- Total Revenues of $567 million for the

Fourth Quarter of 2024, $2.17 billion for the Fiscal Year

2024 - - Cabozantinib Franchise Achieved $1.81 billion in

U.S. Net Product Revenues for the Fiscal Year 2024, including $515

million for the Fourth Quarter of 2024 - - GAAP Diluted EPS

of $0.48 for the Fourth Quarter of 2024, $1.76 for the

Fiscal Year 2024 - - Non-GAAP Diluted EPS of $0.55 for the

Fourth Quarter of 2024, $2.00 for the Fiscal Year 2024 -

- Conference Call and Webcast Today at 5:00 PM Eastern Time

-

Exelixis, Inc. (Nasdaq: EXEL) today reported financial results

for the fourth quarter and fiscal year of 2024, provided an update

on progress toward achieving key corporate objectives, and outlined

its commercial, clinical and pipeline development milestones.

“Exelixis delivered a strong fourth quarter of 2024, positioning

us well to maximize success in 2025,” said Michael M. Morrissey,

Ph.D., President and Chief Executive Officer, Exelixis. “Due to the

continued outsized performance of the cabozantinib franchise, we

generated net product revenues of $515 million and $1.81 billion in

the fourth quarter and full year 2024, respectively. Our current

2025 guidance, which does not include any impact from a potential

U.S. regulatory approval for CABOMETYX® in advanced neuroendocrine

tumors, points to solid growth for the cabozantinib franchise.

We’re launch-ready for this important indication ahead of an April

3, 2025 PDUFA target action date for our U.S. regulatory

filing.”

Dr. Morrissey continued: “We expect zanzalintinib to take center

stage in 2025 as our next franchise opportunity that could improve

standards of care for patients with cancer. Our anticipated

zanzalintinib pivotal data milestones include top-line results from

STELLAR-303 in colorectal cancer and STELLAR-304 in non-clear cell

renal cell carcinoma, and a decision to advance to the phase 3

portion of STELLAR-305 in head and neck cancer, all in the second

half of the year pending event rates for each trial. We are also

excited to deliver on our plan to initiate the STELLAR-311 trial of

zanzalintinib in neuroendocrine tumors in the first half of 2025

and anticipate Merck to initiate two renal cell carcinoma studies

evaluating zanzalintinib plus belzutifan this year. With so much in

store for 2025, the entire Exelixis team has a singular focus on

achieving our mission to help cancer patients recover stronger and

live longer.”

Fourth Quarter and Fiscal Year 2024

Financial Results

Total revenues for the quarter and year ended December

31, 2024 were $566.8 million and $2,168.7 million, as compared to

$479.7 million and $1,830.2 million for the comparable periods in

2023.

Total revenues for the quarter and year ended December 31, 2024

included net product revenues of $515.2 million and $1,809.4

million, respectively, as compared to $429.3 million and $1,628.9

million for the comparable periods in 2023. The increases in net

product revenues, for both periods, were primarily due to an

increase in sales volume and an increase in average net selling

price.

Collaboration revenues, composed of license revenues and

collaboration services revenues, were $51.5 million for the quarter

ended December 31, 2024, as compared to $50.3 million for the

comparable period in 2023. The increase in collaboration revenues

was primarily related to royalty revenues for the sales of

cabozantinib outside of the U.S. generated by Exelixis’

collaboration partners, Ipsen Pharma SAS and Takeda Pharmaceutical

Company Limited, partially offset by a decrease in development cost

reimbursements earned. Collaboration revenues were $359.3 million

for the year ended December 31, 2024, as compared to $201.3 million

for the comparable period in 2023. The increase was primarily

related to the recognition of milestone-related revenues and higher

royalty revenues for the sales of cabozantinib outside of the U.S.

generated by Exelixis’ collaboration partners, partially offset by

a decrease in development cost reimbursements earned.

