false000175950900017595092024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 21, 2024

Lyft, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38846 | | 20-8809830 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

185 Berry Street, Suite 400

San Francisco, California 94107

(Address of principal executive offices, including zip code)

(844) 250-2773

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol | | Name of each exchange

on which registered |

| Class A Common Stock, par value of $0.00001 per share | | LYFT | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 21, 2024 (the “Effective Date”), Lyft, Inc. (the “Company”) entered into Amendment No. 2 to Revolving Credit Agreement (the “Amendment”), with the other loan parties party thereto, JPMorgan Chase Bank, N.A., as administrative agent (the “Agent”), and certain lenders party thereto, which amends that certain Revolving Credit Agreement, dated as of November 3, 2022, by and among the Company, the Agent and certain lenders party thereto from time to time (as amended by Amendment No. 1 to the Revolving Credit Agreement, dated as of December 12, 2023, the “Existing Agreement,” and the Existing Agreement as amended by the Amendment, the “Amended Agreement”).

The Amendment amends the Existing Agreement to, among other things: (a) solely for the purposes of the financial covenant test, replace total leverage with total net leverage, which allows the Company to subtract the lesser of (i)(x) to the extent Free Cash Flow (as defined in the Company’s most recent Quarterly Reports on Form 10-Q and/or Annual Reports on Form 10-K) for the most recently ended trailing four quarters is greater than $100.0 million, $300.0 million and (y) otherwise, $200.0 million and (ii) the amount of unrestricted cash and cash equivalents (as defined in the Amended Agreement) on its consolidated balance sheet as of the calculation date and (b) permit the Company to repurchase up to a specified amount of the Company’s common stock with the proceeds of a convertible note offering.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is attached as Exhibit 10.1 hereto and incorporated herein by reference.

Item 8.01 Other Events.

On February 21, 2024, the Company issued a press release announcing its intention to offer, subject to market and other conditions, $400 million aggregate principal amount of convertible senior notes due 2029 in a private placement to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance. In some cases, you can identify forward looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans or intentions. The forward-looking statements contained in this Current Report on Form 8-K are also subject to other risks and uncertainties, including those more fully described in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 that was filed with the SEC on February 20, 2024. The forward-looking statements in this Current Report on Form 8-K are based on information available to the Company as of the date hereof, and the Company disclaims any obligation to update any forward-looking statements, except as required by law.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits: | | | | | | | | |

Exhibit

No. | | Exhibit Description |

| 10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| | LYFT, INC. |

| | |

| Date: | February 21, 2024 | /s/ Erin Brewer |

| | Erin Brewer |

| | Chief Financial Officer |

AMENDMENT NO. 2 TO REVOLVING CREDIT AGREEMENT, dated as of February 21, 2024 (this “Amendment”), is entered into among Lyft, Inc., a Delaware corporation (the “Borrower”), the other Loan Parties party hereto, the Lenders party hereto and JPMorgan Chase Bank, N.A., as Administrative Agent (in such capacity, the “Administrative Agent”).

WHEREAS, the Borrower, the several banks and other financial institutions party thereto and the Administrative Agent entered into that certain Revolving Credit Agreement, dated as of November 3, 2022 (as amended by Amendment No. 1 to the Revolving Credit Agreement, dated as of December 12, 2023 and as further amended, supplemented or otherwise modified prior to the Amendment Effective Date (as defined below), the “Existing Credit Agreement”; the Existing Credit Agreement, as amended by this Amendment, the “Amended Credit Agreement”; capitalized terms used but not defined in this Amendment shall have the meanings assigned to such terms in the Amended Credit Agreement);

WHEREAS, pursuant to Section 9.02 of the Existing Credit Agreement and the definition of “Required Lenders” as set forth in the Existing Credit Agreement, the Borrower, Lenders constituting the Required Lenders and the Administrative Agent may amend the Existing Credit Agreement as set forth herein; and

WHEREAS, in reliance on the foregoing, upon the terms and subject to the conditions set forth in this Amendment, effective as of the Amendment Effective Date, the Borrower, the Lenders party hereto (which Lenders as of the date hereof constitute the “Required Lenders” under and as defined in the Existing Credit Agreement) and the Administrative Agent agree to amend the Existing Credit Agreement as set forth herein.

NOW, THEREFORE, in consideration of the premises and of the mutual covenants herein contained and for other good and valuable consideration, the receipt of which is hereby acknowledged, the parties hereto agree as follows:

SECTION 1.Amendments.

