0000889331falseLITTELFUSE INC /DE00008893312023-10-312023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 8-K

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: October 31, 2023

(Date of earliest event reported)

LITTELFUSE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 0-20388 | 36-3795742 |

(State of other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

8755 W. Higgins Road, Suite 500, Chicago, IL 60631

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (773) 628-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, par value $0.01 per share | | LFUS | | NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

The information contained within Item 2.02 of this Form 8-K and the Exhibits attached hereto shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

On October 31, 2023, Littelfuse, Inc. (the “Company”) issued a press release announcing the results of its operations for the quarter ended September 30, 2023. A copy of the press release is attached as Exhibit 99.1 to this Form 8-K and incorporated by reference to this Item 2.02 as if fully set forth herein. A copy of the press release will also be available on the Company’s website.

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

To supplement the information in the attached press release, the Company has also prepared a presentation, which will be available on the Company’s website at https://investor.littelfuse.com/events-and-presentations and is attached hereto as Exhibit 99.2 to this Current Report on Form 8-K.

The information contained in the press release and investor presentation attached to this Form 8-K includes forward-looking statements that are intended to be covered by the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include but are not limited to comments with respect to the objectives and strategies, financial condition, results of operations and business of the Company. These forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, and the risk that predictions and other forward-looking statements will not be achieved. The Company cautions you not to place undue reliance on these forward-looking statements as a number of important factors could cause actual future results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements.

A copy of the press release is also posted on the Company's website.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| (d) | Exhibits | |

| The following exhibit is furnished with this Form 8-K: | |

| | |

| | |

| 104 Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| | Littelfuse, Inc. |

| | |

| | |

Date: October 31, 2023 | By: /s/ Meenal A. Sethna |

| | Meenal A. Sethna

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

| | | | | |

| |

| FOR IMMEDIATE RELEASE David Kelley 224-727-2535 dkelley@littelfuse.com |

LITTELFUSE REPORTS THIRD QUARTER RESULTS FOR 2023

Strong Execution Drives Performance Above Guidance

CHICAGO, October 31, 2023 - Littelfuse, Inc. (NASDAQ: LFUS), a diversified, industrial technology manufacturing company empowering a sustainable, connected, and safer world, today reported financial results for the third quarter ended September 30, 2023:

•Net sales of $607.1 million were down 8% versus the prior year period, and down 11% organically

•GAAP diluted EPS was $2.30; adjusted diluted EPS was $2.97

•Cash flow from operations was $161.5 million and free cash flow was $139.8 million

“In the third quarter, sales and earnings exceeded our expectations, despite pockets of end market softness and ongoing inventory destocking” said Dave Heinzmann, Littelfuse President and Chief Executive Officer. “Our year-to-date performance underscores the resilience of our business model, strong cash generation, and consistent execution. Looking ahead, while dynamic macro conditions likely persist, our improved cost structure, healthy balance sheet, and ability to optimize cash flow should position us well into 2024. Our experienced team will continue to leverage our competitive advantages across our evolving and diversified end markets.”

Fourth Quarter of 2023*

Based on current market conditions, for the fourth quarter the company expects,

•Net sales in the range of $520 to $550 million, adjusted diluted EPS in the range of $1.90 to $2.10 and an adjusted effective tax rate of approximately 18%

*Littelfuse provides guidance on a non-GAAP (adjusted) basis. GAAP items excluded from guidance may include the after-tax impact of items including acquisition and integration costs, restructuring, impairment and other charges, certain purchase accounting adjustments, non-operating foreign exchange adjustments and significant and unusual items. These items are uncertain, depend on various factors, and could be material to results computed in accordance with GAAP. Littelfuse is not able to forecast the excluded items in order to provide the most directly comparable GAAP financial measure without unreasonable efforts.

-more-

Dividend

•The company will pay a cash dividend on its common stock of $0.65 per share on December 7, 2023, to shareholders of record as of November 23, 2023.

Conference Call and Webcast Information

Littelfuse will host a conference call on Wednesday, November 1, 2023, at 9:00 a.m. Central Time to discuss the results. The call will be broadcast and available for replay at Littelfuse.com. A slide presentation is available in the Investor Relations section of the company’s website at Littelfuse.com.

About Littelfuse

Littelfuse, Inc. (NASDAQ: LFUS) is a diversified, industrial technology manufacturing company empowering a sustainable, connected, and safer world. Across more than 20 countries, and with approximately 17,000 global associates, we partner with customers to design and deliver innovative, reliable solutions. Serving over 100,000 end customers, our products are found in a variety of industrial, transportation and electronics end markets – everywhere, every day. Learn more at Littelfuse.com.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