Research and development expenses for the quarter ended

December 31, 2024 were $249.0 million, as compared to $244.7

million for the comparable period in 2023. The increase in research

and development expenses for the quarter was primarily related to

increases in license and other collaboration costs, personnel

expenses and higher manufacturing costs to support Exelixis’

development candidates, partially offset by decreases in clinical

trial costs, and consulting and outside services. Research and

development expenses for the year ended December 31, 2024 were

$910.4 million, as compared to $1,044.1 million for the comparable

period in 2023. The decrease in research and development expenses

for the year was primarily related to decreases in license and

other collaboration costs, personnel expenses, consulting and

outside services, and laboratory supplies, partially offset by

higher manufacturing costs to support Exelixis’ development

candidates and clinical trial costs.

Selling, general and administrative expenses for the

quarter ended December 31, 2024 were $134.3 million, as compared to

$131.4 million for the comparable period in 2023. The increase in

selling, general and administrative expenses for the quarter was

primarily related to increases in personnel expenses and

stock-based compensation expenses, partially offset by decreases in

corporate giving and legal and advisory fees. Selling, general and

administrative expenses for the year ended December 31, 2024 were

$492.1 million, as compared to $542.7 million for the comparable

period in 2023. The decrease in selling, general and administrative

expenses for the year was primarily related to decreases in

corporate giving, legal and advisory fees, technology costs, and

stock-based compensation expenses, partially offset by an increase

in personnel expenses.

Provision for income taxes for the quarter and year ended

December 31, 2024 was $44.9 million and $160.4 million,

respectively, as compared to $17.5 million and $49.8 million for

the comparable periods in 2023, primarily due to an increase in

pre-tax income.

GAAP net income for the quarter ended December 31, 2024

was $139.9 million, or $0.49 per share, basic and $0.48 per share,

diluted, as compared to GAAP net income of $85.5 million, or $0.28

per share, basic and $0.27 per share, diluted, for the comparable

period in 2023. GAAP net income for the year ended December 31,

2024 was $521.3 million, or $1.80 per share, basic and $1.76 per

share diluted, as compared to GAAP net income of $207.8 million, or

$0.65 per share, basic and diluted, for the comparable period in

2023.

Non-GAAP net income for the quarter ended December 31,

2024 was $160.3 million, or $0.56 per share, basic and $0.55 per

share, diluted, as compared to non-GAAP net income of $104.2

million, or $0.34 per share, basic and $0.33 per share diluted, for

the comparable period in 2023. Non-GAAP net income for the year

ended December 31, 2024 was $593.6 million, or $2.05 per share,

basic and $2.00 per share, diluted, as compared to non-GAAP net

income of $289.4 million or $0.91 per share, basic and $0.90 per

share, diluted, for the comparable period in 2023.

Non-GAAP Financial

Measures

To supplement Exelixis’ financial results presented in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP), Exelixis presents non-GAAP net income (and the related per

share measures), which excludes from GAAP net income (and the

related per share measures) stock-based compensation expense,

adjusted for the related income tax effect for all periods

presented.

Exelixis believes that the presentation of these non-GAAP

financial measures provides useful supplementary information to,

and facilitates additional analysis by, investors. In particular,

Exelixis believes that these non-GAAP financial measures, when

considered together with its financial information prepared in

accordance with GAAP, can enhance investors’ and analysts’ ability

to meaningfully compare Exelixis’ results from period to period,

and to identify operating trends in Exelixis’ business. Exelixis

has excluded stock-based compensation expense, adjusted for the

related income tax effect, because it is a non-cash item that may

vary significantly from period to period as a result of changes not

directly or immediately related to the operational performance for

the periods presented. Exelixis also regularly uses these non-GAAP

financial measures internally to understand, manage and evaluate

its business and to make operating decisions.

These non-GAAP financial measures are in addition to, not a

substitute for, or superior to, measures of financial performance

prepared in accordance with GAAP. Exelixis encourages investors to

carefully consider its results under GAAP, as well as its

supplemental non-GAAP financial information and the reconciliation

between these presentations, to more fully understand Exelixis’

business. Reconciliations between GAAP and non-GAAP results are

presented in the tables of this release.

