| As filed with the Securities and Exchange Commission on May 17, 2024 |

Registration No. 333- |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

QCR Holdings, Inc.

(Exact Name of Registrant as Specified in Its

Charter)

Delaware

(State or other jurisdiction of

incorporation or organization) |

|

42-1397595

(I.R.S. Employer

Identification No.) |

3551 Seventh Street

Moline, Illinois 61265

(309) 736-3580

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

QCR Holdings, Inc. 2024 Equity Incentive

Plan

(Full Title of the Plan)

Todd A. Gipple

President and Chief Financial Officer

3551 Seventh Street

Moline, Illinois 61265

(309) 736-3580

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copy to:

Abdul R. Mitha, Esq.

Barack Ferrazzano Kirschbaum & Nagelberg

LLP

200 West Madison Street, Suite 3900

Chicago, Illinois 60606

(312) 629-5171

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer x | |

Accelerated filer ¨ |

| Non-accelerated

filer ¨ | |

Smaller reporting company ¨ |

| | |

Emerging

growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

| Item 1. | Plan Information.* |

| Item 2. | Registrant

Information and Employee Plan Annual Information.* |

The Registrant will provide

participants of the QCR Holdings, Inc. 2024 Equity Incentive Plan (the “Plan”), upon written or oral request and without

charge, a copy of the documents incorporated by reference in Item 3 of Part II of this Registration Statement, which are incorporated

by reference in the Section 10(a) prospectus, and all documents required to be delivered to employees pursuant to Rule 428(b) under

the Securities Act of 1933, as amended (the “Securities Act”). Requests for such documents should be directed to QCR Holdings, Inc.,

3551 Seventh Street, Moline, Illinois 61265, Attention: Shellee R. Showalter, telephone number: (309) 743-7760.

* The information specified in this Part I

of Form S-8 is included in documents sent or given to the participants in the Plan as specified by Rule 428(b)(1) of the

Securities Act. Such documents need not be filed with the Securities and Exchange Commission (the “Commission”) either as

part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424. These documents and the documents

incorporated by reference in this registration statement pursuant to Item 3 of Part II of this Form S-8, taken together, constitute

a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. | Incorporation of Documents

by Reference. |

The following documents previously

filed by the Registrant with the Commission are incorporated herein by reference:

| (c) | The Registrant’s Current Reports

on Form 8-K filed on February 26,

2024 and May 17, 2024 (in each case, excluding the information furnished under

Item 2.02 and Item 7.01 of Form 8-K); |

| (d) | All other reports filed pursuant to

Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), since the end of the fiscal year covered by the Annual

Report on Form 10-K referred to in (a) above; and |

| (e) | The description of the Registrant’s

common stock contained in the Registrant's Registration Statement on Form 8-A filed with the Commission on August 9, 1993, as updated by the description of the

Registrant's common stock contained in Exhibit 4.2 of the Registrant’s Annual Report on Form 10-K

for the year ended December 31, 2019, filed with the Commission on March 13, 2020,

and all subsequent amendments or reports filed for the purpose of updating such description. |

Each document or report subsequently

filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of

this Registration Statement, but prior to the filing of a post-effective amendment to this Registration Statement which indicates that

all securities offered by this Registration Statement have been sold or which deregisters all such securities then remaining unsold,

shall be deemed to be incorporated by reference into this Registration Statement from the date of filing of such document or report;

provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of the

Commission shall not be deemed incorporated by reference in this Registration Statement.

Any statement contained in

the documents incorporated, or deemed to be incorporated, by reference herein shall be deemed to be modified or superseded for purposes

of this Registration Statement and the prospectus which is a part hereof to the extent that a statement contained herein or in any other

subsequently filed document which also is, or is deemed to be, incorporated by reference herein modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration

Statement or the prospectus which is a part hereof.

| Item 4. | Description of Securities. |

Not applicable.

| Item 5. | Interests of Named Experts

and Counsel. |

Not applicable.

| Item 6. | Indemnification of Directors

and Officers. |

Delaware

Law. Section 145 of the Delaware General Corporation Law (the “DGCL”) permits a corporation to indemnify

any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding,

whether civil, criminal, administrative or investigative, by reason of the fact that the person is or was a director, officer, employee

or agent of the corporation or another enterprise if serving at the request of the corporation. Depending on the character of the proceeding,

a corporation may indemnify against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually

and reasonably incurred in connection with such action, suit or proceeding if the person indemnified acted in good faith and in a manner

reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding,

had no reasonable cause to believe the person’s conduct was unlawful. In the case of an action by or in the right of the corporation,

no indemnification may be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable

to the corporation unless and only to the extent that the Delaware Court of Chancery or the court in which such action or suit was brought

shall determine that, despite the adjudication of liability, such person is fairly and reasonably entitled to indemnity for such expenses

which the court shall deem proper. Section 145 of the DGCL further provides that to the extent a director or officer of a corporation

has been successful on the merits or in the defense of any action, suit or proceeding referred to above, or in the defense of any claim,

issue or matter therein, he or she shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred

by him or her in connection therewith.

Section 102(b)(7) of

the DGCL permits a corporation to provide in its certificate of incorporation that a director or officer of the corporation shall not

be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer,

except for liability: (a) for any breach of the director’s or the officer’s duty of loyalty to the corporation or its

stockholders, (b) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law,

(c) for payments of unlawful dividends or unlawful stock repurchases, redemptions or other distributions, (d) for any transactions

from which the director or officer derived an improper personal benefit or (e) for an officer’s liability in any action by

or in the right of the corporation.

Certificate

of Incorporation and Bylaws. Article IX of our Certificate of Incorporation and Section 7.2 of our Bylaws provide

that we shall, to the full extent permitted by law, indemnify those persons whom we may indemnify pursuant thereto, and contain provisions

substantially similar to Section 145 of the DGCL.

Liability

Insurance. We have obtained directors’ and officers’ liability insurance. The primary policy provides for

$10 million in primary coverage including prior acts dating to the Company’s inception and liabilities under the Securities

Act.

| Item 7. | Exemption from Registration

Claimed. |

Not applicable.

See Exhibit Index, which is incorporated

herein by reference.

