QCR Holdings, Inc. (NASDAQ: QCRH) (the “Company”) today announced

quarterly net income of $26.7 million and diluted earnings per

share (“EPS”) of $1.58 for the first quarter of 2024, compared to

net income of $32.9 million and diluted EPS of $1.95 for the fourth

quarter of 2023.

Adjusted net income (non-GAAP) and adjusted diluted EPS

(non-GAAP) for the first quarter of 2024 were $26.9 million and

$1.59, respectively. For the fourth quarter of 2023, adjusted net

income (non-GAAP) was $33.3 million and adjusted diluted EPS

(non-GAAP) was $1.97. For the first quarter of 2023, net income and

diluted EPS were $27.2 million and $1.60, respectively, and

adjusted net income (non-GAAP) and adjusted diluted EPS (non-GAAP)

were $28.0 million and $1.65, respectively.

|

|

For the Quarter Ended |

|

|

March 31, |

December 31, |

March 31, |

|

$ in millions (except per share data) |

2024 |

2023 |

2023 |

|

Net Income |

$ |

26.7 |

|

$ |

32.9 |

|

$ |

27.2 |

|

Diluted EPS |

$ |

1.58 |

|

$ |

1.95 |

|

$ |

1.60 |

|

Adjusted Net Income (non-GAAP)* |

$ |

26.9 |

|

$ |

33.3 |

|

$ |

28.0 |

|

Adjusted Diluted EPS (non-GAAP)* |

$ |

1.59 |

|

$ |

1.97 |

|

$ |

1.65 |

|

|

|

|

|

|

|

|

|

|

*Adjusted non-GAAP measurements of financial performance exclude

non-core and/or nonrecurring income and expense items that

management believes are not reflective of the anticipated future

operation of the Company’s business. The Company believes these

adjusted measurements provide a better comparison for analysis and

may provide a better indicator of future performance. See GAAP to

non-GAAP reconciliations.

“We delivered strong first quarter results,

highlighted by significant fee income and continued growth in both

our core deposit and loan balances,” said Larry J. Helling, Chief

Executive Officer. “In addition, we continued to benefit from

well-managed expenses, improved upon our already excellent asset

quality and further strengthened our capital levels.”

“Our bankers grew core deposits significantly

during the quarter, adding to our strong and diversified deposit

franchise. As a result, our ratio of loans held for investment to

deposits improved to 93.6%,” added Mr. Helling.

Net Interest Income of $54.7

million

Net interest income for the first quarter of 2024 totaled $54.7

million, a decrease of $1.0 million from the fourth quarter of

2023. Several non-client factors drove this decrease, including the

maturity of $125 million of interest rates caps on the Company’s

indexed deposits and the conversion of $65 million of subordinated

debt to a higher floating rate, which contributed a combined $1.3

million of additional interest expense. In addition, loan discount

accretion decreased by $310 thousand and there was one less day in

the quarter which had an impact of approximately $600 thousand

decrease in net interest income. However, the Company’s net

interest income driven by core activity saw growth of approximately

$1.2 million during the first quarter, led by continued expansion

in loan and investment yields.

In the first quarter of 2024, net interest margin (“NIM”) was

2.82% and NIM on a tax-equivalent yield (“TEY”) basis (non-GAAP)

was 3.25%, down from 2.90% and 3.32% in the prior quarter,

respectively. Adjusted NIM TEY (non-GAAP) of 3.24%, was also down 5

basis points from 3.29% in the fourth quarter of 2023.

“Our adjusted NIM, on a tax equivalent yield basis, declined by

5 basis points from the fourth quarter of 2023 to 3.24% and was at

the low end of our guidance range,” said Todd A. Gipple, President

and Chief Financial Officer. “The decrease resulted primarily from

non-client factors which collectively contributed to 7 basis points

of NIM dilution. However, we were able to partially offset this

non-client impact with core NIM expansion of 2 basis points.

Notably, our core NIM expansion was less than expected due to

additional shifts in our deposit composition. Looking ahead,

considering the forward yield curve and assuming a static funding

mix, we anticipate that the expansion in loan and investment yields

will generally offset any further increase in our funding

costs.”

Strong Noninterest Income Including $16.5

Million of Capital Markets Revenue

Noninterest income for the first quarter of 2024 totaled $26.9

million, down from the record results of $47.7 million in the

fourth quarter of 2023. The Company generated $16.5 million of

capital markets revenue in the quarter, as compared to the record

$37.0 million in the prior quarter. Wealth management revenue was

$4.3 million for the quarter, up 16% on an annualized basis from

$4.1 million in the prior quarter.

“Our capital markets revenue was $16.5 million in the first

quarter as our LIHTC lending and revenue from swap fees continues

to benefit from the strong demand for affordable housing,” added

Mr. Gipple. “Our LIHTC lending and capital markets revenue

pipelines remain healthy.”

Well-Controlled Noninterest Expenses of

$50.7 Million

Noninterest expense for the first quarter of 2024 totaled $50.7

million, compared to $60.9 million for the fourth quarter of 2023

and $48.8 million for the first quarter of 2023. The linked-quarter

decrease was primarily due to lower incentive-based compensation

related to our record fourth quarter and full year performance.

Exceptional Core Deposit Growth and

Increased Liquidity

During the first quarter of 2024, the Company’s core deposits,

which exclude brokered deposits, increased by $316.2 million, or

20.3% on an annualized basis, to $6.5 billion from $6.2 billion in

the fourth quarter of 2023. “The exceptional deposit growth

experienced in the first quarter reflects our commitment to

expanding our market share with existing clients and establishing

new relationships within the communities we serve,” added Mr.

Helling.

Total uninsured and uncollateralized deposits remain very low at

20% of total deposits as of the end of the first quarter 2024, as

compared to 18% as of the end of the fourth quarter of 2023. The

Company increased its liquidity and maintained approximately $3.2

billion of available liquidity sources as of March 31, 2024, which

includes $1.3 billion of immediately available liquidity.

Continued Strong Loan Growth

During the first quarter of 2024, the Company’s total loans and

leases grew $104.9 million to $6.6 billion, or 6.4% on an

annualized basis. During the quarter, the Company designated $275

million of low-income housing tax credit loans as loans held for

sale in anticipation of the Company’s next loan securitization.

“Our ongoing strong performance validates our differentiated

relationship-based community banking model as well as the

underlying economic resiliency across our markets,” added Mr.

Helling. “Given our current pipeline and the continued strength of

our markets, we are maintaining our loan growth target for the full

year 2024 of 8% to 10%, prior to the loan securitizations that we

have planned for the year.”

Asset Quality Remains

Excellent

Nonperforming assets (“NPAs”) totaled $31.3 million at the end

of the first quarter, an 8.5% reduction from $34.2 million at the

end of the fourth quarter of 2023. The ratio of NPAs to total

assets also improved to 0.36% on March 31, 2024, compared to 0.40%

on December 31, 2023. In addition, the Company’s criticized loans

and classified loans to total loans and leases on March 31, 2024

improved to 2.75% and 1.07%, respectively, as compared to 2.99% and

1.08%, respectively as of December 31, 2023.