2025 Financial Guidance

Exelixis is maintaining the previously provided financial

guidance for fiscal year 2025. Net product and total revenues

guidance do not currently reflect any revenues resulting from a

potential U.S. regulatory approval and commercial launch of

CABOMETYX® (cabozantinib) for the treatment of patients with

previously treated advanced neuroendocrine tumors (NET). The U.S.

Food and Drug Administration (FDA) is currently reviewing Exelixis'

supplemental New Drug Application (sNDA) for this proposed

indication, with a Prescription Drug User Fee Act (PDUFA) target

action date of April 3, 2025.

Total revenues

$2.15 billion - $2.25 billion

Net product revenues

$1.95 billion - $2.05

billion(1)

Cost of goods sold

4% - 5% of net product

revenues

Research and development expenses

$925 million - $975

million(2)

Selling, general and administrative

expenses

$475 million - $525

million(3)

Effective tax rate

21% - 23%

____________________

(1)

Exelixis’ 2025 net product

revenues guidance range includes the impact of a U.S. wholesale

acquisition cost increase of 2.8% for CABOMETYX effective Jan. 1,

2025.

(2)

Includes $40.0 million of

non-cash stock-based compensation expense.

(3)

Includes $60.0 million of

non-cash stock-based compensation expense.

Cabozantinib Highlights

Cabozantinib Franchise Net Product Revenues and

Royalties. Net product revenues generated by the cabozantinib

franchise in the U.S. were $515.2 million during the fourth quarter

of 2024, with net product revenues of $512.8 million from CABOMETYX

and $2.4 million from COMETRIQ® (cabozantinib). For the year ended

December 31, 2024, net product revenues generated by the

cabozantinib franchise in the U.S. were $1,809.4 million, with net

product revenues of $1,798.2 million from CABOMETYX and $11.2

million from COMETRIQ. In 2024, global cabozantinib franchise net

product revenues generated by Exelixis and its partners exceeded

$2.5 billion. Based upon cabozantinib-related net product revenues

generated by Exelixis’ collaboration partners during the quarter

and year ended December 31, 2024, Exelixis earned $44.4 million and

$166.9 million, respectively, in royalty revenues.

Detailed Results from Subgroup Analysis of Phase 3 CABINET

Pivotal Study Evaluating Cabozantinib in Advanced Gastrointestinal

(GI) NET Presented at the American Society of Clinical Oncology

Gastrointestinal Cancers Symposium (ASCO GI 2025). In January

2025, results from a subgroup analysis of the CABINET study of

patients with extra-pancreatic neuroendocrine tumors (epNET)

arising in the GI tract were featured in a poster session at ASCO

GI 2025. The analysis showed cabozantinib was associated with an

improvement in progression-free survival (PFS) compared with

placebo in patients with advanced GI NET, which was a subgroup of

the epNET cohort. Earlier in January, the National Comprehensive

Cancer Network (NCCN) Clinical Practice Guidelines in Oncology for

Neuroendocrine and Adrenal Tumors were updated to include

cabozantinib as category 1 for certain types of NET following

specific treatments, and as a category 2A preferred regimen for

several other forms of advanced NET, depending on site of origin

and grade.

Cabozantinib Data Presentations at the American Society of

Clinical Oncology 2025 Genitourinary Cancers Symposium (ASCO

GU). In February 2025, cabozantinib will be the subject of 16

presentations and poster sessions at this year’s ASCO GU, which is

being held from February 13-15 in San Francisco. Notable

presentations will include final follow-up results from the

CheckMate -9ER trial (median follow-up of 67.6 months).