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which

offers or sales are being made, a post-effective amendment to this Registration Statement: |

| (i) | to include any prospectus required by

Section 10(a)(3) of the Securities Act; |

| (ii) | to reflect in the prospectus any facts

or events arising after the effective date of this Registration Statement (or the most recent

post-effective amendment hereof) which, individually or in the aggregate, represent a fundamental

change in the information set forth in this Registration Statement. Notwithstanding the foregoing,

any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high

end of the estimated maximum offering range may be reflected in the form of prospectus filed

with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in

volume and price represent no more than 20% change in the maximum aggregate offering price

set forth in the “Calculation of Registration Fee” table in the effective registration

statement; and |

| (iii) | to include any material information

with respect to the plan of distribution not previously disclosed in this Registration Statement

or any material change to such information in this Registration Statement; provided, however,

that paragraphs (a)(1)(i) and (a)(1)(ii) above do not apply if the information

required to be included in a post-effective amendment by those paragraphs is contained in

reports filed with or furnished to the Commission by the Registrant pursuant to Section 13

or Section 15(d) of the Exchange Act that are incorporated by reference in this

Registration Statement. |

| (2) | That, for the purpose of determining

any liability under the Securities Act, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering. |

| (b) | The undersigned Registrant hereby undertakes

that, for purposes of determining any liability under the Securities Act, each filing of

the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of

the Exchange Act (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated

by reference in this Registration Statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant

has been advised that in the opinion of the Commission such indemnification is against public

policy as expressed in the Securities Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the

Registrant of expenses incurred or paid by a director, officer or controlling person of the

Registrant in the successful defense of any action, suit or proceeding) is asserted by such

director, officer or controlling person in connection with the securities being registered,

the Registrant will, unless in the opinion of its counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether

such indemnification by it is against public policy as expressed in the Securities Act and

will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Moline, State of Illinois, on this 17th day of

May, 2024.

| QCR

HOLDINGS, INC. |

|

| |

|

| By: |

/s/

Todd A. Gipple |

|

| |

Todd

A. Gipple |

|

| |

President

and Chief Financial Officer |

|

POWER OF ATTORNEY

Each person whose signature

appears below hereby constitutes and appoints each of Larry J. Helling and Todd A. Gipple his or her true and lawful attorney-in-fact

and agent, acting alone, with full power of substitution and resubstitution, to sign on his or her behalf, individually and in each capacity

stated below, all amendments and post-effective amendments to this Registration Statement on Form S-8 and to file the same, with

all exhibits thereto and any other documents in connection therewith, with the Commission under the Securities Act, granting unto said

attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done

in and about the premises, as fully and to all intents and purposes as each might or could do in person, hereby ratifying and confirming

each act that said attorneys-in-fact and agents may lawfully do or cause to be done by virtue thereof.

Pursuant

to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities indicated

below on May 17, 2024.

| Signature |

|

Title |

| |

|

|

| /s/

Marie Z. Ziegler |

|

Chair of the Board

of Directors |

| Marie Z. Ziegler |

|

|

| |

|

|

| /s/

James M. Field |

|

Vice Chair of the

Board of Directors |

| James M. Field |

|

|

| |

|

|

| /s/

Larry J. Helling |

|

Chief Executive Officer

and Director |

| Larry J. Helling |

|

(Principal Executive

Officer) |

| |

|

|

| /s/

Todd A. Gipple |

|

President and Chief

Financial Officer and Director |

| Todd A. Gipple |

|

(Principal Financial

Officer) |

| |

|

|

| /s/

Nick W. Anderson |

|

Chief Accounting

Officer |

| Nick W. Anderson |

|

(Principal Accounting

Officer) |

| Signature |

|

Title |

| |

|

|

| /s/

Mary K. Bates |

|

Director |

| Mary K. Bates |

|

|

| |

|

|

| /s/

John-Paul E. Besong |

|

Director |

| John-Paul E. Besong |

|

|

| |

|

|

| /s/

Brent R. Cobb |

|

Director |

| Brent R. Cobb |

|

|

| |

|

|

| /s/

John F. Griesemer |

|

Director |

| John F. Griesemer |

|

|

| |

|

|

| /s/

Elizabeth S. Jacobs |

|

Director |

| Elizabeth S. Jacobs |

|

|

| |

|

|

| /s/

Mark C. Kilmer |

|

Director |

| Mark C. Kilmer |

|

|

| |

|

|

| /s/

Donna J. Sorenson |

|

Director |

| Donna J. Sorenson |

|

|

EXHIBIT INDEX

Exhibit

Number |

Description |

| |

|

| 4.1 |

Certificate

of Incorporation of QCR Holdings, Inc. and amendments thereto (incorporated by reference to Exhibit 3.1 of the Company’s

Amended Quarterly Report on Form 10-Q/A for the quarter ended September 30, 2011). |

| |

|

| 4.2 |

Bylaws

of QCR Holdings, Inc., as amended and restated (incorporated by reference to Exhibit 3.1 of the Company’s Current

Report on Form 8-K filed August 19, 2022). |

| |

|

| 4.3 |

Specimen

of stock certificate representing QCR Holdings, Inc. common stock (incorporated by reference to Exhibit 4.1 of the Company’s

Registration Statement on Form SB-2 filed August 3, 1993 (Registration No. 33-67028)). |

| |

|

| 4.4 |

QCR

Holdings, Inc. 2024 Equity Incentive Plan (filed as Appendix A to QCR Holdings, Inc.’s Proxy Statement on

Form DEF 14A dated April 4, 2024, and incorporated herein by reference). |

| |

|

| 4.5* |

Form of

QCR Holdings, Inc. 2024 Equity Incentive Plan Nonqualified Stock Option Award Agreement. |

| |

|

| 4.6* |

Form of

QCR Holdings, Inc. 2024 Equity Incentive Plan Restricted Stock Award Agreement. |

| |

|

| 4.7* |

Form of

QCR Holdings, Inc. 2024 Equity Incentive Plan Restricted Stock Unit Award Agreement. |

| |

|

| 5.1* |

Opinion

regarding legality of shares of QCR Holdings, Inc. common stock of Barack Ferrazzano Kirschbaum & Nagelberg LLP. |

| |

|

| 23.1* |

Consent

of Barack Ferrazzano Kirschbaum & Nagelberg LLP (included in Exhibit 5.1). |

| |

|

| 23.2*

|

Consent

of RSM US LLP. |

| |

|

| 24.1* |

Power

of Attorney (included in the signature page hereto). |

| |

|

| 107* |

Filing

Fee Table. |

Exhibit 4.5

QCR

Holdings, Inc.

