false

0000719402

0000719402

2024-10-01

2024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 1, 2024

FIRST NATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

--12-31

|

Virginia

(State or other jurisdiction of incorporation)

|

1-38874

(Commission File Number)

|

54-1232965

(IRS Employer Identification No.)

|

|

112 West King Street

Strasburg, Virginia

(Address of principal executive offices)

|

22657

(Zip Code)

|

(540) 465-9121

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $1.25 per share

|

FXNC

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets. |

Effective October 1, 2024, First National Corporation (the “Company” or “First National”), completed its previously announced merger with Touchstone Bankshares, Inc. (“Touchstone”), pursuant to that certain Agreement and Plan of Merger, dated as of March 25, 2024 (the “Merger Agreement”), by and between the Company and Touchstone, whereby Touchstone Bankshares, Inc. merged with and into First National Corporation (the “Merger”), with First National Corporation surviving.

Under the terms of the Merger Agreement, each outstanding share of Touchstone common stock and preferred stock (on an as-converted, one-for-one basis, which shares of preferred stock converted automatically to common stock at the effective time of the Merger) (collectively, “Touchstone Stock”) was converted into the right to receive, without interest, a number of shares of First National common stock equal to the exchange ratio of 0.8122 shares of First National common stock per one share of Touchstone Stock (the “Merger Consideration”). Cash will also be paid in lieu of fractional shares.

On or around September 11, 2024, transmittal materials were mailed to each holder of record of Touchstone Stock outlining the procedures to surrender certificates representing shares of Touchstone Stock for the Merger Consideration they are entitled to receive.

The foregoing description of the Merger Agreement and the transactions described herein do not purport to be complete and are qualified in their entirety by reference to the Merger Agreement, which is incorporated herein by reference as Exhibit 2.1.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

This Current Report on Form 8-K is being filed in connection with the closing of the previously announced proposed Merger in accordance with the terms and conditions set forth in the Merger Agreement.

Effective upon the consummation of the Merger on October 1, 2024, the Company’s board of directors increased in size from 10 to 13 directors and Ms. Toni T. Lee-Andrews, along with Messrs. William S. Wilkinson and Norman D. Wagstaff, Jr., each a former director of Touchstone, were appointed as directors of the Company, to fill the resulting vacancies on the board.

No committee assignments have been made yet for Ms. Lee-Andrews, or Messrs. Wilkinson and Wagstaff. Each of Ms. Lee-Andrews and Messrs. Wilkinson and Wagstaff will receive compensation as non-employee directors consistent with the Company’s standard compensation practices for non-employee directors. A description of the Company’s standard compensation practices for non-employee directors can be found in the section titled “Director Compensation” in the Company’s definitive proxy statement in connection with its 2024 annual meeting of shareholders filed with the U.S. Securities and Exchange Commission (“SEC”) on March 29, 2024, and is hereby incorporated by reference.

The information relating to each of Ms. Lee-Andrews and Messrs. Wilkinson and Wagstaff under the heading “Interests of Touchstone Directors and Executive Officers in the Merger,” included in the Company’s Registration Statement on Form S-4 (333-280378) filed in connection with the proposed Merger, including under the subheading “Membership of the Board of Directors of the Combined Company and Bank,” included thereunder, is hereby incorporated by reference.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On October 1, 2024, the Board of Directors of the Company amended Article II(A) of the Company’s By-laws, which was effective upon consummation of the Merger. The amendment to Article II(A) increased the size of the Board from 10 to 13 members.

A copy of the By-laws, as amended to date, is attached to this Current Report on Form 8-K as Exhibit 3.1 and is incorporated by reference. The foregoing description of the By-laws is qualified in its entirety by reference to the full text of the By-laws filed with this Current Report on Form 8-K.

On October 1, 2024, the Company issued a press release announcing the completion of the Merger, a copy of which is filed as Exhibit 99.1 and incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

(d)

|

Exhibits. See Exhibit Index Below.

|

Cautionary Note Regarding Forward-Looking Statements

Statements included in this report, which are not historical in nature are intended to be, and hereby are identified as, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “will,” “may,” “anticipate,” “create,” “plan,” “expect,” “should,” and “could” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results. Such risks, uncertainties and assumptions, include, among others, the following: (i) the occurrence of any event, change or other circumstances that could give rise to the right of one or any of the parties to terminate the Merger Agreement; (ii) the possibility that the proposed merger does not close when expected or at all because conditions to closing are not satisfied on a timely basis or at all; and (iii) the outcome of any legal proceedings that may be or have been instituted against the Company or Touchstone.