The Company recorded a total provision for credit losses of $3.0

million during the quarter and the allowance for credit losses to

total loans held for investment was static quarter over quarter at

1.33%.

Continued Strong Capital

Levels

As of March 31, 2024, the Company’s total risk-based capital

ratio was 14.30%, the common equity tier 1 ratio was 9.91% and the

tangible common equity to tangible assets ratio (“TCE”) (non-GAAP)

was 8.94%. By comparison, these respective ratios were 14.29%,

9.67% and 8.75% as of December 31, 2023. The Company remains

focused on growing capital and targeting TCE (non-GAAP) in the top

quartile of the Company’s peer group.

The Company’s tangible book value per share (non-GAAP) increased

by $1.12, or 10.2% annualized, during the fourth quarter.

Accumulated other comprehensive income (“AOCI”) decreased $5.4

million during the quarter primarily due to a decrease in the value

of the Company’s available for sale securities portfolio and

certain derivatives resulting from the change in long-term interest

rates. However, the combination of strong earnings and a modest

dividend contributed to the improvement in tangible book value per

share (non-GAAP).

Conference Call Details

The Company will host an earnings call/webcast tomorrow, April

24, 2024, at 10:00 a.m. Central Time. Dial-in information for the

call is toll-free: 888-346-9286 (international 412-317-5253).

Participants should request to join the QCR Holdings, Inc. call.

The event will be available for replay through May 1, 2024. The

replay access information is 877-344-7529 (international

412-317-0088); access code 3766140. A webcast of the teleconference

can be accessed on the Company’s News and Events page at

www.qcrh.com. An archived version of the webcast will be available

at the same location shortly after the live event has ended.

About UsQCR Holdings, Inc., headquartered in

Moline, Illinois, is a relationship-driven, multi-bank holding

company serving the Quad Cities, Cedar Rapids, Cedar Valley, Des

Moines/Ankeny and Springfield communities through its wholly owned

subsidiary banks. The banks provide full-service commercial and

consumer banking and trust and wealth management services. Quad

City Bank & Trust Company, based in Bettendorf, Iowa, commenced

operations in 1994, Cedar Rapids Bank & Trust Company, based in

Cedar Rapids, Iowa, commenced operations in 2001, Community State

Bank, based in Ankeny, Iowa, was acquired by the Company in 2016,

Springfield First Community Bank, based in Springfield, Missouri,

was acquired by the Company in 2018, and Guaranty Bank, also based

in Springfield, Missouri, was acquired by the Company and merged

with Springfield First Community Bank in 2022, with the combined

entity operating under the Guaranty Bank name. Additionally, the

Company serves the Waterloo/Cedar Falls, Iowa community through

Community Bank & Trust, a division of Cedar Rapids Bank &

Trust Company. Quad City Bank & Trust Company offers equipment

loans and leases to businesses through its wholly owned subsidiary,

m2 Equipment Finance, LLC, based in Waukesha, Wisconsin, and also

provides correspondent banking services. The Company has 36

locations in Iowa, Missouri, Wisconsin and Illinois. As of March

31, 2024, the Company had $8.6 billion in assets, $6.6 billion in

loans and $6.8 billion in deposits. For additional information,

please visit the Company’s website at www.qcrh.com.

Special Note Concerning Forward-Looking

Statements. This document contains, and future oral and

written statements of the Company and its management may contain,

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 with respect to the

financial condition, results of operations, plans, objectives,

future performance and business of the Company. Forward-looking

statements, which may be based upon beliefs, expectations and

assumptions of the Company’s management and on information

currently available to management, are generally identifiable by

the use of words such as “believe,” “expect,” “anticipate,” “bode”,

“predict,” “suggest,” “project”, “appear,” “plan,” “intend,”

“estimate,” ”annualize,” “may,” “will,” “would,” “could,” “should,”

“likely,” “might,” “potential,” “continue,” “annualized,” “target,”

“outlook,” as well as the negative forms of those words, or other

similar expressions. Additionally, all statements in this document,

including forward-looking statements, speak only as of the date

they are made, and the Company undertakes no obligation to update

any statement in light of new information or future events.

A number of factors, many of which are beyond the ability of the

Company to control or predict, could cause actual results to differ

materially from those in its forward-looking statements. These

factors include, among others, the following: (i) the strength of

the local, state, national and international economies(including

effects of inflationary pressures and supply chain constraints);

(ii) the economic impact of any future terrorist threats and

attacks, widespread disease or pandemics, acts of war or other

threats thereof (including the ongoing Israeli-Palestinian conflict

and the Russian invasion of Ukraine), or other adverse external

events that could cause economic deterioration or instability in

credit markets, and the response of the local, state and national

governments to any such adverse external events; (iii) changes in

accounting policies and practices, as may be adopted by state and

federal regulatory agencies, the Financial Accounting Standards

Board or the Public Company Accounting Oversight Board; (iv)

changes in local, state and federal laws, regulations and

governmental policies concerning the Company’s general business as

a result of the upcoming 2024 presidential election or any changes

in response to failures of other banks; (vi) increased

competition in the financial services sector, including from

non-bank competitors such as credit unions and “fintech” companies,

and the inability to attract new customers; (vii) changes in

technology and the ability to develop and maintain secure and

reliable electronic systems; (viii) unexpected results of

acquisitions, which may include failure to realize the anticipated

benefits of acquisitions and the possibility that transaction costs

may be greater than anticipated; (ix) the loss of key executives or

employees; (x) changes in consumer spending; (xi) unexpected

outcomes of existing or new litigation involving the Company; (xii)

the economic impact of exceptional weather occurrences such as

tornadoes, floods and blizzards; (xiii) fluctuations in the value

of securities held in our securities portfolio; (xiv)

concentrations within our loan portfolio, large loans to certain

borrowers, and large deposits from certain clients; (xv) the

concentration of large deposits from certain clients who have

balances above current Federal Deposit Insurance Corporation

insurance limits and may withdraw deposits to diversity their

exposure; (xvi) the level of non-performing assets on our balance

sheets; (xvii) interruptions involving our information technology

and communications systems or third-party servicers; (xviii)

breaches or failures of our information security controls or

cybersecurity-related incidents, and (xixi) the ability of the

Company to manage the risks associated with the foregoing as well

as anticipated. These risks and uncertainties should be considered

in evaluating forward-looking statements and undue reliance should

not be placed on such statements. Additional information concerning

the Company and its business, including additional factors that

could materially affect the Company’s financial results, is

included in the Company’s filings with the Securities and Exchange

Commission.

