30 p.m. Eastern Time on Wednesday, May

15, 2024 (9:30 a.m. Beijing time on Thursday, May 16, 2024).

Please register in advance of the conference

using the link provided below and dial in 10 minutes prior to the

call.

PRE-REGISTER LINK:

https://s1.c-conf.com/diamondpass/10038668-jpo84Gy.html

Upon registration, each participant will receive details for the

conference call, including dial-in numbers, conference call

passcode and a unique access PIN. To join the conference, please

dial the number provided, enter the passcode followed by your PIN,

and you will join the conference.

A telephone replay of the call will be available

after the conclusion of the conference call through May 23,

2024.

Dial-in numbers for the replay are as

follows:

|

U.S./Canada |

1-855-883-1031 |

| Mainland China |

400-1209-216 |

| Hong Kong |

800-930-639 |

| Replay PIN |

10038668 |

| |

|

A live and archived webcast of the conference

call will be available on the Investor Relations section of Dada’s

website at https://ir.imdada.cn/.

Use of Non-GAAP Financial Measures

The Company also uses certain non-GAAP financial

measures in evaluating its business. For example, the Company uses

non-GAAP income/(loss) from operations, non-GAAP net income/(loss),

non-GAAP net margin, and non-GAAP net income/(loss) per ordinary

share as supplemental measures to review and assess its financial

and operating performance. Non-GAAP income/(loss) from operations

is income/(loss) from operations excluding the impact of

share-based compensation expenses and amortization of intangible

assets resulting from acquisitions. Non-GAAP net income/(loss) is

net income/(loss) excluding the impact of share-based compensation

expenses, amortization of intangible assets resulting from

acquisitions, and tax benefit from amortization of such intangible

assets. Non-GAAP net margin is non-GAAP net income/(loss) as a

percentage of total net revenues. Non-GAAP net income/(loss) per

ordinary share is non-GAAP net income/(loss) divided by weighted

average number of shares used in calculating net income/(loss) per

ordinary share.

The Company presents the non-GAAP financial

measures because they are used by the Company’s management to

evaluate the Company’s financial and operating performance and

formulate business plans. Non-GAAP income/(loss) from operations

and non-GAAP net income/(loss) enable the Company’s management to

assess the Company’s financial and operating results without

considering the impact of share-based compensation expenses,

amortization of intangible assets resulting from acquisitions, and

tax benefit from amortization of such intangible assets. The

Company also believes that the use of the non-GAAP financial

measures facilitates investors’ assessment of the Company’s

financial and operating performance.

The non-GAAP financial measures are not defined

under accounting principles generally accepted in the United States

of America (“U.S. GAAP”) and are not presented in accordance with

U.S. GAAP. The non-GAAP financial measures have limitations as

analytical tools. One of the key limitations of using non-GAAP

financial measures is that they do not reflect all items of income

and expense that affect the Company’s operations. Share-based

compensation expenses, amortization of intangible assets resulting

from acquisitions, and tax benefit from amortization of such

intangible assets have been and may continue to be incurred in the

Company’s business and are not reflected in the presentation of

non-GAAP financial measures. Further, the non-GAAP financial

measures may differ from the non-GAAP financial measures used by

other companies, including peer companies, potentially limiting the

comparability of their financial results to the Company’s. In light

of the foregoing limitations, non-GAAP financial measures should

not be considered in isolation from or as an alternative to

financial measures prepared in accordance with U.S. GAAP.

The Company compensates for these limitations by

reconciling the non-GAAP financial measures to the nearest U.S.

GAAP performance measures, which should be considered when

evaluating the Company’s performance. For reconciliations of these

non-GAAP financial measures to the most directly comparable GAAP

financial measures, please see the section of the accompanying

tables titled, “Reconciliations of GAAP and Non-GAAP Results.”

Forward-Looking Statements

This press release contains statements that may

constitute “forward-looking” statements pursuant to the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform

Act of 1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “likely to”

and similar statements. Among other things, quotations in this

announcement, contain forward-looking statements. Dada may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (the “SEC”),

in its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not

historical facts, including statements about Dada’s beliefs, plans

and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: Dada’s strategies; Dada’s future business

development, financial condition and results of operations; Dada’s

ability to maintain its relationship with major strategic

investors; its ability to offer quality on-demand retail experience

and provide efficient on-demand delivery services; its ability to

maintain and enhance the recognition and reputation of its brands;

general economic and business conditions globally and in China and

assumptions underlying or related to any of the foregoing. Further

information regarding these and other risks is included in Dada’s

filings with the SEC. All information provided in this press

release is as of the date of this press release, and Dada does not

undertake any obligation to update any forward-looking statement,

except as required under applicable law.

