false

0001892322

0001892322

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): August 14, 2024

HEARTCORE

ENTERPRISES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41272 |

|

87-0913420 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

1-2-33,

Higashigotanda, Shinagawa-ku, Tokyo, Japan

(Address

of principal executive offices)

+81-3-6409-6966

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions.

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HTCR |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02. Results of Operations and Financial Condition.

On

August 14, 2024, HeartCore Enterprises, Inc. (the “Company”) issued a press release announcing its financial results for

the quarter ended June 30, 2024. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information contained in any website is not a part of this Current Report on Form 8-K.

The

information included in this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the

“Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HEARTCORE

ENTERPRISES, INC. |

| |

|

| Dated:

August 14, 2024 |

By: |

/s/

Sumitaka Yamamoto |

| |

Name: |

Sumitaka

Yamamoto |

| |

Title: |

Chief

Executive Officer |

Exhibit 99.1

HeartCore

Reports Second Quarter 2024 Financial Results

NEW

YORK and TOKYO, August 14, 2024 (GLOBE NEWSWIRE) – HeartCore Enterprises, Inc. (Nasdaq: HTCR) (“HeartCore” or “the

Company”), a leading enterprise software and consulting services company based in Tokyo, reported financial results for the

second quarter ended June 30, 2024.

Second

Quarter 2024 and Recent Operational Highlights

| |

● |

Partnered

with INCUDATA Corp. to enhance corporate digital marketing strategies |

| |

● |

Announced

Go IPO Client, BloomZ, began trading on the Nasdaq Stock Exchange |

| |

● |

Authorized

second dividend payment of $0.02 per share |

| |

● |

Partnered

with Hitachi Systems, Ltd. to offer combined package of HeartCore CMS and GRED Web Security Assessment Cloud |

| |

● |

Announced

and hosted seminar on U.S. exchange listing strategies for Japanese companies with Akerman LLP and Gateway Group |

| |

● |

Sold

a Go IPO Client Warrant for $9 million that will be recognized as revenue when the client becomes a publicly listed company,

which is expected to occur in Fall 2024 |

| |

● |

Disbursed

first dividend payment of $0.02 per share on May 3, 2024 |

| |

● |

Expanded

partnership with Heart-Tech Health |

| |

● |

Engaged

with Onside Content to develop AI-based content marketing evaluation and reporting index solution |

| |

● |

Signed

14th Go IPO Client |

| |

● |

Formed

an Artificial Intelligence Software Development Division |

Management

Commentary

“We

achieved significant strides in our Go IPO business, highlighted by the successful listing of one of our clients on the Nasdaq, which

is the first Japanese IPO since September 2023 and the third IPO since the inception of this business,” said HeartCore CEO Sumitaka

Kanno Yamamoto. “We are hopeful that this milestone marks the genesis of a second wave of Japanese IPOs, as the Go IPO pipeline

continues to show promising developments. Currently, we have three to four clients scheduled to go public by the end of the year. These

Go IPO deals are expected to be instrumental in our second-half performance, and with an optimistic outlook on the resurgence of Japanese

IPOs, we anticipate that our Go IPO business will play a key role in driving profitable returns in the upcoming quarter.”

“With

20% organic growth this quarter, and 30% organic growth expected for 2024, our software division continues to remain a stable growth

engine and reliable source of cash flow, serving as the lifeblood of HeartCore’s business operations. In addition, our strategic

partnerships with Hitachi Systems and INCUDATA Corp., two prominent Japanese IT companies, will further enhance and innovate our software

offerings, which will play a vital role in maintaining our 90% plus customer retention rate and separating ourselves from competitors.

I am very encouraged by every arm within our software umbrella, as each one is projected to be profitable and has proven to deliver immense

value to clients. The next few quarters look extremely bright for HeartCore; we look forward to sharing additional positive news around

our Go IPO initiatives and other general operational updates.”

Second

Quarter 2024 Financial Results

Revenues

were $4.1 million compared to $5.1 million in the same period last year. The decrease was primarily due to an approximate 10% depreciation

on the Japanese yen and a decrease in maintenance and supporting services, as the Company entered into a significant maintenance service

contract with an important customer in 2023. Additionally, although the organic software business has grown by more than 20%, the Company’s

subsidiary, Sigmaways recognized losses within its business, and one of the Company’s GO IPO clients has returned its fees after

discovering that it could not go public.