Contact:Todd A. GipplePresidentChief Financial Officer(309)

743-7745tgipple@qcrh.com

|

QCR Holding, Inc. |

|

Consolidated Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

As of |

|

|

March 31, |

December 31, |

September 30, |

June 30, |

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

CONDENSED BALANCE SHEET |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

$ |

80,988 |

|

$ |

97,123 |

|

$ |

104,265 |

|

$ |

84,084 |

|

$ |

64,295 |

|

|

Federal funds sold and interest-bearing deposits |

|

77,020 |

|

|

140,369 |

|

|

80,650 |

|

|

175,012 |

|

|

253,997 |

|

|

Securities, net of allowance for credit losses |

|

1,031,861 |

|

|

1,005,528 |

|

|

896,394 |

|

|

882,888 |

|

|

877,446 |

|

|

Loans receivable held for sale (1) |

|

275,344 |

|

|

2,594 |

|

|

278,893 |

|

|

295,057 |

|

|

140,633 |

|

|

Loans/leases receivable held for investment |

|

6,372,992 |

|

|

6,540,822 |

|

|

6,327,414 |

|

|

6,084,263 |

|

|

6,049,389 |

|

|

Allowance for credit losses |

|

(84,470 |

) |

|

(87,200 |

) |

|

(87,669 |

) |

|

(85,797 |

) |

|

(86,573 |

) |

|

Intangibles |

|

13,131 |

|

|

13,821 |

|

|

14,537 |

|

|

15,228 |

|

|

15,993 |

|

|

Goodwill |

|

139,027 |

|

|

139,027 |

|

|

139,027 |

|

|

139,027 |

|

|

138,474 |

|

|

Derivatives |

|

183,888 |

|

|

188,978 |

|

|

291,295 |

|

|

170,294 |

|

|

130,350 |

|

|

Other assets |

|

509,768 |

|

|

497,832 |

|

|

495,251 |

|

|

466,617 |

|

|

452,900 |

|

|

Total assets |

$ |

8,599,549 |

|

$ |

8,538,894 |

|

$ |

8,540,057 |

|

$ |

8,226,673 |

|

$ |

8,036,904 |

|

|

|

|

|

|

|

|

|

Total deposits |

$ |

6,806,775 |

|

$ |

6,514,005 |

|

$ |

6,494,852 |

|

$ |

6,606,720 |

|

$ |

6,501,663 |

|

|

Total borrowings |

|

489,633 |

|

|

718,295 |

|

|

712,126 |

|

|

418,368 |

|

|

417,480 |

|

|

Derivatives |

|

211,677 |

|

|

214,098 |

|

|

320,220 |

|

|

195,841 |

|

|

150,401 |

|

|

Other liabilities |

|

184,122 |

|

|

205,900 |

|

|

184,476 |

|

|

183,055 |

|

|

165,866 |

|

|

Total stockholders' equity |

|

907,342 |

|

|

886,596 |

|

|

828,383 |

|

|

822,689 |

|

|

801,494 |

|

|

Total liabilities and stockholders' equity |

$ |

8,599,549 |

|

$ |

8,538,894 |

|

$ |

8,540,057 |

|

$ |

8,226,673 |

|

$ |

8,036,904 |

|

|

|

|

|

|

|

|

|

ANALYSIS OF LOAN PORTFOLIO |

|

|

|

|

|

|

Loan/lease mix: (2) |

|

|

|

|

|

|

Commercial and industrial - revolving |

$ |

326,129 |

|

$ |

325,243 |

|

$ |

299,588 |

|

$ |

304,617 |

|

$ |

307,612 |

|

|

Commercial and industrial - other |

|

1,374,333 |

|

|

1,390,068 |

|

|

1,381,967 |

|

|

1,308,853 |

|

|

1,322,384 |

|

|

Commercial and industrial - other - LIHTC |

|

96,276 |

|

|

91,710 |

|

|

105,601 |

|

|

93,700 |

|

|

97,947 |

|

|

Total commercial and industrial |

|

1,796,738 |

|

|

1,807,021 |

|

|

1,787,156 |

|

|

1,707,170 |

|

|

1,727,943 |

|

|

Commercial real estate, owner occupied |

|

621,069 |

|

|

607,365 |

|

|

610,618 |

|

|

609,717 |

|

|

616,922 |

|

|

Commercial real estate, non-owner occupied |

|

1,055,089 |

|

|

1,008,892 |

|

|

955,552 |

|

|

963,814 |

|

|

982,716 |

|

|

Construction and land development |

|

410,918 |

|

|

477,424 |

|

|

472,695 |

|

|

437,682 |

|

|

448,261 |

|

|

Construction and land development - LIHTC |

|

738,609 |

|

|

943,101 |

|

|

921,359 |

|

|

870,084 |

|

|

759,924 |

|

|

Multi-family |

|

296,245 |

|

|

284,721 |

|

|

282,541 |

|

|

280,418 |

|

|

229,370 |

|

|

Multi-family - LIHTC |

|

1,007,321 |

|

|

711,422 |

|

|

874,439 |

|

|

820,376 |

|

|

740,500 |

|

|

Direct financing leases |

|

28,089 |

|

|

31,164 |

|

|

34,401 |

|

|

32,937 |

|

|

35,373 |

|

|

1-4 family real estate |

|

563,358 |

|

|

544,971 |

|

|

539,931 |

|

|

535,405 |

|

|

532,491 |

|

|

Consumer |

|

130,900 |

|

|

127,335 |

|

|

127,615 |

|

|

121,717 |

|

|

116,522 |

|

|

Total loans/leases |

$ |

6,648,336 |

|

$ |

6,543,416 |

|

$ |

6,606,307 |

|

$ |

6,379,320 |

|

$ |

6,190,022 |

|

|

Less allowance for credit losses |

|

84,470 |

|

|

87,200 |

|

|

87,669 |

|

|

85,797 |

|

|

86,573 |

|

|

Net loans/leases |

$ |

6,563,866 |

|

$ |

6,456,216 |

|

$ |

6,518,638 |

|

$ |

6,293,523 |

|

$ |

6,103,449 |

|

|

|

|

|

|

|

|

|

ANALYSIS OF SECURITIES PORTFOLIO |

|

|

|

|

|

|

Securities mix: |

|

|

|

|

|

|

U.S. government sponsored agency securities |

$ |

14,442 |

|

$ |

14,973 |

|

$ |

16,002 |

|

$ |

18,942 |

|

$ |

19,320 |

|

|

Municipal securities |

|

884,469 |

|

|

853,645 |

|

|

764,017 |

|

|

743,608 |

|

|

731,689 |

|

|

Residential mortgage-backed and related securities |

|

56,071 |

|

|

59,196 |

|

|

57,946 |

|

|

60,958 |

|

|

63,104 |

|

|

Asset backed securities |

|

14,285 |

|

|

15,423 |

|

|

16,326 |

|

|

17,393 |

|

|

17,967 |

|

|

Other securities |

|

40,539 |

|

|

41,115 |

|

|

43,272 |

|

|

43,156 |

|

|

46,535 |

|

|

Trading securities |

|

22,258 |

|

|

22,368 |

|

|

- |

|

|

- |

|

|

- |

|

|

Total securities (3) |

$ |

1,032,064 |

|

$ |

1,006,720 |

|

$ |

