false

0001690680

0001690680

2025-02-12

2025-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date of earliest

event reported):

February 12, 2025

Newmark

Group, Inc.

(Exact name of Registrant as

specified in its charter)

| Delaware |

|

001-38329 |

|

81-4467492 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

125 Park Avenue, New York, NY

10017

(Address of principal executive

offices)

Registrant’s telephone

number, including area code: (212) 372-2000

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange

on which registered

|

| Class A Common Stock, $0.01 par value |

|

NMRK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On February

7, 2025, Newmark Group, Inc. (the “Company”), the Board of Directors of the Company (the

“Board”) and certain executive officers of the Company (collectively, the “Defendants”) entered into a

Stipulation and Agreement of Compromise, Settlement, and Release (the “Settlement Agreement”) with a putative class of

stockholders of the Company (the “Plaintiffs”) to resolve the previously disclosed stockholder derivative litigation

pending in the Court of Chancery (the “Court”) of the State of Delaware (Consolidated C.A. No. 2022-0687) in connection

with the 2021 award of a cash bonus to the Company’s Executive Chairman and the redemption and exchange of partnership units

of Newmark Holdings, L.P. held by the Company’s Executive Chairman and certain other officers of the Company. The

Settlement Agreement is subject to approval by the Court.

Under the terms of the

Settlement Agreement, the settlement will be funded exclusively by insurance proceeds, which will be paid to Plaintiffs’

counsel and the Company. Pursuant to the terms of the Settlement Agreement, the Plaintiffs will release the Board and executive

officers from any civil claims related to the matter. The Settlement Agreement contains no admission of liability by the Board

or other Defendants.

The Company and other Defendants entered

into the Settlement Agreement to avoid the delay, uncertainty and expense of protracted litigation.

Pursuant to the Settlement Agreement,

the Company is publishing the Notice of Pendency and Proposed Settlement of Derivative Action, attached hereto as Exhibit 99.1, and which

will also appear on the Company’s investor relations website at ir.nmrk.com.

The information in this Item 7.01 and

Exhibit 99.1 attached to this Current Report on Form 8-K are being furnished under Item 7.01 of Form 8-K. Such information shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act.

DISCUSSION OF FORWARD-LOOKING STATEMENTS

ABOUT NEWMARK

Statements in this Current Report on Form 8-K and the Notice furnished as Exhibit 99.1 of Current Report that are not historical facts

are “forward-looking statements” that involve risks and uncertainties, which could cause actual results to differ from those

contained in the forward-looking statements. These include statements about the anticipated effects of the Settlement Agreement on the

Company’s business and financial results, which may constitute forward-looking statements and are subject to the risk that the actual

impact may differ, possibly materially, from what is currently expected. Except as required by law, Newmark undertakes no obligation to

update any forward-looking statements. For a discussion of additional risks and uncertainties, which could cause actual results to differ

from those contained in the forward-looking statements, see Newmark’s Securities and Exchange Commission filings, including, but

not limited to, the risk factors and Special Note on Forward-Looking Information set forth in these filings and any updates to such risk

factors and Special Note on Forward-Looking Information contained in subsequent reports on Form 10-K, Form 10-Q or Form 8-K.

ITEM 9.01. Financial Statements and Exhibits

The exhibit index set forth below is incorporated

by reference in response to this Item 9.01.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| Newmark Group, Inc. |

| | | |

| Date: February 12, 2025 | By: | /s/ Howard

W. Lutnick |

| | Name: | Howard

W. Lutnick |

| | Title: | Executive

Chairman |

[Signature Page to Form

8-K regarding Newmark Settlement Agreement and Notice dated February 12, 2025]

3

Exhibit 99.1

IN THE COURT OF CHANCERY

OF THE STATE OF DELAWARE

| IN RE NEWMARK GROUP, INC. DERIVATIVE LITIGATION |

|

CONSOLIDATED

C.A. No. 2022-0687-BWD |

NOTICE OF PENDENCY

AND PROPOSED

SETTLEMENT OF DERIVATIVE ACTION

| TO: | ALL RECORD HOLDERS AND BENEFICIAL OWNERS OF COMMON STOCK OF NEWMARK GROUP, INC. (“NEWMARK”

OR THE “COMPANY”), ALONG WITH THEIR SUCCESSORS AND ASSIGNS, EXCLUDING THE SETTLING DEFENDANTS |

IF YOU HELD COMMON STOCK FOR THE BENEFIT OF ANOTHER,

PLEASE PROMPTLY TRANSMIT THIS DOCUMENT TO SUCH BENEFICIAL OWNER.