(a)On the Amendment Effective Date, the Existing Credit Agreement is hereby amended as follows:

(i)Section 1.01 of the Existing Credit Agreement is hereby amended to add the following defined term in appropriate alphabetical order:

““Free Cash Flow” as defined in Borrower’s most recent Quarterly Reports on Form 10-Q and/or Annual Reports on Form 10-K in respect of such Measurement Period.”

““Total Net Leverage Ratio” means, as of any date of determination, the ratio of (a) (i) all Indebtedness of the Borrower and its Restricted Subsidiaries of the type described in clauses (a) through (e) and (g) and (h) of the definition of “Indebtedness”, and solely with respect to letters of credit, bankers’ acceptances and similar facilities that have been drawn but not yet reimbursed, clause (f) of the definition of “Indebtedness” to the extent reflected as a liability on the balance sheet in accordance with GAAP as of such date, determined on a consolidated basis in accordance with GAAP, minus (ii) the lesser of (A) (1) if Free Cash Flow for the most recently ended Measurement Period is greater than $100,000,000, $300,000,000 or (2) otherwise, $200,000,000 and (B) the amount of Unrestricted

cash and Cash Equivalents on the balance sheet of the Borrower and its Restricted Subsidiaries as of such date, to (b) Consolidated Adjusted EBITDA for the most recently ended Measurement Period.”

(ii)The defined term “Refinancing Indebtedness” in Section 1.01 of the Existing Credit Agreement are hereby amended and replaced in its entirety as follows:

““Refinancing Indebtedness” means refinancings, extensions, renewals, or replacements of Indebtedness so long as such refinancings, extensions, renewals, or replacements do not result in an increase in the principal amount (other than any accrued or capitalized amounts) of the Indebtedness so refinanced, extended, renewed or replaced, other than by the amount equal to any accrued but unpaid interest, the premiums or other amounts paid, and fees and expenses incurred (including, in the case of Convertible Notes, any premium payments with respect to any related Permitted Bond Hedge Transactions), in connection with such refinancing, extension, renewal or replacement and by the amount of unfunded commitments with respect thereto.”

(iii)Section 6.01 of the Existing Credit Agreement is hereby amended by (A) deleting the word “and” at the end of clause (p), (B) deleting the period at the end of clause (q) and replacing with “; and”, and (c) adding a new clause (r) as follows:

“(r) additional Indebtedness consisting of Convertible Notes, in an aggregate principal amount not to exceed $100,000,000, the proceeds of which shall be used to finance a repurchase of shares of common stock of the Borrower.”

(iv)Section 6.07(b) of the Existing Credit Agreement is hereby amended and replaced in its entirety as follows:

“(b) Total Net Leverage Ratio.

(i) For each of the fiscal quarters of the Borrower ending September 30, 2024 and December 31, 2024, the Borrower will not permit, as of the last day of each such fiscal quarter, the Total Net Leverage Ratio to exceed 3.50 to 1.00.

(ii) Commencing with the fiscal quarter of the Borrower ending March 31, 2025, the Borrower will not permit, as of the last day of such fiscal quarter and each subsequent fiscal quarter, the Total Net Leverage Ratio to exceed the Applicable Covenant Level.”

(v)Section 6.08 of the Existing Credit Agreement is hereby amended by (A) deleting the word “and” at the end of clause (i), (B) deleting the period at the end of clause (j) and replacing with “; and”, and (C) adding a new clause (k) as follows:

“(k) following the issuance by the Borrower of any Convertible Notes, the Borrower may use all or a portion of the proceeds of such Convertible Notes to make additional Restricted Payments, in an aggregate amount not to exceed $100,000,000.”

SECTION 2.Conditions Precedent to Effectiveness. This Amendment shall become effective on the first date (the “Amendment Effective Date”) on which all the following conditions are satisfied:

(a)The Administrative Agent (or its counsel) shall have received from each party hereto, including Lenders constituting the “Required Lenders” under and as defined in the Existing Credit Agreement, a counterpart of this Amendment signed on behalf of such party.

(b)Immediately prior to and immediately after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing on the Amendment Effective Date.