2024

Equity Incentive Plan

STOCK

Option Agreement

The individual identified

in the accompanying Notice of Grant of Stock Options and Stock Option Agreement (the “Notice”) is the Participant

for purposes of this Option Agreement (“Option Agreement”). The Participant is hereby granted a nonqualified stock

option (the “Option”) by QCR Holdings, Inc.,

a Delaware corporation (the “Company”), under the QCR Holdings, Inc.

2024 Equity Incentive Plan (the “Plan”).

The Option shall be subject to the terms of the Plan, the terms of the Notice and the terms set forth in this Option Agreement.

Section 1. Award.

The Company hereby grants to the Participant the Option, which represents the right of the Participant to purchase the number of Covered

Shares at the Exercise Price set forth in Section 2 below, subject to the terms of this Option Agreement and the Plan.

Section 2. Information

Included in Notice. The following words and phrases relating to the Option shall have the following meanings:

(a) The

“Participant” is the individual identified in the Notice.

(b) The

“Grant Date” is the date on which the Option was granted to you by the Company as set forth in the Notice.

(c) The

number of “Covered Shares” is the number of Shares over which the Option has been granted as set forth in the Notice.

(d) The

“Exercise Price” is the price to be paid by the Participant per Covered Share as set forth in the Notice.

Except for words and phrases

otherwise defined in this Option Agreement, any capitalized word or phrase in this Option Agreement shall have the meaning set forth in

the Plan.

Section 3. Nonqualified

Stock Option. The Option is not intended to satisfy the requirements applicable to an “incentive stock option” described

in Code Section 422(b).

Section 4. Vesting.

(a) Each

installment of Covered Shares identified in the Notice (each, an “Installment”) shall become vested and exercisable

on the “Vest Date” for such Installment indicated in the Notice; provided that the Participant’s Termination

of Service has not occurred prior to such Vest Date. By accepting this Option, Participant acknowledges and agrees that, for all purposes

under the Plan or any prior equity plan sponsored or maintained by the Company whether relating to this Option or any prior equity grant

to Participant under the Plan or any prior equity plan sponsored or maintained by the Company, continued vesting of any equity award requires

continuous employment of Participant from the date of grant through any specified vesting date.

(b) Notwithstanding

the foregoing provisions of this Section 4, all the Covered Shares shall become fully vested and immediately exercisable upon

the Participant’s Termination of Service due to the Participant’s Disability or the Participant’s death.

(c) Upon

a Change in Control, the Option shall be treated in accordance with Section 4.1 of the Plan.

(d) The

Option shall not be vested and exercisable on or after the Participant’s Termination of Service, except as to that portion of Covered

Shares for which it was vested and exercisable immediately prior to such Termination of Service or became vested and exercisable on the

date of such Termination of Service, and in any event, in accordance with the terms of this Award Agreement.

Section 5. Expiration.

Notwithstanding any term of this Option Agreement to the contrary, the Participant shall forfeit the Option in its entirety as of the

Company’s close of business on the last business day that occurs prior to the Expiration Date. The “Expiration Date”

shall be the earliest to occur of the following:

(a) the

three-month anniversary of the Participant’s Termination of Service other than due to the Participant’s Disability or death

or Termination of Service for Cause; provided, however, that if the Participant shall die after the date of Termination

of Service but before the three-month anniversary of the Participant’s Termination of Service, the Expiration Date shall automatically

be extended to the one-year anniversary of Participant’s Termination of Service;

(b) the

one-year anniversary of the Participant’s Termination of Service due to the Participant’s Disability or death;

(c) the

10-year anniversary of the Grant Date; or

(d) the

effective date of the Participant’s Termination of Service for Cause.

Section 6. Exercise.

(a) Method

of Exercise. The vested portion of the Option may be exercised by the Participant in whole or in part by providing notice of option

exercise to the Corporate Secretary of the Company at its corporate headquarters, in a form prescribed by the Committee or satisfying

such other procedures as shall be set forth by the Committee from time to time. Such notice shall specify the number of Covered Shares

that the Participant elects to purchase, and shall be accompanied by payment of the Exercise Price for such Covered Shares as further

set forth in Section 6(b) below.

(b) Payment

of Exercise Price. Without limitation of Section 8 below, the payment of the Exercise Price shall be made in accordance

with Section 2.2 of the Plan.

(c) Restrictions.

The Option shall not be exercisable if and to the extent the Company determines that such exercise would violate any applicable laws or

the applicable rules of any securities exchange or similar entity, and shall not be exercisable during any blackout period established

by the Company from time to time.

Section 7. Delivery

of Shares. Delivery of Shares or other amounts under this Option Agreement and the Plan shall be subject to the following:

(a) Compliance

with Applicable Laws. Notwithstanding any other term of this Option Agreement or the Plan, the Company shall have no obligation to

deliver any Shares or make any other distribution of benefits under this Option Agreement or the Plan unless such delivery or distribution

complies with all applicable laws and the applicable rules of any securities exchange or similar entity.

(b) Certificates

Not Required. To the extent that this Option Agreement and the Plan provide for the issuance of Shares, such issuance may be effected

on a non-certificated basis, to the extent not prohibited by applicable law or the applicable rules of any securities exchange or

similar entity.

Section 8. Withholding.

The exercise of the Option, and the Company’s obligation to issue Shares upon exercise, is subject to withholding of all applicable

taxes. As permitted by the Committee from time to time, such withholding obligations may be satisfied at the election of the Participant

(a) through cash payment by the Participant, (b) through the surrender of Shares that the Participant already owns, (c) through

the surrender of Shares to which the Participant is otherwise entitled under the Plan or (d) through the withholding of any compensation

or any other amounts payable to the Participant; provided, however, that except as otherwise specifically provided by the

Committee, such Shares under clause (c) may not be used to satisfy more than the maximum individual statutory tax rate for each applicable

tax jurisdiction, or such lesser amount as may be established by the Company.

