UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023.

Commission File Number: 001-39530

ImmunoPrecise Antibodies Ltd.

3204 - 4464 Markham Street, Victoria, British Columbia V8Z 7X8

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

INCORPORATION BY REFERENCE

Exhibits 99.1 and 99.2 of this Form 6-K are incorporated by reference into the Registration Statement on Form F-3 (File No. 333-273197) and Registration Statement on Form S-8 (File No. 333-256730) of the Registrant, ImmunoPrecise Antibodies Ltd.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

IMMUNOPRECISE ANTIBODIES LTD. |

| Date: December 14, 2023 |

|

| |

|

|

| |

By: |

/s/ Kristin Taylor |

| |

Name: |

Kristin Taylor |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

The following Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the unaudited condensed interim consolidated financial statements of ImmunoPrecise Antibodies Ltd. (“the Company”, “ImmunoPrecise” or “IPA”) for the three and six months ended October 31, 2023, together with the audited consolidated financial statements and accompanying MD&A of the Company for the year ended April 30, 2023. This MD&A is the responsibility of management and was reviewed and approved by the Board of Directors of IPA (the "Board") on December 13, 2023.

The referenced financial statements have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board ("IFRS") and as applicable to the preparation of interim financial statements, including IAS 34, Interim Financial Reporting. Except as otherwise noted, all dollar figures in this MD&A are stated in Canadian dollars, which is the Company’s reporting currency.

FORWARD-LOOKING INFORMATION

This MD&A contains certain statements that constitute "forward-looking information" within the meaning of National Instrument 51-102 - Continuous Disclosure Obligations of the Canadian Securities Administrators.

Forward-looking information often, but not always, is identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "expect", "targeting" and "intend" and statements that an event or result "may", "will", "should", "could", or "might" occur or be achieved and other similar expressions.

This document contains forward-looking information about IPA's future outlook, future plans and expenditures, the satisfaction of rights and performance of obligations under agreements to which IPA is a party, product development, future revenue growth, research and development initiatives, and general market trends and developments. These statements, which involve expectations, estimates, and projections, are not guarantees of future performance and involve risks and uncertainties that are difficult to predict and/or are beyond IPA's control.

Forward-looking information is based on certain assumptions, including the progress, timing, and costs related to the execution of IPA's business plan and strategy; estimates and projections regarding the industry in which IPA operates; the future success of research and development activities, including the advancement of IPA's artificial intelligence ("AI") technologies, the LENSai software, and HYFTTM technology. Assumptions are also made on the absence of material changes in various areas such as regulatory environment, general business and economic conditions, market demand for IPA's services, competitive landscape, and technological disruptions. Furthermore, the statements take into account estimates regarding future financing and capital.

The success of IPA's AI technologies is subject to inherent uncertainties of technology development and implementation, including the complexity of tasks the AI is being developed to perform, potential technical difficulties, the necessity for continuous adaptation to new scientific findings and data, and regulatory and ethical considerations. Furthermore, the potential for IPA's AI technologies to generate revenues is contingent upon market acceptance, development of commercially viable applications, and establishment of successful business models.

Forward-looking information inherently carry risks and uncertainties that could cause actual outcomes and results to differ materially from current expectations. Thus, these statements should be approached with caution, and undue reliance on them should be avoided. Some of these risks and uncertainties are outlined in the 'RISKS AND UNCERTAINTIES' section of this MD&A. It is important to note that forward-looking information is not an assurance of future performance. As actual results and future events could vary significantly from those anticipated in these statements, they should not be taken as accurate predictions. Despite the potential updates or revisions of forward-looking information due to new information or future events, IPA is under no obligation to make these changes unless required by law. These cautionary notes serve to qualify all forward-looking information contained in this MD&A explicitly.

CAUTION REGARDING NON-IFRS MEASURES

In addition to the results reported in accordance with IFRS, this MD&A makes reference to certain measures that are not recognized under IFRS and do not have a standardized meaning prescribed by IFRS. They are therefore unlikely to be comparable to similar measures presented by other companies. The Company uses non-IFRS measures, including "adjusted EBITDA" as additional information to complement IFRS measures by providing further understanding of the Company's results of operations from management's perspective. Management believes that these measures provide useful information in that they may exclude amounts that are not indicative of the Company's core operating results and ongoing operations and provide a more consistent basis for comparison between periods. For further details, please refer to the Non-IFRS Financial Measures section later in this document.

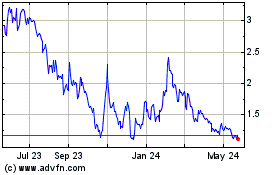

GENERAL

Founded on November 22, 1983, and incorporated under Alberta law, IPA's common shares ("Common Shares") currently trade on the Nasdaq Global Market under the ticker symbol "IPA". As of November 25, 2022, the Company made a strategic decision to voluntarily delist the Common Shares from the TSX Venture Exchange. The corporate headquarters of IPA is situated at 3204 - 4464 Markham Street, Victoria, BC V8Z 7X8.

OVERVIEW

Integrated within ImmunoPrecise's wet lab infrastructure is a diverse array of in silico technologies. As an end-to-end service provider of antibody discovery and development, IPA's state-of-the-art computational methodologies allow the Company to perform detailed and comprehensive evaluations across various stages of biologic discovery and development. The synergy between ImmunoPrecise's in silico analyses and wet lab technologies enhances the efficacy of the workflow, thereby offering a unique value proposition to its partners aimed at reducing the time, cost and risk associated with therapeutic antibody discovery and development. This strategic integration underscores ImmunoPrecise's commitment to innovative solutions, driving not only operational efficiency but also pioneering advancements in the industry.

Services

IPA is a leading biotherapeutic research and technology firm, distinguished by its proficiency in both in silico and wet lab methodologies. At the intersection of systems biology, multi-omics modeling, and complex artificial intelligence systems, the company has carved out a unique space within the field. The core of the company's operations encompasses a diverse suite of proprietary technologies that aid in the exploration, discovery, and development of novel drugs and biologics.

The breadth of services provided by ImmunoPrecise unfolds sequentially in alignment with the process of antibody discovery and development. Starting from the in silico arena, the company utilizes custom antigen modeling, target analysis using Natural Language Processing, and the patented HYFTTM analysis to lay the groundwork for the subsequent experimental phases.

As the projects transition into the wet lab phase, ImmunoPrecise's capabilities diversify, offering an array of services such as design and manufacturing, B cell sorting incorporating IPA's proprietary Function First B Cell screening and sequencing, and the production and screening of custom, immune, and proprietary naïve phage display libraries. IPA's wet lab antibody discovery technologies are compatible with in-depth mining of antibody repertoires by next generation sequencing and computational analysis. The Company's hybridoma discovery and production services, enhanced by multiplexed high-throughput screening and single clone-picking, complement the expertise it possesses with transgenic animals and multi-species antibody discovery.

