Lyra Therapeutics Reports Third Quarter 2024 Financial Results and Provides Corporate Update

November 12 2024 - 3:01PM

Lyra Therapeutics, Inc. (Nasdaq: LYRA) (“Lyra” or the

“Company”), a clinical-stage biotechnology company developing

long-acting, anti-inflammatory sinonasal implants for the treatment

of chronic rhinosinusitis (CRS), today reported its financial

results for the third quarter ended September 30, 2024 and provided

a corporate update.

“We look forward to key milestones in the coming months from the

two ongoing ENLIGHTEN Phase 3 trials that will provide us with

a more complete data set and greater insight into determining a

potential pathway to approval for LYR-210 in CRS patients with and

without nasal polyps. The topline 52-week safety data from the

ENLIGHTEN 1 safety extension study was in-line with the primary

treatment phase, with no product-related serious adverse events,

including for those patients that received a repeat dose, resulting

in a 12-month treatment period. We are anticipating additional data

from the ENLIGHTEN 1 safety extension study in the coming months,

which will be presented at an upcoming medical conference, as well

as topline results from the ENLIGHTEN 2 pivotal trial expected in

Q2 2025,” said Maria Palasis, Ph.D., President and CEO of Lyra

Therapeutics.

Dr. Palasis continued, “We eagerly await the upcoming data

readouts, and they will guide us in making data-driven evaluations

as we determine the potential path for LYR-210 to add value for CRS

patients, investors and other stakeholders.”

The ENLIGHTEN program consists of two pivotal

Phase 3 clinical trials, ENLIGHTEN 1 and ENLIGHTEN 2, to evaluate

the efficacy and safety of LYR-210 for the treatment of CRS. Each

ENLIGHTEN trial has enrolled approximately 180 CRS patients who

have failed medical management and have not had prior ethmoid sinus

surgery, randomized 2:1 to either LYR-210 (7500µg mometasone

furoate) or sham control for 24 weeks.

Topline Results from the ENLIGHTEN 1 52-week extension

study

Today, Lyra reported topline 52-week safety data from the

ENLIGHTEN 1 safety extension study:

- Safety data for LYR-210 was

generally consistent with the 24-week primary treatment phase,

including for those patients that received a repeat dosing,

resulting in a 12-month treatment period.

- LYR-210 was generally well

tolerated, with no product-related serious adverse events. The most

commonly reported adverse events in the study population were

chronic sinusitis, nasal odor, epistaxis, sinusitis, and

nasopharyngitis.

Clinical Program Highlights

Enrollment in ENLIGHTEN 2 completed

- In October 2024, Lyra announced that the pivotal Phase 3

ENLIGHTEN 2 clinical trial of LYR-210 in adult patients with CRS

who have not had prior ethmoid sinus surgery, was fully enrolled,

achieving the expected enrollment timeframe of second half of

2024.

Milestones for Ongoing ENLIGHTEN Pivotal Program of

LYR-210 in CRS

- Topline results from ENLIGHTEN 2 are expected in Q2 2025.

Third Quarter 2024 Financial Highlights

Cash, cash equivalents and short-term investments as of

September 30, 2024 were $51.6 million, compared with $67.5 million

at June 30, 2024. Based on our current business plan, we anticipate

that our cash, cash equivalents and short-term investment balance

is sufficient to fund our operating expenses and capital

expenditures into the first quarter of 2026.

Research and development expenses for the quarter ended

September 30, 2024 were $5.9 million compared to $12.4 million for

the same period in 2023, representing a decrease of $6.5 million.

The decrease in research and development expenses for the three

months ended September 30, 2024 was primarily attributable to

a $3.8 million decrease in clinical related costs as we completed

both the BEACON trial for LYR-220 and the primary study phase of

the ENLIGHTEN 1 trial for LYR-210, a decrease of $2.5 million in

employee related costs primarily driven by the reduction in force

which occurred in May 2024, a decrease in professional and

consulting costs of $0.4 million and a decrease in product

development and manufacturing costs of $0.4 million. This decrease

in costs was partially offset by an increase in allocated costs and

depreciation of $0.6 million.

General and administrative expenses for the quarter ended

September 30, 2024 were $3.9 million compared to $5.0 million for

the same period in 2023, representing a decrease of $1.1 million.

The decrease in general and administrative expenses for the three

months ended September 30, 2024 was primarily driven by a

decrease in professional and consulting fees of $1.0 million as we

scaled back activities subsequent to announcing in May 2024 that

the ENLIGHTEN 1 trial did not meet its primary endpoint, in

addition to a decrease in employee related costs of $0.5 million

primarily due to the reduction in force which occurred in May 2024.