Additional factors that could cause results to differ materially from those described above can be found in the risk factors described in Item 1A. of the Company’s Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2023 and in the joint proxy statement of the Company and Touchstone and a prospectus of the Company regarding the proposed merger that was filed with the SEC on July 9, 2024 pursuant to Rule 424(b)(3) by the Company. All subsequent written and oral forward-looking statements concerning the Company, Touchstone or any person acting on their behalf is expressly qualified in their entirety by the cautionary statements above. Neither the Company nor Touchstone undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

Exhibit No.Description

| 2.1 |

Agreement and Plan of Merger, dated as of March 25, 2024, by and among Touchstone Bankshares, First National Corporation and First Bank (incorporated herein by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on March 26, 2024) * |

|

3.1

|

|

*Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby undertakes to furnish supplemental copies of any of the omitted schedules upon request by the U.S. Securities and Exchange Commission; provided, that the Company may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedules so furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

FIRST NATIONAL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: October 1, 2024

|

By:

|

/s/ M. Shane Bell

|

|

|

|

|

M. Shane Bell

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

Exhibit 3.1

BY-LAWS

OF

FIRST NATIONAL CORPORATION

(as amended October 1, 2024)

ARTICLE I

Stockholders’ Meetings

A. The annual meeting of the stockholders of the Corporation shall be held annually on a date to be fixed by the Board of Directors (beginning in 1984). If that day is a legal holiday, the annual meeting shall be held on the next succeeding day not a legal holiday.

B. All meetings of the stockholders shall be held at the time and place or, in the case of virtual-only meetings, at no physical place but solely by means of remote communication, in each case, as determined by the Board of Directors and stated in the notice of the meeting. Meetings of the stockholders shall be held whenever called by the Chairman of the Board, the President, or a majority of the Directors.

C. The holders of a majority of the outstanding shares of capital stock entitled to vote shall constitute a quorum at any meeting of the stockholders. Less than a quorum may adjourn the meeting to a fixed time and place (if any), no further notice of any adjourned meeting being required. Each stockholder shall be entitled to one vote in person or by proxy for each share entitled to vote then outstanding in his name on the books of the Corporation.

D. The transfer books for shares of capital stock of the Corporation may be closed by order of the Board of Directors for not exceeding fifty (50) days for the purpose of determining stockholders entitled to notice of, or to vote at, any meeting of stockholders or any adjournment thereof, or entitled to receive payment of any dividend, or in order to make a determination of stockholders for any other purpose. In lieu of closing the stock transfer books, the Board of Directors may fix in advance a date as the record date for any such determination of stockholders, such date to be not more than seventy (70) days preceding the date on which the particular action requiring such determination of the stockholders is to be taken.

E. The Chairman of the Board, if there be one, shall preside over all meetings of the stockholders. If he is not present, or there is none in office, the President shall preside. If neither the Chairman of the Board nor the President is present, a Vice President shall preside, or, if none be present, a Chairman shall be elected by the meeting. The Secretary of the Corporation shall act as Secretary of all the meetings, if he be present. If he is not present, the Chairman shall appoint a Secretary of the meeting. The Chairman of the meeting may appoint one or more inspectors of the election to determine the qualification of voters, the validity of proxies and the results of ballots.

F. At an annual meeting of the shareholders of the Corporation, only such business shall be conducted as shall have been properly brought before the meeting. To be brought before an annual meeting, business must be (a) specified in the notice of meeting (or any supplement thereto) given by or at the direction of the Board of Directors, (b) otherwise brought before the meeting by or at the direction of the Board of Directors, or (c) otherwise properly brought before the meeting by a shareholder. For business to be properly brought before an annual meeting by a shareholder, the shareholder must have given timely notice thereof in writing to the Secretary of the Corporation. To be timely, a shareholder’s notice must be delivered to or mailed and received at the principal executive offices of the Corporation, not less than sixty (60) days nor more than ninety (90) days prior to the date of the scheduled annual meeting, regardless of any postponements, deferrals or adjournments of that meeting to a later date; provided, however, that in the event that less than seventy (70) days’ notice or prior public disclosure of the date of the scheduled annual meeting is given or made, notice by a shareholder, to be timely, must be so received not later than the close of business on the tenth (10th) day following the earlier of the day on which such notice of the date of the scheduled annual meeting was mailed or the day on which such public disclosure was made. A shareholder’s notice to the Secretary of the Corporation shall set forth as to each matter the shareholder proposes to bring before the annual meeting (a) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (b) the name and address, as they appear on the Corporation’s books of the shareholder proposing such business and of any other person or entity who is the record or beneficial owner of any shares of the Corporation and who, to the knowledge of the shareholder proposing such business, supports such proposal, (c) the class and number of shares of the Corporation which are beneficially owned and owned of record by the shareholder proposing such business on the date of his notice to the Corporation and the number of shares so owned by any person or entity who, to the knowledge of the shareholder proposing such business, supports such proposal and (d) any material interest (financial or other) of such shareholder in such proposal. Notwithstanding anything in these Bylaws to the contrary, no business shall be conducted at any annual meeting except in accordance with the procedures set forth in this Section F. The Chairman of an annual meeting shall, if the facts warrant, determine and declare to the meeting that business was not properly brought before the meeting in accordance with the provisions of this Section F and if the Chairman should so determine, the Chairman shall so declare to the meeting and any such business not properly brought before the meeting shall not be transacted.