The Company then steps into antibody characterization studies, which encompass affinity measurements, epitope landscape profiling, functional assays, and in silico analyses including immunogenicity, three-dimensional modeling, relative affinity rankings, molecular docking, and off-target analyses. Additional services include the creation of bi-specifics, single domain (such as VHH and VNAR (shark)) antibodies, recombinant cloning, protein and antibody production and downstream processing, stable cell line generation, antibody engineering, optimization including humanization, and cryopreservation and cryostorage.

ImmunoPrecise's wholly-owned subsidiaries, IPA Canada and IPA Europe, have received recognition as approved Contract Research Organizations for top-tier transgenic animal platforms producing antibodies with human antigen binding domains, along with protein manufacturing. The subsidiaries also form a critical component of the Company's R&D investments, promoting the development of proprietary technologies like B cell Select® and DeepDisplayTM platforms, applicable across a wide array of species and strains, including transgenic animals.

Operations of the Company

IPA is a global operation with a presence in Utrecht and Oss in the Netherlands, Diepenbeek in Belgium, Victoria, British Columbia, in Canada and Fargo, North Dakota in the United States. This broad reach enables IPA to tap into thriving locations that strongly support the life sciences industry and the development of artificial intelligence.

The Company's leadership, spanning North America and Europe, holds global responsibility for financial and accounting oversight, sales and marketing, investor relations, and information technology. An enterprise resource management system aids in automating marketing and sales, enhancing customer relationship management, and simplifying accounting, financial reporting, and project management tasks.

The Company's head office is in Victoria, British Columbia, and the base for U.S. operations is in Fargo, North Dakota. IPA Canada operates from Victoria, British Columbia (Canada), performing custom antibody generation since its inception. The Company has recently completed the expansion of its vivarium in Victoria while simultaneously intensifying its capabilities in measuring protein binding kinetics and high-throughput label-free protein-protein interactions and further developing and improving technologies such as its B cell Select® platform.

The acquisition of U-Protein Express B.V. ("UPE") and ModiQuest Research B.V. ("MQR"), now collectively named IPA Europe, has deepened the Company's technological competence, and expanded its capabilities for partners worldwide. The team from MQR in Oss brings extensive expertise in various areas, including in vitro antibody phage library generation, antibody characterization, optimization, and engineering. The UPE team in Utrecht specializes in the production of complex proteins and antibodies, supporting numerous programs across various sectors using their proprietary expression platform rPEx®.

On April 14, 2022, the Company successfully acquired BioStrand BV, BioKey BV, and BioClue BV, a group of innovative artificial intelligence entities based in Belgium. These entities are leaders in the field of multi-omics and in silico biotechnology, specializing in the intricate task of identifying unique biological fingerprints within proteins, RNA, and DNA across multiple information layers, giving rise to unprecedented insights into biological molecules, including intricate relationships between protein structure and function. They have constructed a comprehensive knowledge base of these distinctive biological markers, which serves as a significant tool for their comparison and processing. This strategic acquisition further bolsters the Company's standing in the rapidly advancing fields of multi-omics and in silico antibody discovery and development.

The Company continues to broaden its intellectual property portfolio in additional, meaningful ways, including internal R&D, acquisitions, and collaborations. There is also an emphasis on therapeutic antibody asset development in areas such as oncology, inflammation, neurodegenerative diseases, autoimmunity, and atherosclerosis.

STRATEGY AND OUTLOOK

The management team at IPA places a strong emphasis on initiatives designed to increase revenue, enhance internal assets, and maximize shareholder value. Central to our mission is the aspiration to fundamentally transform the approach to biotherapeutic discovery and development. By integrating our advanced (AI)-driven software, LENSai', we aim to introduce a new paradigm that underscores accuracy, precision, speed, and cost-effectiveness, thereby changing how the world processes complex and disparate data.

One core component of our strategy is the integration of LENSai's in silico capabilities into our services. Through LENSai, we add high through-put in silico analytical capabilities early in the discovery and development cycle, which complements our traditional wet lab services.

Our goal is to remain a preferred partner for therapeutic antibody researchers, providing an integrated, data-driven, technologically advanced continuum of services. We are working towards accelerating the transition of novel therapies from the lab to the clinic by providing a bridge between in silico predictions and wet lab validations. Our in silico tools, powered by LENSai, can predict potential targets and functional outcomes, and provide iterative feedback from our wet lab experiments designed to refine these predictions and improve the accuracy of our AI models.

In 2022, to accommodate operational growth, we relocated our Utrecht facility to larger premises within the Utrecht Science Park, which resulted in a doubling of our lab capacity. This strategic move was driven by the need to meet increasing market demands in Europe, North America, and Asia.

Pharmaceutical industry trends suggest an increasing reliance on external partners like IPA for expertise, cost-effectiveness, and rapid turnaround times. As a service provider with both wet lab and AI-driven in silico capabilities, management believes they align well with these industry needs.

The monoclonal antibody market is experiencing growth, with an increasing focus on antibody R&D in response to the rising incidence of cancer, infectious diseases, and chronic diseases. The therapeutic antibody market, valued at US$115 billion in 2018 according to a study published in the Journal of Biomedical Science in January 2022, is projected to reach US$300 billion by 2025. According to GrandViewResearch.com, the protein and antibody-related service and product market is predicted to grow at a CAGR of 6.2% to US$5.6 billion by 2027.

IPA is not simply adapting to market trends but is attempting to actively set new standards and demonstrate novel capabilities. IPA considers itself leaders in the field of AI-integrated biotherapeutics research. The Company's unique blend of AI-driven in silico capabilities and traditional wet lab services guides our innovation.

AI for Drug Discovery

The initial stage of the drug discovery process involves identifying a novel drug candidate and its therapeutic target. In the context of antibody discovery, this phase involves leveraging AI to speed up the process of identifying and designing new antibodies. The AI platform employs machine learning and other AI methodologies to analyze vast amounts of data related to antibodies, yielding insights into their structure, function, and intermolecular interactions. Potential drug candidates or novel drug targets are evaluated based on parameters such as efficacy, potency, bioavailability, and toxicity.

AI is increasingly becoming a crucial tool in the healthcare industry, especially in the area of drug research. AI technology has the capability to identify therapeutic targets and plays a critical role in the design, discovery, and efficient screening of molecules. According to a 2022 report by ReportLinker, the global AI in Drug Discovery Market, valued at USD 253.8 million in 2019, is projected to reach USD 3.9 billion by 2030, growing at a CAGR of 40.8 % from 2020 to 2030. This anticipated growth is attributed to the ability of AI to understand disease mechanisms, establish biomarkers, and generate data or models for the drug discovery process.

Our acquisition of BioStrand in April 2022 marked a significant advancement for the organization. BioStrand brings its unique and proprietary HYFT™ technology that adds accuracy and transparency (explainability) to traditional AI approaches and algorithms, an extremely important feature, especially in life sciences.

The Company's AI-driven software, LENSai, takes advantage of this technology. It enables us to extract the potential from data, discover connections between data, and pull new and valuable information from existing data. Furthermore, BioStrand's HYFT™ framework converts unstructured data into structured data, allowing for default feature reduction and efficient downstream analysis using advanced AI/ML techniques. The HYFT™ fingerprints create a link between sequences and literature analysis through a bottom-up Natural Language Processing approach, providing a universal syntax for the language of biology. This proprietary pattern and profile detection is crucial for understanding diseases and biological processes.

