Form 8-K - Current report

October 30 2023 - 3:05PM

Edgar (US Regulatory)

false 0001376339 0001376339 2023-10-30 2023-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 30, 2023

MIMEDX GROUP, INC.

(Exact name of registrant as specified in charter)

|

|

|

|

|

| Florida |

|

001-35887 |

|

26-2792552 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1775 West Oak Commons Ct., NE, Marietta GA 30062

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (770) 651-9100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 par value per share |

|

MDXG |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Important Cautionary Statement

This report includes forward-looking statements. Statements regarding: (i) future sales or sales growth; (ii) our 2023 financial goals and expectations for future financial results, including levels of net sales, Adjusted EBITDA, Adjusted EBITDA margin, corporate expenses and cash; (iii) our expectations regarding our new products, including EPIEFFECT; and (iv) demand for our products. Additional forward-looking statements may be identified by words such as “believe,” “expect,” “may,” “plan,” “goal,” “outlook,” “potential,” “will,” “preliminary,” and similar expressions, and are based on management’s current beliefs and expectations.

Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from expectations include: (i) future sales are uncertain and are affected by competition, access to customers, patient access to healthcare providers, the reimbursement environment and many other factors; (ii) the Company may change its plans due to unforeseen circumstances; (iii) the results of scientific research are uncertain and may have little or no value; (iv) our ability to sell our products in other countries depends on a number of factors including adequate levels of reimbursement, market acceptance of novel therapies, and our ability to build and manage a direct sales force or third party distribution relationship; (v) the effectiveness of amniotic tissue as a therapy for particular indications or conditions is the subject of further scientific and clinical studies; and (vi) we may alter the timing and amount of planned expenditures for research and development based on the results of clinical trials and other regulatory developments. The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this report and the Company assumes no obligation to update any forward-looking statement.

Item 2.02 Results of Operations and Financial Condition.

On October 30, 2023, MiMedx Group, Inc. (the “Company”), issued a press release (the “Earnings Press Release”) announcing its results for the third quarter ended September 30, 2023. A copy of the Earnings Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The foregoing information is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition”, including Exhibit 99.1 attached hereto, and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference into another filing under the Exchange Act or Securities Act of 1933, as amended (the “Securities Act”), if such subsequent filing specifically references this Form 8-K. All information in the Earnings Press Release speaks as of the date thereof and the Company does not assume any obligation to update said information in the future. In addition, the Company disclaims any inference regarding the materiality of such information which otherwise may arise as a result of its furnishing such information under Item 2.02 of this report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

On October 30, 2023, at 4:30 p.m. Eastern Daylight Time, the Company intends to host a conference call and webcast (the “Earnings Call”) to discuss its financial and operating results for the third quarter ended September 30, 2023. A copy of the slide presentation to be used by the Company in connection with the Earnings Call is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The foregoing information is furnished pursuant to Item 7.01, including Exhibit 99.2 attached hereto, and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. It may only be incorporated by reference into another filing under the Exchange Act or Securities Act, if such subsequent filing specifically references this Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MIMEDX GROUP, INC. |

|

|

|

|

| October 30, 2023 |

|

|

|

By: |

|

/s/ Doug Rice |

|

|

|

|

|

|

Doug Rice Chief Financial Officer |

Exhibit 99.1

MIMEDX Announces Third Quarter 2023 Operating and Financial Results

Third Consecutive Quarter of Net Sales Growth Exceeding 20% Over the Prior Year Period

Raises Full-Year 2023 Net Sales Percentage Growth Outlook to the High Teens

MARIETTA, GA., October 30, 2023 — MiMedx Group, Inc. (Nasdaq: MDXG) (“MIMEDX” or the “Company”), today

announced operating and financial results for the third quarter 2023, which ended September 30, 2023.

Recent Operating and Financial Highlights:

| |

• |

|

Third quarter 2023 net sales of $81.7 million, an increase of 20.7% over third quarter 2022.

|

| |

• |

|

GAAP net income of $8.5 million for third quarter 2023. |

| |

• |

|

Adjusted EBITDA1 of $17.6 million for third quarter

2023, representing 21.6% of net sales. |

| |

• |

|

Launched EPIEFFECT™, the latest addition to

MIMEDX’s portfolio of Advanced Wound Care products. |

| |

• |

|

Repurchased $9.5 million of a portion of Series B Preferred Stock (“Series B Shares”) held by

certain funds managed by Hayfin Capital Management, LLP (“Hayfin”); Hayfin agreed to retain the balance of its equity position for a period of one-year following the repurchase. |