The statements in this press release that are not historical facts are intended to constitute "forward-looking statements" entitled to the safe-harbor provisions of the Private Securities Litigation Reform Act. Such statements are based on Littelfuse, Inc.’s (“Littelfuse” or the “Company”) current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties, include, but are not limited to, risks and uncertainties relating to general economic conditions; product demand and market acceptance; the impact of competitive products and pricing; product quality problems or product recalls; capacity and supply difficulties or constraints; coal mining exposures reserves; cybersecurity matters; failure of an indemnification for environmental liability; exchange rate fluctuations; commodity and other raw material price fluctuations; the effect of Littelfuse accounting policies; labor disputes; restructuring costs in excess of expectations; pension plan asset returns less than assumed; integration of acquisitions; uncertainties related to political or regulatory changes; and other risks which may be detailed in the company's Securities and Exchange Commission filings. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual results and outcomes may differ materially from those indicated or implied in the forward-looking statements. This release should be read in conjunction with information provided in the financial statements appearing in the company's Annual Report on Form 10-K for the year ended December 31, 2022. Further discussion of the risk factors of the company can be found under the caption "Risk Factors" in the company's Annual Report on Form 10-K for the year ended December 31, 2022, and in other filings and submissions with the SEC, each of which are available free of charge on the company’s investor relations website at investor.littelfuse.com and on the SEC’s website at www.sec.gov. These forward-looking statements are made as of the date hereof. The company does not undertake any obligation to update, amend or clarify these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the availability of new information.

-more

Non-GAAP Financial Measures

The information included in this press release includes the non-GAAP financial measures of organic net sales (decline) growth, adjusted operating income, adjusted operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted diluted earnings per share, adjusted income taxes, adjusted effective tax rate, free cash flow, net debt, consolidated EBITDA, and consolidated net leverage ratio (as defined in the credit agreement). Many of these non-GAAP financial measures exclude the effect of certain expenses and income not related directly to the underlying performance of our fundamental business operations.

A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures is set forth in the attached schedules.

The company believes that organic net sales (decline) growth, adjusted operating income, adjusted operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted diluted earnings per share, adjusted income taxes, and adjusted effective tax rate provide useful information to investors regarding its operational performance because they enhance an investor’s overall understanding of our core financial performance and facilitate comparisons to historical results of operations, by excluding items that are not related directly to the underlying performance of our fundamental business operations or were not part of our business operations during a comparable period. The company believes that free cash flow is a useful measure of its ability to generate cash. The company believes that net debt, consolidated EBITDA, and consolidated net leverage ratio are useful measures of its credit position. The company believes that all of these non-GAAP financial measures are commonly used by financial analysts and others in the industries in which we operate, and thus further provide useful information to investors. Management additionally uses these measures when assessing the performance of the business and for business planning purposes. Note that our definitions of these non-GAAP financial measures may differ from those terms as defined or used by other companies.

LFUS-F

###

| | | | | |

| Littelfuse Inc.

8755 West Higgins Road, Suite 500

Chicago, Illinois 60631

p: (773) 628-1000

www.littelfuse.com |

LITTELFUSE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | |

| | (Unaudited) | | |

| (in thousands) | | September 30,

2023 | | December 31,

2022 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 560,056 | | | $ | 562,588 | |

| Short-term investments | | 229 | | | 84 | |

| Trade receivables, less allowances of $88,440 and $83,562 at September 30, 2023 and December 31, 2022, respectively | | 327,500 | | | 306,578 | |

| Inventories | | 483,075 | | | 547,690 | |

| Prepaid income taxes and income taxes receivable | | 3,776 | | | 7,215 | |

| Prepaid expenses and other current assets | | 83,684 | | | 87,641 | |

| Total current assets | | 1,458,320 | | | 1,511,796 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Net property, plant, and equipment | | 478,906 | | | 481,110 | |

| Intangible assets, net of amortization | | 612,366 | | | 593,970 | |

| Goodwill | | 1,284,343 | | | 1,186,922 | |

| Investments | | 23,371 | | | 24,121 | |

| Deferred income taxes | | 13,598 | | | 14,367 | |

| Right of use lease assets, net | | 51,755 | | | 57,382 | |

| Other long-term assets | | 80,267 | | | 34,066 | |

| Total assets | | $ | 4,002,926 | | | $ | 3,903,734 | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 166,725 | | | $ | 208,571 | |

| | | | |

| | | | |

| | | | |

| Accrued liabilities | | 143,540 | | | 187,057 | |

| Accrued income taxes | | 35,762 | | | 41,793 | |

| Current portion of long-term debt | | 135,619 | | | 134,874 | |

| Total current liabilities | | 481,646 | | | 572,295 | |

| Long-term debt, less current portion | | 857,006 | | | 866,623 | |

| Deferred income taxes | | 106,656 | | | 100,230 | |

| Accrued post-retirement benefits | | 29,445 | | | 28,037 | |

| Non-current operating lease liabilities | | 39,818 | | | 45,661 | |

| Other long-term liabilities | | 83,496 | | | 79,510 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Total equity | | 2,404,859 | | | 2,211,378 | |

| Total liabilities and equity | | $ | 4,002,926 | | | $ | 3,903,734 | |

LITTELFUSE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF NET INCOME

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Nine Months Ended |

| (in thousands, except per share data) | | September 30,

2023 | | October 1,

2022 | | September 30,

2023 | | October 1,

2022 |

| Net sales | | $ | 607,071 | | | $ | 658,880 | | | $ | 1,828,850 | | | $ | 1,900,646 | |