BioStrand's HYFT™ framework makes all accessible biological data rapidly computable. The technology developed by BioStrand offers a solution for "omics" (DNA, RNA, amino acids) data management, analysis, and storage, effectively addressing the current challenges and bottlenecks in bioinformatics. The integration of this technology with the LENSai platform results in an incredibly efficient system for managing and analyzing omics data. This combination of technologies is capable of processing huge tasks at high speed and scale, all while maintaining a light computational footprint.

OVERALL PERFORMANCE AND LIQUIDITY

The Company achieved revenues of $6.2 million and $11.8 million during the three and six months ended October 31, 2023, a 18.6% and 19.9% increase from 2022 revenues of $5.2 million and $9.9 million, respectively. The Company incurred total operating expenses of $6.0 million during the three months ended October 31, 2023, a decrease of $4.6 million compared to the three months ended October 31, 2022. Operating expenses totaled $13.0 million during the six months ended October 31, 2023, a decrease of $10.2 million compared to the six months ended October 31, 2022. Net loss totaled $2.6 million and $6.2 million for the three and six months ended October 31, 2023, compared to a net loss of $7.4 million and $16.7 million during the same periods last year.

As of October 31, 2023, the Company had cash on hand of $6.1 million compared to $8.4 million as of April 30, 2023. The Company expects its cash on hand as of October 31, 2023 will be insufficient to fund the Company's operations for at least one year from the date these financial statements are available to be issued. These conditions raise material uncertainties which cast significant doubt as to whether the Company will be able to continue as a going concern should it not be able to obtain financing necessary to fund its planned revenue growth and working capital requirements.

The Company will need to raise additional funds to finance its operations and strategic goals and there can be no assurances that sufficient funding, including adequate financing, will be available. The ability of the Company to arrange additional financing in the future depends in part on the prevailing capital market conditions and profitability of its operations. If the Company is unable to raise sufficient funds, reductions in expenditures will be required, and this may impact the future growth plans of the Company.

RESULTS OF OPERATIONS

Comparison of the three months ended October 31, 2023 and 2022

Revenue

| |

|

Three Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| Project revenue |

|

5,518 |

|

|

4,729 |

|

|

789 |

|

|

16.7% |

|

| Product sales revenue |

|

577 |

|

|

395 |

|

|

182 |

|

|

46.1% |

|

| Cryostorage revenue |

|

55 |

|

|

60 |

|

|

(5 |

) |

|

-8.3% |

|

| Total revenue |

|

6,150 |

|

|

5,184 |

|

|

966 |

|

|

18.6% |

|

The Company achieved revenue of $6.2 million during the three months ended October 31, 2023, a 18.6% increase from the three months ended October 31, 2022. Growth was primarily driven by increases in protein manufacturing and the Company's B cell Select® platform.

Gross Profit

| |

|

Three Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| Gross profit |

|

2,954 |

|

|

2,779 |

|

|

175 |

|

|

6.3% |

|

| % of total revenue |

|

48% |

|

|

54% |

|

|

|

|

|

|

|

Gross profit totaled $3.0 million during the three months ended October 31, 2023, an increase of 6.3% compared to the three months ended October 31, 2022. The increase in cost of sales is primarily attributable to increases in salary allocated to cost of sales, lab supplies and depreciation allocated to cost of sales.

Research and development

| |

|

Three Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| Research and development |

|

1,037 |

|

|

5,002 |

|

|

(3,965 |

) |

|

-79.3% |

|

During the three months ended October 31, 2023, research and development expenses decreased to $1.0 million from $5.0 million during the three months ended October 31, 2022, reflecting reduced expenditures related to the Company's PolyTope® antibody combination therapy. Research and development expenses for the three months ended October 31, 2023 include $0.6 million in salary costs, including share-based payments (2022 - $0.6 million), and $0.1 million in research expense (2022 - $4.2 million).

Sales and marketing

| |

|

Three Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| Sales and marketing |

|

921 |

|

|

817 |

|

|

104 |

|

|

12.7% |

|

Sales and marketing expenses totaled $0.9 million during the three months ended October 31, 2023, compared to $0.8 million during the three months ended October 31, 2022. Expenditures during the three months ended October 31, 2023, include $0.8 million in salary costs, including share-based payments (2022 - $0.5 million), and $0.1 million in advertising cost (2022 - $0.2 million).

General and administrative

| |

|

Three Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| General and administrative |

|

3,308 |

|

|

3,831 |

|

|

(523 |

) |

|

-13.7% |

|

During the three months ended October 31, 2023, general and administrative expenses totaled $3.3 million, a decrease of $0.5 million compared to the three months ended October 31, 2022. This decrease primarily represents a reduction of $0.5 million in professional fees.

Other Income / Expense

| |

|

Three Months Ended

October 31, |

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

| Accretion |

|

(5 |

) |

|

- |

|

|

(5 |

) |

| Grant income |

|

16 |

|

|

14 |

|

|

2 |

|

| Interest and other income |

|

213 |

|

|

36 |

|

|

177 |

|

| Unrealized foreign exchange gain |

|

209 |

|

|

297 |

|

|

(88 |

) |

| Total other income (expense) |

|

433 |

|

|

347 |

|

|

86 |

|

The Company recorded other income of $0.4 million during the three months ended October 31, 2023, compared to other income of $0.3 million during the three months ended October 31, 2022.

Comparison of the six months ended October 31, 2023 and 2022

Revenue

| |

|

Six Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| Project revenue |

|

10,734 |

|

|

9,063 |

|

|

1,671 |

|

|

18.4% |

|

| Product sales revenue |

|

976 |

|

|

691 |

|

|

285 |

|

|

41.2% |

|

| Cryostorage revenue |

|

127 |

|

|

119 |

|

|

8 |

|

|

6.7% |

|

| Total revenue |

|

11,837 |

|

|

9,873 |

|

|

1,964 |

|

|

19.9% |

|

The Company achieved revenue of $11.8 million during the six months ended October 31, 2023, a 19.9% increase from the six months ended October 31, 2022. Growth was primarily driven by increases in protein manufacturing and the Company's B cell Select® platform.

Gross Profit

| |

|

Six Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| Gross profit |

|

5,747 |

|

|

5,258 |

|

|

489 |

|

|

9.3% |

|

| % of total revenue |

|

49% |

|

|

53% |

|

|

|

|

|

|

|

Gross profit totaled $5.7 million during the six months ended October 31, 2023, an increase of 9.3% compared to the six months ended October 31, 2022. The increase in cost of sales is primarily attributable to increases in salary allocated to cost of sales, lab supplies and depreciation allocated to cost of sales.

Research and development

| |

|

Six Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| Research and development |

|

2,114 |

|

|

11,626 |

|

|

(9,512 |

) |

|

-81.8% |

|

During the six months ended October 31, 2023, research and development expenses decreased to $2.1 million from $11.6 million during the six months ended October 31, 2022, primarily due to significantly reduced expenditures related to the Company's PolyTope® antibody combination therapy. Research and development expenses for the six months ended October 31, 2023 include $1.3 million in salary costs, including share-based payments (2022 - $1.2 million), and $0.3 million in research expense (2022 - $10.0 million).