897,563 |

|

$ |

884,057 |

|

$ |

878,615 |

|

|

Less allowance for credit losses |

|

203 |

|

|

1,192 |

|

|

1,169 |

|

|

1,169 |

|

|

1,169 |

|

|

Net securities |

$ |

1,031,861 |

|

$ |

1,005,528 |

|

$ |

896,394 |

|

$ |

882,888 |

|

$ |

877,446 |

|

|

|

|

|

|

|

|

|

ANALYSIS OF DEPOSITS |

|

|

|

|

|

|

Deposit mix: |

|

|

|

|

|

|

Noninterest-bearing demand deposits |

$ |

955,167 |

|

$ |

1,038,689 |

|

$ |

1,027,791 |

|

$ |

1,101,605 |

|

$ |

1,189,858 |

|

|

Interest-bearing demand deposits |

|

4,714,555 |

|

|

4,338,390 |

|

|

4,416,725 |

|

|

4,374,847 |

|

|

4,033,193 |

|

|

Time deposits |

|

875,491 |

|

|

851,950 |

|

|

788,692 |

|

|

765,801 |

|

|

679,946 |

|

|

Brokered deposits |

|

261,562 |

|

|

284,976 |

|

|

261,644 |

|

|

364,467 |

|

|

598,666 |

|

|

Total deposits |

$ |

6,806,775 |

|

$ |

6,514,005 |

|

$ |

6,494,852 |

|

$ |

6,606,720 |

|

$ |

6,501,663 |

|

|

|

|

|

|

|

|

|

ANALYSIS OF BORROWINGS |

|

|

|

|

|

|

Borrowings mix: |

|

|

|

|

|

|

Term FHLB advances |

$ |

135,000 |

|

$ |

135,000 |

|

$ |

135,000 |

|

$ |

135,000 |

|

$ |

135,000 |

|

|

Overnight FHLB advances |

|

70,000 |

|

|

300,000 |

|

|

295,000 |

|

|

- |

|

|

- |

|

|

Other short-term borrowings |

|

2,700 |

|

|

1,500 |

|

|

470 |

|

|

1,850 |

|

|

1,100 |

|

|

Subordinated notes |

|

233,170 |

|

|

233,064 |

|

|

232,958 |

|

|

232,852 |

|

|

232,746 |

|

|

Junior subordinated debentures |

|

48,763 |

|

|

48,731 |

|

|

48,698 |

|

|

48,666 |

|

|

48,634 |

|

|

Total borrowings |

$ |

489,633 |

|

$ |

718,295 |

|

$ |

712,126 |

|

$ |

418,368 |

|

$ |

417,480 |

|

|

|

|

|

|

|

|

|

(1) Loans with a fair value of $274.8 million, $278.0 million,

$291.0 million and $139.2 million have been identified for

securitization and are included in LHFS at March 31, 2024,

September 30, 2023, June 30, 2023 and March 31, 2023

respectively. |

|

(2) Loan categories with significant LIHTC loan balances have been

broken out separately. Total LIHTC balances within the loan/lease

portfolio were $1.9 billion at March 31, 2024. |

|

(3) As of March 31, 2024 and December 31, 2023, trading securities

consisted of retained beneficial interests acquired in

conjunction with Freddie Mac securitizations completed by the

Company in 2023. |

|

|

|

|

|

|

|

|

QCR Holding, Inc. |

|

Consolidated Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

March 31, |

December 31, |

September 30, |

June 30, |

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

(dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

INCOME STATEMENT |

|

|

|

|

|

|

Interest income |

$ |

115,049 |

|

$ |

112,248 |

|

$ |

108,568 |

|

$ |

98,377 |

$ |

94,217 |

|

|

Interest expense |

|

60,350 |

|

|

56,512 |

|

|

53,313 |

|

|

45,172 |

|

37,407 |

|

|

Net interest income |

|

54,699 |

|

|

55,736 |

|

|

55,255 |

|

|

53,205 |

|

56,810 |

|

|

Provision for credit losses |

|

2,969 |

|

|

5,199 |

|

|

3,806 |

|

|

3,606 |

|

3,928 |

|

|

Net interest income after provision for credit

losses |

$ |

51,730 |

|

$ |

50,537 |

|

$ |

51,449 |

|

$ |

49,599 |

$ |

52,882 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust fees |

$ |

3,199 |

|

$ |

3,084 |

|

$ |

2,863 |

|

$ |

2,844 |

$ |

2,906 |

|

|

Investment advisory and management fees |

|

1,101 |

|

|

1,052 |

|

|

947 |

|

|

986 |

|

879 |

|

|

Deposit service fees |

|

2,022 |

|

|

2,008 |

|

|

2,107 |

|

|

2,034 |

|

2,028 |

|

|

Gains on sales of residential real estate loans, net |

|

382 |

|

|

323 |

|

|

476 |

|

|

500 |

|

312 |

|

|

Gains on sales of government guaranteed portions of loans, net |

|

24 |

|

|

24 |

|

|

- |

|

|

- |

|

30 |

|

|

Capital markets revenue |

|

16,457 |

|

|

36,956 |

|

|

15,596 |

|

|

22,490 |

|

17,023 |

|

|

Securities gains (losses), net |

|

- |

|

|

- |

|

|

- |

|

|

12 |

|

(463 |

) |

|

Earnings on bank-owned life insurance |

|

868 |

|

|

832 |

|

|

1,807 |

|

|

838 |

|

707 |

|

|

Debit card fees |

|

1,466 |

|

|

1,561 |

|

|

1,584 |

|

|

1,589 |

|

1,466 |

|

|

Correspondent banking fees |

|

512 |

|

|

465 |

|

|

450 |

|

|

356 |

|

391 |

|

|

Loan related fee income |

|

836 |

|

|

845 |

|

|

800 |

|

|

770 |

|

651 |

|

|

Fair value gain (loss) on derivatives |

|

(163 |

) |

|

(582 |

) |

|

(336 |

) |

|

83 |

|

(427 |

) |

|

Other |

|

154 |

|

|

1,161 |

|

|

299 |

|

|

18 |

|

339 |

|

|

Total noninterest income |

$ |

26,858 |

|

$ |

47,729 |

|

$ |

26,593 |

|

$ |

32,520 |

$ |

25,842 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

$ |

31,860 |

|

$ |

41,059 |

|

$ |

32,098 |

|

$ |

31,459 |

$ |

32,003 |

|

|

Occupancy and equipment expense |

|

6,514 |

|

|

6,789 |

|

|

6,228 |

|

|

6,100 |

|

5,914 |

|

|

Professional and data processing fees |

|

4,613 |

|

|

4,223 |

|

|

4,456 |

|

|

4,078 |

|

3,514 |

|

|

Post-acquisition compensation, transition and integration

costs |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

207 |

|

|

FDIC insurance, other insurance and regulatory fees |