ARTICLE II

Board of Directors

A. The number of Directors shall be thirteen (13). This number may be increased or decreased at any time by amendment of these By-laws, but shall always be a number of not less than three. Directors must be stockholders. A majority of the Directors shall constitute a quorum. Less than a quorum may adjourn the meeting to a fixed time and place, no further notice of any adjourned meeting being required.

B. Any vacancy arising among the Directors, including a vacancy resulting from an increase by not more than three in the number of Directors, may be filled by the remaining Directors unless sooner filled by the stockholders in meeting.

C. Meetings of the Board of Directors shall be had at times fixed by resolution of the Board or upon the call of the Chairman of the Board, the President, or a majority of the members of the Board. Notice of any meeting not held at a time fixed by a resolution of the Board shall be given to each Director at least two days before the meeting at his residence or business address or by delivering such notice to him or by telephoning it to him at least one day before the meeting. Any such notice shall contain the time and place of the meeting.

D. Meetings may be held without notice if all of the Directors are present or those not present waive notice before or after the meeting.

E. The mandatory retirement age for Directors shall be age 75, meaning that a Director may not stand for reelection following December 31 of the year in which he or she turns 75.

F. Only persons who are nominated in accordance with the procedures set forth in this Section F shall be eligible for election as Directors. Nominations of persons for election to the Board of Directors of the Corporation may be made by or at the direction of the Board of Directors, or by any shareholder of the Corporation entitled to vote for the election of Directors who complies with the notice procedures set forth in this Section F. Such nominations, other than those made by or at the direction of the Board of Directors, shall be made pursuant to timely notice in writing to the Secretary of the Corporation. To be timely, a shareholder’s notice shall be delivered to or mailed and received at the principal executive offices of the Corporations not less than sixty (60) days nor more than ninety (90) days prior to the date of the scheduled annual meeting, regardless of postponements, deferrals, or adjournments of that meeting to a later date; provided, however, in the event that less than seventy (70) days’ notice or prior public disclosure of the date of the meeting is given or made, notice by the shareholder to be timely must be so received not later than the close of business on the 10th day following the earlier of the day on which such notice of the date of the scheduled annual meeting was mailed or the day on which such public disclosure was made. Such shareholder’s notice shall set forth (a) as to each person whom the shareholder proposes to nominate for election as a Director, (i) the name, age, business address and residence address of such person, (ii) the principal occupation or employment of such person, (iii) the class and number of shares of the Corporation which are beneficially owned by such person and (iv) any other information relating to such person that is required to be disclosed in solicitations of proxies for election of Directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; and (b) as to the shareholder giving the notice (i) the name and address of such shareholder and of any other person or entity who is the record or beneficial owner of shares of the Corporation and who, to the knowledge of the shareholder giving notice, supports such nominee(s) and (ii) the class and number of shares of the Corporation which are beneficially owned and owned of record by such shareholder and by any other person or entity who is the record or beneficial owner of shares of the Corporation and who, to the knowledge of the shareholder giving the notice, supports such nominee(s). At the request of the Board of Directors any person nominated by the Board of Directors for election as a Director shall furnish to the Secretary of the Corporation the information required to be set forth in a shareholder’s notice of nomination which pertains to the nominee. No person shall be eligible for election as a Director of the Corporation unless nominated in accordance with the procedures set forth in this Section F. The Chairman of the meeting shall, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the procedures prescribed by the By-laws, and if the Chairman should so determine, the Chairman shall so declare to the meeting and the defective nomination shall be disregarded.

ARTICLE III

Committees

A. The Board of Directors may designate by resolution adopted by a majority of all the Directors two or more of the Directors to constitute an Executive Committee. The Executive Committee, when the Board of Directors is not in session, may to the extent permitted by law exercise all of the powers of the Directors and authorize the seal of the Corporation to be affixed as required. The Executive Committee may make rules for the holding and conduct of its meetings, the notice thereof required, and the keeping of its records.