Sales and marketing

| |

|

Six Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| Sales and marketing |

|

1,984 |

|

|

1,838 |

|

|

146 |

|

|

7.9% |

|

Sales and marketing expenses totaled $2.0 million during the six months ended October 31, 2023, compared to $1.8 million during the six months ended October 31, 2022. Expenditures during the six months ended October 31, 2023, include $1.6 million in salary costs, including share-based payments (2022 - $1.2 million), and $0.3 million in advertising cost (2022 - $0.5 million).

General and administrative

| |

|

Six Months Ended

October 31, |

|

|

|

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

|

Change

% |

|

| General and administrative |

|

7,295 |

|

|

7,626 |

|

|

(331 |

) |

|

-4.3% |

|

During the six months ended October 31, 2023, general and administrative expenses totaled $7.3 million, a decrease of $0.3 million compared to the six months ended October 31, 2022. This decrease primarily represents a reduction of $0.5 million in professional fees.

Other Income / Expense

| |

|

Six Months Ended

October 31, |

|

|

|

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

Change

$ |

|

| Accretion |

|

(10 |

) |

|

(3 |

) |

|

(7 |

) |

| Grant income |

|

299 |

|

|

284 |

|

|

15 |

|

| Interest and other income |

|

356 |

|

|

34 |

|

|

322 |

|

| Unrealized foreign exchange gain |

|

136 |

|

|

320 |

|

|

(184 |

) |

| Total other income (expense) |

|

781 |

|

|

635 |

|

|

146 |

|

The Company recorded other income of $0.8 million during the six months ended October 31, 2023, compared to other income of $0.6 million during the six months ended October 31, 2022.

SUMMARY OF QUARTERLY RESULTS

The following table sets out financial information for the past eight quarters:

| |

|

Three Months Ended ($) |

|

| (in thousands, except share data) |

|

October 31,

2023 |

|

|

July 31,

2023 |

|

|

April 30,

2023 |

|

|

January 31,

2023 |

|

| Total revenue |

|

6,150 |

|

|

5,688 |

|

|

5,621 |

|

|

5,171 |

|

| Cost of sales |

|

3,196 |

|

|

2,893 |

|

|

2,280 |

|

|

2,207 |

|

| Gross profit |

|

2,954 |

|

|

2,795 |

|

|

3,341 |

|

|

2,964 |

|

| Operating expenses |

|

5,977 |

|

|

6,972 |

|

|

9,417 |

|

|

7,544 |

|

| Other income (expenses) |

|

433 |

|

|

350 |

|

|

179 |

|

|

(15 |

) |

| Income taxes |

|

32 |

|

|

(262 |

) |

|

(767 |

) |

|

104 |

|

| Net loss |

|

(2,622 |

) |

|

(3,565 |

) |

|

(5,130 |

) |

|

(4,699 |

) |

| Basic and diluted loss per share* |

|

(0.10 |

) |

|

(0.14 |

) |

|

(0.20 |

) |

|

(0.19 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended ($) |

|

| (in thousands, except share data) |

|

October 31,

2022 |

|

|

July 31,

2022 |

|

|

April 30,

2022 |

|

|

January 31,

2022 |

|

| Total revenue |

|

5,184 |

|

|

4,689 |

|

|

5,239 |

|

|

4,815 |

|

| Cost of sales |

|

2,405 |

|

|

2,210 |

|

|

1,923 |

|

|

2,229 |

|

| Gross profit |

|

2,779 |

|

|

2,479 |

|

|

3,316 |

|

|

2,586 |

|

| Operating expenses |

|

10,603 |

|

|

12,550 |

|

|

7,603 |

|

|

6,892 |

|

| Other income (expenses) |

|

347 |

|

|

288 |

|

|

(82 |

) |

|

689 |

|

| Income taxes |

|

(126 |

) |

|

(403 |

) |

|

275 |

|

|

208 |

|

| Net loss |

|

(7,351 |

) |

|

(9,380 |

) |

|

(4,644 |

) |

|

(3,825 |

) |

| Basic and diluted loss per share* |

|

(0.30 |

) |

|

(0.38 |

) |

|

(0.22 |

) |

|

(0.20 |

) |

*The basic and fully diluted calculations result in the same value due to the anti-dilutive effect of outstanding stock options and warrants.

Revenue

The Company achieved revenue of $6.2 million during the three months ended October 31, 2023, an increase of 18.6% from the same period in the previous year. The Company has recorded record revenue in successive quarters, primarily due to the strength of the Company's protein manufacturing services and B cell Select® platform.

Gross Profit

The Company recorded a gross profit margin of 48% during the three months ended October 31, 2023, while gross profit margins have historically been in the 53-63% range. The decrease in gross profit margin during the three months ended October 31, 2023 was primarily attributable to an increase in salary allocated to cost of sales, lab supplies and depreciation as compared to prior periods.

Operating Expense

The Company's operating expenses have generally trended down over the past year, and total operating expenses for the three months ended October 31, 2023 was the lowest since the three months ended January 31, 2022. Fluctuations in operating expenses have historically been driven primarily by research and development expenses, while sales and marketing and general and administrative expenses have been more stable.

Other Income (Expense)

Other income (expense) is primarily influenced by unrealized foreign exchange gains or losses stemming from contractual and cash holdings denominated in euros or US dollars. This component can vary from quarter to quarter, transitioning between gains and losses due to fluctuations in foreign currency exchange rates.

NON-IFRS MEASURES

The following are non-IFRS measures and investors are cautioned not to place undue reliance on them and are urged to read all IFRS accounting disclosures present in the unaudited condensed interim consolidated financial statements of the Company for the three and six months ended October 31, 2023, together with the audited consolidated financial statements and accompanying MD&A of the Company for the year ended April 30, 2023.

The Company uses certain non-IFRS financial measures as supplemental indicators of its financial and operating performance. These non-IFRS financial measures are adjusted operating EBITDA and adjusted operating expenses. The Company believes these supplementary financial measures reflect the Company's ongoing business in a manner that allows for meaningful period-to-period comparisons and analysis of trends in its business. These non-IFRS measures do not have any standardized meaning prescribed under IFRS and are therefore unlikely to be comparable to similar measures presented by other companies.

The Company defines adjusted operating EBITDA as operating earnings before interest, accretion, taxes, depreciation, amortization, share-based compensation, foreign exchange gain/loss, and asset impairment charges. Adjusted operating EBITDA is presented on a basis consistent with the Company's internal management reports. The Company discloses adjusted operating EBITDA to capture the profitability of its business before the impact of items not considered in management's evaluation of operating unit performance. The most directly comparable IFRS measure to adjusted operating EBITDA is net loss.

The Company defines adjusted operating expenses as operating expenses before taxes, interest, share-based compensation, depreciation, amortization, accretion, foreign exchange loss, and asset impairment charges. Adjusted operating expenses are presented on a basis consistent with the Company's internal management reports. The most directly comparable IFRS measure to adjusted operating expenses is operating expenses.