Gross

profit decreased to $0.8 million compared to $1.5 million in the same period last year. The decrease was primarily due to the aforementioned

reasons above.

Operating

expenses decreased to $2.3 million compared to $3.0 million in the same period last year. The improvement was primarily due to lower

selling and general and administrative expenses.

Net

loss was about $2.2 million or $(0.09) per diluted share compared to a net loss of $1.0 million or $(0.04) per diluted share, in the

same period last year.

As

of June 30, 2024, the Company had cash and cash equivalents of $3.8 million compared to $1.0 million on December 31, 2023.

Six-Months

2024 Financial Results

Revenues

were $9.1 million compared to $13.8 million in the same period last year. The decrease was primarily due to decreased revenues from Go

IPO consulting services, as the Company received warrants from two IPO consulting customers who successfully listed on the Nasdaq in

the same period last year, and a decrease in maintenance and supporting services, as the Company entered into a significant maintenance

service contract with an important customer in 2023. Additionally, although the organic software business has grown by more than 20%,

the Company’s subsidiary, Sigmaways recognized losses within its business, and one of the Company’s GO IPO clients has returned

its fees after discovering that it could not go public.

Gross

profit was $2.8 million compared to $7.1 million in the same period last year. The decrease was primarily due to the aforementioned reasons

above.

Operating

expenses decreased to $5.0 million compared to $6.3 million in the same period last year. The decrease was primarily due to lower selling

and general and administrative expenses.

Net

loss was about $3.7 million or $(0.16) per diluted share compared to a net income of $0.8 million or $0.05 per diluted share, in the

same period last year.

About

HeartCore Enterprises, Inc.

Headquartered

in Tokyo, Japan, HeartCore Enterprises is a leading enterprise software and consulting services company. HeartCore offers Software as

a Service (SaaS) solutions to enterprise customers in Japan and worldwide. The Company also provides data analytics services that allow

enterprise businesses to create tailored web experiences for their clients through best-in-class design. HeartCore’s customer experience

management platform (CXM Platform) includes marketing, sales, service and content management systems, as well as other tools and integrations,

which enable companies to enhance the customer experience and drive engagement. HeartCore also operates a digital transformation business

that provides customers with robotics process automation, process mining and task mining to accelerate the digital transformation of

enterprises. HeartCore’s GO IPOSM consulting services helps Japanese-based companies go public in the U.S. Additional

information about the Company’s products and services is available at and https://heartcore-enterprises.com/.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section

21E of the Securities Exchange Act of 1934, as amended, or the Private Securities Litigation Reform Act of 1995. All statements other

than statements of historical facts included in this press release are forward-looking statements. In some cases, forward-looking statements

can be identified by words such as “believed,” “intend,” “expect,” “anticipate,” “plan,”

“potential,” “continue,” or similar expressions. Such forward-looking statements include risks and uncertainties,

and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking

statements. These factors, risks, and uncertainties are discussed in HeartCore’s filings with the Securities and Exchange Commission.

Investors should not place any undue reliance on forward-looking statements since they involve known and unknown, uncertainties and other

factors which are, in some cases, beyond HeartCore’s control which could, and likely will materially affect actual results, and

levels of activity, performance, or achievements. Any forward-looking statement reflects HeartCore’s current views with respect

to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations,

growth strategy, and liquidity. HeartCore assumes no obligation to publicly update or revise these forward-looking statements for any

reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even

if new information becomes available in the future. The contents of any website referenced in this press release are not incorporated

by reference herein.

HeartCore

Investor Relations Contact:

Gateway

Group, Inc.

Matt

Glover and John Yi

HTCR@gateway-grp.com

(949)

574-3860

HeartCore

Enterprises, Inc.

