EUROPE MARKETS: European Stocks Rise As U.K. Banks Pass Brexit Stress Test; Deutsche Bank Raid Adds Pressure

November 29 2018 - 8:21AM

Dow Jones News

By Emily Horton

British American Tobacco, Nestle, Safran among day's gainers

European markets rose after all FTSE 100 banks passed the Bank

of England's Brexit scenario stress test. But a raid at Deutsche

Bank AG tied to a money-laundering probe limited the gains.

How are the markets performing?

European stocks were up on Thursday, with the Stoxx Europe 600

was up 0.1% to 357.85, after ending little changed on

Wednesday.

The German DAX (DAX) edged up 0.1% to 11,312.10, while the

French CAC rose 0.4% to 5,005.01. The FTSE 100 (0100.HK) was up

0.6% at 7,048.77 after shedding 0.2% on Wednesday.

The British pound was down to $1.2775, from $1.2824 late in New

York on Wednesday and the euro rose slightly to $1.1389, from

$1.1368.

What is driving stocks?

Deutsche Bank AG (DBK.XE)(DBK.XE)was raided by German

prosecutors and police on Thursday

(http://www.marketwatch.com/story/deutsche-bank-raided-over-money-laundering-probe-2018-11-29),

amid suspicions that the bank helped clients set up offshore

accounts in tax havens and failed to inform authorities to

potential money laundering. Deutsche Bank shares fell 1.8% byut

were off their earlier lows.

All British banks passed the Bank of England's Brexit stress

test, which modeled for the most severe outcome of a no-deal

Brexit. Royal Bank of Scotland Group PLC (RBS.LN) was one of the

best, while Barclays PLC (BCS) and Lloyds Banking Group PLC

(LLOY.LN) were among the worst.

However, the BOE offered a bleak outlook for the U.K. economy

under a no-deal Brexit scenario

(http://www.marketwatch.com/story/bank-of-england-shows-bleak-outlook-for-uk-economy-under-no-deal-brexit-scenario-2018-11-28)

and warned that a "disorderly" crash-out Brexit could cause more

damage to the UK economy than the global financial crisis.

Federal Reserve Chairman Jay Powell's comments on Wednesday that

interest rates are now close to neutral helped push the Dow Jones

Industrial Average to its biggest one-day gain since March. On

Thursday, stock futures were nudging lower

(http://www.marketwatch.com/story/stock-futures-point-to-pullback-after-dows-best-day-in-8-months-2018-11-29).

What other stocks are active?

Alcohol, beverage and tobacco stocks were among the biggest

climbers on Thursday, with British American Tobacco PLC (BATS.LN)

up 2.1% and Diageo PLC (DEO) added 0.6%. Heavyweight food and

drinks stock Nestlé S.A.(NESN.EB) firmed 0.9%.

France's Safran SA(SAF.FR) jumped 3.6% on news of an expanded

share-buyback program and a fresh multiyear outlook.

(END) Dow Jones Newswires

November 29, 2018 09:06 ET (14:06 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

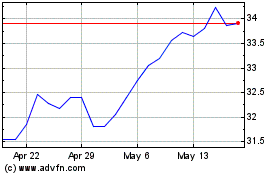

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

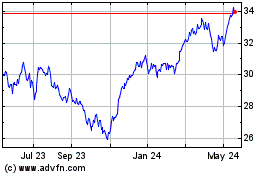

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024