The purpose of this Notice of

Pendency and Proposed Settlement of Derivative Action (this “Notice”) is to inform you of: (i) the pendency of the above-captioned

action (the “Action”), which was brought in the Court of Chancery of the State of Delaware (the “Court”) by stockholders

of Newmark asserting claims on behalf of and for the benefit of Newmark; (ii) the proposed settlement of the Action (the “Settlement”)

as against all defendants, subject to Court approval and other conditions of the Settlement being satisfied, as provided for in a Stipulation

and Agreement of Compromise, Settlement, and Release dated February 7, 2025 (the “Stipulation”), which was filed with the

Court and is publicly available for review; and (iii) your right to participate in a hearing to be held on May 5, 2025, at

11:00 a.m., before The Honorable Bonnie W. David (the “Settlement Hearing”).1 The purpose of the Settlement Hearing to be

held by the Court is to determine whether: (i) Plaintiffs have adequately represented Newmark’s interests; (ii) the proposed Settlement

of the Action should be approved by the Court as fair, reasonable, adequate and in the best interests of Newmark; (iii) the Action should

be dismissed with prejudice as against the Settling Defendants and all of the Released Claims against the Released Persons should be

fully, finally, and forever released, settled, and discharged; (iv) whether and in what amount any Fee and Expense Award should be paid

to Plaintiffs’ Counsel out of the Cash Settlement Amount; (v) whether and in what amount any Plaintiff incentive award should be

paid to any Plaintiff out of the Cash Settlement Amount; and (vi) Judgment approving the Settlement of the Action should be entered in

accordance with the terms of the Stipulation.

| 1 | Capitalized terms not defined in this Notice have the meanings

set forth in the Stipulation, which is publicly available as indicated below. |

PLEASE READ THIS NOTICE CAREFULLY AND IN

ITS ENTIRETY. THIS NOTICE RELATES TO A PROPOSED SETTLEMENT OF THE LITIGATION REFERRED TO IN THE CAPTION AND CONTAINS IMPORTANT INFORMATION

REGARDING YOUR RIGHTS. IF THE COURT APPROVES THE SETTLEMENT, YOU WILL BE FOREVER BARRED FROM CONTESTING THE FAIRNESS, REASONABLENESS,

OR ADEQUACY OF THE SETTLEMENT, AND FROM PURSUING THE SETTLED PLAINTIFF CLAIMS.

The Stipulation was entered

into as of February 7, 2025, by and among: (i) Plaintiffs Cardinal Capital Management, L.L.C. (“Cardinal”), Robert Garfield

(“Garfield”), and Laborers Local No. 231 Pension Fund (“Local No. 231” and, collectively, “Plaintiffs”),

derivatively on behalf of Newmark; (ii) Nominal Defendant Newmark; and (iii) Defendants Howard Lutnick (“Lutnick”), Barry

Gosin (“Gosin”), Michael Rispoli (“Rispoli”), Virginia Bauer, Michael Snow, and Kenneth McIntyre (collectively

the “Settling Defendants” and together with Plaintiffs and Newmark, the “Settling Parties”).

This Notice describes the

rights you may have in the Action and pursuant to the Stipulation and what steps you may take, but are not required to take, in relation

to the Settlement. If the Court approves the Settlement, the Settling Parties will ask the Court at the Settlement Hearing to enter Judgment

dismissing the Action with prejudice as against the Settling Defendants in accordance with the terms of the Stipulation.

WHAT IS THE PURPOSE

OF THIS NOTICE?

The purpose of this Notice

is to explain the Action, the terms of the proposed Settlement, and how the Settlement affects the legal rights of Newmark stockholders.

In a derivative action, one or more persons or entities who are current stockholders of a corporation sue on behalf of

and for the benefit of the corporation, seeking to enforce the corporation’s legal rights.

As described more fully below,

Newmark stockholders have the right to object to the proposed Settlement, the Fee Application by Plaintiffs’ Counsel for an award

of reasonable fees and expenses (the “Fee and Expense Award”), and/or any Plaintiff incentive award. Newmark stockholders

have the right to appear and be heard at the Settlement Hearing, which will be held before The Honorable Bonnie W. David on May 5, 2025,

at 11:00 a.m., at the Court of Chancery of the State of Delaware, Sussex County, 34 The Circle, Georgetown, DE 19947.