The non-IFRS measures are reconciled to reported IFRS figures in the tables below:

| |

|

Three months ended

October 31, |

|

|

Six months ended

October 31, |

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

2023

$ |

|

|

2022

$ |

|

| Net loss |

|

(2,622 |

) |

|

(7,351 |

) |

|

(6,193 |

) |

|

(16,732 |

) |

| Income taxes |

|

32 |

|

|

(126 |

) |

|

(230 |

) |

|

(529 |

) |

| Amortization and depreciation |

|

1,352 |

|

|

1,464 |

|

|

2,847 |

|

|

3,014 |

|

| Accretion |

|

5 |

|

|

- |

|

|

10 |

|

|

3 |

|

| Foreign exchange realized loss |

|

11 |

|

|

78 |

|

|

52 |

|

|

87 |

|

| Interest expense |

|

166 |

|

|

54 |

|

|

312 |

|

|

90 |

|

| Interest and other income |

|

(213 |

) |

|

(36 |

) |

|

(356 |

) |

|

(34 |

) |

| Unrealized foreign exchange gain |

|

(209 |

) |

|

(297 |

) |

|

(136 |

) |

|

(320 |

) |

| Share-based payments |

|

1,120 |

|

|

355 |

|

|

1,120 |

|

|

1,114 |

|

| Adjusted EBITDA |

|

(358 |

) |

|

(5,859 |

) |

|

(2,574 |

) |

|

(13,307 |

) |

| |

|

Three months ended

October 31, |

|

|

Three months ended

October 31, |

|

| (in thousands) |

|

2023

$ |

|

|

2022

$ |

|

|

2023

$ |

|

|

2022

$ |

|

| Operating expenses |

|

(5,977 |

) |

|

(10,603 |

) |

|

(12,951 |

) |

|

(23,154 |

) |

| Amortization and depreciation |

|

804 |

|

|

1,136 |

|

|

1,741 |

|

|

2,382 |

|

| Foreign exchange gain |

|

11 |

|

|

78 |

|

|

52 |

|

|

87 |

|

| Interest expense |

|

166 |

|

|

54 |

|

|

312 |

|

|

90 |

|

| Share-based payments |

|

297 |

|

|

355 |

|

|

1,120 |

|

|

1,114 |

|

| Adjusted Operating Expenses |

|

(4,699 |

) |

|

(8,980 |

) |

|

(9,726 |

) |

|

(19,481 |

) |

LIQUIDITY AND CAPITAL RESOURCES

The Company's objectives when managing capital are to ensure sufficient liquidity for operations and adequate funding for growth and capital expenditures while maintaining an efficient balance between debt and equity. The capital structure of the Company consists of shareholders' equity.

The Company adjusts its capital structure upon approval from its Board, considering economic conditions and the Company's working capital requirements. There were no changes in the Company's approach to capital management during the three and six months ended October 31, 2023. The Company is not subject to any externally imposed capital requirements.

On July 11, 2023, the Company filed a U.S.$300 million shelf registration statement on Form F-3 (File No. 333-273197) (the "Registration Statement") with the United States Securities and Exchange Commission (the "SEC"), under which the Company may offer for sale, from time to time, either separately or together in any combination, equity, debt, or other securities described in the Registration Statement through the 36-month expiration period.

On August 15, 2023, the Company established an at-the-market equity offering facility ("ATM"). An Open Market Sales Agreement ("ATM Agreement") was entered into with Jefferies LLC as sole sales agent ("Agent"). The Company is entitled, at its discretion and from time-to-time during the term of the ATM Agreement, to sell Common Shares through the Agent. The Company filed a prospectus supplement to its Registration Statement in connection with the ATM on August 16, 2023, permitting sales of Common Share for an aggregate gross sales price of up to U.S. $60 million. During the three months ended October 31, 2023, we made no sales under the ATM. See Footnote 15 of the condensed interim financial statements for the three months ended July 31, 2023 for further information on the ATM facility.

As of October 31, 2023, the Company held cash of $6.1 million (April 30, 2023 - $8.4 million) and had working capital of $7.8 million (April 30, 2023 - $10.9 million). During the six months ended October 31, 2023, the cash used in operating activities was $0.9 million. As part of the investing activities, the Company made equipment purchases of $0.4 million, paid deferred acquisition payments of $0.1 million, and sold shares of QVQ Holdings BV for proceeds of $0.1 million. As part of the financing activities, the Company incurred lease repayments of $0.7 million.

The consideration paid for the acquisition of BioStrand includes a contingent earnout payment based on the profitability of BioStrand over a 7-year period, which shall not exceed in total €12.0 million. As of October 31, 2023, the Company's unpaid commitment related to the BioStrand earnout was €12.0 million.

Although the Company is presented as a going concern, the Company does not have cash reserves to fund all its operations for one year, and strategic future growth and expansion plans. The Company has historically incurred net losses. There is no assurance that sufficient revenues will be generated in the near future. To the extent that the Company has negative operating cash flows in future periods, it may need to deploy a portion of its existing working capital to fund such negative cash flows. The Company may need to raise additional funds through issuances of Common Shares and/or through debt financing. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favorable to the Company as those previously obtained, or at all. If the Company is unable to obtain additional financing from outside sources and eventually generate enough revenues, the Company may be forced to sell a portion or all of the Company's assets or curtail or discontinue the Company's operations.

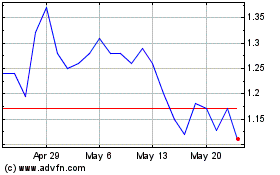

On December 8, 2023, the Company closed an underwritten public offering of 1,265,000 Common Shares, including 165,000 Common Shares issued pursuant to the full exercise by the underwriter of its over-allotment option. The public offering price for each Common Share, before the underwriter's discount and commissions, was U.S.$1.00. The Company intends to use the estimated net proceeds of approximately $1.1 million from the offering for research and development; capital expenditures, including expansion of existing laboratory facilities; and working capital and general corporate purposes. The Common Shares were offered and sold pursuant to its Registration Statement.

CAPITAL EXPENDITURES

The Company made equipment purchases of $0.4 million during the six months ended October 31, 2023 (2022 - $0.8 million).