|

1,945 |

|

|

2,115 |

|

|

1,721 |

|

|

1,927 |

|

1,374 |

|

|

Loan/lease expense |

|

378 |

|

|

834 |

|

|

826 |

|

|

652 |

|

556 |

|

|

Net cost of (income from) and gains/losses on operations of other

real estate |

|

(30 |

) |

|

38 |

|

|

3 |

|

|

- |

|

(67 |

) |

|

Advertising and marketing |

|

1,483 |

|

|

1,641 |

|

|

1,429 |

|

|

1,735 |

|

1,237 |

|

|

Communication and data connectivity |

|

401 |

|

|

449 |

|

|

478 |

|

|

471 |

|

665 |

|

|

Supplies |

|

275 |

|

|

333 |

|

|

335 |

|

|

281 |

|

305 |

|

|

Bank service charges |

|

568 |

|

|

761 |

|

|

605 |

|

|

621 |

|

605 |

|

|

Correspondent banking expense |

|

305 |

|

|

300 |

|

|

232 |

|

|

221 |

|

210 |

|

|

Intangibles amortization |

|

690 |

|

|

716 |

|

|

691 |

|

|

765 |

|

766 |

|

|

Payment card processing |

|

646 |

|

|

836 |

|

|

733 |

|

|

542 |

|

545 |

|

|

Trust expense |

|

425 |

|

|

413 |

|

|

432 |

|

|

337 |

|

214 |

|

|

Other |

|

617 |

|

|

431 |

|

|

814 |

|

|

538 |

|

737 |

|

|

Total noninterest expense |

$ |

50,690 |

|

$ |

60,938 |

|

$ |

51,081 |

|

$ |

49,727 |

$ |

48,785 |

|

|

|

|

|

|

|

|

|

Net income before income taxes |

$ |

27,898 |

|

$ |

37,328 |

|

$ |

26,961 |

|

$ |

32,392 |

$ |

29,939 |

|

|

Federal and state income tax expense |

|

1,172 |

|

|

4,473 |

|

|

1,840 |

|

|

3,967 |

|

2,782 |

|

|

Net income |

$ |

26,726 |

|

$ |

32,855 |

|

$ |

25,121 |

|

$ |

28,425 |

$ |

27,157 |

|

|

|

|

|

|

|

|

|

Basic EPS |

$ |

1.59 |

|

$ |

1.96 |

|

$ |

1.50 |

|

$ |

1.70 |

$ |

1.62 |

|

|

Diluted EPS |

$ |

1.58 |

|

$ |

1.95 |

|

$ |

1.49 |

|

$ |

1.69 |

$ |

1.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

16,783,348 |

|

|

16,734,080 |

|

|

16,717,303 |

|

|

16,701,950 |

|

16,776,289 |

|

|

Weighted average common and common equivalent shares

outstanding |

|

16,910,675 |

|

|

16,875,952 |

|

|

16,847,951 |

|

|

16,799,527 |

|

16,942,132 |

|

|

|

|

|

|

|

|

|

QCR Holding, Inc. |

|

Consolidated Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

As of and for the Quarter Ended |

|

|

March 31, |

December 31, |

September 30, |

June 30, |

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

(dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

COMMON SHARE DATA |

|

|

|

|

|

|

Common shares outstanding |

|

16,807,056 |

|

|

16,749,254 |

|

|

16,731,646 |

|

|

16,713,853 |

|

|

16,713,775 |

|

|

Book value per common share (1) |

$ |

53.99 |

|

$ |

52.93 |

|

$ |

49.51 |

|

$ |

49.22 |

|

$ |

47.95 |

|

|

Tangible book value per common share (Non-GAAP) (2) |

$ |

44.93 |

|

$ |

43.81 |

|

$ |

40.33 |

|

$ |

39.99 |

|

$ |

38.71 |

|

|

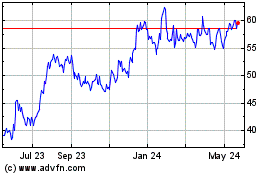

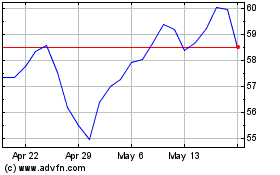

Closing stock price |

$ |

60.74 |

|

$ |

58.39 |

|

$ |

48.52 |

|

$ |

41.03 |

|

$ |

43.91 |

|

|

Market capitalization |

$ |

1,020,861 |

|

$ |

977,989 |

|

$ |

811,819 |

|

$ |

685,769 |

|

$ |

733,902 |

|

|

Market price / book value |

|

112.51 |

% |

|

100.31 |

% |

|

98.00 |

% |

|

83.36 |

% |

|

91.57 |

% |

|

Market price / tangible book value |

|

135.18 |

% |

|

133.29 |

% |

|

120.30 |

% |

|

102.59 |

% |

|

113.43 |

% |

|

Earnings per common share (basic) LTM (3) |

$ |

6.75 |

|

$ |

6.78 |

|

$ |

6.65 |

|

$ |

6.89 |

|

$ |

6.06 |

|

|

Price earnings ratio LTM (3) |

9.00 x |

8.61 x |

7.30 x |

5.96 x |

7.24 x |

|

TCE / TA (Non-GAAP) (4) |

|

8.94 |

% |

|

8.75 |

% |

|

8.05 |

% |

|

8.28 |

% |

|

8.21 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDENSED STATEMENT OF CHANGES IN STOCKHOLDERS'

EQUITY |

|

|

Beginning balance |

$ |

886,596 |

|

$ |

828,383 |

|

$ |

822,689 |

|

$ |

801,494 |

|

$ |

772,724 |

|

|

Net income |

|

26,726 |

|

|

32,855 |

|

|

25,121 |

|

|

28,425 |

|

|

27,157 |

|

|

Other comprehensive income (loss), net of tax |

|

(5,373 |

) |

|

25,363 |

|

|

(19,415 |

) |

|

(6,336 |

) |

|

9,325 |

|

|

Common stock cash dividends declared |

|

(1,008 |

) |

|

(1,004 |

) |

|

(1,003 |

) |

|

(1,003 |

) |

|

(1,010 |

) |

|

Repurchase and cancellation of shares of common stock as a result

of a share repurchase program |

|

- |

|

|

- |

|

|

- |

|

|

(967 |

) |

|

(7,719 |

) |

|

Other (5) |

|

401 |

|

|

999 |

|

|

991 |

|

|

1,076 |

|

|

1,017 |

|

|

Ending balance |

$ |

907,342 |

|

$ |

886,596 |

|

$ |

828,383 |

|

$ |

822,689 |

|

$ |

801,494 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REGULATORY CAPITAL RATIOS (6): |

|

|

|

|

|

|

Total risk-based capital ratio |

|

14.30 |

% |

|

14.29 |

% |

|

14.48 |

% |

|

14.64 |

% |

|

14.64 |

% |

|

Tier 1 risk-based capital ratio |

|

10.50 |

% |

|

10.27 |

% |

|

10.30 |

% |

|

10.34 |

% |

|

10.23 |

% |

|

Tier 1 leverage capital ratio |

|

10.33 |

% |

|

10.03 |

% |

|

9.92 |

% |

|

10.06 |

% |

|

9.73 |

% |

|

Common equity tier 1 ratio |

|

9.91 |

% |

|

9.67 |

% |

|

9.68 |

% |

|

9.70 |

% |

|

9.57 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KEY PERFORMANCE RATIOS AND OTHER METRICS |

