Current Report Filing (8-k)

March 19 2019 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

March 19,

201

9

The First of Long Island Corporation

(Exact name of the registrant as specified in its charter)

|

New York

|

001-32964

|

11-

2672906

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

10 Glen Head Road

|

|

|

|

Glen Head

, New York

|

|

11

545

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(

516

)

671

-

49

00

(Registrant’s telephone number)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item

5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

On March 19, 2019, The First of Long Island Corporation (the “Company”), and its wholly owned subsidiary, The First National Bank of Long Island (the “Bank”), announced that Christopher Becker will succeed Michael Vittorio as President and Chief Executive Officer of the Company and the Bank, effective January 1, 2020. Currently, Mr. Becker serves as Executive Vice President and Chief Risk Officer of the Company and the Bank. Effective upon his appointment as President and Chief Executive Officer, Mr. Becker will be appointed to the Board of Directors of the Company and the Bank.

The Company and the Bank entered into a new employment agreement with Mr. Becker, to be effective January 1, 2020, with terms substantially similar to the employment agreement to which Mr. Vittorio currently is a party. Mr. Becker, age 53, currently is a party to an employment agreement with the Company and the Bank that is disclosed in the Company’s proxy statement dated March 15, 2019 and that will continue to govern the terms of his employment until January 1, 2020. The new employment agreement has a term of three calendar years beginning January 1, 2020, and may be renewed annually for an additional year. The initial base salary is $500,000. If the executive is terminated by the Board without cause or if he terminates his employment following an event constituting Good Reason, he will receive a cash lump sum severance payment equal to three times base salary plus an amount equal to thirty-six times the product of the monthly cost of insurance coverage maintained by the Bank for the executive immediately prior to the date of termination. The cash lump sum payment is conditioned on the executive executing a release of claims against the Company and any affiliate, and their officers, directors, successors and assigns. Upon termination of employment without cause or with Good Reason by the executive on or after a change in control, the executive shall receive a cash lump sum payment equal to three times the sum of the highest rate of base salary payable during the calendar year of termination or either of the two calendar years immediately preceding the date of termination. In addition, the executive shall receive a cash lump sum equal to thirty-six times the monthly cost of insurance coverage maintained by the Bank for the executive immediately prior to the date of termination. The employment agreement subjects the executive to non-compete and non-solicitation provisions for a period of two years following the date of termination, provided, however, that the non-compete restrictions do not apply in the event of the termination for cause or termination of employment following a change in control.

The press release relating to the announcement of the selection of Mr. Becker as the next President and Chief Executive Officer of the Company and the Bank, and the employment agreement entered into with Mr. Becker, are attached as exhibits to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

The First of Long Island Corporation

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

/s/ Mark Curtis

|

|

|

|

Mark Curtis

Senior Executive Vice President,

Chief Financial Officer and Treasurer

|

|

Dated: March 19, 2019

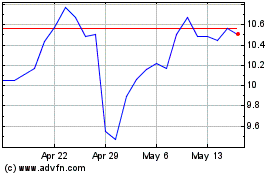

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

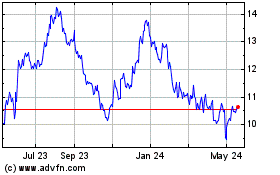

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Apr 2023 to Apr 2024