OUTSTANDING SHARE DATA

The Company's outstanding share information as of December 14, 2023 is as follows:

| Security |

|

Number |

|

|

Exercise Price |

|

Expiry date |

| Issued and outstanding common shares |

|

26,315,260 |

|

|

NA |

|

NA |

| Stock options |

|

20,000 |

|

$ |

4.10 |

|

November 7, 2023 |

| Stock options |

|

180,000 |

|

$ |

5.00 |

|

December 31, 2023 |

| Stock options |

|

60,000 |

|

$ |

5.00 |

|

January 11, 2024 |

| Stock options |

|

250,000 |

|

$ |

8.50 |

|

September 1, 2025 |

| Stock options |

|

199,000 |

|

$ |

20.30 |

|

January 6, 2026 |

| Stock options |

|

10,000 |

|

$ |

10.59 |

|

May 9, 2026 |

| Stock options |

|

28,250 |

|

$ |

6.89 |

|

January 2, 2026 |

| Stock options |

|

314,000 |

|

$ |

7.94 |

|

January 7, 2027 |

| Stock options(1) |

|

31,000 |

|

$ |

8.300 |

|

January 7, 2027 |

| Stock options |

|

25,000 |

|

$ |

6.35 |

|

February 22, 2024 |

| Stock options |

|

80,000 |

|

$ |

5.79 |

|

May 15, 2027 |

| Stock options(1) |

|

26,638 |

|

$ |

5.63 |

|

February 19, 2027 |

| Stock options(1) |

|

557,452 |

|

$ |

5.63 |

|

February 19, 2027 |

| Warrants(1) |

|

130,111 |

|

$ |

16.81 |

|

February 3, 2026 |

| Total |

|

28,226,711 |

|

|

|

|

|

(1) Priced in USD.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not utilize off-balance sheet transactions.

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of the consolidated financial statements in conformity with IFRS required estimates and judgments that affect the amounts reported in the financial statements. Actual results could differ from these estimates and judgments. Estimates are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the year in which the estimate is revised. Estimates and judgments applied in preparation of the consolidated financial statements are the same as those presented in the Company's audited annual financial statements for the year ended April 30, 2023.

ADOPTION OF NEW ACCOUNTING STANDARDS

Standards not yet adopted

Classification of Liabilities as Current or Non-Current (Amendments to IAS 1)

The amendments to IAS 1 provide a more general approach to the classification of liabilities based on the contractual arrangements in place at the reporting date.

These amendments are effective for reporting periods beginning on or after January 1, 2024.

DISCLOSURE CONTROLS AND PROCEDURES

The Chief Executive Officer ("CEO") and the Chief Financial Officer ("CFO") have designed disclosure controls and procedures, or have caused them to be designed under their supervision. Such procedures are designed to ensure that material information relating to the Company and its consolidated subsidiaries is made known to CEO and CFO by others within the Company, and such disclosure controls and procedures are effective to perform the function for which they were established in order to provide reasonable assurance that:

• material information relating to the Company is made known to the CEO and CFO by others, particularly during the period in which the interim and annual filings are being prepared; and

• information required to be disclosed by the Company in its annual filings, interim filings or submitted by it under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation.

In connection with National Instrument 52-109 - Certificate of Disclosure in Issuer's Annual and Interim Filings, the CFO of the Company has filed a 52-109F2 Certificate of Interim Filings, Full Certificate relating to the establishment and maintenance of disclosure controls and procedures and internal controls over financial reporting with respect to the financial information contained in the unaudited condensed interim consolidated financial statements for the three and six months ended October 31, 2022 and this accompanying MD&A.

For further information, the reader should refer to the Company's Certificate of Interim Filings and the Annual Filings on SEDAR+ at www.sedarplus.com and EDGAR at www.sec.gov/edgar.

FINANCIAL INSTRUMENTS

The Company's financial instruments include cash, amounts receivable, restricted cash, investment, accounts payable and accrued liabilities, deferred acquisition payments, and leases. The fair value of investment is determined based on "Level 3" inputs which consist of unobservable inputs to the valuation methodology used. As at October 31, 2023, the Company believes the carrying values of cash, amounts receivable, restricted cash, accounts payable and accrued liabilities, and deferred payments approximate their fair values because of their nature and relatively short maturity dates or durations.

RISKS AND UNCERTAINTIES

There are numerous and varied risks, known and unknown, that may prevent the Company from achieving its goals. A detailed description of the risks and uncertainties pertaining to the Company's operations can be found in the Company's Annual Information Form for the fiscal year ended April 30, 2023. The Company is not aware of any significant changes to the risks and uncertainties disclosed at that time.

The Company's Annual Information Form can be found on SEDAR+ at www.sedarplus.com and EDGAR at www.sec.gov/edgar.

FURTHER INFORMATION:

Additional information relating to the Company can be found on SEDAR+ at www.sedarplus.com and EDGAR at www.sec.gov/edgar.

IMMUNOPRECISE ANTIBODIES LTD.

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended October 31, 2023 and 2022

(Unaudited - Expressed in Canadian Dollars)

IMMUNOPRECISE ANTIBODIES LTD.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Unaudited - Expressed in Canadian dollars) |

| (in thousands) |

Note |

|

October 31,

2023

$ |

|

|

April 30,

2023

$ |

|

| ASSETS |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

| Cash |

|

|

6,017 |

|

|

8,280 |

|

| Amounts receivable, net |

|

|

3,618 |

|

|

3,247 |

|

| Sales tax receivable |

|

|

368 |

|

|

358 |

|

| Income taxes receivable |

|

|

- |

|

|

178 |

|

| Inventory |

|

|

2,452 |

|

|

2,060 |

|

| Unbilled revenue |

|

|

1,066 |

|

|

632 |

|

| Prepaid expenses |

|

|

1,885 |

|

|

2,037 |

|

| |

|

|

15,406 |

|

|

16,792 |

|

| Restricted cash |

|

|

87 |

|

|

86 |

|

| Deposit on equipment |

|

|

375 |

|

|

332 |

|

| Investment at fair value through profit and loss |

|

|

- |

|

|

115 |

|

| Property and equipment |

5, 7 |

|

11,864 |

|

|

10,392 |

|

| Intangible assets |

6 |

|

28,953 |

|

|

30,925 |

|

| Goodwill |

|

|

18,923 |

|

|

19,171 |

|

| Total assets |

|

|

75,608 |

|

|

77,813 |

|

| LIABILITIES |

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

10 |

|

4,113 |

|

|

3,388 |

|

| Deferred revenue |

|

|

1,611 |

|

|

977 |

|

| Income taxes payable |

|

|

565 |

|

|

- |

|

| Leases |

7 |

|

954 |

|

|

1,116 |

|

| Deferred acquisition payments |

|

|

291 |

|

|

439 |

|

| |

|

|

7,534 |

|

|

5,920 |

|

| Leases |

7 |

|

8,620 |

|

|

6,151 |

|

| Deferred acquisition payments |

|

|

279 |

|

|

278 |

|

| Deferred income tax liability |

|

|

7,143 |

|

|

7,661 |

|

| Total liabilities |

|

|

23,576 |

|

|

20,010 |

|

| SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

| Share capital |

8 |

|

117,470 |

|

|

117,470 |

|

| Contributed surplus |

8 |

|

11,916 |

|

|

10,796 |

|

| Accumulated other comprehensive loss |

|

|

1,927 |

|

|

2,625 |

|

| Accumulated deficit |

|

|

(79,281 |

) |

|

(73,088 |

) |

| |

|

|

52,032 |

|

|

57,803 |

|

| Total liabilities and shareholders' equity |

|

|

75,608 |

|

|

77,813 |

|

Nature of operations (Note 1)

Approved and authorized on behalf of the Board of Directors on December 13, 2023.