Pipeline Highlights

Encouraging Results from Phase 1b/2 STELLAR-001 Trial

Evaluating Zanzalintinib Alone or in Combination with Atezolizumab

(Tecentriq®) in Metastatic Colorectal Cancer (CRC) Presented at

ASCO GI 2025. In January 2025, results from an expansion cohort

of the phase 1b/2 STELLAR-001 trial evaluating zanzalintinib alone

or in combination with atezolizumab in patients with previously

treated metastatic CRC were presented during a poster session at

ASCO GI 2025. This cohort of the STELLAR-001 trial included 107

patients randomized 1:1 to receive single-agent zanzalintinib or

zanzalintinib in combination with atezolizumab. Patients had

unresectable, locally advanced or metastatic RAS wild-type CRC that

is non-microsatellite instability-high or non-mismatch

repair-deficient. Results from the presentation demonstrated that

all efficacy parameters, including objective response rate, PFS and

overall survival (OS) favored the combination of zanzalintinib plus

atezolizumab versus zanzalintinib monotherapy in the overall

population, as well as in a subgroup of patients without liver

metastases. These data provide insights into the contribution of

components for the zanzalintinib plus atezolizumab combination and

support zanzalintinib’s ongoing pivotal development in metastatic

CRC. Exelixis anticipates disclosing additional data from

zanzalintinib’s phase 1b/2 studies in the first half of 2025.

Initiation of Phase 1 Clinical Trial Evaluating XL495 in

Patients with Advanced Solid Tumors. In November 2024, Exelixis

announced the initiation of the dose-escalation stage of the

first-in-human phase 1 clinical trial of XL495 in patients with

advanced solid tumors. XL495 is a novel, potent, small molecule

inhibitor of PKMYT1. The dose-escalation stage of this phase 1

study is designed to determine the maximum tolerated dose of XL495.

The expansion cohorts are designed to further assess the

tolerability and activity of XL495 both as monotherapy and in

combination with select cytotoxic agents in tumor-specific

indications. Exelixis plans to present data from the XL495 program,

as well as XL309 (potentially best-in-class small molecule

inhibitor of USP1) and XB010 (5T4-targeting antibody-drug

conjugate), at a scientific meeting in 2025.

Corporate Highlights

Clinical Development Collaboration with Merck to Evaluate

Zanzalintinib in Combination with KEYTRUDA® (pembrolizumab) in Head

and Neck Cancer and with WELIREG® (belzutifan) in Renal Cell

Carcinoma (RCC). In October 2024, Exelixis and Merck (known as

MSD outside of the U.S. and Canada) announced a clinical

development collaboration to evaluate zanzalintinib in combination

with KEYTRUDA in head and neck squamous cell carcinoma (HNSCC), and

zanzalintinib with WELIREG in RCC. Under the terms of the

collaboration, Merck will supply KEYTRUDA, its anti-PD-1 therapy,

for the ongoing, Exelixis-sponsored phase 3 STELLAR-305 pivotal

trial in previously untreated PD-L1 positive recurrent or

metastatic HNSCC. In addition, Merck will sponsor a phase 1/2 trial

and two phase 3 pivotal trials evaluating zanzalintinib in

combination with WELIREG, its oral hypoxia-inducible factor-2 alpha

(HIF-2α) inhibitor, in RCC. Merck will fund one of these phase 3

studies, and Exelixis will co-fund the phase 1/2 trial and the

other phase 3 study, as well as supply zanzalintinib and

cabozantinib. Exelixis maintains all global commercial and

marketing rights to zanzalintinib.

Favorable Ruling in Second Cabozantinib Abbreviated New Drug

Application (ANDA) Litigation Against MSN Pharmaceuticals, Inc.