| Cost of sales | | 380,200 | | | 402,059 | | | 1,122,190 | | | 1,122,258 | |

| Gross profit | | 226,871 | | | 256,821 | | | 706,660 | | | 778,388 | |

| | | | | | | | |

| Selling, general, and administrative expenses | | 87,204 | | | 90,219 | | | 270,057 | | | 258,820 | |

| | | | | | | | |

| Research and development expenses | | 25,484 | | | 25,752 | | | 77,270 | | | 68,796 | |

| Amortization of intangibles | | 16,022 | | | 15,567 | | | 49,773 | | | 39,883 | |

| Restructuring, impairment, and other charges | | 4,516 | | | 3,413 | | | 13,221 | | | 4,265 | |

| Total operating expenses | | 133,226 | | | 134,951 | | | 410,321 | | | 371,764 | |

| Operating income | | 93,645 | | | 121,870 | | | 296,339 | | | 406,624 | |

| | | | | | | | |

| Interest expense | | 10,101 | | | 8,399 | | | 29,803 | | | 17,069 | |

| Foreign exchange loss | | 11,776 | | | 18,191 | | | 8,697 | | | 40,051 | |

| Other (income) expense, net | | (3,527) | | | (698) | | | (11,810) | | | 9,789 | |

| Income before income taxes | | 75,295 | | | 95,978 | | | 269,649 | | | 339,715 | |

| Income taxes | | 17,507 | | | 20,510 | | | 53,045 | | | 59,713 | |

| Net income | | $ | 57,788 | | | $ | 75,468 | | | $ | 216,604 | | | $ | 280,002 | |

| | | | | | | | |

| Earnings per share: | | | | | | | | |

| Basic | | $ | 2.32 | | | $ | 3.05 | | | $ | 8.72 | | | $ | 11.32 | |

| Diluted | | $ | 2.30 | | | $ | 3.02 | | | $ | 8.63 | | | $ | 11.21 | |

| | | | | | | | |

| Weighted-average shares and equivalent shares outstanding: | | | | | | | | |

| Basic | | 24,893 | | | 24,755 | | | 24,838 | | | 24,726 | |

| Diluted | | 25,143 | | | 24,988 | | | 25,100 | | | 24,986 | |

| | | | | | | | |

| Comprehensive income | | $ | 55,654 | | | $ | 47,280 | | | $ | 212,842 | | | $ | 218,262 | |

LITTELFUSE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | |

| | | Nine Months Ended |

| (in thousands) | | September 30, 2023 | | October 1, 2022 |

| OPERATING ACTIVITIES | | | | |

| Net income | | $ | 216,604 | | | $ | 280,002 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | 137,988 | | | 183,942 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Changes in operating assets and liabilities: | | | | |

| Trade receivables | | (21,752) | | | (56,431) | |

| Inventories | | 66,456 | | | (83,803) | |

| Accounts payable | | (38,475) | | | (3,838) | |

| | | | |

| | | | |

| | | | |

| Accrued liabilities and income taxes | | (61,359) | | | (4,399) | |

| Prepaid expenses and other assets | | 13,678 | | | (2,034) | |

| Net cash provided by operating activities | | 313,140 | | | 313,439 | |

| | | | |

| INVESTING ACTIVITIES | | | | |

| Acquisitions of businesses, net of cash acquired | | (198,810) | | | (532,772) | |

| | | | |

| Purchases of property, plant, and equipment | | (63,166) | | | (77,773) | |

| Net proceeds from sale of property, plant and equipment, and other | | 597 | | | 565 | |

| Net cash used in investing activities | | (261,379) | | | (609,980) | |

| | | | |

| FINANCING ACTIVITIES | | | | |

| Net payments of credit facility | | (5,625) | | | 373,125 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Cash dividends paid | | (45,973) | | | (41,055) | |

| All other cash provided by (used in) financing activities | | 4,454 | | | (10,147) | |

| Net cash (used in) provided by financing activities | | (47,144) | | | 321,923 | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | | (7,965) | | | (31,963) | |

| Decrease in cash, cash equivalents, and restricted cash | | (3,348) | | | (6,581) | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 564,939 | | | 482,836 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 561,591 | | | $ | 476,255 | |

LITTELFUSE, INC.

NET SALES AND OPERATING INCOME BY SEGMENT

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter | | Year-to-Date |

| (in thousands) | | 2023 | | 2022 | | | | %

Growth / (Decline) | | 2023 | | 2022 | | | | %

Growth /(Decline) |

| Net sales | | | | | | | | | | | | | | | | |

| Electronics | | $ | 343,933 | | | $ | 397,629 | | | | | (13.5) | % | | $ | 1,052,673 | | | $ | 1,121,626 | | | | | (6.1) | % |

| Transportation | | 177,019 | | | 181,735 | | | | | (2.6) | % | | 515,708 | | | 548,266 | | | | | (5.9) | % |

| Industrial | | 86,119 | | | 79,516 | | | | | 8.3 | % | | 260,469 | | | 230,754 | | | | | 12.9 | % |