Joseph H. Capper, MIMEDX Chief Executive Officer, commented, “We are delighted to report another excellent quarter as the Company continues to execute

across the board - commercially, operationally and financially. Net sales growth exceeded 20%, with an Adjusted EBITDA margin of 21.6% and a $12.5 million increase in our cash balance. Once again, our growth was broad-based, with contributions

from each site-of-service, largely driven by emerging competitive wins and continued uptake in the products we launched in late-2022. Additionally, the Company is

realizing benefits of scale as evidenced by the improvement in our Adjusted EBITDA and Free Cash Flow.2

“With the full commercial launch of EPIEFFECT, the latest addition to our market-leading placental- derived allograft portfolio, we look forward to

closing out an excellent 2023. As a result, we now expect our full-year 2023 net sales percentage growth rate to be in the high teens.”

Regarding

the share repurchase of the Company’s Series B Shares Preferred Stock (“Series B Shares”), Mr. Capper commented, “We greatly appreciate the Hayfin partnership and support of MIMEDX that began in 2020. We view this

transaction as opportunistic, as it eliminates the dividend requirement on the repurchased equity and reduces potential for liquidation pressure upon the future conversion of the balance of Hayfin’s Series B Shares.”

| 1 |

EBITDA, Adjusted EBITDA and related margins, Adjusted Net Income and Adjusted EPS are non-GAAP financial

measures. See “Reconciliation of Non-GAAP Measures” for a reconciliation of EBITDA, Adjusted EBITDA and Adjusted Net Income to Net income (loss) and Adjusted EPS to Diluted earnings per share, located in “Selected Unaudited Financial

Information” of this release. |

| 2 |

Free Cash Flow is a Non-GAAP financial measure. See “Reconciliation of Non-GAAP Measures” for a

reconciliation of Free Cash Flow to cash flows provided by (used in) operating activities, located in “Selected Unaudited Financial Information” of this release. |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

| |

|

(in thousands) |

|

| |

|

2023 |

|

|

2022 |

|

| Net sales |

|

$ |

81,712 |

|

|

$ |

67,689 |

|

| GAAP Net income (loss) |

|

|

8,534 |

|

|

|

(8,426 |

) |

| EBITDA |

|

|

11,648 |

|

|

|

(6,097 |

) |

| Adjusted EBITDA |

|

|

17,619 |

|

|

|

2,381 |

|

| GAAP Net income (loss) per common share - basic |

|

$ |

0.06 |

|

|

$ |

(0.09 |

) |

| GAAP Net income (loss) per common share - diluted |

|

$ |

0.06 |

|

|

$ |

(0.09 |

) |

| Adjusted Earnings (loss) Per Share |

|

$ |

0.05 |

|

|

$ |

(0.03 |

) |

Net Sales

MIMEDX

reported net sales for the three months ended September 30, 2023 of $81.7 million, compared to $67.7 million for the three months ended September 30, 2022, an increase of 20.7%.

| |

• |

|

Net sales from the hospital channel of $47.4 million reflect an increase of 17.9% compared to the prior year

period, |

| |

• |

|

Net sales from the physician office channel of $23.0 million reflect an increase of 17.3% compared to the

prior year period, and |

| |

• |

|

Net sales derived from other

sites-of-service of $11.4 million reflect an increase of 43.7% compared to the prior year period. |

Third quarter net sales growth benefited from strong demand for the Company’s Wound & Surgical product offering across all of its sites-of-service, continued uptake of new products launched in the last twelve months, which primarily impacted the hospital channel, and a contribution associated with the

wind-down of a product line related to the end of a contract.

Gross Profit and Margin

Gross profit for the three months ended September 30, 2023, was $66.9 million, an increase of $11.4 million as compared to the prior year

period.

Gross profit margin for the three months ended September 30, 2023, was 81.9% compared to 82.0% for the three months ended September 30,

2022. Third quarter gross profit margin was roughly flat versus the prior year period due to improvements in yield, partially offset by production variances and the unfavorable impact of the product line related to the end of a contract referenced

above.

Operating Expenses

Selling, general and

administrative expenses for the three months ended September 30, 2023, were $52.6 million, compared to $53.5 million for the three months ended September 30, 2022. The decrease primarily reflects disciplined expense management, more

than offsetting higher commissions associated with increased sales.

Research and development expenses were $3.2 million for the three months ended

September 30, 2023 compared to $6.0 million for the three months ended September 30, 2022. The decrease was primarily driven by the Company’s strategic realignment disbanding its Regenerative Medicine business unit announced in

June 2023.