Section 9. Non-Transferability

of Option. The Option, or any portion thereof, is not transferable except as designated by the Participant by will or by the laws

of descent and distribution or pursuant to a domestic relations order. Except as provided in the immediately preceding sentence, the Option

shall not be assigned, transferred, pledged, hypothecated or otherwise disposed of by the Participant in any way whether by operation

of law or otherwise, and shall not be subject to execution, attachment or similar process. Any attempt at assignment, transfer, pledge,

hypothecation or other disposition of the Option contrary to the provisions hereof, or the levy of any attachment or similar process upon

the Option, shall be null and void and without effect.

Section 10. Heirs

and Successors. This Option Agreement shall be binding upon, and inure to the benefit of, the Company and its successors and assigns,

and upon any person acquiring all or substantially all of the Company’s assets or business. If any rights of the Participant or

benefits distributable to the Participant under this Option Agreement have not been settled or distributed at the time of the Participant’s

death, such rights shall be settled for and such benefits shall be distributed to the Designated Beneficiary in accordance with the provisions

of this Option Agreement and the Plan. The “Designated Beneficiary” shall be the beneficiary or beneficiaries designated

by the Participant in a writing filed with the Committee in such form as the Committee may require. The Participant’s designation

of beneficiary may be amended or revoked from time to time by the Participant in accordance with any procedures established by the Committee.

If a Participant fails to designate a beneficiary, or if the Designated Beneficiary does not survive the Participant, any benefits that

would have been provided to the Participant shall be provided to the legal representative of the estate of the Participant. If a Participant

designates a beneficiary and the Designated Beneficiary survives the Participant but dies before the provision of the Designated Beneficiary’s

benefits under this Option Agreement, then any benefits that would have been provided to the Designated Beneficiary shall be provided

to the legal representative of the estate of the Designated Beneficiary.

Section 11. Administration.

The authority to manage and control the operation and administration of this Option Agreement and the Plan shall be vested in the Committee,

and the Committee shall have all powers with respect to this Option Agreement as it has with respect to the Plan. Any interpretation of

this Option Agreement or the Plan by the Committee and any decision made by the Committee with respect to this Option Agreement or the

Plan shall be final and binding on all persons.

Section 12. Plan

Governs. Notwithstanding anything in this Option Agreement to the contrary, this Option Agreement shall be subject to the terms

of the Plan, a copy of which may be obtained by the Participant from the office of the Corporate Secretary of the Company. This Option

Agreement shall be subject to all interpretations, amendments, rules and regulations promulgated by the Committee from time to time.

Notwithstanding any term of this Option Agreement to the contrary, in the event of any discrepancy between the corporate records of the

Company and this Option Agreement, the corporate records of the Company shall control.

Section 13. Not

an Employment Contract. Neither the Option nor this Option Agreement shall confer on the Participant any rights with respect to

continuance of employment or other service with the Company or a Subsidiary, nor shall they interfere in any way with any right the Company

or a Subsidiary may otherwise have to terminate or modify the terms of the Participant’s employment or other service at any time.

Section 14. No

Rights as Shareholder. The Participant shall not have any rights of a Shareholder with respect to the Covered Shares until a stock

certificate or its equivalent has been duly issued following exercise of the Option as provided herein.

Section 15. Amendment.

Without limitation of Section 18 and Section 19 below, this Option Agreement may be amended in accordance with

the provisions of the Plan, and may otherwise be amended in writing by the Participant and the Company without the consent of any other

person.

Section 16. Governing

Law. This Option Agreement, the Plan and all actions taken in connection herewith and therewith shall be governed by and construed

in accordance with the laws of the State of Delaware without reference to principles of conflict of laws, except as superseded by applicable

federal law.

Section 17. Validity.

If any provision of this Option Agreement is determined to be illegal or invalid for any reason, said illegality or invalidity shall not

affect the remaining parts hereof, but this Option Agreement shall be construed and enforced as if such illegal or invalid provision had

never been included herein.

Section 18. Section 409A

Amendment. The Option is intended to be exempt from Code Section 409A and this Option Agreement shall be administered and

interpreted in accordance with such intent. The Committee reserves the right (including the right to delegate such right) to unilaterally

amend this Option Agreement without the consent of the Participant in order to maintain an exclusion from the application of, or to maintain

compliance with, Code Section 409A; and the Participant hereby acknowledges and consents to such rights of the Committee.

Section 19. Clawback.

The Option and any amount or benefit received under the Plan shall be subject to potential cancellation, recoupment, rescission, payback

or other action in accordance with the terms of any applicable Company or Subsidiary clawback policy (the “Policy”)

or any applicable law, as may be in effect from time to time. The Participant hereby acknowledges and consents to the Company’s

or a Subsidiary’s application, implementation and enforcement of (a) the Policy and any similar policy established by the Company

or a Subsidiary that may apply to the Participant together with all other similarly situated participants, whether adopted prior to or

following the date of this Option Agreement and (b) any provision of applicable law relating to cancellation, rescission, payback

or recoupment of compensation, and agrees that the Company or a Subsidiary may take such actions as may be necessary to effectuate the

Policy, any similar policy and applicable law without further consideration or action.

* * * * *

Exhibit 4.6

QCR

Holdings, Inc.

2024

Equity Incentive Plan

Restricted

Stock Award Agreement

The Participant specified

below is hereby granted a restricted stock award (the “Award”) by QCR Holdings, Inc.,

a Delaware corporation (the “Company”), under the QCR Holdings, Inc.

2024 Equity Incentive Plan (the “Plan”).

The Award shall be subject to the terms of the Plan and the terms set forth in this Restricted Stock Award Agreement (“Award

Agreement”).

Section 1. Award.

The Company hereby grants to the Participant the Award of restricted stock, which represents the right of the Participant to enjoy the

number of Covered Shares set forth in Section 2 below free of restrictions once the Restricted Period ends, subject to the

terms of this Award Agreement and the Plan.

Section 2. Terms

of Restricted Stock Award. The following words and phrases relating to the Award shall have the following meanings:

(a) The

“Participant” is ______________________________.

(b) The

“Grant Date” is ______________________________.

(c) The

number of “Covered Shares” is ______________________ Shares.

Except for words and phrases

otherwise defined in this Award Agreement, any capitalized word or phrase in this Award Agreement shall have the meaning ascribed to it

in the Plan.

Section 3. Restricted

Period.

