Hydrofarm Announces Reverse Stock Split

February 10 2025 - 6:00AM

Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM)

(“Hydrofarm” or the “Company”) today announced that its Board of

Directors has approved a 1-for-10 reverse stock split of the

Company’s common stock, par value $0.0001, which will be effective

at 5:00 pm Eastern Time on February 12, 2025. The Company’s common

stock will continue to be traded on The Nasdaq Capital Market on a

split-adjusted basis beginning on February 13, 2025, under the

Company’s existing trading symbol “HYFM.”

The reverse stock split is intended to regain

compliance with the minimum bid price requirement of $1.00 per

share of the Company’s common stock for continued listing on The

Nasdaq Capital Market. The new CUSIP number following the reverse

stock split will be 44888K407. The Company intends to file a

Certificate of Amendment with the Delaware Secretary of State on

February 12, 2025 to effectuate the reverse split.

The reverse stock split will affect all

stockholders uniformly and will not alter the stockholder’s

percentage ownership interest in the Company, except to the extent

that the reverse stock split results in any of the Company’s

stockholders owning a fractional share as described in more detail

below. The reverse stock split will reduce the number of shares of

common stock issued and outstanding from 46,144,512 to

approximately 4,614,451. The total authorized number of shares will

not be reduced. No fractional shares will be issued in connection

with the reverse stock split. Each stockholder who would otherwise

be entitled to receive a fraction of a share of the Company’s

common stock will be entitled to receive a cash payment based on

the closing price per share of the Company’s common stock as quoted

on the Nasdaq Capital Market on February 12, 2025.

As of the effective date of the reverse stock

split, the number of shares of common stock available for issuance

under the Company’s equity incentive plans and issuable upon the

exercise of stock options, restricted stock units and performance

stock units outstanding immediately prior to the reverse stock

split will be proportionately affected by the reverse stock split.

The exercise prices of the Company’s outstanding options,

restricted stock units and performance stock units will be adjusted

in accordance with their respective terms.

Continental Stock Transfer and Trust Company,

the Company's transfer agent, will act as the exchange agent for

the reverse stock split. Stockholders with common stock in “street

name” will receive instructions from their brokers.

About Hydrofarm Holdings Group, Inc.

Hydrofarm is a leading independent manufacturer

and distributor of branded hydroponics equipment and supplies for

controlled environment agriculture, including grow lights, climate

control solutions, growing media and nutrients, as well as a broad

portfolio of innovative and proprietary branded products. For over

40 years, Hydrofarm has helped growers make growing easier and more

productive. The Company’s mission is to empower growers, farmers

and cultivators with products that enable greater quality,

efficiency, consistency and speed in their grow projects.

Cautionary Note Regarding

Forward-Looking Statements

Statements contained in this press release,

other than statements of historical fact, which address activities,

events and developments that the Company expects or anticipates

will or may occur in the future, including, but not limited to,

information regarding the future economic performance and financial

condition of the Company, the plans and objectives of the Company’s

management, and the Company’s assumptions regarding such

performance and plans are “forward-looking statements” within the

meaning of the U.S. federal securities laws that are subject to

risks and uncertainties. These forward-looking statements generally

can be identified as statements that include phrases such as

“guidance,” “outlook,” “projected,” “believe,” “target,” “predict,”

“estimate,” “forecast,” “strategy,” “may,” “goal,” “expect,”

“anticipate,” “intend,” “plan,” “foresee,” “likely,” “will,”

“should” or other similar words or phrases. Actual results could

differ materially from the forward-looking information in this

release due to a variety of factors, including, but not limited

to:

The market in which we operate has been

substantially adversely impacted by industry conditions, including

oversupply and decreasing prices of the products the Company's end

customers sell, which, in turn, have materially adversely impacted

the Company's sales and other results of operations and which may

continue to do so in the future; If industry conditions worsen or

are sustained for a lengthy period, we could be forced to take

additional impairment charges and/or inventory and accounts

receivable reserves, which could be substantial, and, ultimately,

we may face liquidity challenges; Although equity financing may be

available, the Company's current stock prices are at depressed

levels and any such financing would be dilutive; Interruptions in

the Company's supply chain could adversely impact expected sales

growth and operations; We may be unable to meet the continued

listing standards of Nasdaq; Our restructuring activities may

increase our expenses and cash expenditures, and may not have the

intended cost saving effects; The highly competitive nature of

the Company’s markets could adversely affect its ability to

maintain or grow revenues; Certain of the Company’s products may be

purchased for use in new or emerging industries or segments,

including the cannabis industry, and/or be subject to varying,

inconsistent, and rapidly changing laws, regulations,

administrative and enforcement approaches, and consumer perceptions

and, among other things, such laws, regulations, approaches and

perceptions may adversely impact the market for the Company’s

products; The market for the Company’s products has been impacted

by conditions impacting its customers, including related crop

prices and other factors impacting growers; Compliance with

environmental and other public health regulations or changes in

such regulations or regulatory enforcement priorities could

increase the Company’s costs of doing business or limit the

Company’s ability to market all of its products; Damage to the

Company’s reputation or the reputation of its products or products

it markets on behalf of third parties could have an adverse effect

on its business; If the Company is unable to effectively execute

its e-commerce business, its reputation and operating results may

be harmed; The Company’s operations may be impaired if its

information technology systems fail to perform adequately or if it

is the subject of a data breach or cyber-attack; The Company may

not be able to adequately protect its intellectual property and

other proprietary rights that are material to the Company’s

business; Acquisitions, other strategic alliances and investments

could result in operating and integration difficulties, dilution

and other harmful consequences that may adversely impact the

Company’s business and results of operations. Additional detailed

information concerning a number of the important factors that could

cause actual results to differ materially from the forward-looking

information contained in this release is readily available in the

Company’s annual, quarterly and other reports. The Company

disclaims any obligation to update developments of these risk

factors or to announce publicly any revision to any of the

forward-looking statements contained in this release, or to make

corrections to reflect future events or developments.

Investor ContactAnna Kate Heller /

ICRir@hydrofarm.com

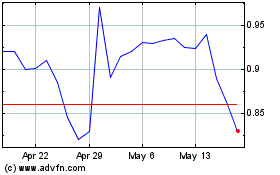

Hydrofarm (NASDAQ:HYFM)

Historical Stock Chart

From Feb 2025 to Mar 2025

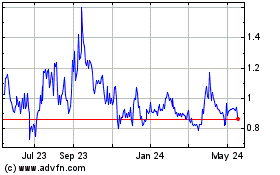

Hydrofarm (NASDAQ:HYFM)

Historical Stock Chart

From Mar 2024 to Mar 2025