Consolidated

Balance Sheets

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,806,349 | | |

$ | 1,012,479 | |

| Accounts receivable | |

| 2,440,872 | | |

| 2,623,682 | |

| Investments in marketable securities | |

| 435,498 | | |

| 642,348 | |

| Investment in equity securities | |

| - | | |

| 300,000 | |

| Prepaid expenses | |

| 3,877,454 | | |

| 536,865 | |

| Current portion of long-term note receivable | |

| 100,000 | | |

| 100,000 | |

| Due from related party | |

| 40,495 | | |

| 44,758 | |

| Other current assets | |

| 199,221 | | |

| 234,761 | |

| Total current assets | |

| 10,899,889 | | |

| 5,494,893 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Accounts receivable, non-current | |

| 640,197 | | |

| - | |

| Property and equipment, net | |

| 640,787 | | |

| 763,730 | |

| Operating lease right-of-use assets | |

| 2,106,466 | | |

| 2,467,889 | |

| Intangible asset, net | |

| 4,196,875 | | |

| 4,515,625 | |

| Goodwill | |

| 3,276,441 | | |

| 3,276,441 | |

| Long-term investment in SAFE | |

| 350,000 | | |

| - | |

| Long-term investment in equity securities | |

| 300,000 | | |

| - | |

| Long-term investment in warrants | |

| 543,120 | | |

| 2,004,308 | |

| Long-term note receivable | |

| 200,000 | | |

| 200,000 | |

| Deferred tax assets | |

| 395,743 | | |

| 369,436 | |

| Security deposits | |

| 310,833 | | |

| 348,428 | |

| Long-term loan receivable from related party | |

| 145,274 | | |

| 182,946 | |

| Other non-current assets | |

| 70,309 | | |

| 71 | |

| Total non-current assets | |

| 13,176,045 | | |

| 14,128,874 | |

| | |

| - | | |

| | |

| Total assets | |

$ | 24,075,934 | | |

$ | 19,623,767 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 1,757,545 | | |

$ | 1,757,038 | |

| Accounts payable and accrued expenses - related party | |

| 21,579 | | |

| - | |

| Accrued payroll and other employee costs | |

| 628,136 | | |

| 723,305 | |

| Due to related party | |

| 140 | | |

| 1,476 | |

| Short-term debt | |

| - | | |

| 135,937 | |

| Current portion of long-term debts | |

| 508,729 | | |

| 371,783 | |

| Insurance premium financing | |

| 112,488 | | |

| - | |

| Factoring liability | |

| 320,759 | | |

| 562,767 | |

| Operating lease liabilities, current | |

| 358,377 | | |

| 396,535 | |

| Finance lease liabilities, current | |

| 15,992 | | |

| 17,445 | |

| Income tax payables | |

| 1,142 | | |

| 162,689 | |

| Deferred revenue | |

| 2,207,420 | | |

| 2,166,175 | |

| Other current liabilities | |

| 9,261,012 | | |

| 216,405 | |

| Total current liabilities | |

| 15,193,319 | | |

| 6,511,555 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Long-term debts | |

| 1,403,569 | | |

| 1,770,352 | |

| Operating lease liabilities, non-current | |

| 1,804,967 | | |

| 2,135,160 | |

| Finance lease liabilities, non-current | |

| 52,055 | | |

| 66,779 | |

| Deferred tax liabilities | |

| 1,175,125 | | |

| 1,264,375 | |

| Other non-current liabilities | |

| 685,364 | | |

| 208,732 | |

| Total non-current liabilities | |

| 5,121,080 | | |

| 5,445,398 | |

| | |

| | | |

| | |

| Total liabilities | |

| 20,314,399 | | |

| 11,956,953 | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Preferred shares ($0.0001 par value, 20,000,000 shares authorized, no shares issued and outstanding as of June 30, 2024 and December 31, 2023) | |

| - | | |

| - | |

| Common shares ($0.0001 par value, 200,000,000 shares authorized; 20,864,144 and 20,842,690 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively) | |

| 2,085 | | |

| 2,083 | |

| Additional paid-in capital | |

| 19,325,270 | | |

| 19,594,801 | |

| Accumulated deficit | |

| (18,047,919 | ) | |

| (14,763,469 | ) |

| Accumulated other comprehensive income | |

| 325,857 | | |

| 331,881 | |

| Total HeartCore Enterprises, Inc. shareholders’ equity | |

| 1,605,293 | | |

| 5,165,296 | |

| Non-controlling interests | |

| 2,156,242 | | |

| 2,501,518 | |

| Total shareholders’ equity | |

| 3,761,535 | | |

| 7,666,814 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 24,075,934 | | |

$ | 19,623,767 | |

HeartCore

Enterprises, Inc.