About Dada Nexus Limited

Dada Nexus Limited is China’s leading local

on-demand retail and delivery platform. It operates JD NOW,

formerly known as JDDJ, one of China’s largest local on-demand

retail platforms for retailers and brand owners, and Dada Now, a

leading local on-demand delivery platform open to merchants and

individual senders across various industries and product

categories. The Company’s two platforms are inter-connected and

mutually beneficial. The vast volume of on-demand delivery orders

from the JD NOW platform increases order volume and density for the

Dada Now platform. Meanwhile, the Dada Now platform enables

improved delivery experience for participants on the JD NOW

platform through its readily accessible fulfillment solutions and

strong on-demand delivery infrastructure.

For more information, please visit https://ir.imdada.cn/.

For investor inquiries, please contact:

Dada Nexus LimitedMs. Caroline DongE-mail: ir@imdada.cn

Christensen

In ChinaMr. Rene VanguestainePhone: +86-178-1749-0483E-mail:

rene.vanguestaine@christensencomms.com

In USMs. Linda BergkampPhone: +1-480-614-3004E-mail:

linda.bergkamp@christensencomms.com

For media inquiries, please

contact:

Dada Nexus Limited E-mail: PR@imdada.cn

Appendix I

|

DADA NEXUS LIMITED |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(Amounts in thousands) |

|

|

|

|

|

|

|

|

|

As of December 31, |

|

As of March 31, |

|

|

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

ASSETS |

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

1,893,032 |

|

2,680,764 |

|

Restricted cash |

|

519,207 |

|

422,872 |

|

Short-term investments |

|

1,558,315 |

|

709,546 |

|

Accounts receivable, net |

|

386,768 |

|

379,553 |

|

Inventories |

|

9,270 |

|

8,551 |

|

Amount due from related parties |

|

1,287,080 |

|

1,118,862 |

|

Prepayments and other current assets |

|

415,326 |

|

140,501 |

|

Total current assets |

|

6,068,998 |

|

5,460,649 |

|

Non-current assets |

|

|

|

|

|

Property and equipment, net |

|

8,392 |

|

7,036 |

|

Intangible assets, net |

|

1,479,644 |

|

1,371,841 |

|

Operating lease right-of-use assets |

|

16,335 |

|

11,693 |

|

Other non-current assets |

|

512 |

|

407 |

|

Total non-current assets |

|

1,504,883 |

|

1,390,977 |

|

TOTAL ASSETS |

|

7,573,881 |

|

6,851,626 |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

5,008 |

|

8,704 |

|

Payable to riders and drivers |

|

867,323 |

|

822,222 |

|

Amount due to related parties |

|

190,039 |

|

102,207 |

|

Accrued expenses and other current liabilities |

|

922,483 |

|

637,514 |

|

Operating lease liabilities |

|

14,719 |

|

10,159 |

|

Total current liabilities |

|

1,999,572 |

|

1,580,806 |

|

Non-current liabilities |

|

|

|

|

|

Deferred tax liabilities |

|

16,979 |

|

14,892 |

|

Non-current operating lease liabilities |

|

414 |

|

133 |

|

Total non-current liabilities |

|

17,393 |

|

15,025 |

|

TOTAL LIABILITIES |

|

2,016,965 |

|

1,595,831 |

|

|

|

|

|

|

|

TOTAL SHAREHOLDERS’ EQUITY |

|

5,556,916 |

|

5,255,795 |

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

7,573,881 |

|

6,851,626 |

|

|

|

|

|

|

|

DADA NEXUS LIMITEDUNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS(Amounts in thousands, except share and per