Restructuring expense and investigation, restatement, and related expenses for the three months ended

September 30, 2023 were immaterial. Investigation, restatement and related expenses were $3.0 million for the three months ended September 30, 2022.

Net income for the three months ended September 30, 2023, was $8.5 million, compared to a net loss of $8.4 million for the three months ended

September 30, 2022.

Liquidity

As of September 30,

2023, the Company had $81.2 million of cash and cash equivalents, compared to $68.7 million as of June 30, 2023 and $66.0 million as of December 31, 2022. Also as of September 30, 2023, the Company had

$49.0 million in long term debt, essentially flat versus the prior year period.

For the third quarter 2023, the Company generated operating cash

flows of $12.8 million, compared to operating cash flow usage of $1.0 million in the prior year period. Also, for the third quarter 2023, the Company generated Free Cash Flow of $12.2 million, compared to negative Free Cash Flow of

$0.6 million in the prior year period.

On October 27, 2023, MIMEDX repurchased 5,000 of its 100,000 shares of Series B Preferred Stock

outstanding held by Hayfin for a lump sum cash payment of $9.5 million, or $6.13 per common share on an as-converted basis. Under the terms of the transaction, Hayfin has agreed to customary lock-up provisions for the remainder of its MIMEDX equity position including any shares of common stock issued upon conversion of any remaining Series B Shares held by Hayfin for a one-year period following the

repurchase.

Financial Goals

Based upon the strong

commercial momentum in the business on a year-to-date basis, MIMEDX expects full year 2023 net sales percentage growth to be in the high teens, driven by continued

demand for the Company’s Wound & Surgical product offering across its sites of service, and ongoing uptake of new products launched in the last twelve months.

Additionally, the Company continues to expect Adjusted EBITDA margin in the second half of 2023 to exceed 20%.

Following the $9.5 million Hayfin preferred share repurchase, the Company anticipates cash on the balance sheet at December 31, 2023 to be above

$80 million.

Conference Call and Webcast

MIMEDX will host a conference call and webcast to review its third quarter 2023 results on Monday, October 30, 2023, beginning at 4:30 p.m., Eastern Time.

The call can be accessed using the following information:

Webcast: Click here

U.S. Investors: 877-407-6184

International Investors: 201-389-0877

Conference ID: 13741654

A replay of the webcast will be

available for approximately 30 days on the Company’s website at www.mimedx.com following the conclusion of the event.

Important Cautionary Statement

This press release includes forward-looking statements. Statements regarding: (i) future sales or sales growth; (ii) our 2023 financial goals and

expectations for future financial results, including levels of net sales, Adjusted EBITDA, Adjusted EBITDA margin, corporate expenses and cash; (iii) our expectations regarding our new products, including EPIEFFECT; and (iv) demand for our

products. Additional forward-looking statements may be identified by words such as “believe,” “expect,” “may,” “plan,” “goal,” “outlook,” “potential,” “will,”

“preliminary,” and similar expressions, and are based on management’s current beliefs and expectations.

Forward-looking statements are

subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual

results to differ from expectations include: (i) future sales are uncertain and are affected by competition, access to customers, patient access to healthcare providers, the reimbursement environment and many other factors; (ii) the

Company may change its plans due to unforeseen circumstances; (iii) the results of scientific research are uncertain and may have little or no value; (iv) our ability to sell our products in other countries depends on a number of factors

including adequate levels of reimbursement, market acceptance of novel therapies, and our ability to build and manage a direct sales force or third party distribution relationship; (v) the effectiveness of amniotic tissue as a therapy for

particular indications or conditions is the subject of further scientific and clinical studies; and (vi) we may alter the timing and amount of planned expenditures for research and development based on the results of clinical trials and other

regulatory developments. The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the Securities and Exchange Commission. Any forward-looking statements

speak only as of the date of this press release and the Company assumes no obligation to update any forward-looking statement.

About MIMEDX

MIMEDX is a pioneer and leader focused on helping humans heal. With more than a decade of helping clinicians manage chronic and other hard-to-heal wounds, MIMEDX is dedicated to providing a leading portfolio of products for applications in the wound care, burn, and surgical sectors of healthcare. The

Company’s vision is to be the leading global provider of healing solutions through relentless innovation to restore quality of life. For additional information, please visit www.mimedx.com.

Contact:

Matt Notarianni

Investor Relations

470.304.7291

mnotarianni@mimedx.com

Selected Unaudited Financial Information

MiMedx Group, Inc.