| Total net sales | | $ | 607,071 | | | $ | 658,880 | | | | | (7.9) | % | | $ | 1,828,850 | | | $ | 1,900,646 | | | | | (3.8) | % |

| | | | | | | | | | | | | | | | |

| Operating income | | | | | | | | | | | | | | | | |

| Electronics | | $ | 77,022 | | | $ | 113,140 | | | | | (31.9) | % | | $ | 247,028 | | | $ | 339,675 | | | | | (27.3) | % |

| Transportation | | 9,694 | | | 12,987 | | | | | (25.4) | % | | 26,015 | | | 57,604 | | | | | (54.8) | % |

| Industrial | | 13,201 | | | 12,178 | | | | | 8.4 | % | | 45,450 | | | 39,968 | | | | | 13.7 | % |

| Other(a) | | (6,272) | | | (16,435) | | | | | N.M. | | (22,154) | | | (30,623) | | | | | N.M. |

| Total operating income | | $ | 93,645 | | | $ | 121,870 | | | | | (23.2) | % | | $ | 296,339 | | | $ | 406,624 | | | | | (27.1) | % |

| Operating Margin | | 15.4 | % | | 18.5 | % | | | | | | 16.2 | % | | 21.4 | % | | | | |

| | | | | | | | | | | | | | | | |

| Interest expense | | 10,101 | | | 8,399 | | | | | | | 29,803 | | | 17,069 | | | | | |

| Foreign exchange loss | | 11,776 | | | 18,191 | | | | | | | 8,697 | | | 40,051 | | | | | |

| Other (income) expense, net | | (3,527) | | | (698) | | | | | | | (11,810) | | | 9,789 | | | | | |

| Income before income taxes | | $ | 75,295 | | | $ | 95,978 | | | | | (21.5) | % | | $ | 269,649 | | | $ | 339,715 | | | | | (20.6) | % |

(a) "other" typically includes non-GAAP adjustments such as acquisition-related and integration costs, purchase accounting inventory adjustments and restructuring and impairment charges. (See Supplemental Financial Information for details.)

N.M. - Not meaningful

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter | | Year-to-Date |

| (in thousands) | | 2023 | | 2022 | | %

(Decline) | | 2023 | | 2022 | | %

Growth /(Decline) |

| Operating Margin | | | | | | | | | | | | |

| Electronics | | 22.4 | % | | 28.5 | % | | (6.1) | % | | 23.5 | % | | 30.3 | % | | (6.8) | % |

| Transportation | | 5.5 | % | | 7.1 | % | | (1.6) | % | | 5.0 | % | | 10.5 | % | | (5.5) | % |

| Industrial | | 15.3 | % | | 15.3 | % | | — | % | | 17.4 | % | | 17.3 | % | | 0.1 | % |

LITTELFUSE, INC.

SUPPLEMENTAL FINANCIAL INFORMATION

(In millions of USD except per share amounts - unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP EPS reconciliation | | | | | | | | |

| | Q3-23 | | Q3-22 | | YTD-23 | | YTD-22 |

| GAAP diluted EPS | | $ | 2.30 | | | $ | 3.02 | | | $ | 8.63 | | | $ | 11.21 | |

| EPS impact of Non-GAAP adjustments (below) | | 0.67 | | | 1.26 | | | 1.09 | | | 2.32 | |

| Adjusted diluted EPS | | $ | 2.97 | | | $ | 4.28 | | | $ | 9.72 | | | $ | 13.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP adjustments - (income) / expense | | | | | | | | |

| | Q3-23 | | Q3-22 | | YTD-23 | | YTD-22 |

| Acquisition-related and integration costs (a) | | $ | 1.8 | | | $ | 6.2 | | | $ | 9.0 | | | $ | 14.8 | |

| | | | | | | | |

| Purchase accounting inventory adjustments (b) | | — | | | 6.8 | | | — | | | 11.6 | |

| Restructuring, impairment and other charges (c) | | 4.5 | | | 3.4 | | | 13.2 | | | 4.3 | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP adjustments to operating income | | 6.3 | | | 16.4 | | | 22.2 | | | 30.7 | |

| Other income, net (d) | | — | | | — | | | (0.2) | | | (0.5) | |

| Non-operating foreign exchange loss | | 11.8 | | | 18.2 | | | 8.7 | | | 40.1 | |

| Non-GAAP adjustments to income before income taxes | | 18.1 | | | 34.6 | | | 30.7 | | | 70.3 | |

| Income taxes (e) | | 1.2 | | | 3.0 | | | 3.2 | | | 12.2 | |

| Non-GAAP adjustments to net income | | $ | 16.9 | | | $ | 31.6 | | | $ | 27.5 | | | $ | 58.1 | |

| | | | | | | | |

| Total EPS impact | | $ | 0.67 | | | $ | 1.26 | | | $ | 1.09 | | | $ | 2.32 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted operating margin / Adjusted EBITDA reconciliation | | | | | | | | |