(a) The

“Restricted Period” for each installment of Covered Shares set forth in the table immediately below (each, an “Installment”)

shall begin on the Grant Date and end as described in the schedule set forth in the table immediately below; provided that the

Participant’s Termination of Service has not occurred prior thereto:

| Installment |

Restricted Period will end on: |

| ___% of Covered Shares |

Date/Event/Other Condition |

(b) Notwithstanding

the foregoing provisions of this Section 3, the Restricted Period for all the Covered Shares shall cease immediately and such

Covered Shares shall become fully vested immediately upon the Participant’s Termination of Service due to the Participant’s

Disability or the Participant’s death.

(c) Upon

a Change in Control, the Award shall be treated in accordance with Section 4.1 of the Plan.

(d) Except

as set forth in Section 3(b) and Section 3(c) above, if the Participant’s Termination of Service

occurs prior to the expiration of one or more Restricted Periods, the Participant shall forfeit all rights, title and interest in and

to any Installment(s) still subject to a Restricted Period as of such Termination of Service.

Section 4. Delivery

of Shares. Delivery of Shares or other amounts under this Award Agreement and the Plan shall be subject to the following:

(a) Compliance

with Applicable Laws. Notwithstanding any other provision of this Award Agreement or the Plan, the Company shall have no obligation

to deliver any Shares or make any other distribution of benefits under this Award Agreement or the Plan unless such delivery or distribution

complies with all applicable laws and the applicable rules of any securities exchange or similar entity.

(b) Certificates

Not Required. To the extent that this Award Agreement and the Plan provide for the issuance of Shares, such issuance may be effected

on a non-certificated basis, to the extent not prohibited by applicable law or the applicable rules of any securities exchange or

similar entity.

Section 5. Withholding.

All deliveries of Covered Shares shall be subject to withholding of all applicable taxes. The Company shall have the right to require

the Participant (or if applicable, permitted assigns, heirs and Designated Beneficiaries) to remit to the Company an amount sufficient

to satisfy any tax requirements prior to the delivery date of any Shares in connection with the Award. As permitted by the Committee from

time to time, such withholding obligation may be satisfied at the election of the Participant (a) through cash payment by the Participant,

(b) through the surrender of Shares that the Participant already owns, (c) through the surrender of Shares to which the Participant

is otherwise entitled under the Plan or (d) through the withholding of any compensation or any other amounts payable to the Participant;

provided, however, that except as otherwise specifically provided by the Committee, such Shares under clause (c) may

not be used to satisfy more than the maximum individual statutory tax rate for each applicable tax jurisdiction, or such lesser amount

as established by the Company.

Section 6. Non-Transferability

of Award. The Award, or any portion thereof, is not transferable except as designated by the Participant by will or by the laws

of descent and distribution or pursuant to a domestic relations order. Except as provided in the immediately preceding sentence, the Award

shall not be assigned, transferred, pledged, hypothecated or otherwise disposed of by the Participant in any way whether by operation

of law or otherwise, and shall not be subject to execution, attachment or similar process. Any attempt at assignment, transfer, pledge,

hypothecation or other disposition of the Award contrary to the provisions hereof, or the levy of any attachment or similar process upon

the Award, shall be null and void and without effect.

Section 7. Dividends.

The Participant shall be entitled to receive dividends and distributions paid on any Installment during the Restricted Period applicable

to such Installment (other than dividends and distributions that may be issued with respect to Shares by virtue of any corporate transaction,

to the extent adjustment is made pursuant to Section 3.4 of the Plan); provided, however, that no dividends or distributions

shall be payable to or for the benefit of the Participant with respect to record dates for such dividends or distributions occurring before

the Grant Date or on or after the date, if any, on which the Participant has forfeited the respective Covered Shares.

Section 8. Voting

Rights. The Participant shall be entitled to vote the Covered Shares during the Restricted Period applicable to each Installment;

provided, however, that the Participant shall not be entitled to vote Covered Shares with respect to record dates occurring before

the Grant Date or on or after the date, if any, on which the Participant has forfeited those Covered Shares.

Section 9. Deposit

of Restricted Stock Award. All Shares issued with respect to Covered Shares shall be registered in the name of the Participant

and shall be retained by the Company, or an agent of the Company, until the end of the Restricted Period applicable to such Covered Shares.

Upon expiration of a Restricted Period with respect to any Covered Shares, such Shares shall be delivered to the Participant in accordance

with Section 4 hereof.

Section 10. Heirs

and Successors. This Award Agreement shall be binding upon, and inure to the benefit of, the Company and its successors and

assigns, and upon any person acquiring all or substantially all of the Company’s assets or business. If any rights of the Participant

or benefits distributable to the Participant under this Award Agreement have not been settled or distributed at the time of the Participant’s

death, such rights shall be settled for and such benefits shall be distributed to the Designated Beneficiary in accordance with the provisions

of this Award Agreement and the Plan. The “Designated Beneficiary” shall be the beneficiary or beneficiaries designated

by the Participant in a writing filed with the Committee in such form as the Committee may require. The Participant’s designation

of beneficiary may be amended or revoked from time to time by the Participant in accordance with any procedures established by the Committee.

If a Participant fails to designate a beneficiary, or if the Designated Beneficiary does not survive the Participant, any benefits that

would have been provided to the Participant shall be provided to the legal representative of the estate of the Participant. If a Participant

designates a beneficiary and the Designated Beneficiary survives the Participant but dies before the provision of the Designated Beneficiary’s

benefits under this Award Agreement, then any benefits that would have been provided to the Designated Beneficiary shall be provided to

the legal representative of the estate of the Designated Beneficiary.

Section 11. Administration. The

authority to manage and control the operation and administration of this Award Agreement and the Plan shall be vested in the Committee,

and the Committee shall have all powers with respect to this Award Agreement as it has with respect to the Plan. Any interpretation of

this Award Agreement or the Plan by the Committee and any decision made by the Committee with respect to this Award Agreement or the Plan

shall be final and binding on all persons.

Section 12. Plan

Governs. Notwithstanding any provision of this Award Agreement to the contrary, this Award Agreement shall be subject to the terms

of the Plan, a copy of which may be obtained by the Participant from the office of the secretary of the Company. This Award Agreement

shall be subject to all interpretations, amendments, rules and regulations promulgated by the Committee from time to time. Notwithstanding

any provision of this Award Agreement to the contrary, in the event of any discrepancy between the corporate records of the Company and

this Award Agreement, the corporate records of the Company shall control.