Condensed Consolidated Balance Sheets

(in thousands) Unaudited

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2023 |

|

|

December 31,

2022 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

81,164 |

|

|

$ |

65,950 |

|

| Accounts receivable, net |

|

|

49,005 |

|

|

|

43,084 |

|

| Inventory |

|

|

19,068 |

|

|

|

13,183 |

|

| Prepaid expenses |

|

|

2,954 |

|

|

|

8,646 |

|

| Other current assets |

|

|

2,311 |

|

|

|

3,335 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

154,502 |

|

|

|

134,198 |

|

| Property and equipment, net |

|

|

7,094 |

|

|

|

7,856 |

|

| Right of use asset |

|

|

2,441 |

|

|

|

3,400 |

|

| Goodwill |

|

|

19,441 |

|

|

|

19,976 |

|

| Intangible assets, net |

|

|

5,395 |

|

|

|

5,852 |

|

| Other assets |

|

|

149 |

|

|

|

148 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

189,022 |

|

|

$ |

171,430 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES, CONVERTIBLE PREFERRED STOCK, AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

9,170 |

|

|

$ |

8,847 |

|

| Accrued compensation |

|

|

23,159 |

|

|

|

21,852 |

|

| Accrued expenses |

|

|

9,444 |

|

|

|

11,024 |

|

| Other current liabilities |

|

|

1,854 |

|

|

|

1,834 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

43,627 |

|

|

|

43,557 |

|

| Long term debt, net |

|

|

48,966 |

|

|

|

48,594 |

|

| Other liabilities |

|

|

2,605 |

|

|

|

4,773 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

95,198 |

|

|

|

96,924 |

|

| Convertible preferred stock |

|

|

92,494 |

|

|

|

92,494 |

|

| Total stockholders’ equity (deficit) |

|

|

1,330 |

|

|

|

(17,988 |

) |

|

|

|

|

|

|

|

|

|

| Total liabilities, convertible preferred stock, and stockholders’ equity (deficit) |

|

$ |

189,022 |

|

|

$ |

171,430 |

|

|

|

|

|

|

|

|

|

|

MiMedx Group, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except share data) Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net sales |

|

$ |

81,712 |

|

|

$ |

67,689 |

|

|

$ |

234,645 |

|

|

$ |

193,466 |

|

| Cost of sales |

|

|

14,790 |

|

|

|

12,188 |

|

|

|

40,792 |

|

|

|

33,947 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

66,922 |

|

|

|

55,501 |

|

|

|

193,853 |

|

|

|

159,519 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

52,571 |

|

|

|

53,475 |

|

|

|

156,773 |

|

|

|

158,838 |

|

| Research and development |

|

|

3,175 |

|

|

|

5,953 |

|

|

|

18,168 |

|

|

|

17,429 |

|

| Restructuring |

|

|

208 |

|

|

|

— |

|

|

|

3,464 |

|

|

|

— |

|

| Investigation, restatement and related |

|

|

(38 |

) |

|

|

3,001 |

|

|

|

4,652 |

|

|

|

8,771 |

|

| Amortization of intangible assets |

|

|

190 |

|

|

|

175 |

|

|

|

570 |

|

|

|

519 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

10,816 |

|

|

|

(7,103 |

) |

|

|

10,226 |

|

|

|

(26,038 |

) |

| Other expense, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(1,680 |

) |

|

|

(1,270 |

) |

|

|

(4,864 |

) |

|

|

(3,566 |

) |

| Other expense, net |

|

|

(11 |

) |

|

|

— |

|

|

|

(42 |

) |

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income tax provision |

|

|

9,125 |

|

|

|

(8,373 |

) |

|

|

5,320 |

|

|

|

(29,605 |

) |

| Income tax provision expense |

|

|

(591 |

) |

|

|

(53 |

) |

|

|

(569 |

) |

|

|

(178 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

8,534 |

|

|

$ |

(8,426 |

) |

|

$ |

4,751 |

|

|

$ |

(29,783 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) available to common shareholders |

|

$ |

6,761 |

|

|

$ |

(10,096 |

) |

|

$ |

(433 |

) |

|

$ |

(34,667 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per common share - basic |

|

$ |

0.06 |

|

|

$ |

(0.09 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.31 |

) |

| Net income (loss) per common share - diluted |

|

$ |

0.06 |

|

|

$ |

(0.09 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.31 |

) |

| Weighted average common shares outstanding - basic |

|

|

116,298,146 |

|

|

|

113,448,251 |

|

|

|

115,528,067 |

|

|

|

112,650,713 |

|

| Weighted average common shares outstanding - diluted |

|

|

119,327,709 |

|

|

|

113,448,251 |

|

|

|

115,528,067 |

|

|

|

112,650,713 |

|

MiMedx Group, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands) Unaudited