Unaudited

Consolidated Statements of Operations and Comprehensive Income (Loss)

| | |

For the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 9,113,120 | | |

$ | 13,829,523 | |

| Cost of revenues | |

| 6,275,050 | | |

| 6,688,004 | |

| Gross profit | |

| 2,838,070 | | |

| 7,141,519 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Selling expenses | |

| 399,115 | | |

| 1,056,704 | |

| General and administrative expenses | |

| 4,428,712 | | |

| 5,133,094 | |

| Research and development expenses | |

| 200,402 | | |

| 119,232 | |

| Total operating expenses | |

| 5,028,229 | | |

| 6,309,030 | |

| | |

| | | |

| | |

| Income (loss) from operations | |

| (2,190,159 | ) | |

| 832,489 | |

| | |

| | | |

| | |

| Other income (expenses): | |

| | | |

| | |

| Changes in fair value of investments in marketable securities | |

| (430,331 | ) | |

| (229,022 | ) |

| Changes in fair value of investments in warrants | |

| (1,237,707 | ) | |

| 166,107 | |

| Interest income | |

| 4,624 | | |

| 50,270 | |

| Interest expenses | |

| (73,701 | ) | |

| (82,454 | ) |

| Other income | |

| 134,874 | | |

| 124,001 | |

| Other expenses | |

| (49,050 | ) | |

| (36,754 | ) |

| Total other expenses | |

| (1,651,291 | ) | |

| (7,852 | ) |

| | |

| | | |

| | |

| Income (loss) before income tax provision | |

| (3,841,450 | ) | |

| 824,637 | |

| | |

| | | |

| | |

| Income tax expense (benefit) | |

| (152,330 | ) | |

| 39,446 | |

| | |

| | | |

| | |

| Net income (loss) | |

| (3,689,120 | ) | |

| 785,191 | |

| Less: net loss attributable to non-controlling interests | |

| (404,670 | ) | |

| (185,298 | ) |

| Net income (loss) attributable to HeartCore Enterprises, Inc. | |

$ | (3,284,450 | ) | |

$ | 970,489 | |

| | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (13,825 | ) | |

| 5,499 | |

| | |

| | | |

| | |

| Total comprehensive income (loss) | |

| (3,702,945 | ) | |

| 790,690 | |

| Less: comprehensive loss attributable to non-controlling interests | |

| (412,471 | ) | |

| (187,258 | ) |

| Comprehensive income (loss) attributable to HeartCore Enterprises, Inc. | |

$ | (3,290,474 | ) | |

$ | 977,948 | |

| | |

| | | |

| | |

| Net income (loss) per common share attributable to HeartCore Enterprises, Inc. | |

| | | |

| | |

| Basic | |

$ | (0.16 | ) | |

$ | 0.05 | |

| Diluted | |

$ | (0.16 | ) | |

$ | 0.05 | |

| | |

| | | |

| | |

| Weighted average common shares outstanding | |

| | | |

| | |

| Basic | |

| 20,859,429 | | |

| 19,959,333 | |

| Diluted | |

| 20,859,429 | | |

| 19,959,333 | |

HeartCore

Enterprises, Inc.

Unaudited

Consolidated Statements of Cash Flows

| | |

For the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash flows from operating activities | |