Section 13. Not

an Employment Contract. Neither the Award nor this Award Agreement shall confer on the Participant any rights with respect to

continuance of employment or other service with the Company or a Subsidiary, nor shall they interfere in any way with any right the Company

or a Subsidiary may otherwise have to terminate or modify the terms of the Participant’s employment or other service at any time.

Section 14. Amendment. Without

limitation of Section 17 and Section 18 below, this Award Agreement may be amended in accordance with the provisions

of the Plan, and may otherwise be amended in writing by the Participant and the Company without the consent of any other person.

Section 15. Governing

Law. This Award Agreement, the Plan and all actions taken in connection herewith and therewith shall be governed by and construed

in accordance with the laws of the State of Delaware, without reference to principles of conflict of laws, except as superseded by applicable

federal law.

Section 16. Validity.

If any provision of this Award Agreement is determined to be illegal or invalid for any reason, said illegality or invalidity shall not

affect the remaining parts hereof, but this Award Agreement shall be construed and enforced as if such illegal or invalid provision had

never been included herein.

Section 17. Section 409A

Amendment. The Award is intended to be exempt from Code Section 409A and this Award Agreement shall be administered and interpreted

in accordance with such intent. The Committee reserves the right (including the right to delegate such right) to unilaterally amend this

Award Agreement without the consent of the Participant in order to maintain an exclusion from the application of, or to maintain compliance

with, Code Section 409A; and the Participant hereby acknowledges and consents to such rights of the Committee.

Section 18. Clawback.

The Award and any amount or benefit received under the Plan shall be subject to potential cancellation, recoupment, rescission, payback

or other action in accordance with the terms of any applicable Company or Subsidiary clawback policy (the “Policy”)

or any applicable law, as may be in effect from time to time. The Participant hereby acknowledges and consents to the Company’s

or a Subsidiary’s application, implementation and enforcement of (a) the Policy and any similar policy established by the Company

or a Subsidiary that may apply to the Participant together with all other similarly situated participants, whether adopted prior to or

following the date of this Award Agreement and (b) any provision of applicable law relating to cancellation, rescission, payback

or recoupment of compensation, and agrees that the Company or a Subsidiary may take such actions as may be necessary to effectuate the

Policy, any similar policy and applicable law, without further consideration or action.

* * * * *

In

witness whereof, the Company has caused this Award Agreement to be executed in its name and on its behalf, and the Participant

acknowledges understanding and acceptance of, and agrees to, the terms of the Plan and this Award Agreement, all as of the Grant Date.

Exhibit 4.7

QCR

Holdings, Inc.

2024

Equity Incentive Plan

Restricted

Stock Unit Award Agreement

The Participant specified

below is hereby granted a restricted stock unit award (the “Award”) by QCR

Holdings, Inc., a Delaware corporation (the “Company”),

under the QCR Holdings, Inc. 2024

Equity Incentive Plan (the “Plan”). The Award shall be subject

to the terms of the Plan and the terms set forth in this Restricted Stock Unit Award Agreement (“Award Agreement”).

Section 1. Award.

The Company hereby grants to the Participant the Award of restricted stock units (each such unit, an “RSU”), where

each RSU represents the right of the Participant to receive one Share in the future once the Restricted Period ends, subject to the terms

of this Award Agreement and the Plan.

Section 2. Terms

of Restricted Stock Unit Award. The following words and phrases relating to the Award shall have the following meanings:

(a) The

“Participant” is ______________________________.

(b) The

“Grant Date” is ______________________________.

(c) The

number of “RSUs” is ______________________ Shares.

Except for words and phrases

otherwise defined in this Award Agreement, any capitalized word or phrase in this Award Agreement shall have the meaning ascribed to it

in the Plan.

Section 3. Restricted

Period.

(a) The

“Restricted Period” for each installment of RSUs set forth in the table immediately below (each, an “Installment”)

shall begin on the Grant Date and end as described in the schedule set forth in the table immediately below; provided that the

Participant’s Termination of Service has not occurred prior thereto:

| Installment |

Restricted Period will end on: |

| __% of RSUs |

Date/Event/Other Condition |

(b) Notwithstanding

the foregoing provisions of this Section 3, the Restricted Period for all the RSUs shall cease immediately and such RSUs shall

become fully vested immediately upon the Participant’s Termination of Service due to the Participant’s Disability or the Participant’s

death.

(c) Upon

a Change in Control, the Award shall be treated in accordance with Section 4.1 of the Plan.

(d) Except

as set forth in Section 3(b) and Section 3(c) above, if the Participant’s Termination of Service

occurs prior to the expiration of one or more Restricted Periods, the Participant shall forfeit all right, title and interest in and to

any Installment(s) still subject to a Restricted Period as of such Termination of Service.

Section 4. Settlement

of RSUs. Delivery of Shares or other amounts under this Award Agreement and the Plan shall be subject to the following:

(a) Delivery

of Shares. The Company shall deliver to the Participant one Share free and clear of any restrictions in settlement of each of the

vested and unrestricted RSUs within 30 days following the end of the respective Restricted Period.

(b) Compliance

with Applicable Laws. Notwithstanding any other term of this Award Agreement or the Plan, the Company shall have no obligation to

deliver any Shares or make any other distribution of benefits under this Award Agreement or the Plan unless such delivery or distribution

complies with all applicable laws and the applicable rules of any securities exchange or similar entity.

(c) Certificates

Not Required. To the extent that this Award Agreement and the Plan provide for the issuance of Shares, such issuance may be effected

on a non-certificated basis, to the extent not prohibited by applicable law or the applicable rules of any securities exchange or

similar entity.

Section 5. Withholding.

All deliveries of Shares pursuant to the Award shall be subject to withholding of all applicable taxes. The Company shall have the right

to require the Participant (or if applicable, permitted assigns, heirs and Designated Beneficiaries) to remit to the Company an amount

sufficient to satisfy any tax requirements prior to the delivery date of any Shares in connection with the Award. As permitted by the

Committee from time to time, such withholding obligation may be satisfied at the election of the Participant (a) through cash payment

by the Participant, (b) through the surrender of Shares that the Participant already owns, (c) through the surrender of Shares

to which the Participant is otherwise entitled under the Plan or (d) through the withholding of any compensation or any other amounts

payable to the Participant; provided, however, that except as otherwise specifically provided by the Committee, such Shares

under clause (c) may not be used to satisfy more than maximum individual statutory tax rate for each applicable tax jurisdiction,

or such lesser amount as may be established by the Company.