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

| Net cash flows provided by (used in) operating activities |

|

$ |

16,518 |

|

|

$ |

(12,269 |

) |

| Net cash flows used in investing activities |

|

|

(1,674 |

) |

|

|

(951 |

) |

| Net cash flows provided by (used in) financing activities |

|

|

370 |

|

|

|

(646 |

) |

|

|

|

|

|

|

|

|

|

| Net change in cash |

|

$ |

15,214 |

|

|

$ |

(13,866 |

) |

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Measures

In addition to our GAAP results, we provide certain non-GAAP metrics including Earnings Before Interest, Taxes,

Depreciation and Amortization (“EBITDA”), Adjusted EBITDA, related margins, Free Cash Flow, Adjusted Net Income, and Adjusted Earnings Per Share (“Adjusted EPS”). We believe that the presentation of these measures provides

important supplemental information to management and investors regarding our performance. These measurements are not a substitute for GAAP measurements. Company management uses these Non-GAAP measurements as

aids in monitoring our ongoing financial performance from quarter-to-quarter and

year-to-year on a regular basis and for benchmarking against comparable companies.

These non-GAAP financial measures reflect the exclusion of the following items:

| |

• |

|

Share-based compensation expense - expense recognized related to awards to various employees pursuant to our

share-based compensation plans. This expense is reflected amongst cost of sales, research and development expense, and selling, general, and administrative expense in the unaudited condensed consolidated statements of operations. Refer to Note 10,

Equity, in our Quarterly Report on Form 10-Q for the three months ended September 30, 2023 for details. |

| |

• |

|

Investigation, restatement, and related (benefit) expense - expenses incurred toward the legal defense of certain

former officers and directors, net of negotiated reductions and settlements of amounts previously advanced. This expense is reflected in the line of the same name in our unaudited condensed consolidated statements of operations.

|

| |

• |

|

Expenses related to the Disbanding of Regenerative Medicine - incremental expenses recognized or incurred

directly as a result of our announcement to disband our Regenerative Medicine segment. This reflects (i) write-downs of clinical trial assets, (ii) charges associated with the wind-down of contracts associated with our clinical trial

program, (iii) severance expenses incurred which were directly attributable to the disbanding, and (iv) impairment of goodwill. Severance expenses are reflected in research and development expense on the unaudited condensed consolidated

statements of operations. All other charges are reflected in restructuring expense in the unaudited condensed consolidated statements of operations. |

| |

• |

|

Reorganization expense - expenses incurred toward the realignment of our operating strategy. These expenses

primarily relate to severance expenses related to certain officers. These expenses are reflected as a component of selling, general, and administrative expense in the unaudited condensed consolidated statements of operations. |

| |

• |

|

Long-Term Income Tax Rate Adjustment - for purposes of calculating Adjusted Net Income (Loss) and Adjusted

Earnings Per Share, reflects our expectation of a long-term effective tax rate, which is normalized and balance sheet-agnostic. Actual reporting tax expense will be based on GAAP earnings, and may differ from the expected long-term effective tax

rate due to a variety of factors, including the utilization of, availability of and ability to use various deferred tax assets, the tax treatment of various transactions included in GAAP net income and other reconciling items that are excluded in

determining Adjusted Net Income (Loss) and Adjusted EPS. The long-term normalized effective tax rate was 25% for both years ended December 31, 2023 and 2022. |

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin

EBITDA is intended to provide a measure of the Company’s operating performance as it eliminates the effects of financing and capital expenditures. EBITDA

consists of GAAP net loss excluding: (i) depreciation, (ii) amortization of intangibles, (iii) interest expense, net, and (iv) income tax provision. Adjusted EBITDA is intended to provide a normalized view of EBITDA and our broader

business operations that we expect to experience on an ongoing basis by removing certain non-cash items and items that may be irregular, one-time, or non-recurring from EBITDA. This enables us to identify underlying trends in our business that could otherwise be masked by such items. Adjusted EBITDA consists of GAAP net income (loss) excluding:

(i) depreciation, (ii) amortization of intangibles, (iii) interest expense, net, (iv) income tax provision, (v) investigation, restatement and related expenses, (vi) reorganization expenses related to severance charges for

certain officers (vii) expenses related to disbanding of the Regenerative Medicine business unit and (viii) share-based compensation.

