EUROPE MARKETS: European Stocks Sink A Day After Fed Decision

December 20 2018 - 9:39AM

Dow Jones News

By Barbara Kollmeyer, MarketWatch

DAX remains in the grip of a bear market

European stocks took a hard hit on Thursday, as investors in the

region got their first chance to react to what many viewed as a

disappointing policy decision by the Federal Reserve.

Banks and major oil companies were leading decliners.

How are the markets performing?

The Stoxx Europe 600 dropped 0.9% to 6,756.69, after finishing

up 0.3% on Wednesday.

The German DAX (DAX) fell 1.1% to 10,647.50. The index is now

down 21.6% from its 52-week high, and has been trading in

bear-market territory for the last several sessions. A bear market

is usually defined as a drop of at least 20% from a recent

peak.

France's CAC 40 tumbled 1.7% to 4,697.06. The FTSE 100 saw the

lightest losses, down just 0.3% to 6,746.92.

Dollar weakness in the wake of the Fed move boosted rivals, such

as the euro , which rose to $1.1460, compared with $1.1379 in New

York late on Wednesday. The pound climbed to $1.2682 from

$1.2662.

What is driving markets?

The Fed was widely expected to increase the federal-funds rate

(http://www.marketwatch.com/story/defying-trump-fed-hikes-interest-rates-by-a-quarter-point-2018-12-19),

and while it penciled in fewer hikes for 2019--two compared with

three before-- investors appeared to be seeking a more dovish move

from the central bank. U.S. stocks, which had rallied in the run-up

to the decision, sold off sharply, with stock futures indicating a

potentially tough session for Wall Street on Thursday.

Europe, which closed before that Fed decision was announced,

followed up on Thursday with losses of its own.

Elsewhere, the Bank of England on Thursday voted unanimously to

keep lending rates on hold, citing concerns over global growth and

Brexit risks. Data showed retail sales rose in November in the

U.K., with a big lift coming from Black Friday online shopping

(http://www.marketwatch.com/story/uk-retail-sales-lifted-by-black-friday-shopping-2018-12-20).

(http://www.marketwatch.com/story/uk-retail-sales-lifted-by-black-friday-shopping-2018-12-20)Airline

stocks were in focus after London Gatwick Airport shut down

(http://www.marketwatch.com/story/major-pharma-companies-plan-to-raise-drug-prices-in-january-report-2018-12-19)

late Wednesday and that continued Thursday, amid reports that two

drones were flying above the airfield led to a formal

investigation.

What stocks are active?

Airline stocks were in focus after London Gatwick Airport shut

dow

(http://www.marketwatch.com/story/major-pharma-companies-plan-to-raise-drug-prices-in-january-report-2018-12-19)n

late Wednesday, amid reports that two drones were flying above the

airfield led to a formal investigation. Ryanair Holdings PLC

(RYAAY) slid 2.6%(LHA.XE) all fell by 2%. Cruise line company

Carnival PLC (CCL.LN) lost 5%.

Danish electronics company Bang & Olufsen A/S (BO.KO) was

one of the biggest midcap fallers, with stocks dropping by 31%.

-- Barbara Kollmeyer contributed to this article

(END) Dow Jones Newswires

December 20, 2018 10:24 ET (15:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

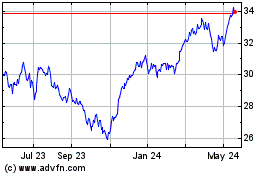

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

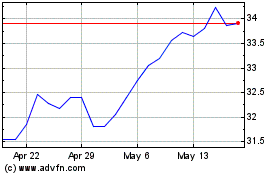

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024