The Court has reserved the

right to adjourn and reconvene the Settlement Hearing, including consideration of the Fee Application, without further notice of any kind

other than oral announcement at the Settlement Hearing or any adjournment thereof, or notation on the docket in the Action. The Court

has further reserved the right to approve the Settlement, according to the terms and conditions of the Stipulation, with such modifications

as may be consented to by the Settling Parties, or as otherwise permitted pursuant to the Stipulation, with or without future notice to

Newmark stockholders. The Court may enter Judgment, and order the payment of the Fee and Expense Award, all without future notice to Newmark

stockholders.

WHAT IS THIS CASE

ABOUT? WHAT HAS HAPPENED SO FAR?

THE FOLLOWING RECITATION DOES NOT CONSTITUTE

FINDINGS OF THE COURT AND SHOULD NOT BE UNDERSTOOD AS AN EXPRESSION OF ANY OPINION OF THE COURT AS TO THE MERITS OF ANY CLAIMS OR DEFENSES

BY ANY OF THE SETTLING PARTIES. IT IS BASED ON STATEMENTS OF THE SETTLING PARTIES AND IS SENT FOR THE SOLE PURPOSE OF INFORMING YOU OF

THE EXISTENCE OF THE ACTION AND OF A HEARING ON A PROPOSED SETTLEMENT SO THAT YOU MAY MAKE APPROPRIATE DECISIONS AS TO STEPS YOU MAY OR

MAY NOT WISH TO TAKE IN RELATION TO THIS LITIGATION.

Newmark is a publicly traded

company that is a full commercial real estate services firm. In 2013, Nasdaq entered into an agreement (the “Nasdaq Transaction”)

with Newmark’s former parent company, BGC Group, Inc. (“BGC”), to purchase BGC’s electronic trading platform,

eSpeed, Inc. (“eSpeed”). Nasdaq agreed to pay BGC $750 million in cash and 14,883,705 shares of Nasdaq stock. The cash component

was paid up front, but the shares were to be paid in fifteen annual installments of 992,247 shares each. The agreement further provided

that, if Nasdaq were to sell eSpeed before the final payment of Nasdaq shares in 2027, all remaining payments of Nasdaq shares would accelerate

with a slight discount.

In late 2017, BGC spun off

Newmark and assigned Newmark the right to receive the Nasdaq shares from the Nasdaq Transaction.

On June 25, 2021, Nasdaq completed

a resale of eSpeed, thereby triggering the accelerated payment of Nasdaq shares to Newmark. This accelerated payment resulted in the transfer

of 6,222,342 shares of Nasdaq stock to Newmark, worth approximately $940 million as of June 25, 2021.

On June 28, 2021, in connection

with Newmark’s accelerated receipt of common shares of Nasdaq, Newmark’s Compensation Committee approved the redemption of

a substantial number of limited partnership units held by partners of the Company (the “2021 Equity Event”), including the

exchange of 16.6 million partnership units held by Newmark officers Lutnick, Gosin, Rispoli, and Stephen Merkel for $146 million.

On December 27, 2021, the

Compensation Committee approved a one-time bonus award to Lutnick of $50 million (the “Bonus”). The award agreement, dated

December 28, 2021 (the “Bonus Effective Date”), provided for an aggregate cash payment of $50 million, payable as follows:

$20 million within three days of the Bonus Effective Date, and $10 million within thirty days following vesting on each of the first,

second, and third anniversaries of the Bonus Effective Date.

On February 7, 2022, Cardinal

served a Delaware General Corporation Law Section 220 (“Section 220”) demand on the Company seeking books and records to investigate

suspected wrongdoing in connection with the 2021 Equity Event and the Bonus. On February 24, 2022, Garfield served a similar Section 220

demand on the Company.

On August 5, 2022, Garfield

filed a derivative complaint on behalf of Newmark in the Court of Chancery of the State of Delaware. On October 7, 2022, Cardinal filed

its derivative complaint on behalf of Newmark in the Court of Chancery of the State of Delaware. On December

13, 2022, the actions filed by Garfield and Cardinal were consolidated and Robbins Geller Rudman & Dowd LLP was appointed as Lead

Counsel.