(c)The representations and warranties contained in Section 3 of this Amendment and in Article 3 of the Existing Credit Agreement shall be true and correct in all material respects on and as of the date hereof, except that (i) for purposes of this Section 2(c), the representations and warranties contained in Section 3.04(a) of the Existing Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to Section 5.01(a) or Section 5.01(b) of the Existing Credit Agreement (subject, in the case of unaudited financial statements furnished pursuant to Section 5.01(b) of the Existing Credit Agreement, to year-end audit adjustments and the absence of footnotes), (ii) to the extent that such representations and warranties in Article 3 of the Existing Credit Agreement specifically refer to the “Effective Date” (as defined in the Existing Credit Agreement), other than with respect to the Section 3.13, such references shall be deemed to refer to the Amendment Effective Date and shall be true and correct in all material respects as of the Amendment Effective Date and (iii) to the extent that such representations and warranties are already qualified or modified by materiality or words of similar effect in the text thereof, they shall be true and correct in all respects.

(d)The Lenders party hereto and the Administrative Agent shall have received on or before the Amendment Effective Date payment of all expenses required to be reimbursed by the Borrower under the Loan Documents for which invoices have been presented at least one (1) Business Day prior to the Amendment Effective Date.

SECTION 3.Representations and Warranties. In order to induce the Lenders party hereto to enter into this Amendment, the Borrower hereby represents and warrants to the Lenders that (a) this Amendment has been duly authorized by all necessary corporate or organizational and, if required, equity holder action and (b) this Amendment has been duly executed and delivered by the Borrower and constitutes a legal, valid and binding obligation of the Borrower, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

SECTION 4.Continuing Effect; No Novation; Reaffirmation.

(a)Except as expressly amended or modified hereby, the Loan Documents shall continue to be and shall remain in full force and effect in accordance with their respective terms. This Amendment shall not constitute an amendment, waiver or modification of any provision of any Loan Document not expressly referred to herein and shall not be construed as an amendment, waiver or modification of any action on the part of the Borrower or the other Loan Parties that would require an amendment, waiver or consent of the Administrative Agent or the Lenders except as expressly stated herein, or be construed to indicate the willingness of the Administrative Agent or any Lender to further amend, waive or modify any provision of any Loan Document amended, waived or modified hereby for any other period, circumstance or event. Except as expressly modified by this Amendment, the Loan Documents are ratified and confirmed and are, and shall continue to be, in full force and effect in accordance with their respective terms. Except as expressly set forth herein, each Lender and the Administrative Agent reserves all of its rights, remedies, powers and privileges under the Existing Credit Agreement, the other Loan Documents, applicable law and/or equity. Any reference to the “Credit

Agreement” in any Loan Document or any related documents shall be deemed to be a reference to the Amended Credit Agreement and the term “Loan Documents” in the Amended Credit Agreement and the other Loan Documents shall include this Amendment. Neither this Amendment nor the execution, delivery or effectiveness of this Amendment shall extinguish the obligations outstanding under the Existing Credit Agreement. Nothing herein contained shall be construed as a substitution or novation of the obligations outstanding under the Existing Credit Agreement, which shall remain in full force and effect, except to any extent modified hereby or by instruments executed concurrently herewith. Nothing implied in this Amendment, the Amended Credit Agreement, the Security Documents, the other Loan Documents or in any other document contemplated hereby or thereby shall be construed as a release or other discharge of any of Borrower or any other Loan Party from any of its obligations and liabilities as a “Borrower”, “Guarantor” or “Loan Party” under the Existing Credit Agreement or any other Loan Document. Each of the Existing Credit Agreement, the Security Documents and the other Loan Documents shall remain in full force and effect, until (as applicable) and except to any extent modified hereby or in connection herewith.

(b)Each Loan Party hereby:

(i)consents to this Amendment and the Amended Credit Agreement and the transactions contemplated thereby and hereby confirms its guarantees, pledges, grants of security interests, acknowledgments, obligations, subordinations and consents under the Security Documents and the other Loan Documents to which it is a party and agrees that notwithstanding the amendment of the Existing Credit Agreement, the effectiveness of this Amendment and the consummation of the transactions contemplated thereby, such guarantees, pledges, grants of security interests, agreements, acknowledgments, obligations, subordinations and consents shall be, and continue to be, in full force and effect,

(ii)ratifies the Security Documents and the other Loan Documents to which it is a party,

(iii)confirms that all of the Liens and security interests created and arising under the Security Documents as existed immediately prior to giving effect to the amendment of the Existing Credit Agreement pursuant to this Amendment remain in full force and effect on a continuous basis, unimpaired, uninterrupted and undischarged, and having the same perfected status and priority as collateral security for the Obligations as existed immediately prior to giving effect to the amendment of the Existing Credit Agreement pursuant to this Amendment,