Section 6. Non-Transferability

of Award. The Award, or any portion thereof, is not transferable except as designated by the Participant by will or by the laws

of descent and distribution or pursuant to a domestic relations order. Except as provided in the immediately preceding sentence, the Award

shall not be assigned, transferred, pledged, hypothecated or otherwise disposed of by the Participant in any way whether by operation

of law or otherwise, and shall not be subject to execution, attachment or similar process. Any attempt at assignment, transfer, pledge,

hypothecation or other disposition of the Award contrary to the provisions hereof, or the levy of any attachment or similar process upon

the Award, shall be null and void and without effect.

Section 7. Dividend

Equivalents. The Participant shall be entitled to receive a payment of additional RSUs equal in value to any dividends and distributions

paid with respect to the RSUs (other than dividends and distributions that may be issued with respect to Shares by virtue of any corporate

transaction, to the extent adjustment is made pursuant to Section 3.4 of the Plan) during the Restricted Period (“Dividend

Equivalents”); provided, however, that no Dividend Equivalents shall be payable to or for the benefit of the Participant

with respect to record dates for such dividends or distributions occurring before the Grant Date or on or after the date, if any, on which

the Participant has forfeited the RSUs. Dividend Equivalents shall be credited at the time the respective dividends or distributions are

paid and shall be subject to the same restrictions applicable to the underlying RSUs.

Section 8. No

Rights as Shareholder. The Participant shall not have any rights of a Shareholder with respect to the RSUs, including but not

limited to, voting rights, prior to the settlement of the RSUs pursuant to Section 4(a) above and issuance of Shares

as provided herein.

Section 9. Heirs

and Successors. This Award Agreement shall be binding upon, and inure to the benefit of, the Company and its successors and assigns,

and upon any person acquiring all or substantially all of the Company’s assets or business. If any rights of the Participant or

benefits distributable to the Participant under this Award Agreement have not been settled or distributed at the time of the Participant’s

death, such rights shall be settled for and such benefits shall be distributed to the Designated Beneficiary in accordance with the provisions

of this Award Agreement and the Plan. The “Designated Beneficiary” shall be the beneficiary or beneficiaries designated

by the Participant in a writing filed with the Committee in such form as the Committee may require. The Participant’s designation

of beneficiary may be amended or revoked from time to time by the Participant in accordance with any procedures established by the Committee.

If a Participant fails to designate a beneficiary, or if the Designated Beneficiary does not survive the Participant, any benefits that

would have been provided to the Participant shall be provided to the legal representative of the estate of the Participant. If a Participant

designates a beneficiary and the Designated Beneficiary survives the Participant but dies before the provision of the Designated Beneficiary’s

benefits under this Award Agreement, then any benefits that would have been provided to the Designated Beneficiary shall be provided to

the legal representative of the estate of the Designated Beneficiary.

Section 10. Administration.

The authority to manage and control the operation and administration of this Award Agreement and the Plan shall be vested in the Committee,

and the Committee shall have all powers with respect to this Award Agreement as it has with respect to the Plan. Any interpretation of

this Award Agreement or the Plan by the Committee and any decision made by the Committee with respect to this Award Agreement or the Plan

shall be final and binding on all persons.

Section 11. Plan

Governs. Notwithstanding any provision of this Award Agreement to the contrary, this Award Agreement shall be subject to the terms

of the Plan, a copy of which may be obtained by the Participant from the office of the Corporate Secretary of the Company. This Award

Agreement shall be subject to all interpretations, amendments, rules and regulations promulgated by the Committee from time to time.

Notwithstanding any provision of this Award Agreement to the contrary, in the event of any discrepancy between the corporate records of

the Company and this Award Agreement, the corporate records of the Company shall control.

Section 12. Not

an Employment Contract. Neither the Award nor this Award Agreement shall confer on the Participant any rights with respect to

continuance of employment or other service with the Company or a Subsidiary, nor shall they interfere in any way with any right the Company

or a Subsidiary may otherwise have to terminate or modify the terms of the Participant’s employment or other service at any time.

Section 13. Amendment.

Without limitation of Section 16 and Section 17 below, this Award Agreement may be amended in accordance

with the provisions of the Plan, and may otherwise be amended in writing by the Participant and the Company without the consent of any

other person.

Section 14. Governing

Law. This Award Agreement, the Plan and all actions taken in connection herewith and therewith shall be governed by and construed

in accordance with the laws of the State of Delaware, without reference to principles of conflict of laws, except as superseded by applicable

federal law.

Section 15. Validity.

If any provision of this Award Agreement is determined to be illegal or invalid for any reason, said illegality or invalidity shall

not affect the remaining parts hereof, but this Award Agreement shall be construed and enforced as if such illegal or invalid provision

had never been included herein.

Section 16. Section 409A

Amendment. The Award is intended to be exempt from Code Section 409A and this Award Agreement shall be administered and

interpreted in accordance with such intent. The Committee reserves the right (including the right to delegate such right) to unilaterally

amend this Award Agreement without the consent of the Participant in order to maintain an exclusion from the application of, or to maintain

compliance with, Code Section 409A; and the Participant hereby acknowledges and consents to such rights of the Committee.

Section 17. Clawback.

The Award and any amount or benefit received under the Plan shall be subject to potential cancellation, recoupment, rescission, payback

or other action in accordance with the terms of any applicable Company or Subsidiary clawback policy (the “Policy”)

or any applicable law, as may be in effect from time to time. The Participant hereby acknowledges and consents to the Company’s

or a Subsidiary’s application, implementation and enforcement of (a) the Policy and any similar policy established by the

Company or a Subsidiary that may apply to the Participant together with all other similarly situated participants, whether adopted prior

to or following the date of this Award Agreement and (b) any provision of applicable law relating to cancellation, rescission, payback

or recoupment of compensation, and agrees that the Company or a Subsidiary may take such actions as may be necessary to effectuate the

Policy, any similar policy and applicable law, without further consideration or action.