On January 10, 2023, Cardinal

and Garfield filed a Verified Consolidated Amended Stockholder Derivative Complaint (the “Consolidated Complaint”). The Consolidated

Complaint alleged that the 2021 Equity Event and the Bonus were not entirely fair, and asserted causes of action for waste, unjust enrichment,

and breach of fiduciary duty.

On March 17, 2023, Defendants

filed their respective answers to the Consolidated Complaint. Defendants denied any wrongdoing and asserted, among other things, that

Plaintiffs would be unable to establish demand futility, that the business judgment rule applied to the 2021 Equity Event and the Bonus,

and that, even if entire fairness applied, the challenged transactions were entirely fair.

Thereafter, the Parties commenced

discovery. Plaintiffs served multiple sets of interrogatories and requests for production of documents on Defendants. Defendants likewise

served interrogatories and requests for production of documents on Plaintiffs. Plaintiffs also served subpoenas on a number of third parties.

The Parties’ written

discovery requests led to substantial meet-and-confer correspondence and numerous teleconferences, and resulted in two motions to compel

by Plaintiffs: one filed in December 2023 and resolved in January 2024, and one filed in October 2024 (which remained pending as of the

time the Parties reached an agreement to resolve this Action).

Plaintiffs ultimately received

from Defendants and various third parties, and then reviewed, 48,704 documents, totaling 471,173 pages. Plaintiffs also reviewed and then

produced to Defendants 26,741 documents, totaling more than 118,159 pages.

Subsequent to the substantial

completion of document discovery, Plaintiffs took the deposition of Defendant Rispoli—Newmark’s Chief Financial Officer—on

October 21, 2024. The Parties also scheduled, and Plaintiffs’ Counsel began preparing for, depositions of each of the remaining

named Defendants in November 2024, plus certain other Newmark employees and third parties. These depositions were put on hold pending

mediation.

On November 25, 2024, the

Parties submitted a stipulation to add Local No. 231 as a Plaintiff to this Action. On November 26, 2024, the Court granted the stipulation.

On December 18, 2024, the

Parties and Defendants’ directors’ and officers’ insurance carriers participated in a day-long mediation session before

David M. Murphy, Esq., of Phillips ADR. The Parties engaged in substantial briefing prior to this mediation session.

The December 18 mediation

did not result in a settlement. However, after the mediation, Mr. Murphy continued to conduct negotiations with the Parties and Defendants’

directors’ and officers’ insurance carriers.

On December 21, 2024, the

Parties agreed to settle the Action, based on the mediator’s recommendation, for a cash payment of $50 million to Newmark, to be

paid by Newmark’s directors’ and officers’ insurance carriers.

Plaintiffs represent that

they have owned at all relevant times and continue to own shares of Newmark common stock.

The Stipulation is intended

to fully, finally, and forever release, resolve, compromise, settle and discharge the Released Claims and terminate the Action as against

the Settling Defendants with prejudice. It is the intention of Plaintiffs and the Settling Defendants that the Settlement will release

the Released Claims against the Released Persons upon Final Approval of the Stipulation.

The entry by the Settling

Parties into the Stipulation is not, and shall not be construed as or deemed to be evidence of, an admission as to the merit or lack of

merit of any Claims or defenses asserted in the Action.

Plaintiffs and Plaintiffs’

Counsel have conducted an investigation and pursued discovery relating to the claims and the underlying events and transactions alleged

in the Action. Plaintiffs and Plaintiffs’ Counsel have analyzed the evidence adduced during their investigation and through discovery,

and have researched the applicable law with respect to Plaintiffs’ claims on behalf of Newmark. In negotiating and evaluating the

terms of the Stipulation, Plaintiffs and Plaintiffs’ Counsel considered the legal and factual defenses to the Settled Plaintiff

Claims. Plaintiffs and Plaintiffs’ Counsel have received sufficient information to evaluate the merits of this Settlement. Based

upon their evaluation, Plaintiffs and Plaintiffs’ Counsel have determined that the Settlement set forth in the Stipulation is fair,

reasonable and adequate and in the best interests of Newmark, and that it confers substantial benefits upon Newmark.