(iv)agrees that each of the representations and warranties made by it in the Security Documents is true and correct in all material respects on and as of the date hereof, except that (i) to the extent that such representations and warranties specifically refer to an earlier date, they shall be true and correct in all material respects as of such earlier date and (ii) to the extent that such representations and warranties are already qualified or modified by materiality or words of similar effect in the text thereof, they shall be true and correct in all respects, and

(v)agrees that it shall take any action reasonably requested by the Administrative Agent to confirm or effect the intent of this Amendment.

SECTION 5.Governing Law; Jurisdiction; Consent to Service of Process; etc..

(a)THIS AMENDMENT AND ANY CLAIM, CONTROVERSY OR DISPUTE UNDER, ARISING OUT OF OR RELATING TO THIS AMENDMENT OR THE OTHER LOAN DOCUMENTS AND THE TRANSACTIONS CONTEMPLATED

HEREBY, WHETHER BASED IN CONTRACT (AT LAW OR IN EQUITY), TORT OR ANY OTHER THEORY, SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK WITHOUT REGARD TO CONFLICTS OF LAW RULES THAT WOULD RESULT IN THE APPLICATION OF A DIFFERENT GOVERNING LAW.

(b)Section 9.03, Sections 9.09(b), (c) and (d), Section 9.10 and Section 9.14 of the Existing Credit Agreement are hereby incorporated herein mutatis mutandis. Without duplication of Section 9.03 of the Existing Credit Agreement, and solely to the extent provided for in Section 9.03(a) of the Existing Credit Agreement, the Borrower shall pay all reasonable and documented out-of-pocket costs and expenses of the Administrative Agent incurred in connection with the negotiation, preparation and execution of this Amendment and the transactions contemplated hereby (including reasonable and documented fees and expenses of Simpson Thacher & Bartlett LLP).

SECTION 6.Entire Agreement. This Amendment, the Amended Credit Agreement and the other Loan Documents represent the entire agreement of the Loan Parties, the Administrative Agent, the Agents and the Lenders with respect to the subject matter hereof and thereof, and there are no promises, undertakings, representations or warranties by the Administrative Agent, any other Agent or any Lender relative to the subject matter hereof not expressly set forth or referred to herein or in the Amended Credit Agreement or the other Loan Documents.

SECTION 7.Loan Document. This Amendment is a Loan Document and shall (unless otherwise expressly indicated herein) be construed, administered and applied in accordance with the terms and provisions of the Amended Credit Agreement.

SECTION 8.Counterparts. This Amendment may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. Delivery of an executed counterpart of a signature page of this Amendment by telecopy, emailed pdf. or any other electronic means that reproduces an image of the actual executed signature page shall be effective as delivery of a manually executed counterpart of this Amendment. The words “execution”, “signed”, “signature”, “delivery” and words of like import in or relating to this Amendment, any document to be signed in connection herewith and the transactions contemplated hereby shall be deemed to include Electronic Signatures, electronic deliveries or the keeping of records in any electronic form (including deliveries by telecopy, emailed pdf. or any other electronic means that reproduces an image of an actual executed signature page),each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be; provided that nothing herein shall require the Administrative Agent to accept Electronic Signatures in any form or format without its prior written consent. Without limiting the generality of the foregoing, each of the parties hereto hereby (i) agrees that, for all purposes, including without limitation, in connection with any workout, restructuring, enforcement of remedies, bankruptcy proceedings or litigation among the Administrative Agent, the Lenders and the Loan Parties, Electronic Signatures transmitted by telecopy, emailed pdf. or any other electronic means that reproduces an image of an actual executed signature page and/or any electronic images of this Amendment or any other Loan Documents (in each case, including with respect to any signature pages thereto) shall have the same legal effect, validity and enforceability as any paper original, and (ii) waives any argument, defense or right to contest the legal effect, validity or enforceability of this Amendment based solely on the lack of paper original copies of any Loan Documents, including with respect to any signature pages thereto.

SECTION 9.Headings. Section headings used in this Amendment are for convenience of reference only, are not part of this Amendment and shall not affect the construction of, or to be taken into consideration in interpreting, this Amendment.

[Remainder of page intentionally left blank; signature pages follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed and delivered by their duly authorized officers as of the date first written above.

