false

--12-31

0001840563

0001840563

2024-11-20

2024-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date

of earliest event reported): November 20, 2024

| Elevai Labs Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-41875 |

|

85-1399981 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

c/o 120 Newport Center Drive, Ste. 250

Newport Beach, CA |

|

92660 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (866) 794-4940

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

|

ELAB |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03 Material Modification to Rights of Security

Holders.

To the extent required by Item 3.03 of Form 8-K,

the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03 Amendment to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

On November 20, 2024, Elevai Labs Inc. (the “Company”)

filed a Certificate of Amendment to the Company’s Third and Amended Certificate of Incorporation, as amended (the “Certificate

of Amendment”), to effect a 1-for-200 reverse stock split (the “reverse stock split”) of the shares of the Company’s

common stock, par value $0.0001 per share (the “Common Stock”), on November 27, 2024. The Certificate of Amendment has no

effect on the par value of the Common Stock. No fractional shares were issued in connection with the reverse stock split and stockholders

received one share of Common Stock in lieu of a fractional share.

The Reverse Stock Split

was approved by the Company’s stockholders on August 12, 2024, at a ratio of not less than 1-for-2 and not greater than 1-for-200,

with the exact ratio, if approved and effected at all, to be set within that range at the discretion of the Chief Executive Officer of

the Company. On August 22, 2024, the board of directors approved a ratio of not less than 1-for-2 and not greater than 1-for-200, with

the exact ratio, if approved and effected at all, to be set within that range at the discretion of the Chief Executive Officer of the

Company.

The Amendment provides

that at the Effective Time, every 200 shares of the Company’s issued and outstanding Common Stock immediately prior to the Effective

Time will automatically be reclassified, without any action on the part of the holder thereof, into one share of Common Stock. Fractional

shares will not be issued pursuant to the Reverse Stock Split and stockholders who otherwise would be entitled to receive a fractional

share in connection with the Reverse Stock Split shall be entitled to receive one whole share at the effective time of the Reverse Stock

Split.

The Company is effectuating

the Reverse Stock Split as part of its efforts to achieve compliance with The Nasdaq Stock Market LLC’s (“Nasdaq”) Listing Rule

5550(a)(2), which requires a minimum closing bid price of $1.00 per share required for continued listing on the Nasdaq.

VStock Transfer, LLC

is acting as exchange agent for the Reverse Stock Split and will send instructions to stockholders of record who hold stock certificates

regarding the exchange of certificates for Common Stock, should they wish to do so. Stockholders who hold their shares in brokerage accounts

or “street name” are not required to take any action to effect the exchange of their shares.

The Common Stock will begin trading on a

reverse stock split-adjusted basis on The Nasdaq Capital Market when the market opens on November 27, 2024. The trading symbol for

the Common Stock remains “ELAB.” The Common Stock will be assigned a new CUSIP number (28622K 203) following the reverse

stock split.

The Company has adjusted the number of shares

available for future grant under its equity incentive plan and has also adjusted the number of outstanding awards, the exercise price

per share of outstanding stock options and other terms of outstanding awards issued to reflect the effects of the reverse stock split.

A copy of the Certificate of Amendment is filed

hereto as Exhibit 3.1 and is incorporated herein by reference.

Item 8.01. Other Information.

On November 22, 2024, the Company issued a press

release announcing the reverse stock split. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K

and is incorporated herein by reference.

The information presented in Item 8.01 of this

Current Report on Form 8-K and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the

Company specifically states that the information is to be considered “filed” under the Exchange Act or specifically incorporates

it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November

22, 2024

| Elevai Labs, Inc. |

|

| |

|

|

| By: |

/s/ Graydon Bensler |

|

| Name: |

Graydon Bensler |

|

| Title: |

Chief Executive Officer, President and Director |

|

3

Exhibit 3.1

Exhibit 99.1

Elevai Labs Inc. Announces Reverse Stock Split to Maintain Nasdaq

Listing Compliance

Newport Beach, Calif., November 22, 2024 – Elevai Labs Inc. (NASDAQ:

ELAB) (“Elevai" or the "Company") announced today it will implement a 1-for-200 reverse stock split (“Reverse

Stock Split”) of its common stock, which will be effective at midnight on November 27, 2024. This initiative aligns with the Company’s

efforts to meet Nasdaq's minimum bid price requirement of $1.00 per share under Listing Rule 5550(a)(2).

Key Details of the Reverse Stock Split:

- Conversion Ratio: Every 200 shares of issued and outstanding common

stock will be automatically consolidated into one share, with no action required from shareholders.

- Fractional Shares: Shareholders entitled to fractional shares will

receive one full share for each fractional portion.

- Updated Stock Identifier: While the trading symbol remains "ELAB",

the common stock now carries a new CUSIP number (28622K 203).

- Equity Adjustments: Outstanding stock awards, options, and the equity

incentive plan have been adjusted proportionally to reflect the new share structure.

Purpose of the Reverse Stock Split:

The Reverse Stock Split is a critical step in ensuring compliance with

Nasdaq’s listing requirements, allowing Elevai to maintain its presence on the Nasdaq Capital Market. A continued listing enhances

the Company’s visibility, strengthens investor confidence, and positions Elevai for future growth.

Impact on Shareholders:

- No Immediate Action Required: Shareholders holding shares through

a broker or in "street name" will see their holdings updated automatically.

- Certificate Holders: Shareholders with physical certificates can

exchange them, if desired, through VStock Transfer, LLC, which will provide detailed instructions.

- Share Value: The Reverse Stock Split does not impact the overall

value of shareholder equity; it only reduces the number of shares outstanding while proportionally adjusting the share price.

Impact on our Common Stock:

-Post Reverse Stock Split there will be approximately

3.07 million shares of common stock issued and outstanding.

Looking Ahead:

“The reverse stock split is a required measure to preserve Elevai’s

Nasdaq listing and set the stage for our continued progress in innovation and shareholder value creation,” said Graydon Bensler,

Chief Executive Officer of Elevai. “We are optimistic about the future and committed to executing our growth strategy.”

For additional information, please refer to Elevai’s full Form

8-K filing available regarding the Reverse Stock Split, filed on November 22, 2024, on the SEC’s website, or contact Elevai directly

at IR@elevailabs.com.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

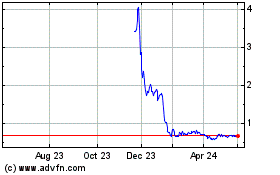

Elevai Labs (NASDAQ:ELAB)

Historical Stock Chart

From Oct 2024 to Nov 2024

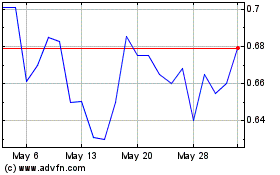

Elevai Labs (NASDAQ:ELAB)

Historical Stock Chart

From Nov 2023 to Nov 2024