"Mitch Levine" Director "Dirk Witters" Director

IMMUNOPRECISE ANTIBODIES LTD.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited - Expressed in Canadian dollars) |

| |

|

|

Three months ended

October 31, |

|

|

Six months ended

October 31, |

|

| (in thousands, except share data) |

Note |

|

2023

$ |

|

|

2022

$ |

|

|

2023

$ |

|

|

2022

$ |

|

| REVENUE |

|

|

6,150 |

|

|

5,184 |

|

|

11,837 |

|

|

9,873 |

|

| COST OF SALES |

|

|

3,196 |

|

|

2,405 |

|

|

6,090 |

|

|

4,615 |

|

| GROSS PROFIT |

|

|

2,954 |

|

|

2,779 |

|

|

5,747 |

|

|

5,258 |

|

| EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

1,037 |

|

|

5,002 |

|

|

2,114 |

|

|

11,626 |

|

| Sales and marketing |

|

|

921 |

|

|

817 |

|

|

1,984 |

|

|

1,838 |

|

| General and administrative |

|

|

3,308 |

|

|

3,831 |

|

|

7,295 |

|

|

7,626 |

|

| Amortization of intangible assets |

6 |

|

711 |

|

|

953 |

|

|

1,558 |

|

|

2,064 |

|

| |

|

|

5,977 |

|

|

10,603 |

|

|

12,951 |

|

|

23,154 |

|

| Loss before other income (expenses) and income taxes |

|

|

(3,023 |

) |

|

(7,824 |

) |

|

(7,204 |

) |

|

(17,896 |

) |

| OTHER INCOME (EXPENSES) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accretion |

|

|

(5 |

) |

|

- |

|

|

(10 |

) |

|

(3 |

) |

| Grant income |

12 |

|

16 |

|

|

14 |

|

|

299 |

|

|

284 |

|

| Interest and other income |

|

|

213 |

|

|

36 |

|

|

356 |

|

|

34 |

|

| Unrealized foreign exchange gain |

|

|

209 |

|

|

297 |

|

|

136 |

|

|

320 |

|

| |

|

|

433 |

|

|

347 |

|

|

781 |

|

|

635 |

|

| Loss before income taxes |

|

|

(2,590 |

) |

|

(7,477 |

) |

|

(6,423 |

) |

|

(17,261 |

) |

| Income taxes |

|

|

(32 |

) |

|

126 |

|

|

230 |

|

|

529 |

|

| NET LOSS FOR THE PERIOD |

|

|

(2,622 |

) |

|

(7,351 |

) |

|

(6,193 |

) |

|

(16,732 |

) |

| OTHER COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items that will be reclassified subsequently to loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exchange difference on translating foreign operations |

|

|

516 |

|

|

1,999 |

|

|

(698 |

) |

|

142 |

|

| COMPREHENSIVE LOSS FOR THE PERIOD |

|

|

(2,106 |

) |

|

(5,352 |

) |

|

(6,891 |

) |

|

(16,590 |

) |

| LOSS PER SHARE - BASIC AND DILUTED |

|

|

(0.10 |

) |

|

(0.30 |

) |

|

(0.25 |

) |

|

(0.67 |

) |

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING |

|

|

25,050,260 |

|

|

24,874,455 |

|

|

25,050,260 |

|

|

24,806,791 |

|

IMMUNOPRECISE ANTIBODIES LTD.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

(Unaudited - Expressed in Canadian dollars) |

| (in thousands, except share data) |

|

Number of

Shares |

|

|

Share

Capital

$ |

|

|

Convertible

Debentures

- Equity

Component

$ |

|

|

Contributed

Surplus

$ |

|

|

Accumulated

Other

Comprehensive

(Loss) Income

$ |

|

|

Accumulated

Deficit

$ |

|

|

Total

$ |

|

| Balance, July 31, 2022 |

|

24,836,723 |

|

|

116,183 |

|

|

- |

|

|

10,303 |

|

|

(4,336 |

) |

|

(55,909 |

) |

|

66,241 |

|

| Shares issued pursuant to option exercise |

|

98,725 |

|

|

871 |

|

|

- |

|

|

(373 |

) |

|

- |

|

|

- |

|

|

498 |

|

| Share-based payments |

|

- |

|

|

- |

|

|

- |

|

|

355 |

|

|

- |

|

|

- |

|

|

355 |

|

| Comprehensive loss for the period |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1,999 |

|

|

(7,351 |

) |

|

(5,352 |

) |

| Balance, October 31, 2022 |

|

24,935,448 |

|

|

117,054 |

|

|

- |

|

|

10,285 |

|

|

(2,337 |

) |

|

(63,260 |

) |

|

61,742 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, July 31, 2023 |

|

25,050,260 |

|

|

117,470 |

|

|

- |

|

|

11,619 |

|

|

1,409 |

|

|

(76,658 |

) |

|

53,840 |

|

| Share-based payments |

|

- |

|

|

- |

|

|

- |

|

|

297 |

|

|

- |

|

|

- |

|

|

297 |

|

| Comprehensive loss for the period |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

518 |

|

|

(2,623 |

) |

|

(2,105 |

) |

| Balance, October 31, 2023 |

|

25,050,260 |

|

|

117,470 |

|

|

- |

|

|

11,916 |

|

|

1,927 |

|

|

(79,281 |

) |

|

52,032 |

|

| (in thousands, except share data) |

|

Number of

Shares |

|

|

Share

Capital

$ |

|

|

Convertible

Debentures

- Equity

Component

$ |

|

|

Contributed

Surplus

$ |

|

|

Accumulated

Other

Comprehensive

(Loss) Income

$ |

|

|

Accumulated

Deficit

$ |

|

|

Total

$ |

|

| Balance, April 30, 2022 |

|

24,476,846 |

|

|

114,559 |

|

|

103 |

|

|

9,630 |

|

|

(2,479 |

) |

|

(46,528 |

) |

|

75,285 |

|

| Shares issued pursuant to option exercise |

|

148,725 |

|

|

1,077 |

|

|

- |

|

|

(459 |

) |

|

- |

|

|

- |

|

|

618 |

|

| Shares issued pursuant to conversion of convertible debentures |

|

309,877 |

|

|

1,418 |

|

|

(103 |

) |

|

- |

|

|

- |

|

|

- |

|

|

1,315 |

|

| Share-based payments |

|

- |

|

|

- |

|

|

- |

|

|

1,114 |

|

|

- |

|

|

- |

|

|

1,114 |

|

| Comprehensive loss for the period |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

142 |

|

|

(16,732 |

) |

|

(16,590 |

) |

| Balance, October 31, 2022 |

|

24,935,448 |

|

|

117,054 |

|

|

- |

|

|

10,285 |

|

|

(2,337 |

) |

|

(63,260 |

) |

|

61,742 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, April 30, 2023 |

|

25,050,260 |

|

|

117,470 |

|

|

- |

|

|

10,796 |

|

|

2,625 |

|

|

(73,088 |

) |

|

57,803 |

|

| Share-based payments |

|

- |

|

|

- |

|

|

- |

|

|

1,120 |

|

|

- |

|

|

- |

|

|

1,120 |

|

| Comprehensive loss for the period |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(698 |