These cost decreases were partially offset by an increase in

allocation and support costs of $0.4 million primarily due to the

increased rent and facilities expenses for the Company’s three

leased facilities for the three months ended September 30, 2024

compared to the three months ended September 30, 2023.

Net loss for the quarter ended September 30, 2024 was $11.9

million compared to $15.7 million for the same period in

2023.

|

|

|

|

LYRA THERAPEUTICS, INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(unaudited) (in thousands, except share

and per share data) |

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Collaboration revenue |

|

$ |

195 |

|

|

$ |

544 |

|

|

$ |

1,325 |

|

|

$ |

1,412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

5,902 |

|

|

|

12,368 |

|

|

|

37,404 |

|

|

|

35,763 |

|

|

General and administrative |

|

|

3,931 |

|

|

|

5,003 |

|

|

|

14,888 |

|

|

|

14,700 |

|

|

Impairment of property and equipment |

|

|

— |

|

|

|

— |

|

|

|

1,883 |

|

|

|

1,592 |

|

|

Impairment of right-of-use assets |

|

|

— |

|

|

|

— |

|

|

|

22,836 |

|

|

|

— |

|

|

Restructuring and other related charges |

|

|

2,804 |

|

|

|

— |

|

|

|

9,254 |

|

|

|

— |

|

|

Total operating expenses |

|

|

12,637 |

|

|

|

17,371 |

|

|

|

86,265 |

|

|

|

52,055 |

|

|

Loss from operations |

|

|

(12,442 |

) |

|

|

(16,827 |

) |

|

|

(84,940 |

) |

|

|

(50,643 |

) |

|

Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

576 |

|

|

|

1,192 |

|

|

|

2,517 |

|

|

|

3,161 |

|

|

Total other income |

|

|

576 |

|

|

|

1,192 |

|

|

|

2,517 |

|

|

|

3,161 |

|

|

Loss before income tax expense |

|

|

(11,866 |

) |

|

|

(15,635 |

) |

|

|

(82,423 |

) |

|

|

(47,482 |

) |

|

Income tax expense |

|

|

(7 |

) |

|

|

(16 |

) |

|

|

(33 |

) |

|

|

(42 |

) |

|

Net loss |

|

|

(11,873 |

) |

|

|

(15,651 |

) |

|

|

(82,456 |

) |

|

|

(47,524 |

) |

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized holding gain (loss) on short-term investments, net of

tax |

|

|

24 |

|

|

|

20 |

|

|

|

(13 |

) |

|

|

(17 |

) |

|

Comprehensive loss |

|

$ |

(11,849 |

) |

|

$ |

(15,631 |

) |

|

$ |

(82,469 |

) |

|

$ |

(47,541 |

) |

|

Net loss per share attributable to common stockholders— basic and

diluted |

|

$ |

(0.18 |

) |

|

$ |

(0.27 |

) |

|

$ |

(1.27 |

) |

|

$ |

(1.04 |

) |

|

Weighted-average common shares outstanding— basic and diluted |

|

|

65,456,735 |

|

|

|

56,953,685 |

|

|

|

64,981,219 |

|

|

|

45,894,643 |

|

|

|

|

|

LYRA THERAPEUTICS, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (unaudited)

(in thousands, except share data) |

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

23,800 |

|

|

$ |

22,353 |

|

|

Short-term investments |

|

|

27,826 |

|

|

|

80,400 |

|

|

Prepaid expenses and other current assets |

|

|

2,818 |

|

|

|

2,068 |

|

|

Total current assets |

|

|

54,444 |

|

|

|

104,821 |

|

|

Property and equipment, net |

|

|

1,613 |

|

|

|

2,043 |

|

|

Operating lease right-of-use assets |

|

|

20,707 |

|

|

|

33,233 |

|

|

Restricted cash |

|

|

1,992 |

|

|

|

1,392 |

|

|

Other assets |

|

|

— |

|

|

|

1,111 |

|

|

Total assets |

|

$ |

78,756 |

|

|

$ |

142,600 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,292 |

|

|

$ |

3,131 |

|

|

Restructuring liability |

|

|

4,855 |

|

|

|

— |

|

|

Accrued expenses and other current liabilities |

|

|

3,197 |

|

|

|

9,374 |

|

|

Operating lease liabilities |

|

|

4,003 |

|

|

|

5,434 |

|

|

Deferred revenue |

|

|

607 |

|

|

|

1,658 |

|

|

Total current liabilities |

|

|

14,954 |

|

|

|

19,597 |

|

|

Operating lease liabilities, net of current portion |

|

|

31,321 |

|

|

|

21,447 |

|

|

Deferred revenue, net of current portion |

|

|

11,862 |

|

|

|

12,136 |

|

|

Total liabilities |

|

|

58,137 |

|

|

|

53,180 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, $0.001 par value, 10,000,000 shares authorized at