A

reconciliation of GAAP net income (loss) to EBITDA and Adjusted EBITDA appears in the table below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net income (loss) |

|

$ |

8,534 |

|

|

$ |

(8,426 |

) |

|

$ |

4,751 |

|

|

$ |

(29,783 |

) |

| Net margin |

|

|

10.4 |

% |

|

|

(12.4 |

)% |

|

|

2.0 |

% |

|

|

(15.4 |

)% |

| Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation expense |

|

|

653 |

|

|

|

831 |

|

|

|

2,054 |

|

|

|

2,549 |

|

| Amortization of intangible assets |

|

|

190 |

|

|

|

175 |

|

|

|

570 |

|

|

|

519 |

|

| Interest expense, net |

|

|

1,680 |

|

|

|

1,270 |

|

|

|

4,864 |

|

|

|

3,566 |

|

| Income tax provision expense (benefit) |

|

|

591 |

|

|

|

53 |

|

|

|

569 |

|

|

|

178 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

11,648 |

|

|

|

(6,097 |

) |

|

|

12,808 |

|

|

|

(22,971 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA margin |

|

|

14.3 |

% |

|

|

(9.0 |

)% |

|

|

5.5 |

% |

|

|

(11.9 |

)% |

| Additional Non-GAAP Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investigation, restatement and related expenses |

|

|

(38 |

) |

|

|

3,001 |

|

|

|

4,652 |

|

|

|

8,771 |

|

| Share-based compensation |

|

|

4,389 |

|

|

|

2,372 |

|

|

|

12,793 |

|

|

|

10,798 |

|

| Reorganization expenses |

|

|

1,412 |

|

|

|

3,105 |

|

|

|

1,412 |

|

|

|

3,105 |

|

| Expenses related to disbanding of Regenerative Medicine business unit |

|

|

208 |

|

|

|

— |

|

|

|

5,599 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

17,619 |

|

|

$ |

2,381 |

|

|

$ |

37,264 |

|

|

$ |

(297 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA margin |

|

|

21.6 |

% |

|

|

3.5 |

% |

|

|

15.9 |

% |

|

|

(0.2 |

)% |

We are not able to provide a reconciliation of our Adjusted EBITDA margin expectation to the corresponding GAAP measure without

unreasonable effort because of the uncertainty and variability of the nature and amount of the non-recurring and other items that are excluded from such non-GAAP

financial measures. Such adjustments in future periods are generally expected to be similar to the kinds of charges excluded from such non-GAAP financial measures in prior periods. The exclusion of these

charges and costs in future periods could have a significant impact on our non-GAAP financial measures.

Free

Cash Flow

Free Cash Flow is intended to provide a measure of our ability to generate cash in excess of capital investments. It provides management

with a view of cash flows which can be used to finance operational and strategic investments.

Free Cash Flow is defined as net cash provided by (used in) operating activities less capital expenditures,

including purchases of equipment.

A reconciliation of GAAP net cash provided by (used in) operating activities to Free Cash Flow appears in the table

below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net cash flows provided by (used in) operating activities |

|

$ |

12,791 |

|

|

$ |

959 |

|

|

$ |

16,518 |

|

|

$ |

(12,269 |

) |

| Purchases of equipment |

|

|

(628 |

) |

|

|

(349 |

) |

|

|

(1,560 |

) |

|

|

(847 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free Cash Flow |

|

$ |

12,163 |

|

|

$ |

610 |

|

|

$ |

14,958 |

|

|

$ |

(13,116 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Income (Loss)

Adjusted Net Income is intended to provide a normalized view of net income by removing items that may be irregular,

one-time, or non-recurring from net income. This enables us to identify underlying trends in our business that could otherwise be masked by such items. Adjusted Net

Income (Loss) consists of GAAP net income (loss) excluding: (i) investigation, restatement and related expenses, (ii) reorganization expenses related to severance charges for certain officers, (iii) expenses related to disbanding of

the Regenerative Medicine business unit and (iv) long-term income tax rate adjustment.