The Settling Defendants deny

any and all allegations of wrongdoing, fault, liability, or damage whatsoever. Specifically, the Settling Defendants deny that they acted

contrary to the best interests of Newmark and its stockholders or breached any duties. The Settling Defendants maintain that

they have meritorious defenses to all claims alleged in the Action. Nothing in the Stipulation shall be construed as any admission by

the Settling Defendants of wrongdoing, fault, liability, or damages whatsoever. Nothing in the Stipulation shall be construed as an allocation

of fault or liability between or among the Settling Defendants.

The Settling Parties recognize

that the Action has been filed and prosecuted by Plaintiffs in good faith and defended by the Settling Defendants in good faith and further

that the terms of the Settlement as set forth herein were negotiated at arm’s length, in good faith, and reflect an agreement that

was reached voluntarily after consultation with experienced legal counsel.

WHAT ARE THE TERMS

OF THE SETTLEMENT?

In consideration for the full

and final release, settlement, and discharge of any and all Released Claims against the Released Persons upon Final Approval, the Settling

Defendants shall cause the Cash Settlement Amount ($50,000,000.00 U.S.) to be paid into escrow by Newmark’s directors’ and

officers’ insurance carriers (who have committed to fund the Cash Settlement Amount), within 15 Business Days after entry of the

Judgment. The Cash Settlement Amount shall be disbursed in the manner set forth in paragraph 2 of the Stipulation.

This Action was brought as

a derivative action on behalf of and for the benefit of Newmark. Stockholders will not receive a direct payment of the Cash Settlement

Amount but will indirectly benefit from the Cash Settlement Amount being paid to Newmark.

WHAT WILL HAPPEN

IF THE SETTLEMENT IS APPROVED?

WHAT CLAIMS WILL

THE SETTLEMENT RELEASE?

If the Settlement is approved,

the Court will enter Judgment, at which time the Action against the Settling Defendants shall be dismissed with prejudice. This dismissal

is without fees or costs, except as expressly provided in the Stipulation.

Upon the Effective Date

and the Settling Parties’ compliance with all terms set forth in the Stipulation, Plaintiffs, on behalf of themselves and

Newmark, and their respective legal representatives, heirs, executors, administrators, predecessors, successors,

predecessors-in-interest, successors-in-interest and assigns, shall thereupon be deemed to have fully, finally, and forever

released, settled, and discharged the Released Defendant Persons from and with respect to every one of the Settled Plaintiff Claims,

and shall thereupon be forever barred and enjoined from commencing, instituting, prosecuting, or continuing to prosecute any Settled

Plaintiff Claims against any of the Released Defendant Persons.

Upon the Effective Date and

the Settling Parties’ compliance with all terms set forth in the Stipulation, the Settling Defendants and their respective legal

representatives, heirs, executors, administrators, predecessors, successors, predecessors-in-interest, successors-in-interest and assigns

shall thereupon be deemed to have fully, finally, and forever released, settled, and discharged the Released Plaintiff Persons from and

with respect to every one of the Settled Defendant Claims, and shall thereupon be forever barred and enjoined from commencing, instituting,

prosecuting, or continuing to prosecute any Settled Defendant Claims against any of the Released Plaintiff Persons.

The contemplated releases

given by the Settling Parties in the Stipulation extend to Released Claims that the Settling Parties did not know or suspect to exist

at the time of the release, which if known, might have affected the decision to enter into this Settlement.

With respect to any and all

Released Claims, the Settling Parties shall be deemed to have waived any and all provisions, rights, and benefits conferred by any law

of the United States, any law of any state, or principle of common law which governs or limits a Person’s release of unknown claims

to the fullest extent permitted by law, and to have relinquished, to the fullest extent permitted by law, the provisions, rights, and

benefits of Section 1542 of the California Civil Code (or any similar, comparable or equivalent provision of any law of any state or territory

of the United States, federal law, or principle of common law), which provides:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS

THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT,

IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.

The Settling Parties shall

be deemed by operation of law to have acknowledged that the foregoing waiver was separately bargained for and is a key element of the

Settlement.

The Settling Parties acknowledge

that they may discover facts in addition to or different from those that they now know or believe to be true with respect to the Released

Claims, but that it is their intention to fully, finally, and forever settle any and all such Released Claims, known or unknown, suspected

or unsuspected, without regard to the subsequent discovery or existence of such additional or different facts, to the fullest extent permitted

by law.

WHAT ARE THE PARTIES’

REASONS FOR THE SETTLEMENT?