) |

|

(6,193 |

) |

|

(6,891 |

) |

| Balance, October 31, 2023 |

|

25,050,260 |

|

|

117,470 |

|

|

- |

|

|

11,916 |

|

|

1,927 |

|

|

(79,281 |

) |

|

52,032 |

|

IMMUNOPRECISE ANTIBODIES LTD.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

For the six months ended October 31, 2023 and 2022

(Unaudited - Expressed in Canadian dollars) |

| (in thousands) |

Note |

|

2023

$ |

|

|

2022

$ |

|

| Operating activities: |

|

|

|

|

|

|

|

| Net loss for the period |

|

|

(6,193 |

) |

|

(16,731 |

) |

| Items not affecting cash: |

|

|

|

|

|

|

|

| Amortization and depreciation |

5, 6, 13 |

|

2,847 |

|

|

3,014 |

|

| Deferred income taxes |

|

|

(416 |

) |

|

(418 |

) |

| Accretion |

|

|

10 |

|

|

3 |

|

| Foreign exchange |

|

|

49 |

|

|

(238 |

) |

| Gain on investment |

|

|

- |

|

|

(8 |

) |

| Share-based payments |

8, 9, 10 |

|

1,120 |

|

|

1,114 |

|

| |

|

|

(2,583 |

) |

|

(13,264 |

) |

| Changes in non-cash working capital related to operations: |

|

|

|

|

|

|

|

| Amounts receivable |

|

|

(45 |

) |

|

(655 |

) |

| Inventory |

|

|

(75 |

) |

|

29 |

|

| Unbilled revenue |

|

|

(429 |

) |

|

(76 |

) |

| Prepaid expenses |

|

|

150 |

|

|

534 |

|

| Accounts payable and accrued liabilities |

10 |

|

679 |

|

|

(127 |

) |

| Sales and income taxes payable and receivable |

|

|

736 |

|

|

(642 |

) |

| Deferred revenue |

|

|

630 |

|

|

147 |

|

| Net cash used in operating activities |

|

|

(937 |

) |

|

(14,054 |

) |

| Investing activities: |

|

|

|

|

|

|

|

| Purchase of equipment |

5 |

|

(435 |

) |

|

(788 |

) |

| Security deposit on leases |

|

|

(49 |

) |

|

40 |

|

| Deferred acquisition payments |

|

|

(146 |

) |

|

(610 |

) |

| Sale of QVQ Holdings BV shares |

|

|

121 |

|

|

61 |

|

| Net cash used in investing activities |

|

|

(509 |

) |

|

(1,297 |

) |

| Financing activities: |

|

|

|

|

|

|

|

| Proceeds on share issuance, net of transaction costs |

8 |

|

- |

|

|

618 |

|

| Repayment of leases |

7 |

|

(715 |

) |

|

(576 |

) |

| Net cash (used in) provided by financing activities |

|

|

(715 |

) |

|

42 |

|

| Decrease in cash during the period |

|

|

(2,161 |

) |

|

(15,309 |

) |

| Foreign exchange |

|

|

(101 |

) |

|

407 |

|

| Cash - beginning of the period |

|

|

8,366 |

|

|

30,047 |

|

| Cash - end of the period |

|

|

6,104 |

|

|

15,145 |

|

| Cash is comprised of: |

|

|

|

|

|

|

|

| Cash |

|

|

6,017 |

|

|

15,059 |

|

| Restricted cash |

|

|

87 |

|

|

86 |

|

| |

|

|

6,104 |

|

|

15,145 |

|

| Cash paid for interest |

|

|

- |

|

|

263 |

|

| Cash paid for income tax |

|

|

- |

|

|

445 |

|

Supplemental cash flow information (Note 14)

1. NATURE OF OPERATIONS

ImmunoPrecise Antibodies Ltd. (the "Company" or "IPA") was incorporated under the laws of Alberta on November 22, 1983. The Company is listed on the NASDAQ Global Market under the trading ticker symbol "IPA". The Company is a supplier of custom antibody discovery services. The address of the Company's corporate office is 3304-4464 Markham Street, Victoria, BC, Canada V8Z 7X8.

Going concern basis

The condensed interim consolidated financial statements have been prepared on the basis of accounting principles applicable to a going concern. The Company has incurred operating losses since its inception, including $2.6 million for the six months ended October 31, 2023, and has accumulated a deficit of $79.3 million as of October 31, 2023. The Company had $6.1 million cash on hand as of October 31, 2023. The Company expects its cash on hand as of October 31, 2023 will be insufficient to fund the Company's operations for at least one year from the date these financial statements are available to be issued. These conditions raise material uncertainties which cast significant doubt as to whether the Company will be able to continue as a going concern should it not be able to obtain financing necessary to fund its planned revenue growth and working capital requirements.

The Company will need to raise additional funds to finance its operations and strategic goals and there can be no assurances that sufficient funding, including adequate financing, will be available. The ability of the Company to arrange additional financing in the future depends in part on the prevailing capital market conditions and profitability of its operations. If the Company is unable to raise sufficient funds, reductions in expenditures will be required, and this may impact the future growth plans of the Company.

2. BASIS OF PRESENTATION

(a) Statement of compliance

These condensed interim consolidated financial statements have been prepared in conformity with International Accounting Standard ("IAS") 34, Interim Financial Reporting, using the same accounting policies as detailed in the Company's audited annual financial statements for the year ended April 30, 2023. They do not include all the information required for complete annual financial statements in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board ("IFRS") and interpretations of the International Financial Reporting Interpretations Committee and therefore should be read together with the audited annual financial statements for the year ended April 30, 2023.

Certain items have been reclassified in the prior year financial statements to conform to the presentation and classification used in the current year. These reclassifications had no effect on the Company's consolidated operating results, financial position or cash flows.

These condensed interim consolidated financial statements were approved by the Company's Board of Directors.

(b) Basis of measurement

These condensed interim consolidated financial statements have been prepared on the historical cost basis. In addition, these condensed interim consolidated financial statements have been prepared using the accrual basis of accounting, except for cashflow information.

(c) Basis of consolidation

These condensed interim consolidated financial statements include the financial statements of the Company and the following subsidiaries which are wholly owned and subject to control by the Company:

| Name of Subsidiary |

% Equity

Interest -

October 31, 2023 and

April 30, 2023 |

Country of

Incorporation |

Functional Currency |

| ImmunoPrecise Antibodies (Canada) Ltd. |

100% |

Canada |

Canadian dollar |

| ImmunoPrecise Antibodies (USA) Ltd. ("IPA USA") |

100% |

USA |

US dollar |

| ImmunoPrecise Antibodies (N.D.) Ltd. |

100% |

USA |

US dollar |

| ImmunoPrecise Antibodies (MA) LLC |

100% |

USA |

US dollar |

| Talem Therapeutics LLC ("Talem") |

100% |

USA |

US dollar |

| ImmunoPrecise Netherlands B.V. |

100% |

Netherlands |

Euro |

| ImmunoPrecise Antibodies (Europe) B.V. ("IPA Europe") |