A reconciliation of GAAP net income (loss) to Adjusted Net Income

(Loss) appears in the table below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net income (loss) |

|

$ |

8,534 |

|

|

$ |

(8,426 |

) |

|

$ |

4,751 |

|

|

$ |

(29,783 |

) |

| Investigation, restatement and related (benefit) expense |

|

|

(38 |

) |

|

|

3,001 |

|

|

|

4,652 |

|

|

|

8,771 |

|

| Restructuring expense |

|

|

208 |

|

|

|

— |

|

|

|

5,599 |

|

|

|

— |

|

| Reorganization expenses |

|

|

1,412 |

|

|

|

3,105 |

|

|

|

1,412 |

|

|

|

3,105 |

|

| Income tax adjustment (based on long term tax rate of 25%) |

|

|

(2,086 |

) |

|

|

620 |

|

|

|

(3,677 |

) |

|

|

4,610 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Net Income (Loss) |

|

$ |

8,030 |

|

|

$ |

(1,700 |

) |

|

$ |

12,737 |

|

|

$ |

(13,297 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Earnings Per Share

Adjusted Earnings Per Share is intended to provide a normalized view of earnings per share by removing items that may be irregular, one-time, or non-recurring from net income. This enables us to identify underlying trends in our business that could otherwise be masked by such items. Adjusted Earnings Per

Share consists of GAAP diluted earnings per share including adjustments for: (i) investigation, restatement and related expenses, (ii) reorganization expenses related to severance charges for certain officers, (iii) expenses related

to disbanding of the Regenerative Medicine business unit and (iv) long-term income tax rate adjustment.

A reconciliation of GAAP diluted earnings per share to Adjusted Earnings Per Share appears in the table

below (per diluted share):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| GAAP net income (loss) per common share – diluted |

|

$ |

0.06 |

|

|

$ |

(0.09 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.31 |

) |

| Investigation, restatement and related (benefit) expense |

|

|

— |

|

|

|

0.03 |

|

|

|

0.04 |

|

|

|

0.08 |

|

| Restructuring expense |

|

|

— |

|

|

|

— |

|

|

|

0.05 |

|

|

|

— |

|

| Reorganization expenses |

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.01 |

|

|

|

0.03 |

|

| Income tax adjustment (based on long term tax rate of 25%) |

|

|

(0.02 |

) |

|

|

0.01 |

|

|

|

(0.03 |

) |

|

|

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Earnings Per Share |

|

$ |

0.05 |

|

|

$ |

(0.03 |

) |

|

$ |

0.06 |

|

|

$ |

(0.16 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding –

adjusted (in millions) |

|

|

119.3 |

|

|

|

113.5 |

|

|

|

116.9 |

|

|

|

112.7 |

|

Exhibit 99.2 Q3:23 Results Conference Call October 30, 2023 HELPING

HUMANS HEAL

Disclaimer & Cautionary Statements This presentation includes

forward-looking statements. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the

forward-looking statements. Such forward-looking statements include statements regarding: • Future sales or sales growth; • Estimates of potential market size for the Company’s current and future products; • Plans for

expansion outside of the U.S.; • The effectiveness of amniotic tissue as a therapy for any particular indication or condition; • Expected spending on research and development; • The Company’s long-term strategy and goals for

value creation, the status of its pipeline products, expectations for future products, and expectations for future growth and profitability 2

Disclaimer & Cautionary Statements Additional forward-looking

statements may be identified by words such as believe, expect, may, plan, potential, will, preliminary, and similar expressions, and are based on management's current beliefs and expectations. Forward-looking statements are subject to risks and

uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from

expectations include: • Future sales are uncertain and are affected by competition, access to customers, patient access to healthcare providers, the reimbursement environment and many other factors; • The future market for the

Company’s products can depend on regulatory approval of such products, which might not occur at all or when expected, and is based in part on assumptions regarding the number of patients who elect less acute and more acute treatment than the

Company’s products, market acceptance of the Company’s products, and adequate reimbursement for such therapies; • The process of obtaining regulatory clearances or approvals to market a biological product or medical device from the

FDA or similar regulatory authorities outside of the U.S. is costly and time consuming, and such clearances or approvals may not be granted on a timely basis, or at all, and the ability to obtain the rights to market additional, suitable products

depends on negotiations with third parties which may not be forthcoming; • Whether there is full access to hospitals and healthcare provider facilities; and • The Company describes additional risks and uncertainties in the Risk Factors

section of its most recent annual report and quarterly reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this press release and the Company assumes no obligation to update any

forward- looking statement. 3

Joe Capper Chief Executive Officer

Recent Highlights Net Sales Gross Margin Net Income $81.7MM 81.9% $8.5MM

Collaboration +20.7% year-over-year Free Cash Flow Adjusted EBITDA Cash $11.7MM $17.6MM $81.2MM 21.6% of net sales 5