* * * * *

In

witness whereof, the Company has caused this Award Agreement to be executed in its name and on its behalf, and the Participant

acknowledges understanding and acceptance of, and agrees to, the terms of the Plan and this Award Agreement, all as of the Grant Date.

Exhibit

5.1

May 17, 2024

QCR Holdings, Inc.

3551 Seventh Street

Moline, Illinois 61265

| Re: | Registration Statement on Form S-8 of QCR Holdings, Inc. |

Ladies and Gentlemen:

We have acted as special counsel

to QCR Holdings, Inc., a Delaware corporation (the “Company”), in connection with the registration under

the Securities Act of 1933, as amended (the “Act”), of 600,000 shares (the “Shares”) of common stock,

$1.00 par value per share, of the Company (the “Common Stock”), authorized for issuance pursuant to the QCR Holdings, Inc.

2024 Equity Incentive Plan (the “Plan”), as set forth in the Registration Statement on Form S-8 being filed

with the Securities and Exchange Commission (the “Commission”) on May 17, 2024 (together with all exhibits thereto,

the “Registration Statement”). This opinion is being furnished in accordance with the requirements of Item 601(b)(5) of

Regulation S-K under the Act.

For the purposes of providing

the opinion contained herein, we have examined and relied upon the originals, or copies certified or otherwise identified to our satisfaction,

of such documents, corporate records, certificates of public officials and other instruments as we have deemed necessary. As to questions

of fact material to this opinion letter, we have relied, with your approval, upon oral and written representations of officers and representatives

of the Company and certificates or comparable documents of public officials and of officers and representatives of the Company. In our

examination, we have assumed, without verification, the genuineness of all signatures, the proper execution of all documents submitted

to us as originals, the conformity with the originals of all documents submitted to us as copies, the authenticity of the originals of

such documents and the legal competence of all signatories to such documents.

The opinions set forth herein

are subject to the following assumptions, qualifications, limitations and exceptions being true and correct at or before the time of the

delivery of any Shares issued pursuant to the Plan: (a) either certificates representing the Shares shall have been duly executed,

countersigned and registered and duly delivered to the person entitled thereto against receipt of the agreed consideration therefor (in

an amount not less than the par value thereof), or if any Share is to be issued in uncertificated form, the Company’s books shall

reflect the issuance of such Share to the person entitled thereto against receipt of the agreed consideration therefor (in an amount not

less than the par value thereof), all in accordance with the Plan; (b) the

Registration Statement, and any amendments thereto (including post-effective amendments), shall have become effective under the Act, and

such effectiveness shall not have been terminated or rescinded; (c) the Shares shall have been issued in accordance with the Plan;

and (d) the Company’s board of directors, or a duly authorized committee thereof, shall have duly authorized the issuance and

sale of such Shares as contemplated by the Plan.

QCR Holdings, Inc.

May 17, 2024

Page 2

Based upon the foregoing,

and subject to the qualifications, assumptions and limitations set forth herein, it is our opinion that the Shares, when issued, will

be validly issued, and subject to the restrictions imposed by the Plan, fully paid and nonassessable.

This opinion letter is limited

to the laws of the State of Delaware, and we do not express any opinion as to the effect of the laws of any other jurisdiction.

We express no opinion with

respect to any specific legal issues other than those explicitly addressed herein. We assume no obligation to update this opinion letter

after the date that the Registration Statement initially becomes effective or otherwise advise you with respect to any facts or circumstances

or changes in law that may occur or come to our attention after such date (even though the change may affect the legal conclusions stated

in this opinion letter).

We hereby consent to the inclusion

of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not admit that we are within the category of

persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission.

| |

Very

truly yours, |

| |

|

| |

/s/

Barack Ferrazzano Kirschbaum & Nagelberg LLP |

Exhibit 23.2

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference in this Registration Statement

on Form S-8 of QCR Holdings, Inc. of our reports dated February 29, 2024, relating to the consolidated financial statements

and the effectiveness of internal control over financial reporting of QCR Holdings, Inc., appearing in the Annual Report on Form 10-K

of QCR Holdings, Inc., for the year ended December 31, 2023.

/s/ RSM US LLP

Davenport, Iowa

May 17, 2024

Exhibit 107

Calculation of

Filing Fee Tables

Form S-8

(Form Type)

QCR Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| Security Type | |

Security

Class

Title | |

Fee

Calculation

Rule | |

Amount

Registered(1) | | |

Proposed

Maximum

Offering Price

Per Unit(2) | | |

Maximum

Aggregate

Offering Price(2) | | |

Fee Rate | | |

Amount of

Registration

Fee | |

| Equity | |

Common

Stock, par

value $1.00 per

share | |

Other(2) | |

| 600,000 | | |

$ | 58.83 | | |

$ | 35,298,000 | | |

| 0.00014760 | | |

$ | 5,209.98 | |

| Total Offering Amounts |

| |

| | | |

| | | |

| | | |

| | | |

$ | 5,209.98 | |

| Total Fee Offsets | |

| |

| |

| | | |

| | | |

| | | |

| | | |

$ | 0.00 | |

| Net Fee Due | |

| |

| |

| | | |

| | | |

| | | |

| | | |

$ | 5,209.98 | |

(1) This Registration Statement on Form S-8 covers: (i) 600,000 shares of common stock, par value $1.00 per share, of QCR Holdings, Inc. (the “Registrant”) issuable pursuant to the QCR Holdings, Inc. 2024 Equity Incentive Plan (the “Plan”); and (ii) pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), any additional shares that become issuable under the Plan by reason of any future stock dividend, stock split or other similar transaction.

(2) Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) and Rule 457(h) of the Securities Act on the basis of the average of the high and low sale prices of the Registrant’s common stock as reported on the Nasdaq Global Market on May 14, 2024, which date is within five business days prior to the filing of this Registration Statement.

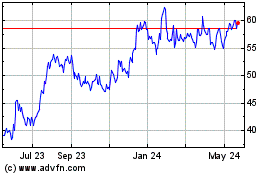

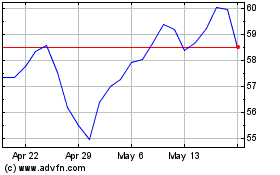

QCR (NASDAQ:QCRH)

Historical Stock Chart

From May 2024 to Jun 2024

QCR (NASDAQ:QCRH)

Historical Stock Chart

From Jun 2023 to Jun 2024