share data) |

|

|

|

|

|

|

|

For the three months ended March 31, |

|

|

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

|

2,535,409 |

|

|

2,451,755 |

|

|

Costs and expenses |

|

|

|

|

|

Operations and support |

|

(1,397,144 |

) |

|

(1,840,027 |

) |

|

Selling and marketing |

|

(1,316,643 |

) |

|

(818,298 |

) |

|

General and administrative |

|

(78,567 |

) |

|

(50,563 |

) |

|

Research and development |

|

(128,795 |

) |

|

(94,059 |

) |

|

Other operating expenses |

|

(12,948 |

) |

|

(14,527 |

) |

|

Total costs and expenses |

|

(2,934,097 |

) |

|

(2,817,474 |

) |

|

Other operating income |

|

12,321 |

|

|

871 |

|

|

Loss from operations |

|

(386,367 |

) |

|

(364,848 |

) |

|

Other income/(expenses) |

|

|

|

|

|

Interest expenses |

|

(451 |

) |

|

— |

|

|

Others, net |

|

35,117 |

|

|

34,822 |

|

|

Total other income, net |

|

34,666 |

|

|

34,822 |

|

|

Loss before income tax benefits |

|

(351,701 |

) |

|

(330,026 |

) |

|

Income tax benefits |

|

1,253 |

|

|

2,055 |

|

|

Net loss |

|

(350,448 |

) |

|

(327,971 |

) |

|

Net loss per ordinary share: |

|

|

|

|

|

Basic |

|

(0.34 |

) |

|

(0.31 |

) |

|

Diluted |

|

(0.34 |

) |

|

(0.31 |

) |

|

Weighted average number of shares used in calculating net

loss per ordinary share |

|

|

|

|

|

Basic |

|

1,023,413,776 |

|

|

1,057,139,291 |

|

|

Diluted |

|

1,023,413,776 |

|

|

1,057,139,291 |

|

|

|

|

|

|

|

|

Net loss |

|

(350,448 |

) |

|

(327,971 |

) |

| Other comprehensive

(loss)/income |

|

|

|

|

|

Foreign currency translation adjustments, net of tax of nil |

|

(29,902 |

) |

|

13,150 |

|

|

Total comprehensive loss |

|

(380,350 |

) |

|

(314,821 |

) |

|

DADA NEXUS LIMITEDReconciliations of GAAP

and Non-GAAP Results(Amounts in thousands, except

share, per share and percentage data) |

|

|

|

|

|

|

|

For the three months ended March 31, |

|

|

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

|

|

|

|

|

|

Loss from operations |

|

(386,367 |

) |

|

(364,848 |

) |

|

Add: |

|

|

|

|

|

Share-based compensation expenses |

|

37,481 |

|

|

15,121 |

|

|

Amortization of intangible assets resulting from acquisitions |

|

132,256 |

|

|

120,066 |

|

| Non-GAAP loss from

operations |

|

(216,630 |

) |

|

(229,661 |

) |

| |

|

|

|

|

| Net loss |

|

(350,448 |

) |

|

(327,971 |

) |

|

Add: |

|

|

|

|

|

Share-based compensation expenses |

|

37,481 |

|

|

15,121 |

|

|

Amortization of intangible assets resulting from acquisitions |

|

132,256 |

|

|

120,066 |

|

|

Income tax benefit |

|

(1,253 |

) |

|

(2,055 |

) |

| Non-GAAP net

loss |

|

(181,964 |

) |

|

(194,839 |

) |

| |

|

|

|

|

| Net revenues |

|

2,535,409 |

|

|

2,451,755 |

|

|

|

|

|

|

|

| Non-GAAP net

margin |

|

-7.2 |

% |

|

-7.9 |

% |

| |

|

|

|

|

| Non-GAAP net loss per

ordinary share |

|

|

|

|

|

Basic |

|

(0.18 |

) |

|

(0.18 |

) |

|

Diluted |

|

(0.18 |

) |

|

(0.18 |

) |

| |

|

|

|

|

| Weighted average

number of shares used in calculating net loss per ordinary

share |

|

|

|

|

|

Basic |

|

1,023,413,776 |

|

|

1,057,139,291 |

|

|

Diluted |

|

1,023,413,776 |

|

|

1,057,139,291 |

|

____________________________

1 Monthly transacting user refers to a user account that placed

at least one order on our JD NOW platform in a given month,

regardless of whether the order was subsequently paid, cancelled,

delivered, returned, or refunded.2 JD NOW was formerly known as

JDDJ. JDDJ brands were upgraded to JD NOW in May 2024.3 Non-GAAP

income/(loss) from operations represents income/(loss) from

operations excluding the impact of share-based compensation

expenses and amortization of intangible assets resulting from

acquisitions. 4 Non-GAAP net income/(loss) represents net

income/(loss) excluding the impact of share-based compensation

expenses, amortization of intangible assets resulting from

acquisitions, and tax benefit from amortization of such intangible

assets. 5 Non-GAAP net income/(loss) per ordinary share is non-GAAP

net income/(loss) divided by weighted average number of shares used

in calculating net income/(loss) per ordinary share.

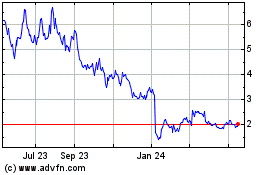

Dada Nexus (NASDAQ:DADA)

Historical Stock Chart

From Dec 2024 to Jan 2025

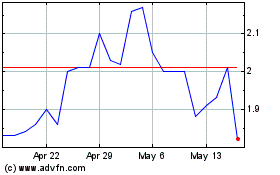

Dada Nexus (NASDAQ:DADA)

Historical Stock Chart

From Jan 2024 to Jan 2025