LYFT, INC., as the Borrower

By: /s/ Erin Brewer

Name: Erin Brewer

Title: Chief Financial Officer

[Lyft, Inc.—Amendment No. 2 to Revolving Credit Agreement]

FLEXDRIVE SERVICES, LLC, as a Loan Party

By: /s/ Caroline Cunningham

Name: Caroline Cunningham

Title: Manager

LYFT BIKES AND SCOOTERS, LLC, as a Loan Party

By: /s/ Christopher Reilly

Name: Christopher Reilly

Title: Assistant Secretary

LYFT HEALTHCARE, INC., as a Loan Party

By: /s/ Caroline Cunningham

Name: Caroline Cunningham

Title: Secretary and Vice President

[Lyft, Inc.—Amendment No. 2 to Revolving Credit Agreement]

JPMORGAN CHASE BANK, N.A.,

as the Administrative Agent and a Lender

By: /s/ Richard Ong Pho

Name: Richard Ong Pho

Title: Executive Director

[Lyft, Inc.—Amendment No. 2 to Revolving Credit Agreement]

KEYBANK NATIONAL ASSOCIATION,

as a Lender

By: /s/ Geoff Smith

Name: Geoff Smith

Title: Senior Vice President

ROYAL BANK OF CANADA,

as a Lender

By: /s/ Theodore Brown

Name: Theodore Brown

Title: Authorized Signatory

BMO,

as a Lender

By: /s/ Scott Bruni

Name: Scott Bruni

Title: Managing Director

BANK OF AMERICA, N.A.,

as a Lender

By: /s/ Marie F. Harrison

Name: Marie F. Harrison

Title: Managing Director

THE TORONTO-DOMINION BANK, NEW YORK BRANCH,

as a Lender

By: /s/ Jon Colquhoun

Name: Jon Colquhoun

Title: Managing Director

[Lyft, Inc.—Amendment No. 2 to Revolving Credit Agreement]

GOLDMAN SACHS LENDING PARTNERS LLC,

as a Lender

By: /s/ Priyankush Goswami

Name: Priyankush Goswami

Title: Authorized Signatory

JEFFRIES FINANCE LLC,

as a Lender

By: /s/ J.R. Young

Name: J.R. Young

Title: Managing Director

[Lyft, Inc.—Amendment No. 2 to Revolving Credit Agreement]

Lyft Announces Private Offering of $400 million of Convertible Senior Notes

SAN FRANCISCO, February 21, 2024 (BUSINESS WIRE)—Lyft, Inc. (“Lyft”) (NASDAQ: LYFT) today announced its intention to offer, subject to market conditions and other factors, $400 million aggregate principal amount of Convertible Senior Notes due 2029 (the “notes”) in a private offering (the “offering”) only to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). Lyft also expects to grant the initial purchasers of the notes an option to purchase, for settlement within a 13-day period beginning on, and including, the date Lyft first issues the notes, up to an additional $60 million aggregate principal amount of the notes, solely to cover over-allotments. The notes will be senior, unsecured obligations of Lyft, and interest will be payable semi-annually in arrears. Upon conversion, Lyft will pay cash up to the aggregate principal amount of the notes to be converted and pay or deliver, as the case may be, cash, shares of Lyft’s Class A common stock (“Class A common stock”) or a combination of cash and shares of Class A common stock, at Lyft’s election, in respect of the remainder, if any, of its conversion obligation in excess of the aggregate principal amount of the notes being converted. The interest rate, conversion rate and other terms of the notes are to be determined upon pricing of the offering.

Lyft intends to use the net proceeds of the offering to (1) repurchase a portion of its 1.50% Convertible Senior Notes due 2025 (the “2025 notes”) concurrently with the pricing of the offering in separate and privately negotiated transactions with certain holders of its 2025 notes (the “concurrent note repurchases”) effected through one of the initial purchasers of the notes or its affiliate, acting as Lyft’s agent, (2) pay the cost of the capped call transactions described below, and (3) purchase up to approximately $50 million of the Class A common stock from institutional investors through one of the initial purchasers of the notes or its affiliate, acting as Lyft’s agent, at a price per share equal to the last reported sale price of the Class A common stock on the Nasdaq Global Select Market on the date of the pricing of the notes. If the initial purchasers exercise their option to purchase additional notes, Lyft expects to use a portion of the net proceeds from the sale of such additional notes to enter into additional capped call transactions with the option counterparties. Lyft intends to use any remaining net proceeds for general corporate purposes, which may include repurchases of additional 2025 notes, working capital, capital expenditures, and potential acquisitions and strategic transactions. From time to time Lyft evaluates potential acquisitions and strategic transactions. However, Lyft has not designated any specific uses and has no current agreements with respect to any material acquisitions or strategic transactions.