| | Q3-23 | | Q3-22 | | YTD-23 | | YTD-22 |

| Net income | | $ | 57.8 | | | $ | 75.5 | | | $ | 216.6 | | | $ | 280.0 | |

| Add: | | | | | | | | |

| Income taxes | | 17.5 | | | 20.5 | | | 53.0 | | | 59.7 | |

| Interest expense | | 10.1 | | | 8.4 | | | 29.8 | | | 17.1 | |

| Foreign exchange loss | | 11.8 | | | 18.2 | | | 8.7 | | | 40.1 | |

| Other (income) expense, net | | (3.5) | | | (0.7) | | | (11.8) | | | 9.8 | |

| GAAP operating income | | $ | 93.6 | | | $ | 121.9 | | | $ | 296.3 | | | $ | 406.6 | |

| Non-GAAP adjustments to operating income | | 6.3 | | | 16.4 | | | 22.2 | | | 30.7 | |

| Adjusted operating income | | $ | 99.9 | | | $ | 138.3 | | | $ | 318.5 | | | $ | 437.3 | |

| Amortization of intangibles | | 16.0 | | | 15.6 | | | 49.8 | | | 39.9 | |

| Depreciation expenses | | 17.9 | | | 17.0 | | | 53.5 | | | 48.3 | |

| Adjusted EBITDA | | $ | 133.8 | | | $ | 170.9 | | | $ | 421.8 | | | $ | 525.5 | |

| | | | | | | | |

| Net sales | | $ | 607.1 | | | $ | 658.9 | | | $ | 1,828.9 | | | $ | 1,900.6 | |

| Net income as a percentage of net sales | | 9.5 | % | | 11.5 | % | | 11.8 | % | | 14.7 | % |

| Operating margin | | 15.4 | % | | 18.5 | % | | 16.2 | % | | 21.4 | % |

| Adjusted operating margin | | 16.5 | % | | 21.0 | % | | 17.4 | % | | 23.0 | % |

| Adjusted EBITDA margin | | 22.0 | % | | 25.9 | % | | 23.1 | % | | 27.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA by Segment | | Q3-23 | | Q3-22 |

| | Electronics | | Transportation | | Industrial | | Electronics | | Transportation | | Industrial |

| GAAP operating income | | $ | 77.0 | | | $ | 9.7 | | | $ | 13.2 | | | $ | 113.1 | | | $ | 13.0 | | | $ | 12.2 | |

| Add: | | | | | | | | | | | | |

| Add back amortization | | 9.8 | | | 3.6 | | | 2.6 | | | 9.7 | | | 4.7 | | | 1.2 | |

| Add back depreciation | | 9.8 | | | 6.6 | | | 1.5 | | | 9.4 | | | 6.7 | | | 1.0 | |

| | | | | | | | | | | | |

| Adjusted EBITDA | | $ | 96.6 | | | $ | 19.9 | | | $ | 17.3 | | | $ | 132.2 | | | $ | 24.4 | | | $ | 14.4 | |

| Adjusted EBITDA Margin | | 28.1 | % | | 11.2 | % | | 20.1 | % | | 33.3 | % | | 13.4 | % | | 18.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA by Segment | | YTD-23 | | YTD-22 |

| | Electronics | | Transportation | | Industrial | | Electronics | | Transportation | | Industrial |

| GAAP operating income | | $ | 247.0 | | | $ | 26.0 | | | $ | 45.5 | | | $ | 339.7 | | | $ | 57.6 | | | $ | 40.0 | |

| Add: | | | | | | | | | | | | |

| Add back amortization | | 30.1 | | | 12.2 | | | 7.5 | | | 22.5 | | | 13.7 | | | 3.7 | |

| Add back depreciation | | 29.1 | | | 20.4 | | | 4.0 | | | 26.5 | | | 19.0 | | | 2.9 | |

| | | | | | | | | | | | |

| Adjusted EBITDA | | $ | 306.2 | | | $ | 58.6 | | | $ | 57.0 | | | $ | 388.7 | | | $ | 90.3 | | | $ | 46.5 | |

| Adjusted EBITDA Margin | | 29.1 | % | | 11.4 | % | | 21.9 | % | | 34.7 | % | | 16.5 | % | | 20.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales reconciliation | | Q3-23 vs. Q3-22 |

| | Electronics | | Transportation | | Industrial | | Total |

| Net sales (decline) growth | | (14) | % | | (3) | % | | 8 | % | | (8) | % |

| Less: | | | | | | | | |

| Acquisitions | | 2 | % | | — | % | | 3 | % | | 2 | % |

| | | | | | | | |

| | | | | | | | |

| FX impact | | 1 | % | | 1 | % | | — | % | | 1 | % |

| Organic net sales (decline) growth | | (17) | % | | (4) | % | | 5 | % | | (11) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales reconciliation | | YTD-23 vs. YTD-22 |

| | Electronics | | Transportation | | Industrial | | Total |

| Net sales (decline) growth | | (6) | % | | (6) | % | | 13 | % | | (4) | % |

| Less: | | | | | | | | |

| Acquisitions | | 8 | % | | — | % | | 4 | % | | 5 | % |

| | | | | | | | |

| | | | | | | | |

| FX impact | | — | % | | — | % | | — | % | | — | % |

| Organic net sales (decline) growth | | (14) | % | | (6) | % | | 9 | % | | (9) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income tax reconciliation | | | | | | | | |