(MSN). In October 2024, the U.S. District Court for the

District of Delaware (the District Court) ruled in Exelixis’ favor,

rejecting MSN’s challenge to three Orange Book-listed patents

related to cabozantinib (U.S. Patents No. 11,091,439 (crystalline

salt forms), 11,091,440 (pharmaceutical composition) and 11,098,015

(methods of treatment)), which expire January 15, 2030. The

District Court’s decision follows an earlier stipulation that MSN’s

proposed generic cabozantinib product (ANDA No. 213878) infringes

the ’439, ’440, and ’015 patents. The District Court also ruled

that Exelixis’ U.S. Patent No. 11,298,349 (pharmaceutical

composition) is not invalid and not infringed by MSN’s proposed

ANDA product. To Exelixis’ knowledge, the FDA has not yet granted

tentative approval of MSN’s proposed ANDA product. On October 23,

2024, the District Court entered final judgment reflecting the

opinion. Based on the District Court’s final judgment should the

FDA ultimately approve MSN’s ANDA, the effective date of any such

approval and commercial launch in the U.S. of MSN’s proposed ANDA

product shall not be a date earlier than January 15, 2030, subject

to Exelixis’ potential additional regulatory exclusivity. On

November 22, 2024, MSN noticed an appeal to the Court of Appeals

for the Federal Circuit and Exelixis noticed a cross-appeal on

November 26, 2024. In February 2025, Exelixis received notice that

MSN submitted to the FDA a Paragraph IV certification regarding

another Exelixis Orange Book patent: U.S. Patent No. 12,128,039

(low impurity), which expires in 2032. Exelixis is evaluating next

steps and will continue to vigorously defend its cabozantinib

intellectual property estate.

Stock Repurchase Program. Under the ongoing 2024-25 $500

million stock repurchase program announced in August 2024, Exelixis

has repurchased $205.6 million of the company’s common stock, at an

average price of $33.62 per share as of the end of fiscal year

2024. This is the third stock repurchase program undertaken by

Exelixis since March 2023. Stock repurchases under this program may

be made from time to time through a variety of methods, which may

include open market purchases, in block trades, accelerated stock

repurchase transactions, exchange transactions, or any combination

of such methods. The timing and amount of any stock repurchases

under the stock repurchase program will be based on a variety of

factors, including ongoing assessments of the capital needs of the

business, alternative investment opportunities, the market price of

Exelixis’ common stock and general market conditions.

Announcement of Key Priorities and Anticipated Milestones for

2025. In January 2025, Exelixis announced its key priorities

and anticipated milestones for 2025, including: the potential

commercial launch of CABOMETYX for the treatment of patients with

previously treated advanced NET following completion of the FDA’s

review of Exelixis’ sNDA, which has a PDUFA action date of April 3,

2025; expansion of zanzalintinib’s pivotal development program with

six ongoing or planned pivotal trials, including two pivotal RCC

studies with Merck and additional studies to be announced in 2025,

as well as initial clinical data readouts from the phase 1b/2

STELLAR-001 and STELLAR-002 clinical studies in the first half of

the year and clinical updates from the pivotal STELLAR-303, -304

and -305 trials in the second half of 2025; accelerating the phase

1 development of XL309 as a potential therapy for tumors that have

become refractory to PARP inhibitor (PARPi) therapy, as well as in

combination with PARPi agents to deepen and prolong responses;

continued progress of phase 1 clinical trials for XB010 and XL495;

potentially filing three Investigational New Drug applications for

the XB628 PD-L1-NKG2A bispecific antibody, XB064 ILT-2 monoclonal

antibody and XB371 TF-topoisomerase I inhibitor antibody-drug

conjugate. Exelixis presented the details of its key priorities and

anticipated milestones at the 43rd Annual J.P. Morgan Healthcare

Conference.

Basis of Presentation

Exelixis has adopted a 52- or 53-week fiscal year that generally

ends on the Friday closest to December 31. For convenience,

references in this press release as of and for the fiscal periods

ended January 3, 2025 and December 29, 2023, are indicated as being

as of and for the periods ended December 31, 2024 and 2023,

respectively.

Conference Call and

Webcast

Exelixis management will discuss the company’s financial results

for the fourth quarter and fiscal year 2024 and provide a general

business update during a conference call beginning at 5:00 p.m. ET

/ 2:00 p.m. PT today, Tuesday, February 11, 2025.

To access the conference call, please register using this link.

Upon registration, a dial-in number and unique PIN will be provided

to join the call. To access the live webcast link, log onto

www.exelixis.com and proceed to the Event Calendar page under the

Investors & News heading. A webcast replay of the conference

call will also be archived on www.exelixis.com for one year.

About Exelixis

Exelixis is a globally ambitious oncology company innovating

next-generation medicines and regimens at the forefront of cancer

care. Powered by drug discovery and development excellence, we are

rapidly evolving our product portfolio to target an expanding range

of tumor types and indications with our clinically differentiated

pipeline of small molecules, antibody-drug conjugates and other

biotherapeutics. This comprehensive approach harnesses decades of

robust investment in our science and partnerships to advance our

investigational programs and extend the impact of our flagship

commercial product, CABOMETYX® (cabozantinib). Exelixis is driven

by a bold scientific pursuit to create transformational treatments

that give more patients hope for the future. For information about

the company and its mission to help cancer patients recover

stronger and live longer, visit www.exelixis.com, follow

@ExelixisInc on X (Twitter), like Exelixis, Inc. on Facebook and

follow Exelixis on LinkedIn.