|

|

|

|

|

|

Return on average assets (annualized) |

|

1.25 |

% |

|

1.53 |

% |

|

1.21 |

% |

|

1.44 |

% |

|

1.37 |

% |

|

Return on average total equity (annualized) |

|

11.83 |

% |

|

15.35 |

% |

|

11.95 |

% |

|

13.97 |

% |

|

13.67 |

% |

|

Net interest margin |

|

2.82 |

% |

|

2.90 |

% |

|

2.89 |

% |

|

2.93 |

% |

|

3.18 |

% |

|

Net interest margin (TEY) (Non-GAAP)(7) |

|

3.25 |

% |

|

3.32 |

% |

|

3.31 |

% |

|

3.29 |

% |

|

3.52 |

% |

|

Efficiency ratio (Non-GAAP) (8) |

|

62.15 |

% |

|

58.90 |

% |

|

62.41 |

% |

|

58.01 |

% |

|

59.02 |

% |

|

Gross loans/leases held for investment / total assets |

|

74.11 |

% |

|

76.60 |

% |

|

74.09 |

% |

|

73.96 |

% |

|

75.27 |

% |

|

Gross loans/leases held for investment / total deposits |

|

93.63 |

% |

|

100.41 |

% |

|

97.42 |

% |

|

92.09 |

% |

|

93.04 |

% |

|

Effective tax rate |

|

4.20 |

% |

|

11.98 |

% |

|

6.82 |

% |

|

12.25 |

% |

|

9.29 |

% |

|

Full-time equivalent employees (9) |

|

986 |

|

|

996 |

|

|

987 |

|

|

1009 |

|

|

969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE BALANCES |

|

|

|

|

|

|

Assets |

$ |

8,550,855 |

|

$ |

8,535,732 |

|

$ |

8,287,813 |

|

$ |

7,924,597 |

|

$ |

7,906,830 |

|

|

Loans/leases |

|

6,598,614 |

|

|

6,483,572 |

|

|

6,476,512 |

|

|

6,219,980 |

|

|

6,165,115 |

|

|

Deposits |

|

6,595,453 |

|

|

6,485,154 |

|

|

6,342,339 |

|

|

6,292,481 |

|

|

6,179,644 |

|

|

Total stockholders' equity |

|

903,371 |

|

|

852,163 |

|

|

837,734 |

|

|

816,882 |

|

|

794,685 |

|

|

|

|

|

|

|

|

|

(1) Includes accumulated other comprehensive income (loss). |

|

|

|

|

|

(2) Includes accumulated other comprehensive income (loss) and

excludes intangible assets. See GAAP to Non-GAAP

reconciliations. |

|

(3) LTM : Last twelve months. |

|

|

|

|

|

|

(4) TCE / TCA : tangible common equity / total tangible assets. See

GAAP to non-GAAP reconciliations. |

|

|

(5) Includes mostly common stock issued for options exercised and

the employee stock purchase plan, as well as stock-based

compensation. |

|

(6) Ratios for the current quarter are subject to change upon final

calculation for regulatory filings due after earnings release. |

|

(7) TEY : Tax equivalent yield. See GAAP to Non-GAAP

reconciliations. |

|

|

|

|

(8) See GAAP to Non-GAAP reconciliations. |

|

|

|

|

|

|

(9) The increase in full-time equivalent employees in the second

quarter of 2023 and the subsequent decline in the third quarter of

2023 includes 19 summer interns. |

|

|

|

|

|

|

|

|

QCR Holding, Inc. |

|

Consolidated Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANALYSIS OF NET INTEREST INCOME AND MARGIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

March 31, 2024 |

|

December 31, 2023 |

|

March 31, 2023 |

|

|

Average Balance |

Interest Earned or Paid |

Average Yield or Cost |

|

Average Balance |

Interest Earned or Paid |

Average Yield or Cost |

|

Average Balance |

Interest Earned or Paid |

Average Yield or Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fed funds sold |

$ |

19,955 |

$ |

269 |

5.42 |

% |

|

$ |

18,644 |

$ |

257 |

5.47 |

% |

|

$ |

19,275 |

$ |

234 |

4.93 |

% |

|

Interest-bearing deposits at financial institutions |

|

91,557 |

|

1,200 |

5.27 |

% |

|

|

72,439 |

|

986 |

5.40 |

% |

|

|

73,584 |

|

821 |

4.53 |

% |

|

Investment securities - taxable |

|

373,540 |

|

4,261 |

4.55 |

% |

|

|

365,686 |

|

4,080 |

4.45 |

% |

|

|

332,640 |

|

3,366 |

4.05 |

% |

|

Investment securities - nontaxable (1) |

|

685,969 |

|

9,349 |

5.45 |

% |

|

|

650,069 |

|

8,380 |

5.15 |

% |

|

|

619,225 |

|

6,791 |

4.39 |

% |

|

Restricted investment securities |

|

38,085 |

|

674 |

7.00 |

% |

|

|

40,625 |

|

670 |

6.45 |

% |

|

|

37,766 |

|

513 |

5.43 |

% |

|

Loans (1) |

|

6,598,614 |

|

107,673 |

6.56 |

% |

|

|

6,483,572 |

|

105,830 |

6.48 |

% |

|

|

6,165,115 |

|

88,548 |

5.82 |

% |

|

Total earning assets (1) |

$ |

7,807,720 |

$ |

123,426 |

6.35 |

% |

|

$ |

7,631,035 |

$ |

120,203 |

6.26 |

% |

|

$ |

7,247,605 |

$ |

100,273 |

5.60 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

$ |

4,529,325 |

$ |

39,072 |

3.47 |

% |

|

$ |

4,465,279 |

$ |

37,082 |

3.29 |

% |

|

$ |

4,067,405 |

$ |

23,776 |

2.37 |

% |

|

Time deposits |

|

1,107,622 |

|

12,345 |

4.48 |

% |

|

|

982,356 |

|

10,559 |

4.26 |

% |

|

|

869,912 |

|

6,003 |

2.80 |

% |

|

Short-term borrowings |

|

1,763 |

|

23 |

5.16 |

% |

|

|

1,101 |

|

15 |

5.18 |

% |

|

|

7,573 |

|

99 |

5.28 |

% |

|

Federal Home Loan Bank advances |

|

355,220 |

|

4,738 |

5.28 |

% |

|

|

360,000 |

|

4,841 |

5.26 |

% |

|

|

296,333 |

|

3,521 |

4.75 |

% |

|

Subordinated debentures |

|

233,101 |

|

3,480 |

5.97 |

% |

|

|

232,994 |

|

3,308 |

5.68 |

% |

|

|

232,679 |

|

3,311 |

5.69 |

% |

|

Junior subordinated debentures |

|

48,742 |

|

692 |

5.62 |

% |

|

|

48,710 |

|

708 |

5.68 |

% |

|

|

48,613 |

|

696 |

5.72 |

% |

|

Total interest-bearing liabilities |

$ |

6,275,773 |

$ |

60,350 |

3.86 |

% |

|

$ |

6,090,440 |

$ |

56,513 |

3.68 |

% |

|

$ |

5,522,515 |

$ |

37,406 |

2.74 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income (1) |

|

$ |

63,076 |

|

|

|

$ |

63,690 |

|

|

|

$ |

62,867 |

|

|

Net interest margin (2) |

|

|

2.82 |

% |

|

|

|

2.90 |

% |

|

|

|

3.18 |

% |

|

Net interest margin (TEY) (Non-GAAP) (1) (2) (3) |

|

|

3.25 |

% |

|

|

|

3.32 |

% |

|

|

|

3.52 |

% |

|

Adjusted net interest margin (TEY) (Non-GAAP) (1) (2) (3) |

|

|

3.24 |

% |

|

|

|

3.29 |

% |

|

|

|

3.47 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes nontaxable securities and loans. Interest earned and