B. Other committees, consisting of two or more directors, may be designated by a resolution adopted by a majority of the Directors present at a meeting at which a quorum is present and shall have the powers and authority of the Board of Directors to the extent specified in the resolution of appointment and not prohibited by law.

ARTICLE IV

Officers

A. The Board of Directors, promptly after its election in each year, shall elect a President (who may be one of the Directors) and a Secretary; a Chairman of the Board and a Vice Chairman of the Board; and may appoint such other officers as it may deem proper. The Chairman of the Board shall serve at the pleasure of the Board and preside at all meetings of the Board of Directors. The Chairman shall have and may exercise such further powers and duties as from time to time may be conferred upon or assigned by the Board of Directors. The Vice Chairman of the Board shall also serve at the pleasure of the Board. The Vice Chairman shall carry out the functions of the Chairman in the absence of the Chairman. Any officer may hold more than one office except that the same person shall not be President and Secretary. The term of office shall be until the first meeting of the Board of Directors following the next annual meeting of the shareholders and until their respective successors is elected, but any officer may be removed at any time by the vote of the Board of Directors. Vacancies among the officers shall be filled by the Directors. The officers of the Corporation shall have such duties as generally pertain to their respective offices as well as such powers and duties as from time to time may be delegated to them by the Board of Directors.

ARTICLE V

Certificate of Stock

A. Each stockholder shall be entitled to a certificate or certificates of stock in such form as may be approved by the Board of Directors signed by the President or a Vice President and by the Secretary or an Assistant Secretary or the Treasurer or any Assistant Treasurer

B. All transfers of stock of the Corporation shall be made upon its books by surrender of the certificate for the shares transferred accompanied by an assignment in writing by the holder and may be accomplished either by the holder in person or by a duly authorized attorney in fact.

C. In case of the loss, mutilation or destruction of a certificate of stock, a duplicate certificate may be issued upon such terms not in conflict with the law as the Board of Directors may prescribe.

D. The Board of Directors may also appoint one or more Transfer Agents and Registrars and may require stock certificates to be countersigned by a Transfer Agent or registered by a Registrar or may require stock certificates to be both countersigned by a Transfer Agent and registered by a Registrar. If certificates of capital stock of the Corporation are signed by a Transfer Agent or by a Registrar (other than the Corporation itself or one of its employees), the signature thereon of the officers of the Corporation and the seal of the Corporation thereon may be facsimiles, engraved or printed. In case any officer or officers who shall have signed, or whose facsimile signature or signatures shall have been used on, any such certificate or certificates shall cease to be such officer or officers of the Corporation, whether because of death, resignation or otherwise, before such certificate or certificates shall have been delivered by the Corporation, such certificate or certificates may nevertheless be issued and delivered as though the person or persons who signed such certificates or whose facsimile signature or signatures shall have been used thereon had not ceased to be such officer or officers of the Corporation.

ARTICLE VI

Seal

A. The seal of the Corporation shall be a flat-faced circular die, of which there may be any number of counterparts, with the word “SEAL” and the name of the Corporation engraved thereon.

ARTICLE VII

Voting of Stock Held

A. Unless otherwise provided by a vote of the Board of Directors, the President or any Vice President may appoint attorneys to vote any stock in any other Corporation owned by this Corporation or may attend any meeting of the holders of stock of such Corporation and vote such shares in person.

Amended by unanimous vote of the Directors on this 1st day of October, 2024.

Exhibit 99.1

First National Corporation Completes Acquisition of Touchstone Bankshares, Inc.

STRASBURG, Va., October 1, 2024 -- First National Corporation (NASDAQ: FXNC) (the “Company” or “First National”), the one-bank holding company of First Bank, announced today that it has completed the acquisition by merger of Touchstone Bankshares, Inc. (“Touchstone”) effective October 1, 2024 (the “Merger”). Immediately following the Merger, Touchstone Bank, the wholly owned subsidiary of Touchstone Bankshares, Inc., was merged with and into First Bank. Pursuant to the previously announced terms of the Merger, each outstanding share of Touchstone Bankshares, Inc. common stock and preferred stock (on an as-converted, one-for-one basis, which shares of preferred stock converted automatically to common stock at the effective time of the Merger) is entitled to receive 0.8122 shares of First National Corporation’s common stock.

Following the Merger, the former branches of Touchstone Bank assumed in the Merger will continue to operate as Touchstone Bank, a division of First Bank, until the systems integration is completed in February 2025. With the addition of Touchstone, the Company would have had approximately $2.1 billion in assets, $1.5 billion in loans and $1.8 billion in deposits on a combined pro-forma basis as of August 30, 2024. The combined company will deliver banking services through 33 branch offices in Virginia and North Carolina and 3 loan production offices, in addition to its full complement of online banking services.