The Settlement set forth in

the Stipulation reflects the results of the Settling Parties’ negotiations and the final terms of their agreement, which was reached

only after arm’s-length negotiations among the Settling Parties, who were all represented by counsel with extensive experience and

expertise in stockholder derivative litigation.

This Settlement is not evidence

of the validity or invalidity of any claims or defenses in the Action or any other actions or proceedings, or of any wrongdoing by any

of Defendants or of any damages or injury to Newmark or Plaintiffs.

Plaintiffs believe that the

Settled Plaintiff Claims had merit when filed and continue to have merit, and Plaintiffs are settling the Settled Plaintiff Claims because

they believe that the Settlement will provide substantial value to Newmark and its stockholders. Plaintiffs have concluded that the Settlement

is fair, reasonable, and in the best interests of Newmark, and that it is reasonable to pursue the Settlement based on the terms and procedures

outlined herein.

The Settling Defendants have

denied, and continue to deny, all allegations of wrongdoing, fault, liability or damage with respect to all claims asserted or that could

be asserted in the Action or any other action, in any court or tribunal, relating to the Bonus and/or the 2021 Equity Event, including

any allegations that Defendants have committed any violations of law, that they have acted improperly in any way, and that they have any

liability or owe any damages of any kind to Newmark or Plaintiffs. The Settling Defendants maintain that their conduct was at all times

proper and in compliance with applicable law, and that if the case proceeded to trial and a decision were issued by the Court, they would

have prevailed on all claims asserted against them. The Settling Defendants further deny any breach of fiduciary duties, waste, unjust

enrichment, or other harm to Newmark or its stockholders. Each of the Settling Defendants asserts that, at all relevant times, he or she

acted in good faith. The Settling Defendants are entering into the Settlement in order to, among other things, terminate all claims that

were or could have been asserted by Plaintiffs or any other Newmark stockholder on behalf of Newmark against the Settling Defendants in the Action or in any other

action, in any court or tribunal, relating to the Bonus and/or the 2021 Equity Event.

HOW WILL THE ATTORNEYS

BE PAID?

Plaintiffs’ Counsel

will submit a Fee Application to the Court for 25% of the Cash Settlement Amount, plus expenses incurred. In addition, one of the Plaintiffs

intends to seek an incentive award, not to exceed $15,000, from the Cash Settlement Amount compensating it for its reasonable time, costs,

and expenses directly relating to its prosecution of the Action. The Settling Parties acknowledge and agree that any Fee and Expense Award

in connection with the Settlement, and any Plaintiff incentive award, shall be paid from the Cash Settlement Amount and shall reduce the

settlement consideration paid to Newmark accordingly.

WHEN AND WHERE

WILL THE SETTLEMENT HEARING BE HELD?

DO I HAVE THE RIGHT TO APPEAR AT THE SETTLEMENT HEARING?

The Court will consider the

Settlement and all matters related to the Settlement, including the Fee Application, at the Settlement Hearing. The Settlement Hearing

will be held before The Honorable Bonnie W. David on May 5,, 2025, at 11:00 a.m., at the Court of Chancery of the State of Delaware, Sussex

County, 34 The Circle, Georgetown, DE 19947.

At the Settlement

Hearing, any current Newmark stockholder who desires to do so may appear personally or by counsel, and show cause, if any, why the

Settlement in accordance with and as set forth in the Stipulation should not be approved as fair, reasonable, and adequate and in

the best interests of Newmark; why the Judgment should not be entered in accordance with and as set forth in the Stipulation; why

the Court should not grant Plaintiffs’ Counsel’s Fee Application; or why the Court should not approve any requested

Plaintiff incentive award; provided, however, that, unless the Court in its discretion otherwise directs, no Newmark stockholder, or

any other Person, shall be entitled to contest the approval of the terms and conditions of the Settlement or (if approved) the

Judgment to be entered thereon, or the Fee and Expense Award, and no papers, briefs, pleadings, or other documents submitted by any