Standard of Care Advanced Therapies Progress With Strategic Priorities

Build leadership position Develop opportunities Demonstrate corporate in Wound & Surgical in adjacent markets discipline around expenses • Solid growth in all sites-of-service• Strategic realignment and • Track record of

delivering strategic planning for 2024 growth, profitability and cash • Growth in Private Office, despite sharpen our focus flow continued in Q3 reimbursement noise in LCD* regions• Targeted expansion of • Balance sheet and cash

flow product offering beyond improvements afford growth • Products launched in Q3:22 amniotic tissue increases optionality in support of continue to contribute to available market opportunity executing on our strategic Hospital growth and

provides opportunity for priorities commercial leverage • EPIEFFECT™ launch underway • Additional opportunities for and SAWC** presence this week• Adjacencies can be pursued scale exist organically and inorganically *LCD =

Local Coverage Determination 6 **SAWC = Symposium on Advanced Wound Care Fall

Doug Rice Chief Financial Officer

Q3:23 Net Sales Site-of-Service Product Mix & Year/Year Growth $81.7

Other $67.7 $11.4MM +44% Private Hospital Office $47.4MM $23.0MM +18% +17% Q3:22 Q3:23 Third consecutive quarter of 20%+ year-over-year net sales growth 8 $ millions

Q3:23 Gross Profit & Gross Margin $67 Q3:23 gross profit growth

driven by higher net sales $56 Gross margin was roughly flat at 81.9% versus the prior year period at 82.0%, due to improvements in yield, partially offset by production variances and a ~82% last time buy related to a contract that concluded Gross

margins Remain focused on driving gross margin percentage back into the mid-80s over the long term Q3:22 Q3:23 9 9 $ millions

Q3:23 Operating Expenses Q3:22 $53.5 $52.6 Q3:23 Post-realignment

R&D spend and continued commercial leverage as the business scales driving $6.0 $3.2 profitability % of net sales 79% 64% 9% 4% R&D SG&A $17.6 $8.5 Achieved positive GAAP net $2.4 income and an Adjusted EBITDA margin above 20% in Q3:23

-$8.4 4% % of net sales -12% 10% 22% Adjusted EBITDA Net Income/Loss 10 $ millions $ millions

Improving Balance Sheet & Cash Flows Unlock Opportunities for

Growth Net Cash Free Cash Flow $32.2 $11.7 $24.7 $7.5 $19.8 $17.4 $0.6 $12.5 -$4.6 -$6.3 Q3:22 Q4:22 Q1:23 Q2:23 Q3:23 Q3:22 Q4:22 Q1:23 Q2:23 Q3:23 11 *Free Cash Flow is defined as net cash provided by (used in) operating activities less capital

expenditures, including purchases of equipment. See our Earnings Release for the quarter ended September 30, 2023 for a reconciliation to the nearest GAAP measure. $ millions $ millions

Joe Capper Chief Executive Officer

Q3:23 Summary Q3:23 & YTD:23 Net Sales Growth Above 20% Year-

Over-Year Continued Demonstration of Leverage with Increasing Scale Q3 & YTD 2023 Q3:23 Adjusted EBITDA of $17.6 Million (21.6% of Net Results Sales) Show Clear Momentum Cash Balance Increase of 23% Since Year End 2022 Continued Roll Out of New

Products in the U.S., Including EPIEFFECT on October 1, 2023 13

* 2023 Outlook as of October 30, 2023 Looking to cap off a strong 2023

Anticipate Full Year 2023 Now Expect Cash to Exceed Expect Adjusted EBITDA Revenue Growth Percentage $80 Million by End of 2023 Margin in 2H:23 to be Above in the High-Teens 20% Revenue Growth Profitability Cash Generation *2023 Outlook provided as

of October 30, 2023. Actual results may differ. We are not able to provide a reconciliation of our Adjusted EBITDA margin expectation to the corresponding GAAP measure without unreasonable effort because of the uncertainty and variability of the

nature and amount of the non-recurring and other items that are excluded from such non-GAAP financial measures. Such adjustments 14 in future periods are generally expected to be similar to the kinds of charges excluded from such non-GAAP financial

measures in prior periods. The exclusion of these charges and costs in future periods could have a significant impact on our non-GAAP financial measures.

Closing Remarks & Q&A

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

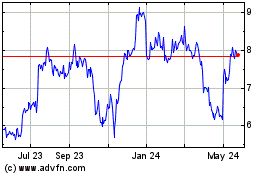

MiMedx (NASDAQ:MDXG)

Historical Stock Chart

From Apr 2024 to May 2024

MiMedx (NASDAQ:MDXG)

Historical Stock Chart

From May 2023 to May 2024