false

0001285819

0001285819

2024-02-01

2024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 1, 2024

OMEROS CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

Washington

|

001-34475

|

91-1663741

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

201 Elliott Avenue West

Seattle, WA

|

|

98119

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (206) 676-5000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value per share

|

OMER

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Definitive Material Agreement.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

On February 1, 2024, Omeros Corporation (“Omeros” or the “Company”) entered into an amended and restated royalty purchase agreement (the “Amendment”) with DRI Healthcare Acquisitions LP (“DRI”) providing for the acquisition by DRI of an expanded interest in certain royalty payments based on annual net sales of Omeros’ former ophthalmologic product OMIDRIA® (the “Purchased Receivables”). The Purchased Receivables comprise a portion of the royalties projected to be paid to Omeros under the terms of the Asset Purchase Agreement (the “Asset Purchase Agreement”) among Omeros, Rayner Surgical Inc. (“Rayner”) and Rayner Surgical Group Limited, pursuant to which the Company sold OMIDRIA and related business assets to Rayner in December 2021.

On September 30, 2022, Omeros and DRI entered into a Royalty Purchase Agreement (the “Original Agreement”) under which Omeros received $125 million in cash in exchange for a portion of Omeros’ royalties on global net sales of OMIDRIA payable by Rayner between September 1, 2022 and December 31, 2030, subject to certain annual caps on the royalty amounts payable to DRI, with Omeros entitled to receive all royalties paid in excess of the applicable caps.

On February 1, 2024, Omeros and DRI entered into the Amendment to effect the sale to DRI of an expanded interest in the OMIDRIA royalties. The Amendment eliminated the annual caps on royalty payments to which DRI is entitled and provides that DRI will now receive all royalties on U.S. net sales of OMIDRIA payable between January 1, 2024 and December 31, 2031. Omeros received $115 million in cash upon closing of the Amendment. Additionally, Omeros is eligible under the Amendment to receive two milestone payments of up to $27.5 million each, payable in January 2026 and January 2028, respectively, based on achievement of certain thresholds for U.S. net sales of OMIDRIA.

DRI is entitled to payment only to the extent of royalty payments that are payable in respect of U.S. net sales of OMIDRIA on or before December 31, 2031 and DRI has no recourse to Omeros’ assets other than the Purchased Receivables. Omeros will be entitled to retain all royalties on any net sales of OMIDRIA outside the U.S. payable from and after January 1, 2024, as well as all royalties on global net sales of OMIDRIA payable from and after December 31, 2031. Under the Asset Purchase Agreement, the term for royalty payments expires based on the last-expiring OMIDRIA-related patent in the relevant country, which in the United States currently extends into 2035.

The Amendment contains other customary terms, conditions and agreements, including representations, warranties and indemnity provisions. Given that this is a partial sale of OMIDRIA royalties, there are no asset pledges or financial covenants. The Amendment will terminate on the the earlier of (i) December 31, 2031, or (ii) the date on which DRI has received the last payment of Purchased Receivables made pursuant to the Asset Purchase Agreement.

The foregoing is a brief description of the material terms of the Amendment and does not purport to be a complete description of the rights and obligations thereunder. A copy of the Amendment will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The Amendment contains representations, warranties and other provisions that were made only for purposes of such agreement and as of specific dates, are solely for the benefit of the parties thereto, and may be subject to limitations agreed upon by such parties. The Amendment is not intended to provide any other factual information about the Company.

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are subject to the “safe harbor” created by those sections for such statements. All statements other than statements of historical fact are forward-looking statements, which are often indicated by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “goal,” “intend,” “likely,” “look forward to,” “may,” “objective,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “slate,” “target,” “will,” “would” and similar expressions and variations thereof. Forward-looking statements, including projections or expectations regarding future net sales of OMIDRIA, future payments to Omeros based on net sales of OMIDRIA, the anticipated duration of rights to receive royalty payments and the future reimbursement status of OMIDRIA are based on management’s beliefs and assumptions and on information available to management only as of the date hereof. Omeros’ actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including, without limitation, reliance on Rayner or others to successfully generate net sales of OMIDRIA, risks associated with product commercialization and commercial operations, regulatory processes and oversight, payment and reimbursement policies applicable to OMIDRIA and the risks, uncertainties and other factors described under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 13, 2023. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements, and the Company assumes no obligation to update these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

OMEROS CORPORATION

|

| |

|

|

|

Date: February 7, 2024

|

By:

|

/s/ Gregory A. Demopulos

|

| |

|

Gregory A. Demopulos, M.D.

|

| |

|

President, Chief Executive Officer and

|

| |

|

Chairman of the Board of Directors

|

v3.24.0.1

Document And Entity Information

|

Feb. 01, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

OMEROS CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 01, 2024

|

| Entity, Incorporation, State or Country Code |

WA

|

| Entity, File Number |

001-34475

|

| Entity, Tax Identification Number |

91-1663741

|

| Entity, Address, Address Line One |

201 Elliott Avenue West

|

| Entity, Address, City or Town |

Seattle

|

| Entity, Address, State or Province |

WA

|

| Entity, Address, Postal Zip Code |

98119

|

| City Area Code |

206

|

| Local Phone Number |

676-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

OMER

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001285819

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

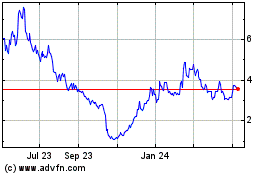

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Mar 2024 to Apr 2024

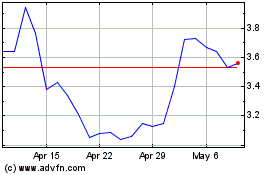

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Apr 2023 to Apr 2024