Eagle Bancorp, Inc. Announces Final Results of its Exchange Offer for its Outstanding 10.00% Senior Notes Due 2029

January 15 2025 - 9:33AM

Eagle Bancorp, Inc. (NASDAQ: EGBN) (“Eagle”) announced today that

as of 5:00 p.m., New York City time, on January 14, 2025 (the

“Expiration Date”), $73.5 million in aggregate principal amount of

outstanding 10.00% Senior Notes due 2029 (CUSIPs: 268948 AC0 and

268948 AD8) (the “Original Notes”) representing approximately 95%

of the $77.7 million total outstanding principal amount of the

Original Notes, were validly tendered and not validly withdrawn in

connection with the previously announced exchange offer (the

“Exchange Offer”) made by Eagle to exchange any and all of the

Original Notes for a like principal amount of notes of the same

series that have been registered under the Securities Act of 1933,

as amended (the “Securities Act”).

As of the Expiration Date, the aggregate

principal amount of the Original Notes specified in the fourth

column in the table below were validly tendered and not validly

withdrawn with respect to the Exchange Offer.

|

CUSIPNumber |

|

Title of the Original Notes |

|

Principal Amount Outstanding |

|

Principal Amount of Original Notes Validly Tendered as of

the Expiration Date |

|

Percentage of Original Notes Validly Tendered as of the

Expiration Date |

| 268948 AC0 (Rule 144A)268948 AD8

(Accredited Investor) |

|

10.00% Senior Notes due 202910.00% Senior Notes due 2029 |

|

$72,500,000$5,165,000 |

|

$72,500,000$1,000,000 |

|

100%19.4% |

| |

|

|

|

|

|

|

|

|

The Exchange Offer was made upon the terms and

conditions set forth in a prospectus filed with the Securities and

Exchange Commission (the “SEC”) on December 3, 2024 (the

“Prospectus”).

The “Settlement Date” with respect to the

Exchange Offer will be promptly following the Expiration Date and

is expected to be January 16, 2025. Upon settlement of the Exchange

Offer, holders who validly tendered their Original Notes by the

Expiration Date and did not validly withdraw their tendered

Original Notes before the Expiration Date are eligible to receive,

subject to the terms and conditions set forth in the Prospectus,

notes of the same series in the same principal amount that have

been registered under the Securities Act (the “Exchange Notes”).

The terms of the Exchange Notes are substantially identical to the

terms of the Original Notes, except that transfer restrictions and

registration rights applicable to the Original Notes do not apply

to the Exchange Notes.

Wilmington Trust, National Association acted as

Exchange Agent for the Exchange Offer. Questions or requests for

assistance related to the Exchange Offer or for additional copies

of the Prospectus may be directed to Wilmington Trust, National

Association at (302) 636-6470 or at Rodney Square North 1100 North

Market Street, Wilmington, Delaware 19890-1626, Attention: Workflow

Management – 5th Floor. You may also contact your broker, dealer,

commercial bank, trust company or other nominee for assistance

concerning the Exchange Offer.

Disclaimer

This press release is for informational purposes

only and does not constitute an offer to purchase, or a

solicitation of an offer to sell, any Original Notes, and does not

constitute an offer to sell, or a solicitation of an offer to

purchase, any Exchange Notes. The Exchange Offer was made solely

pursuant to the Prospectus and related documents. The Exchange

Offer was not made to holders of Original Notes in any jurisdiction

in which the making or acceptance thereof would not be in

compliance with the securities, blue sky or other laws of such

jurisdiction.

About Eagle BancorpEagle is the

holding company for EagleBank, which commenced operations in 1998.

EagleBank is headquartered in Bethesda, Maryland, and operates

through twelve banking offices and four lending offices located in

Suburban Maryland, Washington, D.C. and Northern Virginia. Eagle

focuses on building relationships with businesses, professionals

and individuals in its marketplace.

Caution About Forward-Looking

StatementsThis communication contains “forward-looking

statements” — that is, statements related to future, not past,

events. In this context, forward-looking statements often contain

words such as “expect,” “anticipate,” “intend,” “plan,” “believe,”

“seek,” “see,” “will,” “would,” or “target.” Forward-looking

statements by their nature address matters that are, to different

degrees, uncertain. Statements with respect to the Exchange Offer

are forward-looking statements, based on Eagle’s current

expectations for the Exchange Offer, and are subject to the risk

that the Exchange Offer may not be completed in a timely manner or

at all, and that the final terms of the Exchange Offer may differ,

possibly materially, from those described in this press release due

to future events. For details on factors that could affect these

expectations, see the risk factors and other cautionary language

included in Eagle’s Annual Report on Form 10-K for the year ended

December 31, 2023, and other filings with the SEC. The

forward-looking statements included in this press release are made

only as of the date of this press release, and except as required

by law, we undertake no obligation to update publicly these

forward-looking statements to reflect new information, future

events or otherwise.

EagleBank ContactEric Newell, Chief Financial

Officer, Eagle Bancorp, Inc.240.497.1796

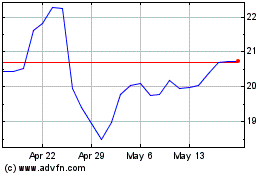

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Dec 2024 to Jan 2025

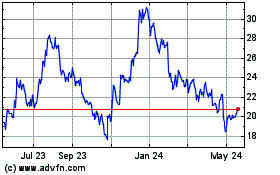

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jan 2024 to Jan 2025