| | Q3-23 | | Q3-22 | | YTD-23 | | YTD-22 |

| Income taxes | | $ | 17.5 | | | $ | 20.5 | | | $ | 53.0 | | | $ | 59.7 | |

| Effective rate | | 23.3 | % | | 21.4 | % | | 19.7 | % | | 17.6 | % |

| Non-GAAP adjustments - income taxes | | 1.2 | | | 3.0 | | | 3.2 | | | 12.2 | |

| Adjusted income taxes | | $ | 18.7 | | | $ | 23.4 | | | $ | 56.2 | | | $ | 71.9 | |

| Adjusted effective rate | | 20.0 | % | | 18.0 | % | | 18.7 | % | | 17.5 | % |

| Free cash flow reconciliation | | | | | | | | |

| | Q3-23 | | Q3-22 | | YTD-23 | | YTD-22 |

| Net cash provided by operating activities | | $ | 161.5 | | | $ | 148.1 | | | $ | 313.1 | | | $ | 313.4 | |

| Less: Purchases of property, plant and equipment | | (21.7) | | | (21.7) | | | (63.2) | | | (77.8) | |

| Free cash flow | | $ | 139.8 | | | $ | 126.5 | | | $ | 250.0 | | | $ | 235.7 | |

| | | | | | | | |

| Consolidated Total Debt | | As of September 30, 2023 |

| | |

| | |

| Consolidated Total Debt | | $ | 992.6 | |

| Unamortized debt issuance costs | | 4.0 | |

| Consolidated funded indebtedness | | 996.6 | |

| Cash held in U.S. (up to $400 million) | | 155.6 |

| Net debt | | $ | 841.0 | |

| | |

| Consolidated EBITDA | | Twelve Months Ended September 30, 2023 |

| Net Income | | $ | 309.7 | |

| Interest expense | | 38.9 | |

| Income taxes | | 63.1 | |

| Depreciation | | 70.2 | |

| Amortization | | 65.6 | |

| Non-cash additions: | | |

| Stock-based compensation expense | | 24.0 | |

| Purchase accounting inventory step-up charge | | 4.1 | |

| Unrealized loss on investments | | 1.2 | |

| Impairment charges | | 9.2 | |

| Other | | (3.7) | |

| Consolidated EBITDA (1) | | $ | 582.3 | |

| | |

| Consolidated Net Leverage Ratio (as defined in the Credit Agreement) * | | 1.4x |

* Our Credit Agreement and Private Placement Note with maturities ranging from 2023 to 2032, contain financial ratio covenants providing that if, as of the last day of each fiscal quarter, the Consolidated Net Leverage ratio at such time for the then most recently concluded period of four consecutive fiscal quarters of the Company exceeds 3.50:1.00, an Event of Default (as defined in the Credit Agreement and Private Placement Senior Notes) is triggered.

The Credit Agreement and Private Placement Senior Notes were amended in Q2 2022 and now allow for the addition of acquisition and integration costs up to 15% of Consolidated EBITDA and the netting of up to $400M of Available Cash (Cash held by US Subsidiaries).

(1) Represents Consolidated EBITDA as defined in our Credit Agreement and Private Placement Senior Notes and is calculated using the most recently concluded period of four consecutive quarters.

Note: Total will not always foot due to rounding.

(a) reflected in selling, general and administrative expenses ("SG&A").

(b) reflected in cost of sales.

(c) reflected in restructuring, impairment and other charges.

(d) reflected YTD gain of $0.2 million from the sale of a building within the Electronics segment in the first quarter of 2023. 2022 amount included $0.5 million gain from the sale of a building within Transportation segment.

(e) reflected the tax impact associated with the non-GAAP adjustments, and 2022 year-to-date amount includes the one-time net benefit of $7.2 million that resulted from the dissolution of one of the Company’s affiliates.