yields on nontaxable securities and loans are determined on a tax

equivalent basis using a 21% tax rate. |

|

(2) See "Select Financial Data - Subsidiaries" for a breakdown of

amortization/accretion included in net interest margin for each

period presented. |

|

(3) TEY : Tax equivalent yield. See GAAP to Non-GAAP

reconciliations. |

|

QCR Holding, Inc. |

|

Consolidated Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

March 31, |

December 31, |

September 30, |

June 30, |

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

(dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

ROLLFORWARD OF ALLOWANCE FOR CREDIT LOSSES ON

LOANS/LEASES |

|

|

|

|

|

|

Beginning balance |

$ |

87,200 |

|

$ |

87,669 |

|

$ |

85,797 |

|

$ |

86,573 |

|

$ |

87,706 |

|

|

Change in ACL for transfer of loans to LHFS |

|

(3,377 |

) |

|

266 |

|

|

175 |

|

|

(2,277 |

) |

|

(1,709 |

) |

|

Credit loss expense |

|

3,736 |

|

|

2,519 |

|

|

3,260 |

|

|

3,313 |

|

|

2,458 |

|

|

Loans/leases charged off |

|

(3,560 |

) |

|

(3,354 |

) |

|

(1,816 |

) |

|

(1,947 |

) |

|

(2,275 |

) |

|

Recoveries on loans/leases previously charged off |

|

471 |

|

|

100 |

|

|

253 |

|

|

135 |

|

|

393 |

|

|

Ending balance |

$ |

84,470 |

|

$ |

87,200 |

|

$ |

87,669 |

|

$ |

85,797 |

|

$ |

86,573 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONPERFORMING ASSETS |

|

|

|

|

|

|

Nonaccrual loans/leases |

$ |

29,439 |

|

$ |

32,753 |

|

$ |

34,568 |

|

$ |

26,062 |

|

$ |

22,947 |

|

|

Accruing loans/leases past due 90 days or more |

|

142 |

|

|

86 |

|

|

- |

|

|

83 |

|

|

15 |

|

|

Total nonperforming loans/leases |

|

29,581 |

|

|

32,839 |

|

|

34,568 |

|

|

26,145 |

|

|

22,962 |

|

|

Other real estate owned |

|

784 |

|

|

1,347 |

|

|

120 |

|

|

- |

|

|

61 |

|

|

Other repossessed assets |

|

962 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

Total nonperforming assets |

$ |

31,327 |

|

$ |

34,186 |

|

$ |

34,688 |

|

$ |

26,145 |

|

$ |

23,023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY RATIOS |

|

|

|

|

|

|

Nonperforming assets / total assets |

|

0.36 |

% |

|

0.40 |

% |

|

0.41 |

% |

|

0.32 |

% |

|

0.29 |

% |

|

ACL for loans and leases / total loans/leases held for

investment |

|

1.33 |

% |

|

1.33 |

% |

|

1.39 |

% |

|

1.41 |

% |

|

1.43 |

% |

|

ACL for loans and leases / nonperforming loans/leases |

|

285.55 |

% |

|

265.54 |

% |

|

253.61 |

% |

|

328.16 |

% |

|

377.03 |

% |

|

Net charge-offs as a % of average loans/leases |

|

0.05 |

% |

|

0.05 |

% |

|

0.02 |

% |

|

0.03 |

% |

|

0.03 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTERNALLY ASSIGNED RISK RATING (1) (2) |

|

|

|

|

|

|

Special mention |

$ |

111,729 |

|

$ |

125,308 |

|

$ |

128,052 |

|

$ |

117,761 |

|

$ |

125,170 |

|

|

Substandard/Classified loans (3) |

|

70,841 |

|

|

70,425 |

|

|

72,550 |

|

|

67,192 |

|

|

74,307 |

|

|

Doubtful/Classified loans (3) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

Criticized loans (4) |

$ |

182,570 |

|

$ |

194,674 |

|

$ |

200,602 |

|

$ |

184,953 |

|

$ |

199,477 |

|

|

|

|

|

|

|

|

|

Classified loans as a % of total loans/leases |

|

1.07 |

% |

|

1.08 |

% |

|

1.10 |

% |

|

1.05 |

% |

|

1.20 |

% |

|

Criticized loans as a % of total loans/leases |

|

2.75 |

% |

|

2.98 |

% |

|

3.04 |

% |

|

2.90 |

% |

|

3.22 |

% |

|

|

|

|

|

|

|

|

(1) During the first quarter of 2024, the Company revised the risk

rating scale used for credit quality monitoring. |

|

(2) Amounts exclude the government guaranteed portion, if any. The

Company assigns internal risk ratings of Pass for the government

guaranteed portion. |

|

(3) Classified loans are defined as loans with internally assigned

risk ratings of 10 or 11 (7 or 8 prior to January 1, 2024),

regardless of performance. |

|

(4) Criticized loans are defined as loans with internally assigned

risk ratings of 9, 10, or 11 (6, 7, or 8 prior to January 1, 2024),

regardless of performance. |

|

|

|

|

|

|

|

|

QCR Holding, Inc. |

|

Consolidated Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

March 31, |

|

December 31, |

|

March 31, |

|

SELECT FINANCIAL DATA - SUBSIDIARIES |

|

|

2024 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

|

|

|

|

|

|

Quad City Bank and Trust (1) |

|

$ |

2,618,727 |

|

|

$ |

2,448,957 |

|

|

$ |

2,548,473 |

|

|

m2 Equipment Finance, LLC |

|

|

350,801 |

|

|

|

345,682 |

|

|

|

317,497 |

|

|

Cedar Rapids Bank and Trust |

|

|

2,423,936 |

|

|

|

2,419,146 |

|

|

|

2,196,560 |

|

|

Community State Bank |

|

|

1,445,230 |

|

|

|

1,426,202 |

|

|

|

1,286,227 |

|

|

Guaranty Bank |

|

|

2,327,985 |

|

|

|

2,281,296 |

|

|

|

2,147,776 |

|

|

|

|

|

|

|

|

|

|

TOTAL DEPOSITS |

|

|

|

|

|

|

|

Quad City Bank and Trust (1) |

|

$ |

2,161,515 |

|

|

$ |

1,878,375 |

|

|

$ |

2,173,343 |

|

|

Cedar Rapids Bank and Trust |

|

|

1,757,353 |

|

|

|

1,748,516 |

|

|

|

1,663,138 |

|

|

Community State Bank |

|

|

1,187,926 |

|

|

|

1,169,921 |

|

|

|

1,086,531 |

|

|

Guaranty Bank |

|

|

1,743,514 |

|

|

|

1,771,371 |

|

|

|

1,646,730 |

|

|

|

|

|

|

|

|

|

|

TOTAL LOANS & LEASES |

|

|

|

|

|

|

|

Quad City Bank and Trust (1) |

|

$ |

2,046,038 |

|

|

$ |

1,983,679 |

|

|

$ |

1,872,029 |

|

|

m2 Equipment Finance, LLC |

|

|

354,815 |

|

|

|

350,641 |

|

|

|

321,495 |

|

|

Cedar Rapids Bank and Trust |

|

|

1,680,127 |

|

|

|

1,698,447 |

|

|

|

1,637,252 |

|

|

Community State Bank |

|

|

1,113,070 |

|

|

|

1,099,262 |

|

|

|

994,454 |

|

|

Guaranty Bank |

|

|

1,809,101 |

|

|

|

1,762,027 |

|

|

|

1,686,287 |

|

|

|

|

|

|

|

|

|

|

TOTAL LOANS & LEASES / TOTAL DEPOSITS |

|

|

|

|

|

|

|

Quad City Bank and Trust (1) |

|

|

95 |

% |

|

|

106 |

% |

|

|

86 |

% |

|

Cedar Rapids Bank and Trust |

|

|

96 |

% |

|

|

97 |

% |

|

|

98 |

% |

|

Community State Bank |

|

|

94 |

% |

|

|

94 |

% |

|

|

92 |

% |

|

Guaranty Bank |

|

|

104 |

% |

|

|

99 |

% |

|

|

102 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LOANS & LEASES / TOTAL ASSETS |