Forward-Looking

Statements

This press release contains forward-looking statements,

including, without limitation, statements related to: Exelixis’

ability to maximize success in 2025; Exelixis’ 2025 financial

guidance, which does not include any impact from a potential U.S.

regulatory approval for CABOMETYX in advanced neuroendocrine

tumors, pointing to solid growth for the cabozantinib franchise;

Exelixis’ launch readiness and the regulatory review process with

respect to Exelixis’ sNDA for cabozantinib in previously treated

advanced pNET and advanced epNET, including the Prescription Drug

User Fee Act target action date assigned by the FDA; Exelixis’

expectation that zanzalintinib will take center stage in 2025 as

Exelixis’ next franchise opportunity that could improve standards

of care for patients with cancer; anticipated zanzalintinib pivotal

data milestones with respect to the STELLAR-303, STELLAR-304, and

STELLAR-305 trials and in the phase 1b/2 STELLAR-001 trial;

Exelixis’ anticipated timing to initiate the STELLAR-311 trial of

zanzalintinib in neuroendocrine tumors in the first half of 2025;

Exelixis’ expectations with respect to its clinical development

collaboration with Merck; Exelixis’ plans to present cabozantinib

data at ASCO GU in February 2025; Exelixis’ plans to present data

from the XL495 program, as well as XL309 and XB010, at a scientific

meeting in 2025; Exelixis’ plans to vigorously defend its

intellectual property estate; Exelixis’ key priorities and

anticipated milestones for 2025; and Exelixis’ scientific pursuit

to create transformational treatments that give more patients hope

for the future. Any statements that refer to expectations,

projections or other characterizations of future events or

circumstances are forward-looking statements and are based upon

Exelixis’ current plans, assumptions, beliefs, expectations,

estimates and projections. Forward-looking statements involve risks

and uncertainties. Actual results and the timing of events could

differ materially from those anticipated in the forward-looking

statements as a result of these risks and uncertainties, which

include, without limitation: the degree of market acceptance of

CABOMETYX and other Exelixis products in the indications for which

they are approved and in the territories where they are approved,

and Exelixis’ and its partners’ ability to obtain or maintain

coverage and reimbursement for these products; the effectiveness of

CABOMETYX and other Exelixis products in comparison to competing

products; the level of costs associated with Exelixis’

commercialization, research and development, in-licensing or

acquisition of product candidates, and other activities; Exelixis’

ability to maintain and scale adequate sales, marketing, market

access and product distribution capabilities for its products or to

enter into and maintain agreements with third parties to do so; the

availability of data at the referenced times; the potential failure

of cabozantinib, zanzalintinib and other Exelixis product

candidates, both alone and in combination with other therapies, to

demonstrate safety and/or efficacy in clinical testing;

uncertainties inherent in the drug discovery and product

development process; Exelixis’ dependence on its relationships with

its collaboration partners, including their pursuit of regulatory

approvals for partnered compounds in new indications, their

adherence to their obligations under relevant collaboration

agreements and the level of their investment in the resources

necessary to complete clinical trials or successfully commercialize

partnered compounds in the territories where they are approved;

complexities and the unpredictability of the regulatory review and

approval processes in the U.S. and elsewhere; Exelixis’ continuing

compliance with applicable legal and regulatory requirements;

unexpected concerns that may arise as a result of the occurrence of

adverse safety events or additional data analyses of clinical

trials evaluating cabozantinib, zanzalintinib and other Exelixis

product candidates; Exelixis’ dependence on third-party vendors for

the development, manufacture and supply of its products and product

candidates; Exelixis’ ability to protect its intellectual property

rights; market competition, including the potential for competitors

to obtain approval for generic versions of Exelixis’ marketed

products; changes in economic and business conditions; and other

factors detailed from time to time under the caption “Risk Factors”

in Exelixis’ most recent Annual Report on Form 10-K and subsequent

Quarterly Reports on Form 10-Q, and in Exelixis’ other future

filings with the Securities and Exchange Commission. All

forward-looking statements in this press release are based on

information available to Exelixis as of the date of this press

release, and Exelixis undertakes no obligation to update or revise

any forward-looking statements contained herein, except as required

by law.