September 30, 2024 and December 31, 2023; no shares issued and

outstanding at September 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 200,000,000 shares authorized at

September 30, 2024 and December 31, 2023; 65,456,735 and 57,214,550

shares issued and outstanding at September 30, 2024 and December

31, 2023, respectively |

|

|

65 |

|

|

|

57 |

|

|

Additional paid-in capital |

|

|

414,345 |

|

|

|

400,685 |

|

|

Accumulated other comprehensive income, net of tax |

|

|

20 |

|

|

|

33 |

|

|

Accumulated deficit |

|

|

(393,811 |

) |

|

|

(311,355 |

) |

|

Total stockholders’ equity |

|

|

20,619 |

|

|

|

89,420 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

78,756 |

|

|

$ |

142,600 |

|

About LYR-210 LYR-210 is an

investigational product candidate for the treatment of chronic

rhinosinusitis (CRS) in patients who have failed current therapies

and require further intervention. LYR-210 is a bioresorbable nasal

implant designed to be inserted in a simple, in-office procedure.

LYR-210 is intended to deliver six months of continuous

anti-inflammatory therapy, mometasone furoate, to the sinonasal

passages to treat CRS. LYR-210 is being evaluated in the ENLIGHTEN

pivotal Phase 3 clinical program.

About Lyra TherapeuticsLyra Therapeutics,

Inc. is a clinical-stage biotechnology company developing

long-acting, anti-inflammatory sinonasal implants for the treatment

of chronic rhinosinusitis (CRS). Lyra Therapeutics is developing

therapies for CRS, a highly prevalent inflammatory disease of the

paranasal sinuses which leads to debilitating symptoms and

significant morbidities. LYR-210, the company’s lead product, is a

bioabsorbable nasal implant designed to be administered in a

simple, in-office procedure and is intended to deliver six months

of continuous anti-inflammatory drug therapy (7500µg mometasone

furoate) to the sinonasal passages for the treatment of CRS with a

single administration. LYR-210, being evaluated in the ENLIGHTEN

Phase 3 clinical program, is intended for patients with and

without nasal polyps. The company’s therapies are intended to treat

the estimated four million CRS patients in the United States who

fail medical management each year. For more information, please

visit www.lyratx.com and follow us on LinkedIn.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements contained in this press release that do not relate

to matters of historical fact should be considered forward-looking

statements, including statements regarding whether LYR-210 could

potentially benefit patients with CRS, the completion of the

Company’s ENLIGHTEN 2 Phase 3 clinical trial, and the timing of the

release of topline data from the ENLIGHTEN 2 Phase 3 clinical

trial. These statements are neither promises nor guarantees, but

involve known and unknown risks, uncertainties and other important

factors that may cause the Company's actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. These and other important factors

discussed under the caption "Risk Factors" in the Company's

Quarterly Report on Form 10-Q filed with the SEC on November 12,

2024 and its other filings with the SEC could cause actual results

to differ materially from those indicated by the forward-looking

statements made in this press release. Any such forward-looking

statements represent management's estimates as of the date of this

press release. While the Company may elect to update such

forward-looking statements at some point in the future, it

disclaims any obligation to do so, even if subsequent events cause

its views to change.

Contact Information:

Jason Cavalier, Chief Financial Officer

917.584.7668

jcavalier@lyratx.com

Media Contact:

Kathryn Morris, The Yates Network LLC

914.204.6412

kathryn@theyatesnetwork.com

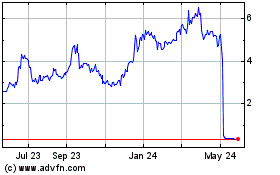

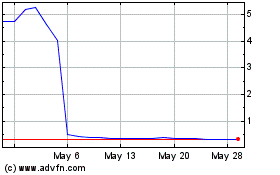

Lyra Therapeutics (NASDAQ:LYRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lyra Therapeutics (NASDAQ:LYRA)

Historical Stock Chart

From Feb 2024 to Feb 2025