The terms of the concurrent note repurchases are anticipated to be individually negotiated with each holder of the 2025 notes participating in the concurrent note repurchases, and will depend on several factors, including the market price of Lyft’s Class A common stock and the trading price of the 2025 notes at the time of each such concurrent note repurchase. No assurance can be given as to how much, if any, of the 2025 notes will be repurchased or the terms on which they will be repurchased. Certain holders of any 2025 notes that Lyft agrees to repurchase may have hedged their equity price risk with respect to such 2025 notes and may, concurrently with the pricing of the notes, unwind all or part of their hedge positions by buying Lyft’s Class A common stock and/or entering into or unwinding various derivative transactions with respect to Lyft’s Class A common stock. Any repurchase of the 2025 notes, and the potential related market activities by holders of the 2025 notes participating in the concurrent note repurchases, together with the repurchase by Lyft of any Class A common stock concurrently with the pricing of the notes, could increase (or reduce the size of any decrease in) the market price of Lyft’s Class A common stock, which may affect the trading price of the notes at that time and the initial conversion price of the notes. Lyft cannot predict the magnitude of such market activity or the overall effect it will have on the price of the notes or our Class A common stock.

In connection with the pricing of the notes, Lyft expects to enter into privately negotiated capped call transactions with one or more of the initial purchasers and/or their respective affiliates and/or other financial institutions (the “option counterparties”). The capped call transactions will cover, subject to anti-dilution adjustments, the number of shares of Class A common stock underlying the notes sold in the offering. The capped call transactions are generally expected to reduce potential dilution to the Class A common stock upon any conversion of notes and/or offset any cash payments Lyft elects to make in excess of the principal amount of converted notes, as the case may be, with such reduction and/or offset subject to a cap.

Lyft has been advised that, in connection with establishing their initial hedges of the capped call transactions, the option counterparties or their respective affiliates expect to purchase shares of Class A common stock and/or enter into various derivative transactions with respect to the Class A common stock concurrently with or shortly after the pricing of the notes. This activity could increase (or reduce the size of any decrease in) the market price of the Class A common stock or the notes at that time. In addition, the option counterparties or their respective affiliates may modify their hedge positions by entering into or unwinding various derivatives with respect to the Class A common stock and/or purchasing or selling the Class A common stock or other securities of Lyft in secondary market transactions following the pricing of the notes and prior to the maturity of the notes (and are likely to do so following any conversion, repurchase or redemption of the notes, to the extent Lyft exercises the relevant election under the capped call transactions). This activity could also cause or avoid an increase or a decrease in the market price of the Class A common stock or the notes, which could affect the ability of noteholders to convert the notes and, to the extent the activity occurs following a conversion or during any observation period related to a conversion of notes, it could affect the number of shares and value of the consideration that noteholders will receive upon conversion of the notes.

The notes will only be offered to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act. Neither the notes nor the shares of Class A common stock potentially issuable upon conversion of the notes, if any, have been, or will be, registered under the Securities Act or the securities laws of any other jurisdiction, and unless so registered, may not be offered or sold in the United States except pursuant to an applicable exemption from such registration requirements.

This announcement is neither an offer to sell nor a solicitation of an offer to buy any of these securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.

Investor Contact:

Sonya Banerjee

investor@lyft.com

Media Contact:

press@lyft.com

v3.24.0.1

Cover Page

|

Feb. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity Registrant Name |

Lyft, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38846

|

| Entity Tax Identification Number |

20-8809830

|

| Entity Address, Address Line One |

185 Berry Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94107

|

| City Area Code |

(844)

|

| Local Phone Number |

250-2773

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value of $0.00001 per share

|

| Trading Symbol |

LYFT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001759509

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

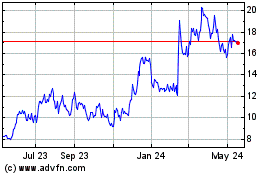

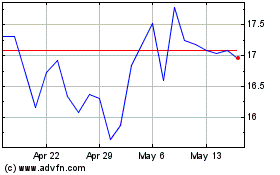

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024