###

1 Q3 2023 EARNINGS RELEASE October 31, 2023

2Littelfuse, Inc. © 2023 Important Information About Littelfuse, Inc. This presentation does not constitute or form part of, and should not be construed as, an offer or solicitation to purchase or sell securities of Littelfuse, Inc. and no investment decision should be made based upon the information provided herein. Littelfuse strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at investor.littelfuse.com. This website also provides additional information about Littelfuse. “Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995. The statements in this presentation that are not historical facts are intended to constitute "forward-looking statements" entitled to the safe-harbor provisions of the Private Securities Litigation Reform Act. Such statements are based on Littelfuse, Inc.’s ("Littelfuse" or the "Company") current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward- looking statements. These risks and uncertainties, include, but are not limited to, risks and uncertainties relating to general economic conditions; product demand and market acceptance; the impact of competitive products and pricing; product quality problems or product recalls; capacity and supply difficulties or constraints; coal mining exposures reserves; cybersecurity matters; failure of an indemnification for environmental liability; exchange rate fluctuations; commodity and other raw material price fluctuations; the effect of Littelfuse accounting policies; labor disputes; restructuring costs in excess of expectations; pension plan asset returns less than assumed; integration of acquisitions; uncertainties related to political or regulatory changes; and other risks which may be detailed in the company's Securities and Exchange Commission filings. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual results and outcomes may differ materially from those indicated or implied in the forward-looking statements. This presentation should be read in conjunction with information provided in the financial statements appearing in the company's Annual Report on Form 10-K for the year ended December 31, 2022. Further discussion of the risk factors of the company can be found under the caption "Risk Factors" in the company's Annual Report on Form 10-K for the year ended December 31, 2022, and in other filings and submissions with the SEC, each of which are available free of charge on the company’s investor relations website at investor.littelfuse.com and on the SEC’s website at http://www.sec.gov. These forward-looking statements are made as of the date hereof. The company does not undertake any obligation to update, amend or clarify these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the availability of new information. Non-GAAP Financial Measures. The information included in this presentation includes the non-GAAP financial measures of organic net sales (decline) growth, adjusted operating margin, adjusted EBITDA margin, adjusted diluted earnings per share, adjusted effective tax rate, free cash flow, and consolidated net leverage ratio (as defined in the credit agreement). A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures are set forth in the appendix. The company believes that these non-GAAP financial measures provide useful information to investors regarding its operational performance, ability to generate cash and its credit position enhancing an investor’s overall understanding of its core financial performance. The company believes that these non-GAAP financial measures are commonly used by financial analysts and provide useful information to analysts. Management uses these measures when assessing the performance of the business and for business planning purposes. Note that the definitions of these non-GAAP financial measures may differ from those terms as defined or used by other companies. DISCLAIMERS

BUSINESS UPDATE Dave Heinzmann, President & CEO

4Littelfuse, Inc. © 2023 Q3 2023 SUMMARY ▪ Solid financial results within a challenging macro environment ▪ Revenue & Adj. EPS exceed guidance ▪ Resilient business model delivers strong year-to-date cash generation ▪ Continued varied market dynamics ▪ Strong automotive content outgrowth ▪ Mixed industrial market trends ▪ Ongoing inventory destocking ▪ Long-term positioning intact amid market cycles ▪ Design activity & win rates remain robust ▪ Content outgrowth momentum continues ▪ Expect to return to growth during 2024

5Littelfuse, Inc. © 2023 2021 – 2025 GROWTH STRATEGY EMPOWERING A SUSTAINABLE, CONNECTED, AND SAFER WORLD Our capabilities, investments & diversification deliver significant value

6Littelfuse, Inc. © 2023 INDUSTRIAL END MARKETS POSITIONED FOR LONG-TERM GROWTH ▪ Broad solutions-focused portfolio delivering global wins for industrial safety, renewables & energy storage ▪ Technical expertise enabling next generation advancements in sustainability & safety applications ▪ Evolving safety requirements driving incremental opportunities ▪ High-growth areas more than offsetting pockets of softer industrial demand ▪ Renewables, infrastructure, power supply & industrial safety remain strong Q3 2023 Highlights

7Littelfuse, Inc. © 2023 TRANSPORTATION END MARKETS EXTENDING OUR LEADERSHIP POSITION ▪ Continued double-digit content outgrowth for broad portfolio of leading passenger vehicle products ▪ Electrification & electronification continue to expand & deliver new business opportunities ▪ Commercial vehicle new business wins across broad range of applications ▪ Multi-technology win for EV truck, leveraging expanded solutions offerings including Embed software ▪ Construction equipment, truck & bus, recreational vehicles ▪ Differentiated technical expertise, customer relationships & design support for next generation applications Q3 2023 Highlights

8Littelfuse, Inc. © 2023 ELECTRONICS END MARKETS EXPANDING OUR LEADERSHIP ▪ Robust design activity for next generation applications ▪ Safety – medical lifesaving & implantable devices ▪ Connectivity – building security ▪ Sustainability – smart water meters, LED lighting ▪ Breadth of product portfolio increasing opportunities for multi-technology solutions ▪ Electrification & electronification across multiple end markets & applications continues to accelerate ▪ Recognized for industry leadership, product innovation & excellence Q3 2023 Highlights

FINANCIAL UPDATE Meenal Sethna, EVP & CFO

10Littelfuse, Inc. © 2023 ▪ Revenue (-8%) / (-11%) organic, vs. PY ▪ Acquisitions +2%, F/X +1% ▪ Margins ▪ Q3: GAAP operating 15.4%; adjusted 16.5% ▪ YTD: GAAP operating 16.2%; adjusted 17.4%; adjusted EBITDA margin 23.1% ▪ Cash Flow ▪ Q3: operating $162m; free cash flow $140m ▪ YTD: operating $313m, free cash flow $250m, +6% vs. PY, 115% conversion ▪ Capital structure strength; maintained net debt/EBITDA leverage 1.4x Q3 2023 TOTAL COMPANY FINANCIAL PERFORMANCE GAAP EPS $3.02 $2.30 Adj. EPS $4.28 $2.97 Adj. EBITDA% 25.9% 22.0% $659 $607 Q3-22 Q3-23 Revenue (in millions) See appendix for GAAP to non-GAAP reconciliation Highlights