Newmark stockholder or any other Person (excluding a party to the Stipulation) shall be received or considered, except by order of

the Court for good cause shown, unless, no later than fifteen (15) Business Days prior to the Settlement Hearing, such Person files

with the Register in Chancery, Delaware Court of Chancery, Sussex County, 34 The Circle, Georgetown, DE 19947, and serves upon the

attorneys listed below: (a) a written notice of intention to appear that includes the name, address, and telephone number of the

objector and, if represented by counsel, the name and address of the objector’s counsel; (b) proof of current Newmark

stockholding; (c) a detailed statement of objections to any matter before the Court; and (d) the grounds thereof or the reasons for

wanting to appear and be heard, as well as all documents or writings the Court shall be asked to consider. These writings must also

be served by File & ServeXpress, by hand, by first-class mail, or by express service upon the following attorneys such that they

are received no later than fifteen (15) Business Days prior to the Settlement Hearing:

Christopher H. Lyons

Tayler D. Bolton

Robbins Geller Rudman & Dowd LLP

1521 Concord Pike, Suite 301

Wilmington, DE 19803

Randall J. Baron

A. Rick Atwood, Jr.

Benny C. Goodman III

Robbins Geller Rudman & Dowd LLP

655 W. Broadway, Suite 1900

San Diego, CA 92101

R. Bruce McNew

Cooch & Taylor, P.A.

The Nemours Building

1000 N. West Street, Suite 1500

Wilmington, DE 19801

Steven J. Purcell

Robert H. Lefkowitz

Stephen C. Childs

Omer Kremer

Purcell & Lefkowitz LLP

600 Mamaroneck Avenue, Suite 400

Harrison, NY 10528

C. Barr Flinn

Paul J. Loughman

Lauren Dunkle Fortunato

Skyler A. C. Speed

Young Conaway Stargatt & Taylor, LLP

100 North King Street

Wilmington, DE 19801

Eric Leon

Nathan Taylor

Meredith Cusick

Latham & Watkins LLP

1271 Avenue of the Americas

New York, NY 10020

Matthew D. Stachel

Sabrina M. Hendershot

Paul, Weiss, Rifkind, Wharton &

Garrison LLP

1313 North Market Street, Suite 806

Post Office Box 32

Wilmington, DE 19899-0032

Andrew Gordon

Staci Yablon

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, NY 10019-6064

Kevin R. Shannon

Jaclyn C. Levy

Christopher D. Renaud

Justin T. Hymes

Potter Anderson & Corroon LLP

1313 N. Market Street

Hercules Plaza, 6th Floor

Wilmington, DE 19801

Unless the Court otherwise

directs, any Person who fails to object in the manner described above shall be deemed to have waived and forfeited any and all rights

such Person may otherwise have to object to the Settlement, any Fee and Expense Award to Plaintiffs’ Counsel, and/or any Plaintiff

incentive award (including any right of appeal) and shall be forever barred from raising such objection in the Action or any other action

or proceeding. Newmark stockholders who do not object need not appear at the Settlement Hearing or take any other action to indicate their

approval.

CAN I SEE THE COURT

FILE?

WHOM SHOULD I CONTACT IF I HAVE QUESTIONS?

This Notice does not purport

to be a comprehensive description of the Action, the allegations related thereto, the terms of the Settlement, or the Settlement Hearing.

For a more detailed statement of the matters involved in the Action, you may inspect the pleadings, the Stipulation, the Orders entered

by the Court, and other papers filed in the Action at the Office of the Register in Chancery in the Court of Chancery of the State of

Delaware, Sussex County, 34 The Circle, Georgetown, DE 19947, during regular business hours of each business day. If you have questions

regarding the Settlement, you may write or call Plaintiffs’ Counsel: Investor Relations, Robbins Geller Rudman & Dowd LLP, 655

W. Broadway, Suite 1900, San Diego, CA 92101, 619-231-1058.

DO NOT CALL OR WRITE THE COURT OR THE OFFICE

OF THE REGISTER IN CHANCERY REGARDING THIS NOTICE

BY ORDER OF THE COURT OF CHANCERY

OF THE STATE OF DELAWARE:

Dated: February 11, 2025

13

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

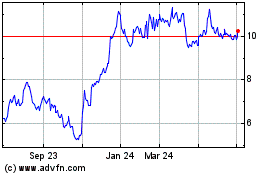

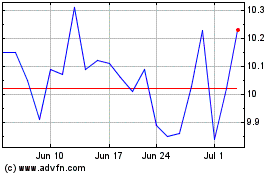

Newmark (NASDAQ:NMRK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Newmark (NASDAQ:NMRK)

Historical Stock Chart

From Feb 2024 to Feb 2025