|

|

|

|

|

|

|

Quad City Bank and Trust (1) |

|

|

78 |

% |

|

|

81 |

% |

|

|

73 |

% |

|

Cedar Rapids Bank and Trust |

|

|

69 |

% |

|

|

70 |

% |

|

|

75 |

% |

|

Community State Bank |

|

|

77 |

% |

|

|

77 |

% |

|

|

77 |

% |

|

Guaranty Bank |

|

|

78 |

% |

|

|

77 |

% |

|

|

79 |

% |

|

|

|

|

|

|

|

|

|

ACL ON LOANS/LEASES AS A PERCENTAGE OF

LOANS/LEASES |

|

|

|

|

|

|

|

Quad City Bank and Trust (1) |

|

|

1.40 |

% |

|

|

1.48 |

% |

|

|

1.41 |

% |

|

m2 Equipment Finance, LLC |

|

|

3.75 |

% |

|

|

3.80 |

% |

|

|

3.13 |

% |

|

Cedar Rapids Bank and Trust |

|

|

1.34 |

% |

|

|

1.39 |

% |

|

|

1.50 |

% |

|

Community State Bank |

|

|

1.12 |

% |

|

|

1.23 |

% |

|

|

1.38 |

% |

|

Guaranty Bank |

|

|

1.15 |

% |

|

|

1.18 |

% |

|

|

1.29 |

% |

|

|

|

|

|

|

|

|

|

RETURN ON AVERAGE ASSETS |

|

|

|

|

|

|

|

Quad City Bank and Trust (1) |

|

|

0.79 |

% |

|

|

0.67 |

% |

|

|

1.23 |

% |

|

Cedar Rapids Bank and Trust |

|

|

3.09 |

% |

|

|

3.78 |

% |

|

|

3.07 |

% |

|

Community State Bank |

|

|

1.25 |

% |

|

|

1.11 |

% |

|

|

1.49 |

% |

|

Guaranty Bank |

|

|

0.88 |

% |

|

|

1.41 |

% |

|

|

1.02 |

% |

|

|

|

|

|

|

|

|

|

NET INTEREST MARGIN PERCENTAGE (2) |

|

|

|

|

|

|

|

Quad City Bank and Trust (1) |

|

|

3.31 |

% |

|

|

3.41 |

% |

|

|

3.44 |

% |

|

Cedar Rapids Bank and Trust |

|

|

3.77 |

% |

|

|

3.84 |

% |

|

|

4.03 |

% |

|

Community State Bank |

|

|

3.75 |

% |

|

|

3.74 |

% |

|

|

3.99 |

% |

|

Guaranty Bank (3) |

|

|

2.98 |

% |

|

|

3.07 |

% |

|

|

3.49 |

% |

|

|

|

|

|

|

|

|

|

ACQUISITION-RELATED AMORTIZATION/ACCRETION INCLUDED IN

NET |

|

|

|

|

|

INTEREST MARGIN, NET |

|

|

|

|

|

|

|

Cedar Rapids Bank and Trust |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

(8 |

) |

|

Community State Bank |

|

|

(1 |

) |

|

|

(1 |

) |

|

|

71 |

|

|

Guaranty Bank |

|

|

396 |

|

|

|

706 |

|

|

|

797 |

|

|

QCR Holdings, Inc. (4) |

|

|

(32 |

) |

|

|

(32 |

) |

|

|

(32 |

) |

|

|

|

|

|

|

|

|

|

(1) Quad City Bank and Trust amounts include m2 Equipment Finance,

LLC, as this entity is wholly-owned and consolidated with the Bank.

m2 Equipment Finance, LLC is also presented separately for certain

(applicable) measurements. |

|

(2) Includes nontaxable securities and loans. Interest earned and

yields on nontaxable securities and loans are determined on a tax

equivalent basis using a 21% federal tax rate. |

|

(3) Guaranty Bank's net interest margin percentage includes various

purchase accounting adjustments. Excluding those adjustments, net

interest margin (Non-GAAP) would have been 2.91% for the quarter

ended March 31, 2024, 2.95% for the quarter ended December 31, 2023

and 3.39% for the quarter ended March 31, 2023. |

|

(4) Relates to the trust preferred securities acquired as part of

the Guaranty Bank acquisition in 2017 and the Community National

Bank acquisition in 2013. |

|

|

|

|

|

|

|

|

|

QCR Holding, Inc. |

|

Consolidated Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

GAAP TO NON-GAAP RECONCILIATIONS |

|

|

2024 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

|

(dollars in thousands, except per share data) |

|

TANGIBLE COMMON EQUITY TO TANGIBLE ASSETS RATIO

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity (GAAP) |

|

$ |

907,342 |

|

|

$ |

886,596 |

|

|

$ |

828,383 |

|

|

$ |

822,689 |

|

|

$ |

801,494 |

|

|

Less: Intangible assets |

|

|

152,158 |

|

|

|

152,848 |

|

|

|

153,564 |

|

|

|

154,255 |

|

|

|

154,467 |

|

|

Tangible common equity (non-GAAP) |

|

$ |

755,184 |

|

|

$ |

733,748 |

|

|

$ |

674,819 |

|

|

$ |

668,434 |

|

|

$ |

647,027 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets (GAAP) |

|

$ |

8,599,549 |

|

|

$ |

8,538,894 |

|

|

$ |

8,540,057 |

|

|

$ |

8,226,673 |

|

|

$ |

8,036,904 |

|

|

Less: Intangible assets |

|

|

152,158 |

|

|

|

152,848 |

|

|

|

153,564 |

|

|

|

154,255 |

|

|

|

154,467 |

|

|

Tangible assets (non-GAAP) |

|

$ |

8,447,391 |

|

|

$ |

8,386,046 |

|

|

$ |

8,386,493 |

|

|

$ |

8,072,418 |

|

|

$ |

7,882,437 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible common equity to tangible assets ratio

(non-GAAP) |

|

8.94 |

% |

|

|

8.75 |

% |

|

|

8.05 |

% |

|

|

8.28 |

% |

|

|

8.21 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This ratio is a non-GAAP financial measure. The Company's

management believes that this measurement is important to many

investors in the marketplace who are interested in changes