Exelixis, the Exelixis logo, CABOMETYX and

COMETRIQ are registered trademarks of Exelixis, Inc.

KEYTRUDA® and WELIREG® are registered

trademarks of Merck Sharp & Dohme LLC, a subsidiary of Merck

& Co., Inc., Rahway, N.J., USA.

TECENTRIQ (atezolizumab) is a registered

trademark of Genentech, a member of the Roche Group.

EXELIXIS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Revenues:

Net product revenues

$

515,232

$

429,336

$

1,809,395

$

1,628,879

License revenues

49,343

45,229

349,244

178,635

Collaboration services revenues

2,180

5,087

10,062

22,694

Total revenues

566,755

479,652

2,168,701

1,830,208

Operating expenses:

Cost of goods sold

19,965

21,753

76,216

72,547

Research and development

249,002

244,670

910,408

1,044,071

Selling, general and administrative

134,328

131,441

492,128

542,705

Impairment of long-lived assets

—

—

51,672

—

Restructuring

254

—

33,660

—

Total operating expenses

403,549

397,864

1,564,084

1,659,323

Income from operations

163,206

81,788

604,617

170,885

Interest income

21,295

21,388

77,156

86,543

Other income (expense), net

272

(137

)

(133

)

93

Income before income taxes

184,773

103,039

681,640

257,521

Provision for income taxes

44,912

17,521

160,373

49,756

Net income

$

139,861

$

85,518

$

521,267

$

207,765

Net income per share:

Basic

$

0.49

$

0.28

$

1.80

$

0.65

Diluted

$

0.48

$

0.27

$

1.76

$

0.65

Weighted-average common shares

outstanding:

Basic

284,527

308,482

290,030

318,151

Diluted

293,546

313,023

296,132

321,464

EXELIXIS, INC.

RECONCILIATION OF GAAP NET

INCOME TO NON-GAAP NET INCOME

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

GAAP net income

$

139,861

$

85,518

$

521,267

$

207,765

Adjustments:

Stock-based compensation - research and

development expenses (1)

8,836

9,041

30,670

34,320

Stock-based compensation - selling,

general and administrative expenses (1)

17,510

15,265

63,166

72,025

Income tax effect of the above

adjustments

(5,896

)

(5,629

)

(21,520

)

(24,691

)

Non-GAAP net income

$

160,311

$

104,195

$

593,583

$

289,419

GAAP net income per share:

Basic

$

0.49

$

0.28

$

1.80

$

0.65

Diluted

$

0.48

$

0.27

$

1.76

$

0.65

Non-GAAP net income per share:

Basic

$

0.56

$

0.34

$

2.05

$

0.91

Diluted

$

0.55

$

0.33

$

2.00

$

0.90

Weighted-average common shares

outstanding:

Basic

284,527

308,482

290,030

318,151

Diluted

293,546

313,023

296,132

321,464

____________________

(1)

Non-cash stock-based compensation expense

used for GAAP reporting in accordance with Accounting Standards

Codification Topic 718, Compensation—Stock Compensation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211666637/en/

Chris Senner Chief Financial Officer Exelixis, Inc. 650-837-7240

csenner@exelixis.com

Susan Hubbard EVP, Public Affairs & Investor Relations

Exelixis, Inc. 650-837-8194 shubbard@exelixis.com

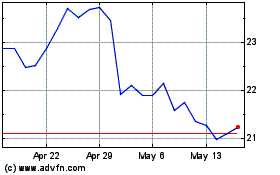

Exelixis (NASDAQ:EXEL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Exelixis (NASDAQ:EXEL)

Historical Stock Chart

From Feb 2024 to Feb 2025