11Littelfuse, Inc. © 2023 $398 $344 Q3-22 Q3-23 Q3 2023 ELECTRONICS SEGMENT FINANCIAL PERFORMANCE Revenue ▪ Revenue (-14%) / organic (-17%), vs. PY ▪ Stronger than expected, worked through semiconductor backlog ▪ Continued softness within consumer & personal electronics, datacom; Partial offset from medical, auto, some industrial markets ▪ Resilient profitability through volatile end markets & inventory rebalancing (in millions) Op Margin 28.5% 22.4% Adj. EBITDA% 33.3% 28.1% Highlights See appendix for GAAP to non-GAAP reconciliation

12Littelfuse, Inc. © 2023 $182 $177 Q3-22 Q3-23 Q3 2023 TRANSPORTATION SEGMENT FINANCIAL PERFORMANCE Revenue ▪ Revenue (-3%) / organic (-4%), vs. PY ▪ Passenger vehicle growth +12% ▪ Several new platform launches, mainly China ▪ Commercial vehicle business (-16%) ▪ Continued inventory destocking, ongoing China weakness ▪ Actions to drive progress towards mid- teens operating margin ▪ Operational footprint shifts ▪ Cost structure reductions ▪ Optimization of product / customer mix (in millions) Op Margin 7.1% 5.5% Adj. EBITDA% 13.4% 11.2% See appendix for GAAP to non-GAAP reconciliation Highlights

13Littelfuse, Inc. © 2023 $80 $86 Q3-22 Q3-23 Q3 2023 INDUSTRIAL SEGMENT FINANCIAL PERFORMANCE Revenue ▪ Revenue +8% / organic +5%, vs. PY ▪ Continued wins across higher-growth end markets ▪ Renewables, energy storage & EV infrastructure ▪ Maintained strong profitability amidst signs of select industrial market softness (in millions) Op Margin 15.3% 15.3% Adj. EBITDA% 18.1% 20.1% See appendix for GAAP to non-GAAP reconciliation Highlights

14Littelfuse, Inc. © 2023 Q4 2023 GUIDANCE ▪ Q4 macro view…expect continuation into 2024 ▪ Continued reduction of inventory across distribution partners & some of our OEMs ▪ Some industrial end market softness ▪ Q4 Sales (-13%) vs. PY; (-12%) sequential ▪ Decline across all segments with typical seasonality…led by electronics segment ▪ Commercial vehicle business…product line pruning ~(-1%) ▪ Q4 EPS $1.90 - $2.10 ▪ Impact mainly from sales volume de-leverage ▪ Adj. tax rate ~18% (in millions) See appendix for GAAP to non-GAAP reconciliation $613 $607 $550 - $520 Q4-22 Q3-23 Q4-23 Revenue Adj. EPS $3.34 $2.97 $1.90 - $2.10 GAAP EPS $3.74 $2.30 - Highlights

15Littelfuse, Inc. © 2023 FULL YEAR 2023 CONSIDERATIONS / EXPECTATIONS ▪ Better than historical financial performance vs. prior market cycles ▪ Positioned for upper-teens FY23 operating margin ▪ F/X neutral to sales at current F/X rates, ~(-$0.35) EPS impact ▪ ~(-50bps) impact to margins ▪ Other Assumptions ▪ $66m amortization expense ▪ $40m interest expense at current rates ▪ Adj. tax rate 18.6% ▪ Expect 100% free cash flow conversion of net income ▪ $90 - $100m in capital expenditures

16Littelfuse, Inc. © 2023 DIVERSIFICATION OF TECHNOLOGIES, END MARKETS & GEOGRAPHIES DELIVERS DOUBLE-DIGIT REVENUE & EARNINGS CAGR '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23F* Revenue (M$) Adjusted EPS ‘08 – ’23F* CAGR: Sales +10% EPS +18% *Based on Q3 YTD 2023 actual results & midpoint of Q4 sales & EPS guidance Resilient business model & strong growth strategy ▪ Expanding leadership in core markets while prioritizing strategic investments to bolster diversified portfolio ▪ Flexible cost structure to drive improved profitability through cycles ▪ Proven team with history of successfully managing through dynamic environments

17Littelfuse, Inc. © 2023 APPENDIX

18Littelfuse, Inc. © 2023 SUPPLEMENTAL FINANCIAL INFORMATION

19Littelfuse, Inc. © 2023 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

20Littelfuse, Inc. © 2023 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

21Littelfuse, Inc. © 2023 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

22Littelfuse, Inc. © 2023 SUPPLEMENTAL FINANCIAL INFORMATION CONT’D

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

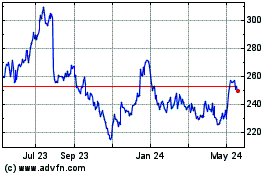

Littelfuse (NASDAQ:LFUS)

Historical Stock Chart

From Oct 2024 to Nov 2024

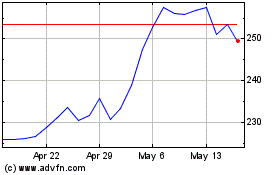

Littelfuse (NASDAQ:LFUS)

Historical Stock Chart

From Nov 2023 to Nov 2024