| | | |

| | |

| Net income (loss) | |

$ | (3,689,120 | ) | |

$ | 785,191 | |

| Adjustments to reconcile net income (loss) to net cash flows used in operating

activities: | |

| | | |

| | |

| Depreciation and amortization expenses | |

| 374,946 | | |

| 306,097 | |

| Amortization of debt issuance costs | |

| 2,296 | | |

| 1,316 | |

| Non-cash lease expense | |

| 182,546 | | |

| 155,301 | |

| Gain on termination of lease | |

| (469 | ) | |

| - | |

| Deferred income taxes | |

| (153,531 | ) | |

| (75,240 | ) |

| Stock-based compensation | |

| 147,754 | | |

| 1,094,393 | |

| Warrants received as noncash consideration | |

| - | | |

| (4,009,335 | ) |

| Changes in fair value of investments in marketable securities | |

| 430,331 | | |

| 229,022 | |

| Changes in fair value of investment in warrants | |

| 1,237,707 | | |

| (166,107 | ) |

| Loss on disposal of property and equipment | |

| 1,894 | | |

| - | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (548,402 | ) | |

| (596,312 | ) |

| Prepaid expenses | |

| 158,110 | | |

| 1,245 | |

| Other assets | |

| (7,526 | ) | |

| 23,277 | |

| Accounts payable and accrued expenses | |

| 272,375 | | |

| (8,359 | ) |

| Accounts payable and accrued expenses - related party | |

| 21,956 | | |

| - | |

| Accrued payroll and other employee costs | |

| (278,361 | ) | |

| 124 | |

| Due to related party | |

| (1,246 | ) | |

| 4,214 | |

| Operating lease liabilities | |

| (183,047 | ) | |

| (147,035 | ) |

| Income tax payables | |

| (152,697 | ) | |

| 106,625 | |

| Deferred revenue | |

| 165,073 | | |

| 810,639 | |

| Other liabilities | |

| 558,667 | | |

| 116,382 | |

| Net cash flows used in operating activities | |

| (1,460,744 | ) | |

| (1,368,562 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchases of property and equipment | |

| (4,134 | ) | |

| (180,451 | ) |

| Prepayment for property and equipment | |

| (35,209 | ) | |

| - | |

| Advance on note receivable | |

| - | | |

| (300,000 | ) |

| Purchase of long-term investment in SAFE | |

| (350,000 | ) | |

| - | |

| Net proceeds from sale of warrants | |

| 5,640,000 | | |

| | |

| Repayment of loan provided to related party | |

| 21,166 | | |

| 23,715 | |

| Payment for acquisition of subsidiary, net of cash acquired | |

| - | | |

| (724,910 | ) |

| Net cash flows provided by (used in) investing activities | |

| 5,271,823 | | |

| (1,181,646 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Payments for finance leases | |

| (8,526 | ) | |

| (11,243 | ) |

| Proceeds from short-term debt | |

| 68,138 | | |

| - | |

| Repayment of short-term and long-term debts | |

| (281,451 | ) | |

| (411,923 | ) |

| Repayment of insurance premium financing | |

| (60,201 | ) | |

| (149,250 | ) |

| Net proceeds from factoring arrangement | |

| - | | |

| 328,967 | |

| Net repayment of factoring arrangement | |

| (242,008 | ) | |

| - | |

| Payments for debt issuance costs | |

| - | | |

| (448 | ) |

| Distribution of dividends | |

| (417,283 | ) | |

| | |

| Capital contribution from non-controlling shareholder | |

| 67,195 | | |

| - | |

| Net cash flows used in financing activities | |

| (874,136 | ) | |

| (243,897 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes | |

| (143,073 | ) | |

| (144,480 | ) |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| 2,793,870 | | |

| (2,938,585 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents - beginning of the period | |

| 1,012,479 | | |

| 7,177,326 | |

| | |

| | | |

| | |

| Cash and cash equivalents - end of the period | |

$ | 3,806,349 | | |

$ | 4,238,741 | |

| | |

| | | |

| | |

| Supplemental cash flow disclosures: | |

| | | |

| | |

| Interest paid | |

$ | 74,063 | | |

$ | 40,083 | |

| Income taxes paid | |

$ | 117,524 | | |

$ | - | |

| | |

| | | |

| | |

| Non-cash investing and financing transactions | |

| | | |

| | |

| Operating lease right-of-use assets obtained in exchange for operating lease liabilities | |

$ | 125,735 | | |

$ | - | |

| Insurance premium financing | |

$ | 172,689 | | |

$ | 389,035 | |

| Liabilities assumed in connection with purchase of property and equipment | |

$ | - | | |

$ | 2,199 | |

| Common shares issued for acquisition of subsidiary | |

$ | - | | |

$ | 3,150,000 | |

| Warrants converted to marketable securities | |

$ | 223,481 | | |

$ | 1,257,868 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

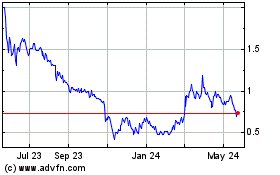

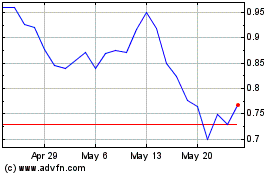

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Jul 2024 to Aug 2024

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Aug 2023 to Aug 2024