Insight Enterprises, Inc. Announces Proposed $500 Million Offering of Senior Notes

May 15 2024 - 7:53AM

Business Wire

Insight Enterprises, Inc. (NASDAQ: NSIT) (the “Company”)

announced today that it intends to offer, subject to market and

other conditions, $500 million aggregate principal amount of Senior

Notes due 2032 (the “notes”). The Company expects to use the net

proceeds of the offering to repay a portion of the outstanding

borrowings under its senior secured revolving credit facility due

2027 and, to the extent of any remaining net proceeds, for general

corporate purposes.

The notes will be senior unsecured obligations of the Company

and will be guaranteed on a senior unsecured basis by each of its

existing and future direct and indirect U.S. subsidiaries that is

or becomes a guarantor or borrower under its ABL facility, subject

to certain exceptions.

The notes will be offered and sold in a transaction exempt from

registration under the Securities Act of 1933 (the “Securities

Act”) only to persons reasonably believed to be qualified

institutional buyers in reliance on Rule 144A under the Securities

Act and to non-U.S. persons outside the United States in reliance

on Regulation S under the Securities Act.

This press release is for informational purposes only and is

neither an offer to sell nor a solicitation of an offer to buy any

security, including the notes, and shall not constitute an offer to

sell or a solicitation of an offer to buy, or a sale of, the notes

or any other security in any jurisdiction in which such offer,

solicitation, or sale is unlawful. The notes have not been and will

not be registered under the Securities Act or any state securities

laws, and may not be offered or sold in the United States absent

registration under the Securities Act or an applicable exemption

from the registration requirements of the Securities Act and

applicable state laws.

Forward-Looking Information

Certain statements in this release are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements, including those

with respect to the proposed offering, the expected terms of the

notes and the expected use of proceeds, are inherently subject to

risks and uncertainties, some of which cannot be predicted or

quantified. Future events and actual results could differ

materially from those set forth in, contemplated by, or underlying

the forward-looking statements. There can be no assurances that the

results discussed by the forward-looking statements will be

achieved, and actual results may differ materially from those set

forth in the forward-looking statements. Some of the important

factors that could cause the Company’s actual results to differ

materially from those projected in any forward-looking statements

include, but are not limited to, the following, which are discussed

in the Company’s filings with the Securities and Exchange

Commission (the “SEC”), including in the “Risk Factors” sections of

the Company’s most recently filed periodic reports on Form 10-K and

Form 10-Q and subsequent filings with the SEC: actions of our

competitors, including manufacturers and publishers of products we

sell; our reliance on our partners for product availability,

competitive products to sell and marketing funds and purchasing

incentives, which can change significantly in the amounts made

available and in the requirements year over year; our ability to

keep pace with rapidly evolving technological advances and the

evolving competitive marketplace; general economic conditions,

economic uncertainties and changes in geopolitical conditions,

including the possibility of a recession or a decline in market

activity as a result of the ongoing conflicts in Ukraine and Gaza;

changes in the IT industry and/or rapid changes in technology; our

ability to provide high quality services to our clients; our

reliance on independent shipping companies; the risks associated

with our international operations; supply constraints for products;

natural disasters or other adverse occurrences, including public

health issues such as pandemics or epidemics; disruptions in our IT

systems and voice and data networks; cyberattacks, outages, or

third-party breaches of data privacy as well as related breaches of

government regulations; intellectual property infringement claims

and challenges to our registered trademarks and trade names;

potential liability and competitive risk based on the development,

adoption, and use of generative artificial intelligence; legal

proceedings, client audits and failure to comply with laws and

regulations; risks of termination, delays in payment, audits and

investigations related to our public sector contracts; exposure to

changes in, interpretations of, or enforcement trends related to

tax rules and regulations; our potential to draw down a substantial

amount of indebtedness; the conditional conversion feature of the

Company’s convertible notes, which has been triggered, and may

adversely affect the Company’s financial condition and operating

results; the Company is subject to counterparty risk with respect

to certain hedge and warrant transactions entered into in

connection with the issuance of the Company’s convertible notes;

increased debt and interest expense and the possibility of

decreased availability of funds under our financing facilities;

possible significant fluctuations in our future operating results

as well as seasonality and variability in client demands; potential

contractual disputes with our clients and third-party suppliers;

our dependence on certain key personnel and our ability to attract,

train and retain skilled teammates; risks associated with the

integration and operation of acquired businesses, including

achievement of expected synergies and benefits; and future sales of

the Company’s common stock or equity-linked securities in the

public market could lower the market price for our common

stock.

Additionally, there may be other risks that are otherwise

described from time to time in the reports that the Company files

with the SEC. Any forward-looking statements in this release speak

only as of the date on which they are made and should be considered

in light of various important factors, including the risks and

uncertainties listed above, as well as others. The Company assumes

no obligation to update, and, except as may be required by law,

does not intend to update, any forward-looking statements.

NSIT-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514210897/en/

Ryan Miyasato Investor Relations Tel. (408) 975-8507 Email:

Ryan.Miyasato@insight.com

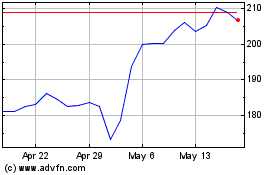

Insight Enterprises (NASDAQ:NSIT)

Historical Stock Chart

From Oct 2024 to Oct 2024

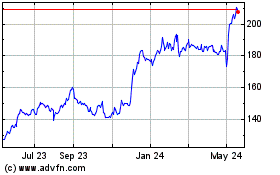

Insight Enterprises (NASDAQ:NSIT)

Historical Stock Chart

From Oct 2023 to Oct 2024