“We are pleased to announce the completion of the merger with Touchstone Bankshares, Inc. and excited to be joining forces with a team of dedicated local bankers committed to their customers and communities,” stated Scott Harvard, President and Chief Executive Officer of the Company. Harvard continued, “We believe that our combined companies will provide significantly more resources to small business customers across all of our markets while positively impacting the communities we serve. For our investors, the combined market capitalization is expected to put the company on the cusp of the Russell 2000 index.”

ABOUT FIRST NATIONAL CORPORATION

First National Corporation (NASDAQ: FXNC) is the parent company and bank holding company of First Bank (the “Bank”), a community bank that first opened for business in 1907 in Strasburg, Virginia. The Bank offers loan and deposit products and services through its website, www.fbvirginia.com, its mobile banking platform, a network of ATMs located throughout its market area, 3 loan production offices, a customer service center in a retirement community, and 33 bank branch office locations located throughout the Shenandoah Valley, the Roanoke Valley, the central and south-central regions of Virginia, the city of Richmond, and in northern North Carolina. In addition to providing traditional banking services, the Bank operates a wealth management division under the name First Bank Wealth Management. The Bank also owns First Bank Financial Services, Inc., which owns an interest in an entity that provides title insurance services.

CAUTION ABOUT FORWARD-LOOKING STATEMENTS

Certain information contained in this discussion may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements relate to First National’s and Touchstone’s respective plans, objectives, expectations and intentions and other statements that are not historical facts, and other statements identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” and “projects,” as well as similar expression. Although each party believes that its expectations with respect to the forward-looking statements are based upon reliable assumptions within the bounds of its knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties. For details on factors that could affect expectations, future events, or results, see the risk factors and other cautionary language included in First National’s Annual Report on Form 10-K for the year ended December 31, 2023, and other filings with the Securities and Exchange Commission (the “SEC”).

Additional risks and uncertainties may include, but are not limited to: (1) the risk that the cost savings and any revenue synergies from the proposed Merger may not be realized or take longer than anticipated to be realized, including due to the state of the economy or other competitive factors in the areas in which the parties operate, (2) disruption from the proposed Merger of customer, supplier, employee or other business partner relationships, including diversion of management's attention from ongoing business operations and opportunities due to the proposed merger, (3) the possibility that the costs, fees, expenses and charges related to the proposed Merger may be greater than anticipated, (4) reputational risk and the reaction of each of the parties’ customers, suppliers, employees or other business partners to the merger, (5) the risks relating to the integration of Touchstone’s operations into the operations of First National, including the risk that such integration will be materially delayed or will be more costly or difficult than expected, (6) the risk of potential litigation or regulatory action related to the proposed Merger, (7) the risk of expansion into new geographic or product markets, (8) the dilution caused by First National’s issuance of additional shares of its common stock in the proposed Merger, and (9) general competitive, economic, political and market conditions. Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found in the joint proxy statement of First National and Touchstone and the prospectus of First National regarding the Merger that was filed with the SEC on July 9, 2024 pursuant to Rule 424(b)(3) by First National and in First National’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s Internet site (http://www.sec.gov). All subsequent written and oral forward-looking statements concerning First National or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. First National does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

CONTACTS

|

Scott C. Harvard

|

M. Shane Bell

|

|

President and CEO

First National Corporation

|

Executive Vice President and CFO

First National Corporation

|

|

(540) 465-9121

|

(540) 465-9121

|

|

sharvard@fbvirginia.com

|

sbell@fbvirginia.com

|

2

v3.24.3

Document And Entity Information

|

Oct. 01, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

FIRST NATIONAL CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 01, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity, Incorporation, State or Country Code |

VA

|

| Entity, File Number |

1-38874

|

| Entity, Tax Identification Number |

54-1232965

|

| Entity, Address, Address Line One |

112 West King Street

|

| Entity, Address, City or Town |

Strasburg

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

22657

|

| City Area Code |

540

|

| Local Phone Number |

465-9121

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

FXNC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000719402

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

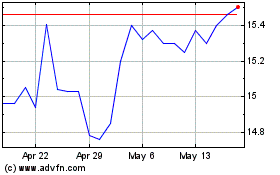

First National (NASDAQ:FXNC)

Historical Stock Chart

From Dec 2024 to Jan 2025

First National (NASDAQ:FXNC)

Historical Stock Chart

From Jan 2024 to Jan 2025